Executive summary:

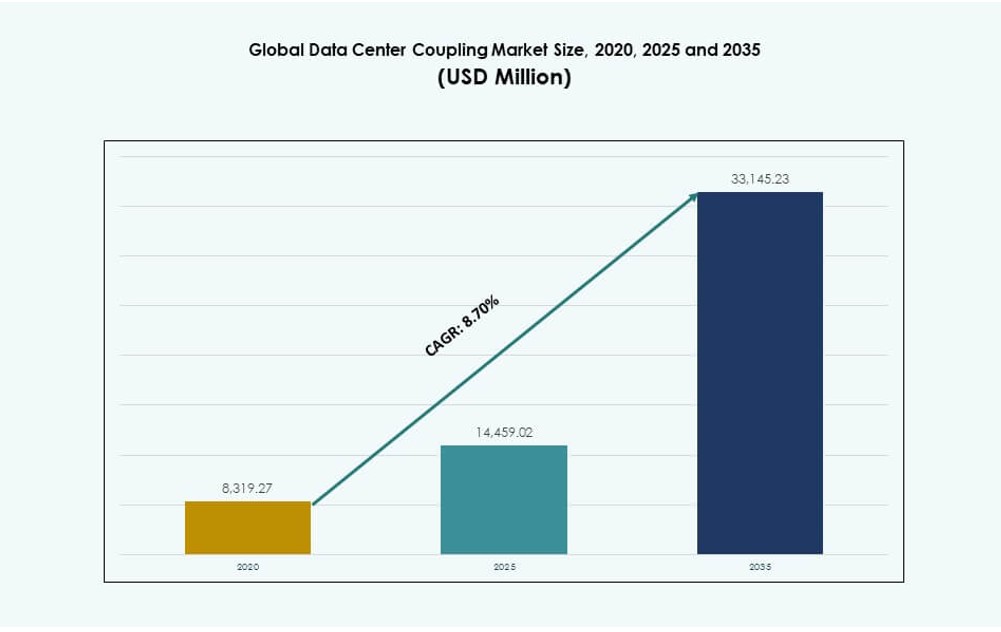

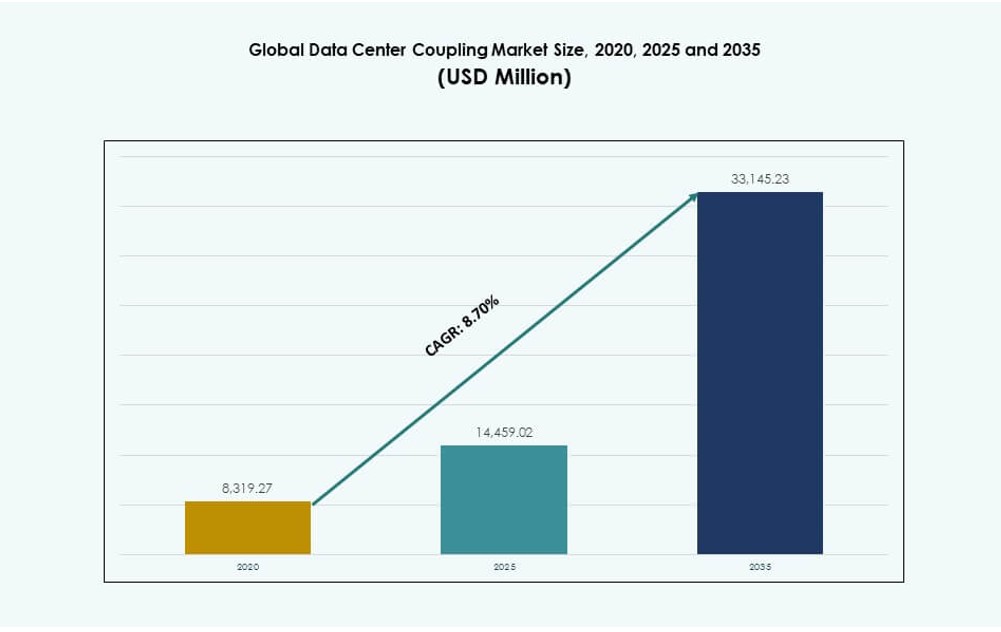

The Global Data Center Coupling Market size was valued at USD 8,319.27 million in 2020 to USD 14,459.02 million in 2025 and is anticipated to reach USD 33,145.23 million by 2035, at a CAGR of 8.70% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Data Center Coupling Market Size 2025 |

