Executive summary:

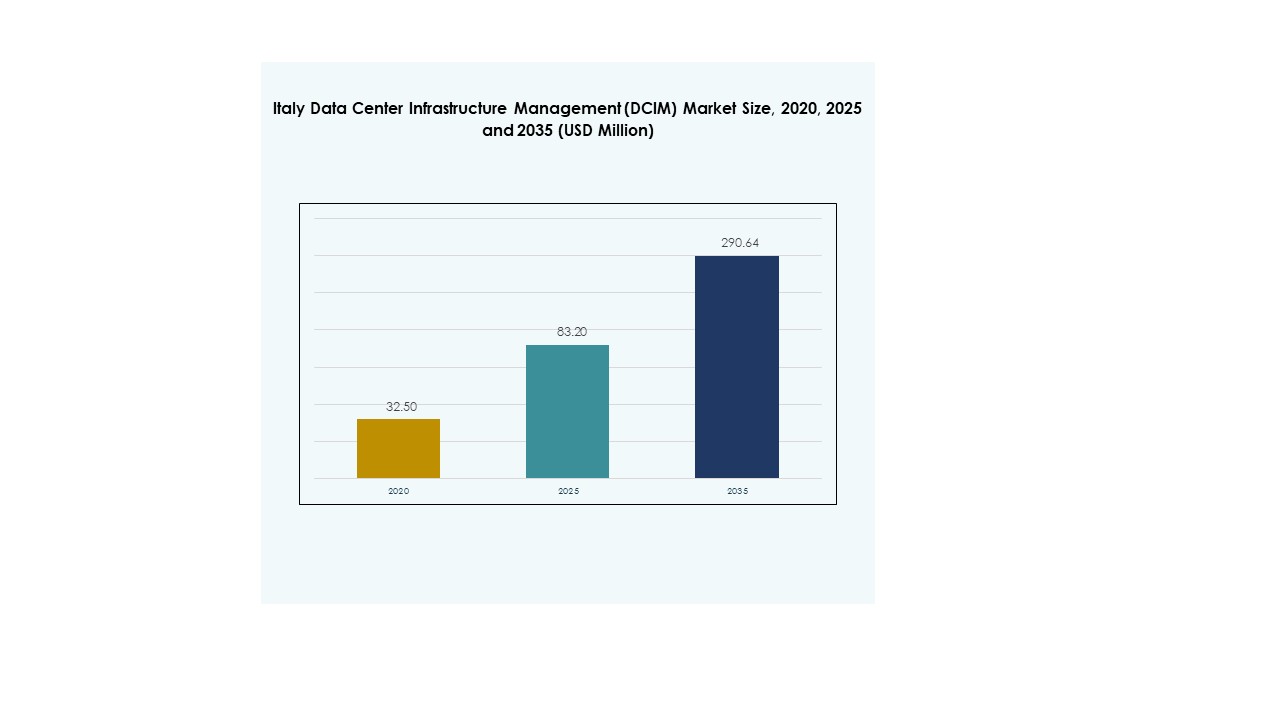

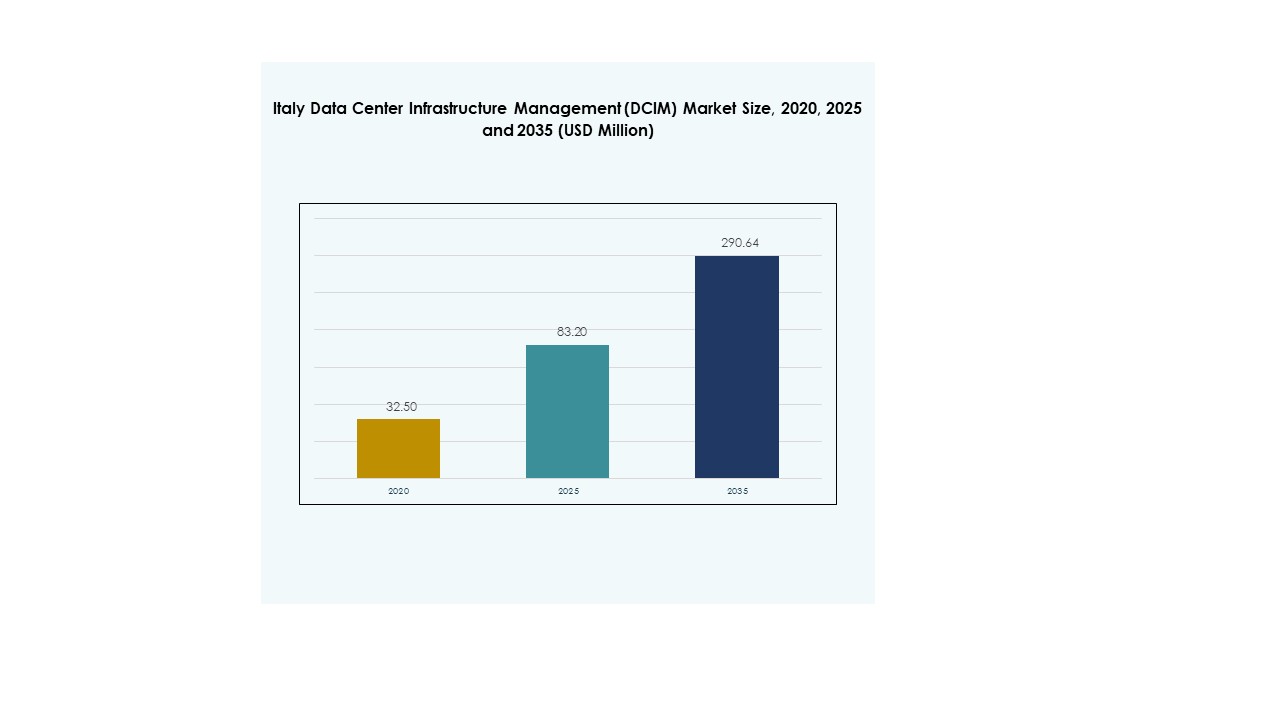

The Italy Data Center Infrastructure Management (DCIM) Market size was valued at USD 32.50 million in 2020 to USD 83.20 million in 2025 and is anticipated to reach USD 290.64 million by 2035, at a CAGR of 15.10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Italy Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 83.20 Million |

| Italy Data Center Infrastructure Management (DCIM) Market, CAGR |

15.10% |

| Italy Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 290.64 Million |

The Italy Data Center Infrastructure Management (DCIM) Market is advancing as enterprises embrace AI, IoT, and automation to optimize data center performance. Innovation in predictive analytics, environmental monitoring, and hybrid integration supports efficiency and resilience. It enables businesses to improve operational reliability, reduce risks, and enhance sustainability. For investors, the sector holds strong strategic importance due to rising digitalization, regulatory compliance, and long-term infrastructure modernization across industries.

Regionally, Northern Italy leads the market, driven by technology hubs, financial institutions, and advanced connectivity infrastructure. Central Italy is emerging as a growing hub with government-driven digital modernization and rising enterprise adoption. Southern Italy shows increasing potential as SMEs and utilities expand digital infrastructure and adopt scalable DCIM platforms. It reflects a balanced geographic spread, highlighting both established leaders and emerging regions contributing to market growth.

Market Drivers

Rising Demand For Energy-Efficient And Automated Data Center Operations

The Italy Data Center Infrastructure Management (DCIM) Market is experiencing growth driven by rising demand for energy-efficient and automated operations. Organizations deploy DCIM to monitor energy use, optimize cooling systems, and cut operational costs. It enhances real-time visibility of infrastructure, improving decision-making and reducing downtime risks. Predictive analytics strengthen reliability and lower maintenance needs. Businesses gain measurable benefits in efficiency and cost control. Investors value its strategic role in sustainable infrastructure. Strong adoption across industries highlights its growing importance. It continues to act as a catalyst for modernization.

