Executive summary:

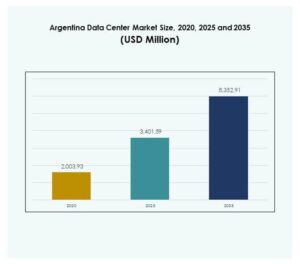

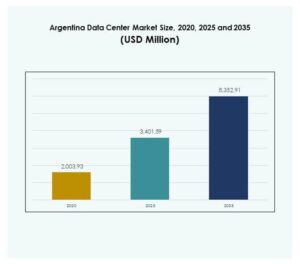

The Argentina Data Center Market size was valued at USD 2,003.93 million in 2020 to USD 3,401.59 million in 2025 and is anticipated to reach USD 8,352.91 million by 2035, at a CAGR of 9.35% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Argentina Data Center Market Size 2025 |

USD 3,401.59 Million |

| Argentina Data Center Market, CAGR |

15.33% |

| Argentina Data Center Market Size 2035 |

USD 8,352.91 Million |

Growth in the Argentina Data Center Market is driven by strong adoption of cloud services, rapid digital transformation across enterprises, and increasing demand for scalable IT infrastructure. Innovation in edge computing, automation, and artificial intelligence integration is reshaping operations, while sustainability goals are influencing design and energy efficiency. The market holds strategic importance as businesses and investors focus on Argentina’s role in enabling secure, reliable, and future-ready digital ecosystems.

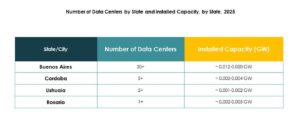

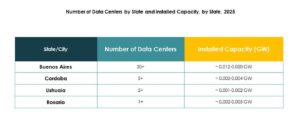

Regionally, Buenos Aires leads as the core hub due to robust connectivity, enterprise concentration, and established infrastructure. Northern Argentina is emerging with rising demand for modular and edge facilities, serving telecom and retail expansion. Southern Argentina is gaining traction through renewable integration, making it attractive for sustainable data centers. This regional diversity strengthens Argentina’s position as a competitive player in Latin America.

Market Drivers

Growing Role of Digital Transformation and Cloud Computing in Expanding Infrastructure

Digital transformation continues to push enterprises toward advanced IT infrastructure, driving demand for scalable and reliable data centers. Argentina’s growing adoption of cloud computing across BFSI, retail, and government sectors accelerates infrastructure development. Companies rely on modern facilities to reduce latency and improve customer experience. The Argentina Data Center Market benefits from strategic investment in hybrid models that balance cost efficiency with security. It is also shaped by the digital-first strategies of local and international firms. Enterprises seek solutions that support business continuity and faster time-to-market. Data security regulations further strengthen the push for advanced centers. Together, these forces make Argentina a strong hub for digital services.

Rising Importance of Innovation Through Edge Computing and Artificial Intelligence Integration

Emerging technologies such as edge computing and AI integration are redefining how data centers operate. Edge facilities bring data closer to end users, supporting low-latency services across healthcare, telecom, and e-commerce. The Argentina Data Center Market gains significance through AI-driven predictive maintenance and energy optimization. It is fostering a competitive edge for operators who can deliver faster, smarter, and more sustainable services. Businesses see value in adopting automation tools that improve efficiency and reduce operational risks. AI is also driving new standards for compliance and monitoring. The integration of advanced analytics strengthens decision-making across industries. This wave of innovation makes data centers essential for enterprise growth.

Expansion of Global Connectivity and Strategic Positioning for Business Growth

Argentina’s strategic location in Latin America boosts its role as a connectivity hub. International firms are increasing investments in subsea cables and high-speed networks to enhance capacity. The Argentina Data Center Market benefits from this expansion, enabling better connectivity to North America and Europe. It is also supported by enterprises seeking to leverage Argentina as a regional data hub. Businesses are drawn by the competitive costs of infrastructure compared to other markets. Strong internet penetration drives further adoption of data-intensive services. Government backing for digital initiatives strengthens infrastructure upgrades. Investors view Argentina as a gateway to regional opportunities.

