Executive summary:

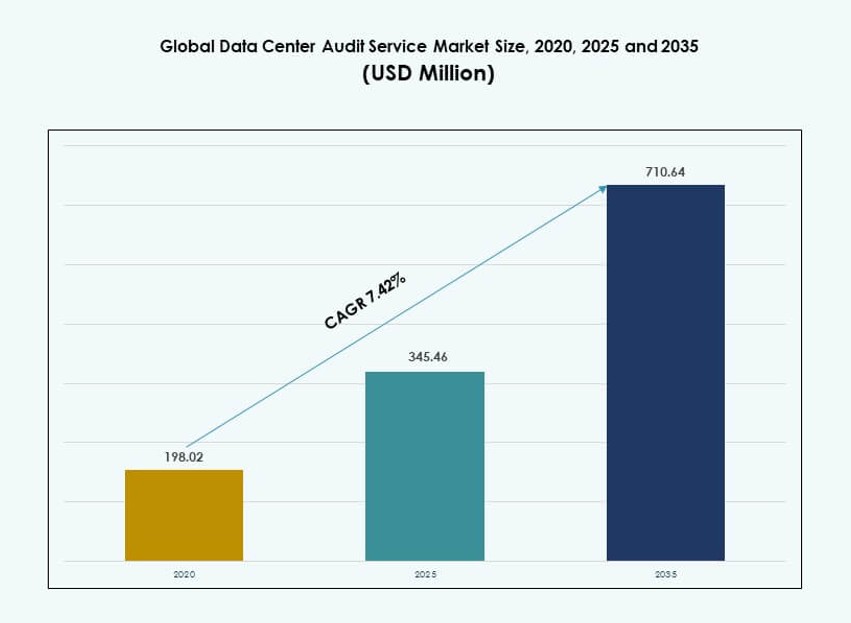

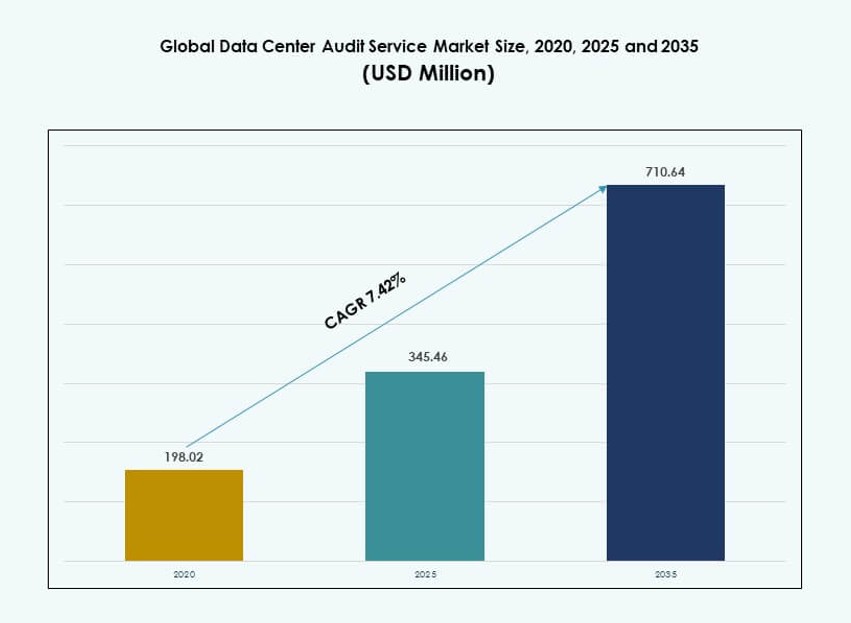

The Global Data Center Audit Service Market size was valued at USD 198.02 million in 2020 to USD 345.46 million in 2025 and is anticipated to reach USD 710.64 million by 2035, at a CAGR of 7.42% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Data Center Audit Service Market Size 2025 |

USD 345.46 Million |

| Data Center Audit Service Market, CAGR |

7.42% |

| Data Center Audit Service Market Size 2035 |

USD 710.64 Million |

The market grows due to rising regulatory pressure and complex data center operations. Operators adopt audits to ensure security, uptime, and compliance across digital infrastructure. Innovation in DCIM tools, automation, and analytics improves audit depth and accuracy. Businesses use audits to reduce risk and support ESG goals. Investors view audited facilities as stable and transparent assets. The market plays a strategic role in long-term infrastructure governance.

