Executive summary:

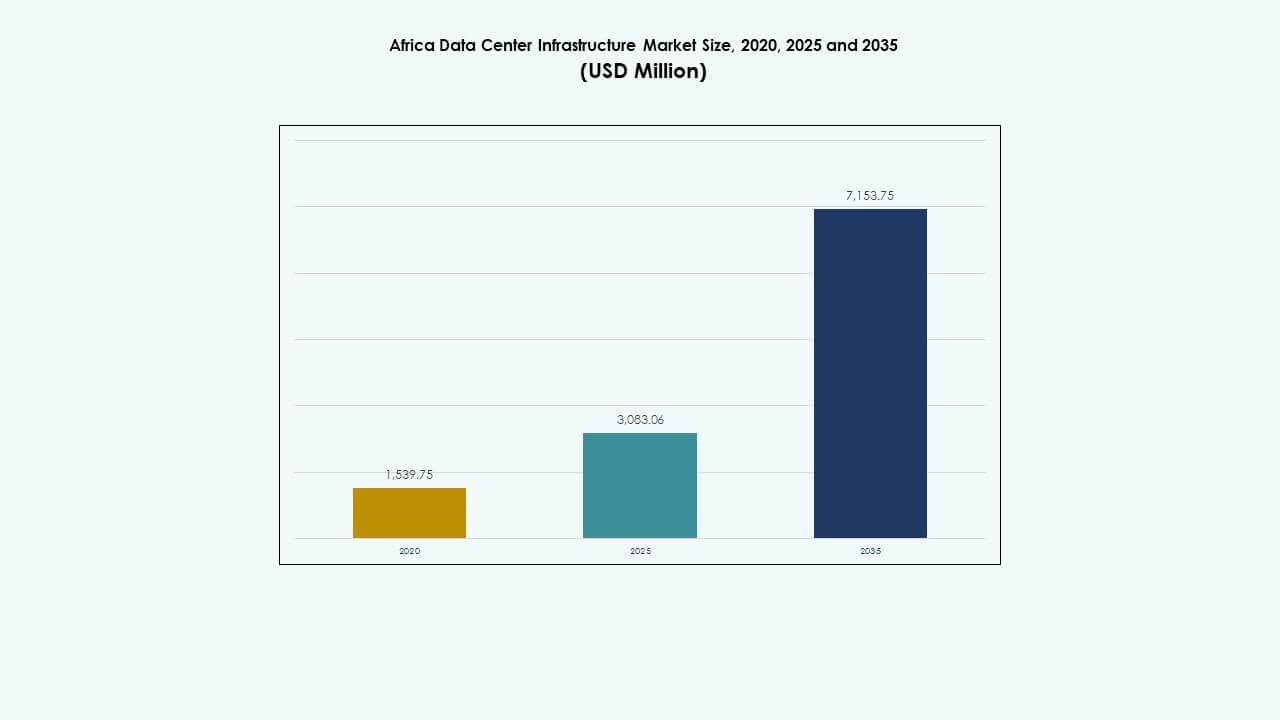

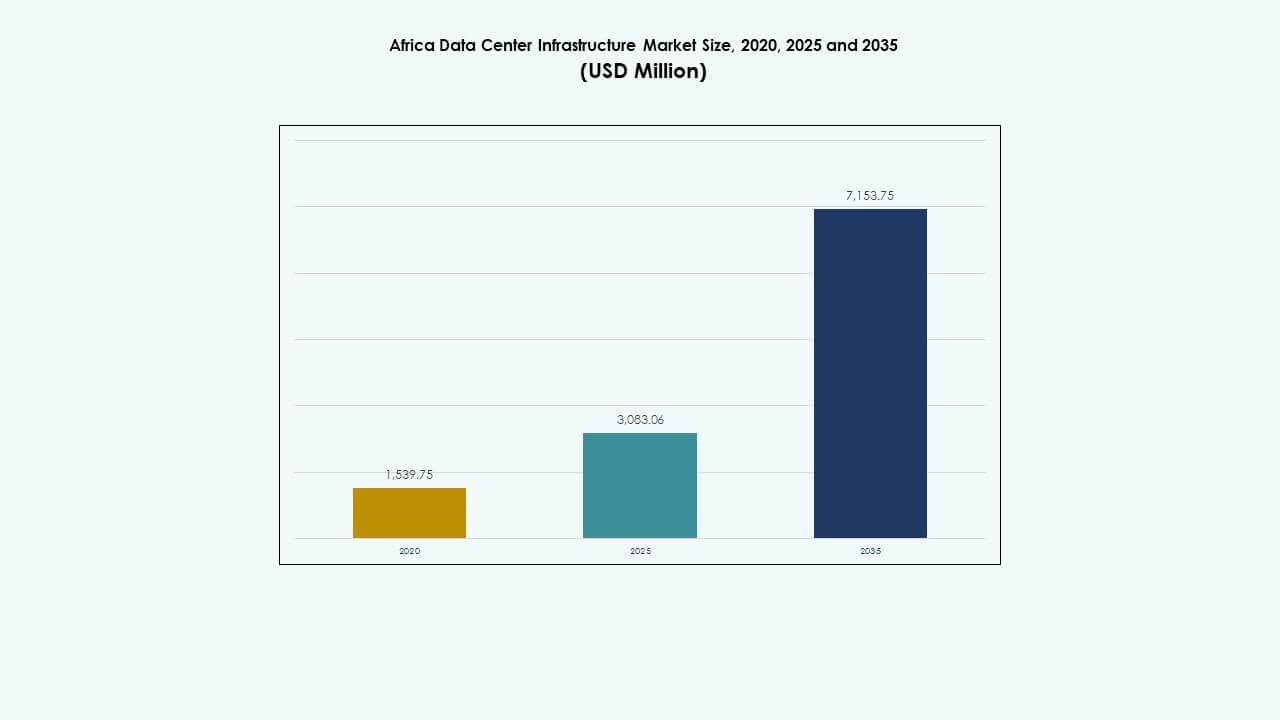

The Africa Data Center Infrastructure Market size was valued at USD 1,539.75 million in 2020, grew to USD 3,083.06 million in 2025, and is anticipated to reach USD 7,153.75 million by 2035, at a CAGR of 8.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Africa Data Center Infrastructure Market Size 2025 |

USD 1,539.75 Million |

| Africa Data Center Infrastructure Market, CAGR |

8.69% |

| Africa Data Center Infrastructure Market Size 2035 |

USD 3,083.06 Million |

The market is gaining traction due to rising demand for cloud services, AI workloads, and local data hosting. Enterprises are shifting toward edge computing and modular facilities to serve high-density applications. Government digitalization programs and private investments are accelerating infrastructure development across metro and secondary cities. Adoption of energy-efficient systems and software-defined infrastructure reflects broader innovation trends. The market holds strategic value for investors targeting underserved digital economies and businesses seeking regional expansion across Africa.

