Executive summary:

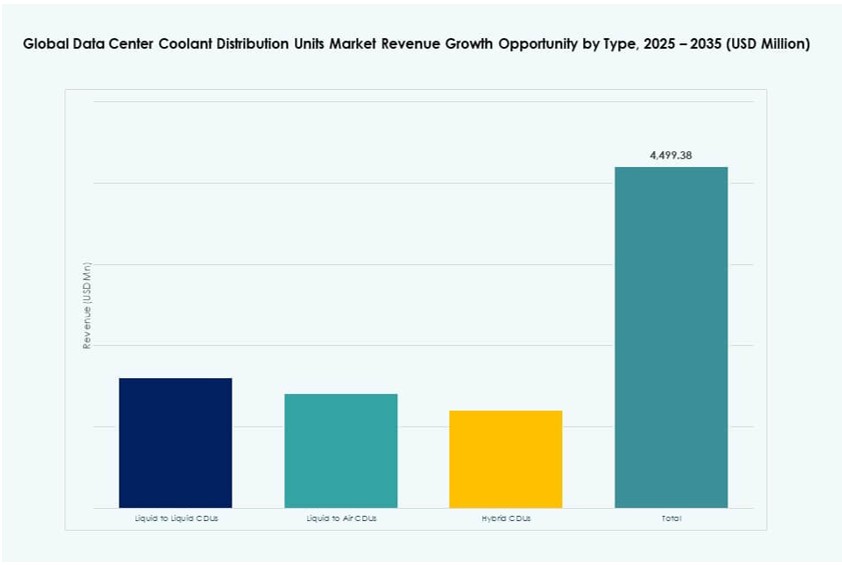

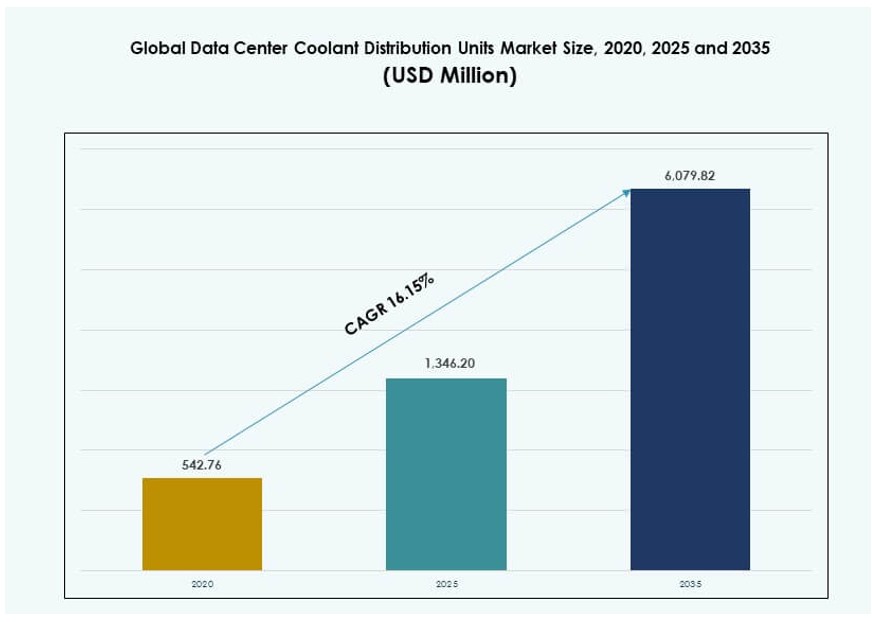

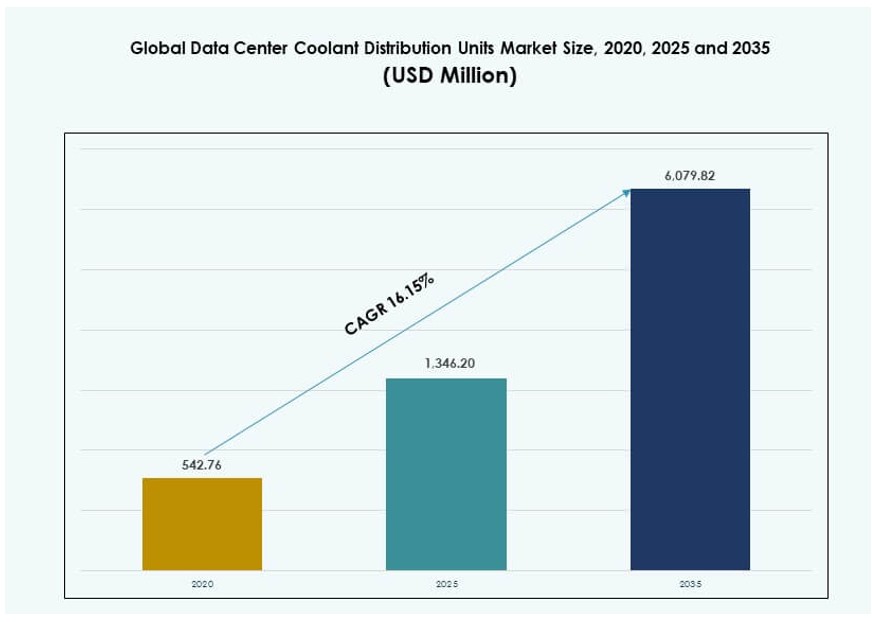

The Global Data Center Coolant Distribution Units Market size was valued at USD 542.76 million in 2020 to USD 1,346.20 million in 2025 and is anticipated to reach USD 6,079.82 million by 2035, at a CAGR of 16.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Data Center Coolant Distribution Units Market Size 2025 |

USD 1,346.20 Million |

| Data Center Coolant Distribution Units Market, CAGR |

16.15% |

| Data Center Coolant Distribution Units Market Size 2035 |

USD 6,079.82 Million |

The market grows due to rapid adoption of AI, cloud, and high‑density computing. Advanced processors generate higher heat loads that air cooling cannot manage. Liquid cooling systems improve efficiency and