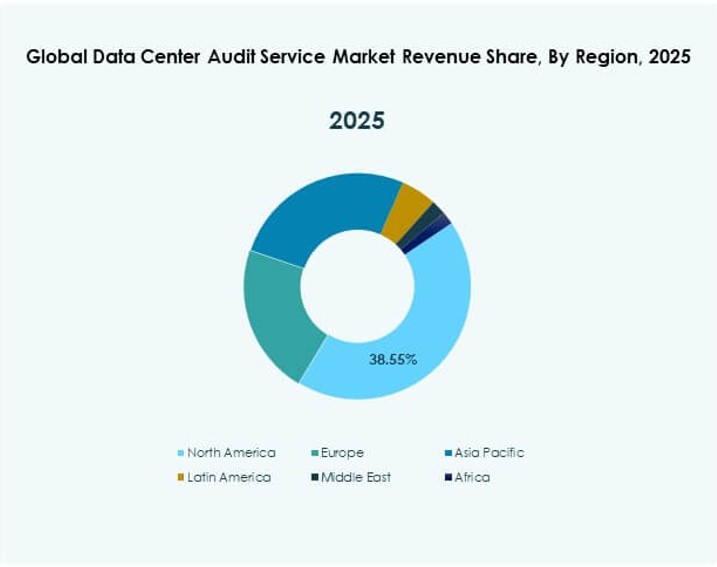

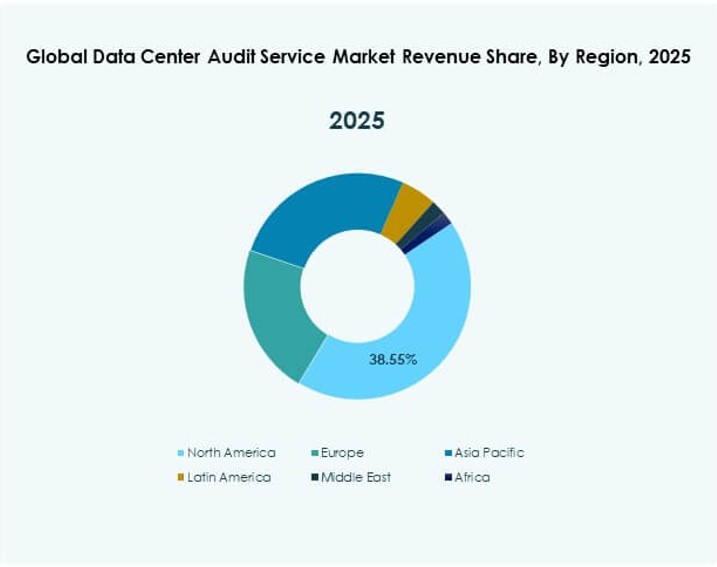

North America leads due to strict compliance norms and large hyperscale presence. The United States drives demand through cloud, finance, and public sector audits. Europe follows with strong focus on energy efficiency and data protection laws. Asia Pacific is emerging rapidly, led by China and India, due to data center expansion. Growth in cloud and edge facilities supports wider regional adoption.

Market Dynamics:

Market Drivers

Increased Regulatory Scrutiny and Rising Demand for Compliance Across Global Data Centers

The Global Data Center Audit Service Market is expanding due to rising global compliance mandates. Enterprises face evolving frameworks like ISO, PCI DSS, SOC 2, and GDPR, pushing regular infrastructure audits. Auditing ensures alignment with uptime standards, risk mitigation, and data protection protocols. Regulatory pressure compels both hyperscale and enterprise operators to adopt structured auditing cycles. Investors prioritize audited assets for long-term resilience and transparency. Compliance services now form a critical component of asset valuation and M&A activities. It supports confidence in operational governance. Market participants increasingly position audit services as assurance layers within broader IT risk frameworks.

Adoption of Smart Infrastructure Driving Advanced Data Center Audit Tools and Services

Smart infrastructure integration in data centers is triggering demand for intelligent audit services. Operators deploy AI, IoT, and DCIM tools, generating real-time performance data across critical systems. Auditors now use digital twins, thermal maps, and AI-assisted diagnostics to assess efficiency, redundancy, and sustainability. The Global Data Center Audit Service Market evolves toward proactive analysis rather than reactive checks. This shift supports early detection of vulnerabilities and higher uptime performance. For businesses, advanced audits lower risk exposure while optimizing infrastructure performance. Investors view smart auditing capabilities as a sign of innovation and resilience. This trend is accelerating in Tier III and IV facilities.