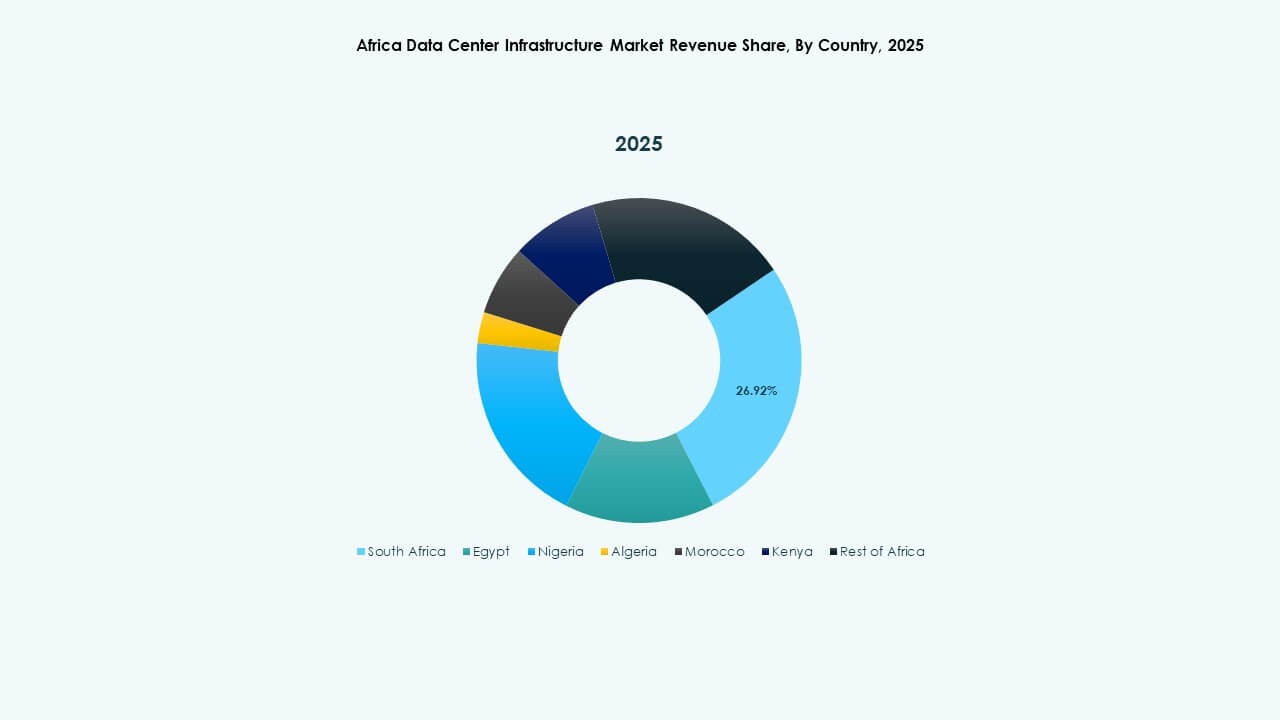

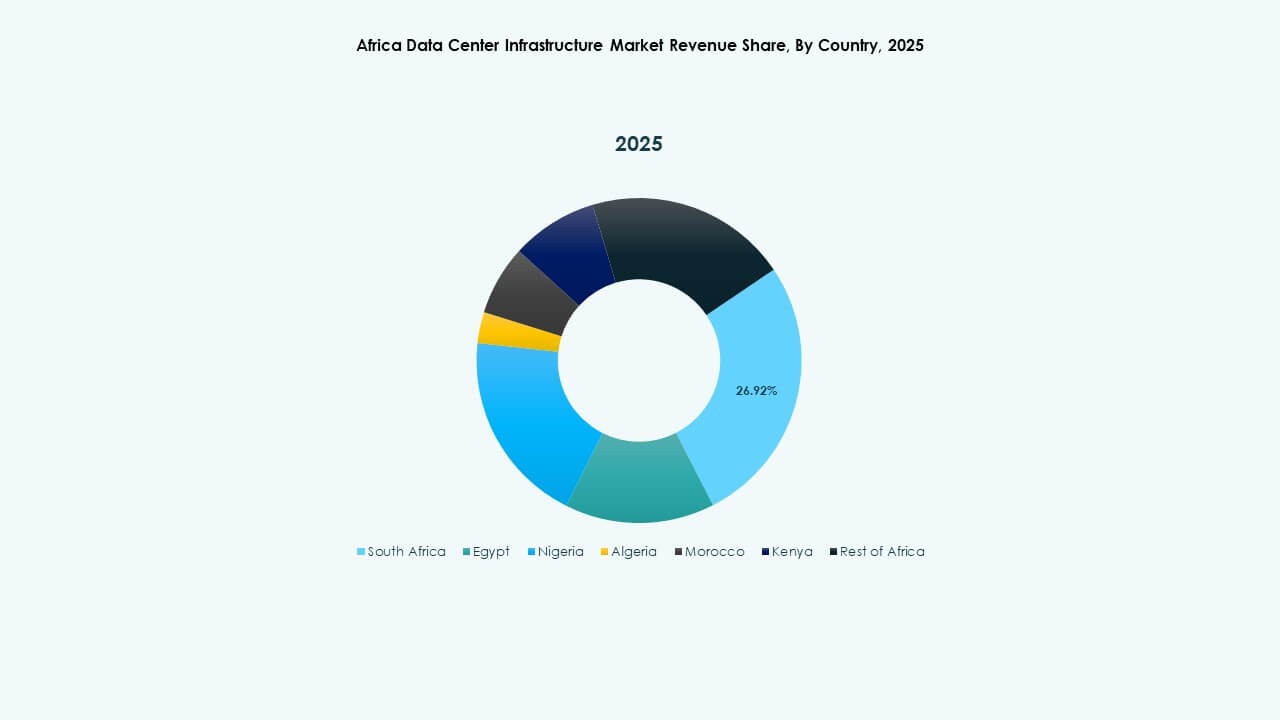

South Africa leads with robust connectivity, a stable power grid, and global cloud investments. Kenya and Nigeria are emerging hubs due to fintech growth, submarine cable landings, and startup ecosystems. Egypt and Morocco are advancing as key North African players through strategic geographic positioning and regulatory reforms. The market also sees new traction in Rwanda and Ghana, supported by public-private partnerships and rising digital service adoption.

Market Dynamics:

Market Drivers

Growing Demand for Digital Infrastructure Across Cloud, Banking, and Telecom Sectors

Rapid digital transformation is creating steady demand for robust computing infrastructure. Telecom operators are expanding fiber backbones and 5G networks, which raises the need for low-latency data centers. Banking and finance sectors are digitizing payment platforms, requiring secure hosting facilities. Cloud service providers are expanding their footprint in the region to improve latency and comply with data sovereignty. The Africa Data Center Infrastructure Market benefits from growing investments across public and private sectors. Global firms are partnering with local players to deploy edge and colocation facilities. Energy-efficient systems and modular data centers gain traction among telecom and fintech firms. Enterprises increasingly prefer local hosting to support digital-first operations across cities and remote zones.

- For instance, MTN South Africa deployed 5G on more than 900 sites in 2024, increasing coverage to 44% of the population.

Accelerated Adoption of Cloud Services and Hyperscale Deployments by Global Players

The shift toward cloud-native applications drives infrastructure modernization in multiple African economies. Enterprises and governments rely on scalable computing platforms, pushing demand for data center expansions. Leading hyperscalers like Microsoft, Google, and Amazon are investing in purpose-built data center campuses in countries like South Africa and Kenya. These deployments focus on renewable energy use, high-density server configurations, and efficient cooling designs. The Africa Data Center Infrastructure Market enables lower latency, better compliance, and regional connectivity for these global players. Managed cloud providers follow suit, offering multi-tenant services in metro areas. Innovation in virtualization and storage systems supports complex workloads. Growing digital services such as e-health, e-learning, and e-commerce further stimulate market maturity.

