Executive summary:

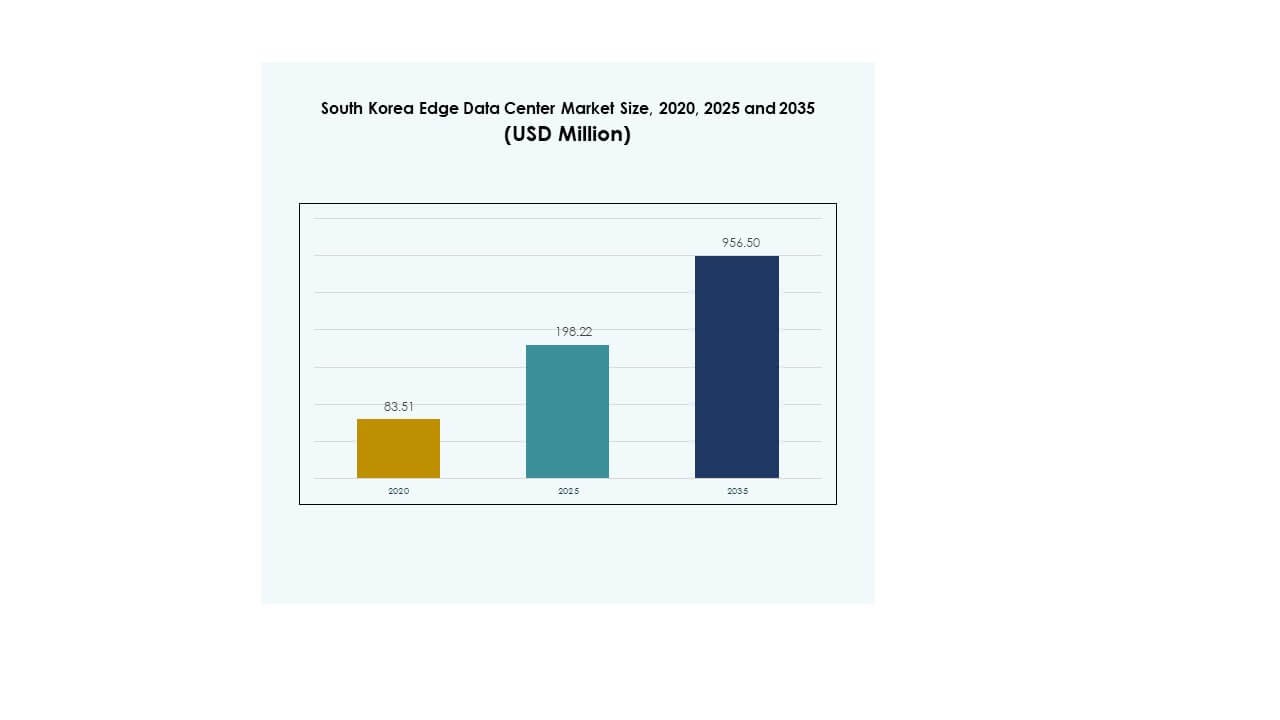

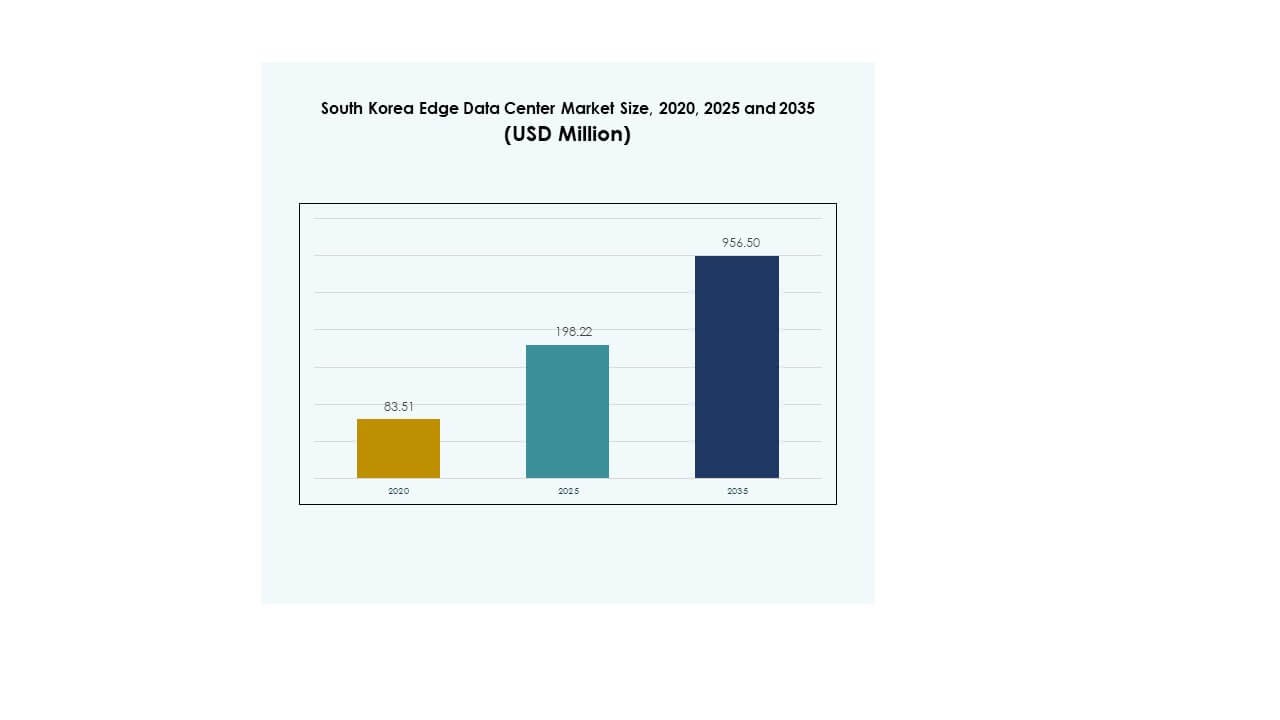

The South Korea Edge Data Center Market size was valued at USD 83.51 million in 2020 to USD 198.22 million in 2025 and is anticipated to reach USD 956.50 million by 2035, at a CAGR of 16.88% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| South Korea Edge Data Center Market Size 2025 |

USD 198.22 Million |

| South Korea Edge Data Center Market, CAGR |

16.88% |

| South Korea Edge Data Center Market Size 2035 |

USD 956.50 Million |

Rapid 5G rollout, AI integration, and cloud expansion are fueling edge infrastructure investments. The market is driven by demand for low-latency data processing and real-time analytics across manufacturing, telecom, and smart city projects. Businesses and investors view this market as strategically vital due to its role in supporting localized computing, data security, and digital transformation initiatives. Innovation in green data centers and automation enhances its long-term sustainability and profitability.

Seoul dominates the South Korea Edge Data Center Market, supported by strong fiber connectivity, dense urban networks, and technology-driven industries. Busan and Incheon are emerging as secondary hubs due to industrial digitization, renewable infrastructure, and strategic trade locations. Regional investments in smart ports, AI logistics, and renewable-powered edge sites strengthen nationwide digital resilience. The country’s balanced regional growth strategy ensures decentralized yet interconnected data infrastructure.

Market Drivers

Growing Adoption of 5G Networks and IoT-Driven Applications

The deployment of 5G networks and expansion of IoT infrastructure are major growth catalysts in the South Korea Edge Data Center Market. Telecom operators and technology companies are investing heavily in localized data processing to reduce latency and support high-bandwidth services. It strengthens real-time analytics and autonomous applications in sectors like transportation and smart cities. Edge nodes near urban areas help improve service quality and optimize connectivity. Businesses leverage faster computing to enhance customer engagement. Investments from SK Telecom and KT Corporation have accelerated edge infrastructure rollouts. The increasing need for cloud-native, decentralized networks sustains continuous demand.

Rise of AI, Cloud Computing, and Data-Intensive Workloads

Artificial intelligence and cloud computing adoption are reshaping the data infrastructure ecosystem. The surge in video analytics, AR/VR, and connected devices fuels strong edge computing requirements. The South Korea Edge Data Center Market benefits from these technological transitions. Localized data centers enable faster data access and improved privacy control. Enterprises prefer edge environments to reduce costs linked with centralized data management. Cloud service providers are integrating distributed models to handle expanding workloads. This digital transformation positions South Korea as a leader in data-centric innovation. The continuous expansion of smart services is strengthening edge ecosystem maturity.