thermal control. Innovation in direct‑to‑chip and immersion designs supports stable performance. Businesses view this market as critical for future‑ready infrastructure. Investors see strong alignment with digital growth and sustainability priorities.

North America leads due to early adoption of hyperscale and AI data centers. The United States drives demand through large cloud and colocation deployments. Europe follows with focus on energy efficiency and green re gulations. Asia Pacific is emerging quickly, led by China, India, and Southeast Asia. Rapid digitalization and new data center builds support regional expansion.

gulations. Asia Pacific is emerging quickly, led by China, India, and Southeast Asia. Rapid digitalization and new data center builds support regional expansion.

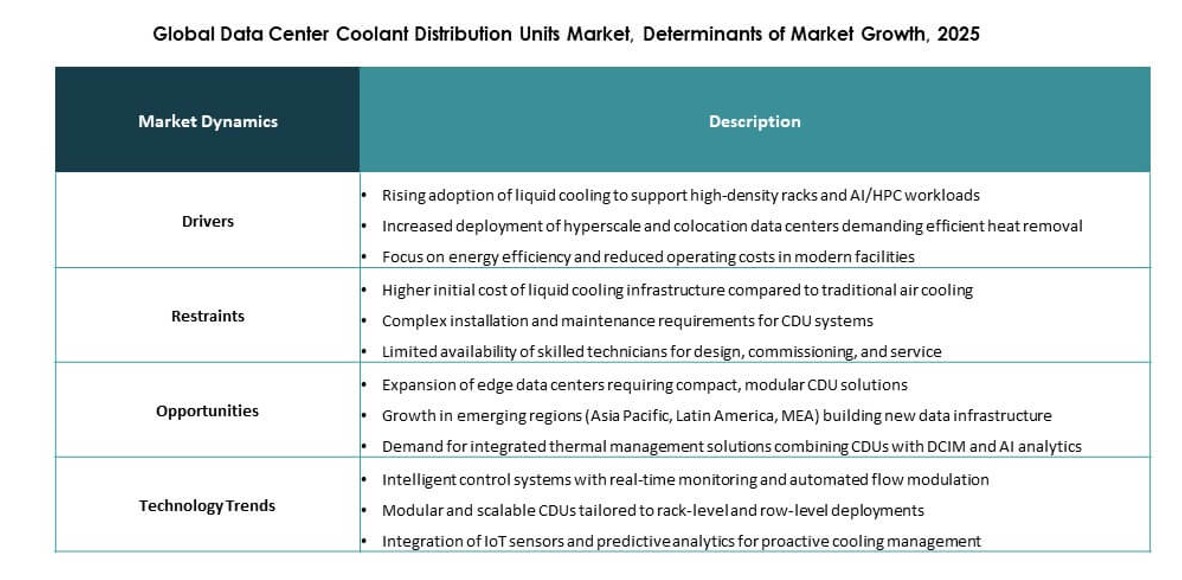

Market Dynamics:

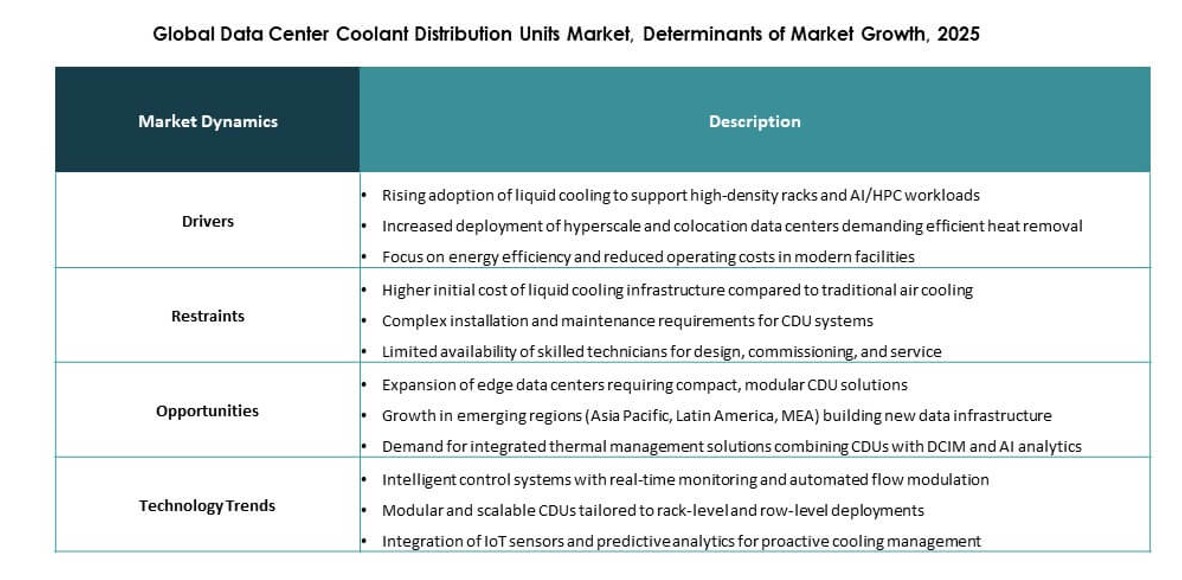

Market Drivers

Adoption of High-Density IT and AI Workloads Across New Data Center Builds

The Global Data Center Coolant Distribution Units Market is gaining momentum as AI training clusters and HPC systems demand efficient thermal control. Conventional air systems fail to support next-gen GPU-intensive computing, pushing adoption of liquid-cooled solutions. Coolant distribution units deliver steady thermal load management in space-constrained rack environments. They improve operational reliability in cloud, hyperscale, and enterprise-grade facilities. Edge computing is expanding localized demand for compact, high-performance cooling. It supports greater density without excessive energy draw or airflow dependency. Organizations require uninterrupted compute cycles for AI and analytics. This demand positions liquid cooling as an infrastructure priority.

- For instance, NVIDIA utilized Vertiv Coolant Distribution Units as part of its Blackwell-based GB200 NVL72 racks, leveraging Vertiv’s Liebert XDU systems to support liquid cooling at scale. This architecture enables a 25× improvement in energy efficiency compared to traditional air-cooled systems and manages thermal loads of up to 120 kW per rack, aligning with Vertiv’s high-density AI-ready infrastructure benchmarks.

Rising Emphasis on Energy Efficiency and Operational Cost Reduction

Energy efficiency remains a top priority for operators managing rising electricity prices and carbon mandates. Coolant distribution units minimize total cooling overhead compared to legacy systems. Their closed-loop systems reduce water usage and support targeted heat transfer. This design aligns with ESG compliance goals and green data center certifications. Integration with smart control platforms ensures optimal runtime and performance monitoring. Businesses gain long-term cost savings and predictable thermal conditions. The Global Data Center Coolant Distribution Units Market enables data centers to hit sustainability metrics while scaling capacity. It serves colocation, hyperscale, and public sector needs.

- For instance, Schneider Electric’s Uniflair cooling systems, including Coolant Distribution Units, have demonstrated up to 40% energy savings when paired with active flow controllers, according to company documentation. Facilities using these systems have achieved Power Usage Effectiveness (PUE) levels as low as 1.12, supported by optimized liquid cooling architectures and smart flow management.