- For instance, in April 2024, Google’s Firmina subsea cable landed at Las Toninas, Argentina, delivering up to 240 Tbps capacity and establishing a direct link between the U.S. and Argentina, according to Google and subsea network operators.

Sustainability Commitments and the Shift Toward Green Data Center Solutions

Sustainability is becoming a key driver of infrastructure investments across the region. Operators are introducing renewable energy integration, efficient cooling technologies, and modular systems. The Argentina Data Center Market responds by adopting energy-efficient designs that reduce carbon footprints. It is shaping corporate ESG strategies, making data centers central to environmental goals. Enterprises demand facilities that balance performance with sustainability. New investments focus on advanced cooling and low-energy hardware. Government policies encourage renewable power adoption in IT infrastructure. This push toward green operations is creating a resilient, forward-looking market.

- For instance, by May 2023, Equinix reported 96% renewable energy coverage for its Buenos Aires data center operations, reflecting a 10-point year-over-year improvement, according to its official sustainability disclosure.

Market Trends

Market Trends

Growing Adoption of Modular and Micro Data Centers for Scalability

Organizations are deploying modular and micro data centers to gain flexibility and cost efficiency. These centers offer quick deployment and adaptability to fluctuating workloads. The Argentina Data Center Market shows growing traction for modular designs in remote areas and tier-two cities. It is supporting businesses that need localized processing capacity. Enterprises prefer modular systems for their reduced upfront investment and faster installation. The trend supports a shift from large-scale facilities to distributed infrastructure. Telecom providers are using micro data centers to enhance 5G services. The modular approach is setting a standard for scalable growth.

Rising Influence of Cloud-Native Applications on Deployment Models

Cloud-native applications are reshaping enterprise deployment strategies across industries. Businesses prioritize hybrid and cloud-based models to enhance agility and control. The Argentina Data Center Market reflects this trend through demand for dynamic infrastructure that supports rapid scaling. It is shaping how enterprises manage IT workloads with improved flexibility. Cloud-native architectures improve disaster recovery and business continuity. The growth of SaaS platforms also strengthens reliance on cloud-ready infrastructure. SMEs see cloud-native adoption as a way to compete with larger players. This alignment is setting new benchmarks for IT modernization.

Focus on Cybersecurity Innovations and Compliance in Data Handling

Rising data volumes require stronger cybersecurity frameworks in data centers. Argentina’s enterprises prioritize solutions that safeguard sensitive financial and healthcare data. The Argentina Data Center Market responds by integrating AI-based threat detection and compliance-driven monitoring systems. It is pushing vendors to adopt zero-trust architectures and real-time monitoring. Enterprises seek facilities that meet both international and regional compliance standards. Stronger cybersecurity positions data centers as reliable partners in digital growth. Managed security services also grow in demand among SMEs. This trend reflects the increasing role of compliance in market expansion.

Adoption of High-Density Computing and Next-Generation Hardware

Data-intensive applications demand higher processing power and storage. Enterprises in Argentina are adopting high-density servers, advanced GPUs, and flash storage systems. The Argentina Data Center Market benefits from facilities designed to support AI workloads and complex analytics. It is enhancing processing capabilities for healthcare imaging, e-commerce analytics, and telecom services. Operators focus on liquid cooling systems to support hardware density. Businesses adopt next-gen servers to manage IoT and big data applications. Vendors are innovating with energy-efficient rack designs to lower operational costs. High-density infrastructure strengthens the long-term resilience of data centers.

Market Challenges

Economic Volatility and High Cost of Infrastructure Development

Argentina faces persistent economic instability that affects large-scale infrastructure projects. The Argentina Data Center Market must navigate challenges such as inflation, currency fluctuations, and limited access to foreign capital. It is harder for smaller operators to fund facility expansion under these conditions. Import taxes and supply chain delays increase the cost of critical hardware. Businesses hesitate to commit to long-term IT investments amid financial uncertainty. Limited investor confidence restricts the pace of expansion. Higher operational costs reduce competitiveness against more stable regional markets. Despite strong demand, financial risks remain a significant barrier.