- For instance, Sudlows leverages thermal imaging and real-time power monitoring in its data center assessments, covering 500+ audits annually across Tier-certified sites.

Sustainability Mandates and Energy Optimization Goals Creating Audit-Driven Operational Models

Sustainability is a top driver pushing data centers to integrate energy efficiency audits into core operations. Governments and ESG-focused investors demand proof of carbon footprint reduction and PUE optimization. Audits help quantify performance gaps and identify retrofit opportunities in HVAC, lighting, and backup systems. The Global Data Center Audit Service Market enables transparent energy benchmarking and operational upgrades. Service providers expand offerings in green certifications, LEED readiness, and carbon audits. For operators, it builds credibility and meets client expectations for eco-aligned operations. Auditing supports renewable energy integration and infrastructure modernization. The market thus becomes central to long-term decarbonization goals.

Rapid Growth in Edge and Hyperscale Deployments Demanding Scalable Audit Frameworks

Expanding deployment of hyperscale campuses and distributed edge nodes increases the complexity of auditing. Traditional audits focused on single-site enterprise data centers. New models span multiple geographies, vendors, and cloud-hybrid environments. The Global Data Center Audit Service Market now includes scalable frameworks tailored to modular builds and high-density workloads. Service providers offer tiered audit solutions across lifecycle stages—planning, deployment, operation, and decommissioning. For hyperscalers, standardized audits support SLA compliance and investor transparency. For edge sites, audits validate network readiness and physical resilience. The shift requires specialized expertise and audit automation tools, enabling growth in global service portfolios.

- For instance, EPI has deployed its EPI Data Center Framework in over 60 countries, standardizing audit practices across hyperscale and modular facilities.

Market Trends

Integration of Predictive Analytics and AI in Audit Execution and Decision Making

AI and machine learning are transforming how audits are conducted in modern data centers. Predictive analytics now supports pre-audit risk mapping, anomaly detection, and scoring models. Real-time data streams from DCIM and BMS systems feed audit algorithms to highlight inefficiencies and security gaps. Auditors use these tools to focus on high-risk zones before physical inspections. The Global Data Center Audit Service Market integrates these features into audit dashboards, improving speed and depth. AI-powered audits reduce labor costs, standardize results, and increase frequency. This data-driven model appeals to colocation clients and regulatory agencies alike.

Growth of Cloud-Based Audit Platforms Offering On-Demand, Scalable Services

Cloud-native audit platforms are gaining traction, especially in multi-site and hybrid data center environments. These platforms allow operators to access audit logs, compliance reports, and infrastructure benchmarks from centralized dashboards. They support version control, audit trail management, and workflow tracking. The Global Data Center Audit Service Market increasingly features cloud tools that align with enterprise governance models. Cloud delivery reduces audit preparation time, enhances collaboration, and enables quick remediation tracking. Vendors differentiate through API integrations and modular compliance toolkits. This model supports scaling audit services without high capital investments.

Vendor Consolidation and Strategic Alliances Shaping the Competitive Audit Landscape

Mergers and partnerships are reshaping the audit service provider landscape. Large engineering firms are acquiring niche audit companies to offer bundled services across energy, infrastructure, and compliance. This consolidation improves geographic reach, domain specialization, and service standardization. The Global Data Center Audit Service Market sees these alliances as critical for Tier III and IV deployments. Vendors now offer turnkey audit contracts for hyperscale builds and multinational clients. Strategic partnerships between software firms and audit providers support integration of advanced tools and analytics. These shifts improve operational depth and broaden client bases.

Shift Toward Real-Time and Continuous Auditing to Support High-Availability Environments

Auditing is moving from scheduled to real-time cycles in critical infrastructure environments. Continuous auditing models track performance, temperature, and risk indicators 24/7. DCIM platforms generate logs automatically flagged for auditor review. The Global Data Center Audit Service Market sees strong demand for live dashboards, instant alerts, and automated compliance checks. This model supports high-availability needs in healthcare, finance, and public sector data centers. Real-time audits reduce incident response time and meet stringent uptime SLAs. Clients value continuous assurance over point-in-time certification. This trend is transforming audit engagement models and pricing strategies.

