Executive summary:

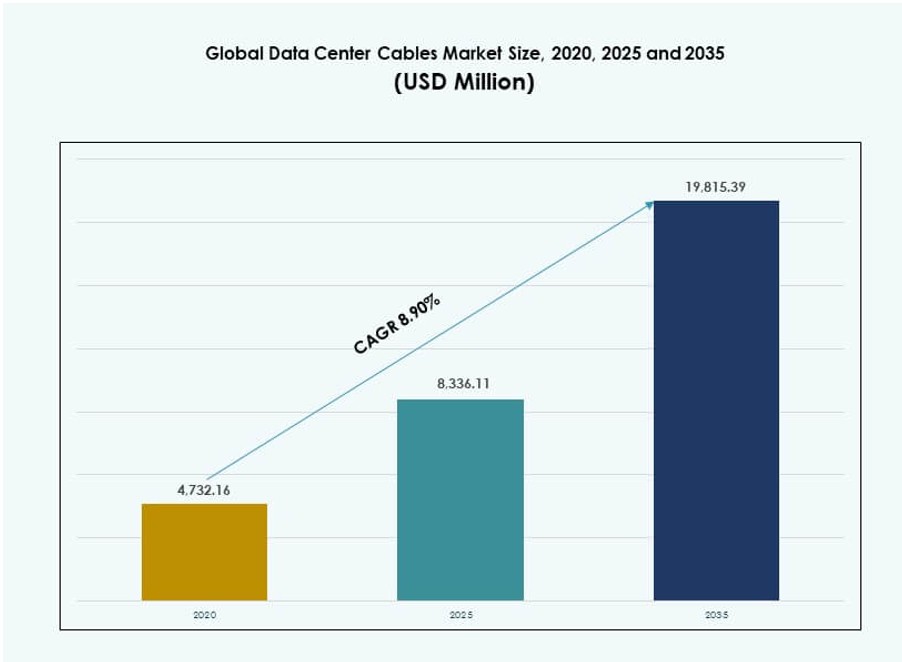

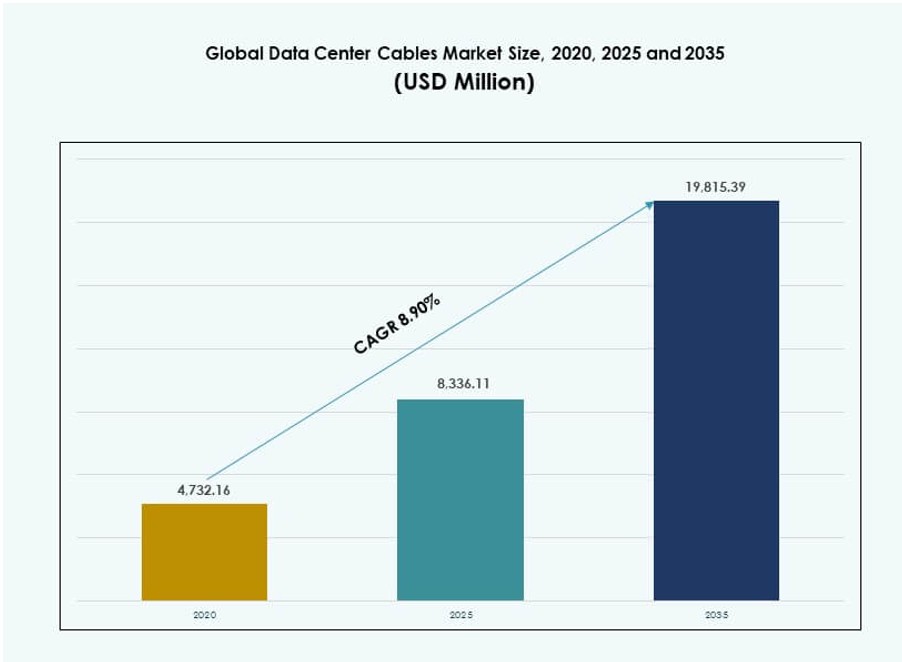

The Global Data Center Cables Market size was valued at USD 4,732.16 million in 2020 to USD 8,336.11 million in 2025 and is anticipated to reach USD 19,815.39 million by 2035, at a CAGR of 8.90% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Data Center Cables Market Size 2025 |

USD 8,336.11 Million |

| Data Center Cables Market, CAGR |

8.90% |

| Data Center Cables Market Size 2035 |

USD 19,815.39 Million |

Rising cloud workloads, AI deployments, and edge computing are transforming cabling infrastructure across hyperscale and enterprise data centers. Operators prioritize high-speed, low-latency solutions like fiber optics to support dense rack environments and fast data flow. Innovation in pre-terminated, modular, and smart cables enhances deployment speed and operational uptime. The market plays a vital role in enabling scalable digital infrastructure, making it a strategic investment focus for enterprises and infrastructure-focused investors.

