Executive summary:

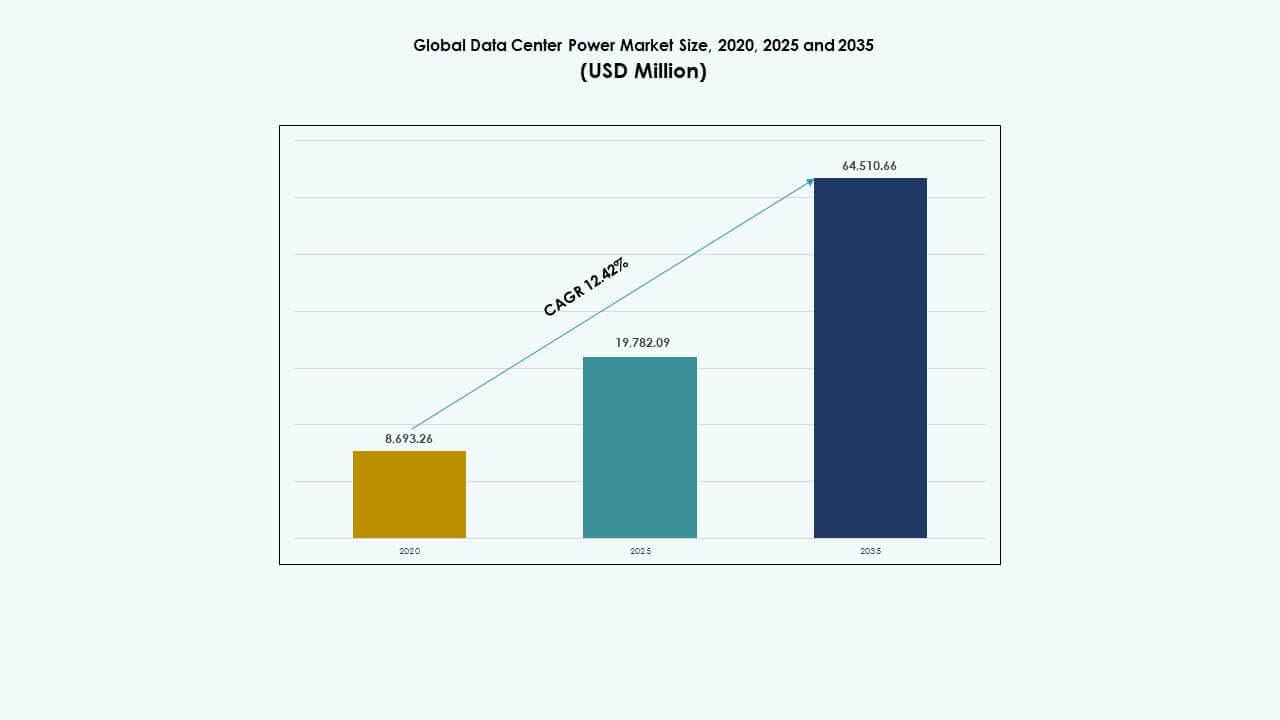

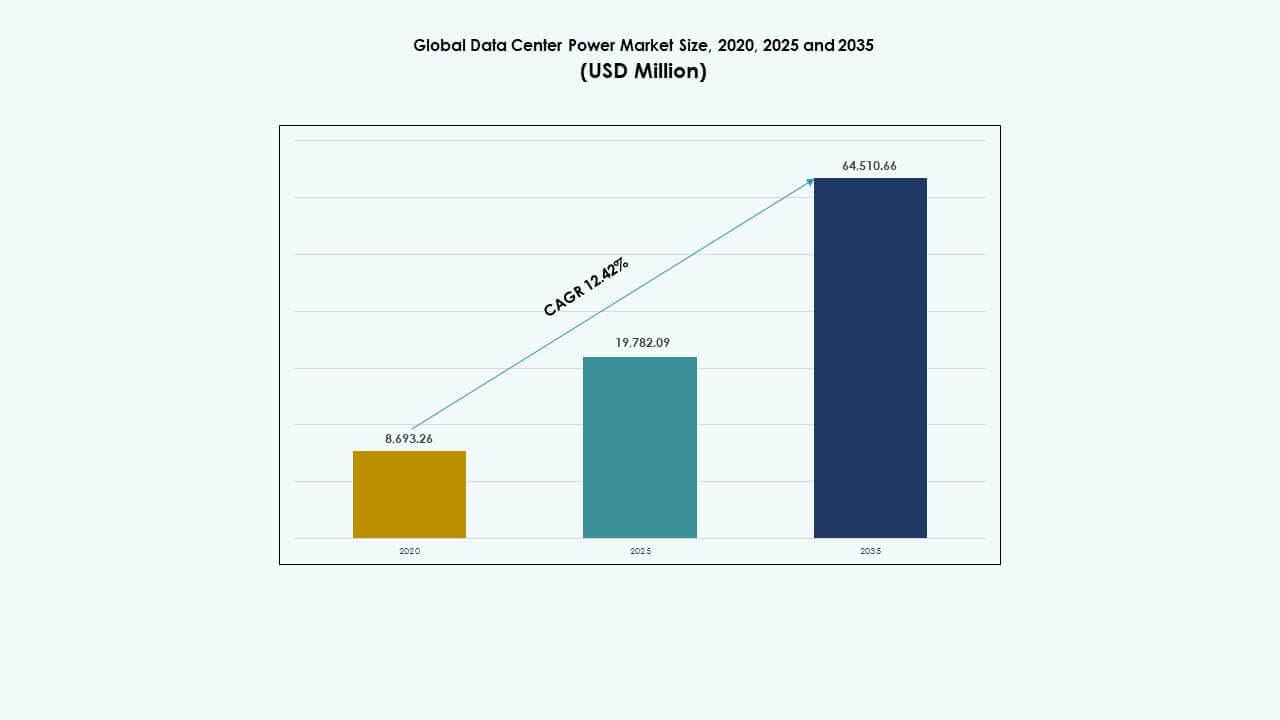

The Global Data Center Power Market size was valued at USD 8,693.26 million in 2020, grew to USD 19,782.09 million in 2025, and is anticipated to reach USD 64,510.66 million by 2035, at a CAGR of 12.42% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Data Center Power Market Size 2025 |