Energy-Efficient Infrastructure Adoption to Combat Power Instability and Operating Costs

Power reliability remains a concern in parts of Africa, prompting demand for stable and efficient data center infrastructure. Operators adopt uninterruptible power supplies, battery energy storage, and advanced switchgears to reduce outages. Renewable energy integration is gaining traction to mitigate rising grid tariffs and ensure sustainability. Efficient cooling solutions like containment systems and water-cooled chillers help control energy use. The Africa Data Center Infrastructure Market is adopting smart power management tools to optimize uptime and cost. AI-based monitoring systems track power quality, rack temperature, and airflow patterns in real time. These innovations attract investors and operators focusing on ESG-linked projects. Vendors supplying UPS, PDUs, and BESS systems see growing interest from operators seeking long-term savings.

- For instance, Ericsson enabled MTN’s 5G core upgrade handling 2.52 million active sessions and 40 Gbps throughput without disruption.

Shift Toward Edge and Modular Infrastructure to Support Regional Connectivity

Regional expansion and growing rural demand are pushing operators to deploy edge and modular systems. These prefabricated, compact facilities are faster to install and more cost-effective than traditional builds. They help extend connectivity beyond Tier I cities into smaller towns and underserved zones. The Africa Data Center Infrastructure Market supports this shift by enabling low-latency workloads close to the end-user. Operators use containerized solutions to bypass construction delays and optimize capital costs. These systems come pre-equipped with power, cooling, and IT racks, making deployment easier. IoT, mobile payments, and digital education require low-latency infrastructure, accelerating edge site rollouts. Modular formats also support future scaling, allowing flexible upgrades without major reconstruction.

Market Trends

Rise of Colocation and Carrier-Neutral Facilities for Enterprises and Cloud Providers

Enterprise clients seek cost-effective and scalable hosting without managing data centers on their own. Colocation providers offer shared infrastructure with high redundancy and interconnectivity, appealing to telecom, fintech, and government clients. The Africa Data Center Infrastructure Market is witnessing a rise in carrier-neutral facilities to enable flexible bandwidth and cross-connects. These sites support rich network ecosystems, making them ideal for cloud on-ramps and edge deployments. Strategic hubs in Nairobi, Johannesburg, and Lagos are expanding to meet this growing demand. Local and regional operators are investing in Tier III and Tier IV certified builds. Long-term contracts and service-level agreements are key selling points. Data center service bundling, such as disaster recovery and managed hosting, also drives adoption.

Investments in Green Data Centers Backed by ESG and Carbon-Neutral Goals

Sustainability is becoming a defining trend in infrastructure planning. New projects are incorporating solar and wind power through on-site generation or clean energy procurement. Operators aim for energy-efficient cooling technologies and LEED-certified construction. The Africa Data Center Infrastructure Market reflects this shift, with investors preferring green-certified facilities. Government tenders and public-private partnerships increasingly require sustainability clauses. Operators use advanced BMS and DCIM tools to track energy, water, and emissions metrics. Modular design also reduces construction waste and site disruption. Sustainability drives cost savings over the long term, especially where power costs are volatile. Data center operators highlight ESG credentials to attract global clients and funding institutions.

Edge Analytics and 5G-Driven IT Architecture for Smart Cities and Services

Smart city projects, IoT applications, and connected services are reshaping demand patterns. Applications like traffic monitoring, e-surveillance, and remote healthcare require local data processing. This need drives edge computing infrastructure in urban and semi-urban zones. The Africa Data Center Infrastructure Market is adapting by supporting small-footprint, distributed IT environments. Operators use edge nodes to handle data closer to the user, minimizing latency. Integration with 5G infrastructure improves speed and service delivery for real-time applications. These edge deployments rely on compact UPS, micro cooling, and secure remote management tools. Edge data centers also support last-mile connectivity, critical for smart agriculture and education services.

Vendor Consolidation and M&A Activity in Response to Growing Market Maturity

The African infrastructure landscape is experiencing a wave of consolidation. Global data center providers are acquiring or partnering with local firms to expand regional presence. Equipment vendors merge or form alliances to offer bundled solutions. The Africa Data Center Infrastructure Market shows signs of maturity, where established players dominate multi-country footprints. M&A activity helps fast-track land acquisition, power procurement, and client base expansion. Combined portfolios provide scale advantages, allowing investment in high-tier, large-capacity centers. Integrated offerings across electrical, mechanical, and IT components become standard. This consolidation also creates opportunities for service integration across the lifecycle—from design to maintenance.

Market Challenges

Limited Grid Stability, High Energy Costs, and Access to Renewable Power

Grid power remains unreliable across many African countries, often marked by outages and voltage fluctuations. Operators need to invest in backup systems, driving up capital and operational expenditure. Diesel generators and traditional fuel-based systems remain costly and unsustainable over time. The Africa Data Center Infrastructure Market struggles with high electricity tariffs and inconsistent supply. Renewable integration is complex due to policy gaps and infrastructure constraints. Building green data centers demands long planning cycles, land acquisition, and interconnection approvals. Hybrid energy models face delays in technical design and regulatory alignment. Investors view power supply uncertainty as a top barrier to expansion and profitability.

Skilled Workforce Shortage and Gaps in Technical Project Execution

The development of high-performance data centers requires specialized engineering talent across electrical, mechanical, and IT domains. Africa faces a shortage of skilled professionals in data center design, construction, and operations. The Africa Data Center Infrastructure Market suffers from longer project timelines due to skill gaps and training delays. Multinational firms often bring in foreign experts, increasing costs. Local capacity building through certifications and technical institutes is still evolving. Language, regulatory, and process differences slow down collaboration between global suppliers and local contractors. This challenge affects everything from infrastructure quality to after-sales service, limiting scalability and performance assurance.