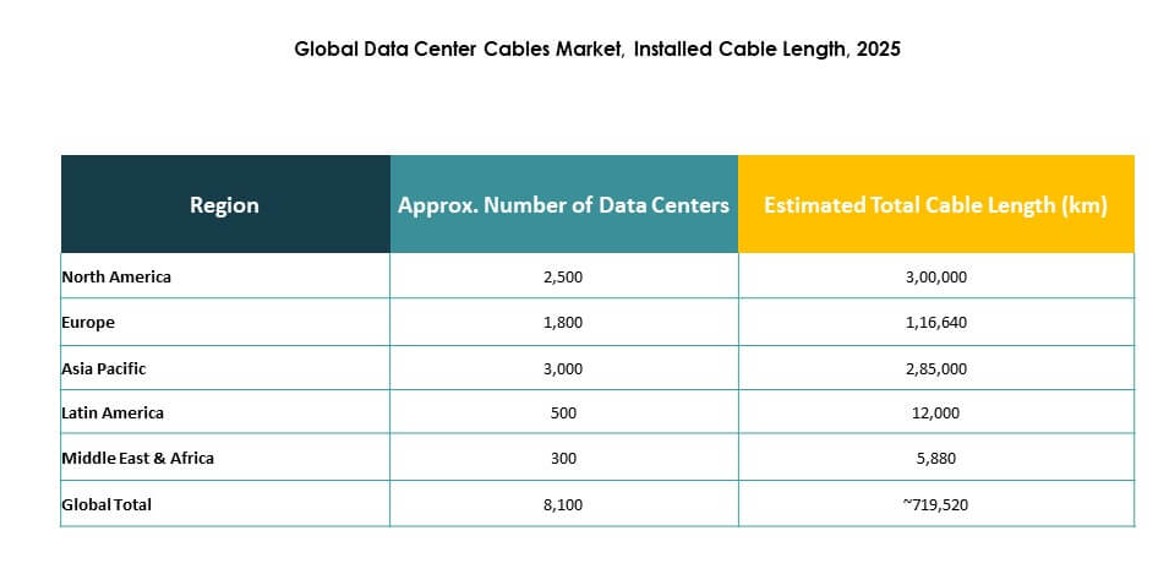

North America leads the market with hyperscale expansions, dense colocation hubs, and early adoption of 400G Ethernet. Asia-Pacific is growing rapidly, driven by cloud growth, regulatory demand for data localization, and digitalization across India, China, and Southeast Asia. Europe maintains steady demand through green data centers and modular deployments. Latin America and the Middle East & Africa are emerging with increasing infrastructure investment and cloud region expansion.

