Executive summary:

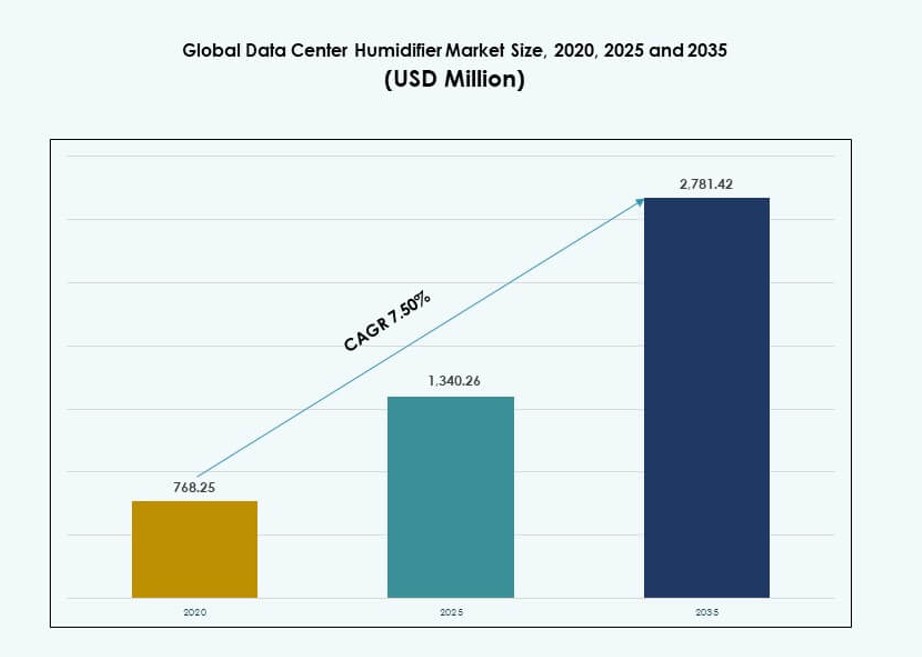

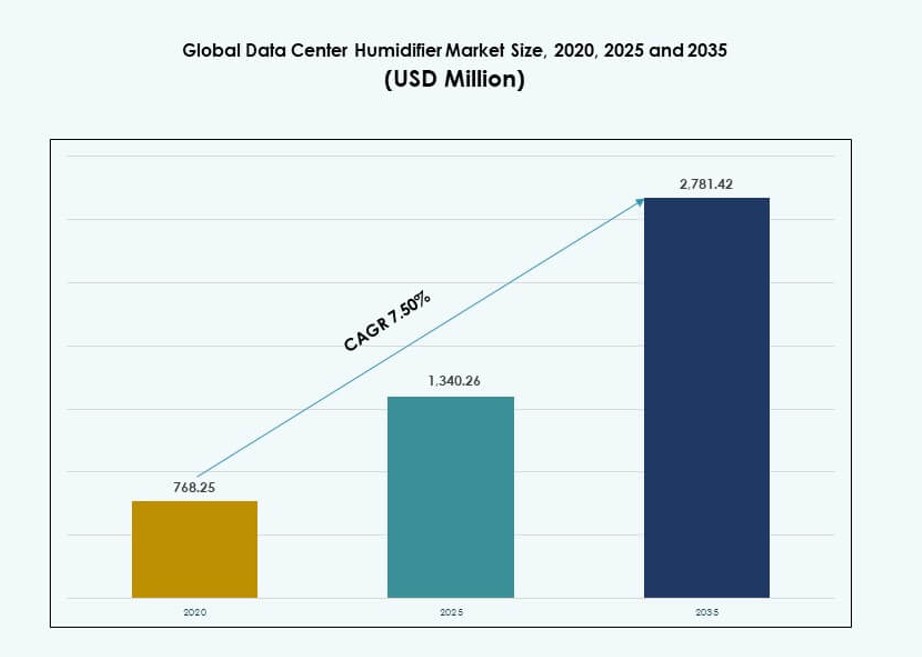

The Global Data Center Humidifier Market size was valued at USD 768.25 million in 2020, grew to USD 1,340.26 million in 2025, and is anticipated to reach USD 2,781.42 million by 2035, at a CAGR of 7.50% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Data Center Humidifier Market Size 2025 |