Market Opportunities

Emergence of Underserved Economies and Government Digitalization Programs

Many African countries remain underpenetrated in digital infrastructure, offering strong upside potential. Governments are launching e-governance and digital inclusion programs that need secure hosting solutions. The Africa Data Center Infrastructure Market can support public cloud expansion, national ID systems, and digital health projects. Donor funding and development finance institutions show growing interest in financing core IT infrastructure. Local firms seek affordable hosting close to end-users, creating space for edge and colocation formats.

Growth in Fintech, Streaming, and E-Commerce Supporting Data Localization

The rise of local content platforms, online retail, and digital banking drives demand for low-latency and secure data hosting. Data sovereignty laws encourage in-country data storage. The Africa Data Center Infrastructure Market benefits from this shift by offering scalable, secure infrastructure. Content delivery networks and fintech players increasingly require edge infrastructure to reduce lag and boost uptime. This opens opportunities in second-tier cities and remote zones.

Market Segmentation

By Infrastructure Type

Electrical infrastructure dominates the Africa Data Center Infrastructure Market due to unstable grid power and high energy needs. Operators invest heavily in UPS, battery storage, and PDUs to ensure uptime. Mechanical systems such as cooling units and chillers follow, as temperature regulation is critical in hot climates. IT and network infrastructure is gaining traction with rising adoption of cloud, AI, and big data platforms. Civil and architectural components play a vital role in ensuring structural resilience and modular scalability.

