Executive summary:

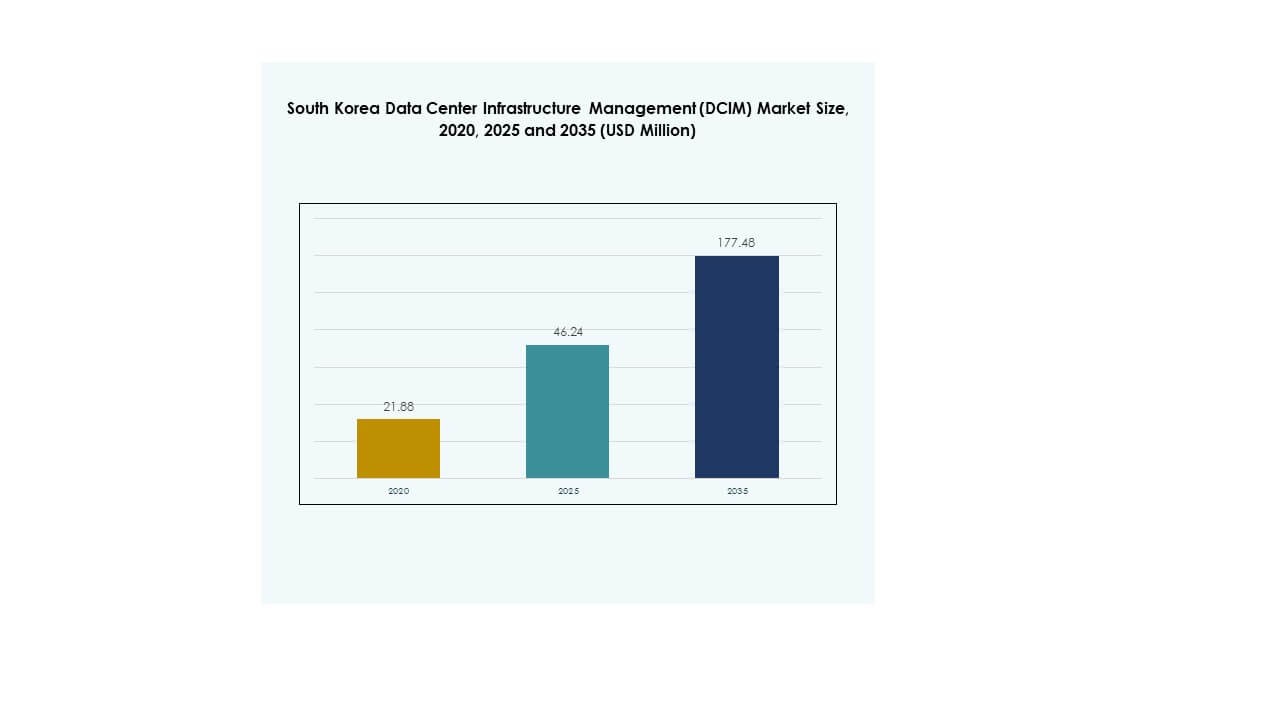

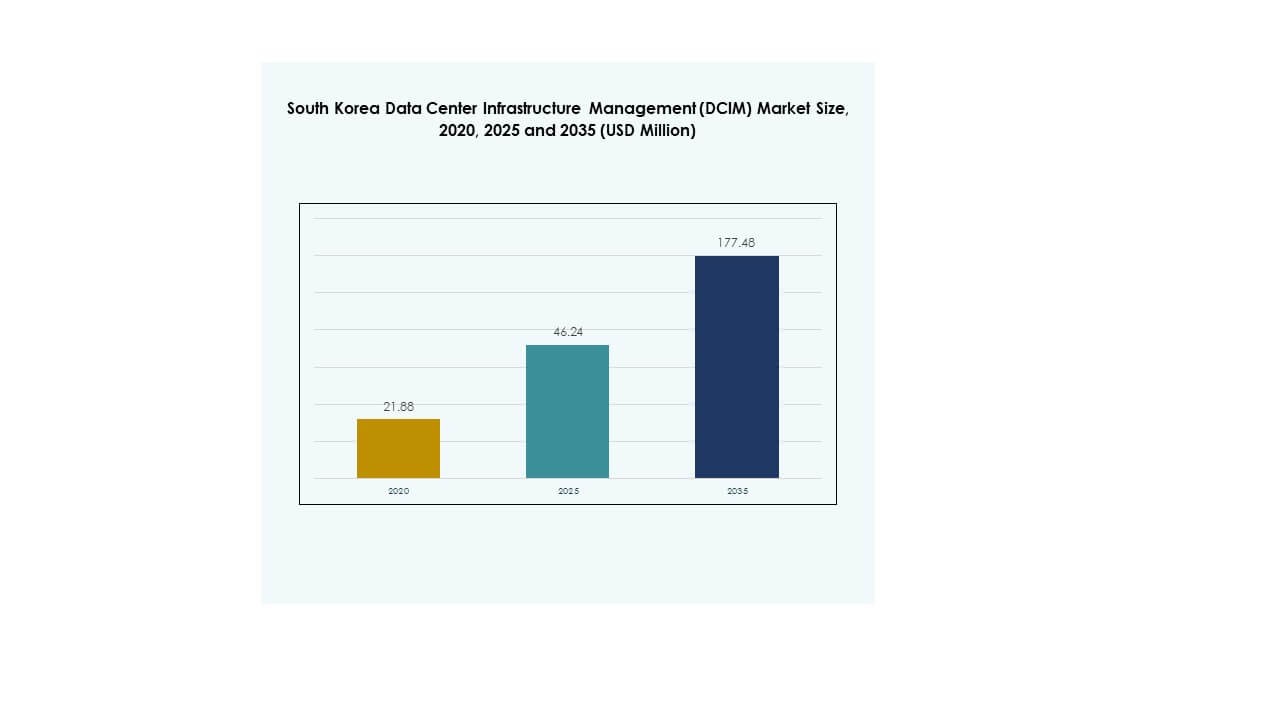

The South Korea Data Center Infrastructure Management (DCIM) Market size was valued at USD 21.88 million in 2020 to USD 46.24 million in 2025 and is anticipated to reach USD 177.48 million by 2035, at a CAGR of 16.16% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| South Korea Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 46.24 Million |

| South Korea Data Center Infrastructure Management (DCIM) Market, CAGR |

16.16% |

| South Korea Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 177.48 Million |

Market growth is driven by rapid adoption of cloud computing, AI-powered monitoring, and edge data center expansion. Enterprises are integrating advanced automation to enhance energy efficiency and operational control. The shift toward hybrid ecosystems highlights its role in ensuring resilience and uptime for critical operations. For businesses and investors, it represents a strategic growth sector that aligns with South Korea’s national focus on digital innovation and infrastructure modernization.

Regionally, South Korea stands as a leading hub in Asia-Pacific due to robust IT infrastructure, government-backed initiatives, and investments from hyperscale providers. Neighboring countries like Japan and Singapore also demonstrate strong adoption with advanced telecom and cloud ecosystems. Emerging markets across Southeast Asia are following, supported by rising digital transformation initiatives. This positioning ensures South Korea remains a critical anchor for regional data infrastructure development.

Market Drivers

Rapid Technology Adoption and Integration of Advanced Infrastructure Tools

The South Korea Data Center Infrastructure Management (DCIM) Market is expanding with fast adoption of cloud, IoT, and AI-driven solutions. Companies focus on operational efficiency by using advanced monitoring and automation tools. It allows enterprises to lower costs while improving energy optimization across facilities. Investors view the sector as highly strategic due to its long-term growth potential. Enterprises adopt these solutions to manage workloads effectively in data-heavy environments. Demand is rising in industries shifting toward digital-first strategies. It creates a strong ecosystem of technology providers and end users. Market growth links directly with South Korea’s broader digital economy agenda.

- For instance, Samsung SDS unveiled its “AI Full-stack” strategy at REAL Summit 2025 in Seoul, presenting integrated AI services across infrastructure, consulting, platforms, and solutions to accelerate enterprise digital transformation in South Korea.