USD 19,782.09 Million |

| Data Center Power Market, CAGR |

12.42% |

| Data Center Power Market Size 2035 |

USD 64,510.66 Million |

The market is gaining momentum due to growing demand for energy-efficient infrastructure, real-time power monitoring, and resilient backup systems. Data centers are shifting toward modular UPS, lithium-ion battery adoption, and software-defined power control to reduce downtime and energy loss. Technology providers invest in intelligent PDUs, hybrid power chains, and predictive maintenance tools. This evolution makes the market critical for businesses aiming to ensure digital service continuity, while investors view it as a high-growth, innovation-driven infrastructure segment with strong long-term value.

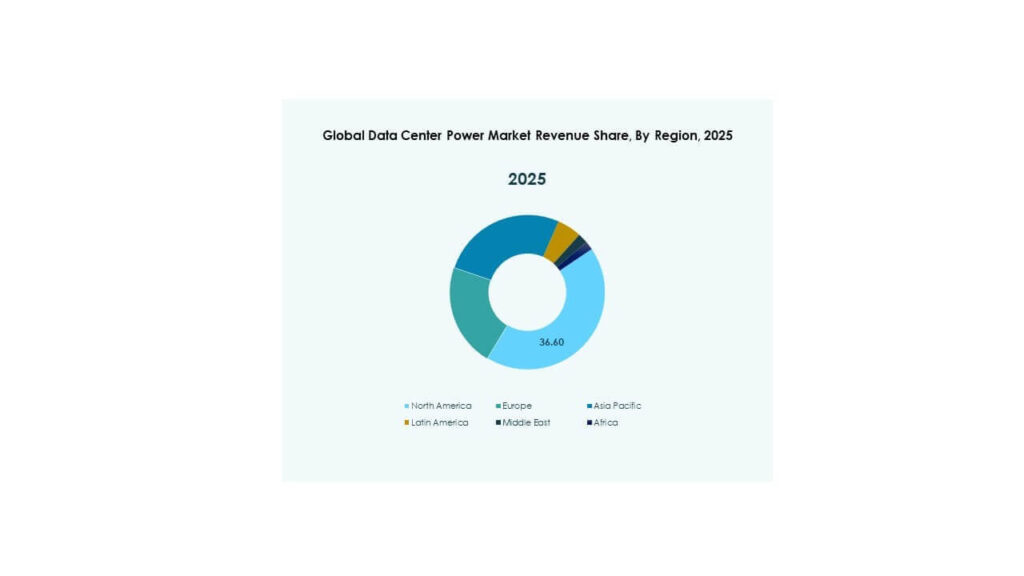

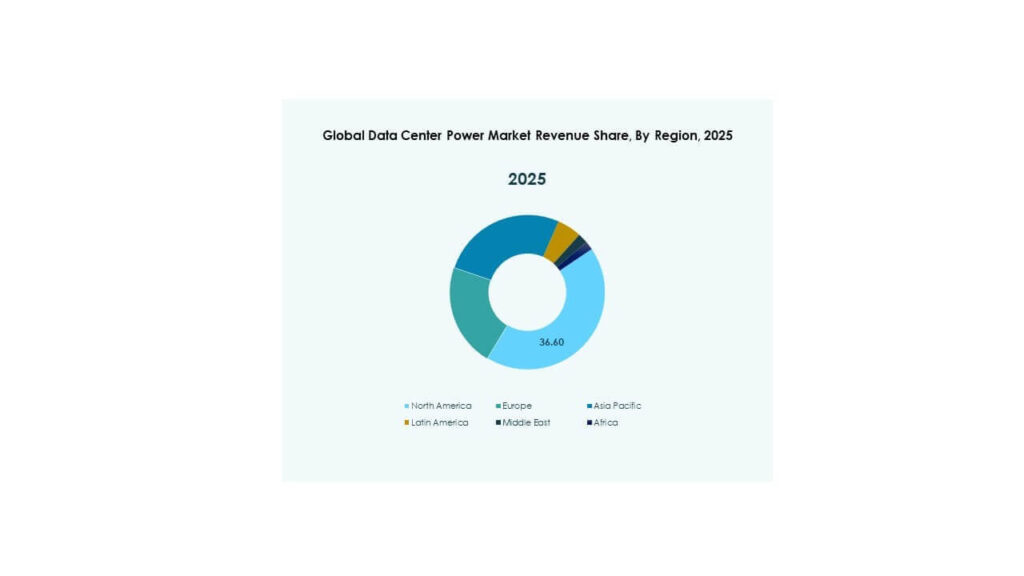

North America leads due to extensive hyperscale investments and mature regulatory frameworks promoting efficient power use. Europe follows with widespread colocation demand and carbon neutrality mandates across major economies. Asia Pacific is emerging rapidly, led by China, India, and Southeast Asia, where governments and cloud providers expand digital infrastructure. Latin America, the Middle East, and Africa show steady growth driven by new data center developments and cloud service adoption, though challenges in grid reliability remain.