Skilled Workforce Gaps and Limited Renewable Energy Availability

The lack of a skilled workforce poses challenges in managing advanced facilities. The Argentina Data Center Market requires talent for cybersecurity, AI integration, and hybrid infrastructure management. It is constrained by slow workforce development in specialized IT roles. Operators struggle to retain skilled professionals due to higher offers abroad. Renewable energy adoption also lags behind demand for green facilities. Data centers face rising electricity costs and limited access to sustainable power. This imbalance hinders long-term ESG commitments. Workforce and energy shortages risk slowing market momentum.

Market Opportunities

Growing Regional Demand for Cloud and Colocation Services

Enterprises are turning to colocation and cloud-based models for cost savings and scalability. The Argentina Data Center Market is positioned to benefit from increasing adoption across SMEs and multinational companies. It is supported by the rising need for secure, compliant, and flexible hosting solutions. Local providers are partnering with global players to expand capacity. Investors see value in targeting underserved regions within the country. Hybrid deployment creates opportunities for vendors offering tailored solutions. Demand for low-latency platforms further strengthens colocation growth.

Focus on Renewable Energy Integration and Green Certifications

Sustainability-driven investments open new opportunities for operators. The Argentina Data Center Market shows rising interest in facilities with renewable integration and green certifications. It is helping businesses meet ESG goals while reducing operational costs. Green data centers attract international investors seeking eco-friendly markets. Renewable power also positions Argentina as a regional leader in sustainable IT. The focus on green strategies encourages collaboration between operators and energy providers. Eco-certifications enhance brand credibility for providers targeting global clients.

Market Segmentation

By Component

Hardware dominates the Argentina Data Center Market, driven by growing demand for servers, racks, and cooling systems. Hardware accounts for the largest share as enterprises invest heavily in advanced networking and storage. Software solutions such as DCIM and virtualization tools are gaining traction, enhancing management and automation. Services remain critical for integration, consulting, and managed support. The hardware segment maintains leadership due to its essential role in expanding data-intensive workloads.

By Data Center Type

Hyperscale data centers lead the Argentina Data Center Market, reflecting strong demand from cloud service providers and large enterprises. Colocation facilities hold significant share as SMEs and multinationals prefer outsourcing infrastructure. Enterprise data centers continue to serve industry-specific needs but face slower growth. Edge and modular facilities are gaining traction in remote areas. Mega and internet data centers support global connectivity demands. Hyperscale dominance highlights Argentina’s role in supporting large-scale cloud ecosystems.

By Deployment Model

Cloud-based deployment dominates the Argentina Data Center Market, driven by demand for flexibility, scalability, and lower costs. Hybrid models are gaining momentum as businesses seek a balance between control and efficiency. On-premises deployments remain relevant in government and regulated industries. Cloud platforms also drive innovation through SaaS adoption and data-intensive applications. Hybrid adoption is expanding across BFSI and healthcare, reinforcing multi-model strategies. Cloud-based models maintain dominance due to rapid adoption across all enterprise sizes.

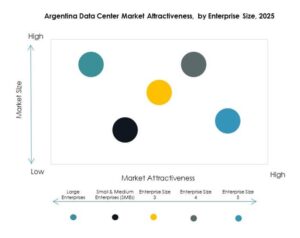

By Enterprise Size

Large enterprises dominate the Argentina Data Center Market with a higher share, given their stronger budgets and larger IT requirements. SMEs contribute significantly through growing cloud adoption and colocation usage. It is becoming easier for smaller businesses to access advanced infrastructure through managed services. SMEs play an important role in expanding market breadth. Large enterprises maintain leadership due to higher data processing and compliance needs. Both segments highlight diverse demand across industries.

By Application / Use Case

IT & Telecom dominate the Argentina Data Center Market due to increasing demand for connectivity and data services. BFSI also represents a large share as financial institutions prioritize secure and compliant hosting. Healthcare and retail sectors adopt digital platforms, driving demand for edge and modular centers. Media and entertainment leverage high-density computing for streaming services. Manufacturing and government sectors invest in secure infrastructure for critical operations. IT & Telecom maintain leadership due to high network reliance.