- For instance, Fastweb’s Milan data center was Italy’s first to receive Uptime Institute Tier IV Constructed Facility (TCCF) certification. It houses 162 racks (42U each) with an average power density of 7.5 kW per rack and supports a total IT load of 1,250 kW. The facility implements hot-aisle containment, achieves a PUE of 1.25, and maintains over 99.997% uptime reliability.

Increasing Adoption Of Advanced Technologies Like AI, IoT, And Predictive Analytics

Wider adoption of AI and IoT drives innovation within the Italy Data Center Infrastructure Management (DCIM) Market. These technologies deliver actionable insights for asset performance, capacity planning, and fault detection. It allows enterprises to implement predictive analytics, minimizing disruptions and maximizing uptime. AI integration also supports intelligent automation in monitoring workloads. IoT-enabled sensors provide continuous data on environmental conditions. Businesses leverage this data for proactive planning. Investors recognize the scalability of such solutions for long-term gains. It strengthens resilience and performance for enterprises embracing digital strategies.

- For instance, the EXSCALATE4CoV project, coordinated by Dompé and involving CINECA, exploited Europe’s top supercomputing infrastructure and AI-driven workflows to accelerate drug discovery against COVID-19. CINECA contributed high-performance computing and code optimization, while the platform managed experiment execution, data pipelines, and virtual screening tasks.

Strategic Shift Toward Cloud And Hybrid Infrastructure Models Across Industries

The shift toward hybrid infrastructure accelerates the Italy Data Center Infrastructure Management (DCIM) Market adoption. Businesses integrate on-premises assets with scalable cloud models for workload optimization. It creates demand for unified monitoring platforms capable of controlling diverse resources. Cloud adoption improves flexibility and reduces capital expenditures. Hybrid models strengthen security while ensuring scalability. DCIM platforms enable smooth integration across multi-environment data centers. Enterprises achieve higher productivity while reducing risks of fragmentation. It positions DCIM solutions as a cornerstone in evolving IT environments.

