Executive summary:

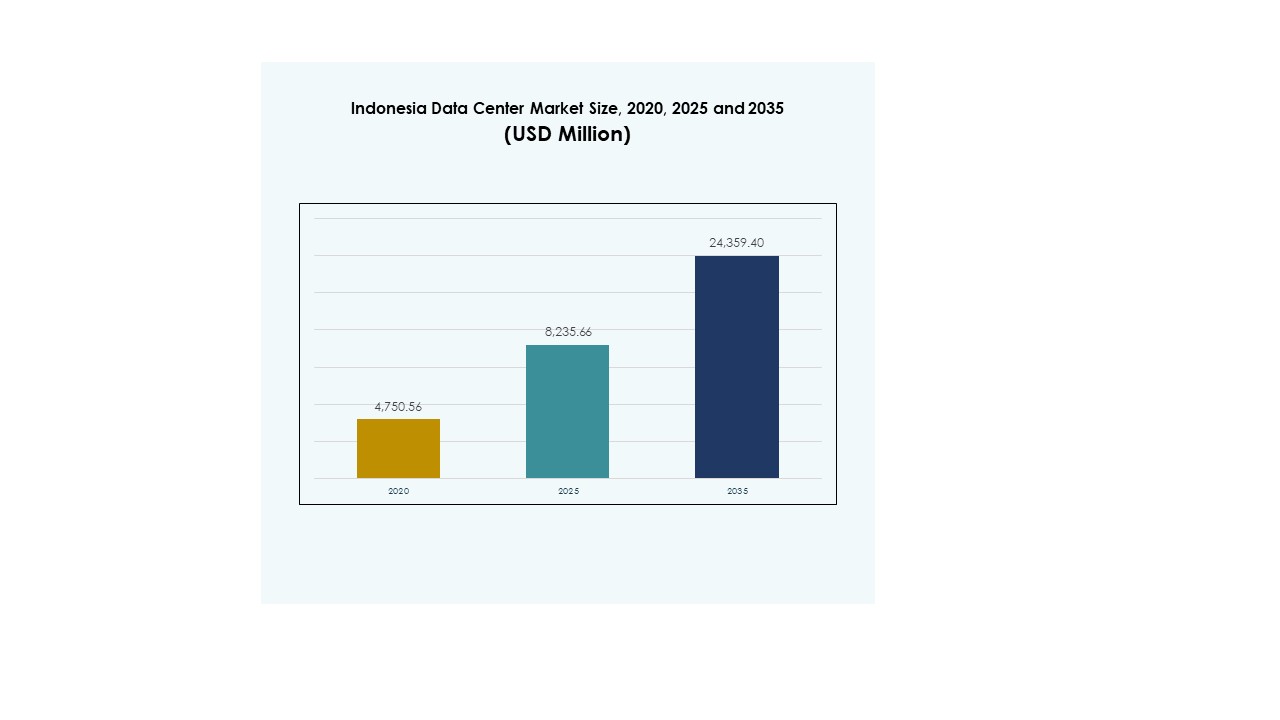

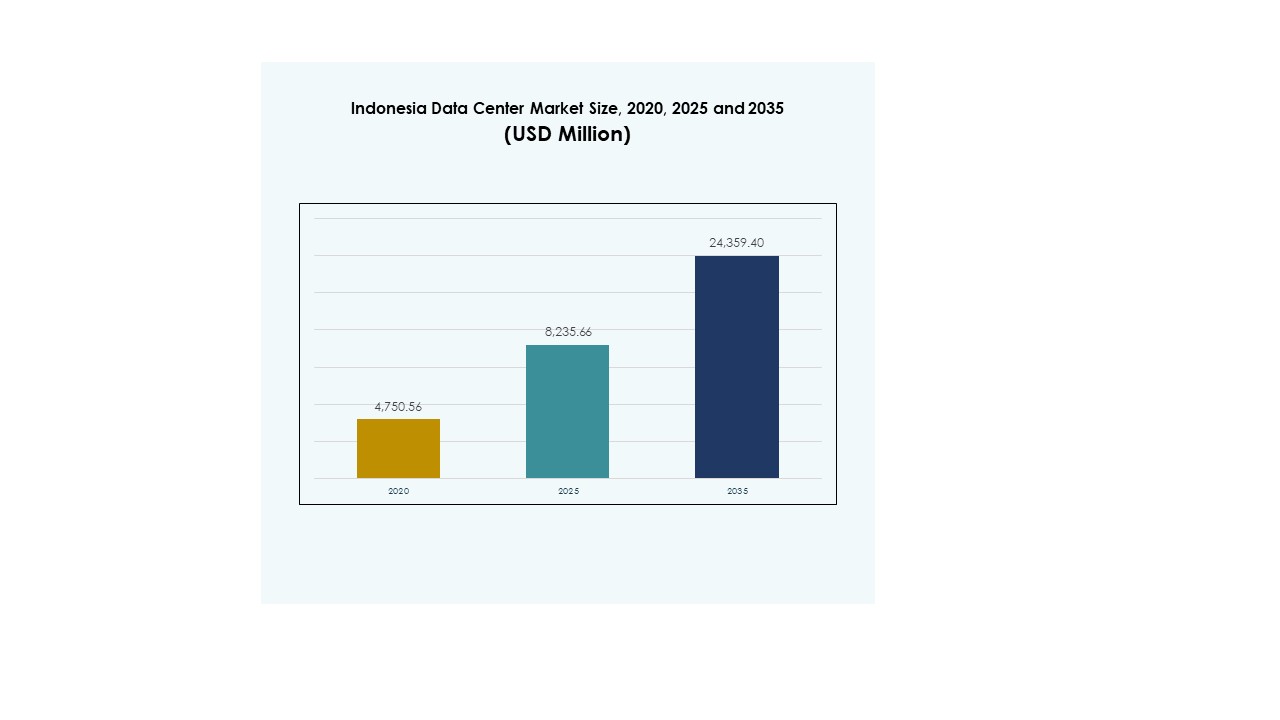

The Indonesia Edge Data Center Market size was valued at USD 117.03 million in 2020, increased to USD 296.84 million in 2025, and is anticipated to reach USD 1,608.31 million by 2035, at a CAGR of 18.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Indonesia Edge Data Center Market Size 2025 |