USD 1,340.26 Million |

| Data Center Humidifier Market, CAGR |

7.50% |

| Data Center Humidifier Market Size 2035 |

USD 2,781.42 Million |

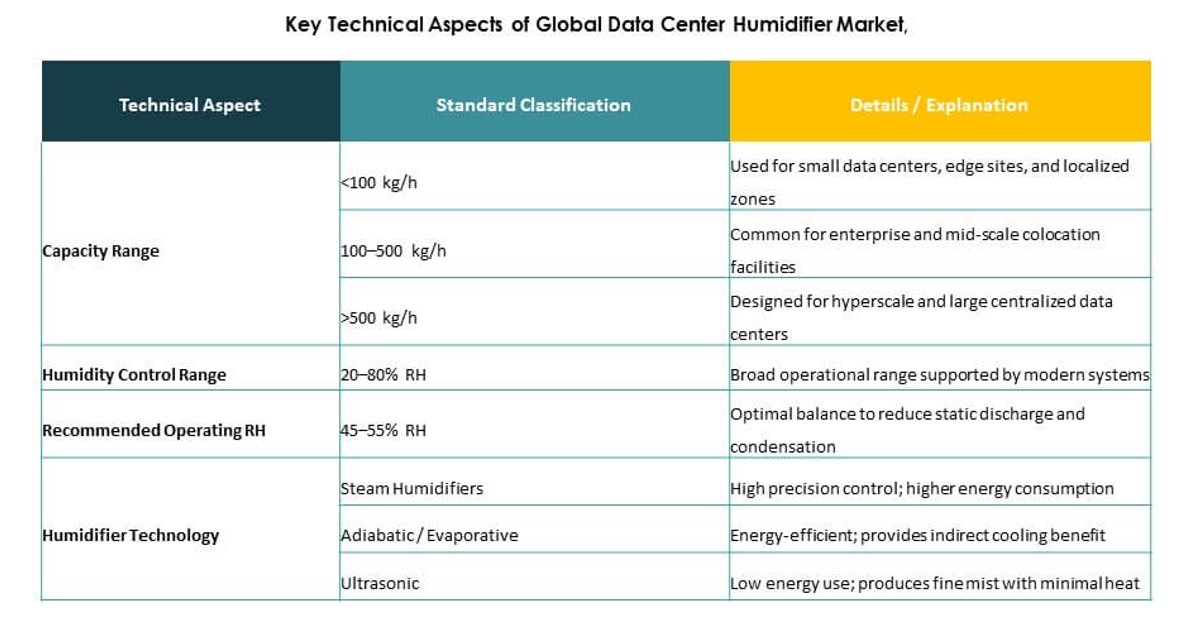

Demand is rising due to the need for strict humidity control in high-density and AI-enabled data centers. Businesses are integrating IoT-connected humidifiers with advanced control logic to maintain uptime and reduce risk from static discharge. Ultrasonic and adiabatic technologies are replacing energy-intensive steam systems. Vendors focus on automated platforms and predictive maintenance tools to align with green building goals. It remains a strategic area for operators seeking to optimize thermal performance and reduce operational risk.