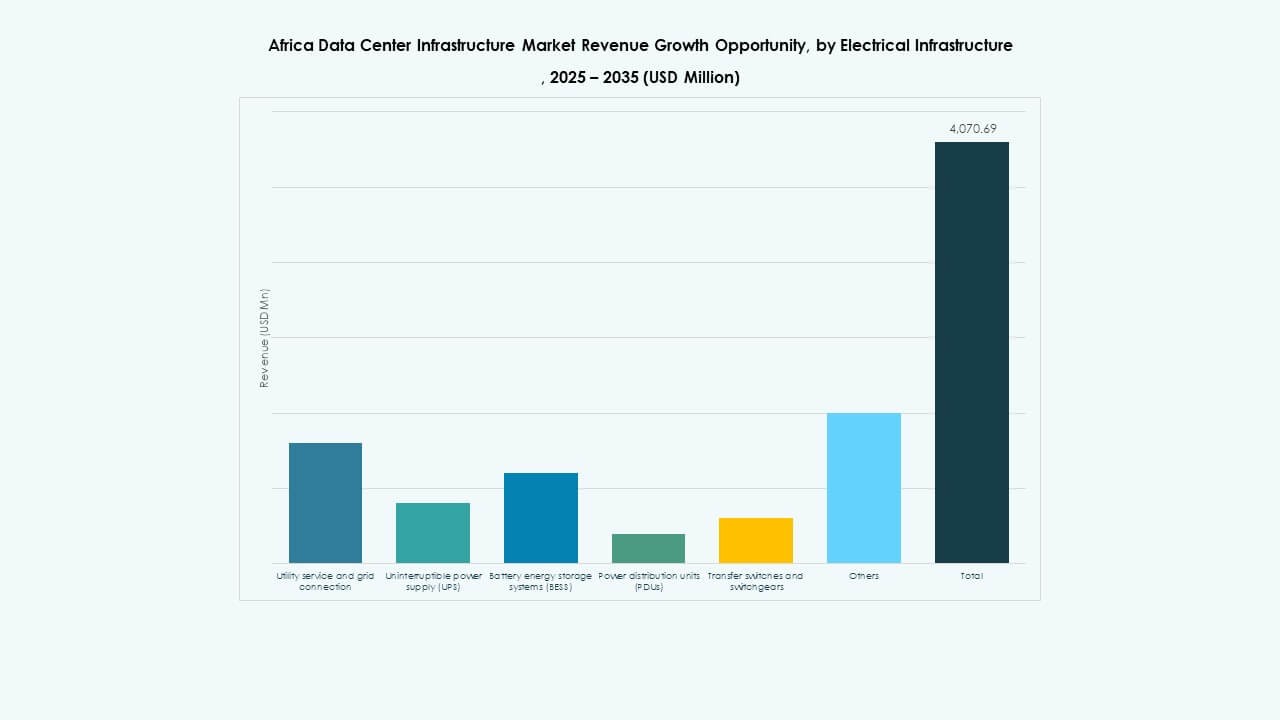

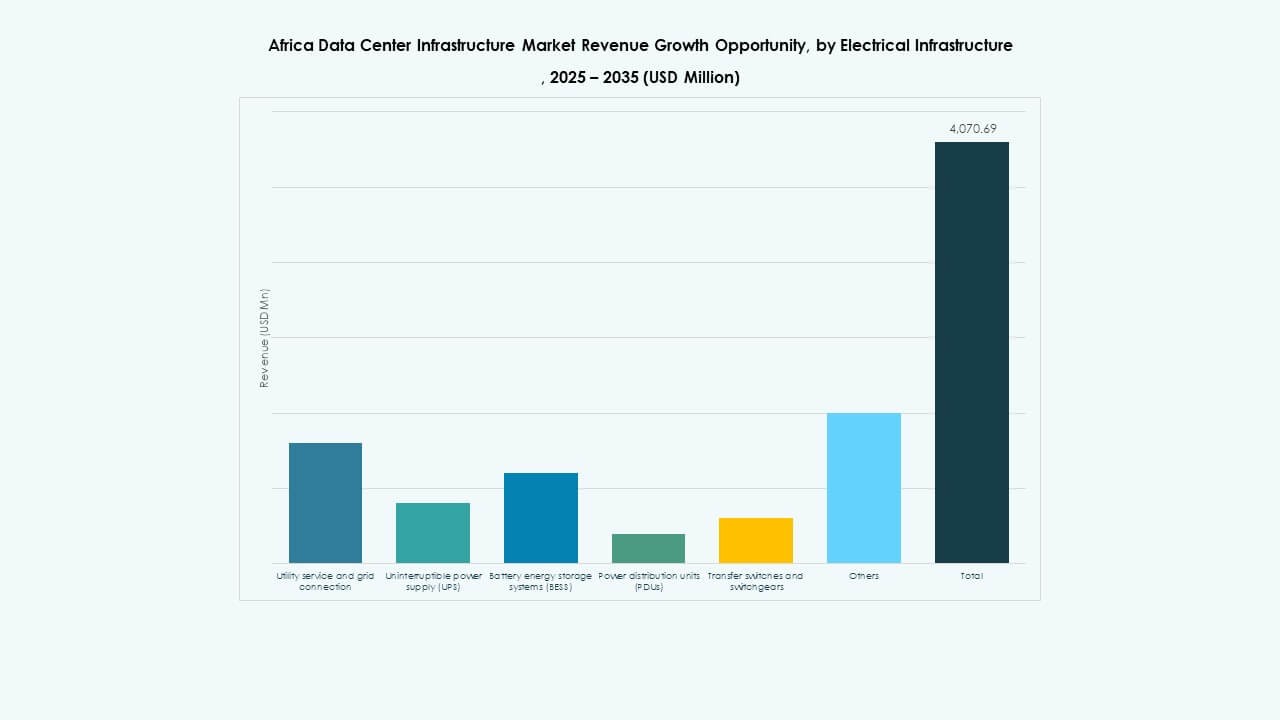

By Electrical Infrastructure

Uninterruptible power supply (UPS) and power distribution units (PDUs) lead due to their central role in uptime assurance. The Africa Data Center Infrastructure Market sees increasing deployment of Battery Energy Storage Systems (BESS) to reduce reliance on generators. Switchgears and utility grid connections remain essential, but high costs and delays limit penetration. Operators prefer integrated electrical solutions for easier management and better efficiency. Demand grows for modular UPS and smart PDUs with energy analytics.