USD 296.84 Million |

| Indonesia Edge Data Center Market, CAGR |

18.24% |

| Indonesia Edge Data Center Market Size 2035 |

USD 1,608.31 Million |

The market growth is driven by rapid digital transformation, 5G rollout, and widespread cloud adoption. Enterprises are embracing localized computing for faster data processing and reduced latency. Advancements in AI, IoT, and smart infrastructure development are reshaping operations, enabling businesses to enhance service quality and data security. For investors, the market presents strategic potential as Indonesia becomes a major regional hub for scalable, sustainable digital infrastructure.

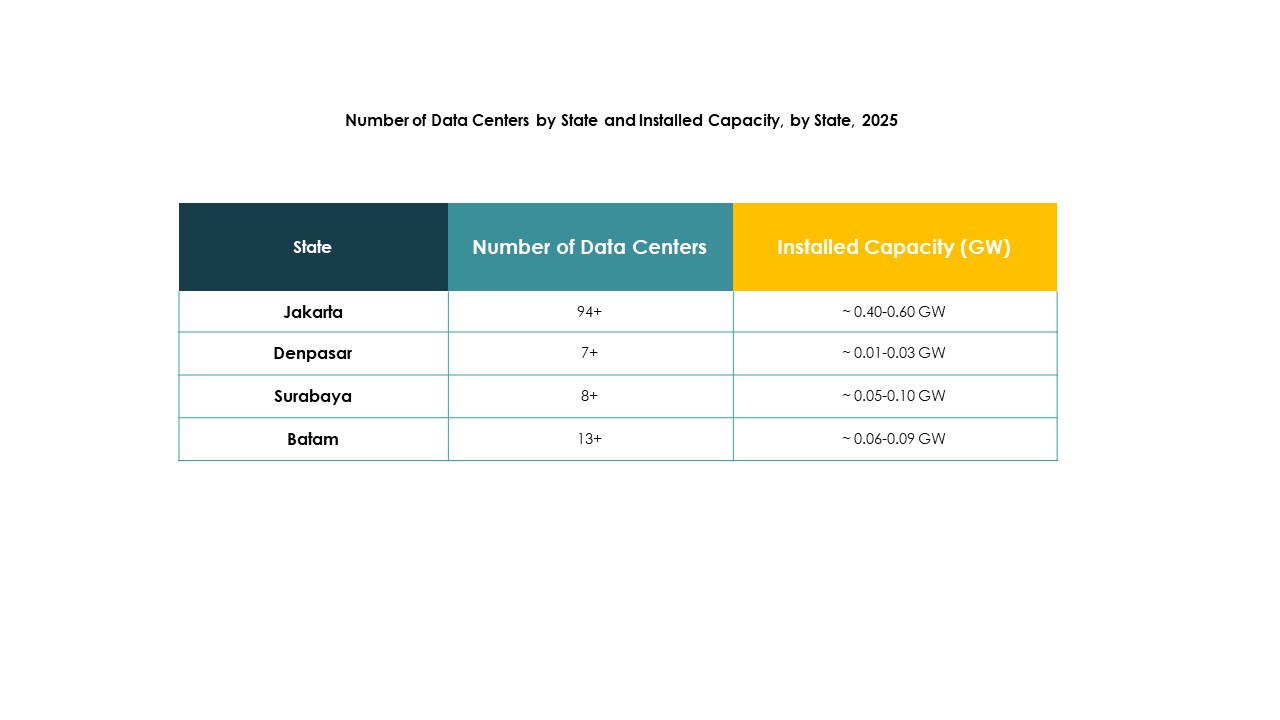

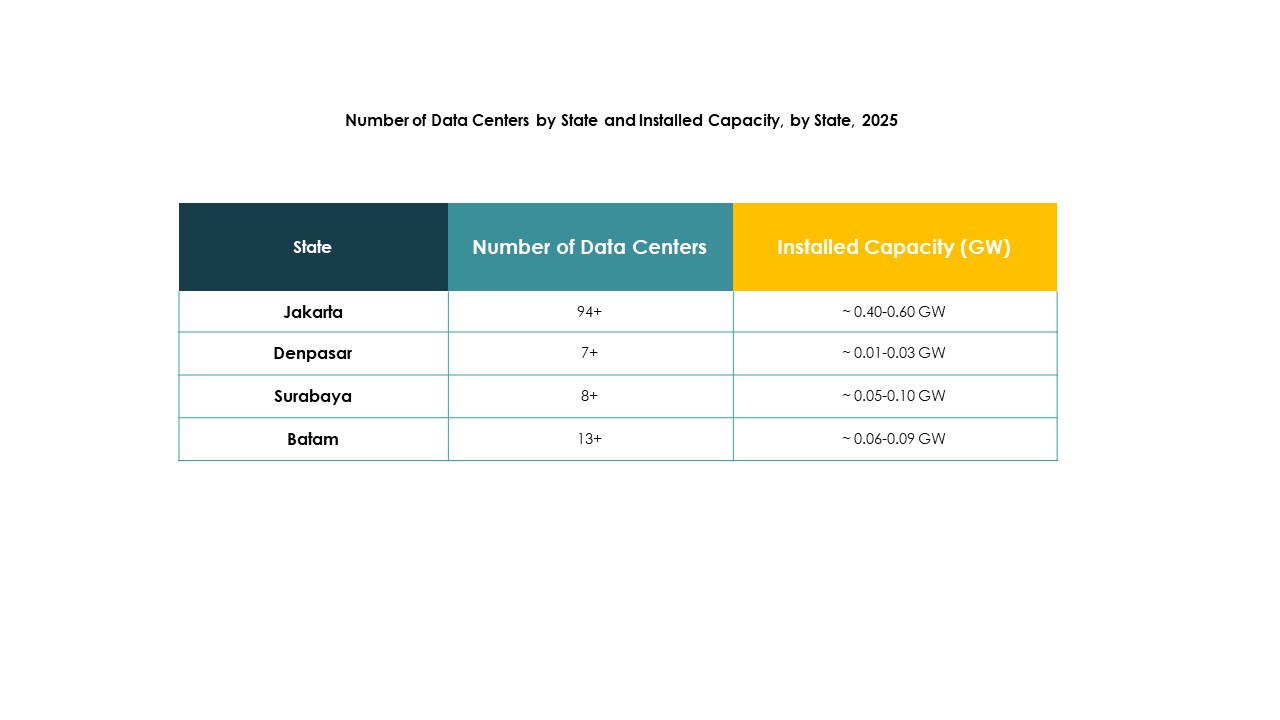

Jakarta leads the market due to its robust connectivity, advanced infrastructure, and concentration of hyperscale facilities. Surabaya, Batam, and Medan are emerging as secondary hubs, supported by industrial expansion and data localization policies. Proximity to Singapore and growing digital ecosystems further strengthen Indonesia’s position as a regional leader in Southeast Asia’s data center landscape.

Market Drivers

Rising Demand for Low-Latency Computing and Real-Time Applications

The Indonesia Edge Data Center Market is expanding rapidly due to the strong need for low-latency data processing. Enterprises across manufacturing, retail, and telecom are adopting edge infrastructure to support real-time analytics and IoT applications. Smart cities and autonomous systems rely on rapid data access closer to end users. Edge computing reduces dependency on distant cloud servers, enhancing responsiveness. It also supports time-sensitive operations like financial trading and remote healthcare. Businesses see local data hosting as a competitive advantage. Investors are focusing on facilities positioned near user hubs to capitalize on these latency-sensitive demands.

Integration of 5G Networks and Smart Infrastructure Development

The integration of nationwide 5G networks and digital infrastructure projects is a key driver for growth. Telecom operators are deploying edge nodes to optimize bandwidth and improve network efficiency. 5G-enabled edge data centers allow faster transmission for AI, AR/VR, and streaming applications. The government’s smart city initiatives increase demand for local data hubs. It supports infrastructure modernization while ensuring regulatory data sovereignty. Enterprises are leveraging these advancements to enhance service reliability and speed. Investors recognize the scalability potential of 5G-enabled edge environments in industrial and commercial applications. This synergy strengthens Indonesia’s role in Southeast Asia’s digital economy.

- For example, in 2023, Telkomsel deployed around 1,000 Huawei EasyAAU antenna units on the 2.3 GHz spectrum in Bali under its “5G City” project, achieving a 3.8× improvement in average downlink throughput compared to previous technologies, marking a major milestone for 5G deployment efficiency in the Asia-Pacific region.

Growing Enterprise Cloud Adoption and Decentralized Data Ecosystems