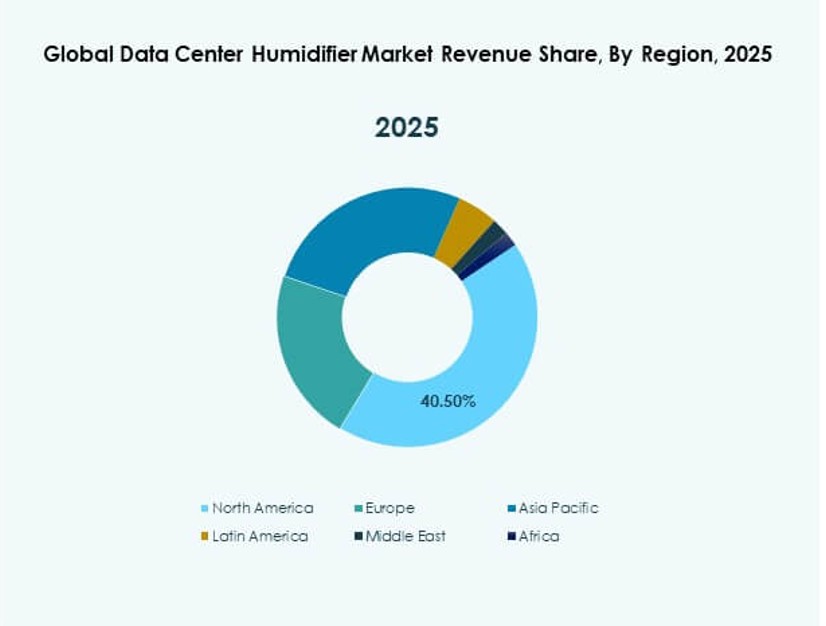

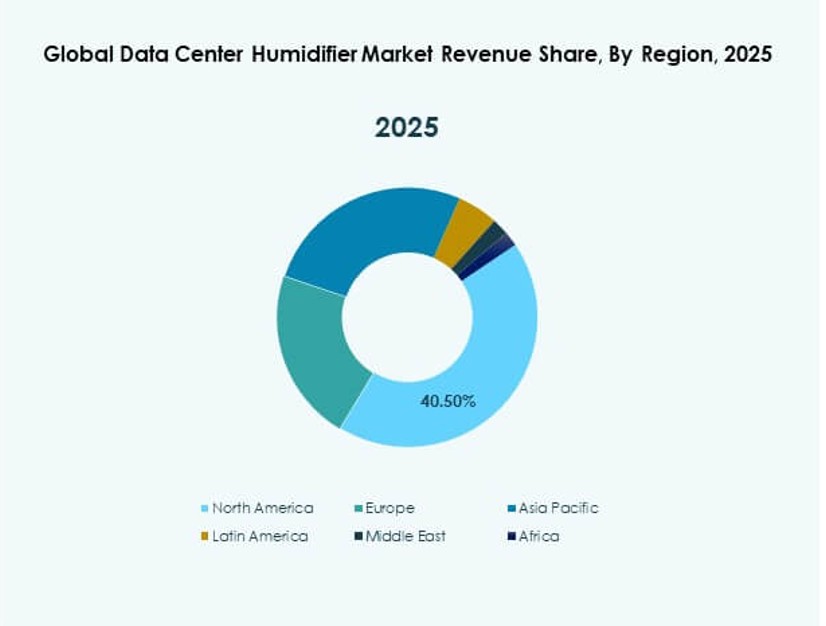

North America leads the market due to hyperscale growth, harsh winter climates, and dense colocation activity. Europe follows, driven by energy efficiency mandates and sustainability compliance in top data center hubs. Asia-Pacific is emerging fast, supported by infrastructure investments in China, India, and Southeast Asia. Latin America and the Middle East show steady uptake due to new-build digital infrastructure, while Africa sees modular adoption tied to telecom and cloud expansion.

Market Dynamics:

Market Drivers

Surge in Data Center Construction Across Emerging and Developed Economies

The market gains from global digitalization and rising cloud consumption. Large-scale data center projects demand precise humidity control to ensure uninterrupted server operations. Humidifiers help control electrostatic discharge and maintain material stability. Governments support data center zones with infrastructure incentives. Enterprises expand IT footprints, needing dependable environmental control. Innovations in energy-efficient humidification match sustainability goals. Modular and scalable humidifier systems support fast deployments. The Global Data Center Humidifier Market benefits from this steady expansion across colocation, enterprise, and edge environments.

- For instance, Vantage Data Centers broke ground on its Lighthouse project in Port Washington, Wisconsin, in late 2025, creating a 902 MW campus with four data centers as part of the $15 billion Oracle-OpenAI Stargate initiative.

Technology Integration and Smart Monitoring Demand in Mission-Critical Environments

Facilities demand humidity systems that integrate into building management systems (BMS). Smart control technologies enable real-time feedback, predictive maintenance, and precise control. IoT-based humidifiers enhance operational visibility and responsiveness. Centralized platforms help reduce manual oversight while improving uptime. Integration with energy and cooling systems drives cross-functional efficiencies. Vendors innovate around automated sensors and programmable logic controllers. Smart humidification aligns with growing demand for intelligent infrastructure. The Global Data Center Humidifier Market addresses the strategic need for controlled, connected ecosystems.

