Executive summary:

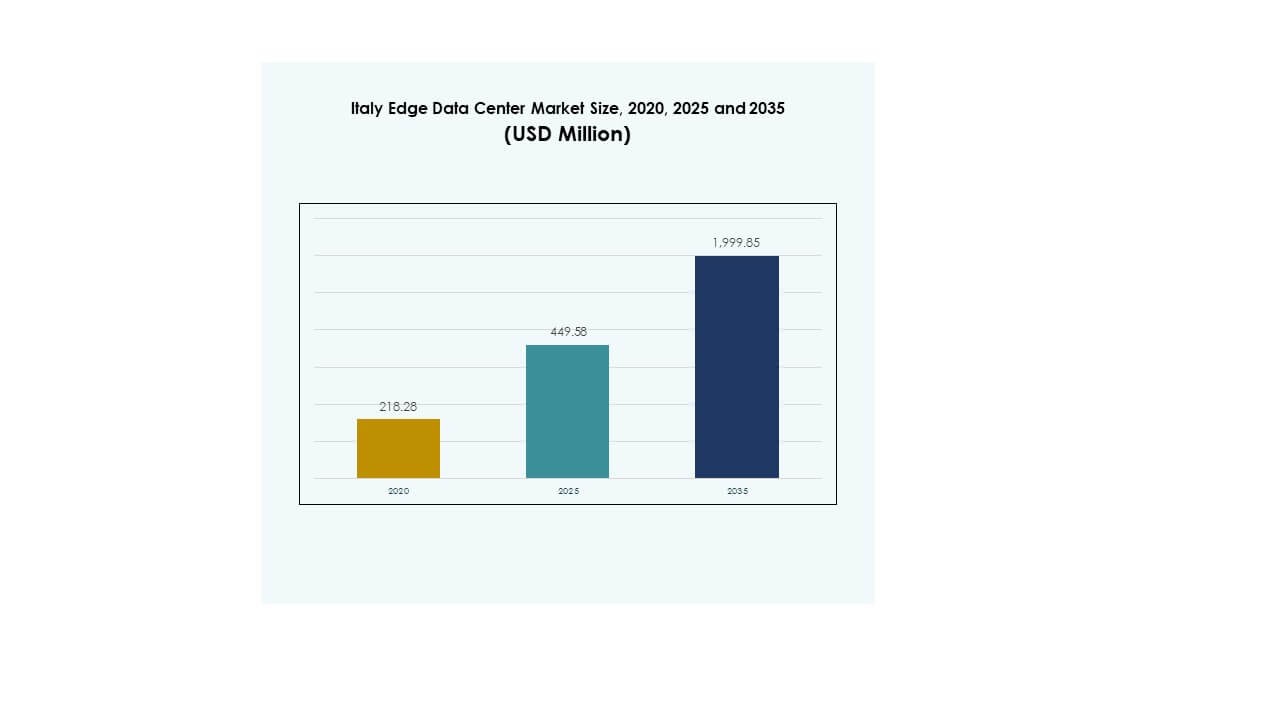

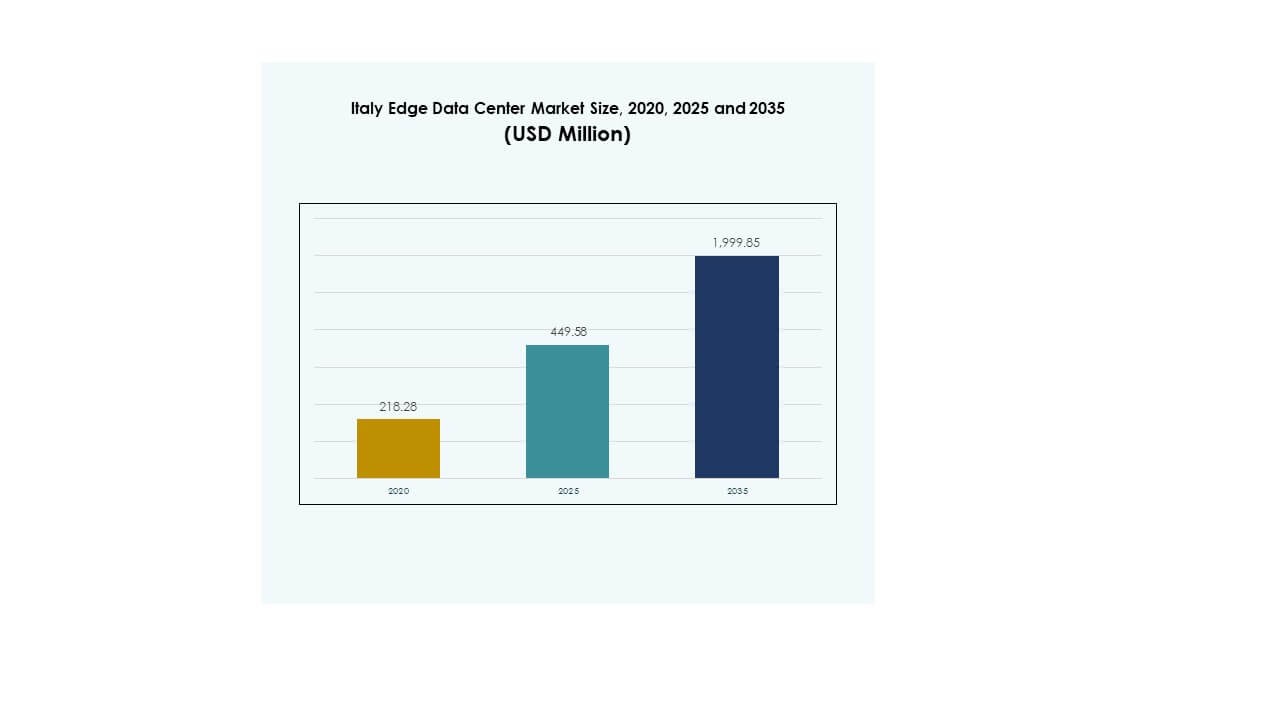

The Italy Edge Data Center Market size was valued at USD 218.28 million in 2020 to USD 449.58 million in 2025 and is anticipated to reach USD 1,999.85 million by 2035, at a CAGR of 15.97% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Italy Edge Data Center Market Size 2025 |

USD 449.58 Million |

| Italy Edge Data Center Market, CAGR |

15.97% |

| Italy Edge Data Center Market Size 2035 |

USD 1,999.85 Million |

The market is driven by the rapid expansion of 5G networks, increased data consumption, and growing adoption of IoT and AI-based solutions. Enterprises are shifting toward decentralized computing models to reduce latency and enhance real-time processing capabilities. The rise of smart cities, cloud integration, and automation across industries highlights the strategic value of edge infrastructure for investors and businesses seeking efficient, scalable, and energy-optimized operations.

Regionally, Northern Italy leads due to its strong industrial ecosystem and advanced digital infrastructure across Lombardy and Turin. Central Italy is gaining momentum with smart city projects and government-led digitization initiatives. Southern Italy shows emerging potential through renewable-powered edge facilities and regional connectivity developments that strengthen its role in national and cross-border data processing networks.

Market Drivers

Rising 5G Integration and Edge Computing Expansion Across Key Industries

The Italy Edge Data Center Market is gaining traction due to 5G integration and rising data traffic. Telecom providers and enterprises are deploying edge nodes to process data closer to users, cutting latency and boosting real-time responsiveness. This supports advanced applications in manufacturing, healthcare, and mobility sectors. 5G enables decentralized infrastructure that improves network performance and reliability. Growing consumer demand for streaming, IoT, and connected devices further strengthens market penetration. Edge infrastructure reduces cloud dependency, creating faster service delivery. It also helps businesses meet low-latency requirements vital for industrial automation and connected logistics.