- For instance, in August 2025, SK Group partnered with Amazon Web Services (AWS) to begin construction of an AI-focused data center in Ulsan. The facility will feature large-scale GPU deployment to support advanced AI and edge computing workloads, marking a major milestone in South Korea’s digital infrastructure development.

Government Initiatives Supporting Digital Transformation and Green Infrastructure

South Korea’s government policies emphasize digital inclusion, sustainability, and industrial competitiveness. It has launched programs to support smart manufacturing, cloud innovation, and carbon-neutral data infrastructure. The national digital strategy encourages private-public collaborations for green energy-powered edge facilities. The South Korea Edge Data Center Market benefits from regulatory clarity, efficient zoning, and energy-efficient design standards. These initiatives attract investments from domestic and foreign operators. Local municipalities are offering tax benefits to promote smart grid integration. The policy focus on digital sovereignty ensures secure data localization. Continuous government support sustains long-term infrastructure resilience.

- For instance, in 2022, LG Uplus completed its second hyperscale data center in Anyang, Gyeonggi Province. The facility integrates solar, fuel cell, and geothermal energy systems, achieving annual energy savings of 121 GWh and reducing CO₂ emissions by 55,000 tons, highlighting its commitment to sustainable data infrastructure.

Strategic Importance for Enterprises and Global Investors

Edge computing holds strategic value for global investors targeting Asia’s connected economy. Businesses rely on edge facilities for better latency, scalability, and data security. The South Korea Edge Data Center Market stands as a key investment destination due to advanced connectivity and energy efficiency. It enables companies to support 5G-based consumer and industrial solutions effectively. The sector’s growth enhances digital competitiveness in regional markets. Strategic partnerships between telecoms and hyperscalers are expanding service diversity. For investors, stable regulatory environments and rising data consumption ensure predictable returns. This momentum underlines its strategic relevance across digital ecosystems.

Market Trends

Integration of AI-Driven Automation and Predictive Maintenance Systems

AI-driven automation is transforming the operational efficiency of edge data centers. Intelligent monitoring tools detect performance issues and optimize resource utilization. The South Korea Edge Data Center Market is embracing predictive analytics to prevent downtime and reduce energy waste. Automated cooling and power systems minimize operational costs. Data center operators are integrating robotic systems for infrastructure maintenance. These technologies ensure stable uptime and faster scalability. AI-enabled management enhances precision across edge nodes. The continued integration of smart technologies fosters a self-optimizing infrastructure ecosystem.

Expansion of Modular and Prefabricated Edge Data Center Designs

The growing preference for modular designs allows faster deployment and flexible scalability. Prefabricated data centers can be installed within weeks, supporting rapid digital expansion. The South Korea Edge Data Center Market benefits from this shift in design and construction approach. Modular facilities cater to remote industrial zones and smart city hubs. They reduce installation costs and environmental impact. Local manufacturers are adopting containerized data centers for rural digital access. Prefabrication helps meet time-sensitive deployment needs in telecom and enterprise sectors. It enhances network agility while supporting sustainable construction practices.

Increasing Focus on Renewable and Energy-Efficient Data Centers

Sustainability has become a defining trend within South Korea’s data infrastructure landscape. Operators are investing in solar and wind-powered systems to meet emission targets. The South Korea Edge Data Center Market aligns with the nation’s 2050 carbon neutrality goals. Green building certifications like LEED and RE100 drive infrastructure design. Renewable power integration reduces operating costs and enhances brand reputation. Companies are using advanced cooling technologies to minimize energy usage. Energy efficiency metrics are becoming key investment evaluation criteria. The trend strengthens global investor confidence in sustainable digital infrastructure.

Growing Use of Edge-to-Cloud Integration for Business Agility

Businesses demand seamless data flow between edge networks and cloud ecosystems. The integration supports low-latency applications and real-time analytics for enterprises. The South Korea Edge Data Center Market is witnessing an upsurge in hybrid infrastructure investments. Telecoms and hyperscalers collaborate to expand multi-access edge computing capabilities. This synergy improves scalability and service delivery speed. Companies benefit from cost optimization through data distribution. Hybrid architectures are evolving to manage complex, data-heavy workloads. The adoption of edge-to-cloud synergy defines the next phase of digital transformation.