Push Toward Sustainability and Low-Energy Operation in Thermal Management

Data centers seek to reduce energy intensity across cooling and humidification. Adiabatic and ultrasonic humidifiers offer low-energy alternatives to traditional steam systems. Facilities target green certifications, driving retrofits and upgrades. Sustainability targets from hyperscale operators reshape equipment selection criteria. Humidifier vendors prioritize efficiency and low water usage. Hybrid models balance performance with resource conservation. The market evolves toward solutions with lower environmental footprints. The Global Data Center Humidifier Market aligns with ESG commitments from operators and investors.

Expanding Edge Computing Applications Requiring Decentralized Humidity Control

Edge data centers require compact, reliable humidification to operate in diverse environments. Mobile and remote units need low-maintenance, point-of-use humidifiers. Telecom and retail networks increase deployment of micro data centers. Each site demands consistent air quality and equipment protection. Humidifier systems offer resilience in distributed, harsh, or variable locations. Vendors introduce flexible designs suited for space-constrained deployments. Growth in real-time services, IoT, and 5G drives edge expansion. The Global Data Center Humidifier Market supports decentralized operations with adaptive technologies.

- For instance, Nscale signed a 10‑year colocation agreement for 40 MW of critical IT load at WhiteFiber’s NC‑1 AI data center campus in Madison, North Carolina, with phased delivery planned through mid‑2026, supporting AI infrastructure growth.

Market Trends

Shift Toward Ultrasonic and Adiabatic Systems for High-Efficiency Operations

Operators move away from high-energy steam-based units toward low-energy humidification systems. Ultrasonic systems offer fine control and minimal water waste. Adiabatic options cool and humidify simultaneously, improving cooling efficiency. These systems suit greenfield projects focused on long-term operating cost reduction. Market leaders invest in R&D for noise-free, compact ultrasonic models. Energy savings enhance total cost of ownership across the facility lifecycle. These trends align with green building initiatives. The Global Data Center Humidifier Market adapts to this shift with scalable, smart-enabled systems.

Rising Adoption of Modular and Scalable Humidification Systems

Operators prefer modular equipment that can scale with demand. Prefabricated systems reduce installation time and allow easy upgrades. Humidifiers follow this trend with configurable models and plug-and-play interfaces. Edge and hyperscale data centers benefit from modular designs. They allow phased deployment across expanding rack densities. Portable and ceiling-mounted units provide flexibility in constrained spaces. Customization grows with application-specific needs. The Global Data Center Humidifier Market integrates scalability as a key product feature.

Demand Growth for Automated and Remote-Controlled Humidification Solutions

Operators prioritize automated humidifiers with smart sensors and remote access. Remote monitoring platforms allow predictive maintenance and real-time alerts. Integration with building management systems boosts performance visibility. AI-assisted humidity control helps maintain ideal operating conditions. Vendors embed software for analytics and diagnostics. This trend reduces downtime and supports labor efficiency. Advanced systems appeal to colocation providers and hyperscale clients. The Global Data Center Humidifier Market benefits from automation-driven differentiation.

Focus on Health and Compliance in Air Quality Control in Sensitive Facilities

Humidity control links to air quality standards in mission-critical environments. Data centers with medical, pharmaceutical, or financial workloads demand stricter control. Compliance with ISO and ASHRAE guidelines influences humidifier selection. Vendors offer certifications for hygiene and precision control. Clean-room and white-space specifications dictate fine-tuned humidity delivery. HEPA integration and antimicrobial features gain traction. The market sees demand from regulated, sensitive infrastructure segments. The Global Data Center Humidifier Market aligns its offerings to meet these needs.

Market Challenges

Energy and Water Consumption Constraints Limiting Adoption in Cost-Sensitive Facilities

Traditional humidifier systems often consume large amounts of energy and water. Operators face pressure to lower their power usage effectiveness (PUE) and environmental footprint. Many regions impose water restrictions, limiting evaporative and steam-based humidifier use. Operational costs rise when facilities adopt inefficient legacy systems. Upgrades involve high capital investment, creating hesitation in small and mid-sized enterprises. The lack of standardized efficiency metrics across product lines adds procurement complexity. Humidifier designs must now align with broader sustainability mandates. The Global Data Center Humidifier Market must address these operational constraints.