USD 14,459.02 Million |

| Data Center Coupling Market, CAGR |

8.70% |

| Data Center Coupling Market Size 2035 |

USD 33,145.23 Million |

The market expands due to higher data center complexity and tighter system integration needs. Operators adopt advanced coupling solutions to align power, cooling, and mechanical systems. Innovation focuses on modular designs and compatibility with AI workloads. Industry shifts toward high-density and liquid-cooled environments strengthen demand. Businesses use coupling systems to protect uptime and asset performance. Investors value this market for its link to long-term digital infrastructure growth.

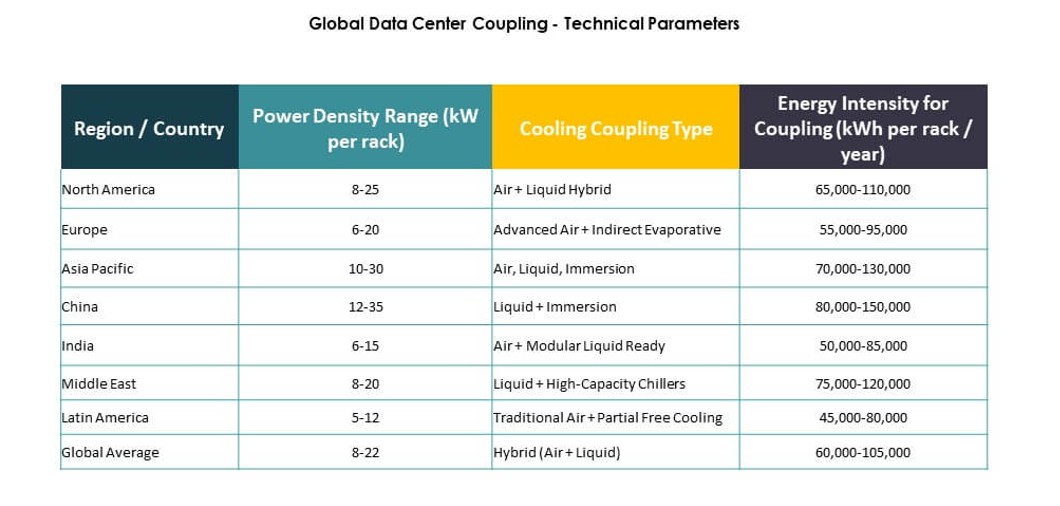

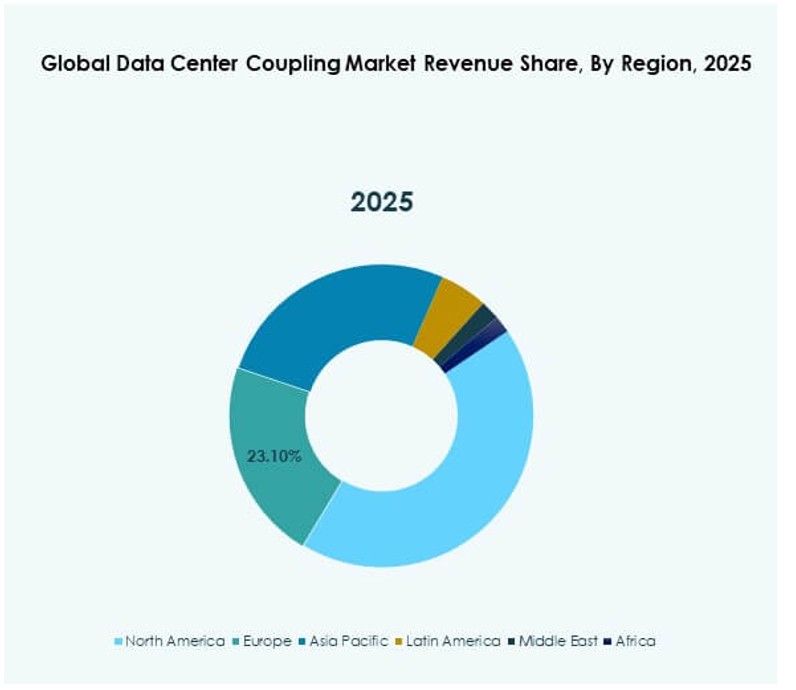

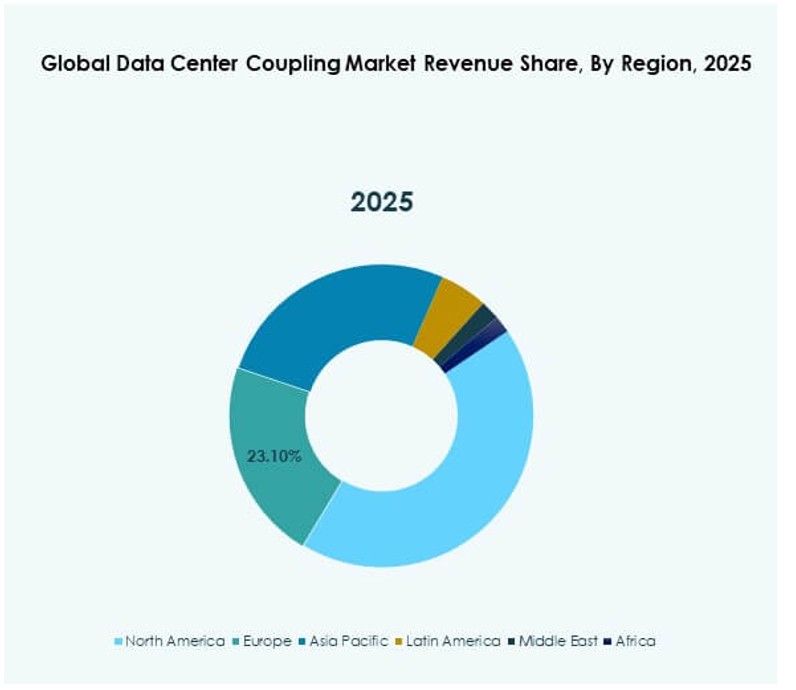

North America leads due to strong hyperscale and AI data center deployment, led by the United States. Europe follows with emphasis on efficiency, compliance, and Tier III facilities. Asia-Pacific emerges as a high-growth region, driven by China, India, and Southeast Asia. These countries invest in cloud and digital services. The Middle East gains traction from large-scale digital infrastructure programs.

Market Dynamics:

Market Drivers

Rising Integration Needs Across Power, Cooling, And Mechanical Systems

The Global Data Center Coupling Market grows due to rising infrastructure complexity cross modern facilities. Data centers deploy tightly integrated power, cooling, and mechanical systems to support continuous operations. Coupling solutions ensure stable system interaction across critical loads and operating conditions. Operators prioritize uptime, fault isolation, and system coordination. It supports synchronized performance across interconnected subsystems. Hyperscale expansion raises demand for resilient and interoperable architectures. Enterprises seek standardized coupling designs to simplify system management. This approach reduces operational risk and improves lifecycle control. Investors view integration-driven demand as structurally stable.