Increasing enterprise migration toward hybrid and multi-cloud setups strengthens edge deployment momentum. Companies in finance, e-commerce, and logistics use edge data centers for localized processing and data security. It complements public cloud systems by improving control and compliance. The rise in content delivery networks also drives distributed infrastructure investments. Edge locations are becoming critical for ensuring user experience consistency. Businesses view these centers as vital extensions of their digital backbone. The hybrid approach aligns with Indonesia’s growing need for regulatory data localization. It also improves disaster recovery and operational resilience across enterprises.

Expansion of Hyperscale Investments and Renewable Energy Integration

Hyperscale providers are increasingly investing in modular edge sites powered by clean energy. This expansion meets Indonesia’s sustainability goals while boosting operational efficiency. Renewable-powered data centers help reduce carbon footprints and energy costs. Global firms are partnering with local players to establish regional presence. It reflects a shift toward decentralized yet green computing environments. Government support for renewable integration accelerates these developments. Investors see long-term gains in aligning with ESG standards. The convergence of sustainability and digital transformation drives innovation in edge infrastructure design and deployment.

- For example, in July 2025, NeutraDC (a Telkom Indonesia subsidiary) partnered with Medco Power to deploy solar energy at its Batam hyperscale data center facility, with the initial development phase delivering around 20MW of renewable-powered capacity at the Kabil Industrial Estate. This ESG-focused project aims to provide clean electricity for large-scale AI and digital workloads, and the facility is scheduled to begin operations in Q3 2025.

Market Trends

Emergence of AI-Driven Data Optimization and Predictive Maintenance

AI integration in edge operations is transforming performance optimization and reliability. Advanced algorithms help manage workloads, predict failures, and enhance uptime. It enables dynamic allocation of processing power and energy resources. Predictive maintenance reduces operational costs by minimizing downtime. AI-powered monitoring tools are now common in edge environments. The Indonesia Edge Data Center Market benefits from such intelligent automation. Businesses view these solutions as essential for scalable digital transformation. The trend reflects a wider move toward self-healing, energy-efficient infrastructure in Southeast Asia.

Rising Focus on Modular and Scalable Edge Infrastructure Design

Demand for modular construction is increasing to meet rapid deployment needs. Prefabricated modules enable quicker installations and flexible scalability. It reduces setup time for data center operators serving dynamic workloads. Modular designs also simplify maintenance and relocation for enterprises. The Indonesia Edge Data Center Market favors these approaches to support regional expansion. It supports both urban and remote installations, improving accessibility. Investors appreciate the reduced capital risk of modular systems. This trend enhances the adaptability and resilience of Indonesia’s growing digital infrastructure.