Innovation in Energy Efficiency and Sustainability Solutions Driving Adoption

Sustainability drives innovation within the South Korea Data Center Infrastructure Management (DCIM) Market as firms aim to reduce energy waste. Operators adopt smart cooling, renewable integration, and AI-based efficiency tools. It improves PUE and reduces operational risks tied to rising energy costs. Government regulations on carbon reduction make efficiency investments a necessity. Global players expand portfolios to meet local sustainability goals. Energy optimization is a critical selling point for investors and enterprises. Strong collaboration between technology providers and energy regulators accelerates adoption. Sustainability is now positioned as both a cost and risk management driver.

Strategic Importance of DCIM Solutions for Business Continuity and Competitiveness

Enterprises in the South Korea Data Center Infrastructure Management (DCIM) Market focus on DCIM to maintain continuity and competitiveness. It ensures systems are resilient against failures and cyber risks. Strategic adoption creates visibility over operations, strengthening long-term planning. For investors, reliable DCIM solutions safeguard infrastructure returns. Businesses benefit from reduced downtime and improved service delivery. Organizations can align IT with strategic growth initiatives using these solutions. Demand is high from financial and telecom sectors that prioritize uptime. Strong emphasis on digital resilience highlights its importance as a business differentiator.

- For instance, KT Cloud announced the establishment of its AI Data Center Demonstration Center at the Mok-dong DC 2 Center in Seoul, set for launch in November 2025, to showcase and validate next-generation data center capabilities focused on real-time continuity and resilience for large-scale telecom and financial workloads.

Industry Shifts Toward Hybrid Ecosystems and Intelligent Automation

Shifts toward hybrid environments drive demand in the South Korea Data Center Infrastructure Management (DCIM) Market. Enterprises prefer flexible models integrating cloud, edge, and on-premises data centers. It offers scalability without compromising control. AI-driven automation further supports predictive management and real-time optimization. Global providers introduce hybrid-ready solutions that strengthen resilience. Businesses in manufacturing and e-commerce see it as key to handling traffic surges. Strong demand comes from industries modernizing digital operations. Intelligent ecosystems position DCIM as a central component of South Korea’s digital competitiveness.