Growing Regulatory Focus On Compliance And Sustainable Digital Infrastructure

Regulatory pressure supports rapid adoption of the Italy Data Center Infrastructure Management (DCIM) Market. Governments set benchmarks on carbon neutrality and energy standards. It compels enterprises to deploy DCIM tools to meet compliance. Platforms provide detailed energy tracking, ensuring adherence to sustainability goals. Businesses benefit by avoiding penalties while enhancing corporate image. Investors value compliance-driven adoption as a low-risk growth enabler. Regulatory frameworks reinforce resilience and sustainable operations. It creates long-term demand across sectors adapting to policy-driven expectations.

Market Trends

Expanding Use Of Modular And Prefabricated Data Center Solutions

The Italy Data Center Infrastructure Management (DCIM) Market is seeing rising demand for modular and prefabricated solutions. Modular infrastructure accelerates deployment, reduces upfront costs, and ensures scalability. It complements DCIM platforms by enabling seamless monitoring of prefabricated modules. Enterprises benefit from flexible expansion strategies. Prefabricated models support hybrid workloads while aligning with green energy goals. Businesses reduce construction time while improving operational visibility. Investors support projects offering rapid time-to-market. It strengthens overall adaptability in competitive environments.

Integration Of Renewable Energy Sources Into Data Center Operations

Sustainability initiatives fuel renewable integration in the Italy Data Center Infrastructure Management (DCIM) Market. Operators adopt solar, wind, and hydrogen-based energy systems. It enhances carbon neutrality while cutting operating costs. DCIM tools ensure precise monitoring of renewable inputs and load balancing. Enterprises demonstrate alignment with corporate social responsibility targets. Investors back green projects offering long-term savings. Regulatory incentives further accelerate clean energy adoption. It reinforces the role of DCIM as a driver of sustainable operations.

Growing Emphasis On Edge Data Centers To Support Emerging Applications

Edge expansion is becoming a defining trend in the Italy Data Center Infrastructure Management (DCIM) Market. Enterprises require faster response times for IoT, AI, and 5G services. It creates demand for smaller, distributed facilities integrated with DCIM tools. Edge data centers optimize latency-sensitive workloads. Businesses ensure consistent performance with unified monitoring platforms. This supports connected ecosystems across industries. Investors see potential in emerging edge deployments. It secures growth through localized and efficient infrastructure strategies.

Increased Focus On Cybersecurity Integration With Infrastructure Monitoring

Cybersecurity integration is reshaping strategies in the Italy Data Center Infrastructure Management (DCIM) Market. Operators embed advanced security protocols within DCIM tools. It strengthens real-time monitoring of vulnerabilities and threats. Businesses minimize risks by linking physical infrastructure data with IT security. This reduces exposure to cyberattacks while supporting compliance standards. Enterprises value resilience across hybrid and multi-cloud models. Investors consider secure systems essential for protecting digital assets. It elevates DCIM into a critical component of digital risk management.

Market Challenges

High Implementation Costs And Complex Integration Across Legacy Infrastructure

The Italy Data Center Infrastructure Management (DCIM) Market faces challenges due to high costs of implementation and complex integration. Enterprises operating legacy systems struggle to adopt advanced solutions. It requires significant investment in hardware, software, and staff training. Many organizations hesitate to migrate due to cost pressures. Integration across diverse IT environments demands expertise. Limited budgets in SMEs restrict rapid uptake. Investors view these barriers as slowing adoption. It creates a divide between large enterprises and smaller firms.

Shortage Of Skilled Workforce And Rising Concerns On Data Security Risks

Another challenge in the Italy Data Center Infrastructure Management (DCIM) Market lies in workforce skill gaps and data security risks. Organizations require trained staff to manage DCIM tools effectively. It remains difficult to find expertise for predictive analytics and hybrid monitoring. Cybersecurity risks further complicate adoption strategies. Growing sophistication of threats increases operational vulnerabilities. Enterprises hesitate to fully transition without robust security assurance. Talent shortages restrict innovation and scalability. It slows widespread adoption despite rising industry demand.

Market Opportunities

Expanding Cloud-Based DCIM Platforms Offering Scalability And Cost Advantages

The Italy Data Center Infrastructure Management (DCIM) Market presents opportunities through cloud-based DCIM platforms. These platforms provide scalability, lower upfront costs, and quick deployment. It helps businesses optimize hybrid workloads effectively. SMEs benefit from subscription-based models reducing capital expenditures. Cloud-driven DCIM adoption enhances remote monitoring. Investors value recurring revenue potential of service providers. It creates sustainable growth momentum for businesses. It will drive new investments in next-generation platforms.

Increasing Focus On Green Data Centers And Energy Optimization Tools

A strong opportunity emerges from sustainability in the Italy Data Center Infrastructure Management (DCIM) Market. Enterprises prioritize energy optimization to meet compliance and environmental goals. It increases demand for DCIM tools integrating renewable energy monitoring. Operators showcase leadership in carbon neutrality initiatives. Businesses gain reputational advantages with eco-friendly operations. Investors back projects aligned with global climate objectives. Demand for energy-efficient infrastructure grows steadily. It ensures long-term adoption of sustainable solutions.

