Executive summary:

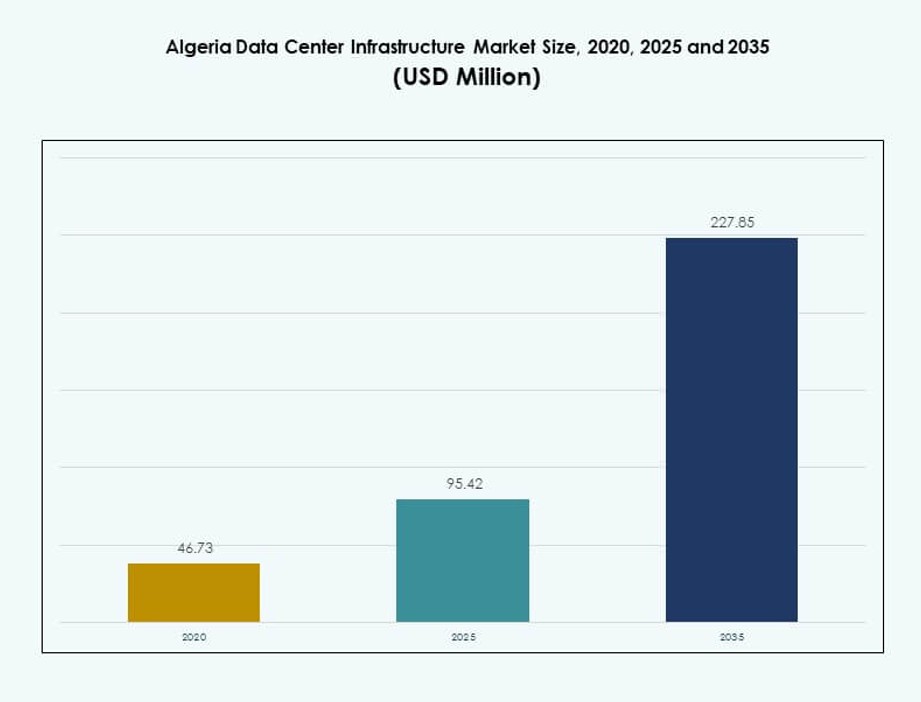

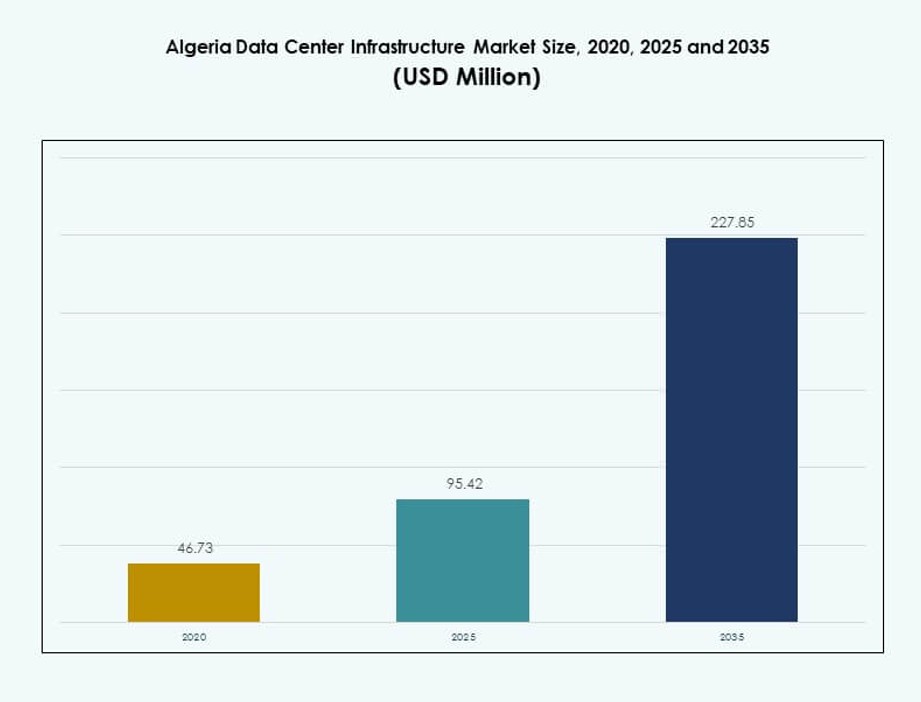

The Algeria Data Center Infrastructure Market size was valued at USD 46.73 million in 2020 to USD 95.42 million in 2025 and is anticipated to reach USD 227.85 million by 2035, at a CAGR of 9.00% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Algeria Data Center Infrastructure Market Size 2025 |