Growth in Liquid Cooling Innovation and Cooling Interface Diversification

Liquid cooling has evolved beyond early niche deployments into a mainstream technology across new builds. Advanced CDU systems now support immersion cooling, direct-to-chip modules, and rear-door heat exchangers. This versatility drives stronger adoption in AI, research, and defense applications. CDUs enable precise flow and temperature control, supporting customized rack-level deployment. It supports multi-interface ecosystems, enhancing vendor flexibility and infrastructure agility. Operators gain efficiency without sacrificing layout freedom. The Global Data Center Coolant Distribution Units Market benefits from ongoing R&D investments and system compatibility upgrades. It unlocks new revenue channels for suppliers targeting enterprise and cloud clients.

Strategic Role in Data Center Design Optimization and Thermal Resilience

Cooling systems play a mission-critical role in uptime assurance, especially in Tier III and IV data centers. CDUs reduce risk of thermal hotspots and downtime in AI-dense environments. Facility designers now integrate CDU specifications during early-stage architecture planning. The Global Data Center Coolant Distribution Units Market supports modular deployments for edge, containerized, and multi-tenant builds. It provides thermal resilience under rapid load shifts and seasonal variations. Business continuity demands high-performance infrastructure that balances cost, density, and space efficiency. The market allows operators to achieve SLA compliance while minimizing energy penalties and footprint.

Market Trends

Integration of CDUs into Liquid Cooling Ecosystems for AI and Quantum Workloads

The Global Data Center Coolant Distribution Units Market is shaped by demand for integrated liquid cooling ecosystems. CDUs now operate as core components in systems designed for AI, quantum, and accelerated computing clusters. These workloads generate high heat flux that requires direct and efficient removal. Liquid-to-liquid CDUs enable energy reuse and loop separation across racks. Integration with digital twins and DCIM tools supports predictive cooling. CDUs are being bundled with immersion tanks and RDHx panels. Vendors offer modular CDU designs to fit legacy or greenfield layouts. This ecosystem-based approach drives deeper penetration across segments.

Shift Toward Modular and Scalable CDU Units in Edge and Remote Deployments

The market sees growing interest in modular CDU systems optimized for remote and edge applications. Operators need space-efficient cooling units that can be shipped, installed, and scaled easily. These units often support variable capacity ranges and interchangeable cooling interfaces. Their plug-and-play nature speeds up deployment timelines for edge colocation hubs and telecom nodes. Compact CDUs are tailored for mobile, containerized, and military-grade data centers. They address thermal challenges in bandwidth-intensive and latency-sensitive environments. The Global Data Center Coolant Distribution Units Market reflects this shift toward rapid-deployment infrastructure across geographies.

Smart CDU Integration with IoT Sensors and AI-Based Monitoring Tools

Smart cooling has emerged as a core trend with CDUs now featuring embedded sensors and AI analytics. Operators track flow rate, inlet temperature, power draw, and coolant quality in real time. Data informs predictive maintenance and dynamic workload balancing. Integration with DCIM platforms and BMS software enhances transparency and control. This digitization trend improves efficiency, reduces manual intervention, and aligns with Industry 4.0 practices. The Global Data Center Coolant Distribution Units Market enables better lifecycle management of cooling assets through automation and analytics. This evolution supports large-scale deployments where human oversight is limited.

OEM Consolidation and Vertical Integration Across Cooling Supply Chains

Vendor ecosystems in the cooling sector are undergoing rapid change. OEMs now pursue vertical integration strategies to offer complete liquid cooling portfolios. CDU suppliers align with immersion tank makers, pump vendors, and fluid formulation specialists. This reduces system compatibility issues and enhances service bundling. Supply chain consolidation supports economies of scale and pricing leverage. The Global Data Center Coolant Distribution Units Market reflects this consolidation, especially in the U.S., China, and Germany. It increases availability of turnkey cooling solutions and accelerates project rollouts for clients seeking end-to-end infrastructure support.

Market Challenges

High Initial Capital Costs and Integration Barriers in Brownfield Deployments

The Global Data Center Coolant Distribution Units Market faces hurdles in brownfield environments where integration of liquid cooling can be complex and expensive. Retrofitting CDUs requires adjustments to existing racks, fluid handling, and electrical systems. In older facilities, operators often delay adoption due to upfront CAPEX and downtime risks. Small operators struggle to justify ROI within short upgrade cycles. Limited technical expertise in fluid dynamics also creates adoption friction. Vendors must support flexible retrofit kits, installation training, and pre-configured CDU modules. The transition from air to liquid cooling remains uneven across operator types.