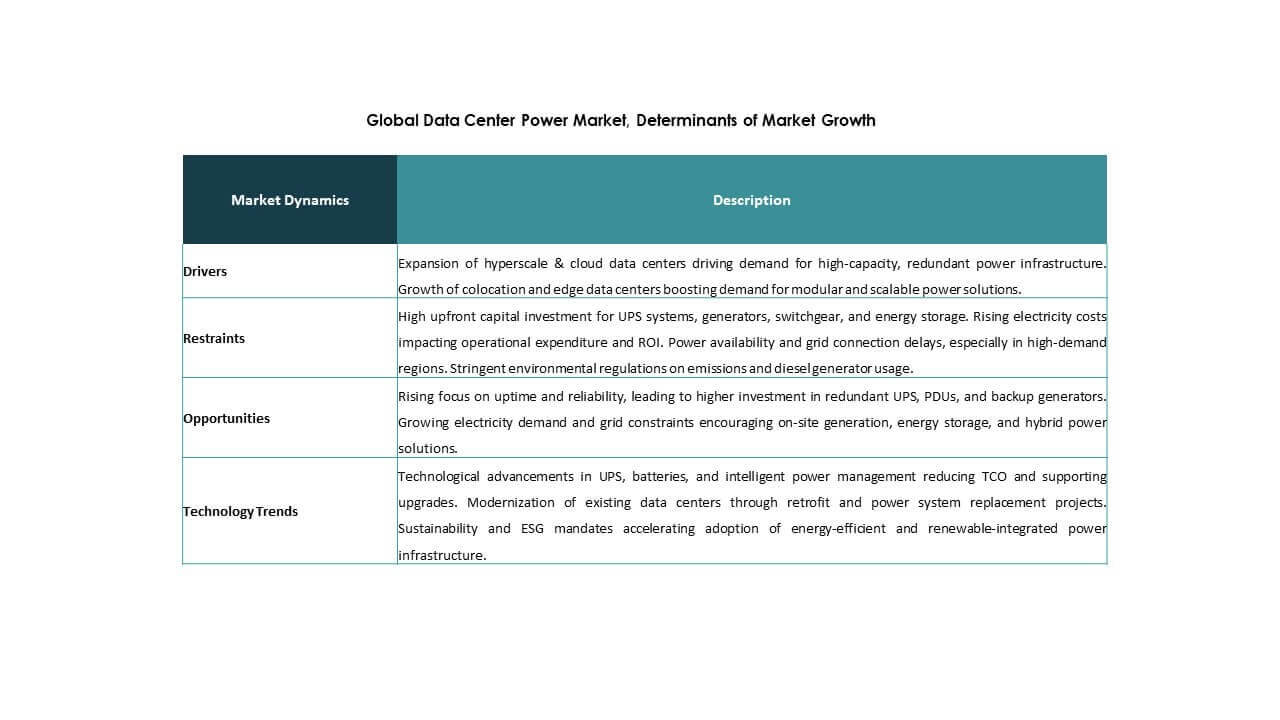

Market Dynamics:

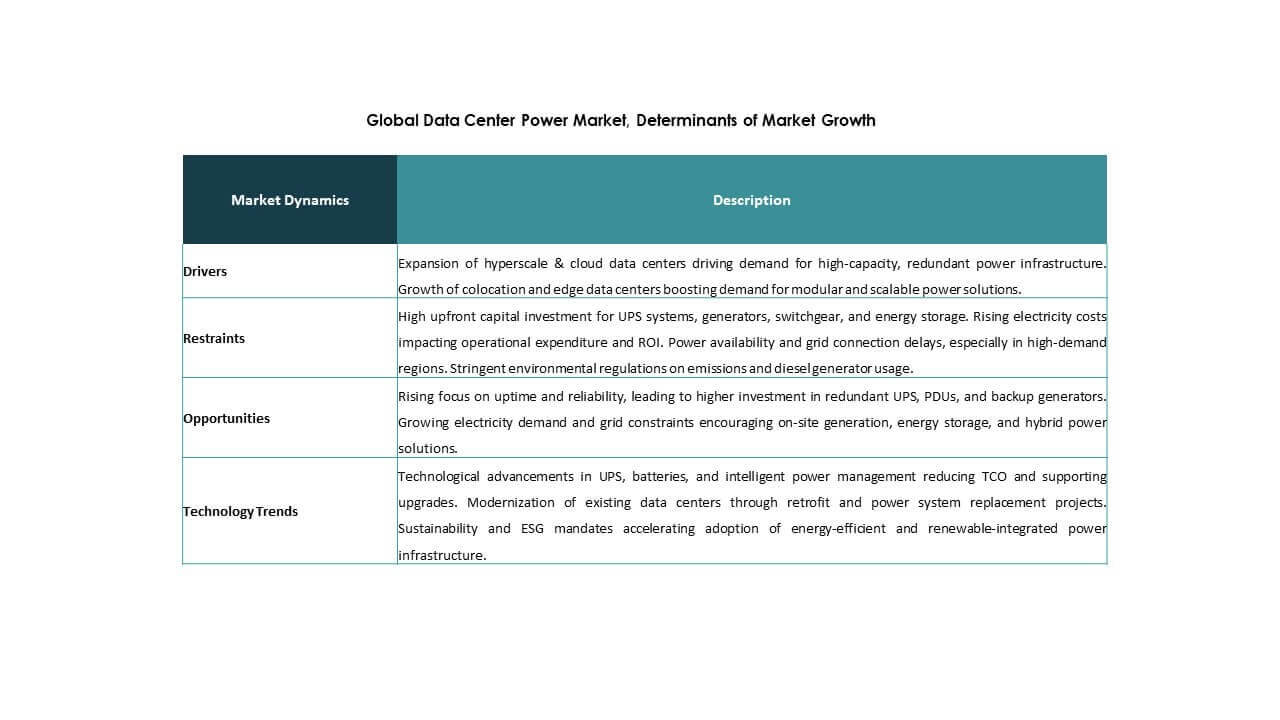

Market Drivers

Rising Hyperscale Data Center Investments Demanding Scalable and Efficient Power Infrastructure