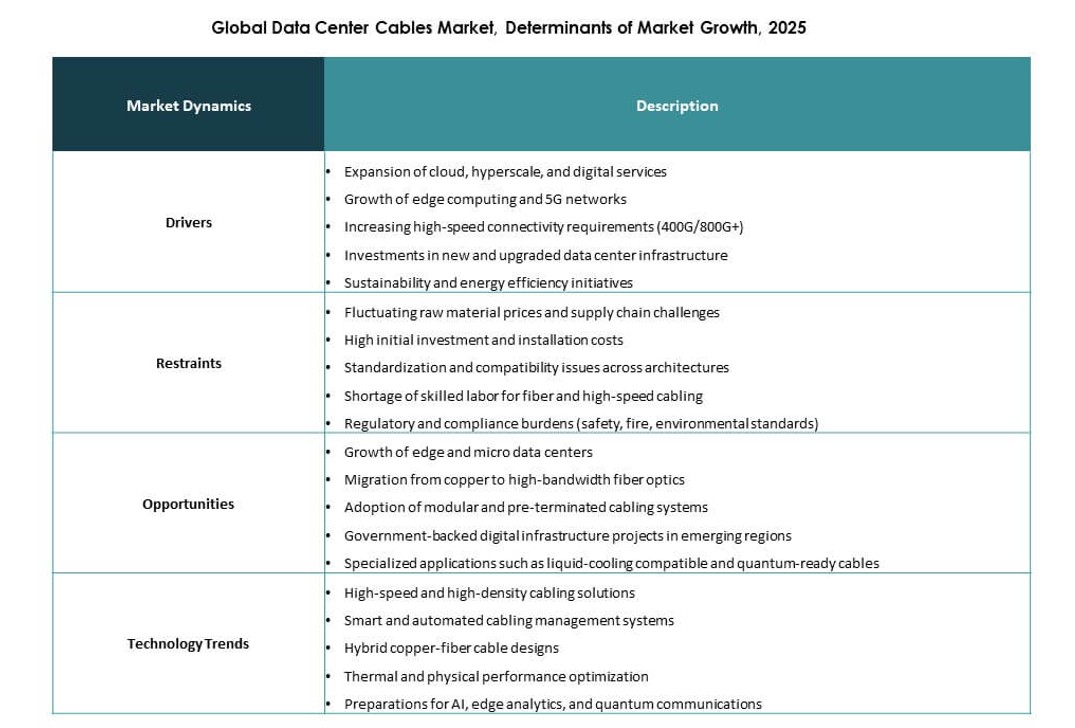

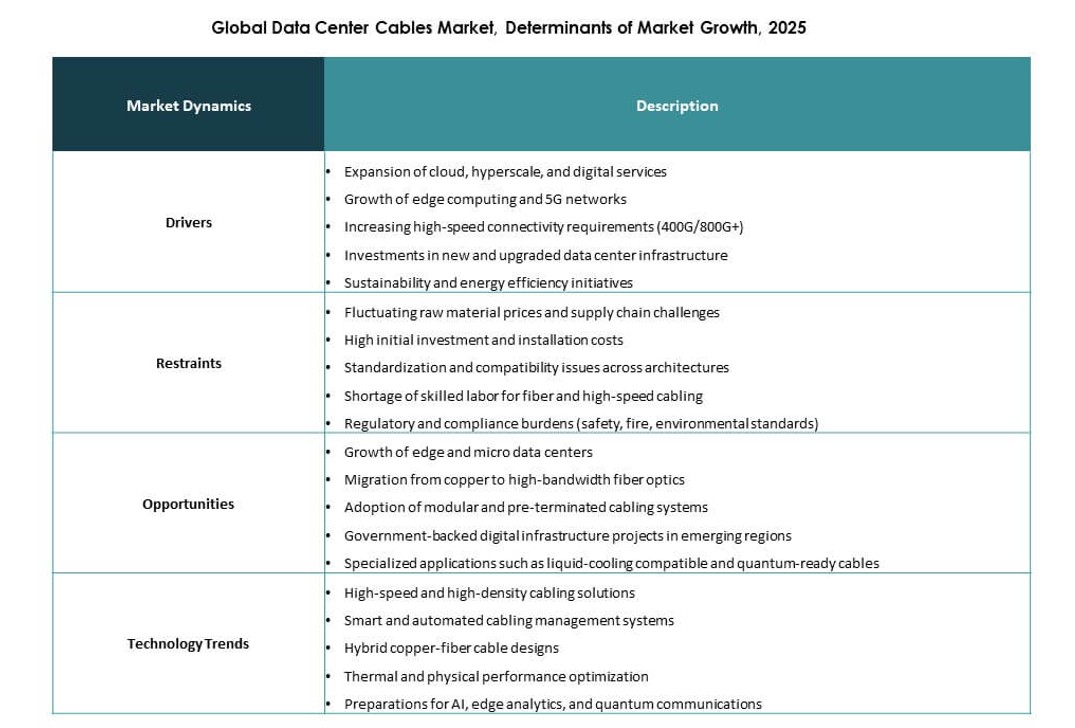

Market Dynamics:

Market Drivers

Rising Demand for High‑Speed and Reliable Data Transmission Infrastructure

Cloud computing, big data, and AI workloads are reshaping enterprise networks, pushing the need for low-latency and high-bandwidth transmission. The Global Data Center Cables Market plays a central role in enabling consistent, high-speed data delivery across dense server environments. Hyperscale operators are upgrading infrastructure to ensure uninterrupted service and capacity expansion. Fiber-optic solutions lead due to their speed, bandwidth, and signal integrity. Copper cables remain in demand for shorter connections and budget-sensitive builds. Enterprises are prioritizing high-availability systems that reduce data loss and improve throughput. Investment in cabling now directly supports operational continuity. Vendors that offer technically advanced and reliable cables gain strategic preference. This driver firmly anchors long-term infrastructure spending in the digital economy.

- For instance, Microsoft has deployed hollow‑core fiber (HCF) technology across parts of its Azure network to improve data transmission performance. The company reports that HCF enables significantly lower latency and faster signal propagation compared to conventional single‑mode fiber, supporting high‑performance cloud and AI workloads.

Expansion of Hyperscale and Colocation Data Center Facilities Worldwide

Major hyperscale companies are deploying new sites across key global regions to meet surging cloud and content delivery demands. The Global Data Center Cables Market benefits directly from this expansion, as every facility requires robust cabling systems to interconnect servers, switches, and power infrastructure. Colocation operators follow suit by offering space to enterprises that need scalable digital capacity. Standardized build designs have created consistent demand for structured cabling. Fiber and high-performance copper are used across all zones within these centers. Colocation growth diversifies end-user needs, encouraging flexible cable types and configurations. Long-term framework agreements favor vendors with global scale. Installation speed, reliability, and compliance features remain decisive buying factors. These deployments open stable revenue streams for global cable manufacturers and suppliers.

Shift Toward High‑Density Racks and Advanced Network Architectures

High-density rack configurations are gaining traction to optimize real estate, energy use, and operational overheads within facilities. The Global Data Center Cables Market is evolving to support tighter layouts that demand improved airflow, signal integrity, and space-saving routing. Cable design now prioritizes slimmer profiles, higher bend tolerance, and compatibility with high-speed standards. Operators are adopting structured cabling that ensures modularity and ease of scale. This architecture simplifies future network upgrades while reducing operational disruptions. It also minimizes errors during installation and supports automation in monitoring and fault detection. Pre-terminated cables and plug-and-play modules accelerate rollout timelines. Data centers investing in rack density require advanced cable solutions. Vendors with modular, scalable products stand to benefit significantly from this structural shift.

- For instance, hyperscale data centers with AI workloads now demand significantly more fiber cabling than traditional setups, often requiring 2–4 times the fiber count to support more than 3,000 fibers per rack. This reflects the need for higher bandwidth and dense connectivity to handle advanced computing and fast data flows.