By End User Industry

Cloud service providers dominate the Argentina Data Center Market, reflecting rapid expansion of cloud-first strategies. Enterprises follow with significant investments in hybrid and colocation facilities. Colocation providers serve SMEs and multinational clients seeking scalability and cost efficiency. Government agencies also contribute with investments in secure and compliant infrastructure. Cloud service providers remain dominant due to their ability to deliver large-scale, flexible platforms.

Regional Insights

Buenos Aires and Central Argentina Leading with Strong Infrastructure Investments

Buenos Aires accounts for 48% of the Argentina Data Center Market share, making it the central hub for infrastructure growth. It is supported by robust connectivity, skilled workforce, and strong enterprise presence. Multinationals prefer this region due to its established digital ecosystem. Data-intensive industries like BFSI and IT services cluster in the capital. Investments in subsea cables also enhance Buenos Aires’s global connectivity. The region continues to dominate with sustained demand.

- For instance, Telecom Argentina was selected to provide the cable landing station and backhaul for the ARBR submarine cable system between Buenos Aires and São Paulo, a 4-fiber pair system with 48 Tbps design capacity, marking Argentina’s first non-incumbent transoceanic cable link, according to credible industry reports.

Northern Argentina Emerging with Rising Demand for Edge Facilities

Northern Argentina holds 32% share of the Argentina Data Center Market, driven by increased adoption of edge and modular facilities. It is emerging as a key growth region for telecom operators and SMEs. Local demand for cloud services and retail e-commerce supports infrastructure expansion. Operators focus on scalable solutions to meet demand outside Buenos Aires. Government projects enhance connectivity in remote areas. Northern Argentina shows strong growth potential.

- For example, Claro Argentina announced a USD 30 million investment in a new 1,300 m² modular data center in Buenos Aires in August 2024, built to Tier III standards. Datawaves completed the assembly of the facility by September 2025.

Southern Argentina Gaining Traction Through Renewable Integration and Specialized Facilities

Southern Argentina represents 20% share of the Argentina Data Center Market, with growing importance due to renewable energy projects. It is becoming attractive for sustainable data center operations. Operators invest in hydro and wind power to support low-carbon facilities. The region also attracts industries seeking specialized hosting in energy and manufacturing. Investments in modular systems support operations in less urbanized areas. Southern Argentina is shaping its role as a sustainability-focused hub.

Competitive Insights:

- Telecom Argentina

- Equinix Argentina

- Telecom Personal

- Level 3 / CenturyLink

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The Argentina Data Center Market is shaped by strong competition between local telecom providers and global cloud giants. Telecom Argentina and Telecom Personal lead in connectivity and enterprise services, supported by large domestic networks. Equinix and Digital Realty Trust expand colocation and interconnection services with robust infrastructure investments. It is also influenced by hyperscale growth from AWS, Microsoft, and Google, which strengthen Argentina’s role in the regional cloud ecosystem. NTT Communications Corporation and Level 3/CenturyLink enhance international connectivity and managed service capabilities. Companies compete through infrastructure expansion, energy efficiency strategies, and partnerships that improve scalability and compliance. The competitive landscape reflects a balance of global expertise and domestic reach, enabling Argentina to attract sustained digital investments.

Recent Developments:

- In September 2025, Telecom Argentina announced an ambitious plan to upgrade all 16 of its national data centers, aiming to expand each site’s capacity to 10MW to support the growing demand for AI workloads and corporate clients. The flagship Pacheco facility near Buenos Aires is already operating at high occupancy, with further expansions planned subject to customer contracts.

- In September 2025, supermarket chain Coto inaugurated a new modular data center in Argentina. This move reflects Coto’s ongoing strategy to optimize IT operations and data management capabilities, helping scale its growing retail business through high-performance, flexible data center infrastructure.

- In August 2025, Cirion Technologies announced a major expansion of its BUE1 Data Center in Buenos Aires, strengthening its commitment to innovation and regional connectivity across Argentina. The development will add over 2MW of capacity and approximately 160 additional racks, specifically designed to meet the rising demands for artificial intelligence workloads and high availability.

Market Trends

Market Trends