USD 95.42 Million |

| Algeria Data Center Infrastructure Market, CAGR |

9.00% |

| Algeria Data Center Infrastructure Market Size 2035 |

USD 227.85 Million |

Rapid cloud adoption, AI deployment, and national data localization efforts are key growth drivers. Enterprises and public institutions shift to digital-first models, requiring robust and scalable infrastructure. Innovations in liquid cooling, modular systems, and high-density racks support emerging AI and IoT workloads. Strategic partnerships between global vendors and local operators further strengthen capabilities. The market holds long-term investment value due to increasing regulatory clarity and the push for digital sovereignty across industries.

Northern Algeria, particularly Algiers and Oran, leads in infrastructure deployment due to urban density, subsea connectivity, and strong government presence. These regions attract most colocation, enterprise, and public cloud builds. Western zones such as Tlemcen are emerging with tech zone developments and educational infrastructure support. Southern and central regions remain underpenetrated but show potential through government-led digital inclusion projects and land availability for modular builds.

Market Dynamics:

Market Drivers

Surging Demand for Scalable IT Infrastructure Among Government and Private Enterprises

The Algeria Data Center Infrastructure Market is growing as both public and private sectors seek scalable IT setups. Ministries and state-backed entities require secure hosting and local cloud solutions. Banking, telecom, and utility sectors push demand for Tier III and Tier IV facilities. Enterprise workloads are shifting from legacy systems to digital-first frameworks. This migration fuels investment in advanced data center infrastructure. Strategic partnerships are helping companies build high-efficiency facilities. Integration of power backup systems and cooling upgrades is underway to support workload reliability. It positions Algeria as a vital regional hub for digital transformation and business continuity. Market attractiveness grows as investors recognize long-term ROI from government incentives.

- For instance, Algérie Télécom partnered with Huawei in February 2025 to deploy a 400G WDM national optical backbone network, enhancing capacity for colocation and hyperscale development across Tier III and Tier IV facilities.

Adoption of Cloud, AI, and IoT Driving Facility Modernization and New Builds

Rapid adoption of cloud computing, AI, and IoT applications creates pressure for high-performance computing infrastructure. Local demand for smart platforms requires agile data center ecosystems. IoT-enabled cities and utility modernization rely on real-time data processing. Enterprises need high-speed networks and scalable server capacity to process large datasets. This drives interest in modular and container-based builds. AI workloads influence GPU deployment and high-density racks. Efficient thermal management and power utilization have become strategic priorities. Algeria Data Center Infrastructure Market reflects this shift through rising demand for energy-efficient, scalable environments. Global providers and regional contractors are accelerating their Algeria-specific investments.

Energy Security, Redundancy, and Sustainability Standards Supporting Investment Push

Power reliability and redundancy are now central to facility planning. Algeria’s investment in utility-grade backup and energy-efficient cooling enhances infrastructure resilience. UPS, BESS, and PDUs are increasingly adopted in urban centers. Tier III and Tier IV builds demand N+1 and 2N configurations for mission-critical uptime. Sustainability standards such as low PUE and eco-cooling methods shape build strategies. Solar integration and desert cooling systems gain attention in new projects. It creates a balanced proposition between operational continuity and carbon reduction. The Algeria Data Center Infrastructure Market gains momentum from this energy-focused transformation, attracting long-term infrastructure investors seeking ESG-aligned growth.

Digital Sovereignty, Data Localization, and Regulatory Modernization Fueling Activity

New data protection laws and sovereign cloud priorities are influencing infrastructure design. Algeria aims to retain sensitive data within national borders, boosting local capacity needs. Regulatory shifts enforce stronger data compliance and reporting layers. This compels both international and local firms to invest in Algerian facilities. Telecom regulations promote better interconnection and NIXP upgrades, improving digital flow. Public cloud players form partnerships with local integrators to meet these rules. National-level digitization policies expand use cases in health, education, and citizen services. The Algeria Data Center Infrastructure Market gains strategic relevance through alignment with national cyber and digital sovereignty goals.