Market Segmentation

By Component

In the Italy Data Center Infrastructure Management (DCIM) Market, solutions hold the dominant share due to their critical role in monitoring and controlling infrastructure resources. Services segment is expanding as enterprises rely on consulting, integration, and managed offerings for customization. Businesses prioritize advanced platforms for predictive analytics and energy management. Growth in service adoption is driven by SMEs seeking cost-efficient outsourcing. Together, solutions and services ensure balanced adoption across industries.

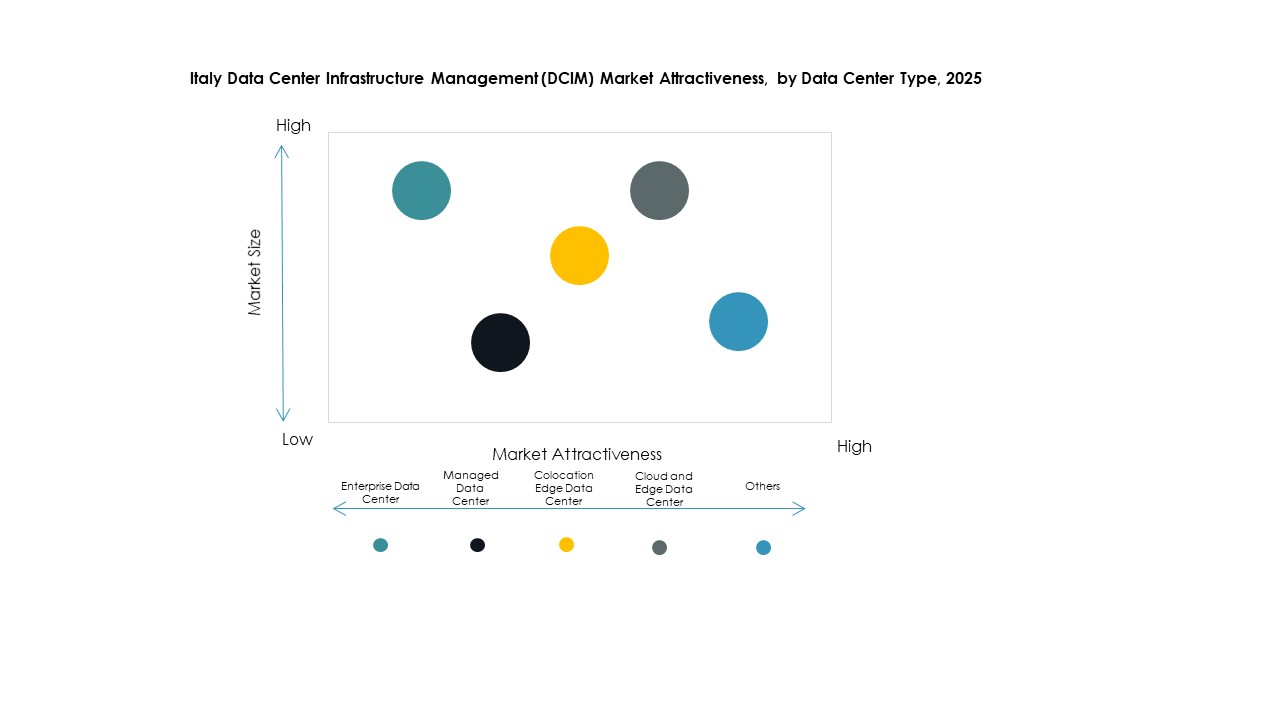

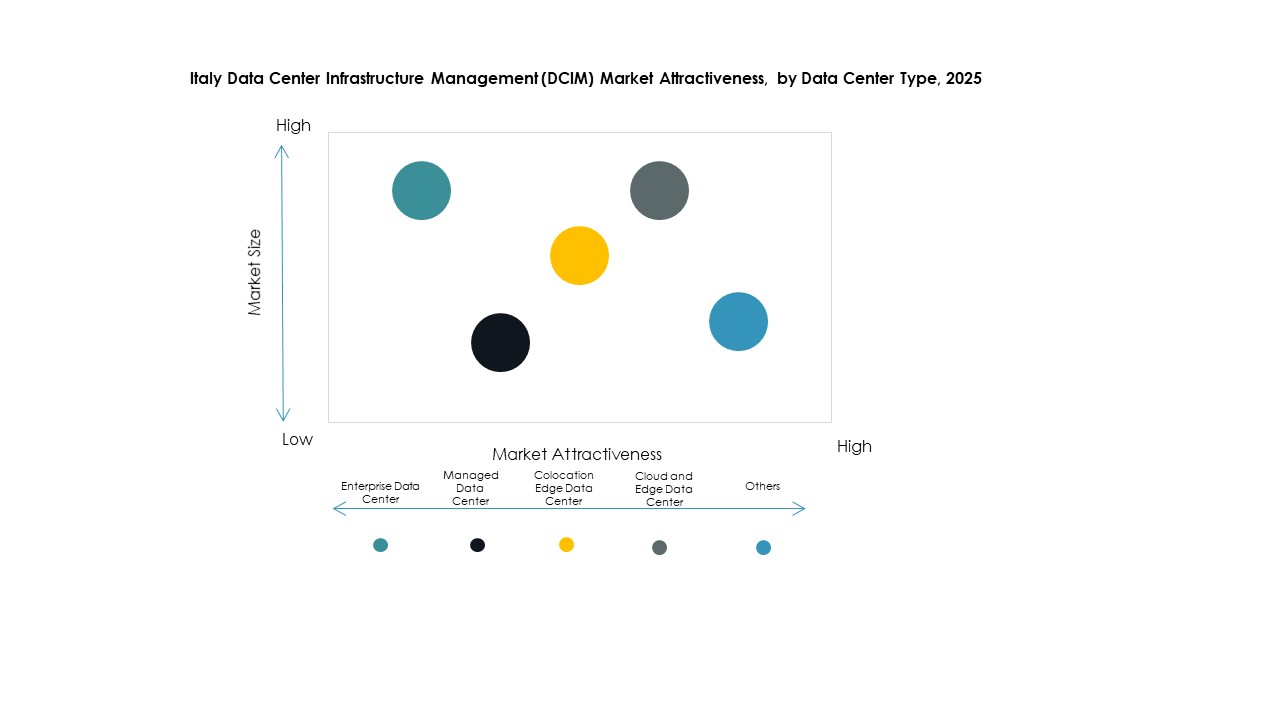

By Data Center Type

Enterprise data centers lead the Italy Data Center Infrastructure Management (DCIM) Market, supported by large-scale organizations focusing on in-house monitoring systems. Cloud and edge data centers show strong growth driven by digital transformation and 5G expansion. Managed and colocation facilities attract businesses outsourcing infrastructure needs. Hybrid adoption strengthens demand for DCIM to ensure visibility across distributed assets. This segment reflects diversification in infrastructure strategies across industries.

By Deployment Model

On-premises models remain significant in the Italy Data Center Infrastructure Management (DCIM) Market due to enterprise control and compliance requirements. Cloud-based DCIM adoption is accelerating because of cost flexibility and remote accessibility. Hybrid deployment models are gaining traction as they combine scalability with security benefits. Enterprises choose models aligning with workload distribution and budget. Demand for hybrid is particularly strong among regulated industries balancing performance with compliance.

By Enterprise Size

Large enterprises dominate the Italy Data Center Infrastructure Management (DCIM) Market, reflecting their ability to invest in advanced monitoring and automation. Small and medium enterprises are adopting cloud-based DCIM to reduce capital expenditure. It allows SMEs to enhance efficiency without major infrastructure changes. Large enterprises focus on predictive analytics, while SMEs prioritize cost-effective tools. This segmentation highlights the scalability of DCIM across organization sizes.