- For instance, TIM (Telecom Italia) partnered with Google Cloud and Ericsson to develop a 5G Edge Cloud platform in Italy, combining Google’s distributed cloud infrastructure with TIM’s network to support low-latency industrial and enterprise applications. The collaboration focuses on enabling advanced automation, AI, and IoT services across manufacturing and telecom sectors.

Government Digitalization Programs and Smart City Development Driving Infrastructure Growth

Government initiatives toward digital transformation and smart cities are major growth accelerators. Italy’s national digital agenda supports investments in data infrastructure and urban connectivity. Smart city projects across Milan, Turin, and Bologna deploy edge computing for energy management and traffic optimization. Public-private partnerships are encouraging data center expansion with renewable integration. These programs enhance energy efficiency, improve connectivity, and attract technology investors. It reinforces the country’s position as a digital innovation hub in Southern Europe. Businesses benefit through better service delivery and data sovereignty. It positions Italy as a favorable market for data-centric industries and investors.

Accelerating AI, IoT, and Cloud Workload Adoption Creating Edge Demand

Expanding AI, IoT, and cloud workloads are fueling edge deployment in Italy. Enterprises use edge facilities for real-time analytics, predictive maintenance, and automation. Edge computing complements AI-driven decision-making by processing critical data locally. Cloud providers are integrating distributed nodes to enhance performance for regional clients. This combination creates a balanced hybrid IT environment that lowers latency and operational costs. High-speed edge networks support growing industrial and consumer data usage. It helps businesses achieve operational scalability and resilience. Increased enterprise adoption ensures long-term digital competitiveness and attracts global technology investments.

Strategic Business Focus on Data Localization and Energy-Efficient Operations

Companies prioritize data localization to comply with European data privacy laws. Edge centers in Italy provide secure, localized data management for enterprises and government bodies. Operators invest in renewable energy sources and liquid cooling technologies to reduce power usage. Sustainable design attracts enterprises with ESG commitments and green mandates. Localized edge facilities also minimize cross-border data transfers, ensuring compliance with GDPR. It gives businesses better control over data flows and improves operational transparency. These developments enhance trust among clients in regulated industries like finance and healthcare. The market’s strategic role strengthens Italy’s position in the EU’s digital ecosystem.

- For instance, Adriatic DC announced plans to redevelop Bari’s former Manifattura Tabacchi industrial site into a 200 MW data center campus as part of its Puglia Data Center Valley initiative. The project aims to strengthen Southern Italy’s digital infrastructure and position the region as a strategic hub for large-scale data operations.

Market Trends

Adoption of Modular and Scalable Edge Infrastructure for Flexible Deployment

The Italy Edge Data Center Market is witnessing strong adoption of modular and scalable infrastructure. Operators are investing in prefabricated edge modules that reduce construction time and costs. Modular designs support quick deployment in urban and remote regions, aligning with 5G rollout needs. Enterprises choose flexible capacity options that grow with data demand. This design shift improves energy efficiency and operational flexibility. The modular trend also supports colocation providers targeting distributed applications. It creates sustainable, high-performance setups across diverse locations. Investors find modular edge projects attractive due to faster returns and lower upfront capital.

Focus on Renewable Energy Integration and Sustainability Initiatives

Sustainability is transforming data infrastructure strategies in Italy. Operators increasingly adopt renewable power sources like solar and hydro energy for edge operations. Green building standards and advanced cooling systems reduce carbon footprints. Companies integrate AI-based monitoring for real-time energy optimization. The national push toward net-zero emissions enhances funding for eco-efficient infrastructure. Renewable integration strengthens Italy’s appeal among ESG-driven investors and global cloud firms. It also helps meet the EU’s stringent environmental targets for data centers. This trend positions Italy as a sustainable digital hub for future-oriented operations.