Strategic Importance of Cabling in Data Center Performance and ROI

Cabling infrastructure directly impacts performance, scalability, and operational cost across data centers. The Global Data Center Cables Market holds strategic value as reliable cabling ensures uptime, reduces failure rates, and minimizes replacement costs. Poor cabling can result in signal degradation, latency spikes, and frequent troubleshooting. Enterprises view structured cabling as a long-term capital asset rather than a short-cycle purchase. This approach favors future-ready systems with high compatibility and support for upcoming standards like 800G Ethernet. Lifecycle planning now includes cabling replacement schedules, energy efficiency assessments, and airflow impact analysis. Investors monitor infrastructure robustness to assess ROI potential. Vendors that integrate intelligence, quality, and support into their cable offerings gain premium positioning. Strategic alignment with business continuity objectives strengthens the case for quality-focused cabling investments.

Market Trends

Growing Preference for Fiber‑Rich Network Topologies Across Data Centers

Network architectures are shifting toward fiber-rich topologies, especially in hyperscale and cloud data centers. The Global Data Center Cables Market is seeing strong traction in single-mode and multi-mode fiber deployments. Operators require longer reach and higher bandwidth across distributed zones. Fiber helps meet low-latency needs critical for AI training, real-time analytics, and high-performance workloads. Backbone and inter-rack connectivity increasingly favor fiber due to low signal attenuation. Enterprises view fiber as a future-proof medium, reducing replacement risk. Cabling vendors are expanding fiber product lines with optimized bend radius and thermal resilience. Training programs and handling guidelines are improving deployment quality. This shift is redefining procurement standards and vendor qualification benchmarks.

Adoption of Pre‑Terminated and Modular Cabling Solutions

Pre-terminated systems are emerging as a preferred choice for quick and efficient deployments in high-growth environments. The Global Data Center Cables Market is embracing modular architectures to meet demand for speed, scalability, and ease of maintenance. These systems reduce manual splicing errors and cut installation time by up to 60%. Operators favor plug-and-play solutions during expansions and retrofits. Standardized modular kits support predictable layouts and airflow optimization. Vendors are offering customized trunk assemblies and labeled patch panels to streamline workflows. Maintenance teams benefit from simplified fault isolation and faster repairs. Reduced downtime supports SLA compliance and customer satisfaction. This trend is strengthening the role of integrated cabling services in overall data center design.

Increased Focus on Cable Management and Structured Layouts

Structured cabling design is gaining importance as data centers grow more complex and dense. The Global Data Center Cables Market includes rising demand for cable trays, labeling systems, and routing accessories. Well-managed layouts support efficient airflow, simplify maintenance, and enhance visual audits. Operators enforce layout standards to ensure safety and compliance. Messy or congested cabling leads to overheating, difficulty in tracing faults, and higher risk of accidental disconnects. Structured systems also support tiered access control, disaster recovery planning, and workflow optimization. Vendors offering cable management bundles gain traction with infrastructure teams. It reflects a shift toward holistic cabling solutions that go beyond signal transmission to include operational efficiency.

Rising Alignment with Energy Efficiency and Sustainability Goals

Operators are aligning cabling choices with broader ESG and energy-efficiency targets. The Global Data Center Cables Market is adapting through innovations in low-loss cables, lightweight materials, and LSZH (low smoke zero halogen) jackets. These developments support greener infrastructure with reduced fire risk and easier recyclability. Governments and investors are pushing for sustainable data centers, making green materials a procurement priority. LSZH cables meet both safety and environmental compliance needs. High-efficiency designs also reduce cooling requirements and improve thermal management. Vendors are emphasizing sustainability certifications and environmental disclosures in bids. This trend places pressure on legacy cable types and drives adoption of greener alternatives across large-scale deployments.

Market Challenges

Complex Installation Requirements and Skilled Labor Constraints

High-performance cables often require precise installation and testing to meet performance standards. The Global Data Center Cables Market faces growing concerns around labor availability and field execution quality. Fiber cabling, in particular, demands trained personnel for splicing, termination, and validation. Skilled labor shortages delay project schedules and increase risk of defects. Mismatched connectors or improper bends can impact signal quality, increasing rework costs. Vendors are responding with training programs and pre-terminated options to reduce on-site complexities. However, not all data center operators can afford the higher cost of modular systems. The ongoing skill gap remains a critical factor influencing deployment efficiency and operational risk.

Price Pressure and Standardization Across Large‑Scale Deployments

Data center operators, especially hyperscalers, seek to reduce per-port costs and enforce procurement standardization. The Global Data Center Cables Market experiences strong price pressure due to high-volume contracts and limited differentiation. Standard cable categories like Cat6 and OM3 have become commoditized, tightening supplier margins. Fluctuations in copper and polymer prices further disrupt cost stability. Vendors struggle to balance innovation with affordability, especially when competing in government or colocation bids. Standardized bill-of-materials frameworks limit room for customization. Without added value in services or performance, suppliers risk being replaced purely on pricing. This pricing sensitivity makes it difficult for smaller players to compete at scale.