Market Trends

Market Trends

Rising Demand for Edge Data Centers and Distributed Infrastructure

The South Korea Data Center Infrastructure Management (DCIM) Market reflects demand for edge computing due to real-time processing needs. Growth of IoT, 5G, and smart city initiatives strengthens this trend. It drives deployment of smaller, distributed facilities supported by DCIM platforms. Edge sites demand higher automation due to limited human oversight. Enterprises focus on localized data handling for performance and compliance. Technology vendors offer DCIM solutions optimized for remote management. It positions edge centers as critical to future infrastructure growth. This shift reshapes strategies of both global and domestic providers.

Integration of AI-Driven Analytics and Predictive Monitoring Capabilities

Analytics and AI are defining the South Korea Data Center Infrastructure Management (DCIM) Market. Predictive capabilities allow enterprises to anticipate system failures and plan responses. It reduces downtime while optimizing workloads. Businesses use AI-driven DCIM platforms to improve resource efficiency. Telecom and cloud providers adopt intelligent monitoring to handle large-scale demand. Vendors enhance software with automated dashboards and alerts. AI integration supports fast decision-making at the operator level. This trend reinforces the role of DCIM in ensuring system stability.

Growing Partnerships Between Global and Local Technology Providers

Collaborations drive growth within the South Korea Data Center Infrastructure Management (DCIM) Market. Local firms gain access to advanced platforms while global players strengthen presence. It creates synergies in customization, compliance, and service delivery. Enterprises benefit from integrated solutions tailored to Korean regulations. Strategic partnerships help scale operations across diverse sectors. Increasing collaborations also expand R&D in sustainability and automation. The partnerships focus on long-term commitments, ensuring technology localization. They reinforce the competitive advantage of South Korea as a regional hub.

Focus on Cybersecurity Integration Within Infrastructure Management Solutions

Cyber resilience is becoming a trend in the South Korea Data Center Infrastructure Management (DCIM) Market. Enterprises recognize vulnerabilities tied to hybrid and distributed models. It increases demand for integrated cybersecurity features within DCIM. Providers incorporate advanced threat detection and compliance tools. Industries such as finance and defense drive this need strongly. Investors prioritize vendors that align with global security standards. Organizations prefer DCIM solutions offering both performance visibility and data security. The trend strengthens market appeal among critical infrastructure operators.

Market Challenges

Market Challenges

High Implementation Costs and Complex Integration Across Diverse Infrastructures

The South Korea Data Center Infrastructure Management (DCIM) Market faces challenges tied to cost and complexity. Initial investments for advanced systems are significant. It creates barriers for small and medium-sized enterprises. Integration with legacy IT infrastructure often requires additional expertise. Businesses face hurdles in aligning operational practices with new tools. The complexity can delay adoption and weaken short-term ROI. Vendors must address these challenges with modular and scalable offerings. High upfront costs remain a key obstacle for broader market penetration.

Shortage of Skilled Professionals and Rising Compliance Requirements

The shortage of skilled professionals impacts the South Korea Data Center Infrastructure Management (DCIM) Market. Expertise is critical for managing hybrid ecosystems and AI-enabled platforms. It hinders organizations from fully utilizing solutions. Rising compliance requirements create additional strain on enterprises. IT teams must balance regulatory alignment with innovation. Lack of talent slows efficiency gains expected from DCIM. Training and workforce development are strategic needs for sustainability. Addressing this issue is essential for maintaining competitiveness.

Market Opportunities

Expansion of Cloud-Based DCIM Platforms to Support SMEs and Large Enterprises

The South Korea Data Center Infrastructure Management (DCIM) Market offers opportunities in cloud-based DCIM platforms. It enables both SMEs and large enterprises to scale flexibly. Growth in subscription models lowers adoption barriers. Vendors can tap expanding demand from businesses seeking agility. It supports cost efficiency for firms managing limited resources. Enterprises embrace cloud adoption to improve uptime and resilience. Service providers gain recurring revenue through SaaS models. Cloud-driven opportunities strengthen the long-term digital ecosystem.

Adoption of Green Data Center Strategies and Renewable Integration

Opportunities exist in sustainable infrastructure within the South Korea Data Center Infrastructure Management (DCIM) Market. Enterprises pursue energy optimization and renewable integration to reduce emissions. Vendors providing eco-friendly tools capture strong demand. It aligns with national sustainability goals and investor priorities. Businesses benefit from reduced operational costs through green initiatives. Growth of ESG-driven investments supports adoption further. Technology suppliers are focusing R&D on smart cooling and renewable support. This opportunity positions sustainability as a critical market growth driver.