Supply Chain Constraints and Standardization Gaps in Emerging Markets

Emerging regions face challenges related to CDU availability, fluid compatibility, and regulatory gaps. Supply chains for specialty components and maintenance kits are underdeveloped in Africa, Latin America, and Southeast Asia. Variability in safety norms, certification needs, and fluid handling protocols creates procurement delays. Lack of global standardization in CDU interfaces and fluid specifications slows deployment. The Global Data Center Coolant Distribution Units Market must navigate inconsistent regulatory ecosystems. Local vendors struggle to scale under fragmented frameworks, which limits market access and interoperability in multivendor deployments.

Market Opportunities

AI Infrastructure Growth and Hyperscale Expansion Creating New CDU Demand

The rise of AI infrastructure across hyperscale campuses and research networks unlocks high-growth potential for coolant distribution units. Operators need reliable thermal systems for GPU clusters and large memory nodes. CDUs enable energy-efficient cooling at rack level without costly airflow retrofits. The Global Data Center Coolant Distribution Units Market benefits from planned AI cloud region launches across Asia and North America. It opens opportunities for OEMs, integrators, and fluid innovators targeting AI-ready infrastructure.

Sustainability Goals Driving Demand for Liquid Cooling Adoption

Sustainability mandates and green certifications are accelerating liquid cooling investments. CDUs reduce energy consumption and water waste compared to traditional systems. Governments and data center operators prioritize low-PUE infrastructure and closed-loop cooling. The market supports ESG goals and aligns with LEED or BREEAM standards. It creates opportunities for fluid recyclers, CDU refurbishers, and monitoring solution providers. The Global Data Center Coolant Distribution Units Market plays a central role in net-zero infrastructure transition.

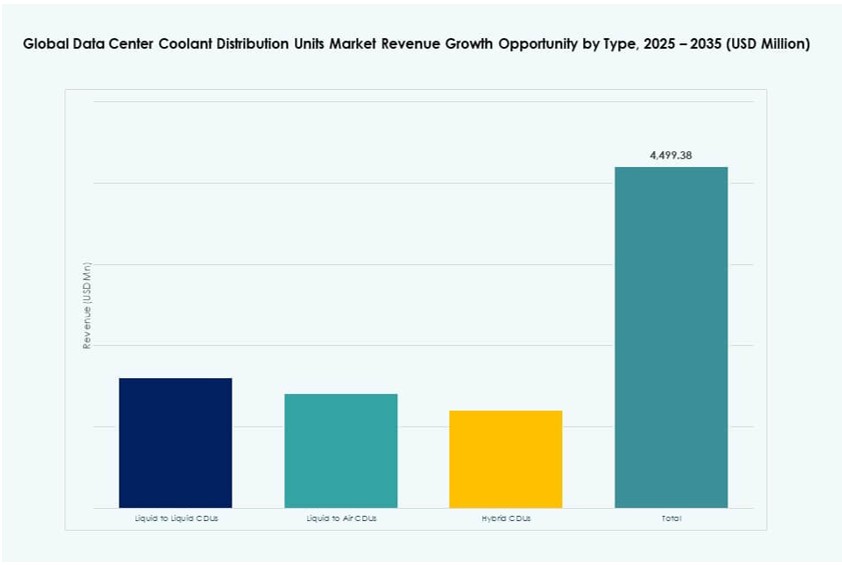

Market Segmentation

By Product

Liquid-to-liquid CDUs dominate the Global Data Center Coolant Distribution Units Market due to superior thermal transfer efficiency and closed-loop design. These units allow rack-level control, enable coolant reuse, and support complex deployments. Liquid-to-air CDUs hold moderate share, ideal for hybrid environments without liquid return lines. Hybrid CDUs serve transitional facilities needing flexible cooling interfaces. Liquid-to-liquid units account for over 60% market share due to high deployment across hyperscale and AI-focused data centers.

By Application

Hyperscale operators lead the application segment, driving over 45% of total demand. Their need for dense compute, AI cluster cooling, and energy efficiency makes CDUs essential. Colocation providers follow, integrating CDU systems to meet client SLAs and PUE targets. Edge data centers adopt compact units supporting space and power constraints. Enterprise use remains steady in regions with digital transformation. The Global Data Center Coolant Distribution Units Market sees rising adoption across all segments with hyperscale demand outpacing others.