Expansion Of High-Density And AI-Optimized Data Center Architectures

AI workloads increase rack density and thermal stress across compute environments. The lobal Data Center Coupling Market benefits from this structural shift in infrastructure design. Coupling components manage vibration, heat transfer, and electrical alignment under high loads. It supports stable operation without performance degradation. Operators redesign layouts to accommodate accelerated compute intensity. Higher power density requires precise coordination between cooling and electrical systems. Vendors focus on compatibility with liquid cooling and advanced power delivery. Capital flows toward suppliers aligned with AI-ready infrastructure requirements.

- For instance, Parker Hannifin partnered with Intel via the Open Compute Project in October 2024 to develop UQD and Blindmate couplings, enabling leak-free liquid cooling for next-gen AI servers. These couplings meet Intel’s UQD specs and reduce thermal management complexity in dense deployments.

Focus On Reliability, Redundancy, And Uptime Assurance

Service-level commitments drive sustained infrastructure investment across large and mid-sized data centers. The Global Data Center Coupling Market plays a core reliability role within mission-critical environments. Coupling systems prevent cascading failures between power, cooling, and mechanical modules. It enables fast isolation during faults and supports controlled shutdowns when required. Enterprises demand predictable maintenance cycles to avoid service disruption. Colocation providers depend on robust coupling to maintain tenant confidence and contract compliance. High-availability designs rely on redundant coupling paths to protect workloads. Investors favor markets tied to long-term reliability spending due to stable demand profiles.