- For instance, in November 2024, Algeria’s People’s National Assembly launched a secure data center featuring advanced data archiving, processing, and cybersecurity layers following its earlier collaboration with Huawei in April 2024 for government-focused infrastructure.

Market Trends

Growth of Modular and Prefabricated Data Center Construction Across Urban Zones

Data center developers in Algeria are shifting toward modular and prefabricated designs to reduce lead times. These factory-built systems support faster deployments with scalable capacity. Companies adopt containerized modules to match demand fluctuations. Urban locations benefit from plug-and-play facilities to address rapid digitization. Modular formats also simplify transport and setup in constrained city sites. Firms leverage prefabrication to ensure consistent quality and reduce on-site labor. Algeria Data Center Infrastructure Market reflects this trend in several new builds across Algiers and Oran. Government-backed tech zones also encourage modular expansion to meet growing workload needs.

Rising Integration of Liquid-Cooled Racks and Advanced Thermal Management Systems

Thermal efficiency remains a key concern as rack density rises in hyperscale and enterprise builds. Operators increasingly deploy liquid-cooled racks to manage heat from AI and high-performance computing loads. Systems such as rear-door heat exchangers and direct-to-chip cooling are gaining traction. Algeria’s hot climate makes advanced thermal systems vital for year-round stability. Chiller-less data halls and containment systems help reduce energy consumption. Vendors partner with local HVAC firms to integrate region-suitable cooling solutions. The Algeria Data Center Infrastructure Market aligns with global efficiency trends by incorporating sustainable cooling designs. These upgrades improve energy ratios and lower operating costs.

Colocation and Hyperscale Collaboration Boosting Facility Sharing and Interconnection

Enterprises prefer colocation services to reduce capital costs and ensure uptime. Colocation providers in Algeria offer carrier-neutral connectivity, enabling flexible deployment. Global hyperscalers seek joint-venture formats to meet data localization and compliance rules. This has led to demand for high-capacity campuses near NIXP nodes. Interconnection-rich environments help businesses scale cloud workloads quickly. Local players benefit from shared infrastructure and redundant connectivity layers. Algeria Data Center Infrastructure Market witnesses joint builds between telcos and hyperscale partners. This trend fosters a shared digital backbone that supports multi-tenant, high-density operations.

Artificial Intelligence Workloads Driving High-Performance Infrastructure Upgrades

AI applications demand intensive compute, specialized GPUs, and faster interconnects. Data centers in Algeria are scaling to host AI-based workloads in sectors like telecom and banking. Rack design adapts to support higher thermal loads and multi-node server clusters. Cabling and network upgrades are deployed to meet low-latency performance benchmarks. Edge AI workloads push smaller facilities to adopt compact AI-ready systems. Infrastructure upgrades also support video analytics, autonomous systems, and cybersecurity monitoring. The Algeria Data Center Infrastructure Market grows more AI-capable with increased investment in power-dense environments. High compute demand influences both architecture and component selection.

Market Challenges

Inconsistent Grid Power and High Energy Costs Disrupt Infrastructure Planning

Power reliability remains a concern in various Algerian subregions. Grid fluctuations affect critical uptime metrics and force developers to invest in large-scale UPS and BESS systems. This increases upfront capital costs and operating complexity. Cooling needs in hot climates further raise energy demand, impacting long-term cost structures. Diesel dependency in backup systems faces regulatory and environmental scrutiny. In remote areas, lack of utility infrastructure delays project timelines. The Algeria Data Center Infrastructure Market sees barriers in achieving cost-efficient operations across multiple sites. It prompts the need for energy diversification and demand-side innovation.