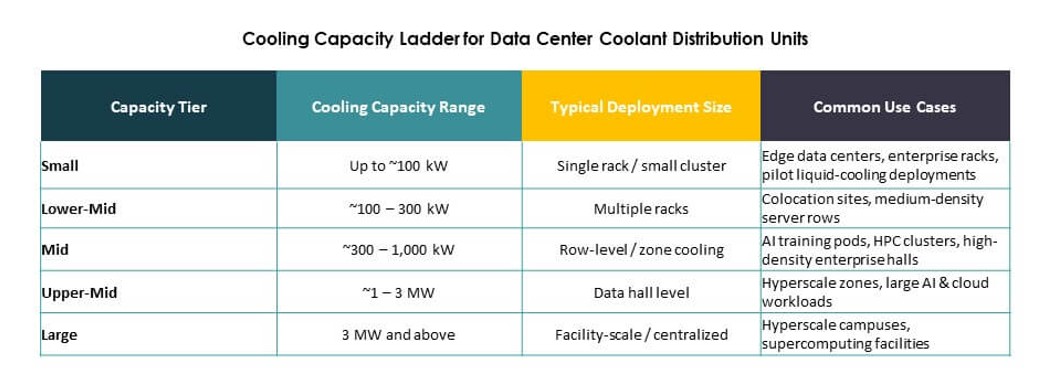

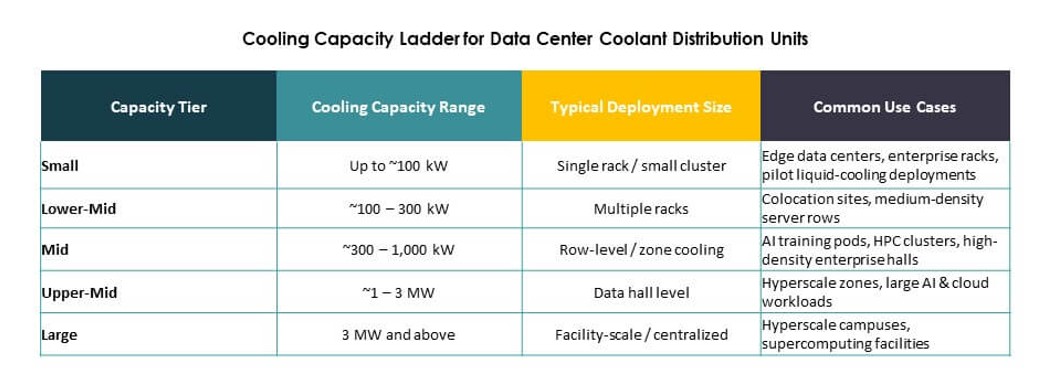

By Capacity Range

100–400 kW units represent the leading segment, supporting high-density racks without overprovisioning. These units balance performance and scalability for most Tier III and Tier IV environments. Up to 100 kW units address smaller or modular builds, often in edge or enterprise deployments. ≥1 MW systems are gaining traction for large AI clusters and national cloud grids. The Global Data Center Coolant Distribution Units Market shows highest growth in mid-capacity units due to flexible integration and cost-efficiency.