Hyperscale operators continue to expand their global footprint, pushing demand for high-capacity power systems. Operators like Amazon, Microsoft, and Google are deploying multi-megawatt facilities with strict uptime and efficiency needs. This shift drives adoption of modular uninterruptible power supply (UPS) systems, intelligent switchgear, and advanced battery storage. The Global Data Center Power Market plays a key role in supporting these hyperscale projects. Compact, high-efficiency power systems help lower total cost of ownership and floor space consumption. Technologies like lithium-ion batteries and hot-swappable modules improve availability and speed of maintenance. Businesses rely on scalable power infrastructure to manage rapid capacity expansion. Investors monitor capital deployment in energy-efficient systems to track market readiness. Power infrastructure now directly impacts digital business continuity and speed-to-market.

- For instance, Microsoft announced a $3.2 billion investment in 2024 to expand its Sweden data centers in Gävle, Sandviken, and Staffanstorp, deploying over 20,000 GPUs for AI workloads supported by advanced cooling systems.

Technology Advancements in UPS, Batteries, and Power Monitoring Accelerating System Modernization

The market benefits from innovation across UPS systems, battery chemistries, and integrated monitoring platforms. Vendors introduce high-efficiency UPS with double conversion and ECOnversion modes to reduce losses. Lithium-ion and nickel-zinc batteries replace lead-acid units, offering better life cycle and thermal performance. AI-enabled monitoring systems detect faults, optimize load balance, and prevent energy waste. The Global Data Center Power Market supports modernization efforts that meet dynamic computing demands. Legacy systems are being replaced by space-saving and modular power units. Facilities demand predictive insights and real-time performance analytics to improve power chain transparency. Adoption of intelligent power components reduces operational risks. Organizations integrate new tech stacks to ensure performance aligns with uptime SLAs.

- For instance, Eaton’s 93PM G2 UPS supports 50-360 kVA loads with up to 97% efficiency in double conversion mode and over 99% in Energy Saver System mode.

Regulatory Pressures and Sustainability Goals Fuel Shift Toward Green Power Solutions

Energy efficiency regulations in Europe, the U.S., and parts of Asia shape the next wave of power system innovation. Operators must align with carbon neutrality targets, making power usage effectiveness (PUE) a critical metric. The Global Data Center Power Market supports low-loss transformers, energy-efficient switchgear, and renewable integration. Facilities adopt on-site solar or purchase green power contracts to meet emission limits. Eco-mode operation, dynamic load management, and power optimization software reduce consumption during off-peak periods. Businesses view green power as both a compliance necessity and branding advantage. Investors increasingly favor companies with net-zero-aligned infrastructure. The trend drives upgrades across power systems, cabling, and cooling integration. Industry leaders view sustainable power design as a core competitive factor.

Digital Transformation and Edge Computing Require Agile and Distributed Power Architectures

Enterprise digitalization, AI processing, and IoT devices shift workloads closer to users. Edge data centers emerge across cities, factories, and telecom nodes. These setups demand compact, flexible, and remotely managed power solutions. The Global Data Center Power Market supports edge infrastructure with scalable battery banks, micro-UPS, and smart PDUs. Businesses rely on distributed architecture to reduce latency and ensure localized uptime. Energy-efficient components and real-time fault isolation minimize disruption at edge locations. Remote monitoring, firmware updates, and fault diagnostics are essential features. Market participants invest in plug-and-play systems for rapid deployment in edge environments. Digital services now depend on resilient power networks spanning core and edge nodes.

Market Trends

Growing Shift Toward Software-Defined Power Management and Automation Integration

Operators adopt software-defined power control systems for real-time optimization and automation. These platforms analyze energy usage, monitor load fluctuations, and adjust power flow. Virtual power management replaces manual scheduling, improving uptime and reducing errors. The Global Data Center Power Market is increasingly shaped by integration of analytics-driven systems. Operators prioritize automation for both hyperscale and colocation environments. Centralized dashboards allow unified oversight of power health across distributed sites. Smart algorithms balance loads and anticipate faults using predictive modeling. Facilities adopt automation to reduce human errors and meet SLA commitments. Software-defined control becomes a core tool in managing complex, high-density power setups.

Rising Popularity of Liquid-Cooled Racks Driving High-Density Power Requirements

AI training and HPC workloads raise rack density to 30 kW and above. This shift increases demand for precision power delivery and backup at the rack level. Facilities deploy liquid cooling and rear-door heat exchangers, requiring compact power equipment nearby. The Global Data Center Power Market supports this trend by offering high-efficiency PDUs, busbars, and low-profile UPS units. Operators design power chains around thermal limits and cooling integration. Intelligent PDUs with per-outlet metering gain adoption for localized power control. Liquid cooling adoption reshapes how power infrastructure is deployed. Racks now act as self-contained systems with tightly coupled power and thermal components. Power delivery becomes part of the server-level design strategy.