Market Segmentation

By Component

In the South Korea Data Center Infrastructure Management (DCIM) Market, solutions dominate due to rising adoption of monitoring and automation platforms. Enterprises use advanced tools for power, asset, and capacity management. It strengthens control and supports predictive decision-making. Services also gain traction as businesses seek specialized integration support. Vendors expand consulting and managed services to complement solutions. Strong reliance on software platforms maintains the dominance of the solutions segment.

By Data Center Type

Enterprise data centers hold a significant share in the South Korea Data Center Infrastructure Management (DCIM) Market. They benefit from advanced monitoring needs and large-scale workloads. Managed and colocation data centers are also expanding due to outsourcing preferences. Cloud and edge data centers experience rapid growth with 5G and IoT adoption. It strengthens hybrid infrastructure demand. Colocation facilities attract investment for their scalability and cost benefits.

By Deployment Model

Cloud-based deployment is expanding in the South Korea Data Center Infrastructure Management (DCIM) Market. Enterprises shift to subscription-driven platforms to optimize costs. On-premises models remain important for security-focused sectors. Hybrid deployment is growing fastest, offering flexibility and control. It enables businesses to balance workloads effectively across environments. Vendors promote hybrid DCIM as an enterprise-ready model. This mix strengthens the long-term outlook for deployment diversity.

By Enterprise Size

Large enterprises dominate the South Korea Data Center Infrastructure Management (DCIM) Market due to their complex infrastructures. These companies require advanced DCIM platforms for efficiency. SMEs are expanding adoption through cloud-based solutions. It lowers costs and supports flexible scaling. Market growth is strongly linked with the digitization of smaller businesses. Vendors create simplified packages to meet SME needs. Both segments show strong momentum, but large enterprises lead adoption.