Market Challenges

Limited Skilled Workforce and Technical Capacity Gaps Across Emerging Markets

The Global Data Center Audit Service Market faces constraints due to shortage of certified auditors and skilled professionals. Emerging regions often lack local expertise in Tier certification, ISO frameworks, or power efficiency audits. Service providers struggle to maintain quality and consistency in geographically dispersed operations. Clients delay audits or rely on partial assessments due to resource gaps. Training programs are expensive and slow to scale. Smaller firms can’t afford continuous certification updates. It creates delays in audit cycles and reduces client confidence. Vendors must invest in remote tools, modular audits, and regional knowledge hubs to address this gap.

Fragmented Standards and Inconsistent Regulatory Frameworks Hindering Audit Adoption

Lack of harmonized global audit standards limits audit service scalability and cross-border alignment. Different regions follow varied compliance rules, certification norms, and reporting formats. The Global Data Center Audit Service Market must navigate fragmented ecosystems that increase audit complexity. Clients operating in multiple regions face overlapping or conflicting audit requirements. This inflates cost and slows down implementation timelines. Service providers face high overhead to maintain region-specific expertise. Standardization initiatives move slowly, leaving gaps in enforcement and interpretation. Harmonization is essential for wider audit adoption and global service consistency.

Market Opportunities

Sustainability Reporting and ESG Integration Creating Demand for Specialized Audit Services

Operators are under pressure to meet ESG goals and sustainability benchmarks. This creates demand for audit services that verify energy use, carbon output, and PUE improvements. The Global Data Center Audit Service Market supports operators in documenting progress, securing certifications, and aligning with investor expectations. Vendors offering ESG-aligned audits gain competitive advantage in hyperscale and enterprise segments.

Edge and Modular Data Centers Opening Opportunities for Audit-as-a-Service Models

Edge deployments require frequent, lightweight audits across distributed locations. Traditional audits are too costly or slow for these use cases. The Global Data Center Audit Service Market can meet this need with remote, subscription-based models. It creates recurring revenue for vendors and cost savings for operators seeking flexible, scalable oversight.