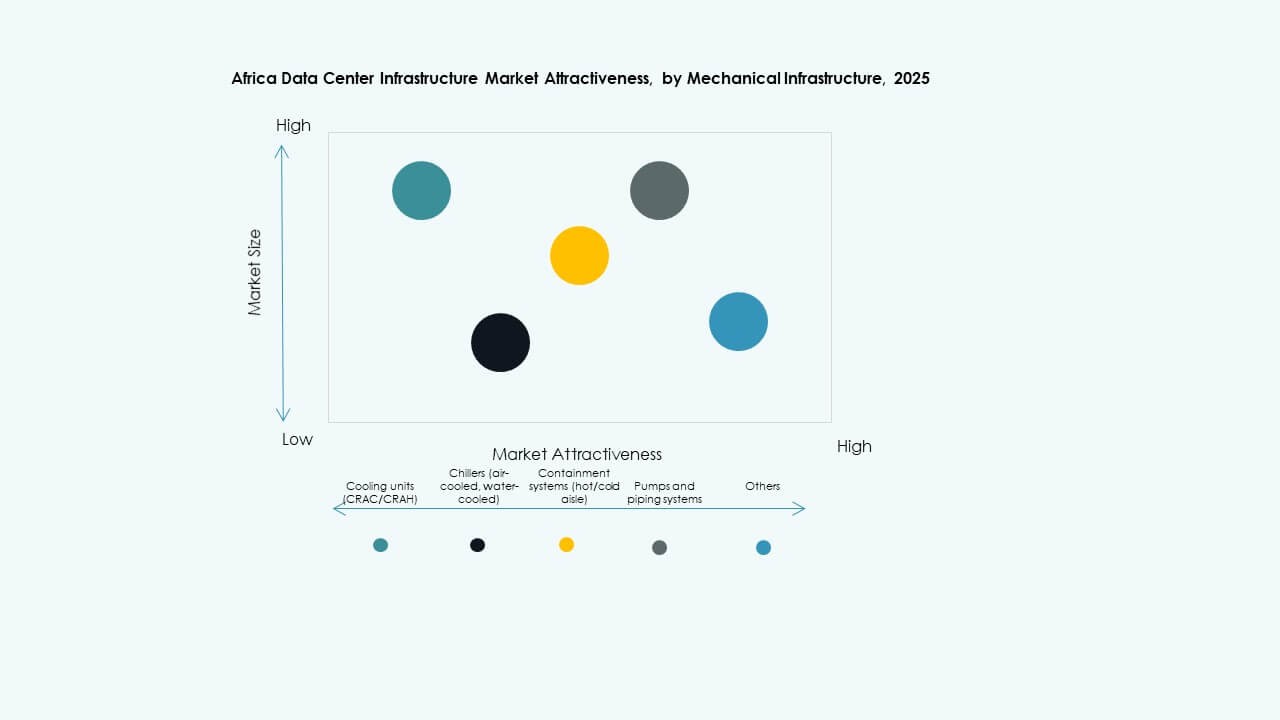

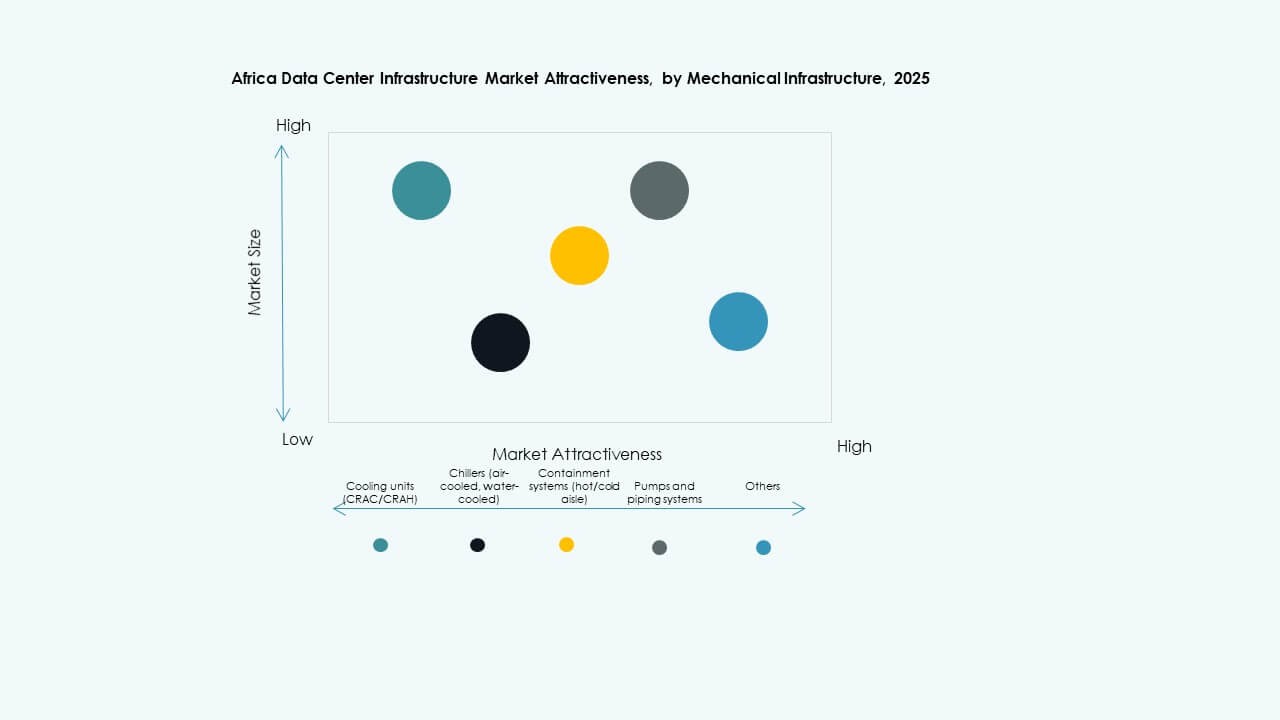

By Mechanical Infrastructure

Cooling units such as CRAC/CRAH dominate due to climate conditions in most African countries. Containment systems are becoming popular to improve cooling efficiency. Chillers—both air- and water-cooled—are key in mid- to large-size facilities. Pumps and piping systems remain standard in high-density deployments. Energy efficiency and water availability determine mechanical design choices. The Africa Data Center Infrastructure Market shows growing interest in evaporative and liquid cooling systems.

By Civil / Structural & Architectural

Modular and prefabricated building systems are gaining traction due to speed and flexibility. Superstructures made of steel frames dominate, especially for Tier III and IV builds. Site preparation, raised floors, and suspended ceilings support efficient airflow and cabling. The Africa Data Center Infrastructure Market values adaptable construction methods that reduce cost and time. Building envelope systems are optimized for heat insulation and energy performance.

By IT & Network Infrastructure

Server and storage segments lead IT infrastructure adoption, with hyperscalers driving demand. Networking equipment follows, enabling interconnectivity between racks and external networks. Cabling and optical fiber are essential for low-latency connections. Racks and enclosures are growing with high-density server configurations. The Africa Data Center Infrastructure Market supports scalable and integrated IT environments. Enterprises seek bundled solutions for speed, security, and remote manageability.