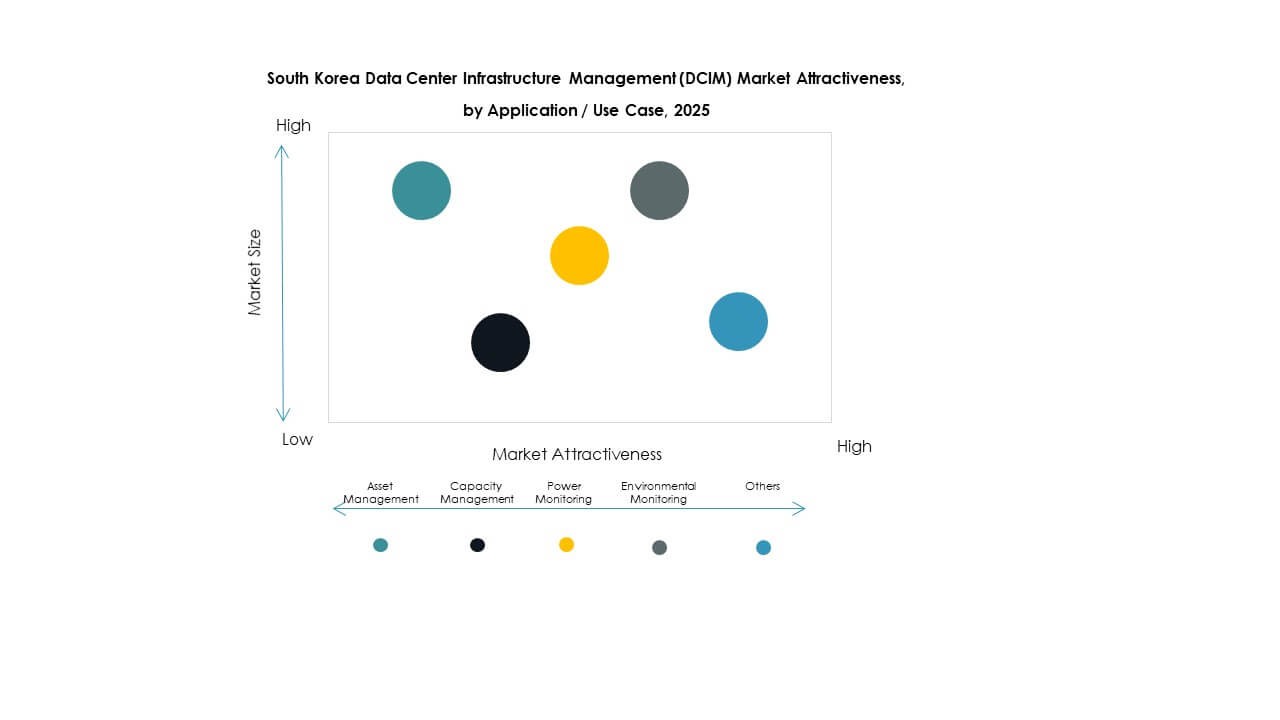

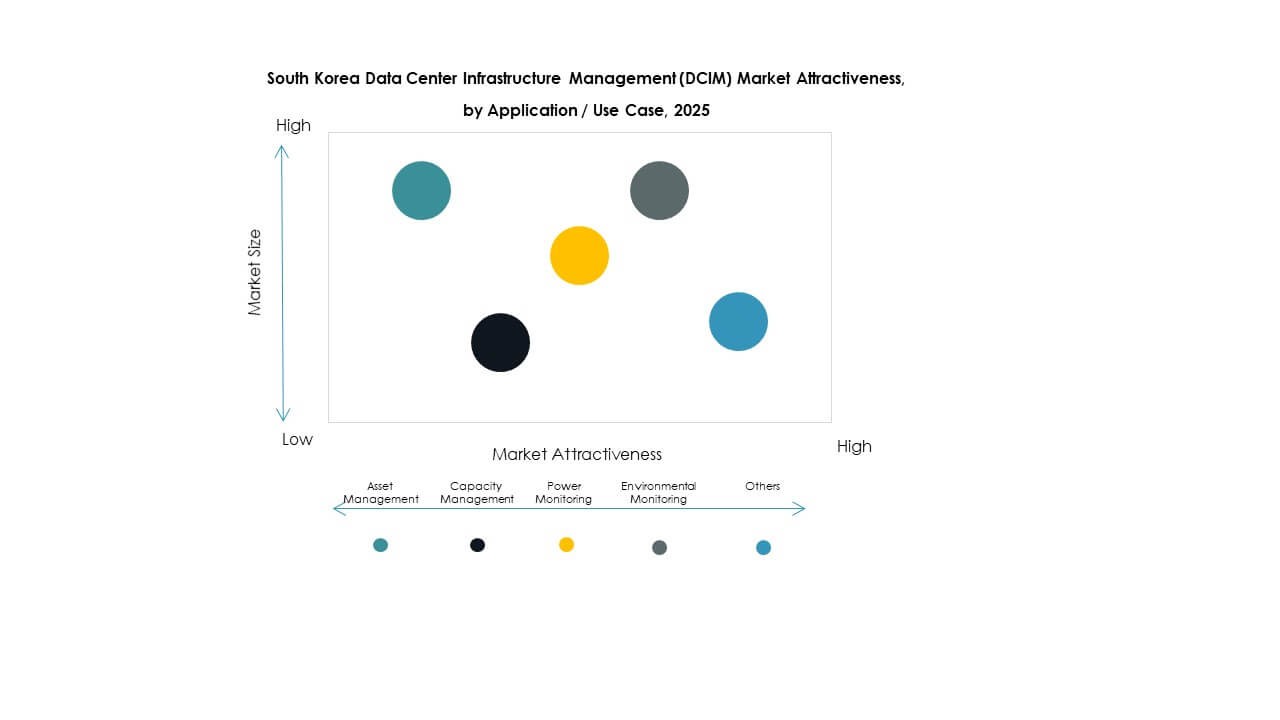

By Application / Use Case

Power monitoring dominates applications in the South Korea Data Center Infrastructure Management (DCIM) Market. It ensures energy optimization and operational reliability. Asset management and capacity management also drive strong adoption. Environmental monitoring grows due to rising sustainability regulations. BI and analysis support decision-making with predictive insights. Each application strengthens operational resilience. Market leadership remains with power monitoring, reflecting the energy efficiency priority.