Integration Complexity and Retrofitting Limitations in Existing Facilities

Upgrading or retrofitting humidifiers into operational data centers can disrupt workflows. Space constraints and incompatible HVAC systems hinder integration. Many legacy facilities lack digital infrastructure to support smart humidifier controls. Manual systems delay response times during environmental fluctuations. Custom retrofits drive up engineering costs and implementation timelines. Facility managers often postpone upgrades due to downtime risk. Compatibility with existing cooling, airflow, and automation systems remains a challenge. The Global Data Center Humidifier Market navigates these obstacles with adaptable, modular designs.

Market Opportunities

Increased Demand from Hyperscale and Greenfield Data Center Projects Worldwide

Large-scale data centers under construction create steady demand for high-capacity humidifiers. These projects seek sustainable, efficient solutions from the design phase. Vendors offering energy-efficient models with smart features gain preference. Governments incentivize localized manufacturing and deployment. Custom humidification solutions create long-term vendor relationships. The Global Data Center Humidifier Market taps this opportunity by aligning with construction timelines and ESG goals.

Rising Need for Edge, Modular, and Containerized Data Centers in Emerging Economies

Growth in decentralized IT infrastructure drives demand for compact, low-maintenance humidifiers. Point-of-use solutions cater to mobile and modular deployments in remote areas. Sectors such as telecom, banking, and logistics expand their edge presence. Vendors supplying rugged, scalable systems gain competitive advantage. The Global Data Center Humidifier Market benefits from demand across multiple edge-intensive applications.