Integration of Renewable Power and Green Data Operations

Energy-efficient edge centers powered by renewables are becoming mainstream. Operators use solar and wind power systems to reduce emissions and costs. The Indonesia Edge Data Center Market is witnessing strong adoption of green standards. It aligns with global carbon neutrality commitments and government sustainability targets. Companies deploy advanced cooling and monitoring technologies to minimize energy loss. Clean energy sourcing attracts ESG-focused investors seeking sustainable portfolios. The shift toward environmentally responsible edge centers strengthens Indonesia’s regional leadership. It reflects the country’s focus on balancing growth with environmental goals.

Expansion of Cross-Border Connectivity and Regional Data Corridors

Improved connectivity between Indonesia and neighboring countries drives regional competitiveness. Edge facilities near Batam and Jakarta are linked to Singapore’s data ecosystems. It enhances data flow efficiency across Southeast Asia. Businesses benefit from seamless interconnectivity for regional cloud applications. The Indonesia Edge Data Center Market capitalizes on this strategic location advantage. It attracts hyperscale operators establishing multi-country service routes. Strengthened fiber networks support greater redundancy and lower transmission costs. The trend solidifies Indonesia’s status as a digital gateway within ASEAN.

Market Challenges

Market Challenges

High Energy Consumption and Limited Grid Reliability in Edge Operations

Energy efficiency remains a major concern for data center operators. Indonesia’s power grid infrastructure faces reliability challenges, especially in remote regions. The Indonesia Edge Data Center Market requires substantial investments in energy storage and backup solutions. It increases operational expenditure and reduces sustainability margins. Managing heat and power distribution in high-density racks is complex. Operators need advanced cooling systems to prevent thermal inefficiencies. The lack of standardized renewable sourcing complicates sustainability efforts. Balancing growth with environmental and operational constraints remains a key challenge for long-term scalability.

Regulatory Complexity and Shortage of Skilled Technical Workforce

Navigating regulatory frameworks for data localization, cybersecurity, and environmental compliance is difficult. The Indonesia Edge Data Center Market faces multiple jurisdictional hurdles across provinces. Operators must meet diverse licensing, safety, and energy efficiency standards. The shortage of skilled professionals in data center engineering intensifies operational challenges. Training programs and certifications are still developing in the local market. It slows the adoption of advanced automation and AI management systems. Investors encounter delays in project approvals and infrastructure setup. Addressing these regulatory and human capital issues is vital for sustained market expansion.

Market Opportunities

Strategic Investments in Smart Cities and Digital Ecosystem Expansion

Government initiatives promoting smart city development present major opportunities. The Indonesia Edge Data Center Market supports localized computing for traffic, healthcare, and public services. It strengthens integration between IoT platforms and civic infrastructure. Investors are targeting mid-sized cities for early infrastructure deployment. Telecom and cloud providers are forming strategic partnerships to develop data corridors. These collaborations unlock new commercial opportunities across industries. Businesses benefit from improved digital accessibility and service reliability. The rising demand for smart urban networks ensures consistent market expansion.

Growth of Edge-to-Cloud Integration and AI-Driven Applications

Edge-to-cloud frameworks are gaining momentum across multiple industries. The Indonesia Edge Data Center Market provides localized platforms for AI, analytics, and automation. It enhances speed, reduces latency, and ensures compliance with local regulations. Enterprises are integrating AI at the edge to improve customer experience. Cloud providers see strong potential for hybrid architectures supporting real-time workloads. Investors are drawn to scalable platforms serving both enterprise and consumer applications. The trend reinforces Indonesia’s role in the regional digital transformation ecosystem.

