Executive summary:

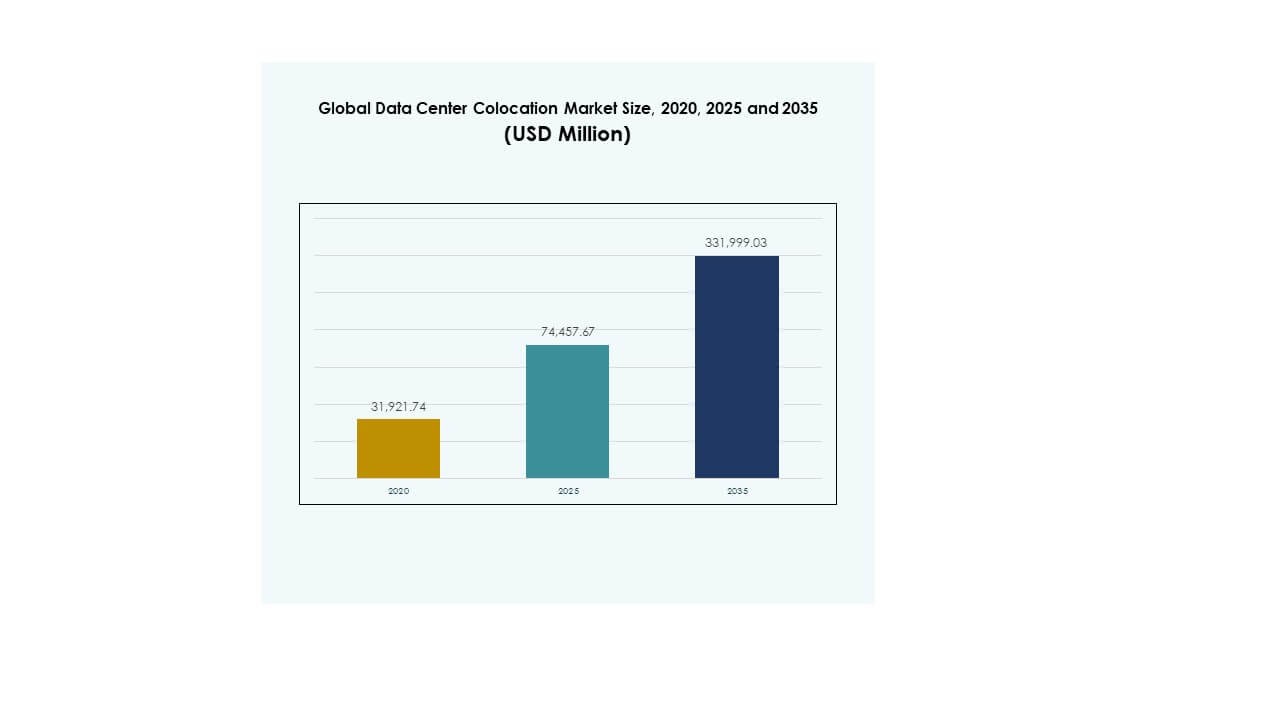

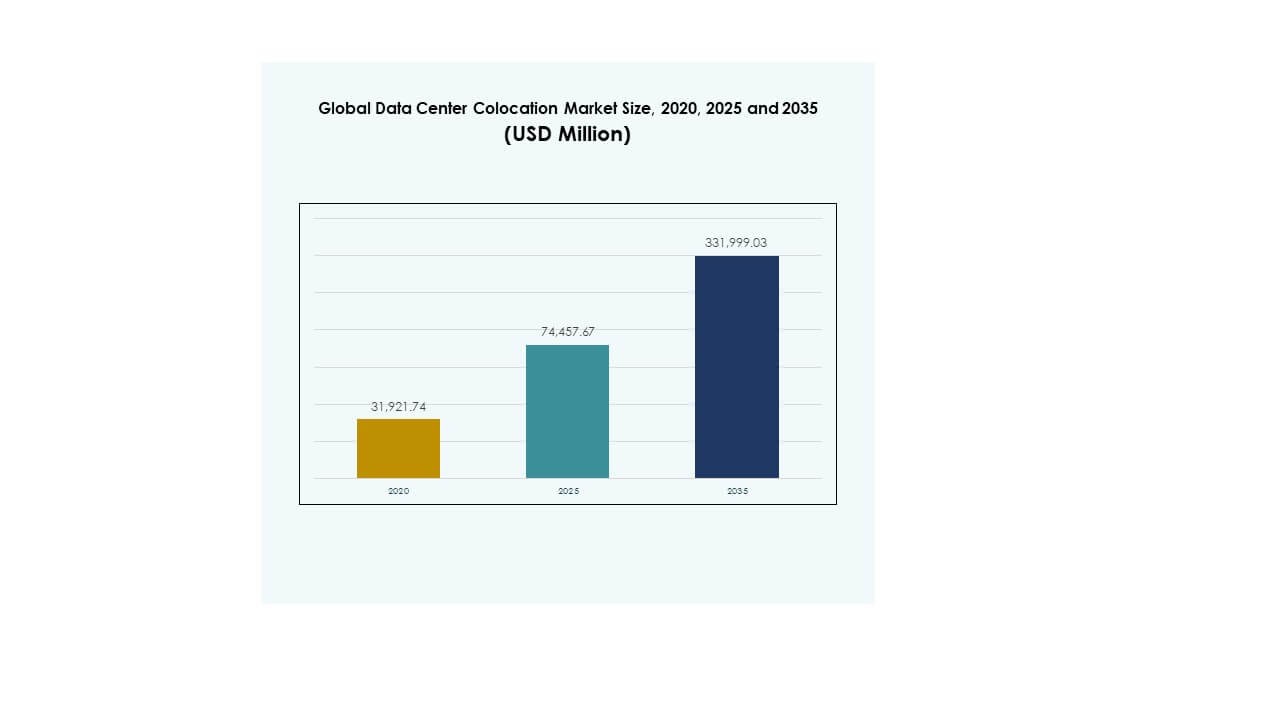

The Global Data Center Colocation Market size was valued at USD 31,921.74 million in 2020 to USD 74,457.67 million in 2025 and is anticipated to reach USD 3,31,999.03 million by 2035, at a CAGR of 16.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Data Center Colocation Market Size 2025 |

USD 74,457.67 Million |

| Data Center Colocation Market, CAGR |

16.05% |

| Data Center Colocation Market Size 2035 |

USD 3,31,999.03 Million |

The market is witnessing strong growth driven by rapid digital transformation across industries, increased adoption of cloud computing, and expanding edge infrastructure. It is becoming a strategic pillar for enterprises aiming to scale operations efficiently while maintaining strong data security and regulatory compliance. Investments in AI, automation, and energy-efficient infrastructure are reshaping facility design and service delivery. The market plays a critical role in supporting high-performance workloads, making it a priority for both enterprises and institutional investors.