Market Opportunities

Expansion in Emerging Data Center Markets and New Cloud Regions

Emerging economies are witnessing rapid data center growth due to rising internet penetration and cloud adoption. The Global Data Center Cables Market stands to benefit from fresh infrastructure demand across Asia-Pacific, Latin America, and Africa. Government initiatives supporting digital hubs and 5G networks further accelerate investments. Cloud providers entering these regions create new opportunities for cabling vendors. Colocation providers build capacity in Tier 2 cities, requiring modular and efficient cable systems. Vendors with local manufacturing and partnerships can capture early market share. Early engagement builds long-term visibility and customer loyalty. This expansion wave will reshape the global demand map for structured cabling.

Innovation in High‑Speed and Smart Cabling Solutions

Advancements in data rates and management capabilities are opening new product categories. The Global Data Center Cables Market benefits from cables designed to support 400G/800G Ethernet, integrated sensors, and real-time performance tracking. These smart cables help data centers detect faults, temperature fluctuations, and physical strain. Enterprises focused on uptime and predictive maintenance prefer intelligent systems. High-speed cables support new compute loads like generative AI and GPU clusters. Vendors investing in R&D gain an edge in strategic contracts. Innovation serves both performance and operational goals, unlocking premium pricing segments. This area offers strong growth potential over the next decade.

Market Segmentation:

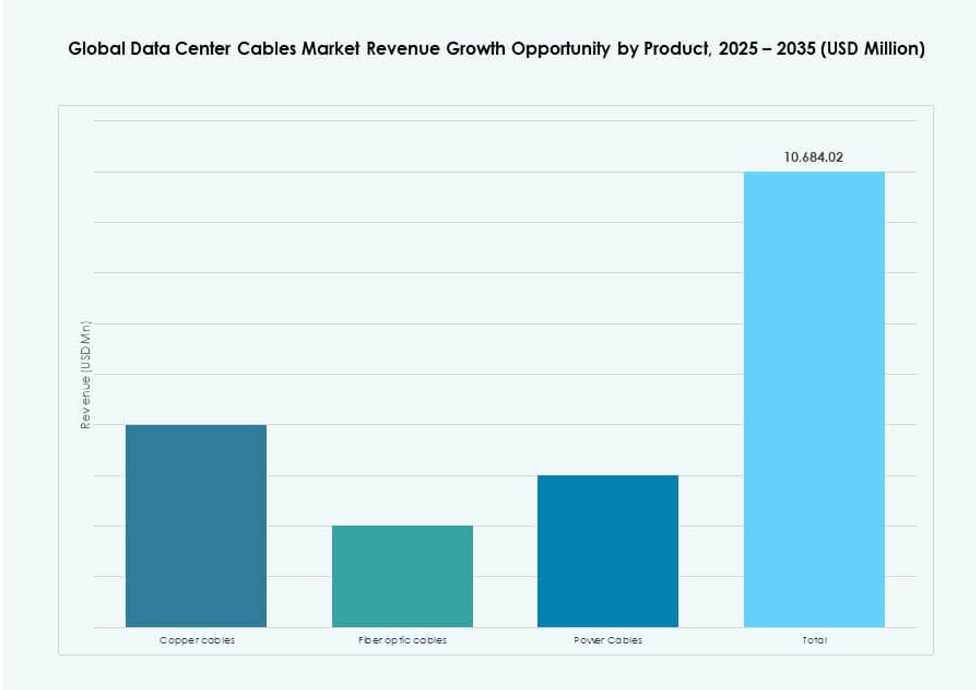

By Product

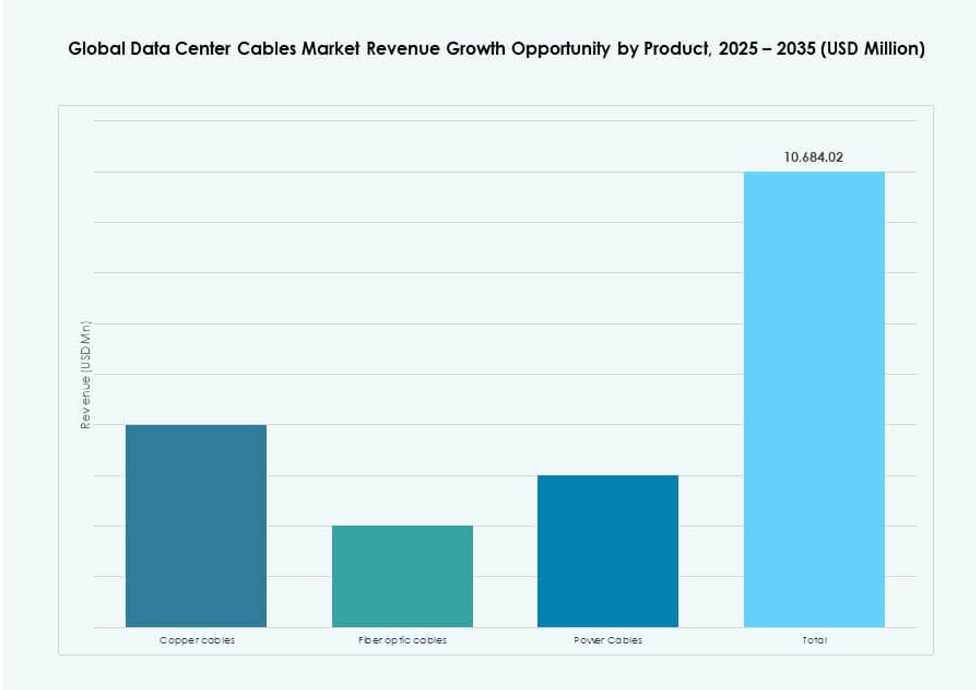

Fiber optic cables dominated the Global Data Center Cables Market, accounting for over 45% share in 2025. Their ability to support high bandwidth and long-distance transmission makes them the preferred option for hyperscale and cloud networks. Copper cables maintained relevance for short-range connectivity and budget-focused deployments. Power cables saw steady adoption as data centers scaled up their energy infrastructure. The market shows a clear shift toward fiber, driven by AI workloads, cloud computing, and the transition to 400G/800G environments.

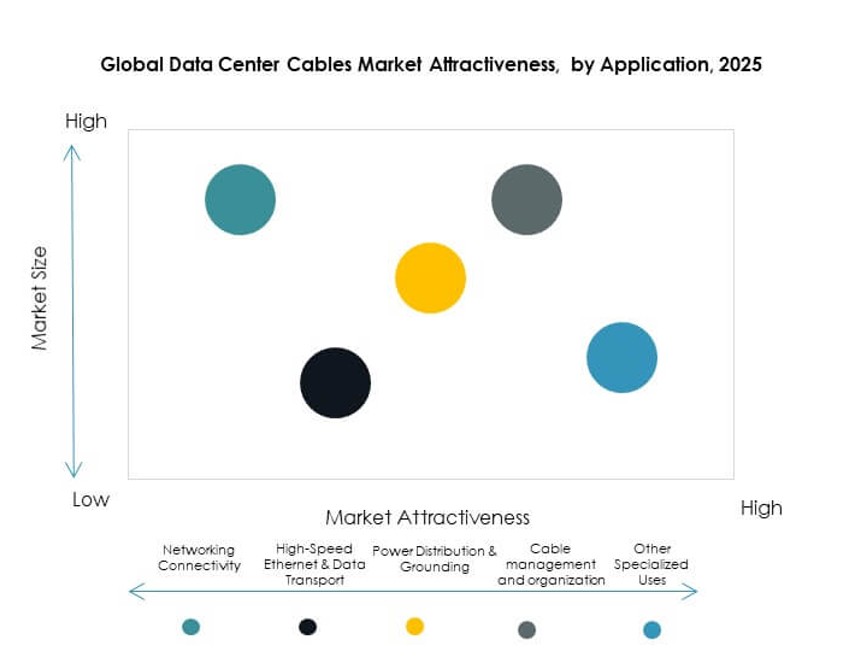

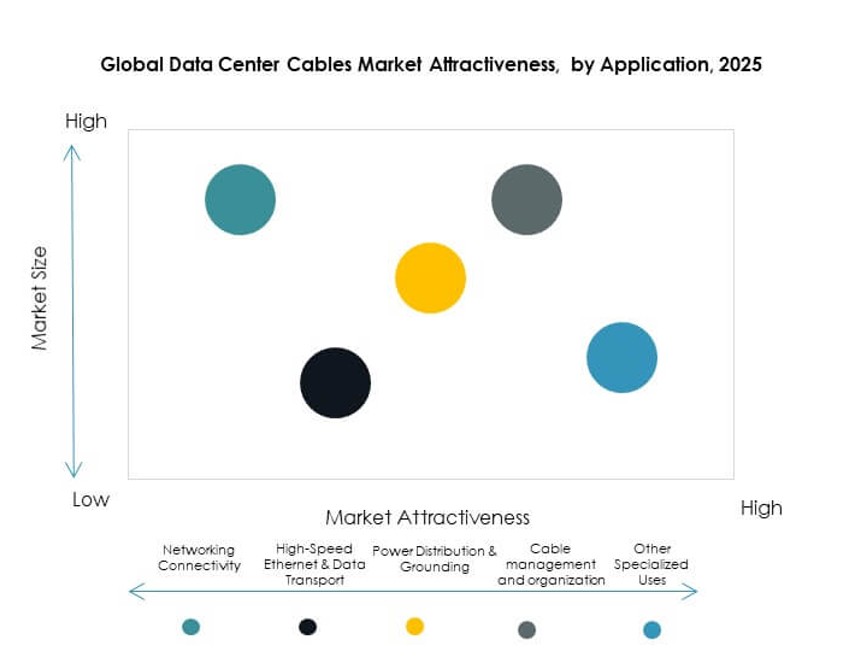

By Application

Networking connectivity held the largest share in the Global Data Center Cables Market, supporting core and access layer traffic. High-speed Ethernet and data transport applications rapidly expanded with growing demand for low-latency environments. Power distribution remained essential for uptime and safe operations. Cable management solutions gained traction in high-density layouts. Other specialized uses such as sensor-enabled monitoring systems started to influence product differentiation. Vendors now bundle multiple use-case options within structured cabling packages.