Market Challenges

High Capital Expenditure and Limited Space for Urban Deployment

Building advanced edge facilities requires substantial investment in technology, security, and power systems. Urban space constraints make it difficult for operators to establish large-scale centers. The South Korea Edge Data Center Market faces challenges related to infrastructure density and zoning laws. Land scarcity in Seoul and metropolitan regions increases leasing costs. Limited real estate availability delays project completion. Power supply reliability adds complexity to deployment planning. Companies are exploring vertical and micro-edge solutions to manage space issues. Financial burden and spatial constraints remain key obstacles for sustainable expansion.

Data Security Concerns and Integration Complexity Across Networks

The increase in data traffic across distributed networks raises cybersecurity and compliance challenges. Protecting sensitive information during real-time transfers remains critical for businesses. The South Korea Edge Data Center Market contends with integration complexity due to hybrid systems. Aligning security protocols across cloud and edge environments demands advanced encryption. Cyber risks linked with AI and IoT systems require robust management frameworks. Operators must ensure compliance with national data protection regulations. Complex interconnections increase operational risks for enterprises. Developing secure, scalable solutions remains a major technical and strategic concern.

Market Opportunities

Rising Demand for Smart Infrastructure and Real-Time Analytics

The shift toward connected industries and smart city initiatives presents strong expansion potential. Enterprises are adopting edge computing for faster decision-making and localized insights. The South Korea Edge Data Center Market benefits from real-time analytics in manufacturing, healthcare, and retail. It supports automation, predictive analytics, and digital twin applications. Businesses are targeting faster data processing for improved operational agility. Demand for low-latency edge facilities is accelerating across industrial zones. This growth offers new partnership and innovation opportunities for service providers.

Strategic Collaborations and Expansion of 5G Ecosystem

Telecom operators and hyperscale providers are forming alliances to extend 5G infrastructure reach. The South Korea Edge Data Center Market supports integration between connectivity and computation layers. It attracts foreign investors seeking stable market conditions and digital maturity. Network providers deploy distributed infrastructure to enhance regional coverage. Cross-sector collaborations encourage shared investment in high-density edge zones. These partnerships strengthen service availability for enterprises and consumers. The expanding 5G ecosystem ensures continuous innovation and new market entrants.

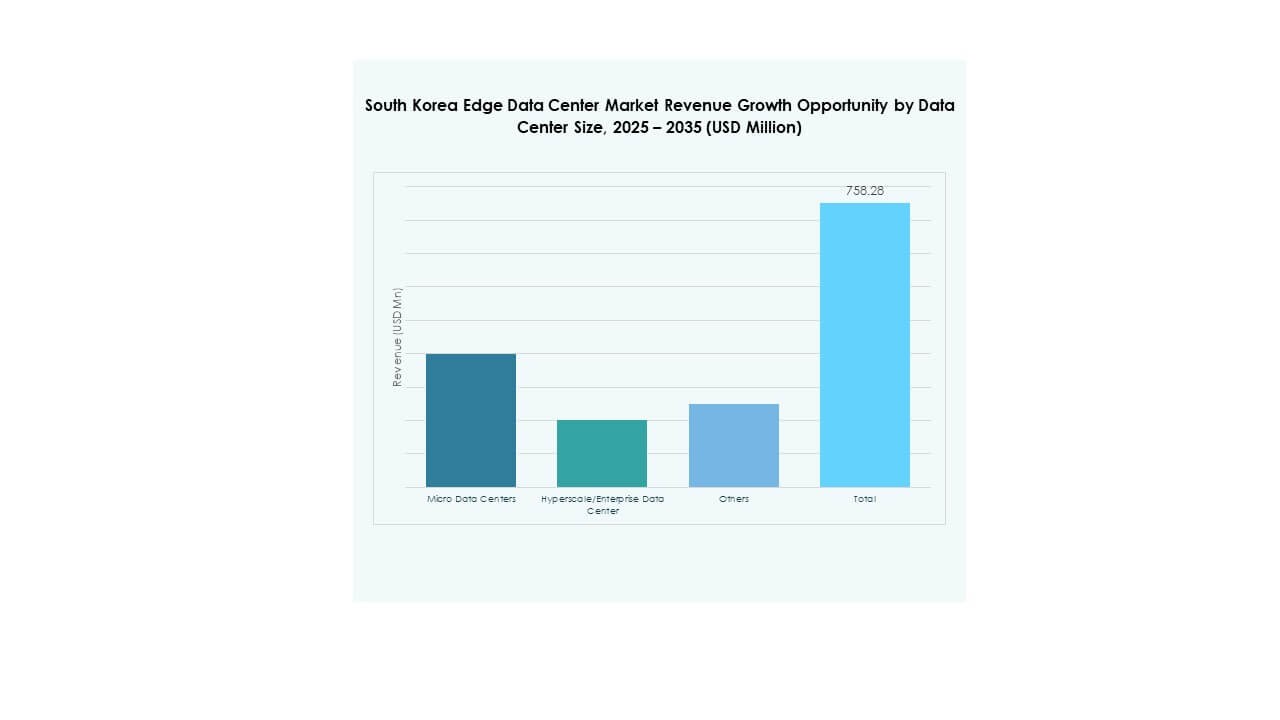

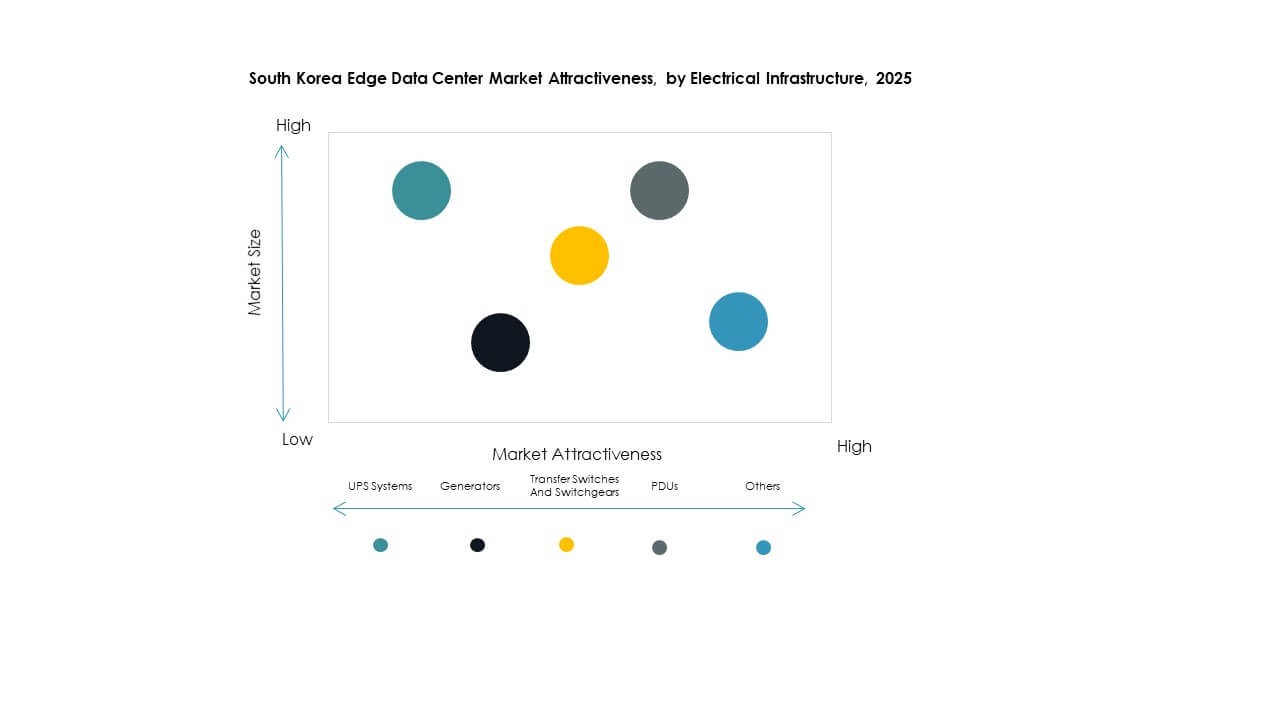

Market Segmentation

By Component

Solutions dominate the South Korea Edge Data Center Market due to strong demand for high-performance computing, storage, and networking equipment. Businesses prioritize infrastructure scalability and low-latency processing systems. Services such as maintenance, consulting, and integration are growing steadily. Vendors focus on offering tailored service packages for cloud migration and infrastructure optimization. Enterprises depend on software-defined systems for flexible deployment. Increasing digital workloads sustain hardware investment. Solution providers are enhancing product portfolios for advanced edge automation.

By Data Center Type

Colocation edge data centers hold a leading share due to enterprise demand for cost-effective, scalable, and secure facilities. Managed and cloud edge centers are growing with rising cloud adoption. The South Korea Edge Data Center Market benefits from partnerships between colocation providers and telecom operators. Enterprises prefer outsourcing infrastructure to focus on core operations. Cloud-based models cater to evolving storage and analytics requirements. Managed service centers support performance monitoring and disaster recovery. Colocation ensures flexibility and reliability in high-density network environments.

By Deployment Model

Hybrid deployment dominates due to its ability to balance control, flexibility, and cost efficiency. The South Korea Edge Data Center Market sees enterprises combining on-premises and cloud resources for optimal performance. On-premises models serve organizations needing high security and compliance. Cloud-based models attract startups and SMEs for their affordability. Hybrid systems enable workload distribution between edge and core networks. The approach ensures redundancy and improves service uptime. Vendors are offering unified management platforms to optimize deployment efficiency.

By Enterprise Size

Large enterprises lead the segment due to higher infrastructure budgets and complex workload demands. The South Korea Edge Data Center Market supports enterprise-scale digital transformation projects. SMEs are rapidly adopting micro-edge facilities to enhance agility and efficiency. Large corporations deploy edge nodes across multiple sites for redundancy. SMEs benefit from cloud-based and colocation services to manage scalability. Both segments depend on real-time data processing for business growth. Investments in IT modernization sustain adoption across all enterprise categories.

By Application / Use Case

Power monitoring and environmental monitoring dominate the use-case segment due to energy optimization requirements. The South Korea Edge Data Center Market emphasizes sustainable operations with advanced management tools. Asset and capacity management tools enhance operational efficiency and uptime. BI and analysis applications are growing with demand for localized insights. Operators use monitoring software for predictive maintenance and compliance reporting. Real-time applications reduce downtime and enhance infrastructure lifespan. Smart automation continues to shape application development priorities.

By End User Industry

IT and telecommunications lead the end-user segment, driven by 5G expansion and data-heavy services. BFSI, healthcare, and retail sectors follow, utilizing localized computing for security and speed. The South Korea Edge Data Center Market benefits from growing industrial and defense applications. Energy and utilities integrate edge systems for grid management and IoT applications. Healthcare providers adopt edge analytics for patient data optimization. Retailers leverage it for real-time inventory control. Demand across multiple sectors ensures balanced growth momentum.

Regional Insights

Seoul Metropolitan Region – Leading Edge Infrastructure Hub (52% Market Share)

Seoul dominates the South Korea Edge Data Center Market due to dense connectivity, population concentration, and advanced technology infrastructure. The region hosts major telecom and cloud providers, including KT, LG U+, and SK Telecom. Its robust fiber network and government-backed innovation zones attract major investments. Proximity to financial, retail, and healthcare hubs supports demand for edge computing. Continuous expansion of 5G coverage and smart city initiatives enhances Seoul’s leadership. The metropolitan area remains the central hub for digital transformation projects.

- For instance, Digital Edge, in partnership with SK Ecoplant, launched the SEL2 data center in Seoul in 2024, delivering 36 MW IT load at Ready-for-Service and forming part of a 100+MW campus in Incheon, with cabinet densities up to 130kW using liquid cooling solutions and market-leading annualized PUE of 1.25, supporting cloud and AI applications.

Busan and Incheon – Emerging Regional Edge Growth Centers (31% Market Share)

Busan and Incheon are emerging as secondary hubs driven by port logistics, industrial automation, and renewable infrastructure integration. The South Korea Edge Data Center Market is expanding in these cities due to strategic coastal locations and trade-driven industries. Investments in data connectivity and low-latency services are strengthening their roles in national infrastructure. Busan’s smart port initiative encourages deployment of localized computing for supply chain management. Incheon benefits from proximity to major transport routes and airports. Both cities are integral to Korea’s decentralized data expansion strategy.

- For instance, Busan New Port’s Phase 2-4 terminal expansion in 2025 added 4.7 million TEUs of annual container capacity, introduced automated stacking cranes (ASCs), and integrated rail with direct links to Seoul, Daejeon, and Gwangju, fundamentally modernizing logistics and supply chain efficiency. Digital Edge also acquired a major site in Bupyeong-gu, Incheon, to develop South Korea’s largest data center campus at 120 MW capacity, forging a strategic partnership with SK Ecoplant and enabling carrier dense connectivity extension between Incheon and Seoul’s major business districts.