Deployment of AI-Enabled Monitoring and Automation Systems

Edge facilities are evolving through AI-based automation for predictive maintenance and system optimization. Operators implement AI to track cooling efficiency, security, and workload balancing. Automation reduces human intervention and downtime, ensuring consistent uptime performance. Smart systems improve data security through real-time threat detection. Enterprises benefit from reduced operational costs and faster service scalability. It enhances customer experience in sectors like telecom, BFSI, and retail. The integration of automation boosts competitiveness and operational reliability. The trend ensures Italy remains at the forefront of intelligent infrastructure innovation.

Expanding Edge Connectivity to Support Industrial and Autonomous Applications

Edge connectivity expansion is a defining trend supporting Italy’s digital industries. Manufacturers and transport companies deploy edge nodes to enable autonomous vehicles and smart factories. Enhanced fiber networks and private 5G deployments strengthen operational efficiency. It creates real-time coordination across distributed systems. Edge computing supports precision manufacturing, robotics, and logistics automation. Telecom firms partner with enterprises to launch localized edge zones. This trend reflects the shift toward distributed digital ecosystems. It also strengthens Italy’s role in cross-border data exchange across Southern Europe.

Market Challenges

High Energy Costs and Power Infrastructure Limitations Impacting Edge Expansion

The Italy Edge Data Center Market faces energy-related challenges that slow capacity expansion. Rising electricity prices increase operational costs for data center operators. Aging grid infrastructure and regional supply instability affect deployment consistency. Operators need heavy investment to ensure reliable power redundancy and sustainability. It limits new entrants from scaling efficiently in smaller cities. Transitioning to renewable energy sources requires capital-intensive retrofitting and infrastructure redesign. The imbalance between energy demand and supply poses strategic planning hurdles. Investors must manage long-term power security risks to maintain profitability and service reliability.

Regulatory Complexity and Land Availability Constraints in Urban Locations

Regulatory procedures and land constraints create significant market barriers. Urban centers like Milan and Rome experience rising real estate costs and zoning restrictions. Securing land for edge facilities requires lengthy approval cycles and complex environmental reviews. Operators navigate strict EU data protection and sustainability compliance standards. It complicates site selection and project execution timelines. Smaller players struggle to align operations with evolving regulatory demands. Network expansion in underserved regions is also constrained by limited infrastructure incentives. These obstacles slow the pace of nationwide edge ecosystem development.

Market Opportunities

Rising Cloud Partnerships and Strategic Investments from Global Operators

The Italy Edge Data Center Market offers strong opportunities through cloud partnerships and international investments. Global firms collaborate with Italian telecoms to expand distributed cloud presence. Investors target high-growth cities where 5G and IoT adoption is accelerating. These partnerships foster infrastructure modernization and service innovation. Growing demand for AI, gaming, and digital commerce enhances investment potential. Italy’s central location strengthens its appeal as a Southern European data hub. It enables low-latency connectivity across cross-border digital ecosystems. This dynamic attracts large-scale funding from hyperscale and regional operators.

Emerging Role in Supporting AI, Healthcare, and Smart Manufacturing Applications

Edge data centers enable digital transformation across high-growth industries. Healthcare providers use edge computing for remote monitoring and telemedicine solutions. Manufacturing plants leverage local data processing for automation and quality control. The AI sector depends on edge infrastructure for low-latency model training and analytics. These use cases drive sustained infrastructure demand in Italy. Enterprises pursue digital innovation using distributed edge platforms. It positions the country as a regional technology leader with scalable growth potential.

Market Segmentation

By Component

The solution segment dominates the Italy Edge Data Center Market with advanced systems for storage, networking, and computing. Solutions offer high performance, scalability, and integration with cloud ecosystems. Businesses rely on hardware and software solutions to optimize edge workloads. Service providers also expand managed and maintenance offerings for enterprises. Service segments are growing as companies outsource data center management. It enhances efficiency and reduces operational risks. Edge service integration accelerates innovation and ensures continuous uptime for critical applications.