Market Segmentation

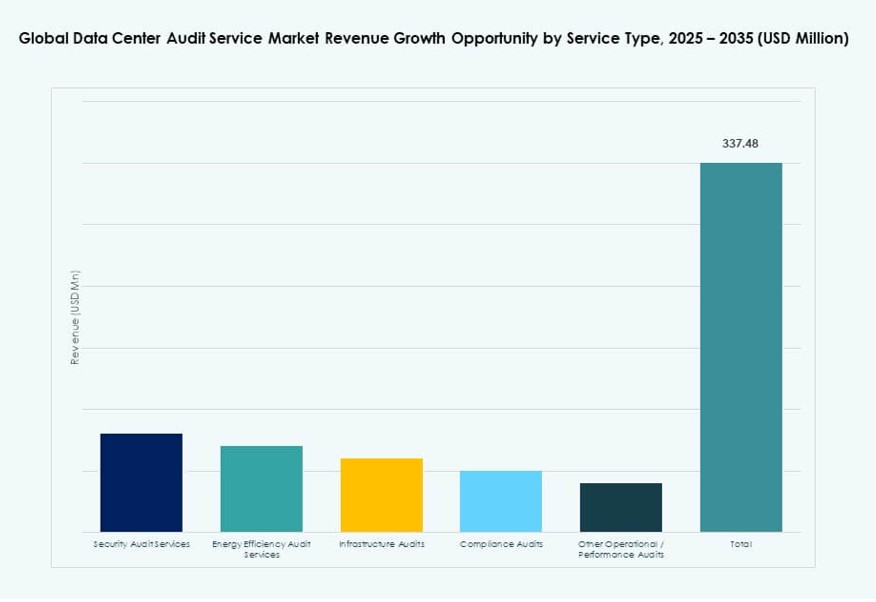

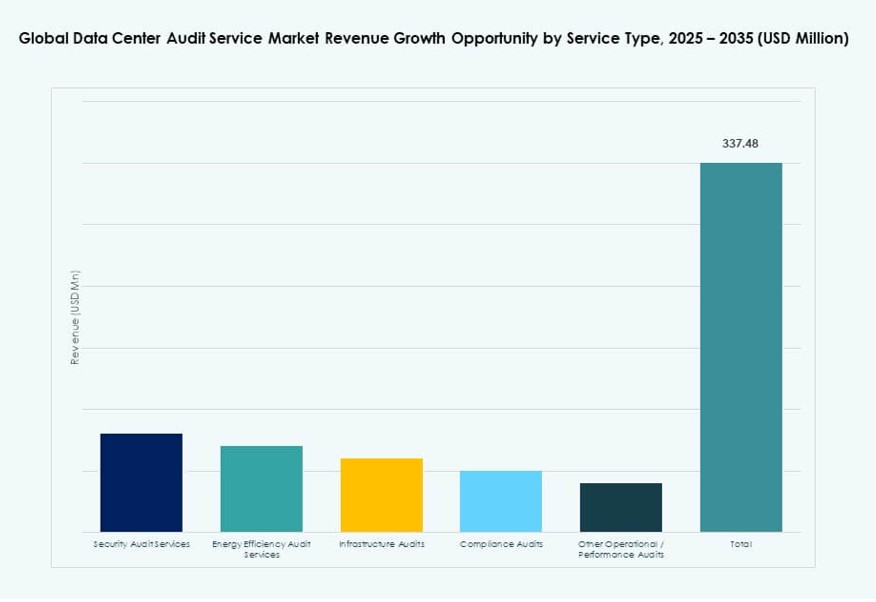

By Service Type

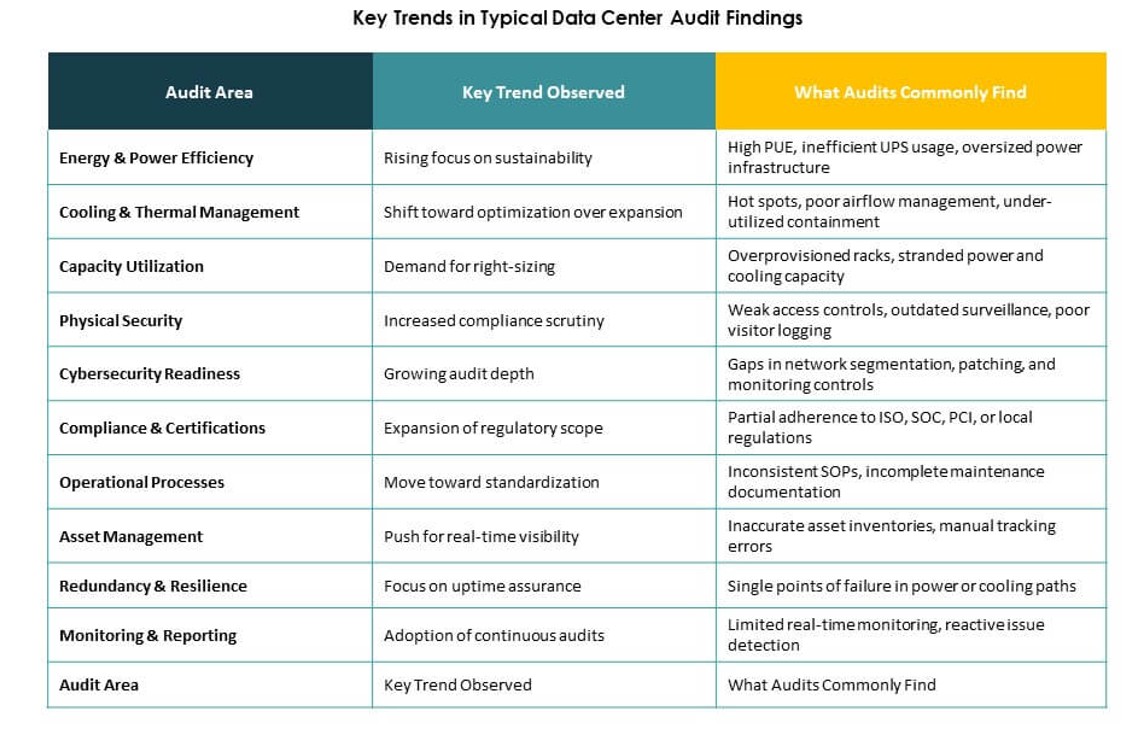

Security audit services dominate the Global Data Center Audit Service Market, driven by rising cyber threats and compliance regulations. Energy efficiency audits follow closely, supporting decarbonization and operational savings. Infrastructure and compliance audits are standard in enterprise and colocation builds. Demand is highest among Tier III/IV facilities needing full-spectrum auditing. Service diversity is expanding as operators seek bundled compliance support.