Market Segmentation

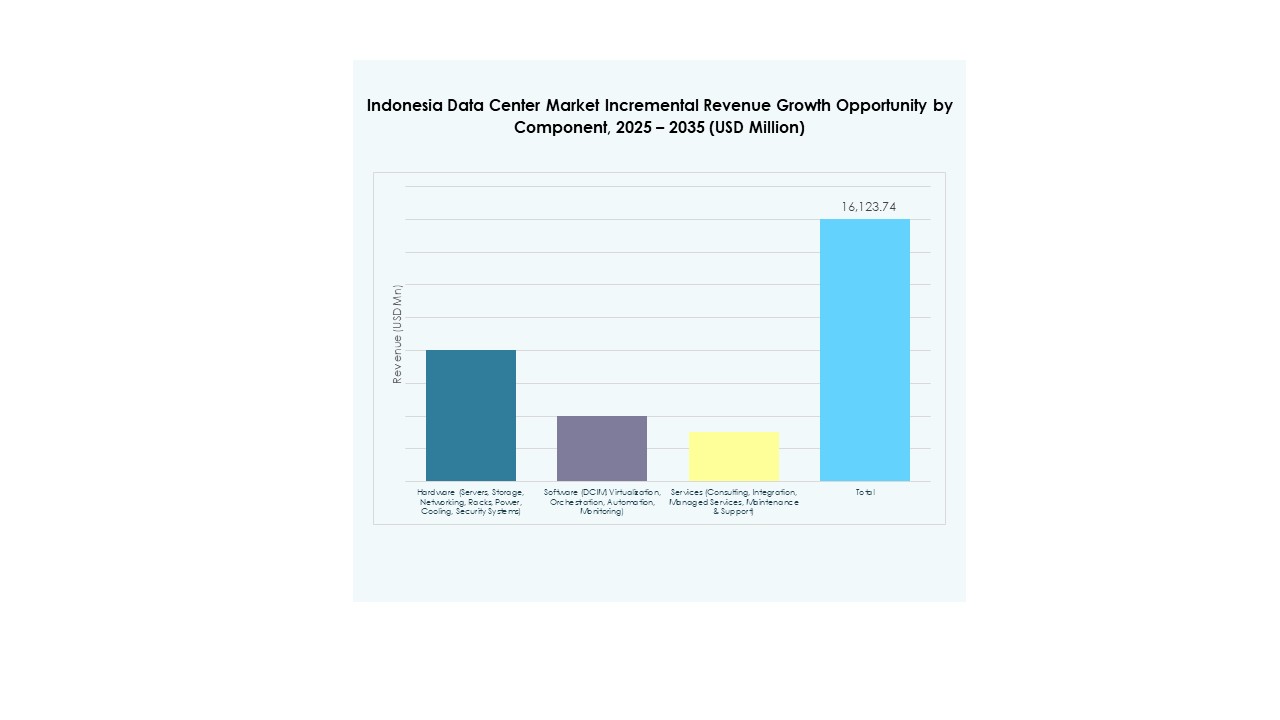

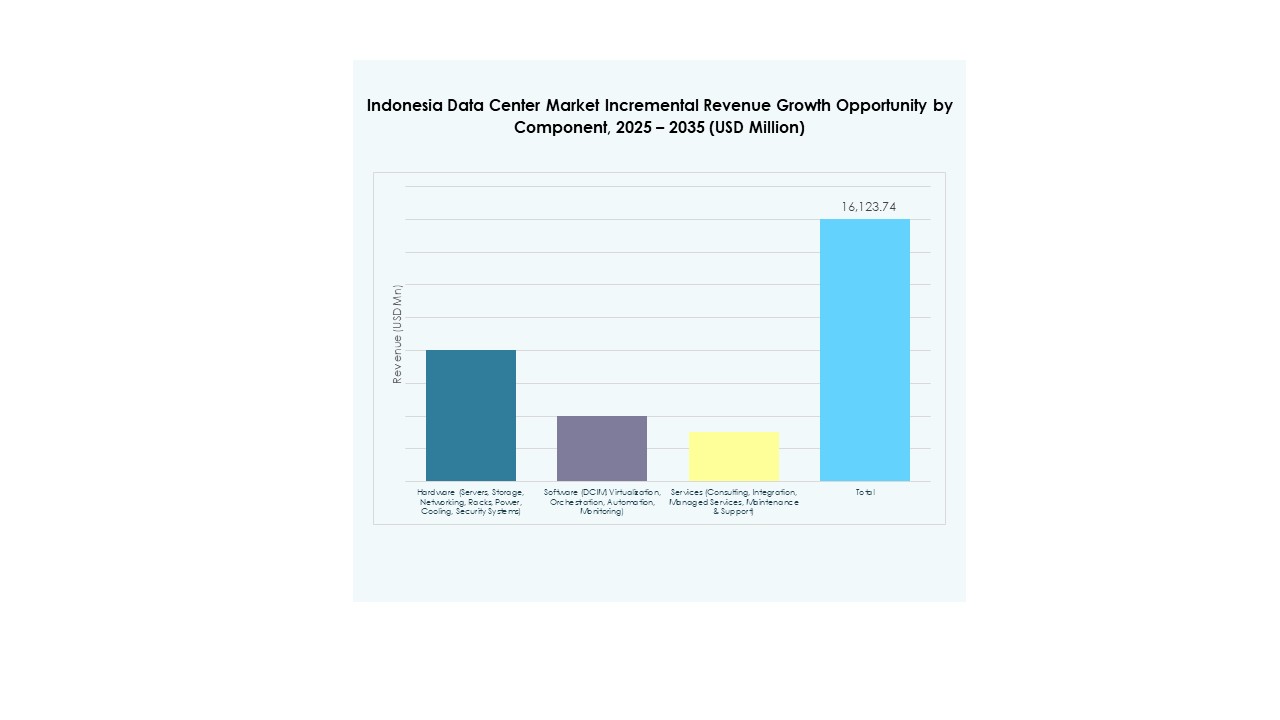

By Component

Solutions dominate the Indonesia Edge Data Center Market, accounting for the largest revenue share. Core components include cooling systems, networking, power management, and IT infrastructure. These elements ensure performance efficiency and uptime reliability. Service segments such as integration and consulting are growing as operators seek technical expertise. Increasing automation and modular design also fuel solution demand. Rising investments from telecom and cloud providers strengthen the market’s hardware foundation. Edge facilities rely heavily on advanced systems to handle dense workloads effectively.

By Data Center Type

Colocation edge data centers hold the largest market share due to flexibility and cost efficiency. They provide scalable resources to multiple clients, reducing capital burden. The Indonesia Edge Data Center Market benefits from this shared infrastructure model. Cloud and managed data centers are also expanding to meet enterprise storage needs. Demand for enterprise data centers remains steady for compliance and security reasons. Emerging operators invest in micro-edge sites for rural and industrial applications. These varied types ensure balanced market growth across user categories.

By Deployment Model

Cloud-based deployment dominates due to increasing enterprise cloud adoption. It offers scalability, lower costs, and seamless connectivity for hybrid infrastructures. The Indonesia Edge Data Center Market relies on cloud integration for application hosting and data analysis. On-premises deployment continues in sectors requiring strict control and compliance. Hybrid models are gaining traction for balancing flexibility and security. Businesses prefer multi-cloud connectivity to improve redundancy. Continuous innovation in cloud-native architecture strengthens the hybrid edge model’s role in enterprise transformation.

By Enterprise Size

Large enterprises lead the market with the highest adoption rate of edge solutions. They demand robust computing power for analytics, AI, and real-time operations. The Indonesia Edge Data Center Market supports large organizations with scalable infrastructure. SMEs are emerging users driven by digital transformation and e-commerce growth. Service providers are offering affordable, modular setups to attract these enterprises. The availability of managed services lowers entry barriers. Improved internet access across smaller cities accelerates SME participation in edge adoption.

