Executive summary:

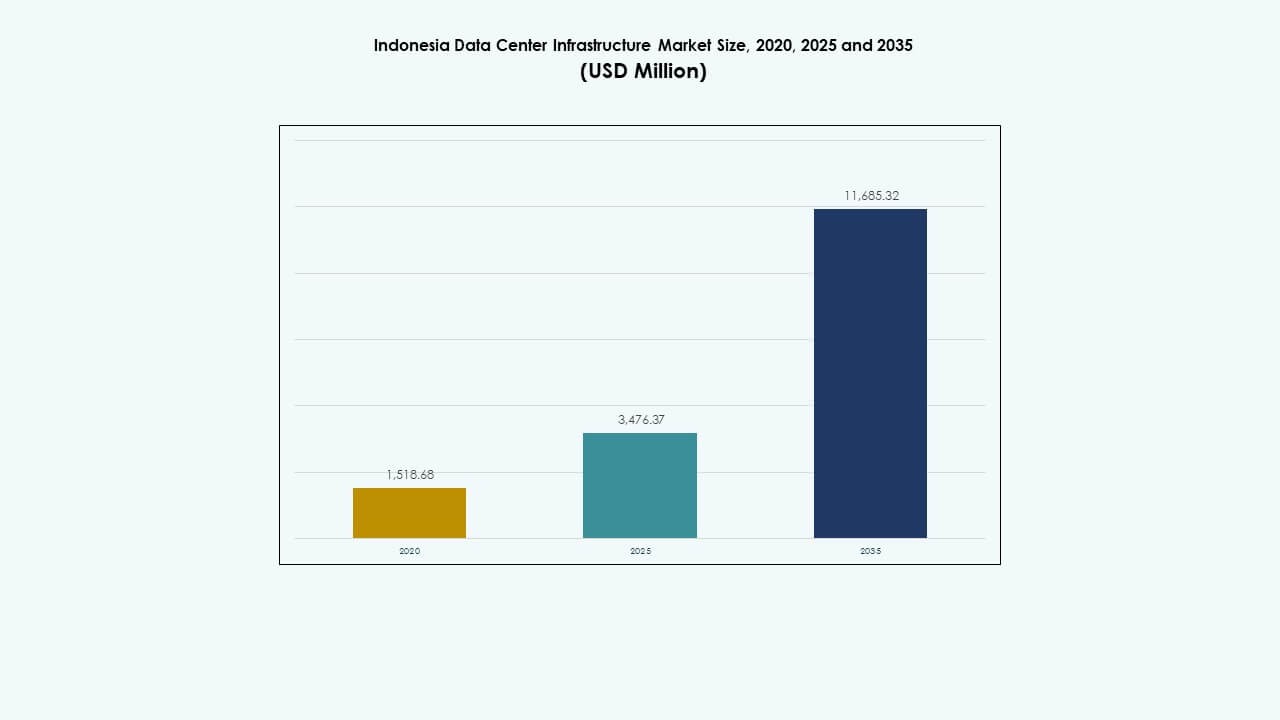

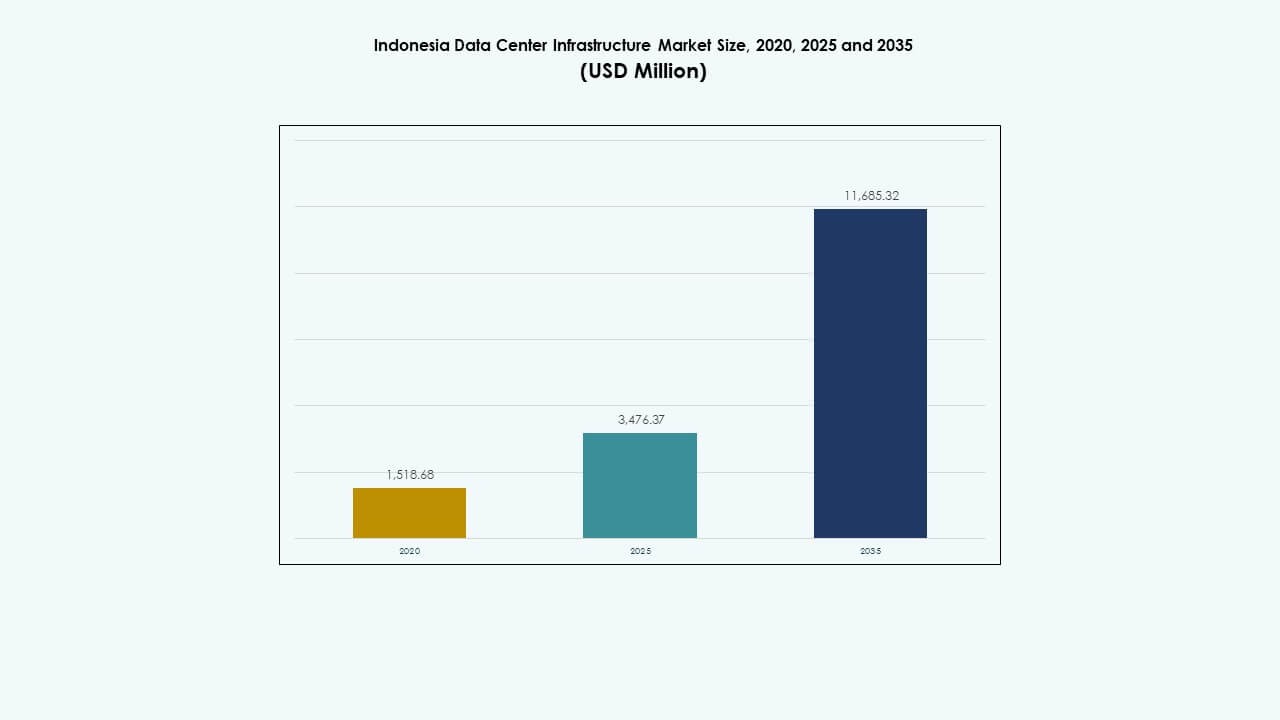

The Indonesia Data Center Infrastructure Market size was valued at USD 1,518.68 million in 2020 to USD 3,476.37 million in 2025 and is anticipated to reach USD 11,685.32 million by 2035, at a CAGR of 12.78% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Indonesia Data Center Infrastructure Market Size 2025 |

USD 3,476.37 Million |

| Indonesia Data Center Infrastructure Market, CAGR |

12.78% |

| Indonesia Data Center Infrastructure Market Size 2035 |

USD 11,685.32 Million |

Strong cloud migration, hyperscale entry, and rising digital service demand drive expansion. Enterprises adopt hybrid cloud and edge computing to support local data needs. Operators deploy AI-ready infrastructure, high-density racks, and modular systems to reduce build time and operating costs. Government policy encourages local hosting, boosting demand for compliant and scalable infrastructure. For investors, the market offers long-term stability due to contract-based recurring revenues and growing connectivity.

Java leads the market due to Jakarta’s dominance in finance, telecom, and cloud traffic. West Java emerges with land availability and better power infrastructure, drawing hyperscale interest. Batam gains momentum for cross-border connectivity with Singapore. Eastern provinces remain nascent but offer long-term potential tied to grid upgrades and fiber rollout. Regional dynamics reflect varied infrastructure readiness, making location a key factor in market entry strategy.

Market Dynamics:

Market Dynamics:

Rapid Cloud Adoption And Enterprise Digital Migration Across Industries

Enterprises move workloads to cloud platforms to improve scale and reliability. Banks adopt private and hybrid cloud for data control. E-commerce firms need low latency infrastructure for peak traffic. Government digitization programs increase secure hosting demand. The Indonesia Data Center Infrastructure Market supports these transitions at scale. Operators expand capacity to meet uptime needs. Businesses value predictable operating costs and service quality. Investors view demand stability as a strong return driver. Long-term contracts reduce revenue risk.

- For instance, Microsoft opened its Indonesia Central cloud region in May 2025, expanding to over 70 Azure regions globally with AI-ready hyperscale infrastructure.

Hyperscale Investment And Platform Expansion By Global Technology Firms

Global cloud providers expand regional footprints to serve Southeast Asia. Indonesia attracts hyperscale builds due to population scale. Content platforms require proximity to end users. Large campuses improve efficiency and energy use. The Indonesia Data Center Infrastructure Market benefits from anchor tenants. Hyperscale projects create strong supplier ecosystems. Power, cooling, and network vendors gain volume demand. Investors track hyperscale commitments for capacity visibility. Scale economics strengthen competitive positioning.

- For instance, Princeton Digital Group broke ground on a USD 1 billion, 120 MW campus in Greater Jakarta.

Network Modernization And Subsea Cable Connectivity Improvements

New subsea cables improve international bandwidth access. Domestic fiber networks connect secondary cities. Low latency supports fintech and streaming platforms. Operators prefer carrier-neutral facilities for flexibility. The Indonesia Data Center Infrastructure Market gains from interconnection density. Network upgrades reduce reliance on offshore hosting. Enterprises gain better service control and compliance. Infrastructure funds value stable traffic growth. Connectivity strength raises asset valuation.

Policy Support And Local Data Sovereignty Requirements

Data rules encourage local hosting for sensitive workloads. Public agencies prefer domestic infrastructure providers. Licensing clarity improves project approvals. The Indonesia Data Center Infrastructure Market aligns with national digital goals. Local ownership rules shape partnership models. Compliance needs drive steady colocation demand. Developers plan long-term assets with policy visibility. Investors favor regulated demand environments. Sovereignty rules reduce offshore competition.

Market Trends

Shift Toward High-Density Racks And Advanced Cooling Designs

Operators deploy higher rack densities to support AI workloads. Liquid cooling gains pilot adoption across new sites. Space efficiency becomes a core design metric. Power distribution designs adapt to heavier loads. The Indonesia Data Center Infrastructure Market reflects global density trends. Cooling vendors develop localized solutions. Energy efficiency metrics influence customer choice. Asset designs focus on future upgrades. Technical flexibility becomes a selling point.

Rising Preference For Modular And Scalable Build Approaches

Developers adopt modular designs to reduce build timelines. Factory-built systems improve quality control. Capacity adds align with demand phases. The Indonesia Data Center Infrastructure Market favors flexible expansion models. Modular power rooms reduce onsite risk. Standardized designs support faster certification. Investors value phased capital deployment. Scalability improves internal rate returns. Speed to market strengthens competitiveness.

Growth Of Carrier-Neutral And Interconnection-Focused Facilities

Enterprises demand choice across telecom providers. Carrier-neutral sites enable network diversity. Cloud on-ramps attract digital platforms. The Indonesia Data Center Infrastructure Market sees higher interconnection density. Facilities position as digital exchange hubs. Neutrality increases tenant retention. Network-rich campuses command premium pricing. Operators invest in meet-me rooms. Connectivity depth shapes market leadership.

Operational Focus On Energy Efficiency And Cost Optimization

Energy costs drive operating strategy decisions. Operators track PUE metrics closely. Smart monitoring tools optimize load management. The Indonesia Data Center Infrastructure Market reflects efficiency-led competition. Customers prefer transparent energy practices. Automation reduces manual maintenance costs. Asset managers prioritize operational margins. Efficiency gains extend asset life. Sustainability links to long-term value.

Market Challenges

Market Challenges

Power Availability Constraints And Grid Reliability Issues

Grid stability varies across regions. Power delays slow project commissioning. Backup systems raise capital costs. The Indonesia Data Center Infrastructure Market faces infrastructure gaps. Developers invest heavily in redundancy. Fuel logistics add operational complexity. Power pricing volatility affects margins. Remote sites face higher risk exposure. Long lead times challenge expansion plans.

Land Acquisition Complexity And Regulatory Approval Delays

Urban land scarcity raises site costs. Zoning rules differ by province. Approval cycles extend development timelines. The Indonesia Data Center Infrastructure Market must manage local processes. Community concerns affect site selection. Environmental reviews add compliance steps. Foreign investors need local partners. Delays impact project returns. Execution risk remains high.

Market Opportunities

Expansion Into Secondary Cities And Emerging Digital Corridors

Secondary cities show rising enterprise demand. Manufacturing zones require local data processing. The Indonesia Data Center Infrastructure Market can decentralize capacity. Lower land costs improve project economics. Regional governments welcome investment. Fiber rollout supports new locations. Early movers gain market share. Enterprises value regional resilience. Investors benefit from diversification.

Integration Of Renewable Energy And Green Infrastructure Models

Renewable sourcing gains policy support. Solar and hydro options attract operators. The Indonesia Data Center Infrastructure Market can lower carbon intensity. Green power improves tenant appeal. Long-term energy contracts stabilize costs. Sustainability credentials attract global clients. Financing access improves for green assets. Energy innovation boosts asset value. Environmental alignment supports long-term growth.

Market Segmentation

By Infrastructure Type

Electrical and mechanical systems dominate capital allocation due to uptime needs. Electrical infrastructure holds the largest share. Cooling and power systems drive performance reliability. Civil and structural work supports long asset life. IT and network layers enable service delivery. The Indonesia Data Center Infrastructure Market prioritizes resilient core systems. Integration across layers improves efficiency. Growth links to hyperscale and colocation builds. Infrastructure balance defines competitiveness.

By Electrical Infrastructure

UPS systems and switchgears command high investment focus. Battery storage adoption rises for backup support. Grid connection quality shapes site viability. The Indonesia Data Center Infrastructure Market relies on redundancy design. Power distribution units support high-density racks. Transfer switches ensure seamless failover. Vendors compete on reliability metrics. Electrical upgrades drive retrofit demand. Power resilience remains critical.

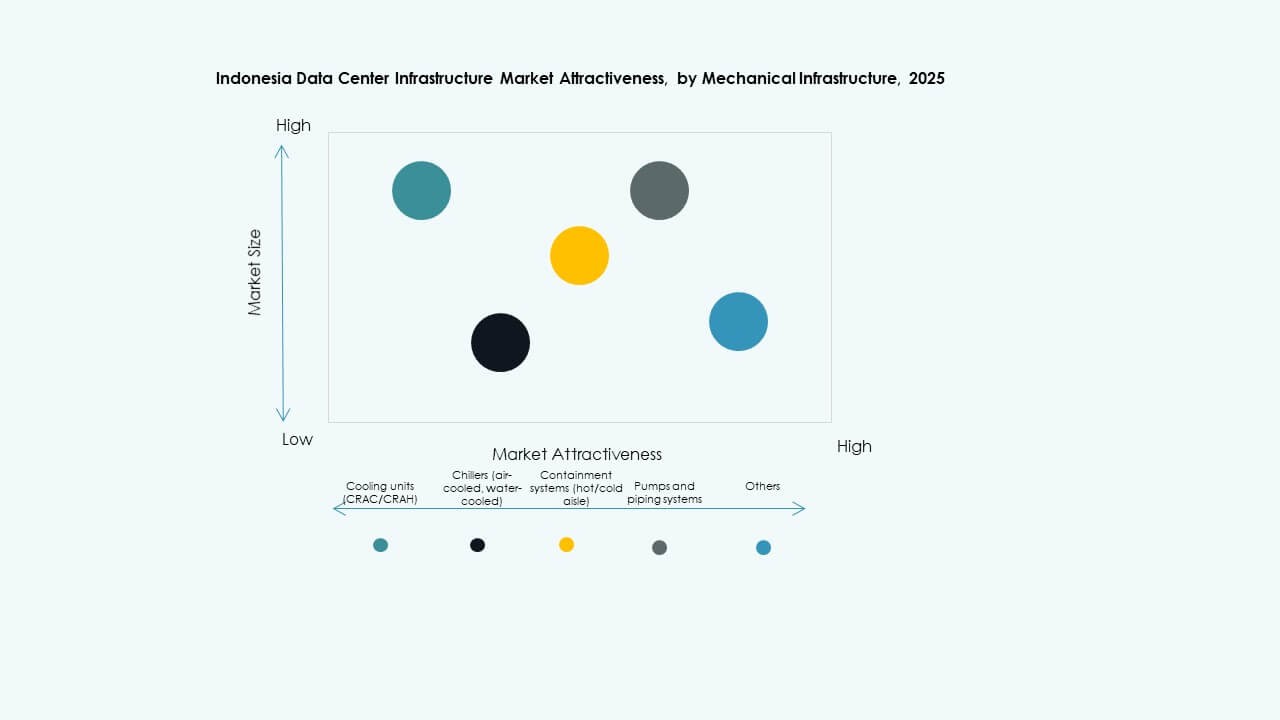

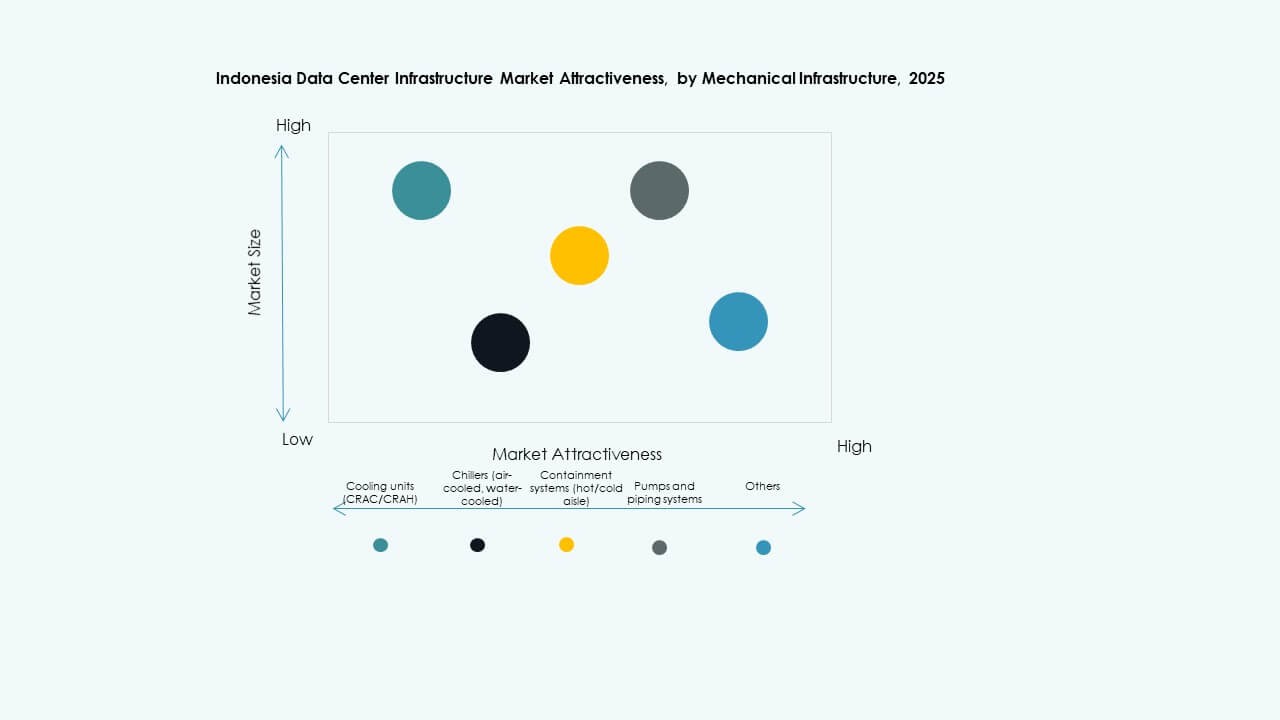

By Mechanical Infrastructure

Cooling units and chillers lead spending. Containment systems improve airflow control. Pumps and piping ensure thermal stability. The Indonesia Data Center Infrastructure Market adopts efficient cooling layouts. Mechanical systems adapt to tropical climate needs. Reliability affects operating cost outcomes. Innovation targets energy savings. Maintenance quality shapes uptime performance. Mechanical design drives efficiency gains.

By Civil / Structural & Architectural

Foundations and superstructure dominate early costs. Building envelopes support climate control. Raised floors remain common in enterprise sites. The Indonesia Data Center Infrastructure Market adopts modular buildings. Structural resilience supports long asset life. Architectural design improves airflow management. Pre-engineered systems reduce build risk. Civil works enable expansion readiness. Site quality affects scalability.

By IT & Network Infrastructure

Servers and storage drive compute capacity. Networking equipment supports low latency needs. Cabling ensures scalable connectivity. The Indonesia Data Center Infrastructure Market aligns IT spend with tenant demand. Racks and enclosures support density shifts. Optical fiber supports interconnection growth. Vendors focus on performance reliability. Upgrade cycles drive repeat demand. IT layers define service quality.

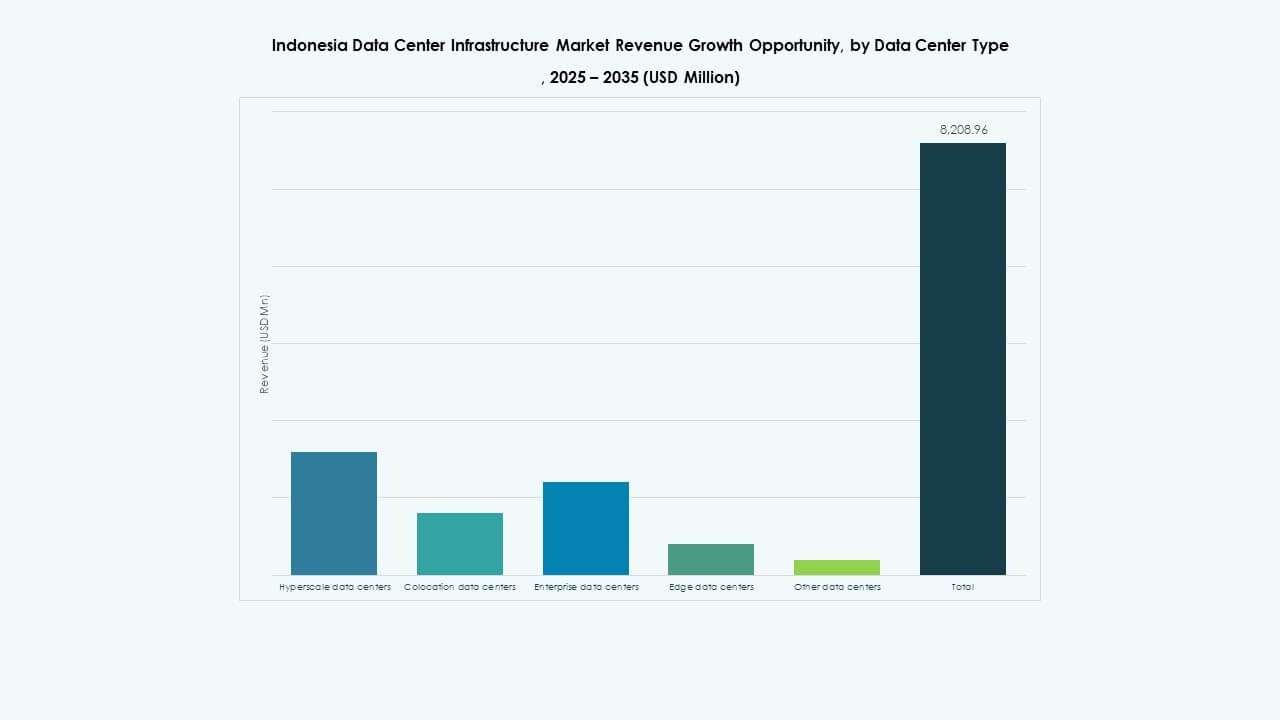

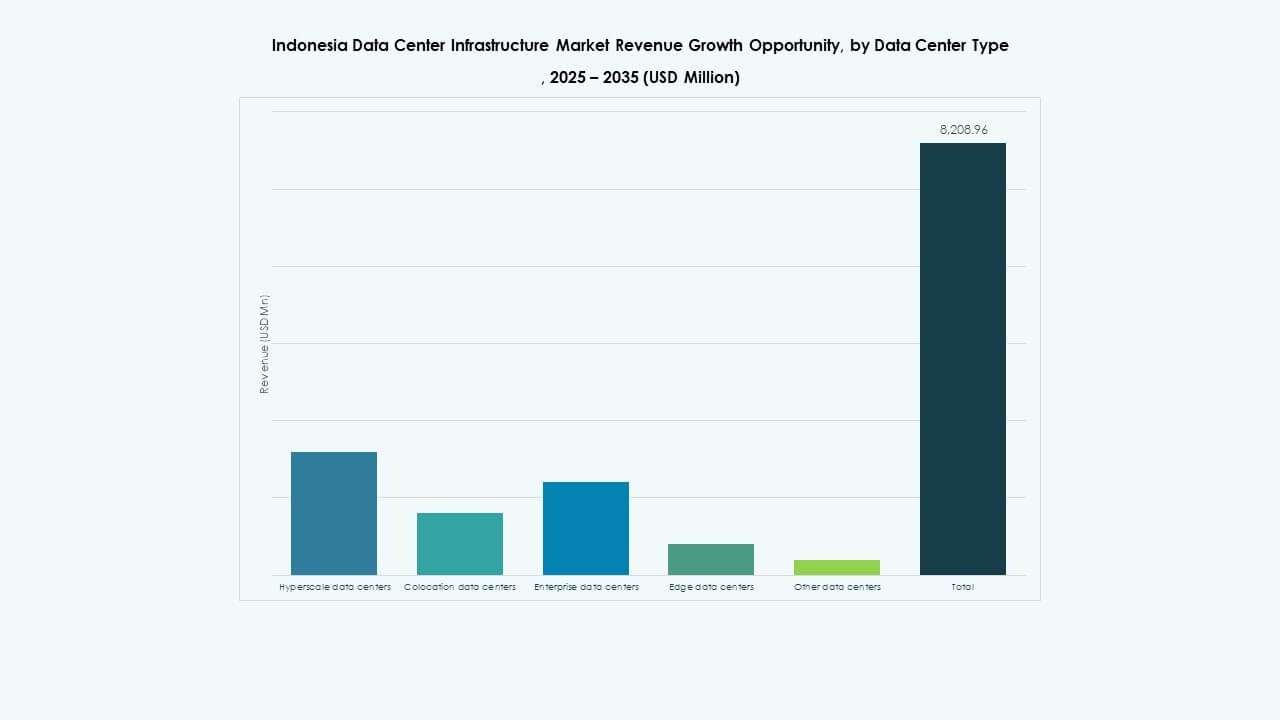

By Data Center Type

Colocation data centers lead market share. Hyperscale facilities show fastest growth. Enterprise sites maintain stable demand. The Indonesia Data Center Infrastructure Market supports mixed deployment models. Edge data centers emerge near users. Colocation attracts diverse tenants. Hyperscale anchors regional capacity. Type mix shapes investment strategy. Demand diversity strengthens resilience.

By Delivery Model

Design-build and EPC models dominate new projects. Turnkey delivery reduces coordination risk. Modular factory-built models gain traction. The Indonesia Data Center Infrastructure Market favors speed and cost certainty. Construction management suits complex campuses. Retrofit projects address legacy upgrades. Delivery choice affects timelines. Investors prefer predictable execution. Model flexibility supports expansion.

By Tier Type

Tier 3 facilities hold the largest share. Tier 4 sites serve critical workloads. Tier 2 supports cost-focused users. The Indonesia Data Center Infrastructure Market balances cost and resilience. Tier standards guide tenant selection. Higher tiers attract regulated industries. Certification impacts pricing power. Upgrade paths influence asset planning. Tier mix reflects demand diversity.

Regional Insights

Java Region

Java holds over half of total market share. Jakarta remains the primary demand center. Financial services and cloud platforms dominate uptake. The Indonesia Data Center Infrastructure Market concentrates capacity here. Network density supports interconnection growth. Power access remains relatively stable. West Java gains from industrial expansion. Investors favor mature demand clusters.

Sumatra And Batam Corridor

This subregion holds a moderate market share. Batam benefits from proximity to Singapore. Cross-border connectivity supports latency-sensitive workloads. The Indonesia Data Center Infrastructure Market sees rising interest here. Industrial parks attract colocation projects. Power access improves steadily. Regulatory alignment supports growth. Strategic location drives investor interest.

- For instance, DBS and UOB provided a $412 million loan in 2025 to finance DayOne’s Nongsa Digital Park data center campus development.

Eastern Indonesia And Emerging Provinces

These regions hold a smaller market share. Demand grows from government and regional enterprises. Connectivity gaps limit rapid expansion. The Indonesia Data Center Infrastructure Market remains early-stage here. Infrastructure upgrades support gradual growth. Renewable energy potential attracts pilots. Land availability offers long-term options. Early investment positions future leaders.

- For instance, Indonesia advanced Batam as a national data center hub in 2025 through government initiatives targeting strategic digital infrastructure.

Competitive Insights:

- Telkom Indonesia

- DCI Indonesia

- Equinix, Inc.

- EdgeConneX

- Schneider Electric

- Vertiv Group Corp.

- Delta Electronics

- Huawei Technologies Co., Ltd.

- Cisco Systems, Inc.

- Dell Inc.

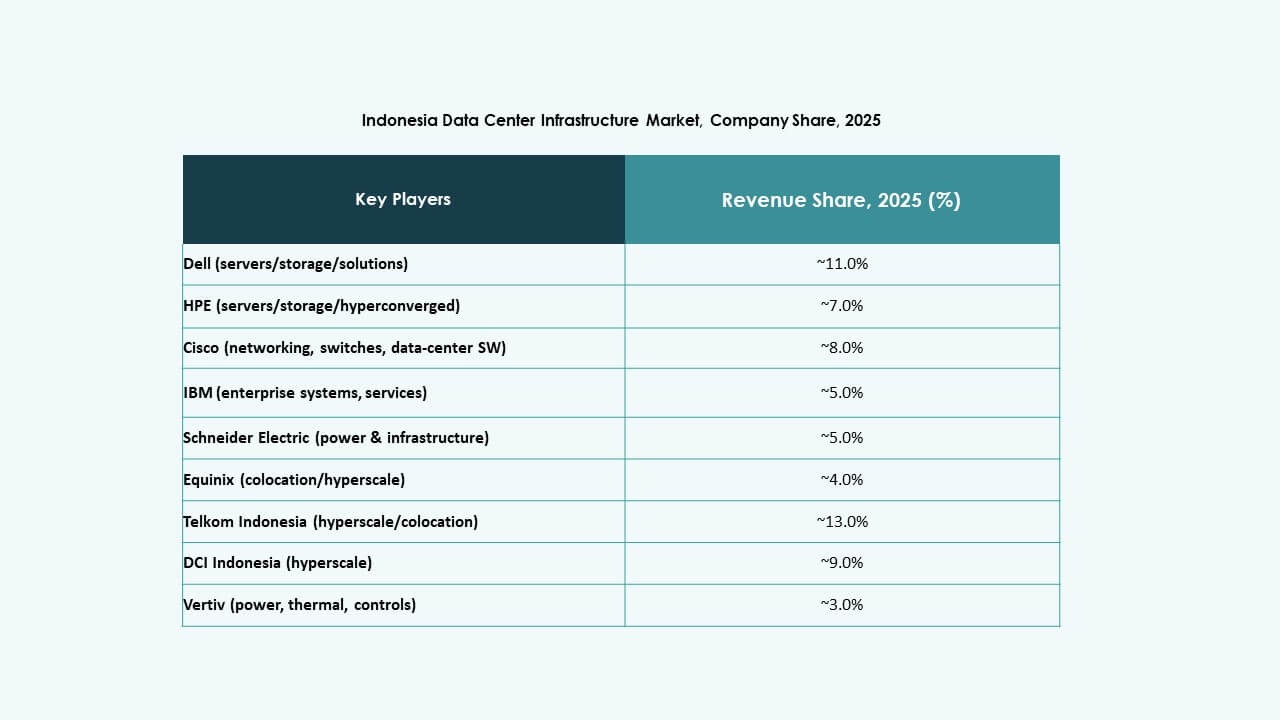

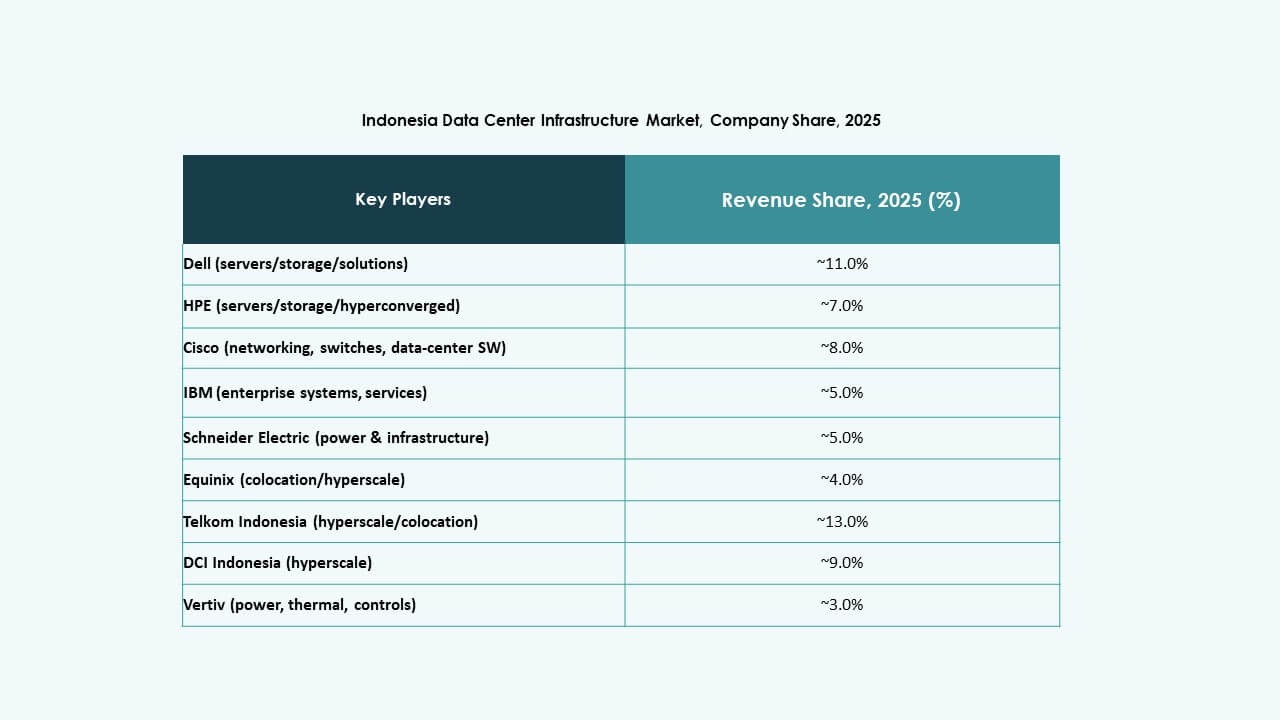

The Indonesia Data Center Infrastructure Market features strong competition between local providers and global infrastructure firms. Telkom Indonesia and DCI Indonesia lead domestic deployments with large-scale facilities backed by national carriers. Equinix and EdgeConneX strengthen international connectivity through carrier-neutral platforms. Schneider Electric, Vertiv, and Delta Electronics compete across electrical and mechanical infrastructure segments, focusing on high-efficiency systems. Huawei, Cisco, and Dell support IT stack deployments with end-to-end hardware and software offerings. Vendors aim to differentiate through modular design, energy savings, and fast delivery models. Service integration, reliability, and sustainability remain key value drivers. The market rewards firms that combine technical performance with local regulatory compliance and scalable delivery across core and edge locations. It continues to attract strategic partnerships between telecoms, cloud providers, and engineering specialists.

Recent Developments:

- In July 2025, NTT Global Data Centers reached a construction milestone by topping out its Jakarta 2A facility set to launch in early 2026. NEC partnered with Bank Mandiri in December 2025 to deploy NTP servers enhancing transaction accuracy in Indonesian data centers.

- In March 2025, Edgnex Data Centers announced a $2.3 billion investment for an AI-optimized data center in Indonesia, following land acquisition. Construction began shortly after, marking the company’s second facility there and aligning with Southeast Asia expansion goals.

- In February 2025, Gaw Capital Partners launched its first phase of a carrier-neutral colocation data center in Nongsa Digital Park, Indonesia, through a joint venture with Sinar Primera named Golden Digital Gateway. The facility opened after just over nine months of construction, supporting Indonesia’s digital growth with scalable infrastructure.

Market Dynamics:

Market Dynamics:

Market Challenges

Market Challenges