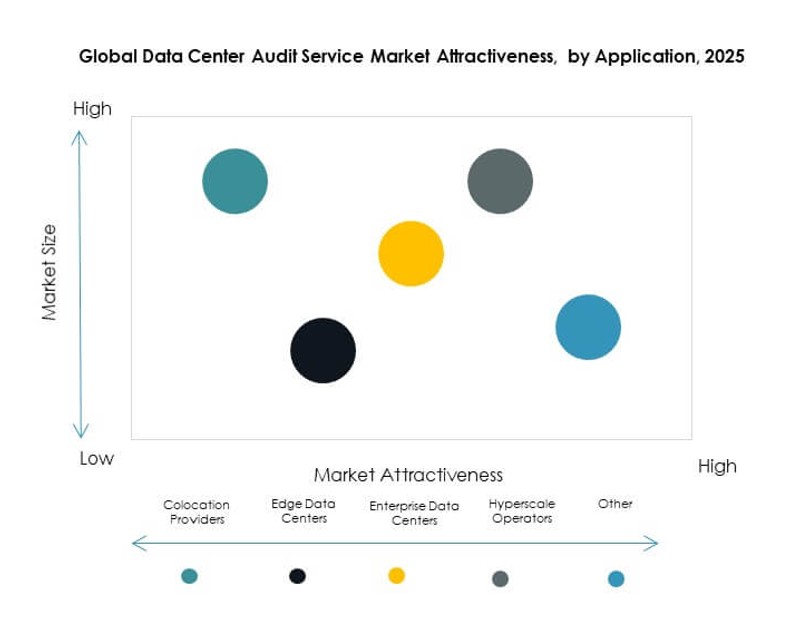

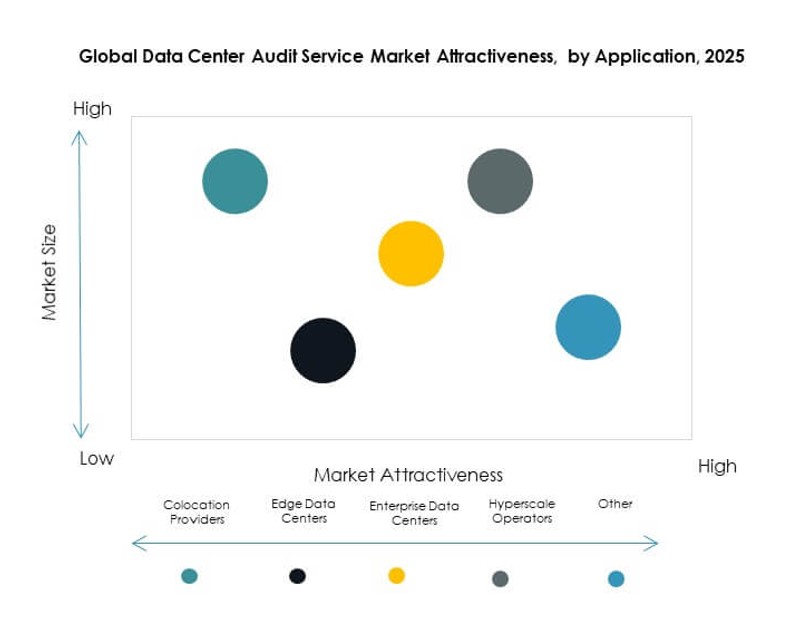

By Application

Hyperscale operators represent the largest application segment in the Global Data Center Audit Service Market. These players prioritize audit services to maintain SLAs, uptime, and environmental compliance across global campuses. Enterprise data centers also show steady demand for routine compliance and performance checks. Edge deployments require smaller, scalable audits. Colocation providers use audits to validate client infrastructure and attract new tenants.

By End User

Large data centers account for the bulk of demand in the Global Data Center Audit Service Market. Their complex architecture and compliance obligations require frequent, specialized audits. Small and medium data centers are adopting audits gradually, often focusing on energy or performance checks. Service providers are tailoring packages to address size-based needs with cost-effective options.

By Deployment Model

On-premise audit services remain dominant, especially in secure enterprise environments. However, cloud-based auditing is gaining traction across colocation and hybrid models. The Global Data Center Audit Service Market sees colocation audit services expanding as multi-tenant requirements grow. Hybrid models balance flexibility, scalability, and cost-efficiency for regional and international deployments.