Standardization of Power Systems for Multi-Tenant Colocation and Build-to-Suit Facilities

Colocation providers seek standardized power systems to speed up onboarding and reduce complexity. Tenants expect plug-and-play power configurations across global sites. The Global Data Center Power Market responds with modular units, universal switchgear, and pre-assembled busways. These solutions reduce deployment timelines and improve service consistency. Standardized designs enable predictable scaling for tenants across regions. Power skids, integrated panels, and repeatable configurations lower operating risk. Operators streamline procurement and maintenance using pre-certified system blocks. Standardization also supports compliance with global safety and reliability codes. It helps data centers remain competitive in delivering turnkey capacity with guaranteed uptime.

Integration of Renewable Energy and On-Site Generation With Backup Power Systems

Operators pursue hybrid energy strategies that mix grid power, renewables, and on-site generation. Fuel cells, solar panels, and microturbines are integrated with diesel generators and battery banks. The Global Data Center Power Market adapts to manage these sources through bidirectional inverters and energy management systems. Facilities use AI to optimize renewable usage during peak solar or wind periods. Backup systems are reconfigured to support variable input profiles and fast load switching. Power systems now act as grid-interactive nodes in smart energy networks. Businesses use this model to hedge against utility price spikes and outages. Regulatory incentives further support on-site energy generation deployment.

Market Challenges

Complexity in Power System Integration Across Diverse Infrastructure Profiles and Locations

Data centers range from hyperscale to edge, with unique power architecture needs. Integrating standardized systems across varied environments introduces complexity. Power components must align with cooling systems, space constraints, and regional codes. The Global Data Center Power Market faces rising integration costs and design inconsistency. Facilities operating globally must deal with voltage variations, supply chain fragmentation, and installation skill gaps. Remote sites add risk due to limited maintenance access and slower fault resolution. Operators must balance redundancy with efficiency to avoid overdesign. Rapid expansion makes it harder to maintain uniform system performance across all facilities.

Cost Pressures and Supply Chain Disruptions Impacting Deployment Timelines and Availability

Capital-intensive power systems compete with budget constraints in many regions. Supply disruptions affect availability of switchgear, batteries, and controllers. Lead times for key components extend due to material shortages and geopolitical tensions. The Global Data Center Power Market faces risk of delayed deployments and missed SLAs. Price volatility in lithium and copper raises BOM costs. Operators struggle to lock in long-term pricing for power equipment. Cost-cutting initiatives may limit system resilience or lifecycle value. Vendors also face rising logistics expenses and certification delays. These pressures force buyers to seek balance between affordability, speed, and reliability.

Market Opportunities

Expansion of AI, Cloud, and 5G Infrastructure Unlocking Demand for Next-Gen Power Solutions

Cloud growth, AI workloads, and 5G networks increase demand for agile power systems. The Global Data Center Power Market benefits from these sectors as they build high-density, distributed facilities. New power formats are required to meet space, heat, and uptime constraints. Vendors offering modular, intelligent, and edge-ready systems can capture emerging demand. These applications create sustained need for high-efficiency, low-footprint solutions.

Sustainability Goals and Energy Regulations Creating Demand for Eco-Efficient Power Infrastructure

Global sustainability efforts push operators toward green power adoption. It accelerates demand for low-loss equipment, battery recycling, and software-optimized systems. The Global Data Center Power Market creates space for innovation in clean energy integration. Vendors offering certified, eco-mode systems gain traction with ESG-focused buyers. Compliance with energy codes becomes a growth catalyst.

Market Segmentation:

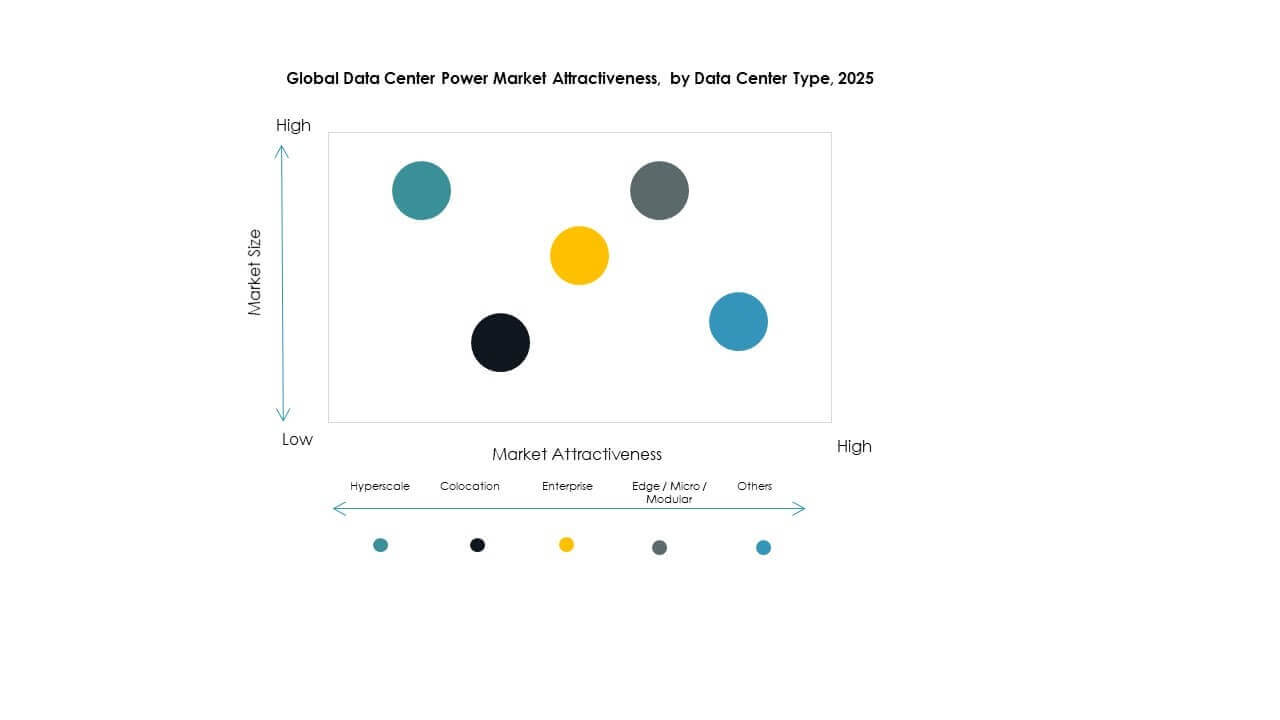

By Type Segment Analysis

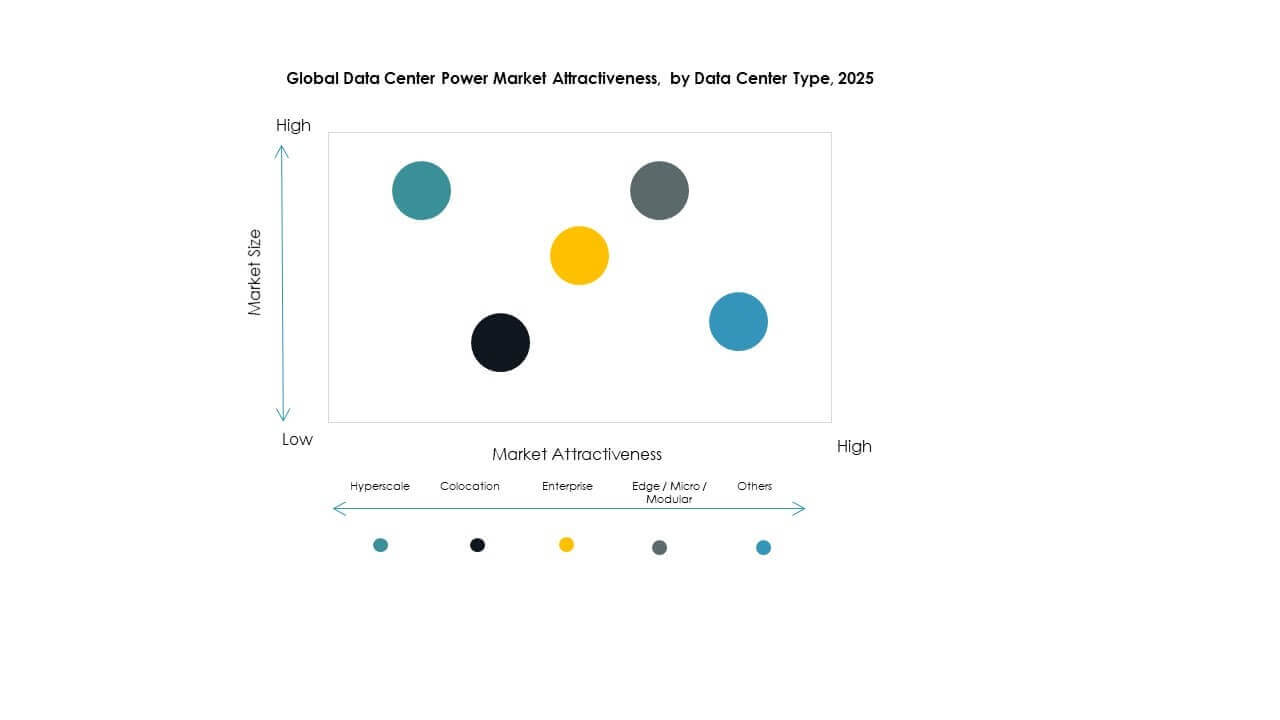

The Global Data Center Power Market’s type segment is led by hyperscale and cloud/Internet data centers due to rapid growth in cloud services and AI workloads. Hyperscale facilities demand high-capacity power systems for reliability and efficiency, driving large share. Colocation and enterprise facilities follow, expanding capacity to support digital transformation. Edge/micro/modular and mega data centers grow due to distributed computing needs. Hyperscale adoption boosts scalable UPS, PDUs, and modular power units. Demand for tailored power designs and remote monitoring propels growth. Large cloud operators and telco expansions sustain segment dominance and investment.