Daegu, Daejeon, and Gwangju – High-Tech Development Corridors (17% Market Share)

These inland cities are evolving into high-tech clusters for industrial and R&D applications. The South Korea Edge Data Center Market benefits from university partnerships and government incentives promoting smart manufacturing. Edge nodes in these regions support AI-driven production and renewable energy systems. Daejeon’s science complex fosters collaboration between public institutions and startups. Gwangju and Daegu are advancing digital infrastructure to support local industries. The push toward balanced regional growth ensures equitable access to edge computing nationwide.

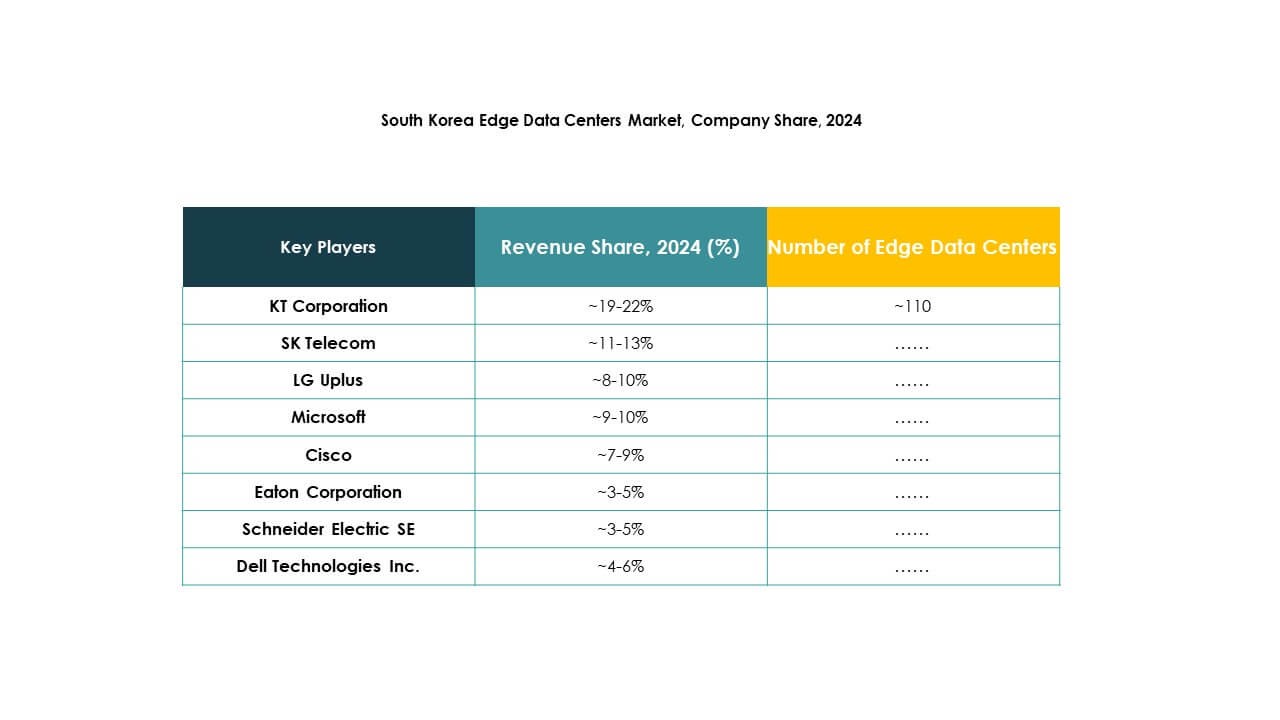

Competitive Insights:

- KT Corporation

- SK Telecom

- LG Uplus

- CJ HelloVision

- EdgeConneX

- Eaton Corporation

- Dell Technologies Inc.