By Data Center Tier

Tier III data centers lead demand in the Global Data Center Audit Service Market due to high availability needs and client-facing operations. Tier IV facilities follow closely, requiring stringent, certified audits. Tier I and II sites adopt audits more slowly, often during retrofits or sustainability upgrades. Audit frequency and scope increase with tier level.

Regional Insights:

North America Leads in Audit Adoption Due to Compliance, Hyperscale Growth, and Sustainability Mandates

North America accounts for around 39% of the Global Data Center Audit Service Market in 2025. The U.S. drives most demand due to strict regulatory requirements, investor scrutiny, and rapid hyperscale expansion. Operators conduct routine audits across Tier III and Tier IV campuses to maintain uptime and compliance. Canada supports regional growth through rising energy efficiency and ESG audit demand. High market maturity strengthens audit penetration. The presence of global audit firms supports advanced service adoption. Strong governance frameworks sustain long-term regional leadership.

- For instance, Digital Realty underwent comprehensive energy and operational audits across its North American portfolio, achieving ENERGY STAR certification for 31 of its data centers, which represent over 500 MW of IT capacity and maintain an average Power Usage Effectiveness (PUE) of 1.45.

Europe Follows with Strong Sustainability Focus and Regulatory‑Driven Audit Demand

Europe holds nearly 28% market share in the Global Data Center Audit Service Market during 2025. Germany, the UK, and France lead due to strict energy efficiency laws and GDPR compliance needs. Operators prioritize carbon reporting, efficiency audits, and regulatory validation. Tier II and Tier III cities show growing demand for modular audit services. Government incentives support audit adoption. Centralized compliance frameworks improve service consistency. A skilled auditor base strengthens regional execution.

Asia Pacific Emerges as the Fastest‑Growing Region with Rising Edge and Enterprise Demand

Asia Pacific contributes around 24% to the Global Data Center Audit Service Market in 2025 and shows the strongest growth trajectory. China and India lead due to cloud expansion and digital infrastructure investment. Southeast Asia adds momentum through colocation and enterprise deployments. Operators seek audits to align with global uptime and security standards. Regional expertise remains uneven, but vendor expansion improves access. Demand for hybrid audits remains high. Government digital programs accelerate long-term adoption.

- For instance, ST Telemedia Global Data Centres (STT GDC) reports independently assured sustainability results across its Asia‑Pacific portfolio. In FY2024, third‑party assurance providers validated a 51.8% reduction in carbon intensity for STT GDC India and a 34.5% improvement in Water Usage Effectiveness, supported by optimized cooling audits in India and Singapore.

Competitive Insights:

- Workspace Technology

- CND

- Siemon

- EPI

- APL Data Center

- Sudlows

- PRIME

- Silverback

- Oxley Technologies

- Bureau Veritas

The Global Data Center Audit Service Market features a competitive mix of regional specialists and global infrastructure consultancies. Large players such as Bureau Veritas and EPI lead with certified audit frameworks and multi-regional presence. Emerging firms like Sudlows and Silverback focus on Tier certification, energy audits, and performance benchmarking. Players differentiate through service flexibility, audit depth, and tool integration. It is shaped by growing demand for ESG audits, hybrid cloud compliance, and real-time monitoring. Strategic partnerships and bundled audit solutions are rising across enterprise and hyperscale segments. Companies with DCIM integration and modular audit offerings gain preference among clients seeking scalable, automated audits.

Recent Developments:

- In December 2024, Schellman & Company, LLC completed a carve-out acquisition of Connor Consulting’s Third-Party Risk Management (TPRM) practice. This move enhances Schellman’s compliance and audit capabilities, including data center-related services like SOC, ISO, and FedRAMP assessments, strengthening its position in the market.

- In August 2024, Schellman formed a strategic partnership with Secuvy to deliver integrated data protection and compliance solutions for AWS storage users. The collaboration combines Secuvy’s privacy technology with Schellman’s audit expertise for standards like HIPAA, PCI DSS, and SOC, targeting data center operators’ regulatory needs.

- In January 2024, Eviden (Atos Group’s digital division) announced a five-year strategic partnership with Microsoft to co-develop cloud, AI, and data solutions. This expands Eviden’s data management and security offerings, relevant to data center audits through cybersecurity and compliance services.