Shift Toward Modular And Scalable Data Center Design Models

Prefabricated and modular builds gain acceptance across hyperscale, colocation, and edge deployments. The Global Data Center Coupling Market supports this construction shift through standardized and scalable interfaces. Coupling units allow rapid assembly during initial builds and smooth expansion over time. It improves speed to market for operators facing urgent capacity needs. Standard interfaces simplify upgrades without major structural changes. Vendors align product designs with modular construction practices. This approach reduces project risk and planning complexity. Scalability attracts long-term infrastructure capital seeking flexible growth models.

- For instance, Schneider Electric’s prefabricated modular power platforms were central to new AI-ready deployments in Switch campuses, enabling fast-track site construction. These systems combine coupling, UPS, and cooling to reduce deployment timelines and enhance adaptability.

Market Trends

Adoption Of Standardized Coupling Interfaces Across Data Center Designs

The Global Data Center Coupling Market shows rising standard alignment across new and retrofit deployments. Operators seek vendor-neutral interfaces that reduce lock-in risk and enhance compatibility. Standard coupling designs reduce integration complexity across power, cooling, and mechanical systems. It improves procurement flexibility and accelerates commissioning timelines. OEMs are updating portfolios to meet common interface protocols that simplify deployment and reduce engineering delays. This shift aligns with modular and prefabricated data center trends. Standardization also eases future upgrades and maintenance cycles. Buyers gain stronger negotiating power and vendor flexibility. Growing market maturity and cross-vendor interoperability needs continue to accelerate interface unification.

Growth Of Liquid Cooling Compatible Coupling Solutions

Liquid cooling adoption shapes product development strategies across thermal infrastructure segments. The Global Data Center Coupling Market adapts to this shift with specialized coupling solutions built for liquid-cooled environments. These couplings support fluid-based thermal transfer in high-density rack configurations. It addresses heat removal challenges linked to AI and HPC workloads. Manufacturers focus on leak-resistant seals, material resilience, and low-maintenance connectors. Operators prioritize coupling products that allow flexible integration with cold plate and immersion cooling systems. Product design now includes compatibility with existing rack layouts and coolant types. Demand grows for backward-compatible solutions in hybrid cooling environments. Liquid cooling readiness is becoming a default expectation in new builds.

Increasing Use Of Digital Monitoring In Coupling Systems

Smart infrastructure gains attention as operators emphasize predictive operations. The Global Data Center Coupling Market integrates sensors, diagnostics, and embedded electronics within coupling systems. These couplings provide real-time condition data across temperature, vibration, and fluid flow parameters. It supports predictive maintenance models and extends component life. Operators reduce unplanned downtime and shift to data-informed asset planning. Vendors embed digital monitoring features into both new and retrofit coupling units. Integration with facility monitoring systems enhances visibility and control. This digital layer differentiates products in competitive bids. Growth in AI data centers strengthens the shift toward sensor-enabled coupling infrastructure.

Preference For Compact And Space-Efficient Coupling Designs

Space optimization drives mechanical and electrical coupling design across dense facility footprints. The Global Data Center Coupling Market responds with compact, low-profile solutions that suit tight rack and aisle configurations. Smaller footprints support high-density equipment layouts while maintaining airflow and service access. It improves energy efficiency by minimizing obstruction and supporting unobstructed thermal paths. Operators value simplified installation, cable routing, and physical accessibility during maintenance. Manufacturers refine materials, connection geometries, and component form factors to meet these constraints. Facility designers seek coupling systems that minimize footprint without sacrificing reliability or performance. Product evolution aligns with micro and edge data center formats. Space-efficient coupling is now considered a design standard across new builds.

Market Challenges

High Customization Requirements Across Diverse Data Center Architectures

The Global Data Center Coupling Market faces design complexity challenges as data center architectures vary significantly across operators, tiers, and regional requirements. Facilities differ by power density, cooling systems, and physical layout, making universal coupling designs impractical. Coupling solutions often require engineering-level customization to ensure compatibility with site-specific parameters. It raises design and production costs and extends delivery cycles. Vendors must manage compliance with regional codes, environmental standards, and operational policies. Long qualification and testing cycles delay deployment in sensitive environments. Smaller suppliers face scalability limitations when serving multiple use cases. Custom requirements create a fragmented value chain that complicates manufacturing and procurement.