Limited Local Component Manufacturing and Engineering Skills Affect Supply Chains

Local availability of precision electrical, mechanical, and IT infrastructure components remains limited. Firms rely heavily on imports, which face delays and tariff risks. Skilled labor shortages in specialized engineering fields slow deployment and maintenance activities. Training programs and industry partnerships are insufficient to meet rising demand. Complex systems such as modular UPS or containment setups need foreign technical support. It hampers rapid scalability in tiered or hyperscale builds. The Algeria Data Center Infrastructure Market struggles with ecosystem maturity in supplier depth and technical workforce readiness. Long-term localization efforts will be vital to close this gap.

Market Opportunities

National Cloud Strategy and Government Digitization Creating Demand for Local Hosting

Algeria’s push for digital transformation across public services expands the scope for sovereign cloud. Ministries and state-run enterprises need secure, low-latency hosting to run mission-critical applications. Government procurement shifts toward local data residency requirements, favoring domestic facility operators. Local firms gain contracts for design, construction, and managed hosting. The Algeria Data Center Infrastructure Market benefits from these national cloud mandates, enabling sustainable demand pipelines.

International Partnerships, Tech Zones, and Telecom Reform Enabling New Entrants

Regulatory improvements and tech park development offer incentives to new data center players. International firms seek joint ventures with local ISPs and construction firms. Liberalization in telecom boosts NIXP participation and interconnect growth. These reforms enhance Algeria’s appeal for foreign direct investment in digital infrastructure. It supports innovation across project models and technical delivery formats within the Algeria Data Center Infrastructure Market.

Market Segmentation

By Infrastructure Type

Electrical infrastructure dominates the Algeria Data Center Infrastructure Market due to the critical need for reliable power. High investments in UPS, battery systems, and PDUs secure uninterrupted operations. Mechanical infrastructure sees demand from large-scale cooling systems suited to Algeria’s climate. IT and network infrastructure drive growth in AI-ready servers and high-speed connectivity. Civil works focus on modular designs for faster deployment. Architectural upgrades like raised flooring support efficient airflow and cable routing.

By Electrical Infrastructure

UPS systems and power distribution units hold significant share within this segment. Frequent power instability makes reliable backup essential. Battery energy storage systems (BESS) gain interest for their scalability and lower emissions. Transfer switches and switchgear support smooth grid-to-generator transitions. Utility services and grid connection upgrades are critical in new tech zones. Algeria Data Center Infrastructure Market shows rising demand for N+1 and 2N power setups across enterprise and colocation centers.

By Mechanical Infrastructure

Cooling units like CRAC and CRAH dominate due to rising rack density. Chillers, especially air-cooled variants, are widely adopted in urban builds. Containment systems reduce airflow losses and improve energy use. Pumps and piping systems are optimized for high-volume facilities. Advanced thermal systems are preferred in hyperscale environments. Algeria Data Center Infrastructure Market focuses on thermal efficiency and reliability amid climate-related constraints.