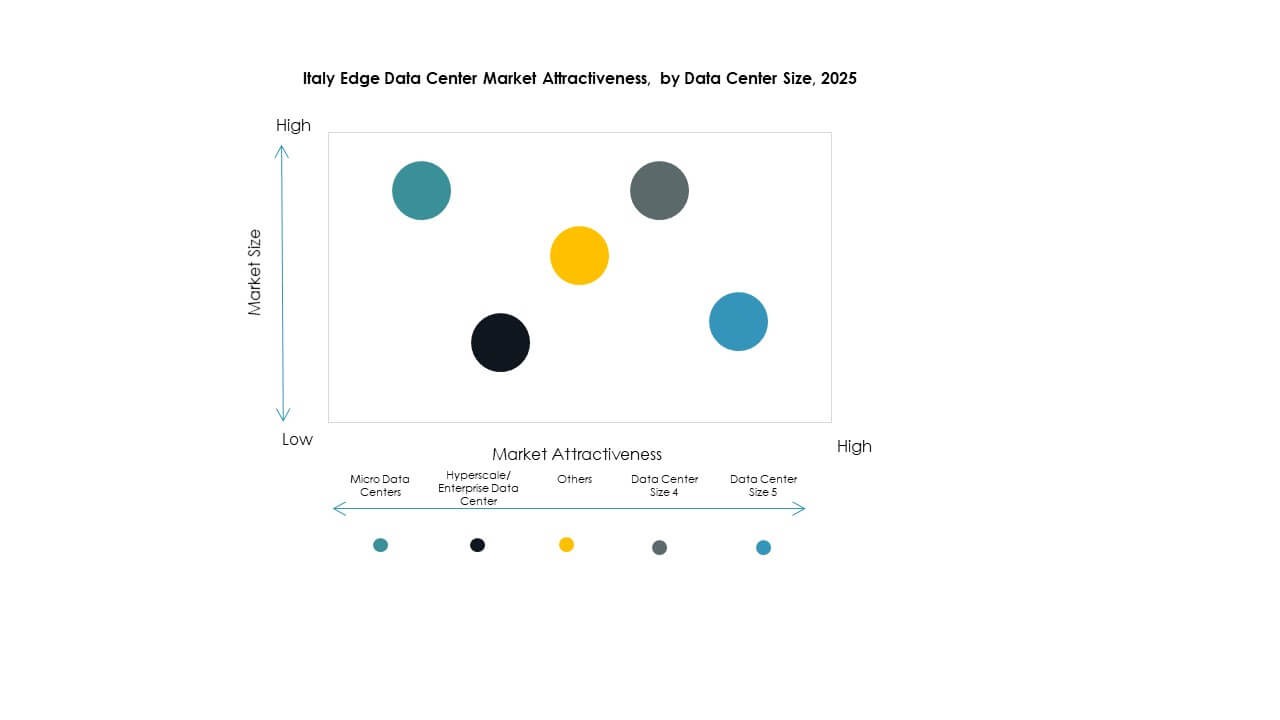

By Data Center Type

Colocation edge data centers hold the largest market share due to flexible leasing models and cost efficiency. Enterprises prefer shared infrastructure to handle growing data volumes while controlling expenses. Managed and cloud edge centers follow with increasing adoption across telecom and IT sectors. The expansion of colocation facilities supports distributed computing and real-time applications. Small enterprises leverage these models for scalability and reliability. Enterprise-specific centers remain relevant for security-focused clients. It supports diversified infrastructure growth across Italy’s digital ecosystem.

By Deployment Model

Hybrid deployment dominates the market as enterprises blend on-premises and cloud resources. Hybrid setups ensure agility and data security by balancing workloads between local and remote nodes. Cloud-based models are growing fast due to digital transformation across industries. On-premises options retain value for industries requiring strict data control. Businesses gain scalability and operational efficiency through flexible deployment. Hybrid systems reduce dependency on single-cloud environments. It strengthens operational continuity and supports real-time service delivery.