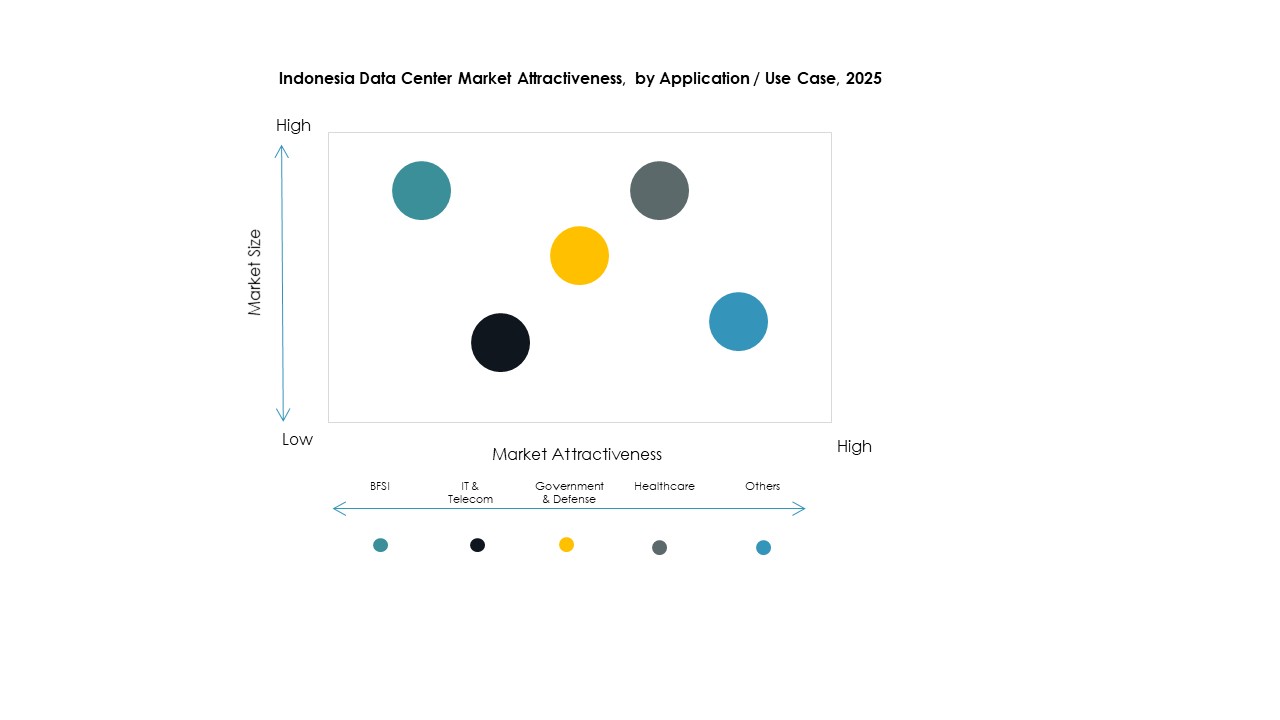

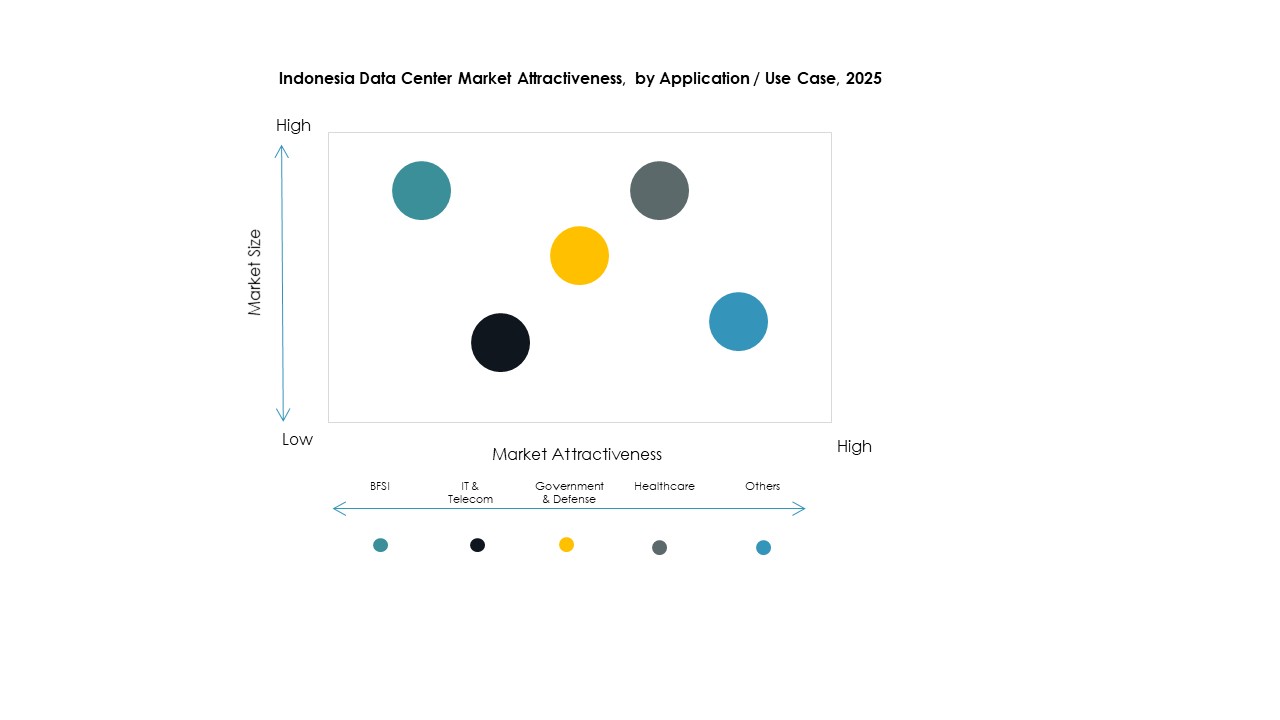

By Application / Use Case

Power monitoring dominates the market due to operational efficiency and cost-saving needs. It ensures continuous uptime and energy optimization in high-density setups. The Indonesia Edge Data Center Market gains traction from BI and analytics applications driving enterprise insights. Environmental monitoring is expanding to meet sustainability standards. Asset and capacity management tools help optimize resource allocation. These applications support performance visibility across distributed sites. Real-time analytics capabilities create stronger competitive advantages for enterprises using localized data systems.