Market Segmentation

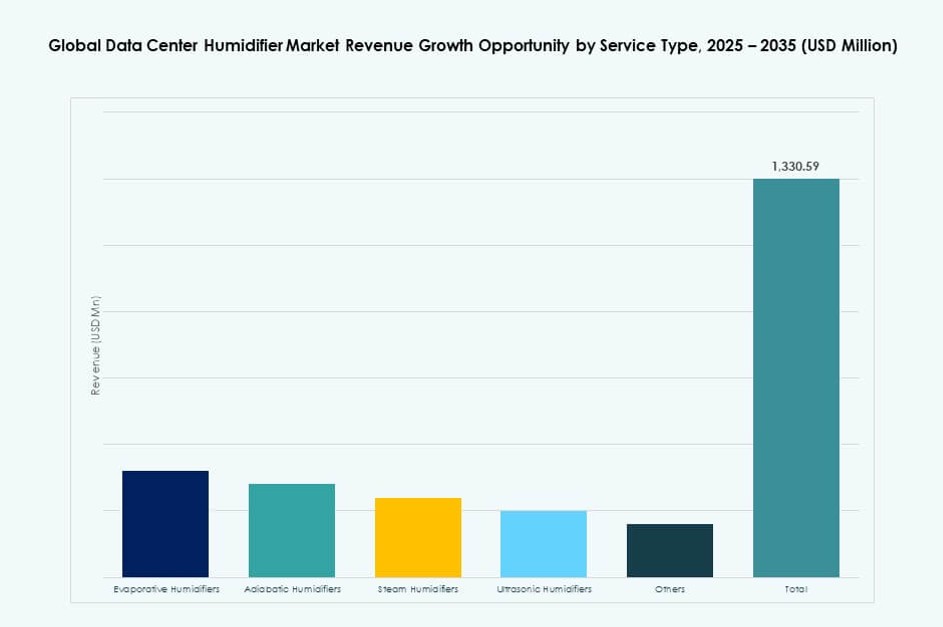

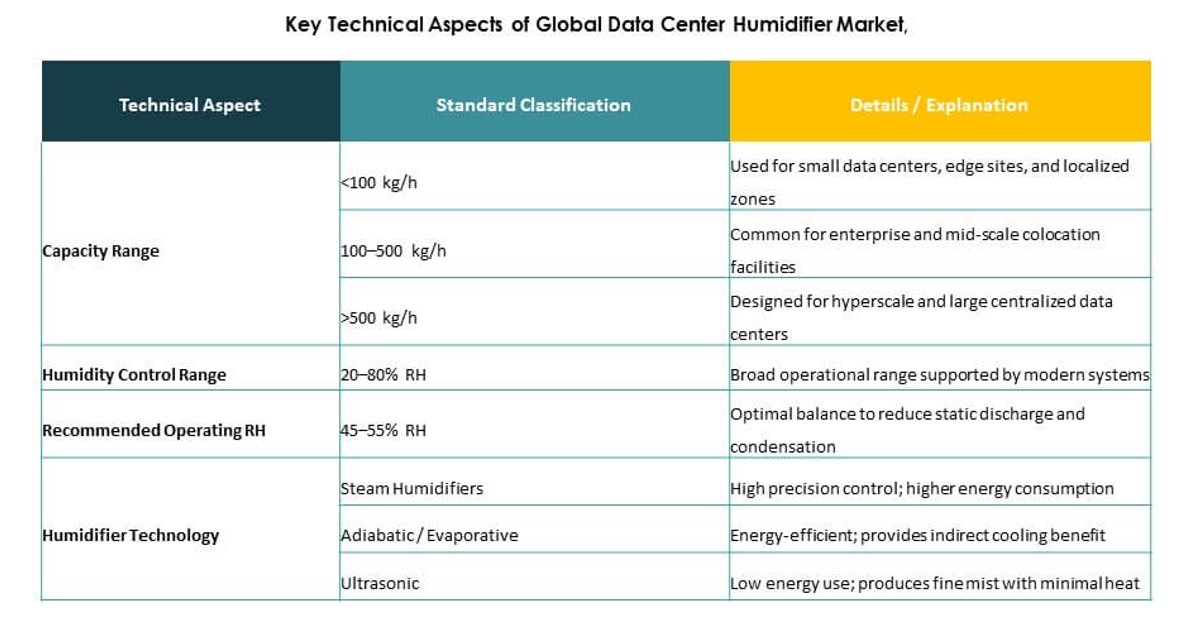

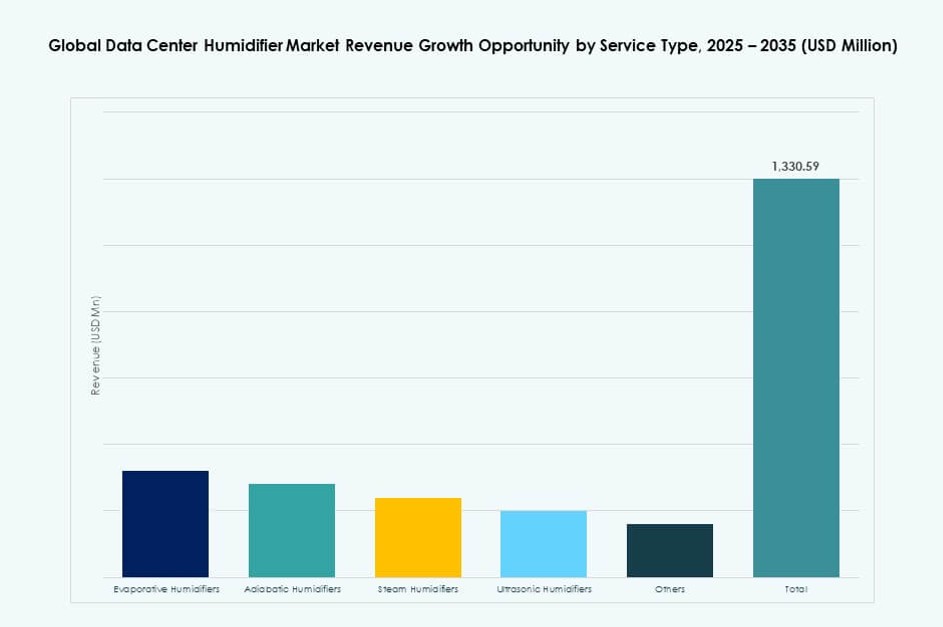

By Product

Evaporative humidifiers dominate due to their balance of performance and cost-efficiency. They maintain humidity without high energy use, making them suitable for medium and large-scale facilities. Steam humidifiers follow, used where precise temperature and humidity levels are required. Ultrasonic humidifiers gain traction in energy-conscious and compact deployments. Adiabatic systems support integrated cooling. The Global Data Center Humidifier Market sees diverse product preferences aligned to facility size and energy priorities.