By Enterprise Size

Large enterprises lead the market share due to high investment in digital transformation and IoT adoption. These companies prioritize scalability, redundancy, and compliance standards. SMEs show growing participation, supported by affordable edge-as-a-service models. Flexible infrastructure solutions allow SMEs to modernize operations cost-effectively. Edge adoption enhances competitiveness in logistics, retail, and manufacturing sectors. Larger firms continue driving demand for high-capacity nodes and advanced cooling systems. It establishes a balanced ecosystem that caters to varied business needs.

By Application / Use Case

Power monitoring and environmental monitoring applications dominate due to the need for efficiency and sustainability. These systems enable energy optimization and operational resilience. Capacity management and asset monitoring are also expanding with IoT-based analytics. BI and analytics applications leverage edge nodes for real-time decision-making. Such solutions support continuous system performance tracking. Enterprises use analytics-driven insights to optimize operations and lower costs. It supports long-term infrastructure reliability and business growth.

By End User Industry

IT and telecommunications dominate the Italy Edge Data Center Market with extensive infrastructure expansion. BFSI and retail sectors are increasing edge investments to support digital services. Healthcare and energy industries adopt edge computing for data-intensive operations. Aerospace and defense use edge systems for secure and real-time data transfer. SMEs in retail and logistics embrace edge-based analytics for optimization. These industries fuel multi-sector adoption of distributed computing. It enhances digital transformation momentum across Italy’s economic landscape.

Regional Insights

Regional Insights

Northern Italy: Industrial and Digital Infrastructure Hub – 52% Market Share

Northern Italy leads the Italy Edge Data Center Market with major data hubs in Milan and Turin. The region hosts strong industrial clusters and telecom innovation centers. It benefits from advanced fiber connectivity, renewable energy availability, and enterprise concentration. Large-scale investments from global and domestic operators strengthen its dominance. The area’s strategic proximity to European networks enhances cross-border connectivity. It remains the preferred destination for hyperscale and edge deployments. Continuous infrastructure upgrades sustain its leadership position.

- For instance, Equinix opened its ML5 International Business Exchange (IBX) data center in Milan, offering capacity for over 1,450 cabinet equivalents and more than 45,000 square feet of colocation space; the site incorporates modular Flexible Data Center (FDC) designs, delivers 100% renewable energy for operations, and is built to LEED Gold standards.

Central Italy: Growing Smart City and Public Sector Digitization – 31% Market Share

Central Italy shows steady market growth, supported by smart city projects and government digital initiatives. Cities like Florence and Rome are investing in urban automation and AI-driven public systems. Edge facilities improve public service delivery and traffic management efficiency. The education and healthcare sectors also contribute to increasing data workloads. Regional policies support sustainable data infrastructure expansion. It is becoming a crucial zone for localized enterprise and government services. Growing public-private partnerships ensure steady investment inflow.

- For instance, in October 2024, Aruba S.p.A officially inaugurated its Rome Hyper Cloud Data Centre campus spanning 74,000 m², with 52,000 m² dedicated to data centers including five independent facilities that will collectively reach 30MW IT power under a 2N or higher redundancy scheme, and featuring green-by-design operations with high-efficiency cooling and photovoltaic systems.

Southern Italy: Renewable-Powered Edge Growth and Cross-Border Connectivity – 17% Market Share

Southern Italy emerges as an expanding frontier for renewable-powered edge facilities. Regions like Puglia and Sicily host projects integrating solar and hydro energy with edge computing. The area’s proximity to North Africa enables strategic data routing and trade connectivity. Telecom expansion supports digital access for underserved communities. It fosters inclusive regional development and innovation. Global operators are evaluating new investments to strengthen capacity. It ensures balanced nationwide growth of Italy’s digital infrastructure landscape.