By End User Industry

IT and telecommunications lead the market, holding the highest share. These sectors require low-latency networks and secure cloud access. The Indonesia Edge Data Center Market supports digital transformation across BFSI, healthcare, and retail sectors. E-commerce companies depend on edge centers for efficient content delivery. Energy and utilities leverage them for smart grid operations. Aerospace and defense use edge systems for secure communications. The diversity of applications ensures long-term stability and market maturity.

Regional Insights

Regional Insights

Jakarta and Java Region – Core Digital and Hyperscale Hub (Market Share: 45%)

Jakarta and Java dominate the Indonesia Edge Data Center Market, driven by strong infrastructure and enterprise concentration. The region hosts most hyperscale and telecom-led edge facilities. Its proximity to international fiber networks enhances connectivity and redundancy. Major operators select Jakarta for its regulatory support and dense enterprise ecosystem. It continues attracting foreign investments in green and modular centers. The region’s dominance reflects Indonesia’s centralized digital economy and advanced technology adoption rate.

- For example, PT DCI Indonesia expanded its capacity to surpass 100 MW IT load (with planned expansion to 300 MW), serving AWS, Google, and Alibaba Cloud, and remains the only Southeast Asia provider with Tier IV Design and Constructed Facility Certification from the Uptime Institute as of Q1 2025.

Sumatra and Batam Region – Cross-Border Connectivity and Industrial Growth (Market Share: 30%)

Sumatra and Batam serve as strategic cross-border hubs connecting Indonesia with Singapore and Malaysia. The Indonesia Edge Data Center Market benefits from the region’s growing industrial zones. Batam’s proximity to Singapore enables fast data transfer for hyperscale operators. Several new data corridors are being developed to enhance redundancy. The area supports industrial IoT, logistics, and e-commerce industries. Local governments promote renewable power integration to improve reliability. The region’s connectivity and cost advantages attract regional and international investors.

- For example, BDx Indonesia, a joint venture between Indosat Ooredoo Hutchison, Lintasarta, and BDx Data Centers, launched Indonesia’s first sovereign AI data center park (CGK4 campus) in December 2024, powered by renewable energy. This campus is equipped with NVIDIA AI and accelerated computing platforms and is linked to BDx Indonesia’s interconnected ecosystem for seamless core and edge deployments.

Sulawesi, Kalimantan, and Eastern Indonesia – Emerging Growth Frontiers (Market Share: 25%)

Eastern Indonesia is emerging as the next frontier for edge infrastructure development. The Indonesia Edge Data Center Market is expanding across cities such as Makassar and Balikpapan. These areas are central to new smart city and energy projects. Government investments in submarine cable systems improve inter-island data exchange. Edge facilities in these regions serve mining, energy, and logistics sectors. It enables balanced nationwide data distribution and business continuity. Emerging hubs in the east will enhance Indonesia’s overall digital inclusion and resilience.