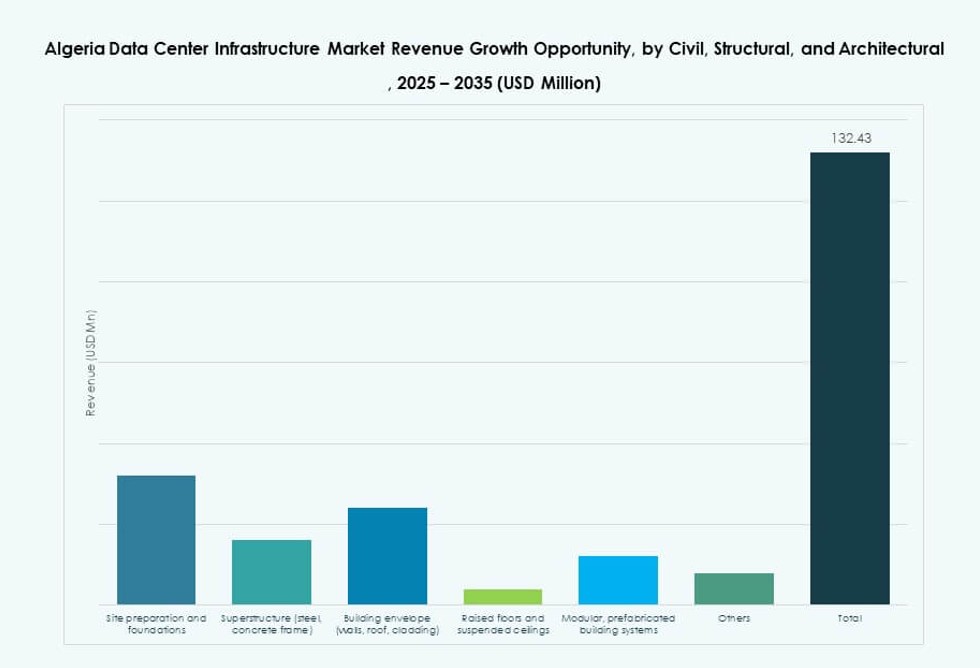

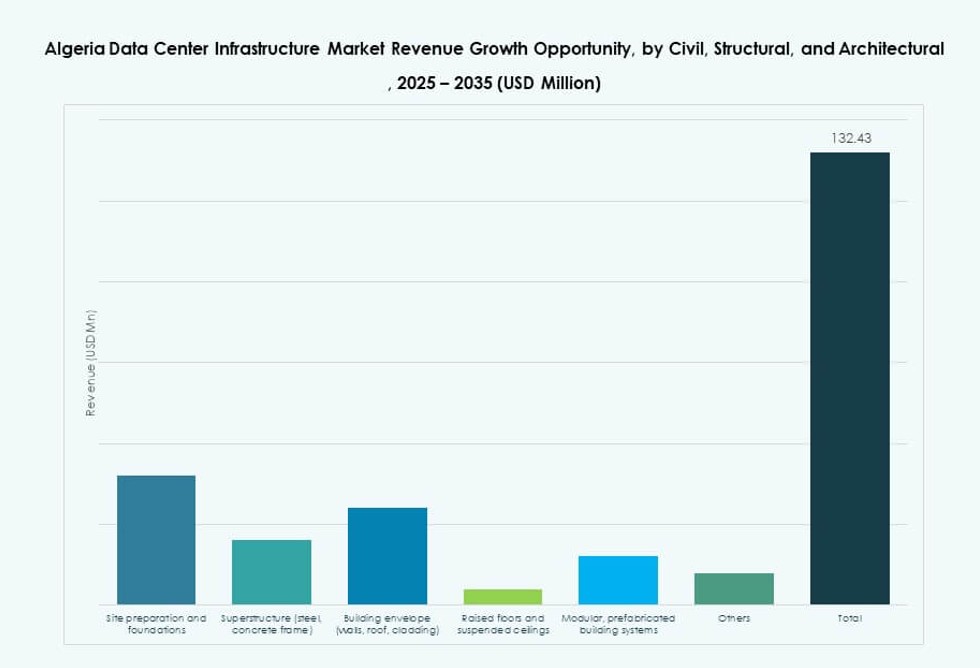

By Civil / Structural & Architectural

Site preparation and steel superstructures represent key investments in civil infrastructure. Raised floors and suspended ceilings enhance cable management and cooling performance. Modular and prefabricated building systems reduce construction time and improve build quality. Envelope designs with insulated panels support temperature control. It enables faster rollouts and consistent quality. Algeria Data Center Infrastructure Market benefits from these design trends, especially in tech parks and urban expansions.

By IT & Network Infrastructure

Networking equipment and servers account for major IT investments. Storage infrastructure expands to support video, AI, and analytics workloads. Racks and enclosures grow with higher-density deployments. Cabling upgrades focus on fiber and high-speed interconnects. It drives performance and uptime. Algeria Data Center Infrastructure Market sees strong demand for scalable and modular IT systems supporting emerging digital use cases.

By Data Center Type

Colocation and enterprise data centers hold dominant share, driven by telecom and BFSI sectors. Hyperscale builds are limited but growing via joint ventures. Edge facilities rise with IoT and smart city expansion. Public-private partnerships support small enterprise data center builds. Algeria Data Center Infrastructure Market is evolving into a multi-model ecosystem, driven by demand diversity and data localization mandates.

By Delivery Model

Turnkey and design-build models lead due to simplicity in large-scale deployment. Construction management sees traction in public sector projects. Retrofit and upgrade models are used in legacy sites adapting to modern loads. Modular factory-built models grow in new tech parks. Algeria Data Center Infrastructure Market responds to rising need for flexible delivery methods across urban and semi-urban areas.

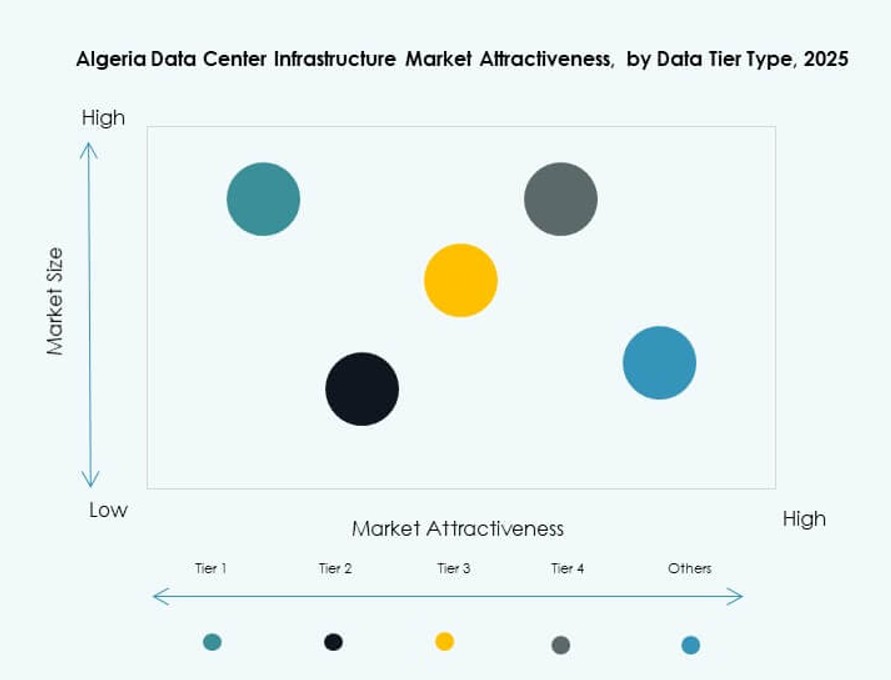

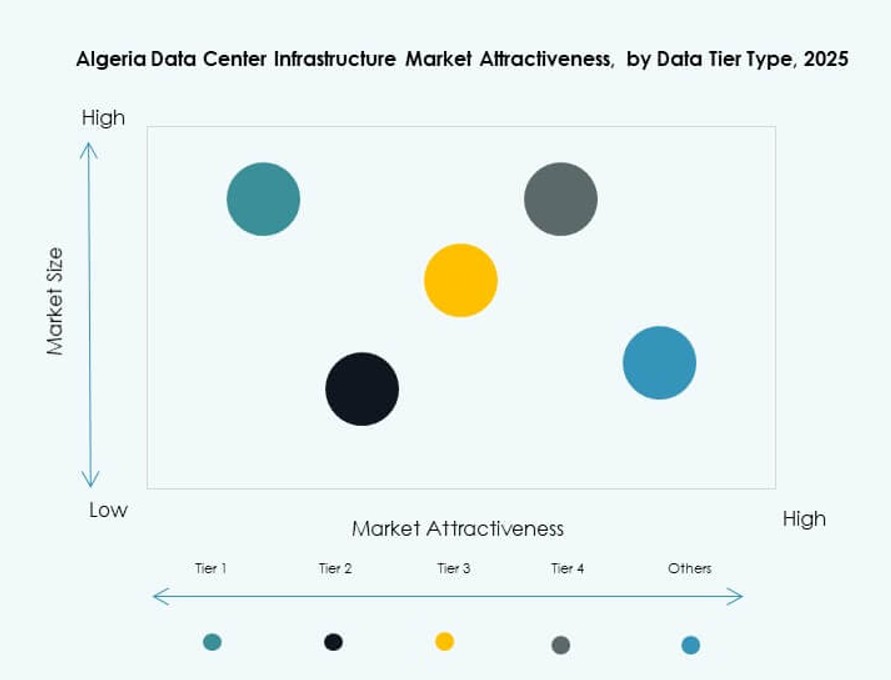

By Tier Type

Tier III dominates due to balance between redundancy and cost. Tier IV sees use in mission-critical public applications. Tier I and II are present in low-density regions. Standardization and certification trends are boosting Tier III adoption. Algeria Data Center Infrastructure Market increasingly aligns builds with international tiering to gain investor confidence and enterprise trust.

