Executive summary:

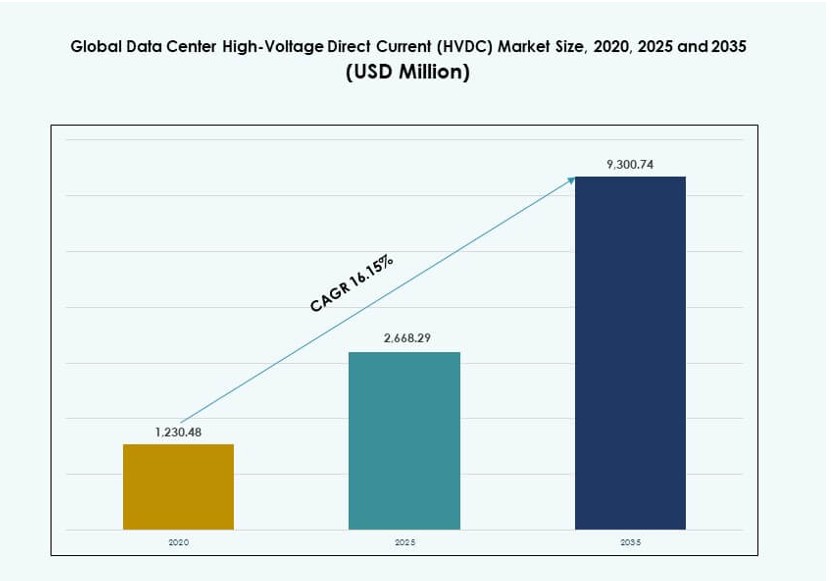

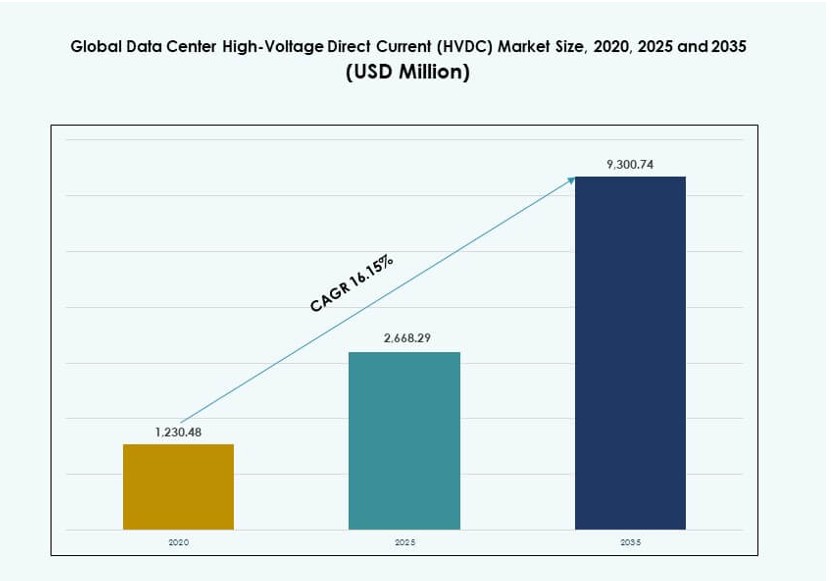

The Global Data Center High-Voltage Direct Current (HVDC) Market size was valued at USD 1,230.48 million in 2020 to USD 2,668.29 million in 2025 and is anticipated to reach USD 9,300.74 million by 2035, at a CAGR of 16.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Data Center High-Voltage Direct Current (HVDC) Market Size 2025 |

USD 2,668.29 Million |

| Data Center High-Voltage Direct Current (HVDC) Market, CAGR |

16.15% |

| Data Center High-Voltage Direct Current (HVDC) Market Size 2035 |

USD 9,300.74 Million |

The market is driven by rising demand for energy-efficient power delivery in modern data centers. Operators adopt HVDC to reduce power losses and support high-density computing. Growth in AI workloads and cloud platforms accelerates this shift. Technology innovation in power electronics improves reliability and scalability. Businesses see HVDC as a long-term cost control solution. Investors value its role in sustainable infrastructure. The market supports future-ready data center designs.