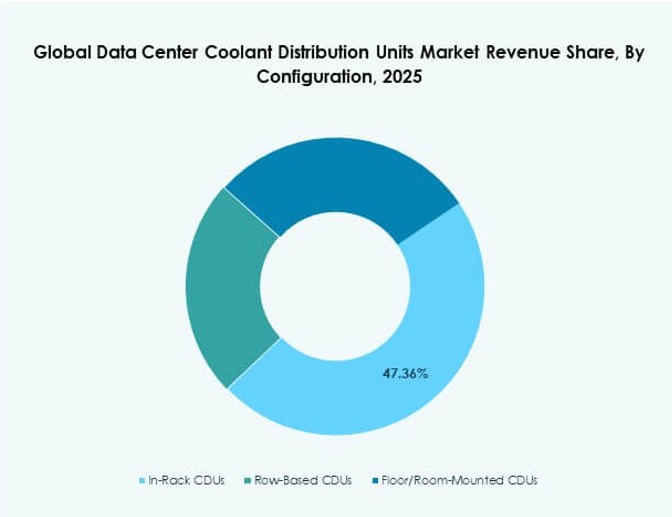

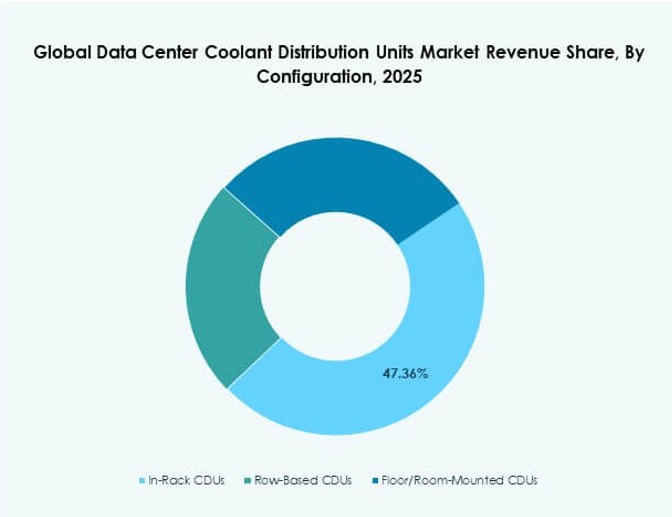

By Configuration

Row-based CDUs dominate due to their balance of space efficiency and fluid distribution precision. These units support multiple racks with controlled flow and are popular in hyperscale and colocation sites. In-rack CDUs offer localized control but higher installation density. Floor-mounted CDUs support legacy systems with space availability. The Global Data Center Coolant Distribution Units Market benefits from growing deployment of row-based systems in greenfield sites with centralized cooling strategies.

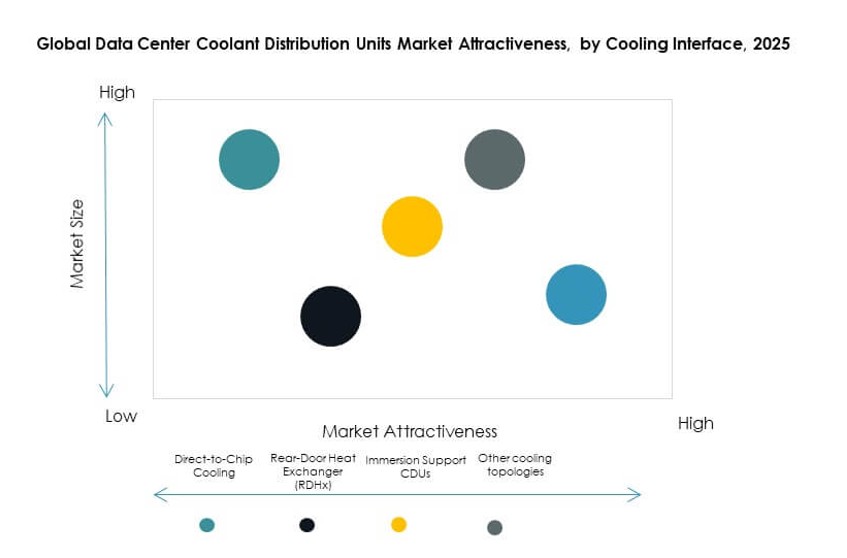

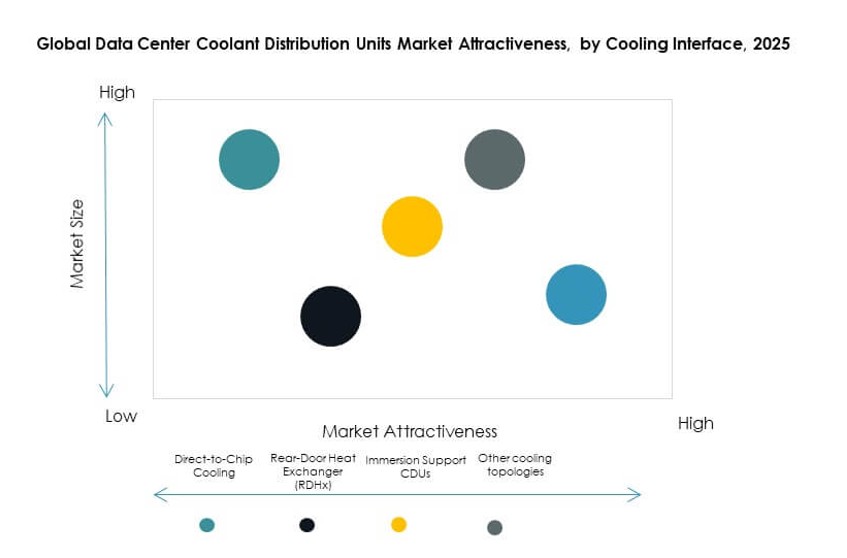

By Cooling Interface

Direct-to-chip cooling holds the highest share among cooling interfaces, driven by AI and HPC growth. This method ensures heat is removed at the source, improving thermal performance. RDHx-based CDUs provide retrofit-friendly options for existing data halls. Immersion-support CDUs gain traction in research and cloud-native builds. Other interfaces include hybrid or customized solutions for mixed environments. The Global Data Center Coolant Distribution Units Market favors direct-to-chip due to efficiency and vendor alignment.