Supply Chain And Material Cost Volatility

Component sourcing issues directly affect delivery timelines in the Global Data Center Coupling Market. Coupling systems rely on precision-manufactured parts and materials such as stainless steel, copper, and specialized polymers. Volatile prices for these inputs disrupt planning and inventory control. It pressures supplier contracts and undermines cost predictability for large infrastructure projects. Global logistics constraints, including freight delays and regional disruptions, introduce additional risk across delivery schedules. Operators prefer vendors with stable sourcing networks and proven fulfillment track records. Strategic sourcing partnerships and inventory buffers help reduce exposure to external shocks. Still, cost control remains a central challenge in maintaining project profitability. Vendors must continuously balance quality, speed, and pricing flexibility in a volatile global environment.

Market Opportunities

Expansion Of Edge And Regional Data Center Networks

The Global Data Center Coupling Market gains from rapid edge data center expansion and regional digital infrastructure development. Telecom and cloud service providers deploy smaller, decentralized facilities to improve latency and meet localized demand. Coupling systems support these compact builds by enabling modular, space-efficient integration of power and cooling components. It enables rapid regional rollout by simplifying installation and reducing configuration time. Standardized coupling modules align with prefabricated site designs, reducing lead times. Vendors access new volume streams from multiple small-to-mid-scale deployments rather than centralized hyperscale projects. Edge data centers require lightweight, scalable coupling formats that adapt to constrained environments. Governments and private networks push regional infrastructure to serve smart cities and IoT ecosystems. Investors see strong upside in this distributed architecture trend due to its sustained scalability and geographic diversity.

Retrofit And Upgrade Demand From Aging Data Centers

Legacy data centers require modernization to support today’s high-density and AI workloads. The Global Data Center Coupling Market benefits from strong retrofit demand as operators upgrade outdated mechanical, electrical, and thermal links. These upgrades enhance system reliability, safety, and energy efficiency while meeting new operational benchmarks. Operators replace aging coupling systems to improve compatibility with current cooling and power delivery standards. It extends the life of infrastructure and defers full facility replacement. Regulatory and sustainability compliance upgrades further drive recurring replacement cycles. Vendors offer retrofit-friendly coupling solutions that match legacy layouts while delivering modern performance. Facility owners prioritize low-disruption retrofits that can be phased with live operations. This creates a steady aftermarket revenue stream and positions retrofit coupling as a resilient segment of the market.