- Fujitsu

- Cisco

- SixSq

- Microsoft

- VMware

- Schneider Electric SE

- Rittal GmbH & Co. KG

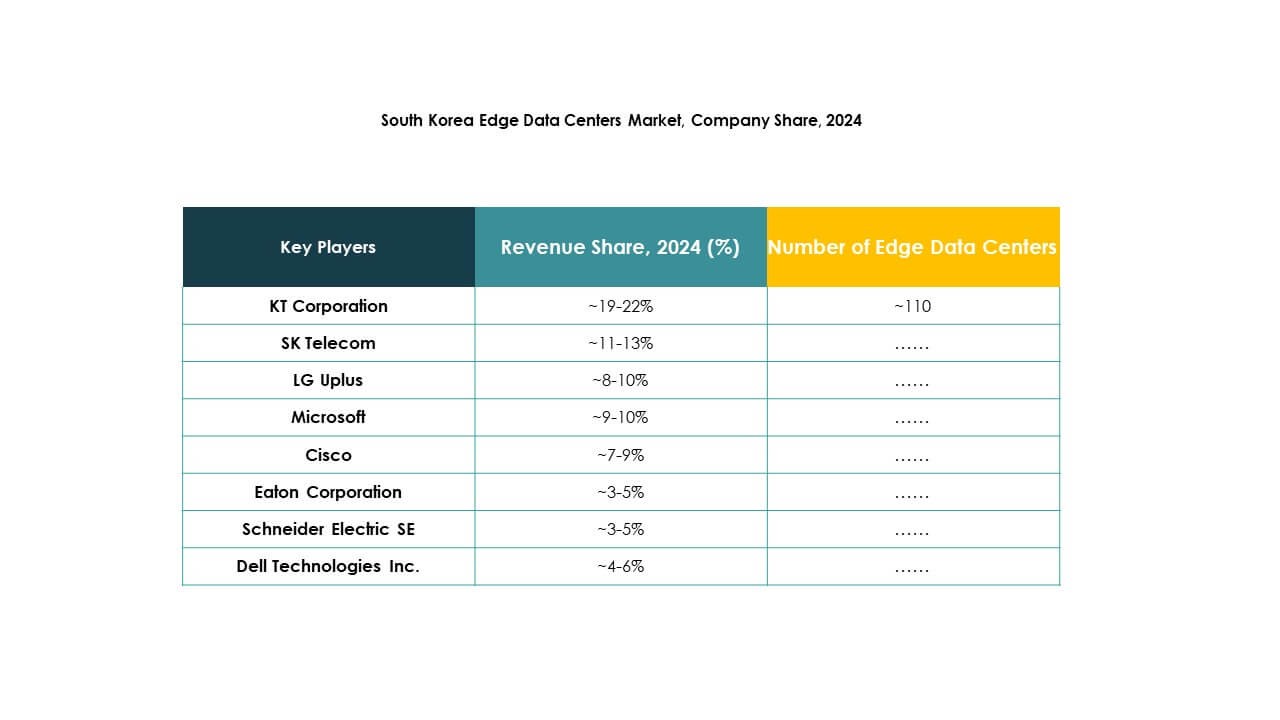

The South Korea Edge Data Center Market features a balanced mix of telecom giants, IT solution providers, and infrastructure specialists. KT Corporation, SK Telecom, and LG Uplus lead the market through extensive 5G and edge integration projects. Global players like Cisco, Dell Technologies, and Microsoft focus on modular and hybrid computing solutions. Schneider Electric and Rittal emphasize energy-efficient and prefabricated data center designs. EdgeConneX and VMware strengthen localized edge capabilities through partnerships with Korean enterprises. It continues to evolve with growing collaboration between domestic operators and international hyperscalers to enhance capacity, sustainability, and service innovation.

Recent Developments:

- Fujitsu announced in October 2025 an expanded strategic partnership with NVIDIA to deliver full-stack AI infrastructure, focusing on green computing and liquid-cooled data center solutions. This effort aims to reduce power consumption and environmental impact for Korean enterprises adopting advanced AI and cloud services.

- In July 2025, LG Uplus began a pilot project to test AI-powered cooling technologies for its data centers. This initiative is a collaboration with LG Electronics and LG CNS, leveraging AI-based controls to optimize cooling efficiency and support the growing demand for energy-efficient, high-performance data centers amidst the rise of AI applications.

- In June 2025, KT Corporation has taken a major step forward with the launch of its Gyeongbuk AI Cloud Data Center in Yecheon-gun. This advanced facility, created in partnership with Gyeongsangbuk-do and Yecheon County, focuses on supporting AI workloads and resilient cloud services, aiming to decentralize South Korea’s data infrastructure and boost economic growth regionally.