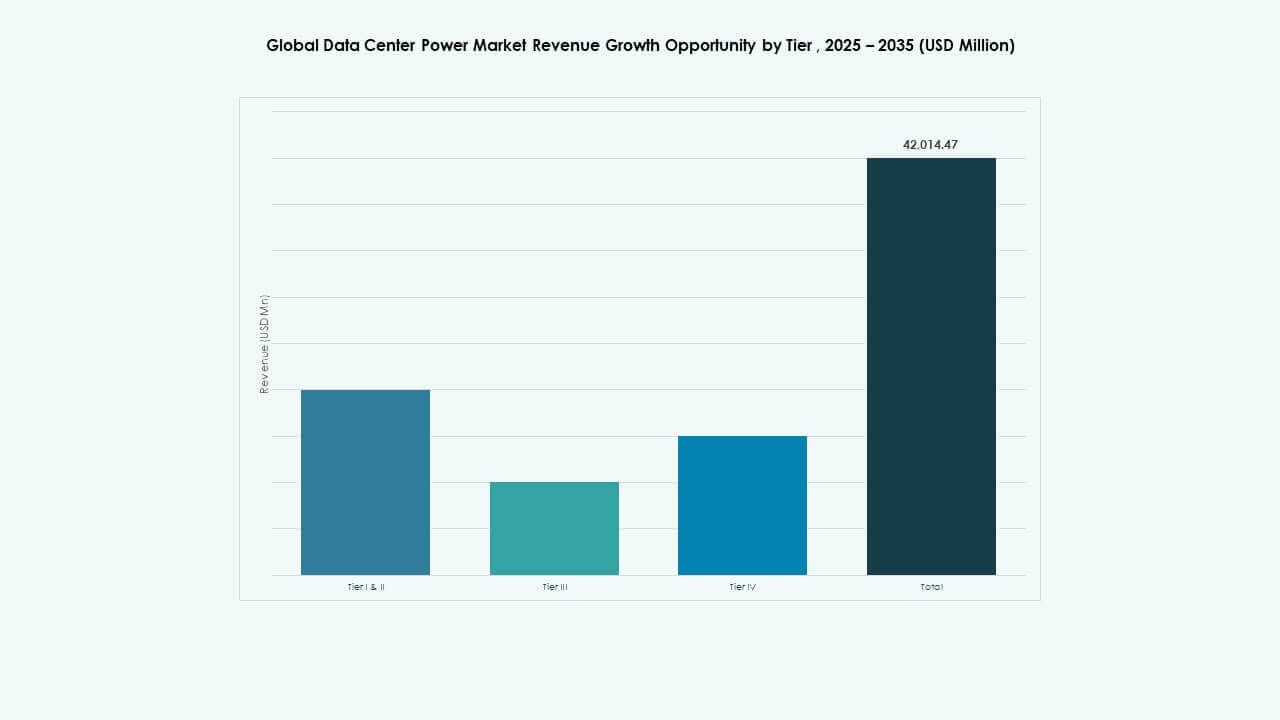

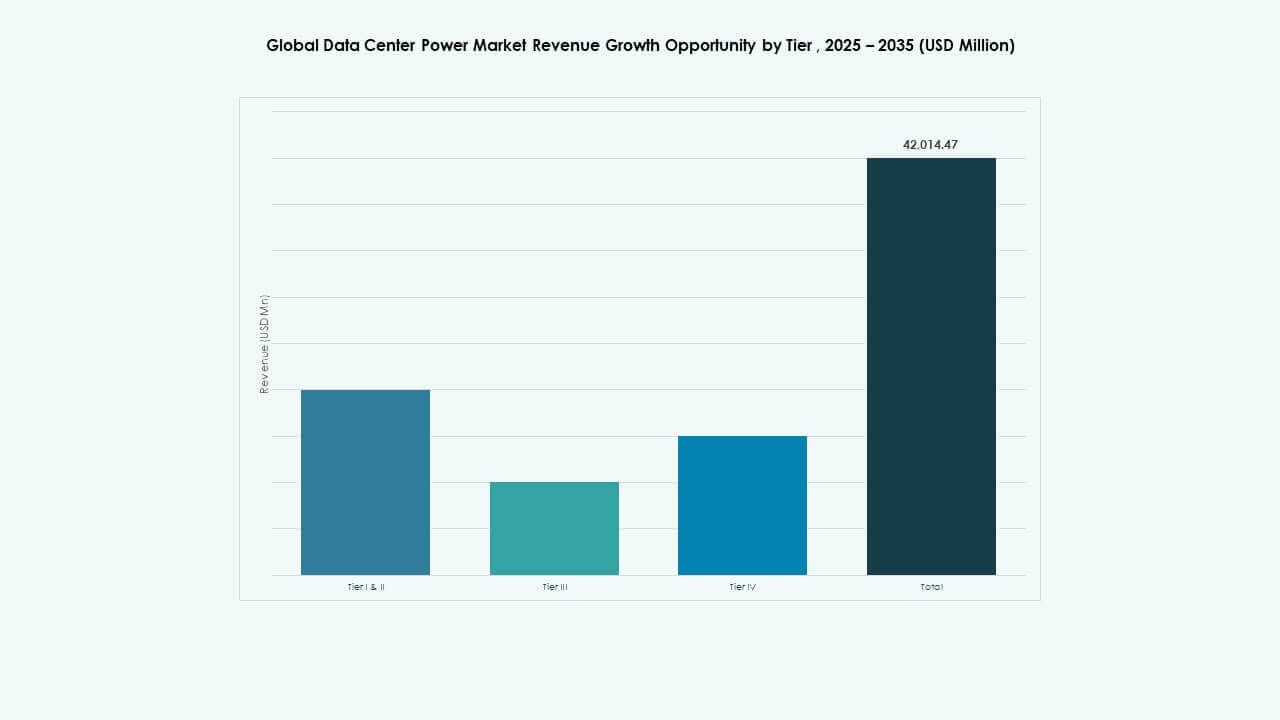

By Tier Segment Analysis

Tier III holds a dominant position in the Global Data Center Power Market due to its balanced uptime and cost profile. Many operators prefer Tier III for high availability and redundancy without the cost of Tier IV. Tier IV grows in hyperscale and critical enterprise scenarios needing near-zero downtime. Tier I & II retain niche use in smaller facilities with lower power demands. Tier III’s broad adoption supports robust power distribution, backup, and maintenance frameworks. Rising compliance with uptime standards and service agreements fuels investment in higher-tier power infrastructure. The tier mix shapes system design and resilience.

By Component Segment Analysis

In the Global Data Center Power Market, solutions claim the largest share, driven by UPS, PDU, and busway demand. UPS systems secure continuous power and reduce outage risk. PDUs optimize distribution and load balancing. Busway systems support flexible power routing in dense rack deployments. Services, including design, integration, and support, gain traction as facilities seek seamless deployment and lifecycle care. Design & consulting ensures fit-for-purpose power plans. Integration & deployment shorten time-to-value. Support & maintenance uphold uptime SLAs. The solutions focus reflects facility needs for robust hardware, while services enhance operational effectiveness and long-term reliability.