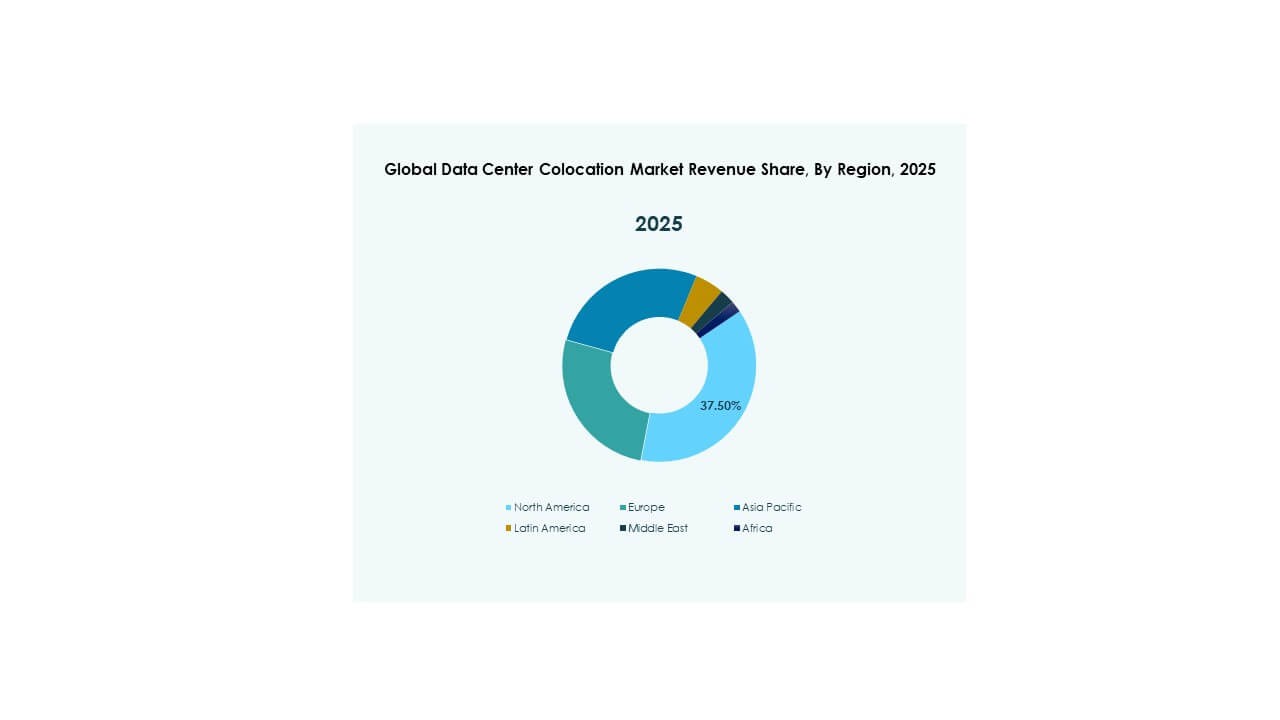

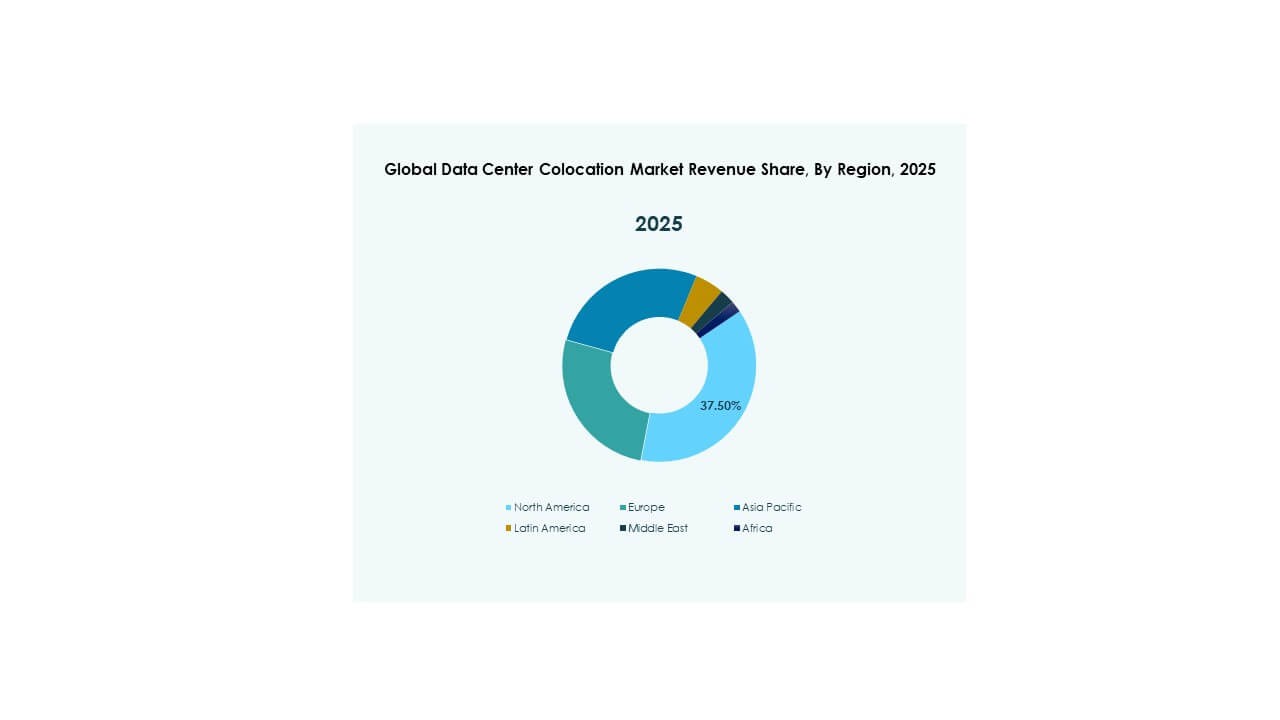

North America leads the market with a mature colocation ecosystem and strong hyperscale presence. Europe is strengthening its position through sustainable data center development and strict regulatory frameworks. Asia Pacific is emerging rapidly, supported by growing cloud adoption, strong enterprise demand, and expanding digital economies. Latin America, the Middle East, and Africa are seeing rising infrastructure investments, positioning them as new growth frontiers in the coming years.

Market Drivers

Growing Enterprise Adoption of Scalable and Cost-Efficient IT Infrastructure

The Global Data Center Colocation Market is experiencing rapid adoption due to rising enterprise demand for scalable IT infrastructure. Businesses are shifting from traditional on-premises data centers to shared facilities to reduce capital expenditure. It provides flexibility to expand or contract capacity without investing in physical infrastructure. Enterprises leverage these facilities to support hybrid IT environments and disaster recovery strategies. Strategic outsourcing enables faster deployment of digital applications. Strong connectivity options enhance network reliability and uptime. This shift reflects a broader digital transformation strategy. Investors see stable returns through recurring revenue models and long-term contracts.

Accelerating Cloud Integration and Digital Transformation Across Industries

Enterprises are rapidly integrating cloud solutions with colocation services to meet growing digital workloads. It allows hybrid cloud models to function seamlessly, supporting distributed applications. Industries such as BFSI, retail, and manufacturing are moving mission-critical workloads to colocation facilities to optimize