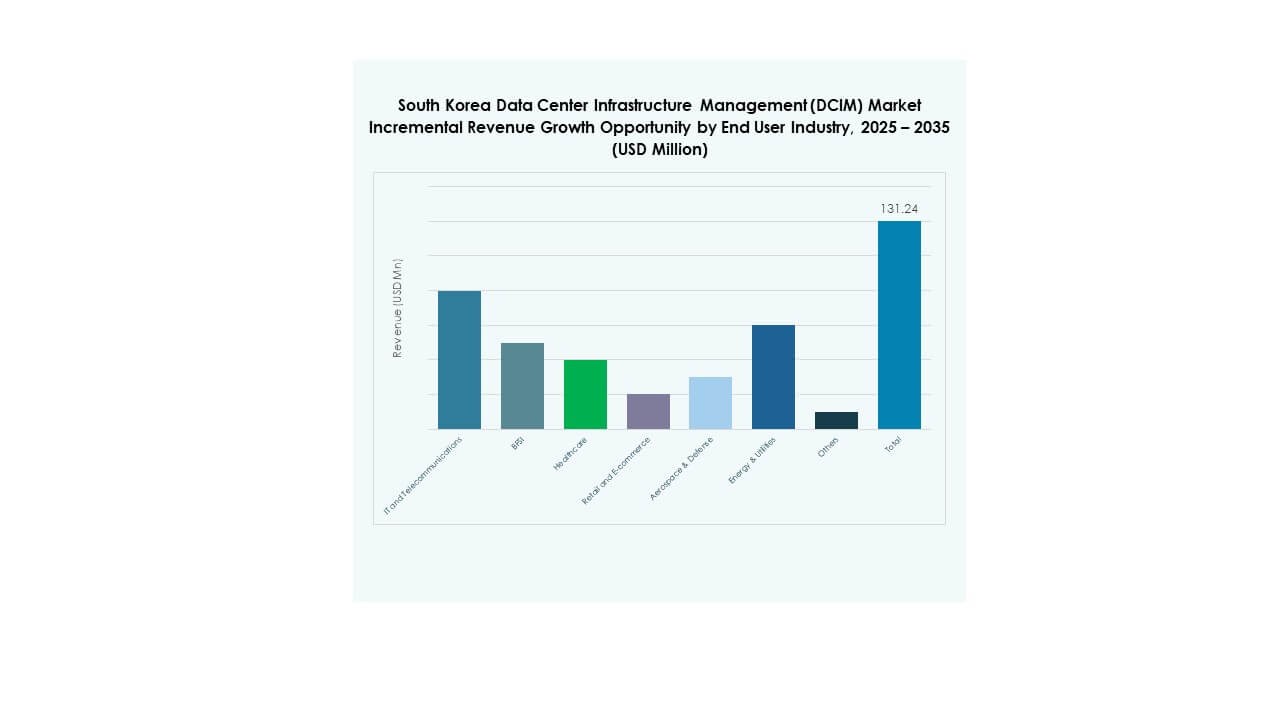

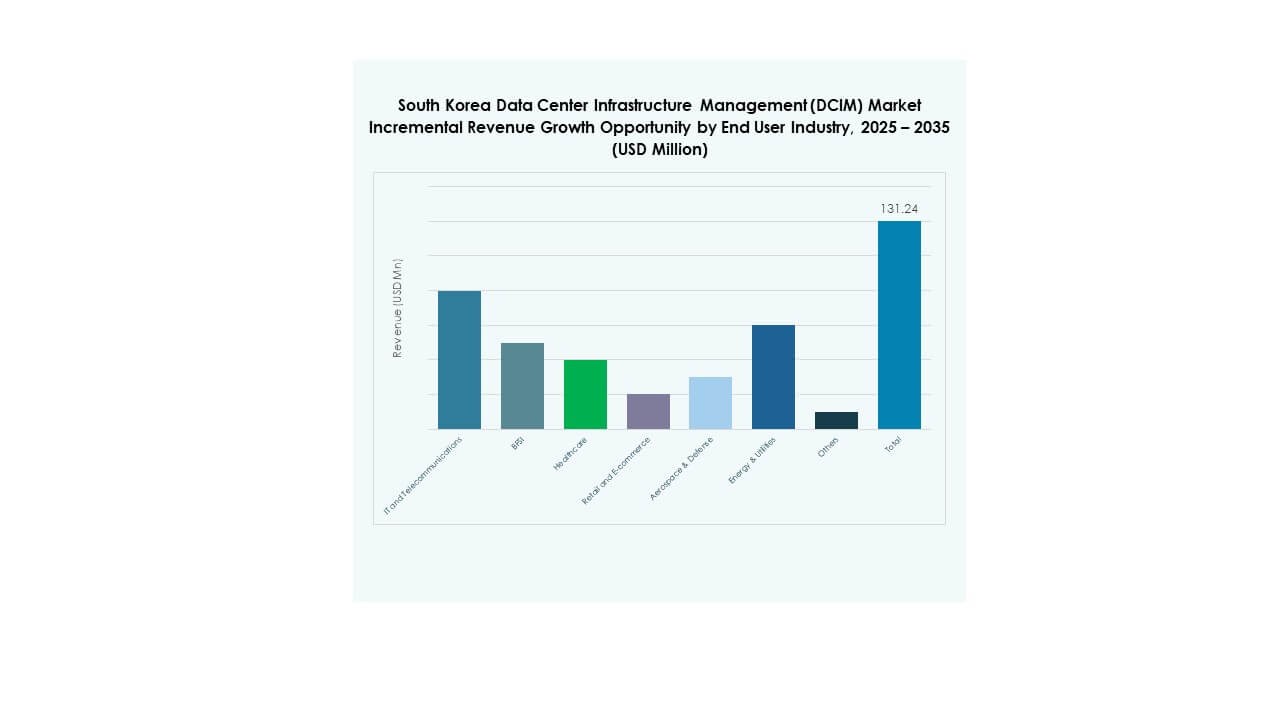

By End User Industry

IT and telecommunications dominate the South Korea Data Center Infrastructure Management (DCIM) Market. Strong reliance on digital infrastructure drives high adoption. BFSI follows with demand for secure and reliable operations. Healthcare and retail expand adoption due to data-intensive applications. Energy and utilities also integrate DCIM for efficiency. Aerospace and defense focus on security-compliant models. Broader adoption across industries highlights DCIM’s versatile role.

Regional Insights

Regional Insights

Seoul Capital Region

The Seoul Capital Region dominates the South Korea Data Center Infrastructure Management (DCIM) Market with a market share of 54%. It hosts the majority of hyperscale and enterprise data centers due to advanced infrastructure and strong connectivity. Global and domestic providers such as Naver Cloud, LG CNS, and Samsung SDS anchor their operations here, driving demand for DCIM platforms. Government digitalization projects and high customer density strengthen growth further. It also benefits from proximity to financial and telecom hubs, where uptime is critical. The concentration of technology and talent reinforces Seoul’s leadership position.