By Power Rating Segment Analysis

Among power ratings, 1,000 to 5,000 kVA dominates the Global Data Center Power Market due to its fit for colocation, enterprise, and mid-sized hyperscale facilities. This range balances capacity, cost, and flexibility, making it a preferred choice. Below 1,000 kVA serves edge and micro data centers, gaining ground with distributed architectures. Higher brackets (5,000 to 10,000 kVA and above) support large hyperscale and mega data centers, expanding with AI and cloud demand. Growth in high-performance computing and large-scale servers pushes demand for 5,000+ kVA systems. Diverse rating needs drive tailored power designs and modular scalability.

By End‑User Segment Analysis

IT & telecommunications lead the Global Data Center Power Market due to constant data traffic growth and telecom digital services. This segment demands reliable and efficient power systems for 24/7 operations. BFSI follows with strict uptime and data integrity needs, boosting power redundancy and monitoring adoption. Government and energy sectors invest to modernize critical infrastructure. Healthcare and retail segments grow with digital record management and omnichannel demands. Others, including education and media, contribute to diversified uptake. End users prioritize low downtime, scalable capacity, and integrated power analytics to support digital service continuity and future expansion.

Regional Insights:

North America and Europe Leading Due to Hyperscale Growth and Strong Regulatory Compliance

North America dominates the Global Data Center Power Market with a market share of 35–38%, led by the U.S. The region hosts a dense concentration of hyperscale operators such as Amazon, Microsoft, and Google, each driving high-capacity power demand. Investment in green data centers and microgrids supports sustainable infrastructure. Europe follows with a share of 23–25%, supported by strong regulatory frameworks and energy efficiency mandates. Key countries like Germany, the UK, and the Netherlands deploy advanced UPS and PDU systems to meet cloud and colocation needs. Both regions benefit from mature IT ecosystems and well-established power component suppliers. The market reflects rising demand for resilient and low-loss infrastructure to meet ESG targets.

- For instance, in June 2025, AWS proposed a 1,370-acre data center campus in Louisa County, Virginia, with plans for up to 7.2 million sq ft of space and seven substations. The project was officially withdrawn in July 2025 following community opposition, though AWS continues to develop two other approved campuses in the region.

Asia Pacific Emerging Rapidly with Strong Investments in Digital Infrastructure and Edge Expansion

Asia Pacific holds a 28–30% share of the Global Data Center Power Market, driven by China, India, Japan, and Southeast Asia. The region experiences high demand due to 5G rollout, cloud expansion, and smart city programs. China and India invest heavily in hyperscale and colocation facilities to support e-commerce, fintech, and AI workloads. Japan and South Korea emphasize reliability and renewable integration in power systems. Southeast Asian nations like Indonesia, Malaysia, and the Philippines are gaining share through growing digital economies and favorable policy frameworks. Regional operators deploy modular and edge-ready power units to support distributed architecture. The market benefits from a mix of demand scale, favorable demographics, and public-private infrastructure initiatives.

Latin America, Middle East, and Africa Gaining Traction with Targeted Cloud and Government Deployments

Latin America accounts for 5–6% of the Global Data Center Power Market, with Brazil and Mexico leading growth through government data projects and colocation demand. The Middle East contributes 4–5%, driven by the UAE, Saudi Arabia, and Israel focusing on AI and smart infrastructure. Africa holds 2–3% share, led by South Africa and Nigeria, where operators seek improved digital access. These regions face infrastructure gaps but attract foreign investments to scale up data capacity. Power reliability and grid integration remain critical barriers. The market here supports diesel-hybrid systems, scalable UPS, and remote monitoring for power fault mitigation. It reflects untapped potential with growing cloud and telecom footprints.

- For instance, by late 2025, Microsoft had invested over $7.3 billion to expand its UAE data center region, deploying infrastructure equivalent to 21,500 Nvidia H100 GPUs. A 200 MW expansion with G42, announced in November 2025, supports regional AI capacity and power demand within the Global Data Center Power Market.

Competitive Insights:

- ABB

- Black Box

- CyrusOne

- Eaton

- Equinix Inc.

- GDS Holdings

- Generac Power Systems, Inc.

- General Electric Company

- Huawei Technologies Co., Ltd.

- Legrand

- N1 Critical Technologies

- NTT Global Data Centers

- Raman Power Technologies

- Rittal GmbH & Co. KG

- Schneider Electric

- Vertiv Group Corp.

The Global Data Center Power Market features a highly competitive landscape shaped by global OEMs, power technology providers, and colocation operators. ABB, Schneider Electric, Vertiv, and Eaton dominate the hardware supply for UPS systems, PDUs, and switchgear. These companies invest in modular design, AI-powered energy monitoring, and low-loss components. Equinix, NTT, and GDS Holdings lead colocation expansion, focusing on sustainable energy and high-efficiency systems. Huawei and GE support regional deployments with integrated power and digital solutions. Players compete on energy efficiency, uptime, lifecycle cost, and scalability. It rewards innovation in hybrid power architecture and ESG-compliant infrastructure. Partnerships, acquisitions, and regional data center build-outs drive long-term positioning. Market share is closely linked to technology advancement and global supply capabilities.

Recent Developments:

- In December 16, 2025, ABB officially announced an agreement to acquire IPEC, a UK-based technology company specializing in advanced electrical diagnostics and 24/7 monitoring systems.

- In November 2025, ABB announced the expansion of its partnership with Applied Digital to supply medium-voltage power technology for the Polaris Forge 2 data center campus in North Dakota, US.

- In November 2025, Babcock & Wilcox (B&W) officially announced its entry into the AI data center power market through a major agreement with Applied Digital (APLD)