Regional Insights

North America Leads in CDU Deployment Due to Early Liquid Cooling Adoption

North America accounts for around 39% of the Global Data Center Coolant Distribution Units Market. The U.S. leads in CDU penetration due to early adoption of liquid cooling by hyperscale and colocation operators. High electricity costs and sustainability goals encourage use of efficient thermal solutions. Multiple AI datacenter projects in the U.S. and Canada accelerate CDU demand. Vendors in the region offer integrated CDU systems, retrofits, and fluid innovations. Government-backed green data center incentives support future growth.

- For instance, Digital Realty reports that a major share of its U.S. data center capacity holds ENERGY STAR certification, reflecting strong energy performance across its portfolio. The company highlights the use of advanced cooling and efficiency programs, supported by third‑party verification, to improve operational sustainability in North American facilities.

Europe Focuses on Energy Efficiency and Sustainable Data Infrastructure

Europe holds nearly 26% market share, with strong traction in Germany, the UK, and France. Regulatory mandates such as the European Green Deal push CDU adoption for improved PUE. Operators deploy liquid cooling to meet carbon and water use targets. RDHx and hybrid CDU models are gaining favor in older European facilities. The market sees demand from enterprise and colocation players balancing ESG goals with thermal resilience. OEMs localize supply chains to meet European compliance.

Asia Pacific Emerges as the Fastest-Growing Region with Strong AI and Cloud Expansion

Asia Pacific represents about 23% of the Global Data Center Coolant Distribution Units Market and is the fastest-growing subregion. China, India, and Singapore drive demand through hyperscale campus builds and public cloud expansion. Government investments in AI, digital sovereignty, and smart infrastructure require efficient cooling. Liquid-to-liquid CDUs are deployed in new-generation data centers designed for low PUE. The region sees strong vendor partnerships, innovation hubs, and fluid technology trials. Local manufacturing boosts CDU adoption and cost competitiveness.

- For instance, ST Telemedia Global Data Centres (STT GDC) partnered with CoolIT Systems to deploy CHx coolant distribution units in its Singapore and India facilities. These deployments contributed to a 34.5% improvement in Water Usage Effectiveness (WUE) from its 2020 baseline, with audited liquid-to-chip cooling systems supporting a consistent WUE of 1.25 m³/MWh in high-density environments.

Competitive Insights:

- Vertiv

- Schneider Electric

- nVent

- CoolIT Systems

- Rittal

- Delta Electronics

- STULZ

- Boyd Corporation

- Asetek

- Envicool

The Global Data Center Coolant Distribution Units Market features a mix of global OEMs and niche liquid cooling specialists. Vertiv and Schneider Electric lead with integrated solutions and strong hyperscale presence. CoolIT Systems, Asetek, and DCX Liquid Cooling target high-density deployments in AI and HPC environments. Rittal and Delta Electronics bring modular CDU systems with advanced controls, while STULZ and Boyd specialize in custom cooling infrastructure. New entrants focus on immersion-ready CDUs and fluid optimization technologies. It is highly competitive, with vendors differentiating through thermal efficiency, digital integration, and fluid compatibility. Companies pursue OEM alliances, regional expansion, and vertical integration to strengthen their position.

Recent Developments:

- In January 2026, Vertiv highlighted expectations for adaptive liquid cooling and digital twins shaping data center operations. The announcement emphasized powering up AI infrastructure with precision coolant distribution units to optimize energy use in hyperscale facilities.

- In January 2026, DCX Liquid Cooling Systems announced its new 8MW Facility Coolant Distribution Unit (FDU V2AT2), optimized for 45°C warm-water cooling in hyperscale data centers supporting next-gen NVIDIA Vera Rubin AI deployments.

gulations. Asia Pacific is emerging quickly, led by China, India, and Southeast Asia. Rapid digitalization and new data center builds support regional expansion.

gulations. Asia Pacific is emerging quickly, led by China, India, and Southeast Asia. Rapid digitalization and new data center builds support regional expansion.