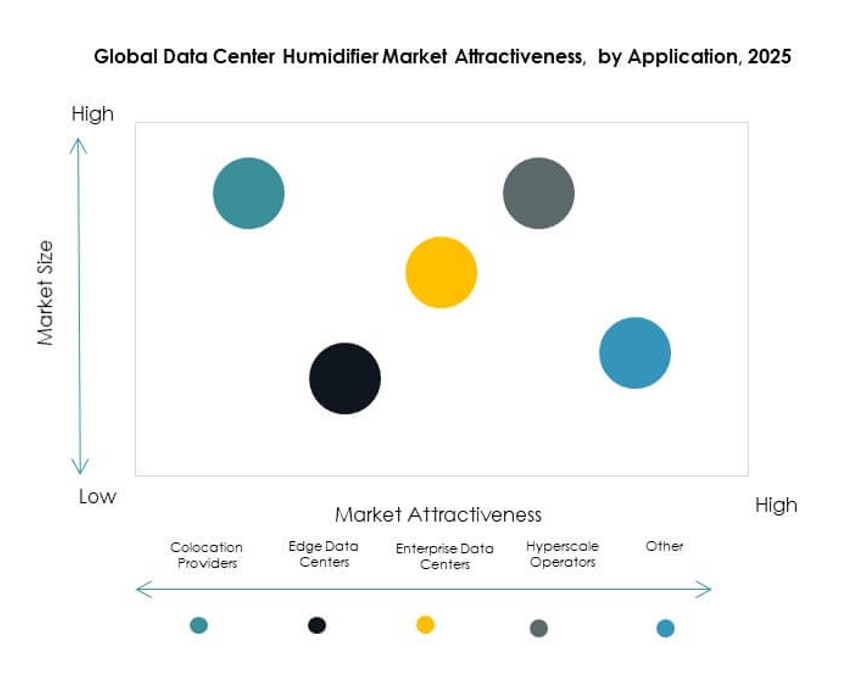

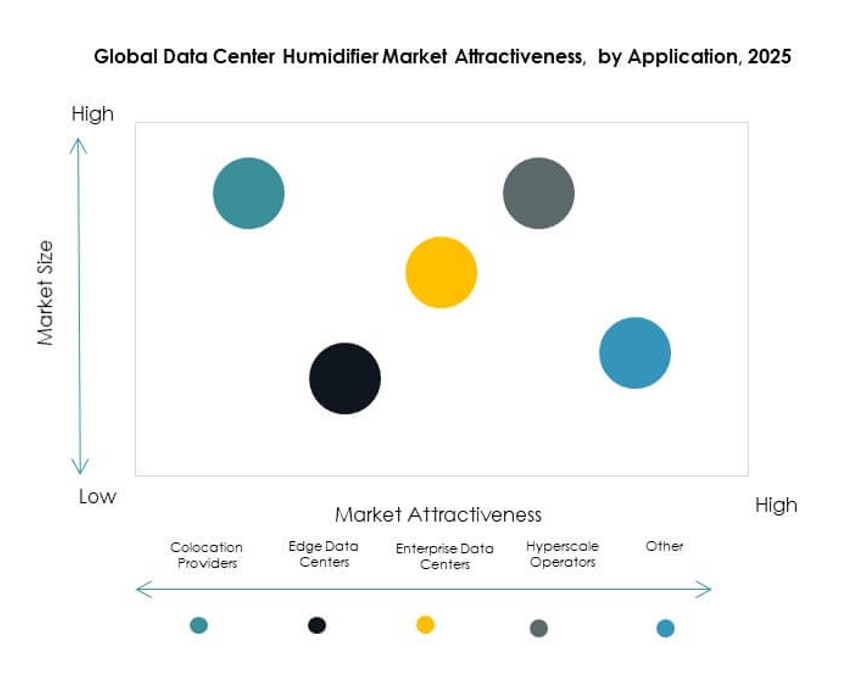

By Application

Colocation providers lead due to high-density deployments needing uniform humidity control. Hyperscale operators follow, investing in advanced humidification for energy efficiency and uptime. Enterprise data centers maintain steady demand through infrastructure refresh cycles. Edge data centers adopt smaller, autonomous units. The Global Data Center Humidifier Market supports a range of operational scales, with demand driven by data criticality and environmental control needs.

By Capacity Range

The 100 to 500 Kg/H segment holds the largest share, serving most medium to large facilities. Above 500 Kg/H units are deployed in hyperscale and industrial-grade data centers with large cooling zones. Less than 100 Kg/H systems find use in edge and telecom environments. The Global Data Center Humidifier Market reflects capacity demand based on square footage and cooling strategy.

By Deployment Model

Centralized humidifier systems dominate in large facilities for consistent control across zones. They integrate well into existing HVAC frameworks. Point of use systems are growing in edge and containerized centers. These decentralized units reduce installation time and enable site-specific adjustment. The Global Data Center Humidifier Market balances centralized control with localized precision.

By Sales Channel

Direct sales lead due to custom integration and long-term service contracts. OEM integrators supply bundled HVAC solutions with embedded humidification. Distributors cater to replacement and small-scale purchases. The Global Data Center Humidifier Market supports varied channel strategies based on customer type and facility size.

By Control Technology

Automatic PID control systems lead due to their accuracy and adaptability. Automatic on-off control is used in cost-sensitive or legacy upgrades. Manual systems are declining but remain in small or temporary setups. The Global Data Center Humidifier Market prioritizes automation for performance reliability and compliance needs.

Regional Insights

North America leads the Global Data Center Humidifier Market with a 36% market share, driven by hyperscale expansion and colder climates. The U.S. accounts for most demand, supported by leading cloud and colocation providers. Canada’s green data center push contributes to high-efficiency humidifier use. Mexico sees growth in modular deployments supporting cross-border data traffic.

- For instance, Microsoft reduced its data centers’ average Water Usage Effectiveness (WUE) to 0.30 liters per kWh in its last fiscal year through advanced cooling designs that minimize humidification needs.

Europe follows with a 29% share, led by the UK, Germany, and the Netherlands. Stringent environmental regulations and demand for green building certifications fuel humidifier adoption. Data center clusters across Frankfurt, Paris, and London push demand for advanced humidification. Southern Europe deploys systems suited for dry heat and high seasonal variation.

Asia-Pacific holds 24% share, emerging as the fastest-growing region. China, India, and Australia drive hyperscale investments and telecom edge networks. Humidifier adoption aligns with rising digital workloads and smart city initiatives. Southeast Asia sees growth in localized and modular deployments. The region benefits from infrastructure expansion and rising internet penetration.

- For instance, Microsoft aims to deploy zero-water cooling across all data centers by 2027, saving over 125 million liters annually per site through chip-level closed-loop tech that limits traditional humidifier reliance.

Competitive Insights:

- Condair Group AG

- Munters Group AB

- Carrier Global Corporation

- Trane Technologies

- Honeywell International Inc.

- DriSteem (part of Research Products Corporation)

- Nortec Humidity Inc.

- Carel Industries S.p.A.

- Johnson Controls International plc

- Daikin Industries, Ltd.

The Global Data Center Humidifier Market features a mix of multinational HVAC companies and niche humidifier solution providers. Leading vendors focus on product innovation, energy-efficient systems, and seamless integration with data center cooling and control platforms. Companies compete on reliability, automation features, and compliance with data center standards. Strategic priorities include offering modular designs, low-maintenance components, and scalable deployment models. Partnerships with OEM integrators and regional distributors help extend geographic reach. Key players invest in R&D for adiabatic and ultrasonic systems that support green data center goals. Market concentration is moderate, with established firms holding a strong presence in North America and Europe, while Asia-Pacific attracts new entrants due to rapid infrastructure expansion. The market continues to reward firms aligning products with hyperscale and edge facility requirements.

Recent Developments:

- In December 2025, Trane Technologies agreed to acquire Stellar Energy Digital, a provider of liquid-to-chip data center cooling solutions, including facilities and 700 employees to bolster its thermal management.

- In October 2025, Johnson Controls International plc made a multi-million-dollar strategic investment in Accelsius, a pioneer in two-phase direct-to-chip liquid cooling for high-density data centers.

- In July 2024, Condair Group AG acquired Kuul, a US-based evaporative media manufacturer, to expand its evaporative cooling and humidification solutions, including the Condair ME system widely used in data centers. This move enhances Condair’s global distribution of media for adiabatic pre-cooling in data centers and industrial applications.

- In July 2024, Munters Group AB signed an agreement to acquire Geoclima, an Italian chiller manufacturer, broadening its data center cooling portfolio with air- and water-cooled solutions.

The acquisition strengthens Munters’ offerings for energy-efficient data center cooling amid rising AI demands.