- For instance, Naver opened its GAK Sejong data center campus in late 2023, designed with a capacity to host up to 600,000 servers, strengthening its AI and cloud infrastructure presence in South Korea.

Gyeonggi and Incheon Corridor

The Gyeonggi and Incheon corridor accounts for 28% of the South Korea Data Center Infrastructure Management (DCIM) Market. Large-scale developments in Namyangju and Pyeongtaek expand the subregion’s role in hosting AI-ready facilities. Kakao Corp and global hyperscale firms are actively investing here to balance capacity beyond Seoul. It is supported by favorable land availability and proximity to the capital region. Energy-efficient operations are emphasized, making DCIM tools crucial for optimizing power and cooling. The corridor’s rapid expansion positions it as a secondary hub with strong growth potential.

- For instance, Kakao Corp completed construction of the Kakao Data Center in Ansan, Gyeonggi Province in September 2023, supporting advanced AI workloads with an annual capacity exceeding 100,000 servers and a power usage effectiveness (PUE) rating below 1.4, which directly addresses energy efficiency and scalable infrastructure for hyperscale operations in the corridor

Busan and Regional South Korea

Busan and other southern regions hold 18% of the South Korea Data Center Infrastructure Management (DCIM) Market. Busan Global Cloud Data Center by LG CNS is a flagship example, recognized for sustainability and renewable integration. This region benefits from strategic positioning near undersea cable networks, making it vital for international data flows. It attracts investment in green data centers aligned with RE100 commitments. Strong logistics and port connectivity enhance its competitiveness for global operators. It is expected to grow steadily as enterprises seek geographic diversity and disaster recovery capabilities.