performance. The increasing use of data analytics, AI, and IoT drives demand for low-latency infrastructure. This integration strengthens operational resilience and improves cost efficiency. Businesses reduce complexity by partnering with colocation providers for managed services. Investors view this trend as a critical enabler for digital expansion. Strategic cloud adoption continues to accelerate market penetration.

- For example, Digital Realty launched its ServiceFabric Connect platform across 61 sites in 32 metro markets, enabling seamless network and cloud interconnection. The platform supports hybrid IT environments and partners with major connectivity providers, including Zayo, to expand its global reach.

Rising Demand for High-Performance Edge Computing and Data Localization

Edge computing is transforming how data is processed, stored, and delivered. The Global Data Center Colocation Market benefits from the need to bring computing power closer to users. Edge facilities enable real-time analytics and support latency-sensitive applications. National regulations are strengthening data localization requirements, creating steady demand for localized colocation services. This shift improves compliance, reduces latency, and enhances customer experience. Enterprises adopt edge-based colocation to support advanced technologies like autonomous systems and smart cities. Service providers are expanding their footprints in Tier 2 and Tier 3 cities. Investors focus on regional infrastructure growth and expansion potential.

- For example, NES Data launched a 5 MW edge data center in Pune, India, in 2024 and announced plans to expand its total capacity to over 100 MW by 2027. The project marks the company’s entry into the Indian market and supports growing regional digital infrastructure demand.