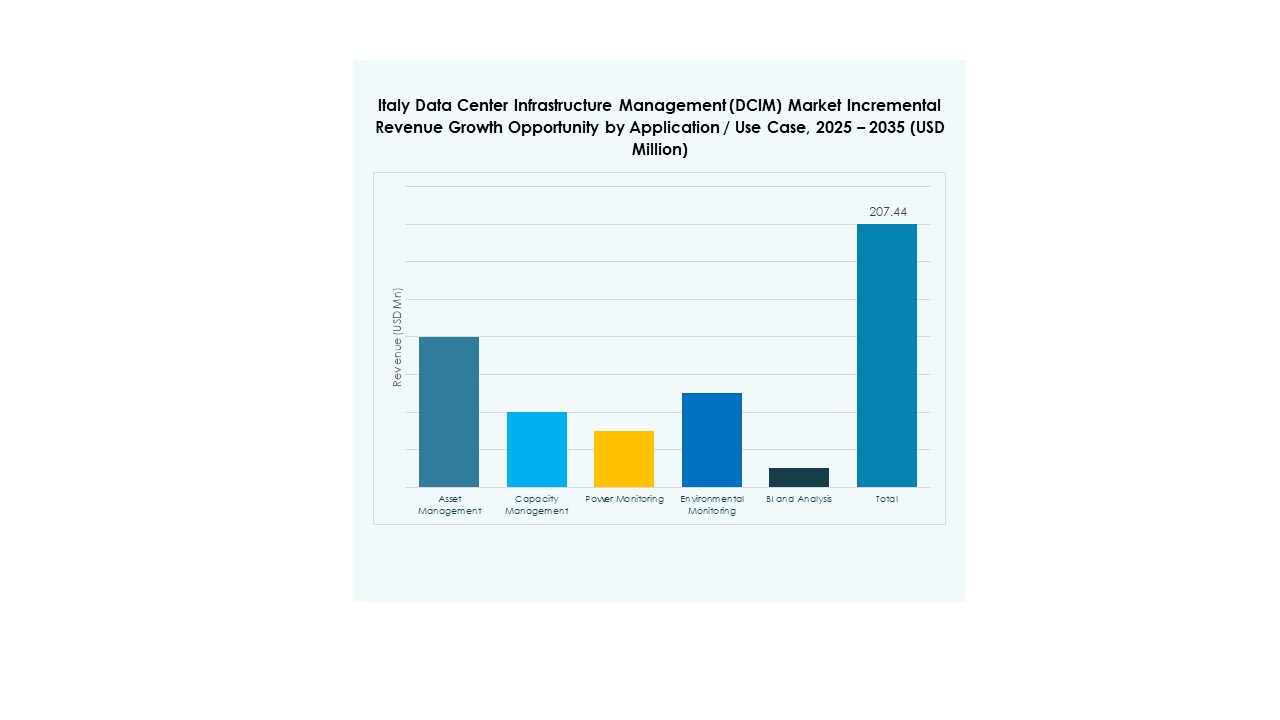

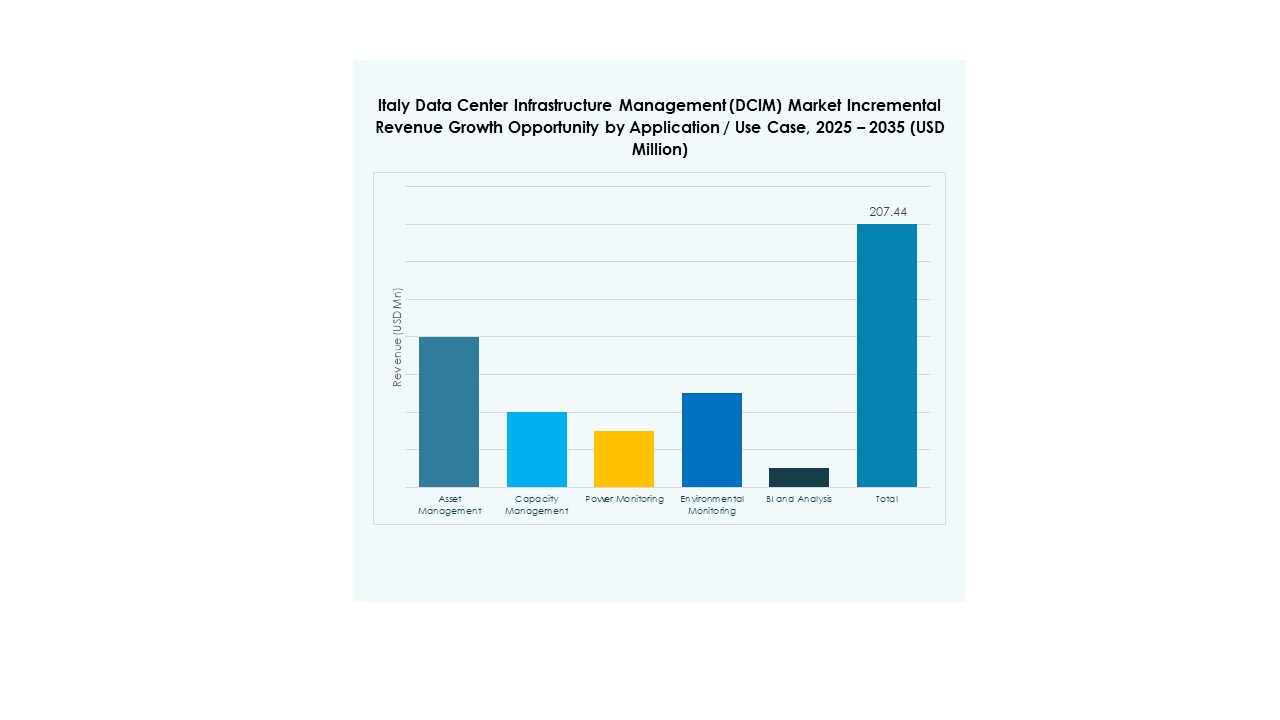

By Application / Use Case

Power monitoring and capacity management are dominant applications in the Italy Data Center Infrastructure Management (DCIM) Market, driven by demand for energy optimization and predictive planning. Asset management supports long-term operational visibility, while environmental monitoring ensures compliance with sustainability targets. Business intelligence and analysis tools gain momentum for strategic planning. Each use case reflects increasing need for comprehensive visibility into data center operations.

By End User Industry

IT and telecommunications lead the Italy Data Center Infrastructure Management (DCIM) Market due to high digital infrastructure investments. BFSI follows with strong demand for secure and compliant monitoring. Healthcare and retail sectors expand adoption to support data-intensive operations. Aerospace and defense prioritize resilience and security. Energy and utilities emphasize efficient power monitoring. Other industries continue exploring DCIM adoption as part of digital modernization.

Regional Insights

Northern Italy Driving Market Leadership With 45% Share

Northern Italy dominates the Italy Data Center Infrastructure Management (DCIM) Market with 45% share. Strong presence of financial institutions and technology hubs drives adoption. Enterprises invest heavily in hybrid and cloud-driven DCIM platforms. It benefits from advanced connectivity and strong renewable integration initiatives. Data center clusters around Milan strengthen its role. Investors target the region for innovation-driven projects. It continues to lead with advanced adoption.

- For instance, Equinix operates multiple Milan IBX data centers, including ML5 located next to Via Caldera. ML5 offers 6 MW of IT power capacity with advanced cooling systems and supports ultra-low latency connectivity for financial and cloud services, reinforcing Milan’s role as a digital hub.

Central Italy Emerging As A Growing Hub With 30% Share

Central Italy holds 30% share of the Italy Data Center Infrastructure Management (DCIM) Market. Government modernization programs and regulatory compliance initiatives boost adoption. Enterprises adopt cloud-based models to optimize efficiency. It benefits from academic institutions supporting digital skill development. Retail and healthcare sectors increase demand for DCIM in this region. Investors recognize its potential as a growth hub. It strengthens Italy’s digital infrastructure base.

- For instance, Aruba S.p.A. expanded its Global Cloud Data Center (IT3) campus in Ponte San Pietro with two new facilities: one with 9 MW power and another with 8 MW power, boosting Italy’s cloud infrastructure capacity. Aruba also operates the Hyper Cloud Data Center (IT4) in Rome, a major campus interconnected with multiple backbones, supporting high connectivity, regulatory compliance, and energy-efficient operations.

Southern Italy Showing Potential With 25% Share

Southern Italy captures 25% share of the Italy Data Center Infrastructure Management (DCIM) Market. Adoption rises with growing SME activity and regional digitalization programs. Energy and utilities drive demand for power and capacity monitoring. It reflects rising importance of localized data infrastructure. Cloud-driven adoption supports cost-sensitive businesses. Investors show interest in emerging projects across this region. It positions Southern Italy as an important growth frontier.

Competitive Insights:

- it Data Centers

- Serverplan

- Seeweb

- Oneview Software

- Fastweb Data Centers

- TIM Data Centers

- ABB Ltd.

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd

- IBM

- Schneider Electric SE

- Siemens AG

- Hewlett Packard Enterprise (HPE)

- Delta Electronics

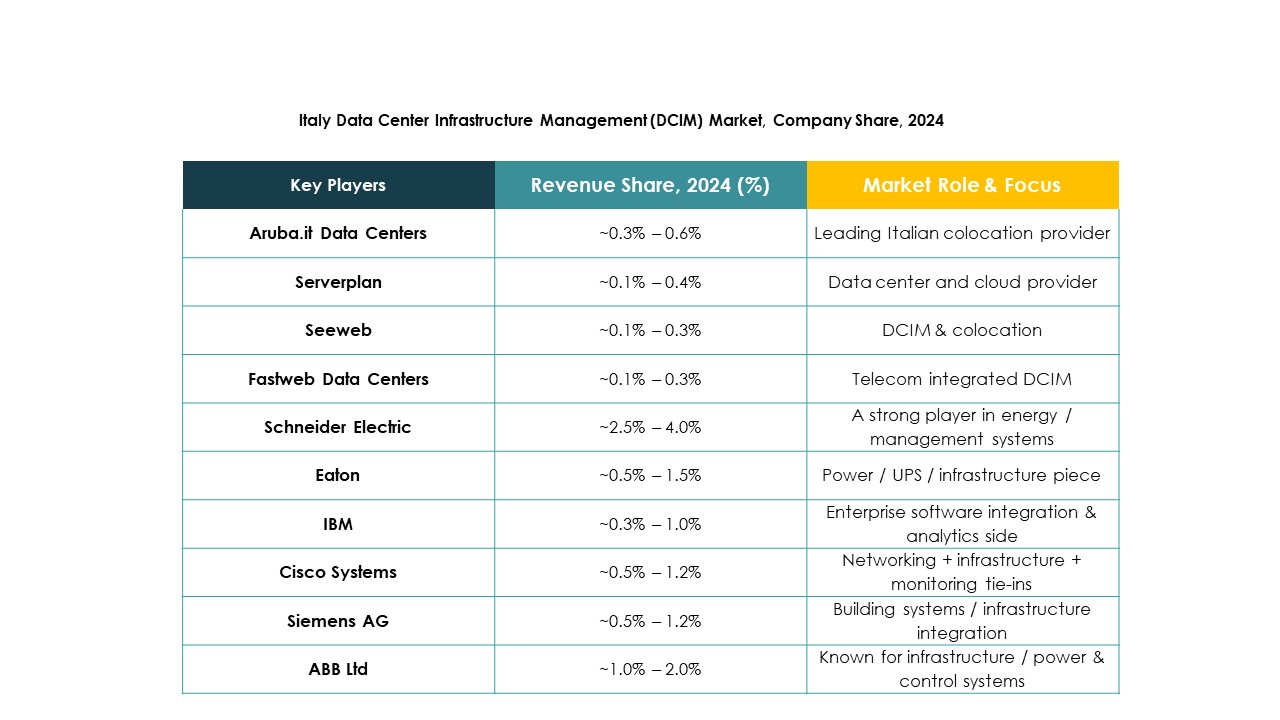

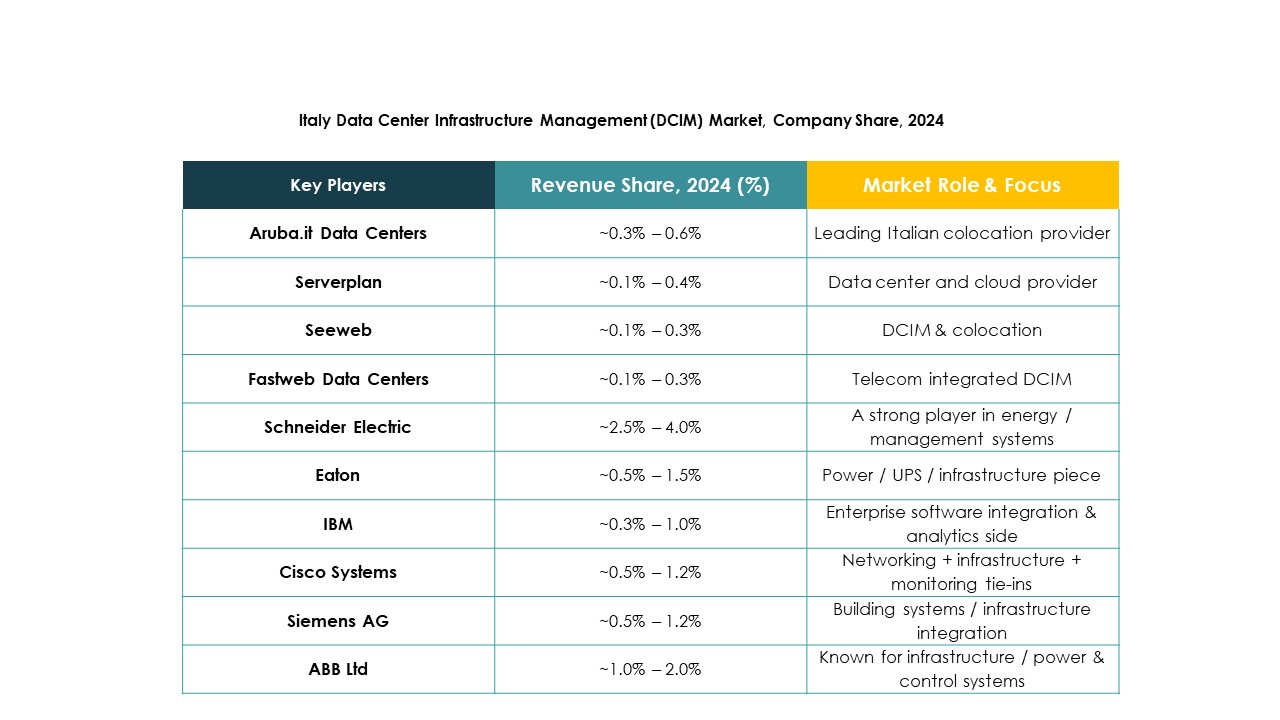

The Italy Data Center Infrastructure Management (DCIM) Market is defined by strong competition between global technology leaders and domestic providers. Local firms such as Aruba.it Data Centers, TIM Data Centers, and Fastweb emphasize regional presence and tailored services, supporting enterprises with secure and scalable facilities. Global vendors including Schneider Electric, IBM, Huawei, and HPE focus on advanced DCIM platforms, integrating AI, IoT, and energy optimization features. It creates a landscape where multinational expertise combines with regional knowledge, offering enterprises both innovation and localized support. Strategic partnerships, product innovation, and regulatory compliance drive market positioning, with players competing on sustainability, automation, and hybrid infrastructure integration.

Recent Developments:

- In July 2025, Modius, Inc. also announced a strategic partnership with Mitsubishi Heavy Industries to co-develop next-generation DCIM solutions, likely targeting enhanced infrastructure monitoring and sustainability features.

- In April 2025, Oomnitza launched a new DCIM product tailored for AI-era IT operations. It enables enterprises to monitor hybrid infrastructure, control costs, enforce compliance, and integrate data center assets into a unified visibility platform.

- In April 2025, Modius, Inc. revealed a 3D visualization feature for its OpenData® DCIM platform. This enhancement improves spatial views of data center assets, facilitating better management and planning.

- In April 2024, STACK Infrastructure announced a major sustainable investment exceeding USD 1.2 billion for its Italian data center campuses, including the development of water-efficient infrastructure, e-waste recycling programs, and electric vehicle charging stations to enhance eco-friendly operations and support Italy’s climate neutrality objectives.