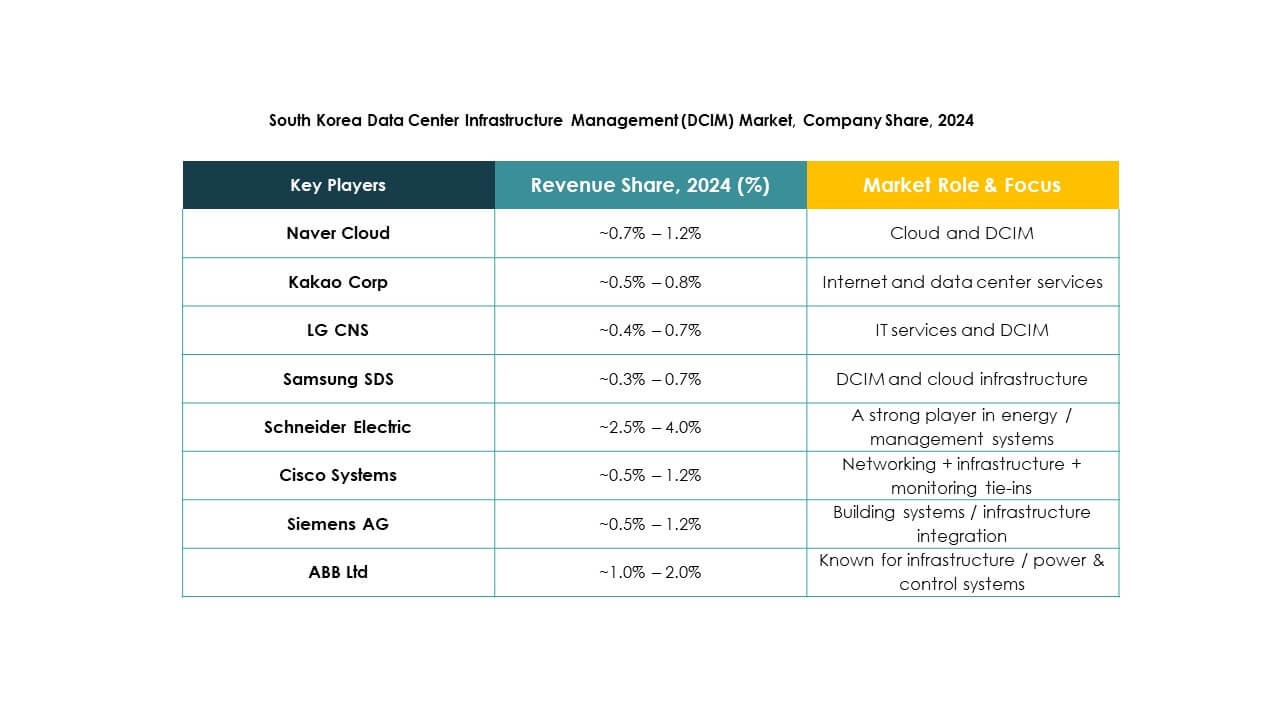

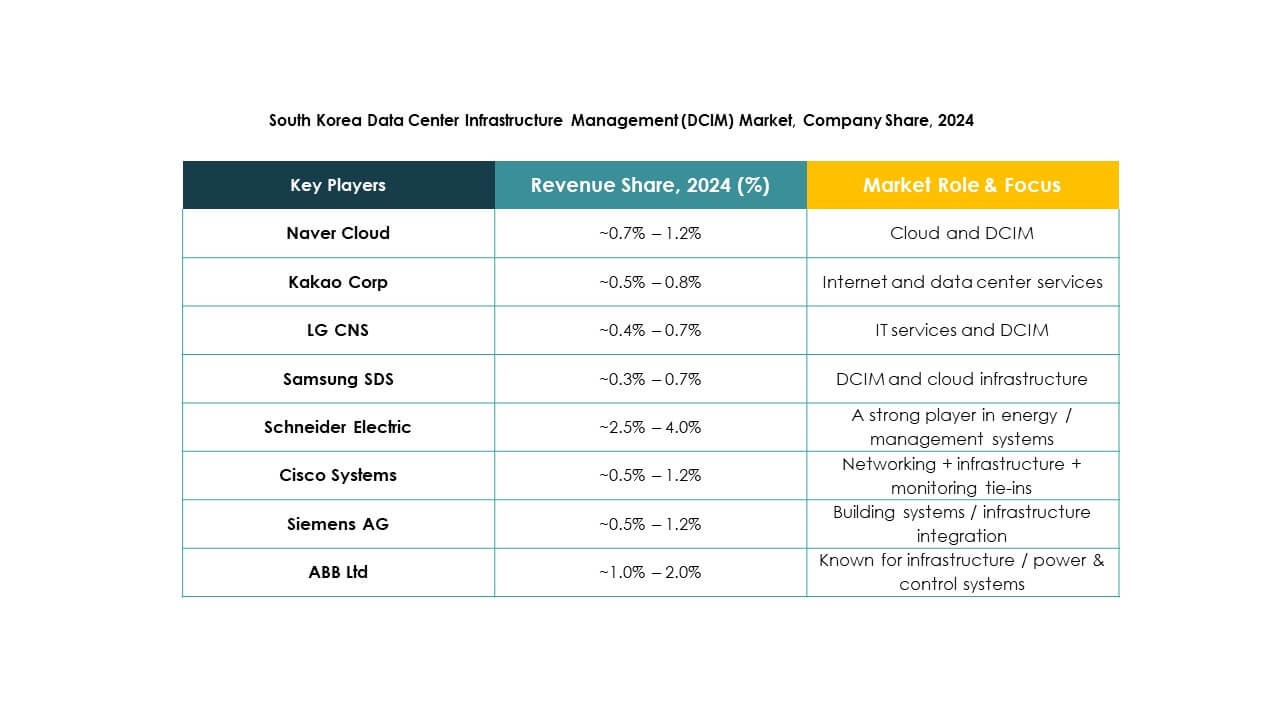

Competitive Insights:

- Naver Cloud

- Kakao Corp

- LG CNS

- Samsung SDS

- ABB Ltd.

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd

- Schneider Electric SE

- Siemens AG

The South Korea Data Center Infrastructure Management (DCIM) Market features strong competition among global technology leaders and domestic digital service providers. Naver Cloud, Kakao Corp, LG CNS, and Samsung SDS strengthen their positions with localized solutions and integration expertise. Global vendors such as ABB, Cisco, Eaton, Huawei, Schneider Electric, and Siemens focus on advanced automation, energy optimization, and hybrid deployment models. It reflects a balanced landscape where global firms deliver technology depth, while local firms drive adaptability and market reach. Competition is marked by product innovation, regulatory compliance alignment, and sustainability commitments. Strategic partnerships and continuous R&D investments remain vital for maintaining differentiation and expanding market presence across high-growth segments.

Recent Developments:

- In September 2025, Naver Cloud signed a memorandum of understanding with SK hynix to jointly develop and optimize next-generation AI memory and storage products at Naver Cloud’s actual AI service environment, showcasing a significant collaboration aimed at advancing AI data center capabilities in South Korea.

- In August 2025, LG CNS announced international expansion by signing a $72 million contract for constructing a hyperscale AI data center in Jakarta, Indonesia. While this deal marks LG CNS’s first overseas project, it highlights the company’s leadership in smart engineering and data center management, which influences its advanced DCIM practices in South Korea.

- In July 2025, Naver Cloud entered into a partnership with LS Electric to integrate AI into data center power systems, focusing on deploying “AI Agents” that enhance ease-of-use and management for power equipment, further progressing in smart DCIM solutions.

- In June 2025, SK Group, one of South Korea’s leading conglomerates, formed a partnership with Amazon Web Services (AWS) to expand cloud infrastructure across the country with a focus on AI-driven data center development. As part of this collaboration, both companies began construction on a hyperscale, AI-focused data center in Ulsan, which is expected to play a pivotal role in bringing new digital capabilities to the South Korea Data Center Infrastructure Management (DCIM) market.

- In June 2025, Kakao Corp unveiled plans for a new 92,000 square meter data center in Namyangju, Gyeonggi Province, following an agreement with local officials and targeting a 2029 completion date to provide core infrastructure for AI development and stable digital operations.

Market Trends

Market Trends Market Challenges

Market Challenges Regional Insights

Regional Insights