Technological Innovation Driving Automation and Energy Efficiency

Automation, AI, and advanced monitoring tools are redefining operational efficiency. It enhances capacity planning, security, and performance optimization. Colocation operators deploy intelligent power management systems to reduce energy use and operational costs. Sustainability goals push companies to adopt green technologies, renewable energy integration, and cooling innovations. These innovations attract hyperscalers and enterprises seeking efficiency gains. Digital twin solutions are improving asset lifecycle management and uptime reliability. The market is witnessing partnerships to modernize facilities and accelerate deployment timelines. Investors are drawn to strong growth potential driven by technological innovation and sustainable operations.

Market Trends

Strategic Expansion of Hyperscale and Hybrid Infrastructure Networks

The Global Data Center Colocation Market is witnessing an increase in hyperscale expansion and hybrid infrastructure adoption. Hyperscale operators are partnering with colocation providers to enhance global reach and reduce time-to-market. It supports the surge in demand for cloud computing and AI-driven workloads. Hybrid infrastructure combines on-premises and cloud environments, improving agility. Enterprises prefer hybrid models to optimize workloads. This expansion enhances interconnection capabilities and supports rapid deployment of digital services. Investors focus on long-term growth through scalable infrastructure. The trend aligns with global digitalization efforts.

Adoption of Sustainable Infrastructure and Renewable Energy Integration

Sustainability is becoming a core priority for data center strategies. Colocation providers are integrating renewable energy sources to minimize carbon footprints. It drives operational efficiency and helps meet environmental goals. Green building certifications and energy-efficient cooling systems are gaining traction. Operators are investing in advanced power usage effectiveness technologies to enhance performance. Enterprises prefer facilities with strong ESG commitments. This trend improves brand image and regulatory compliance. Long-term contracts with renewable energy suppliers support cost predictability. Investors value sustainable infrastructure for future-proof portfolios.

Rapid Deployment of AI-Enabled Automation and Smart Management Solutions

Colocation facilities are increasingly integrating AI and automation to streamline operations. Intelligent monitoring systems enhance predictive maintenance and security. It improves operational reliability and reduces manual intervention. Smart cooling and energy optimization systems lower power consumption. Automated management platforms provide better workload visibility and resource utilization. The integration of AI improves risk management and service delivery. Enterprises gain more control and performance flexibility. Investors recognize the value of such advancements in sustaining profitability.

Geographic Diversification and Strategic Market Entry in Emerging Regions

Global operators are expanding into emerging regions with high digital growth potential. The Global Data Center Colocation Market is seeing strong interest in Asia Pacific, Latin America, and Africa. It enables operators to capture rising demand in underserved markets. Strategic partnerships and joint ventures accelerate entry into these regions. Enterprises benefit from improved network redundancy and coverage. Emerging economies provide cost advantages for infrastructure development. This trend aligns with the growing importance of localized infrastructure. Investors focus on market diversification and long-term stability.

Market Challenges

Rising Operational Costs and Energy Supply Constraints Impacting Profitability

Colocation operators face rising costs associated with energy consumption, real estate, and equipment maintenance. The Global Data Center Colocation Market is sensitive to power availability and cost fluctuations. It creates pressure on profit margins and limits expansion in power-constrained areas. Energy price volatility increases the operational risk for operators. Complex cooling requirements in high-density facilities add to cost burdens. Providers must adopt advanced energy management solutions to remain competitive. Limited grid capacity in some regions delays deployment timelines. Investors evaluate the impact of energy constraints carefully before funding expansions. Balancing cost control with technological advancement remains a key challenge.

Regulatory Complexities and Cybersecurity Risks Limiting Infrastructure Growth

Colocation providers operate within strict regulatory frameworks on data security, privacy, and cross-border data flows. It complicates expansion strategies and operational compliance. Stringent localization requirements increase the cost and complexity of deployment. Cybersecurity risks are growing with the increase in connected systems and digital workloads. Providers face pressure to invest in advanced security solutions to protect customer data. Regional differences in compliance standards create barriers to international expansion. Managing risk while maintaining service availability requires strong infrastructure planning. Investors monitor regulatory trends closely to assess long-term market stability.

Market Opportunities

Strategic Integration of AI, Edge, and Cloud to Unlock New Infrastructure Growth

The Global Data Center Colocation Market offers strong opportunities through integration of AI, edge computing, and cloud services. It enables businesses to optimize data processing, storage, and connectivity. Edge facilities bring computing closer to users, improving performance for latency-sensitive applications. AI enhances energy management and predictive maintenance. Cloud integration supports scalability and innovation. These developments open new revenue streams for providers. Enterprises use these opportunities to strengthen digital competitiveness. Investors benefit from stable, long-term infrastructure growth.

Accelerating Investments in Emerging Markets with Strong Digital Growth Potential

Emerging economies present significant infrastructure opportunities for colocation expansion. It allows operators to access large, underserved customer bases and growing digital economies. Asia Pacific, Latin America, and Africa are seeing rapid adoption of cloud and edge technologies. Governments support digital transformation through favorable policies and infrastructure programs. Lower construction costs increase investment attractiveness. Strategic partnerships accelerate entry into these markets. Investors see high returns in early-stage regional development.

Market Segmentation

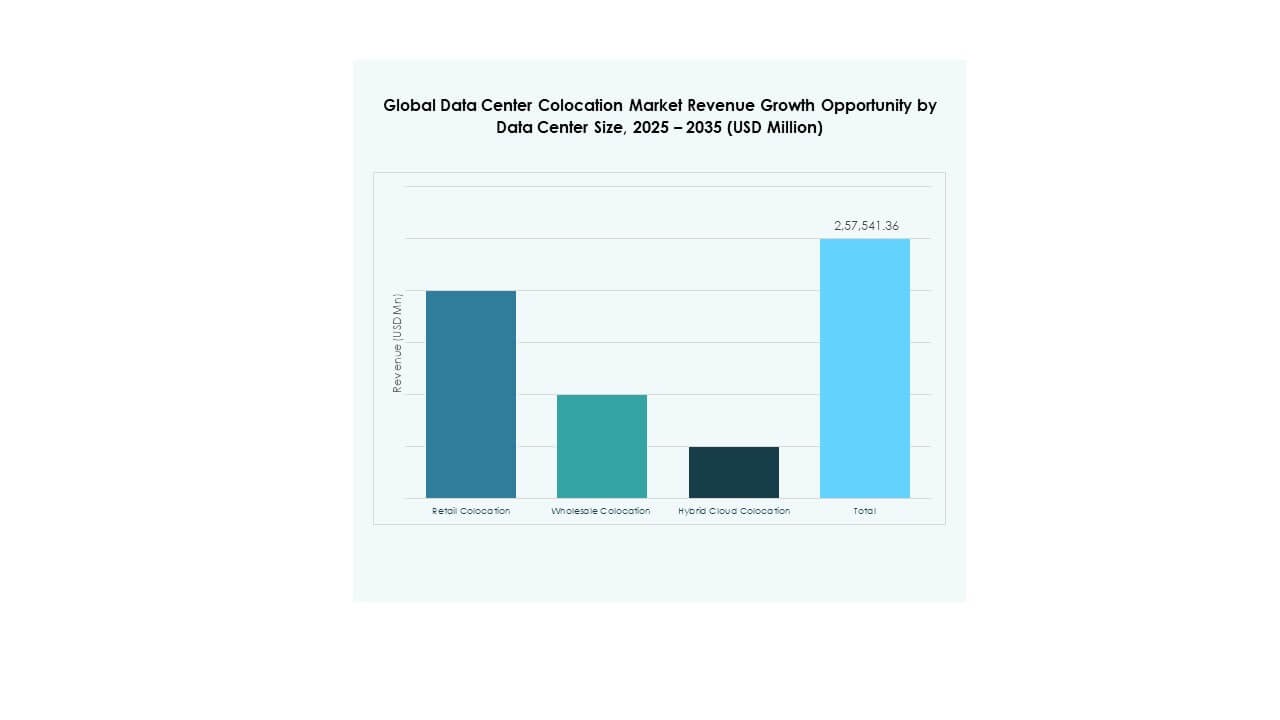

By Type

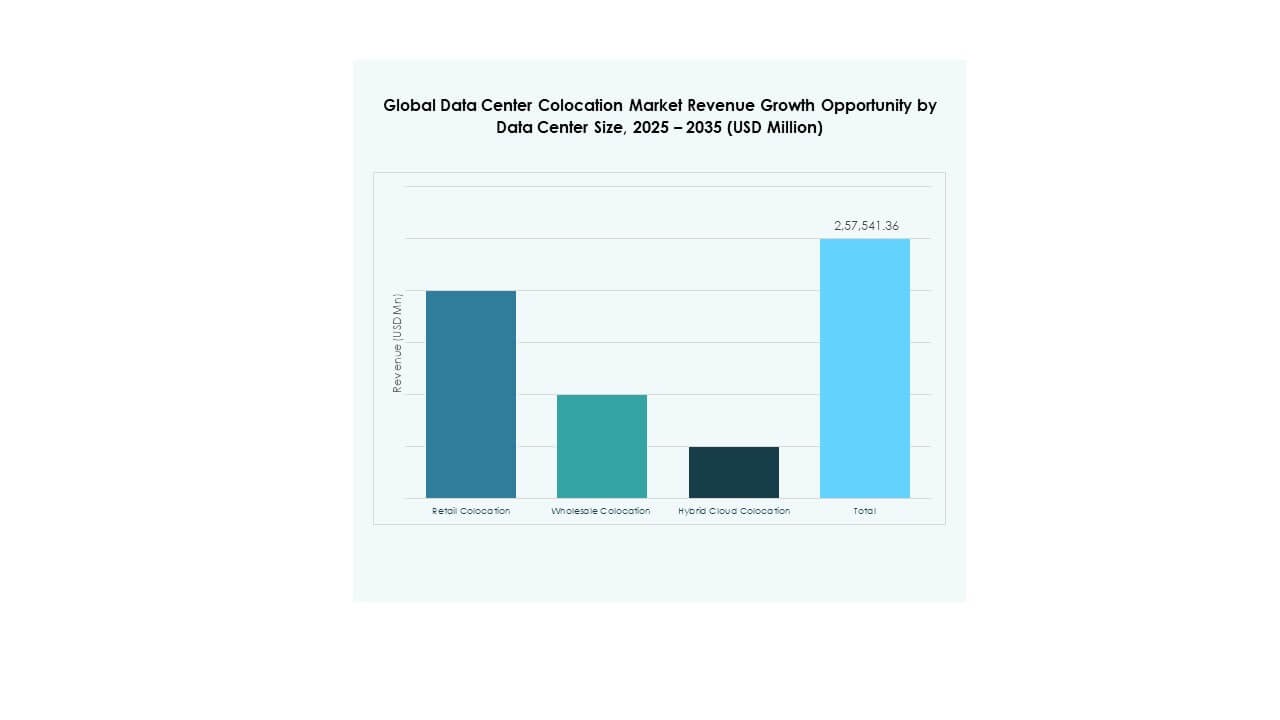

Retail Colocation dominates the Global Data Center Colocation Market with a significant share due to strong enterprise demand for scalable infrastructure. Businesses prefer retail models to maintain control while reducing costs. Wholesale Colocation supports large-scale deployments for hyperscale operators and cloud providers. Hybrid Cloud Colocation is growing fast due to rising adoption of hybrid IT strategies. This segment provides flexible capacity and seamless cloud integration. Retail models remain attractive for enterprises seeking agility and security.

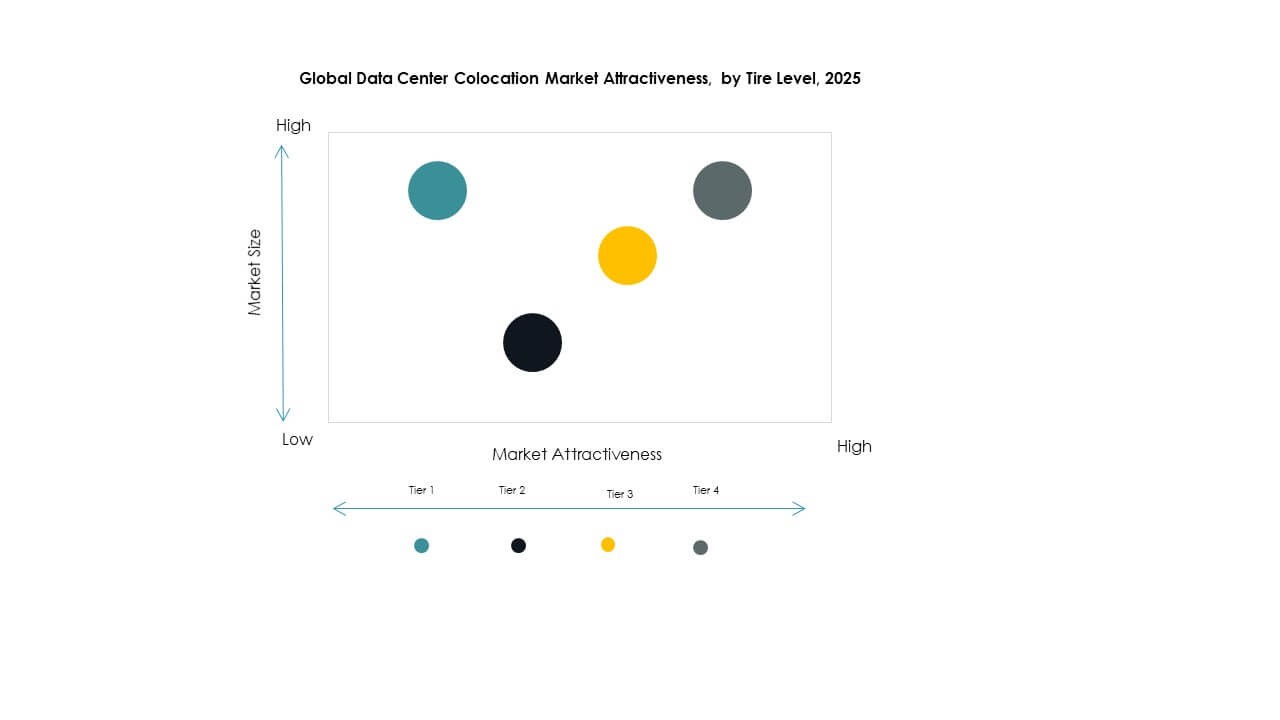

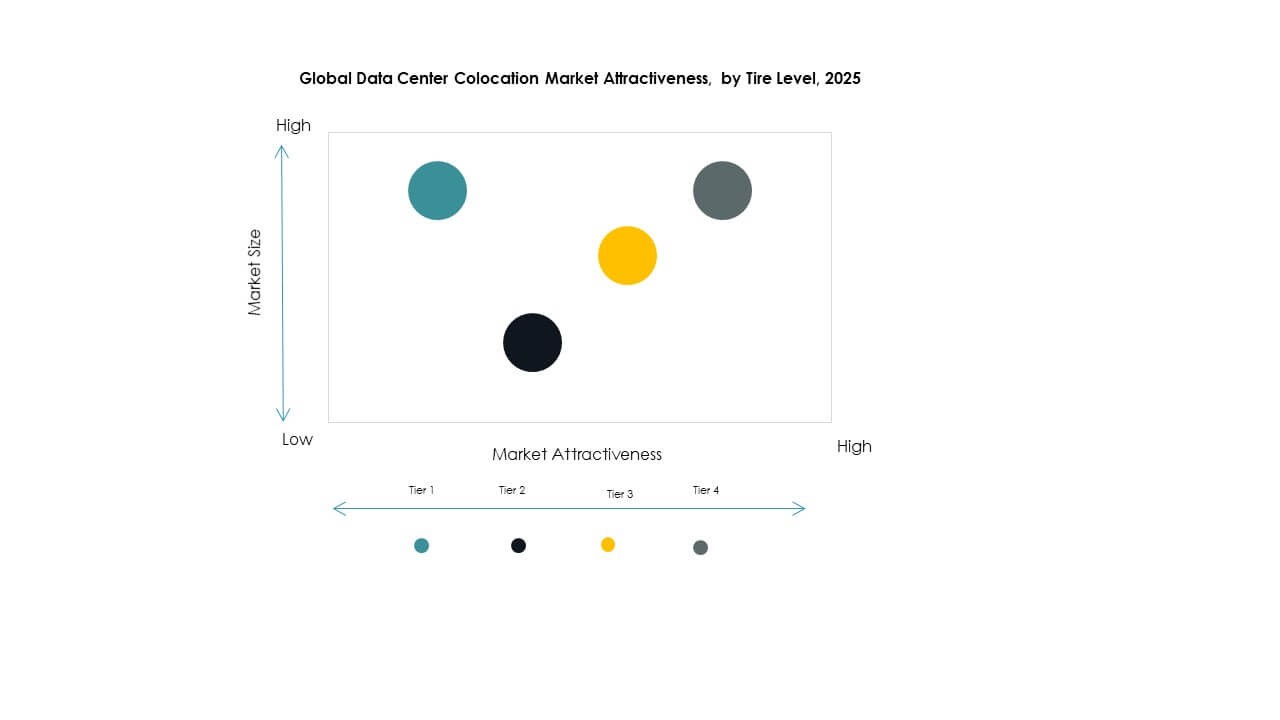

By Tier Level

Tier 3 facilities lead the Global Data Center Colocation Market due to their high reliability and cost efficiency. Enterprises choose Tier 3 because it balances redundancy with operational cost. Tier 4 facilities are gaining attention for mission-critical workloads requiring maximum uptime. Tier 1 and Tier 2 serve smaller businesses with moderate performance needs. The shift toward Tier 3 reflects enterprise focus on operational stability and scalability. Providers are investing in Tier 3 expansion to meet growing demand.

By Enterprise Size

Large Enterprises dominate the Global Data Center Colocation Market due to their high IT infrastructure requirements and complex workloads. They use colocation services to enhance global reach and operational resilience. SMEs are increasing adoption to support digital transformation without heavy capital investment. Affordable, flexible, and managed colocation solutions attract smaller firms. This shift supports broader market penetration across industries. Large enterprises continue to drive revenue through long-term contracts and advanced service requirements.

By End User Industry

IT & Telecom holds the largest share in the Global Data Center Colocation Market, driven by cloud services, edge computing, and increasing data consumption. BFSI and healthcare sectors rely on colocation for security and compliance. Retail, media, and entertainment industries use these facilities to support omnichannel and streaming services. Other sectors are adopting colocation to improve digital service delivery. Strong demand from IT & Telecom continues to anchor market growth and infrastructure investment.

Regional Insights:

North America