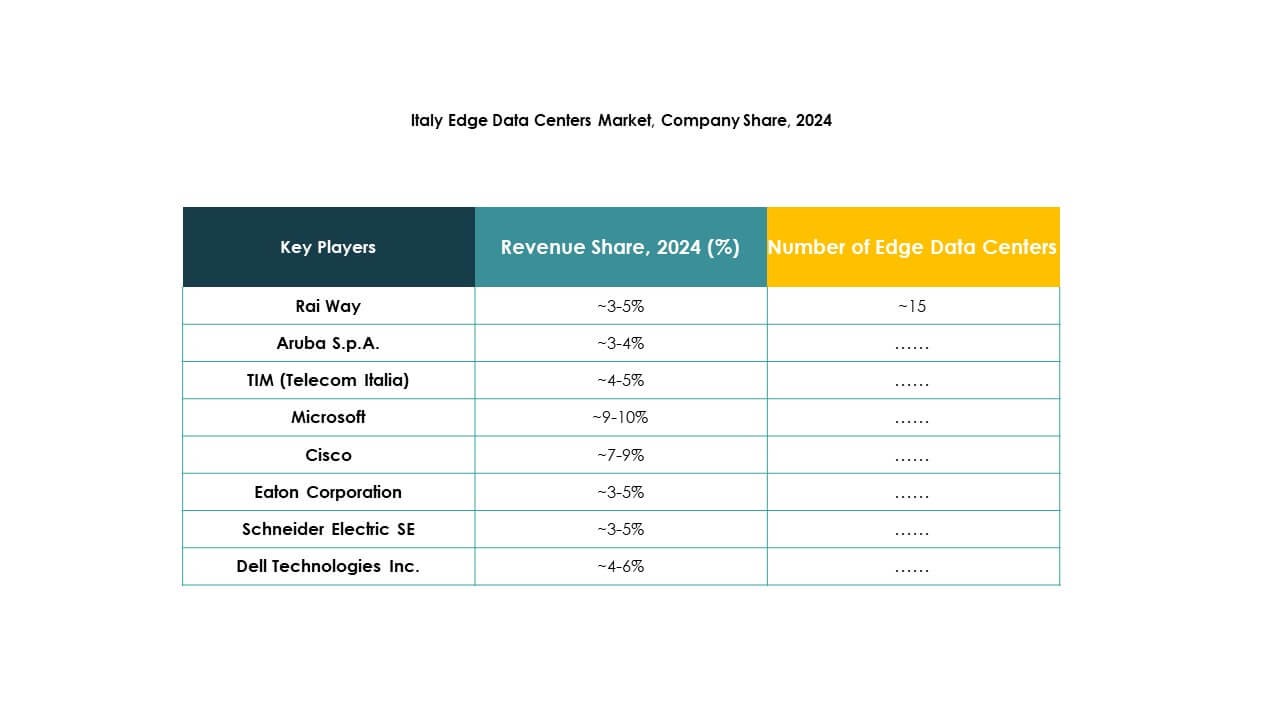

Competitive Insights:

- Rai Way

• Aruba S.p.A.

• TIM (Telecom Italia)

• EdgeConneX

• Eaton Corporation

• Dell Technologies Inc.

• Fujitsu

• Cisco

• SixSq

• Microsoft

• VMware

• Schneider Electric SE

• Rittal GmbH & Co. KG

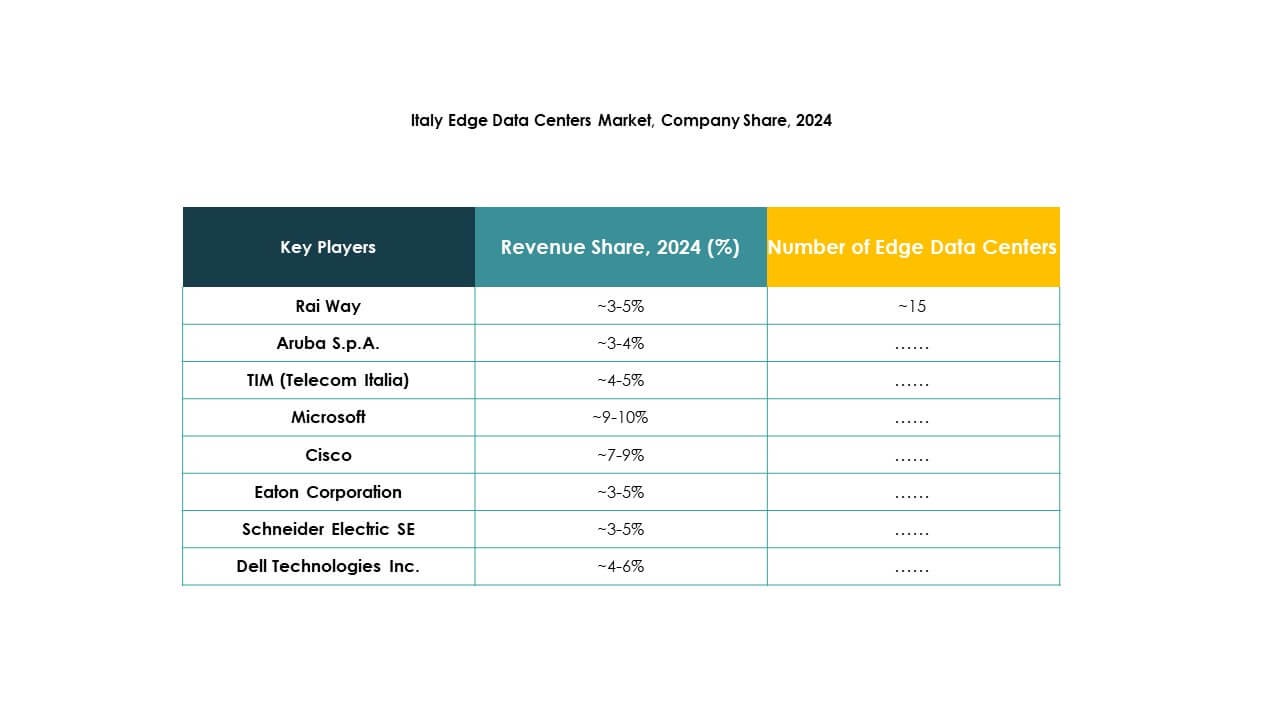

The Italy Edge Data Center Market features strong competition driven by telecom operators, IT service providers, and infrastructure specialists. Companies focus on expanding edge facilities to meet low-latency and high-bandwidth requirements for 5G, IoT, and AI applications. Rai Way and TIM strengthen their national network coverage, while Aruba S.p.A. invests in green and modular data centers. Global players like Microsoft, Cisco, and Dell Technologies enhance interoperability and hybrid cloud solutions. Schneider Electric and Rittal lead in energy-efficient hardware and cooling systems. EdgeConneX and SixSq focus on software-defined edge platforms that optimize workload performance. It continues to evolve with strategic collaborations, mergers, and R&D investments supporting sustainable digital infrastructure growth.

Recent Developments:

- In October 2025, Gcore, known for its edge AI and cloud solutions, introduced the AI Cloud Stack, a next-generation platform designed to accelerate private AI cloud adoption for Italian enterprises and hyperscalers with advanced, hyperscaler-grade functionality.

- In October 2024, Aruba S.p.A. officially inaugurated its Hyper Cloud Data Centre campus in Rome, significantly expanding its infrastructure footprint in Italy. The new site features five independent data centers scheduled to be fully operational by the first half of 2025, further solidifying Aruba’s position as a leading provider of hyperscale and edge data center services.

- In September 2025, Open Fiber launched a new edge data center facility outside Pescara, marking its third major edge site in Italy, with plans for at least a dozen more such facilities to strengthen regional low-latency computing infrastructure.

- In September 2025, Eaton Corporation accelerated its data center solutions for AI workloads in partnership with NVIDIA. This collaboration aims to help Italian and global data centers transition to high-voltage direct current (HVDC) power infrastructure capable of supporting advanced training and inference workloads in the edge computing era.

Regional Insights

Regional Insights