Regional Insights

Northern Region Holds Largest Share Due to Dense Urbanization and Capital Connectivity (63%)

The northern region, including Algiers and Oran, dominates the Algeria Data Center Infrastructure Market with a 63% share. Urban density, access to subsea cables, and strong utility infrastructure drive concentration here. Proximity to regulatory bodies, financial institutions, and tech parks attracts hyperscale and colocation developments. Most government initiatives, including national cloud efforts, are centered in this region. It becomes the default choice for enterprises seeking secure, low-latency hosting.

- For instance, WebServices Data Center in Algiers operates across 85 m² with a 2000 KVA power supply and N+1 redundancy. Its location near regulatory bodies, financial institutions, and innovation hubs supports demand for enterprise and colocation services.

Western and Coastal Regions Emerging as Secondary Hubs With Tech Zone Growth (21%)

Western Algeria, led by cities like Tlemcen, sees increasing activity due to new tech zones and education clusters. Coastal areas benefit from international connectivity routes and export-facing businesses. Local ISPs expand interconnection capacity to meet growing demand from SMEs and public sector users. It holds 21% of the market and continues to gain traction from infrastructure investments. Developers target these zones with modular builds and edge-ready setups.

- For instance, the government broke ground on March 16, 2025, for Algeria’s first AI data center in Oran’s Akid Lotfi district, equipped with GPUs to support researchers, startups, and academic users. Developers target these zones with modular builds and edge-ready setups.

Southern and Central Algeria Expanding Slowly With Government-Backed Infrastructure Projects (16%)

Southern and central regions hold 16% market share, supported by national inclusion programs. Government pushes for regional digital access drive investments in Tier I and Tier II facilities. Lower real estate costs and land availability attract future-oriented developers. However, grid limitations and technical skill shortages slow scale-up. Algeria Data Center Infrastructure Market in these regions depends on state-led infrastructure and PPP formats to ensure digital inclusion.

Competitive Insights:

- Algérie Télécom

- Schneider Electric

- Huawei Technologies Co., Ltd.

- Vertiv Group Corp.

- IBM

- Cisco Systems, Inc.

- Dell Inc.

- Oracle

- Hewlett Packard Enterprise (HPE)

- ABB

The Algeria Data Center Infrastructure Market features a competitive mix of global technology vendors and domestic operators. International players like Huawei, Schneider Electric, and Vertiv offer integrated power and cooling solutions tailored to local operating conditions. Algérie Télécom plays a vital role in connectivity and public sector deployments. IBM, Dell, and Cisco compete in high-performance computing and enterprise infrastructure. Oracle and HPE support digital transformation in regulated sectors like banking and government. It shows strong alignment with cloud migration, AI workloads, and regulatory compliance needs. Local partnerships and design-build models shape competitive positioning across urban and emerging regions. Players focus on modular builds, liquid cooling, and low-latency network integration to strengthen market presence. Competitive intensity is rising as government projects and colocation demand expand the opportunity landscape.

Recent Developments:

- In December 2025, Hewlett Packard Enterprise sold its Telco Solutions business to HCLTech, strengthening capabilities in telecom engineering, AI, and cloud-native services that could indirectly influence data center markets, though not explicitly linked to Algeria.

- In March 2025, the Algerian government broke ground on a new AI data center in Oran, aimed at supporting researchers, startups, and academic institutions with AI technology access. The foundation stone was laid by the Minister of Post and Telecommunications.

- In February 2025, Algérie Télécom partnered with Huawei to deploy a national 400G WDM all-optical backbone network, enhancing high-speed connectivity and supporting Algeria’s data center infrastructure growth for cloud services and 5G backhaul.

- In November 2024, Algeria’s People’s National Assembly inaugurated a modern parliament data center featuring advanced data processing, storage, archiving, and security systems. This followed an April 2024 agreement with Huawei for government data center projects.