By End-user

Hyperscale data centers led the Global Data Center Cables Market with over 50% share in 2025, driven by rapid cloud region expansion. Colocation providers followed closely, benefiting from enterprise outsourcing trends. Enterprise data centers continued to upgrade legacy systems for better performance. Cloud service providers contributed to sustained demand with their modular and rapidly scaling infrastructure. End-user diversification supported a balanced growth outlook across segments, with hyperscalers setting the pace for product innovation and scale.

By Wire Category

Category 6A cables led the Global Data Center Cables Market, holding around 35% share due to high-speed capability and reduced crosstalk. Category 6 and 7 also showed strong usage in core network layers. Category 5E continued to decline due to performance limitations. Operators preferred higher-grade cables that support faster Ethernet and future upgrades. The shift toward high-density and high-throughput setups pushed demand for shielded and low-latency wire types across all deployment scales.

By Component

Cables remained the dominant component in the Global Data Center Cables Market, with nearly 60% share in 2025. Connectors gained traction as high-density designs required reliable terminations. Accessories such as trays, organizers, and patch panels became critical for structured deployment. Smart components that include monitoring or sensing capabilities also gained interest. Component-level integration helped reduce downtime, increase rack density, and support better airflow, improving operational efficiency and cable performance.

By Vertical

The IT & Telecom vertical led the Global Data Center Cables Market, contributing nearly 40% share due to high network loads and digital transformation. BFSI followed, with increased demand for secure and resilient infrastructure. Healthcare and government sectors adopted structured cabling for data protection and uptime. Retail and e-commerce platforms invested in cloud-driven infrastructure. Energy and utilities pushed growth through edge computing and real-time control systems. Diverse vertical needs helped vendors tailor cable systems for industry-specific standards.

Regional Insights:

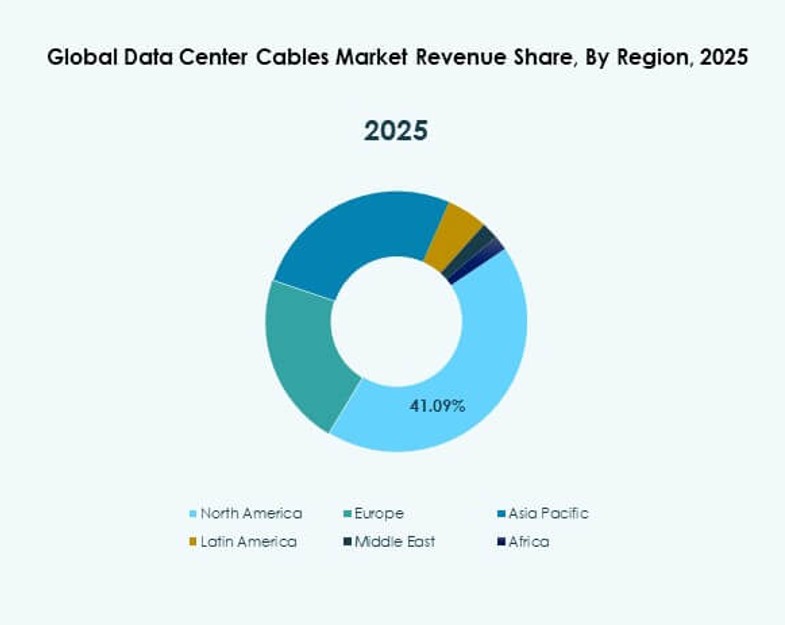

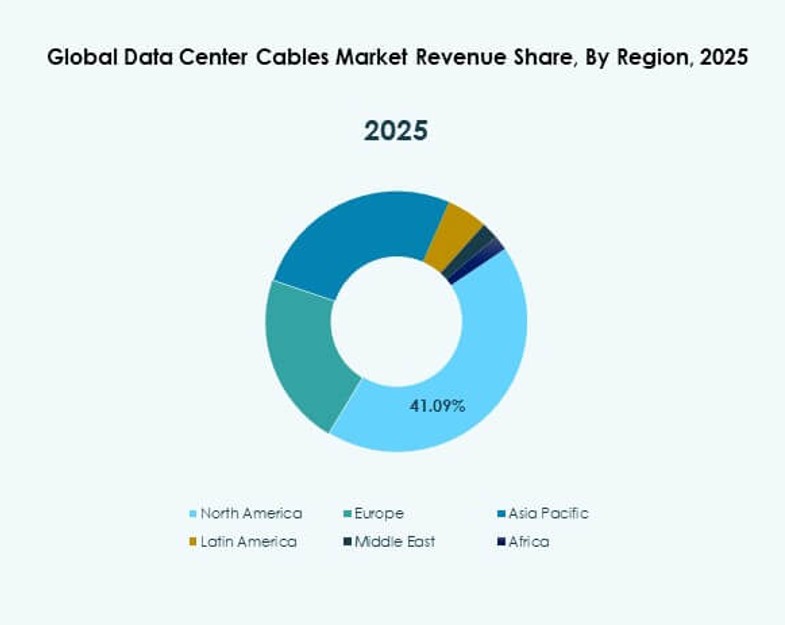

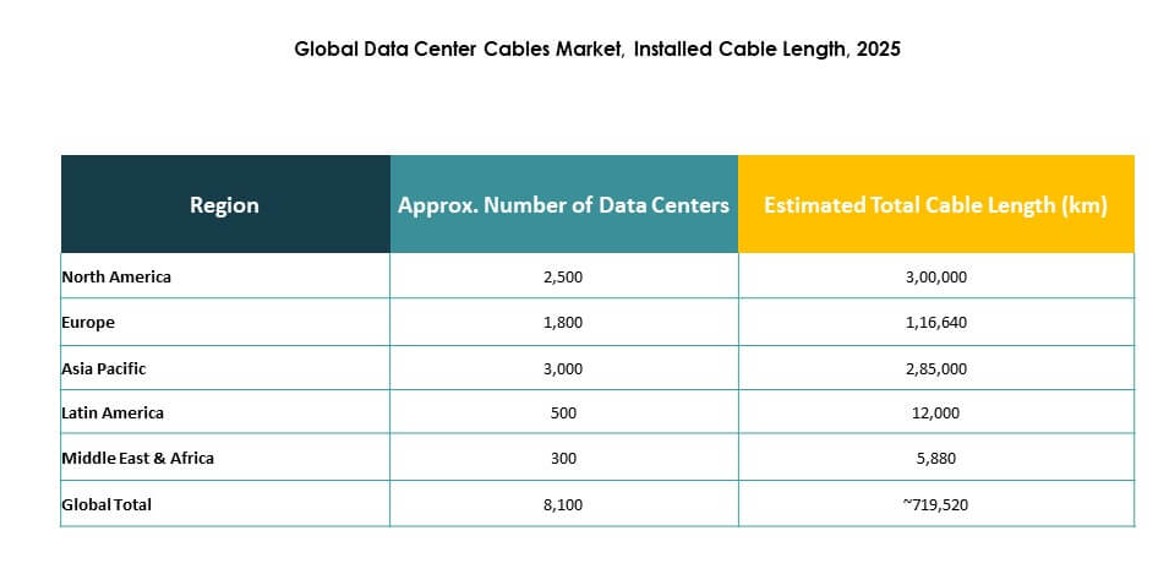

North America led the Global Data Center Cables Market, accounting for 38% share in 2025, driven by hyperscale data center expansions in the U.S. and Canada. Strong cloud presence, early adoption of high-speed fiber networks, and dense colocation hubs supported steady cable demand. Vendors benefited from long-term contracts, local assembly, and robust upgrade cycles. The region also served as a base for innovation and rapid deployment of 400G+ infrastructure. Strategic investments in AI infrastructure created additional cabling demand.

Asia-Pacific followed with 27% share in 2025, driven by data localization laws, booming internet usage, and enterprise digitalization across China, India, Japan, and Southeast Asia. Governments prioritized local cloud zones and edge facility growth, pushing fiber cable installations. India and Indonesia saw rapid growth in colocation capacity, while China led with hyperscale investments. The region remained cost-sensitive but growth-focused, attracting both global and regional vendors to compete aggressively on scale, flexibility, and compliance.

- For instance, Alibaba Cloud operates multiple data centers in Indonesia to support enterprise workloads and meet local data sovereignty requirements. Its Jakarta region provides low-latency access and localized cloud infrastructure for regulated sectors.

Europe accounted for 18% of the Global Data Center Cables Market, with growing demand for green and energy-efficient cabling solutions. Germany, the UK, and the Netherlands led in deployments, supported by connectivity initiatives and enterprise cloud migration. The region adopted modular and pre-terminated cable systems to reduce energy use and meet carbon-neutral targets. Latin America (9%) and the Middle East & Africa (8%) remained emerging markets with rising digital infrastructure investments, opening new growth corridors for structured cabling providers.

- For instance, Equinix strengthened its São Paulo data center footprint with advanced interconnection facilities that support high‑performance connectivity for enterprises and cloud providers. In Riyadh, stc group and Huawei deployed an optical fiber sensing solution over 50 km to enhance network resilience and monitoring in challenging environments.

Competitive Insights:

- CommScope

- Corning Incorporated

- Prysmian Group

- Belden Inc.

- TE Connectivity

- Furukawa Electric Co., Ltd.

- Panduit Corporation

- Leviton Manufacturing Co., Inc.

- AFL Global

- Schneider Electric SE

The Global Data Center Cables Market is highly competitive, with multinational players dominating supply chains and contract wins. It includes vertically integrated firms with strong R&D capabilities and regional manufacturing presence. CommScope and Corning lead in fiber-optic innovation and hyperscale deployments. Prysmian Group and TE Connectivity offer diverse portfolios across power, fiber, and copper categories. Panduit and Belden maintain strong traction through modular solutions and structured cabling systems. Most leaders focus on strategic partnerships, high-speed product lines, and intelligent monitoring features. Competitive advantage stems from technical performance, supply chain scale, and custom engineering support. It continues to evolve with high-speed demands, sustainability metrics, and pre-terminated system preferences shaping vendor strategies.

Recent Developments:

- In November 2025, Megaport entered an agreement to acquire Latitude.sh merging network-as-a-service with compute infrastructure across over 1,000 data centers. This move enhances global connectivity for data-intensive cable applications.