The North America Global Data Center Colocation Market size was valued at USD 12,306.15 million in 2020 to USD 27,922.37 million in 2025 and is anticipated to reach USD 1,23,755.96 million by 2035, at a CAGR of 15.98% during the forecast period. North America holds 38.5% of the global market share, supported by advanced infrastructure and strong hyperscale activity. It benefits from high cloud adoption and a dense network of interconnection hubs. The U.S. drives regional leadership with massive investments from hyperscale providers and enterprises. Canada and Mexico are expanding their data center footprints with renewable energy integration and strategic incentives. It strengthens operational reliability through large-scale deployments and carrier-neutral interconnections. The region remains attractive for investors due to predictable regulatory frameworks and strong demand. Its mature ecosystem sets the benchmark for operational efficiency and global connectivity.

- For example, Equinix’s DC12 data center in Ashburn, Virginia is located at the heart of “Data Center Alley” and is recognized for its high-density interconnection ecosystem, with over 37,000 cross-connects deployed across the Washington D.C. metro area as of July 2024. This directly supports dense, carrier-neutral interconnection hubs and hyperscale activity, setting the benchmark for operational efficiency and reliability.

Europe

The Europe Global Data Center Colocation Market size was valued at USD 8,940.26 million in 2020 to USD 19,527.86 million in 2025 and is anticipated to reach USD 81,694.34 million by 2035, at a CAGR of 15.32% during the forecast period. Europe accounts for 27.6% of the global market share, driven by sustainability-focused development and strict data compliance frameworks. The UK, Germany, and France lead with energy-efficient designs and strong connectivity. It benefits from a growing ecosystem of regional and hyperscale operators. Data sovereignty and environmental goals shape investment strategies across major countries. Renewable energy adoption supports cost predictability and regulatory compliance. The region’s strong backbone network enhances operational performance and security. Investors value the steady growth pace and predictable returns. It continues to strengthen its role as a strategic hub for global infrastructure expansion.