By Data Center Type

Colocation data centers hold a significant share, driven by SME and enterprise demand for cost-effective hosting. Hyperscale facilities are emerging in South Africa, Kenya, and Nigeria, attracting global players. Edge data centers grow in underserved cities with rising digital service needs. The Africa Data Center Infrastructure Market also supports enterprise builds for banks, telecoms, and government institutions. Hybrid models combining core and edge deployments are gaining momentum.

By Delivery Model

Design-build and EPC models lead due to their flexibility in managing large, complex projects. Turnkey and modular factory-built approaches gain popularity for their speed and ease. Retrofit and upgrade services are in demand due to evolving requirements and aging infrastructure. The Africa Data Center Infrastructure Market supports construction management models where regional regulations require close monitoring. Operators select delivery formats based on project size, timeline, and cost efficiency.

By Tier Type

Tier III data centers dominate, offering a balance between redundancy and cost. Tier IV facilities are limited but growing with hyperscale demand. Tier II formats remain common for enterprise and local service providers. Tier I has minimal presence due to limited resilience. The Africa Data Center Infrastructure Market trends toward higher-tier facilities in urban hubs while deploying lower tiers in remote zones. Certification improves investor confidence and tenant acquisition.

Regional Insights

Southern Africa Leads with 42% Market Share Backed by Strong Telecom and Cloud Ecosystems

South Africa is the clear leader in the Africa Data Center Infrastructure Market, with Johannesburg and Cape Town as digital hubs. It hosts most hyperscale campuses and carrier-neutral facilities. Regulatory clarity, fiber backbone, and access to power support this leadership. Southern Africa’s ecosystem enables growth in cloud, fintech, and media hosting. The region also attracts foreign direct investment for greenfield data center parks. Power availability remains better than other subregions.

- For instance, Teraco completed a 30MW expansion at its JB4 Bredell Campus in Johannesburg in 2025, reaching 50MW total critical IT power load across 14 data halls.

Western Africa Accounts for 28% Share, Driven by Nigeria, Ghana, and Côte d’Ivoire

Nigeria leads this subregion due to strong mobile adoption, fintech expansion, and Lagos-based data center growth. Ghana and Côte d’Ivoire see rising activity from local and regional operators. The Africa Data Center Infrastructure Market benefits from efforts to localize data processing and reduce offshore dependency. Governments push digital service reforms, while submarine cable landings support regional connectivity. Infrastructure gaps in rural areas limit wider adoption but present future opportunities.

Eastern and Northern Africa Collectively Hold 30% Market Share, Showing Rising Activity

Kenya anchors East Africa’s development with Nairobi emerging as a regional tech hub. Rwanda and Ethiopia follow with growing government-backed initiatives. In Northern Africa, Egypt and Morocco invest in data hubs linked to Europe and the Middle East. These countries provide strategic locations for cross-border data exchange. The Africa Data Center Infrastructure Market in these regions sees demand from e-learning, e-health, and public sector digitization. Infrastructure reliability and political stability remain key growth enablers.

- For instance, Africa Data Centres launched a 10 MW facility in Lagos, serving hyperscale and cloud clients across West Africa. Teraco completed a 30 MW expansion at its JB4 campus in Johannesburg, scaling to 50 MW total IT load. iXAfrica secured RMB financing for a 20 MW expansion at its Nairobi campus, supporting Tier III AI and hyperscale demand.

Competitive Insights:

- Khazna Data Centers

- Gulf Data Hub

- G42 / Core42

- Equinix, Inc.

- Huawei Technologies Co., Ltd.

- Schneider Electric

- Vertiv Group Corp.

- Dell Inc.

- Hewlett Packard Enterprise (HPE)

- Cisco Systems, Inc.

The Africa Data Center Infrastructure Market features a blend of global technology providers and regional operators competing across infrastructure layers. Global players like Schneider Electric, Vertiv, and Huawei supply critical electrical and mechanical systems. Server, storage, and network segments are led by Dell, Cisco, HPE, and Huawei. Colocation and hyperscale infrastructure are expanding through firms like Equinix, G42, and Khazna Data Centers, which invest in large-scale facilities in South Africa, Kenya, and Egypt. Regional firms such as Gulf Data Hub provide modular and scalable designs tailored for Africa’s climate and power conditions. Strategic partnerships, government-backed contracts, and local assembly facilities give competitive edge. The market rewards players that offer energy-efficient, high-reliability, and flexible systems aligned with digital inclusion goals. It continues to attract new investments as demand for low-latency cloud and enterprise hosting accelerates.

Recent Developments:

- In September 2025, iXAfrica secured RMB financing for a 20 MW expansion at its Nairobi One Campus in Kenya, boosting total capacity to 22.5 MW with Tier 3 capabilities for AI and hyperscale workloads.

- In May 2025, Africa Data Centres deployed a self-cooling rack technology from Gold Synergy at its CPT1 facility in Cape Town, South Africa, enhancing high-density computing efficiency and sustainability for AI-driven demands.