Market Segmentation

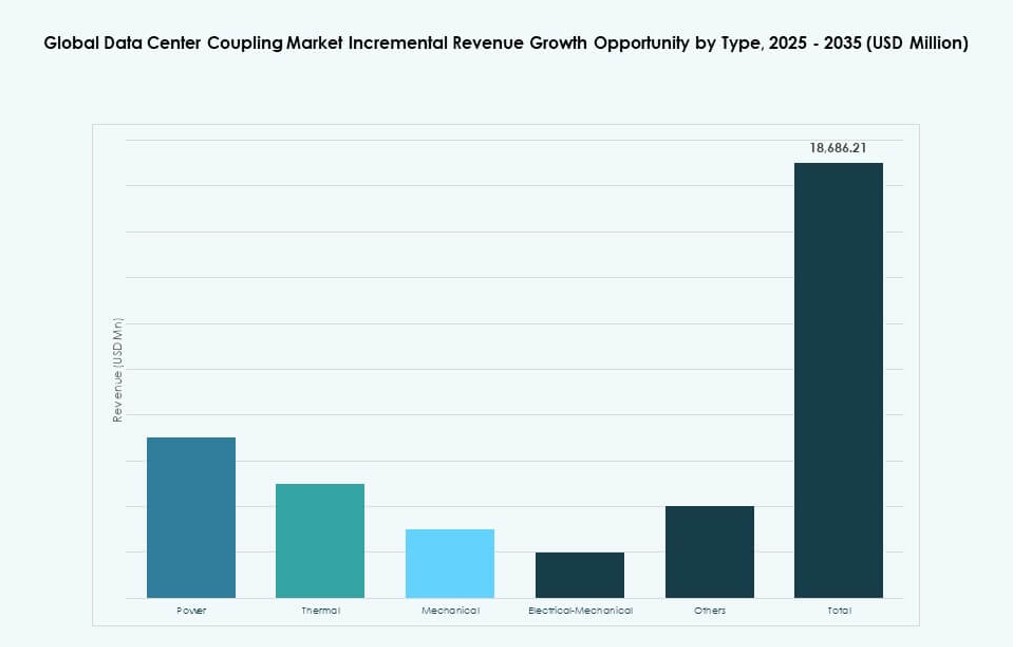

By Type

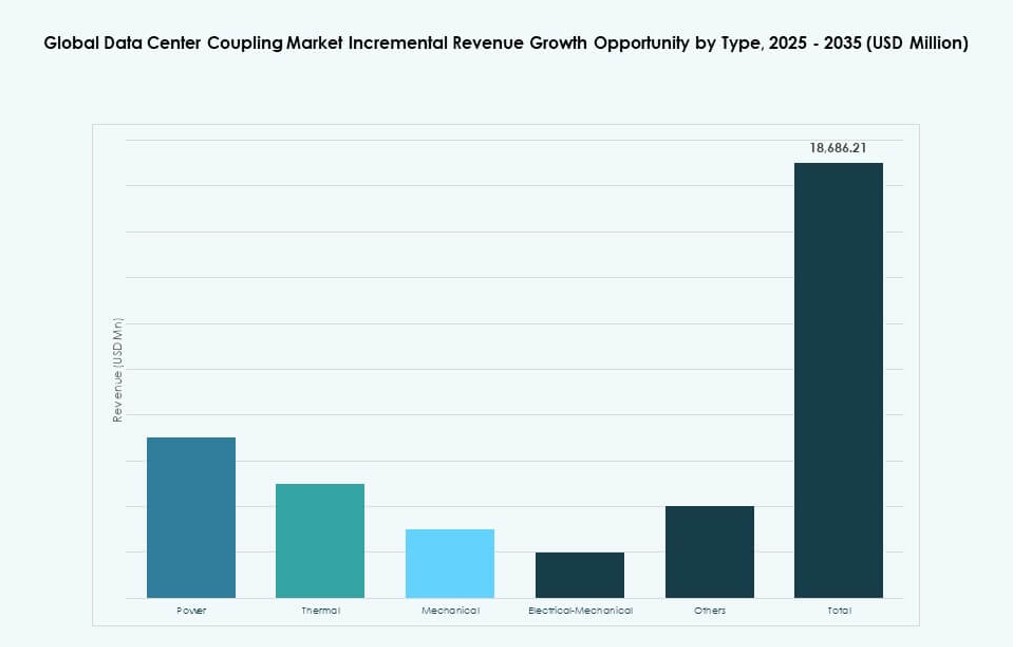

The Global Data Center Coupling Market sees power coupling as the dominant type, holding nearly 35% share due to critical power continuity needs. Thermal coupling follows with about 25% share, driven by rising cooling complexity. Mechanical coupling accounts for close to 20%, supporting vibration and alignment control. Electrical-mechanical coupling gains traction in integrated designs. Other types serve niche use cases. Growth aligns with system integration intensity.

By Tier

Tier III data centers lead with nearly 40% market share due to balanced cost and reliability. Tier IV follows with around 25%, supported by mission-critical demand. Tier II holds about 20%, serving regional facilities. Tier I remains limited to small deployments. Investment focus favors higher-tier reliability.

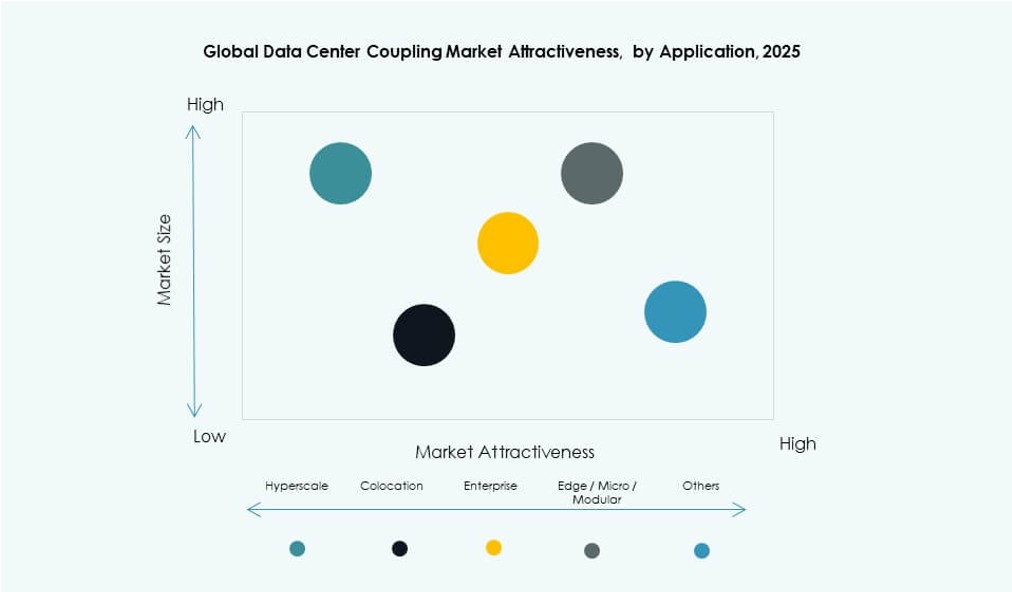

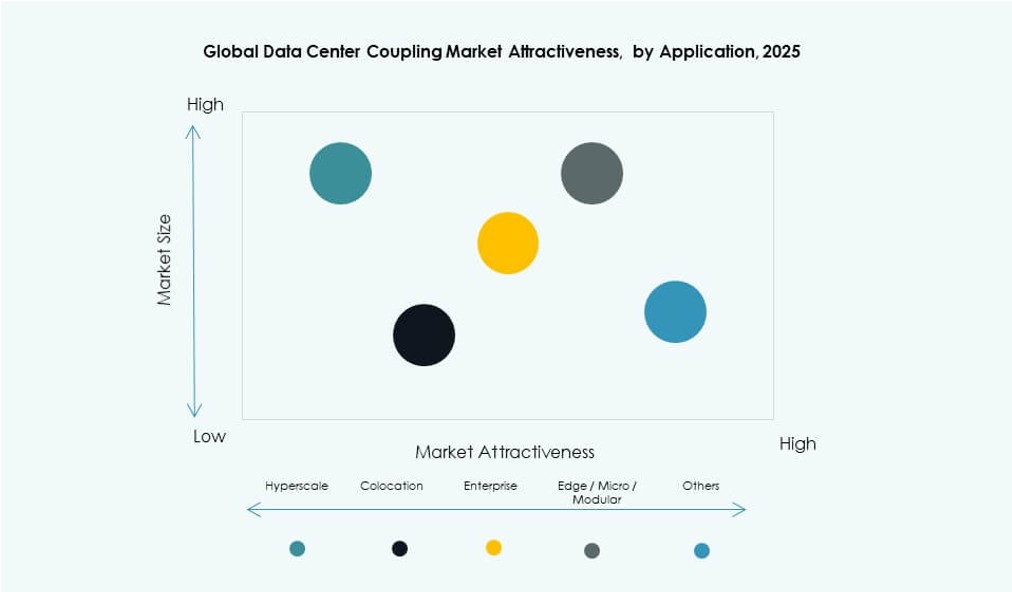

By Application

Hyperscale data centers dominate with over 45% share due to massive infrastructure scale. Colocation follows near 30%, driven by multi-tenant reliability needs. Enterprise data centers hold about 15%. Edge data centers show fast growth from a smaller base. Other data centers remain niche. Scale and uptime drive dominance.

Regional Insights

North America

The Global Data Center Coupling Market shows North America leading with nearly 38% share. The United States anchors regional demand through large-scale hyperscale deployments and AI infrastructure growth. It benefits from early adoption of modular systems and high-performance coupling technologies. Canada’s market is supported by steady cloud service expansion and regional data sovereignty initiatives. Mexico contributes through increased colocation activity in urban hubs, driven by cross-border digital traffic. Strong public and private investment in data centers reinforces long-term market stability. The region’s mature infrastructure and technological leadership sustain consistent demand for advanced coupling systems.

- For instance, Schneider Electric partnered with Switch in November 2025 to supply prefabricated power modules and chillers under a $1.9 billion capacity deal, supporting new AI-ready data centers across the U.S.

Europe

Europe accounts for around 26% share of the Global Data Center Coupling Market. Germany, the UK, and France dominate regional activity through enterprise cloud, colocation, and government-led digital infrastructure programs. The region benefits from a strong regulatory environment that emphasizes energy efficiency, operational reliability, and compliance. Data sovereignty policies accelerate local facility builds in response to GDPR and national mandates. Investment is concentrated in Tier III and Tier IV facilities, requiring advanced coupling for power and cooling integration. Environmental goals further shape product selection, favoring compact, modular, and sustainable coupling formats. Market maturity and steady refresh cycles sustain vendor opportunities across Western and Northern Europe.

- For instance, ABB launched its HiPerGuard medium-voltage UPS solution for European clients in 2025, providing advanced fault-tolerant coupling for critical power systems in AI-focused data centers.

Asia-Pacific And Rest Of World

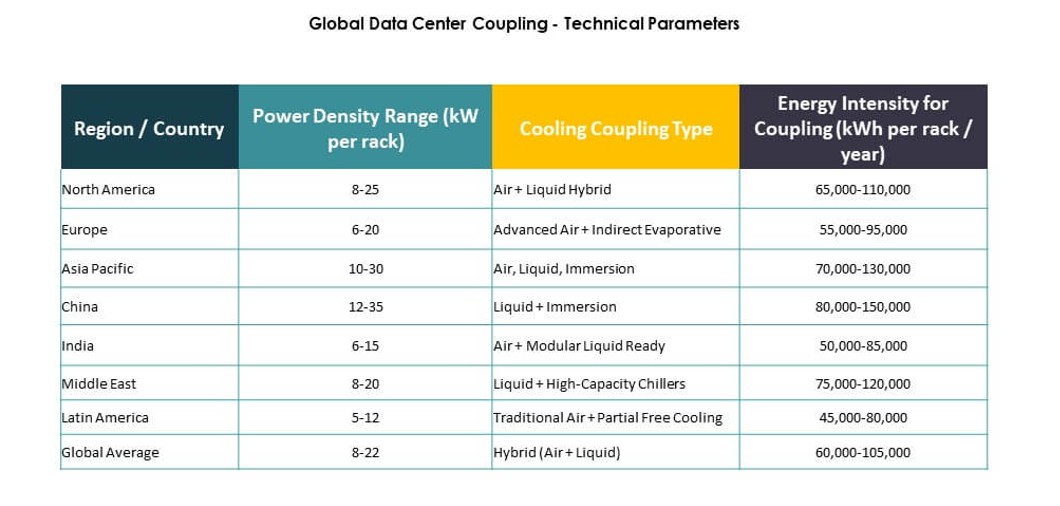

Asia-Pacific holds close to 24% share and is the fastest-growing region in the Global Data Center Coupling Market. China and India lead with large-scale cloud investments, digital economy initiatives, and industrial AI expansion. Southeast Asia—including Indonesia, Vietnam, and the Philippines—adds momentum through e-commerce, fintech, and hyperscale demand. The Middle East holds around 7%, with the UAE and Saudi Arabia accelerating data center builds under national digital agendas. Africa and Latin America account for roughly 5% combined, driven by telecom growth and public cloud entry. These emerging regions present long-term opportunities through greenfield developments and regional cloud zones. Vendor success will depend on localization, scalability, and supply flexibility across diverse infrastructure stages.

Competitive Insights:

- Schneider Electric

- Vertiv

- Eaton

- ABB

- Delta Electronics

- Huawei Technologies

- Siemens

- Legrand

- Mitsubishi Electric

- Rittal

The Global Data Center Coupling Market features a concentrated competitive landscape led by global infrastructure and power management companies. Schneider Electric and Vertiv maintain strong presence with integrated coupling systems tailored for hyperscale and colocation facilities. Eaton and ABB leverage their electrical engineering expertise to deliver power and mechanical coupling solutions. It supports long-term reliability across diverse data center tiers. Huawei and Delta Electronics focus on scalable thermal coupling systems across Asia-Pacific markets. Siemens and Legrand invest in modular designs that align with emerging automation demands. Mitsubishi Electric and Rittal offer custom solutions across industrial and enterprise deployments. Market leadership depends on innovation, global supply capacity, and alignment with edge and AI data center trends.

Recent Developments:

- In November 2025, Schneider Electric expanded its partnership with Switch through a $1.9 billion capacity agreement for prefabricated power modules and chillers to support AI data centers.

- In November 2025, ABB furthered its power technology partnership with Applied Digital to deliver medium voltage infrastructure for a second AI-ready data center campus in North Dakota, with orders booked in Q4 2025.