North America leads adoption due to hyperscale expansion and focus on energy efficiency. The United States remains the core contributor. Asia-Pacific is emerging fast, driven by data center growth in China, India, and Japan. Europe shows steady uptake supported by sustainability targets and high power costs. The Middle East is gaining attention through new digital hubs. These regions shape long-term market expansion.

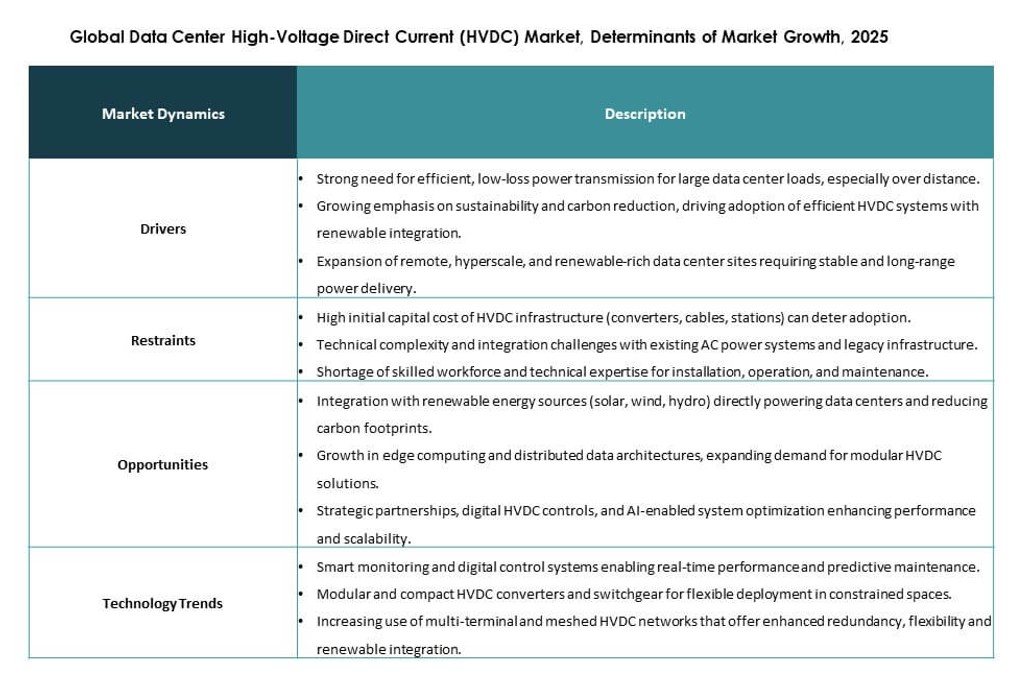

Market Dynamics:

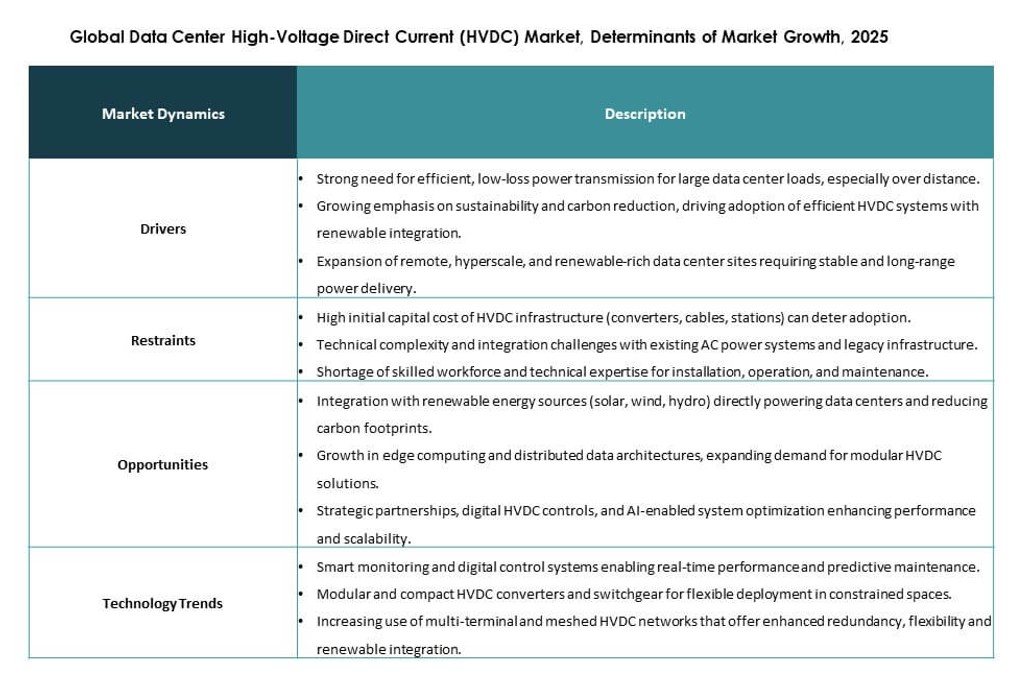

Market Drivers

Rising Demand For Energy-Efficient Power Architecture In Data Centers

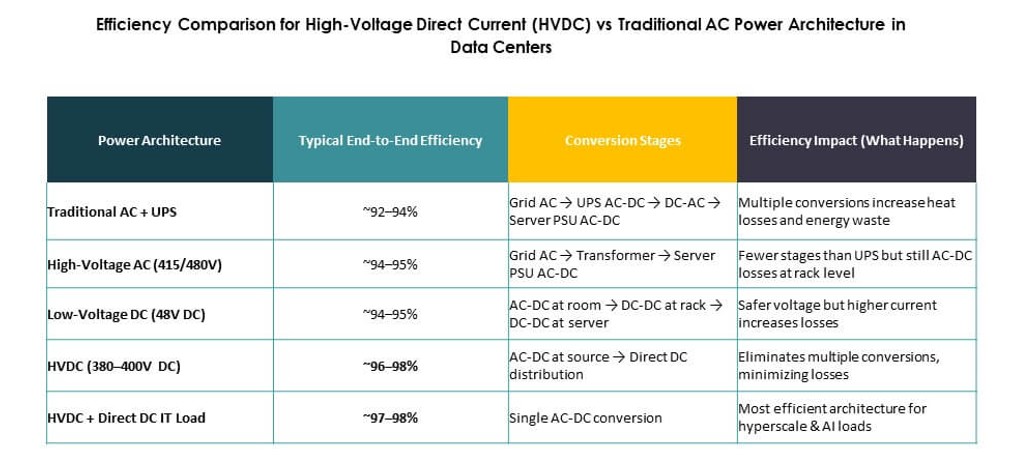

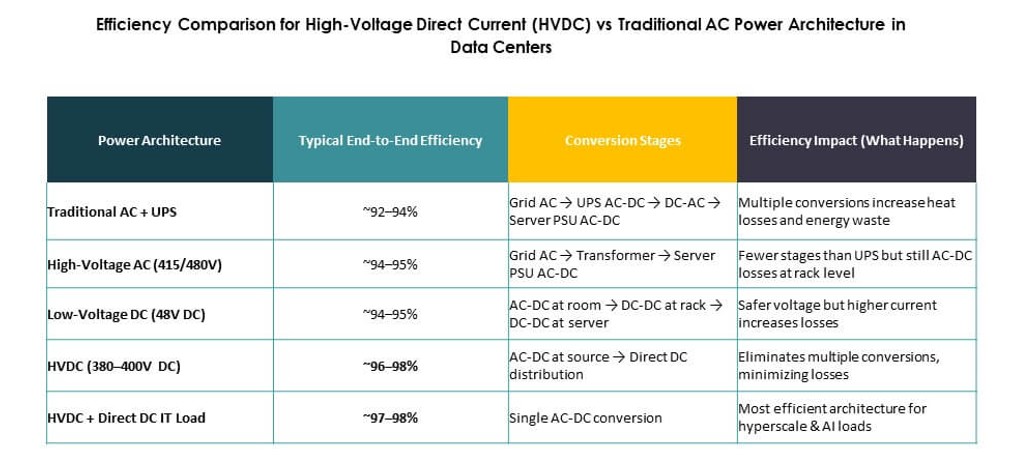

The Global Data Center High-Voltage Direct Current (HVDC) Market gains momentum from strong demand for energy efficiency. Data centers face pressure to cut power losses and reduce operating costs. HVDC systems support direct power delivery with fewer conversion stages. This design improves electrical efficiency across high-density server racks. Operators favor this approach to support sustainability targets. Enterprises view HVDC as a long-term infrastructure upgrade. Investors value its role in margin improvement. The shift strengthens confidence in large-scale deployment plans.

Growth Of High-Density Computing And AI Workloads

The Global Data Center High-Voltage Direct Current (HVDC) Market benefits from rising AI and high-performance computing loads. Advanced workloads demand stable power at higher rack densities. Traditional AC systems struggle with efficiency at these levels. HVDC supports consistent voltage delivery across dense environments. Hyperscale operators rely on this advantage for AI clusters. Cloud providers use it to support accelerated computing roadmaps. The technology aligns with next-generation server designs. Strategic adoption improves uptime and scalability.

- For instance, NVIDIA’s DGX H100 systems are optimized for high-density racks using 415V AC or 380–800V DC architectures. These setups, deployed with partners like ABB and Schneider Electric, support racks exceeding 40 kW while enabling power conversion efficiencies of up to 95% through reduced transformation stages.

Infrastructure Modernization And Power Reliability Priorities

The Global Data Center High-Voltage Direct Current (HVDC) Market advances with global infrastructure modernization efforts. Data center operators focus on reliability and power quality. HVDC reduces failure points within internal power chains. The architecture supports faster fault isolation and recovery. Enterprises value improved resilience for mission-critical operations. Colocation providers use this strength to attract premium tenants. Utilities also support HVDC-ready campuses. The market gains trust from long-term infrastructure planners.

- For instance, Mitsubishi Electric has supplied advanced power distribution systems for data centers in Japan that focus on reduced conversion stages and enhanced reliability. Its HVDC‑ready architectures aim to streamline electrical pathways and improve operational stability in high‑density computing environments.

Investor Focus On Long-Term Cost And Asset Performance

The Global Data Center High-Voltage Direct Current (HVDC) Market holds strategic value for investors and developers. HVDC lowers lifetime energy and maintenance costs. Asset owners gain predictable performance across long operating cycles. The approach supports future capacity expansion without major redesign. Financial models favor systems with lower loss profiles. Investors see alignment with ESG goals and efficiency metrics. Data center platforms adopt HVDC to protect asset value. This driver reinforces capital inflow into the segment.

Market Trends

Integration Of HVDC With Liquid Cooling Architectures

The Global Data Center High-Voltage Direct Current (HVDC) Market shows a clear trend toward cooling integration. Operators pair HVDC with liquid cooling systems. This combination supports extreme rack densities. Power and thermal management align more closely under this model. Vendors design compact power units for liquid-cooled halls. Hyperscale facilities adopt this structure first. The trend reshapes data hall layouts. It supports next-generation compute environments.

Standardization Of HVDC Designs Across Hyperscale Campuses

The Global Data Center High-Voltage Direct Current (HVDC) Market reflects growing design standardization. Large operators push repeatable HVDC modules across sites. Standard layouts reduce deployment time and risk. Engineering teams gain faster commissioning cycles. Suppliers align products with these templates. This trend improves supply chain efficiency. Consistency strengthens procurement leverage. It supports rapid global expansion plans.

Growing Collaboration Between Power And Data Center Vendors

The Global Data Center High-Voltage Direct Current (HVDC) Market benefits from deeper vendor collaboration. Power equipment firms partner with data center specialists. Joint solutions address power, cooling, and monitoring needs. Integrated offerings reduce system complexity. Customers prefer single-vendor accountability. These partnerships speed product innovation. Market competition shifts toward solution depth. The trend favors established technology providers.

Adoption Of HVDC In Edge And Modular Data Centers

The Global Data Center High-Voltage Direct Current (HVDC) Market expands into edge deployments. Modular data centers adopt HVDC for compact power design. Space constraints favor simplified electrical layouts. Edge operators value fast deployment and efficiency. HVDC supports remote and urban locations. Vendors offer preconfigured power modules. This trend broadens addressable demand. It supports decentralized digital infrastructure growth.

Market Challenges

High Initial Capital Cost And Retrofit Complexity

The Global Data Center High-Voltage Direct Current (HVDC) Market faces cost-related barriers. HVDC systems require higher upfront investment. Retrofit projects face design and downtime risks. Many facilities still rely on legacy AC infrastructure. Operators hesitate to replace functional systems. Skilled labor availability also remains limited. Planning complexity slows decision cycles. These factors restrain short-term adoption.

Limited Standard Awareness And Regulatory Alignment

The Global Data Center High-Voltage Direct Current (HVDC) Market encounters awareness challenges. Many operators lack deep technical familiarity with HVDC. Electrical codes vary across regions. Approval processes remain unclear in some markets. Utility coordination adds complexity to deployment. Training gaps affect operational confidence. Vendor education efforts continue to expand. These issues slow broader market penetration.

Market Opportunities

Expansion Of Hyperscale And AI-Driven Data Center Projects

The Global Data Center High-Voltage Direct Current (HVDC) Market holds strong opportunity in hyperscale growth. AI workloads drive new campus construction. Greenfield projects favor HVDC-friendly designs. Developers seek efficiency from day one. This shift opens large-volume contracts. Vendors gain long-term supply relationships. The opportunity supports rapid market scaling.

Emerging Markets And Renewable Power Integration

The Global Data Center High-Voltage Direct Current (HVDC) Market gains opportunity from emerging regions. New data center hubs adopt modern power systems. Renewable energy integration supports HVDC use cases. Operators seek efficient power from solar and wind. Governments support advanced infrastructure investment. This creates fresh demand channels. The opportunity improves global reach.

Market Segmentation

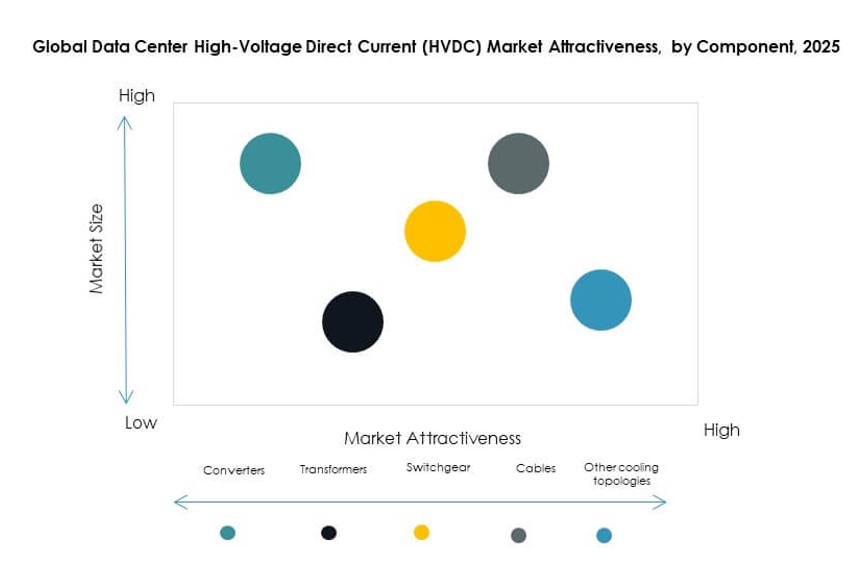

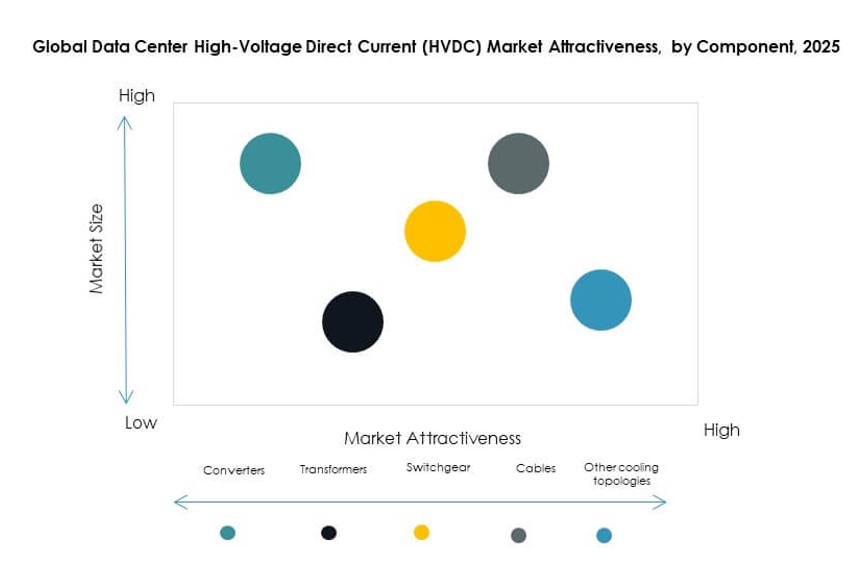

By Component

The Global Data Center High-Voltage Direct Current (HVDC) Market shows dominance of liquid-to-liquid CDUs, holding over 40% share. These systems support high-density and liquid-cooled environments. Liquid-to-air CDUs follow due to lower complexity and cost. Hybrid CDUs gain traction in mixed cooling setups. Growth links closely to AI workloads and rack density trends. Component selection depends on thermal strategy. Vendors focus on efficiency and modular design. Innovation drives differentiation in this segment.

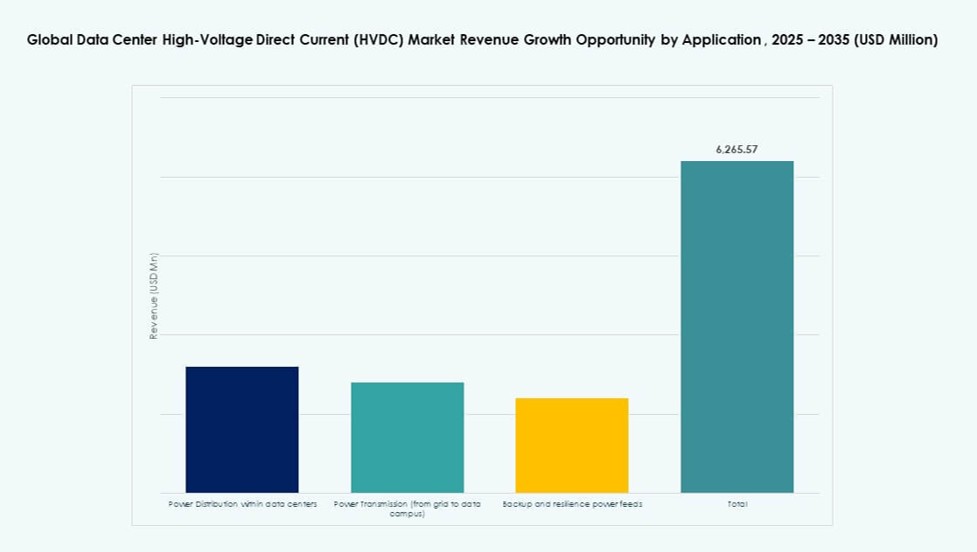

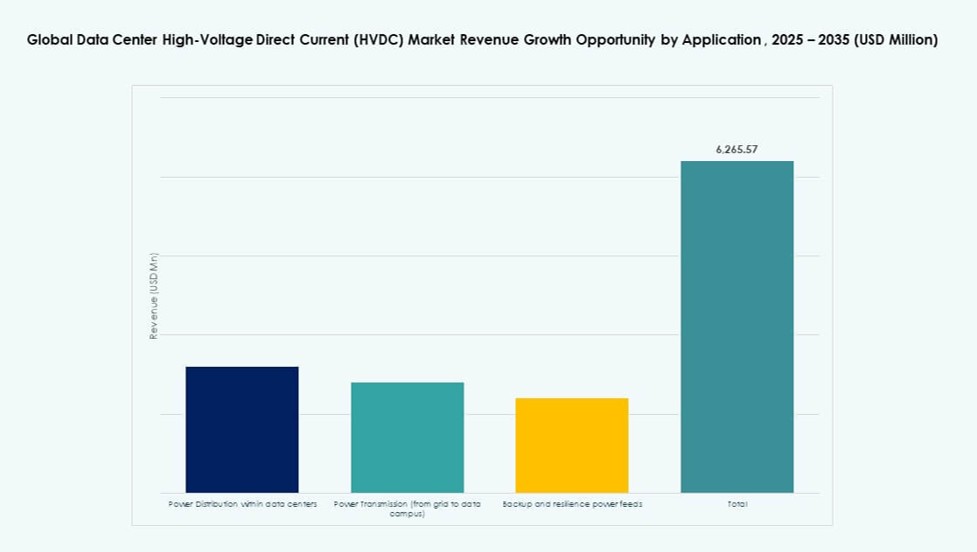

By Application

The Global Data Center High-Voltage Direct Current (HVDC) Market sees power distribution within data centers lead with nearly 45% share. Internal distribution benefits most from reduced conversion losses. Power transmission applications grow with large campuses. Backup and resilience feeds gain relevance for uptime needs. Other uses remain niche. Application growth follows scale and reliability demand. Operators prioritize efficiency at the rack level. This segment reflects core value creation.

By Vertical

The Global Data Center High-Voltage Direct Current (HVDC) Market is led by IT and telecom with over 50% share. Cloud service providers drive this dominance. BFSI adopts HVDC for mission-critical reliability. Healthcare shows steady uptake for data-intensive systems. Government and utilities expand digital infrastructure. Vertical growth aligns with data sensitivity. Power stability remains the key driver. Adoption varies by regulatory environment.

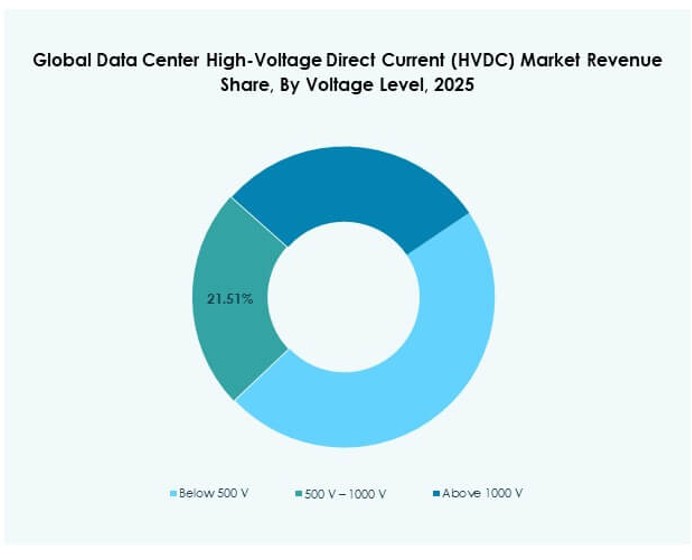

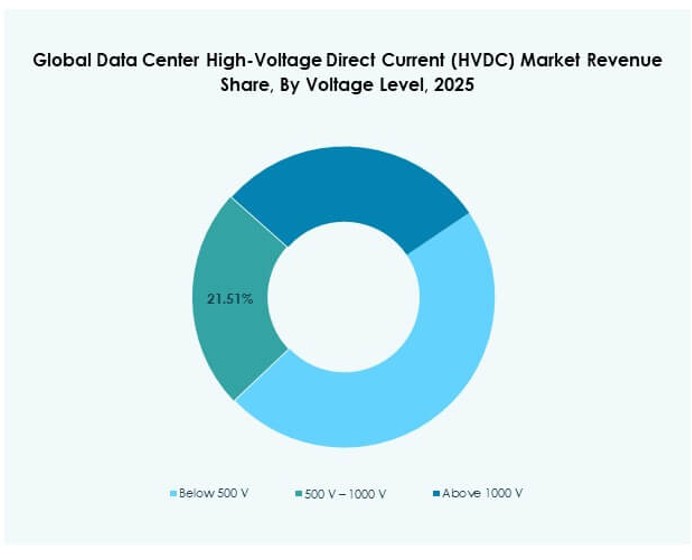

By Voltage Level

The Global Data Center High-Voltage Direct Current (HVDC) Market favors the 500 V–1000 V range, accounting for around 45% share. This range balances efficiency and safety. Above 1000 V systems serve hyperscale needs. Below 500 V supports smaller deployments. Voltage choice reflects facility scale. Higher levels support dense computing. Standards influence adoption speed. Vendors tailor solutions by voltage class.

By End-user

The Global Data Center High-Voltage Direct Current (HVDC) Market is dominated by hyperscale data centers with nearly 55% share. Large operators invest in custom power systems. Colocation providers follow with steady adoption. Enterprise data centers adopt selectively. Edge and micro facilities show rising interest. End-user needs differ by scale. Efficiency and uptime guide decisions. Growth remains strongest in hyperscale projects.

Regional Insights

North America And Europe

The Global Data Center High-Voltage Direct Current (HVDC) Market is led by North America with about 38% share. The U.S. drives adoption through hyperscale expansion. Strong focus on energy efficiency supports growth. Europe follows with nearly 28% share. High electricity costs push efficiency upgrades. Sustainability regulations encourage advanced power systems. Both regions show mature adoption patterns.

Asia-Pacific

The Global Data Center High-Voltage Direct Current (HVDC) Market sees Asia-Pacific emerging rapidly with around 26% share. China and Japan lead large-scale deployments. India shows strong growth potential. Cloud investment fuels demand across the region. Power infrastructure upgrades support HVDC adoption. Governments promote digital infrastructure. The region offers long-term expansion opportunities.

- For instance, Huawei’s HVDC + direct mains supply designs operating at 240 V to 336 V have been shown in industry reports to increase power supply efficiency into the 94–95% range, highlighting the performance advantage over traditional UPS‑based power chains in large data center environments.

Latin America, Middle East, And Africa

The Global Data Center High-Voltage Direct Current (HVDC) Market remains nascent in these regions with about 8% share combined. Brazil leads Latin America adoption. The Middle East invests in new hyperscale hubs. Africa remains early stage but promising. Digital transformation drives future demand. Power efficiency gains attention. These regions offer untapped growth potential.

- For instance, Equinix operates the SP4 data center in São Paulo as part of its Brazil portfolio, emphasizing energy efficiency and modular design. The company reports global average PUEs near 1.45 and adopts advanced power and cooling technologies to improve performance across its Latin American sites.

Competitive Insights:

- ABB Ltd.

- Siemens AG

- General Electric Company (GE / GE Vernova)

- Hitachi Energy Ltd.

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Eaton Corporation plc

- Delta Electronics, Inc.

- Huawei Technologies Co., Ltd.

- Vertiv Group Corp.

The Global Data Center High-Voltage Direct Current (HVDC) Market is highly consolidated, with major players shaping product innovation and regional deployment. It favors companies with deep expertise in power electronics, grid infrastructure, and modular integration. Top players compete on efficiency, reliability, and ease of deployment across high-density data centers. Firms like ABB, Siemens, and GE dominate global contracts due to their scalable solutions and global supply chains. Asian vendors such as Delta Electronics and Huawei grow quickly in regional deployments. Key players expand portfolios through strategic acquisitions and partnerships to address demand across colocation and hyperscale environments. The market supports differentiation via control systems, redundancy models, and sustainability alignment. It rewards firms that reduce installation complexity while meeting demanding energy efficiency targets.

Recent Developments:

- In January 2026, ST Telemedia Global Data Centres launched Southeast Asia’s first HVDC-powered AI infrastructure testbed, known as FutureGrid Accelerator, in partnership with LITEON and Amperesand. This initiative validates HVDC systems at power loads of at least 325kW using LITEON’s data center reference architecture and Amperesand’s Solid State Transformer technology, aiming for up to 30% energy savings and support for ultra-high-density racks over 1,000kW.

- In December 2025, GE Vernova’s Electrification Systems business secured a contract from POWERGRID to refurbish the Chandrapur 2×500 MW back-to-back HVDC link in India, marking its first such project there. The upgrade includes advanced HVDC controls and valves produced in India to enhance grid reliability between western and southern regions.

- In December 2025, GE Vernova’s Electrification Systems business was awarded a major contract by Adani Energy Solutions Ltd. to deliver HVDC technology for the 2.5 GW Khavda–South Olpad renewable power transmission corridor in India. The project supports renewable energy integration and is expected to be booked as an order in early 2026.