Asia Pacific

The Asia Pacific Global Data Center Colocation Market size was valued at USD 7,617.77 million in 2020 to USD 20,076.69 million in 2025 and is anticipated to reach USD 1,00,127.25 million by 2035, at a CAGR of 17.33% during the forecast period. Asia Pacific holds 25.9% of the global market share and is emerging as the fastest-growing region. China, India, Japan, and Australia anchor this expansion with strong digital infrastructure investments. It benefits from large user bases, rising cloud demand, and supportive government policies. Rapid digitalization is driving colocation demand across BFSI, retail, and manufacturing sectors. Operators are expanding in Tier 2 cities to meet local latency and compliance needs. Strong submarine cable connectivity boosts cross-border data flows. Investors see high growth potential in early-stage deployments and market scalability. It is positioned as a key engine of future global capacity growth.

- For example, AirTrunk launched its TOK2 Tokyo West campus in May 2024, offering a scalable capacity exceeding 110 MW. The facility is designed for high energy efficiency with a targeted PUE of 1.15, positioning it among Japan’s major hyperscale data center developments.

Latin America

The Latin America Global Data Center Colocation Market size was valued at USD 1,584.43 million in 2020 to USD 3,636.12 million in 2025 and is anticipated to reach USD 14,719.09 million by 2035, at a CAGR of 14.94% during the forecast period. Latin America represents 4.2% of the global market share, supported by improving digital infrastructure. Brazil leads the market with growing hyperscale activity and renewable energy potential. Mexico, Chile, and Colombia are building capacity to meet increasing enterprise demand. It benefits from strategic investments aimed at reducing latency and improving connectivity. Expanding internet penetration fuels demand for colocation services across multiple sectors. Regional governments support deployment through infrastructure programs and tax incentives. Investors target this region for early-stage growth opportunities. It continues to build strong positioning as a regional connectivity hub.

Middle East

The Middle East Global Data Center Colocation Market size was valued at USD 833.16 million in 2020 to USD 1,854.00 million in 2025 and is anticipated to reach USD 6,922.18 million by 2035, at a CAGR of 14.01% during the forecast period. The Middle East holds 2.0% of the global market share, with rising investments from telecom operators and cloud providers. UAE and Saudi Arabia are driving growth with national digitalization programs. It benefits from strategic positioning that connects Europe, Africa, and Asia. Regional governments promote colocation through smart city projects and data localization policies. Hyperscale players are entering the market to capture expanding enterprise demand. Renewable energy and green data center initiatives strengthen competitiveness. Investors recognize long-term potential in infrastructure modernization. It plays a growing role in enabling regional digital economies.

Africa

The Africa Global Data Center Colocation Market size was valued at USD 639.98 million in 2020 to USD 1,440.63 million in 2025 and is anticipated to reach USD 4,780.21 million by 2035, at a CAGR of 12.66% during the forecast period. Africa accounts for 1.5% of the global market share and is gradually expanding its colocation capacity. South Africa leads with a well-developed digital ecosystem and international connectivity. Nigeria, Egypt, and Kenya are investing in new facilities to meet rising data demands. It benefits from submarine cable expansions and data localization policies. Infrastructure development is accelerating to support cloud adoption. Strategic partnerships with global operators are shaping early-stage market growth. Investors view Africa as a long-term opportunity for infrastructure diversification. It is steadily positioning itself as an emerging digital hub.

Competitive Insights:

- China Telecom Corporation Limited

- Cologix

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Centersquare

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- Iron Mountain, Inc.

- NTT Ltd. (NTT DATA)

- QTS Realty Trust, LLC

- Rackspace Technology

- Telehouse (KDDI CORPORATION)

- Zayo Group, LLC

The Global Data Center Colocation Market features a highly competitive landscape shaped by global and regional operators with strong infrastructure portfolios. It reflects aggressive expansion strategies, including facility modernization, renewable energy integration, and interconnection service enhancements. Market leaders such as Equinix, Digital Realty Trust, and NTT Ltd. focus on hyperscale deployments and hybrid cloud enablement to capture enterprise and cloud-native workloads. Mid-tier players strengthen competitiveness through specialized offerings, flexible service models, and geographic diversification. Telecom operators like China Telecom leverage extensive network reach to integrate colocation with connectivity services. Strategic mergers, partnerships, and acquisitions are common to gain scale and expand market coverage. Investment in automation, security, and green data centers plays a critical role in strengthening long-term market positions.

Recent Developments:

- In October 2025, Vertiv announced the launch of a new power distribution unit designed specifically for AI data centers, aiming to address the soaring energy demands and improve operational efficiency for colocation providers managing high-performance workloads.

- In October 2025, Centersquare revealed its acquisition of 10 data centers across the US and Canada, which expanded its total portfolio to 80 facilities, reinforcing its presence in North American colocation markets and meeting growing regional cloud and enterprise demand.

- In October 2025, Aligned Data Centers is reported to be set for a $40 billion takeover by Global Infrastructure Partners (GIP), a move anticipated to drive further expansion and innovation in colocation services and infrastructure investments.