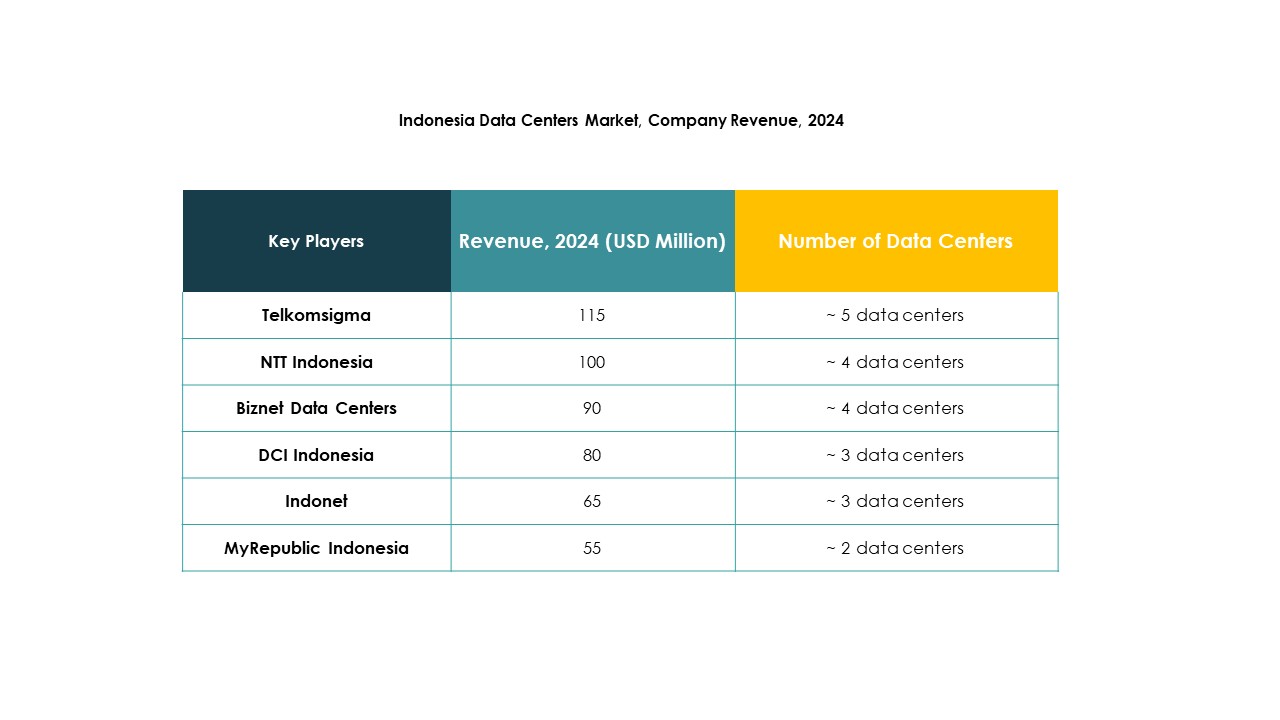

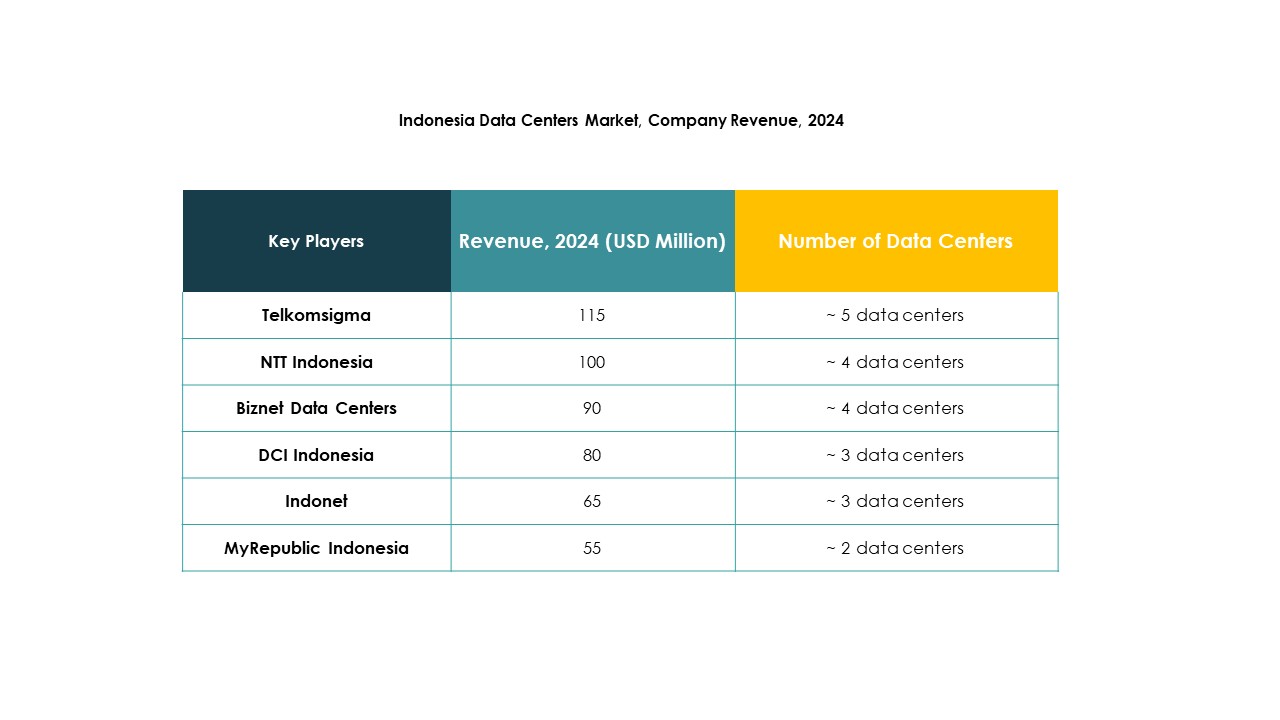

Competitive Insights:

Competitive Insights:

- Telkom Indonesia

- Indosat Ooredoo

- XL Axiata

- DCI Indonesia

- EdgeConneX

- Fujitsu

- Cisco

- Eaton Corporation

- Dell Technologies Inc.

- Microsoft

- VMware

- Schneider Electric SE

- Rittal GmbH & Co. KG

The Indonesia Edge Data Center Market features strong competition among telecom operators, global technology providers, and infrastructure specialists. Telkom Indonesia and DCI Indonesia lead through large-scale facility expansions and localized edge deployments. Global players such as Schneider Electric and Cisco strengthen competitiveness through advanced power, cooling, and network automation systems. It benefits from rapid digital transformation, 5G integration, and the growing need for AI-driven workloads. Strategic alliances between hyperscale providers and telecom firms are reshaping service offerings. Vendors emphasize modular, green, and hybrid solutions to align with sustainability goals. This competitive ecosystem drives continuous innovation and infrastructure modernization across the Indonesian data economy.

Recent Developments:

- In September 2025, Telin (a subsidiary of Telkom Indonesia) signed an MoU with Digital Realty Bersama during BATIC 2025, aiming to advance data center interconnection and boost the national digital ecosystem. The partnership is designed to enhance international connectivity and provide Indonesian businesses with superior digital infrastructure, accelerating growth at both regional and global levels.

- In August 2024, Telkom Indonesia took a significant step by appointing Goldman Sachs and Mandiri Sekuritas as advisors to help secure a strategic investor for its data center business, NeutraDC. This move is part of Telkom’s strategy to unlock greater value and accelerate its expansion within Indonesia’s digital economy, building on NeutraDC’s established network of hyperscale and edge data centers across the country.

- In August 2025, Indosat Ooredoo Hutchison also launched an AI-powered Security Operations Center in partnership with Cisco, targeting improved threat detection and security capabilities for Indonesian enterprises and the digital ecosystem at large.

- In June 2025, Edgnex Data Centers by Damac announced a landmark project to develop a next-generation AI-powered data center in Jakarta with a future projected capacity of 144MW and a total investment of $2.3 billion. Land acquisition was completed in March 2025, and the project entered its early construction phase, with the first section set to be operational by December 2026.

Market Challenges

Market Challenges Regional Insights

Regional Insights Competitive Insights:

Competitive Insights: