Executive summary:

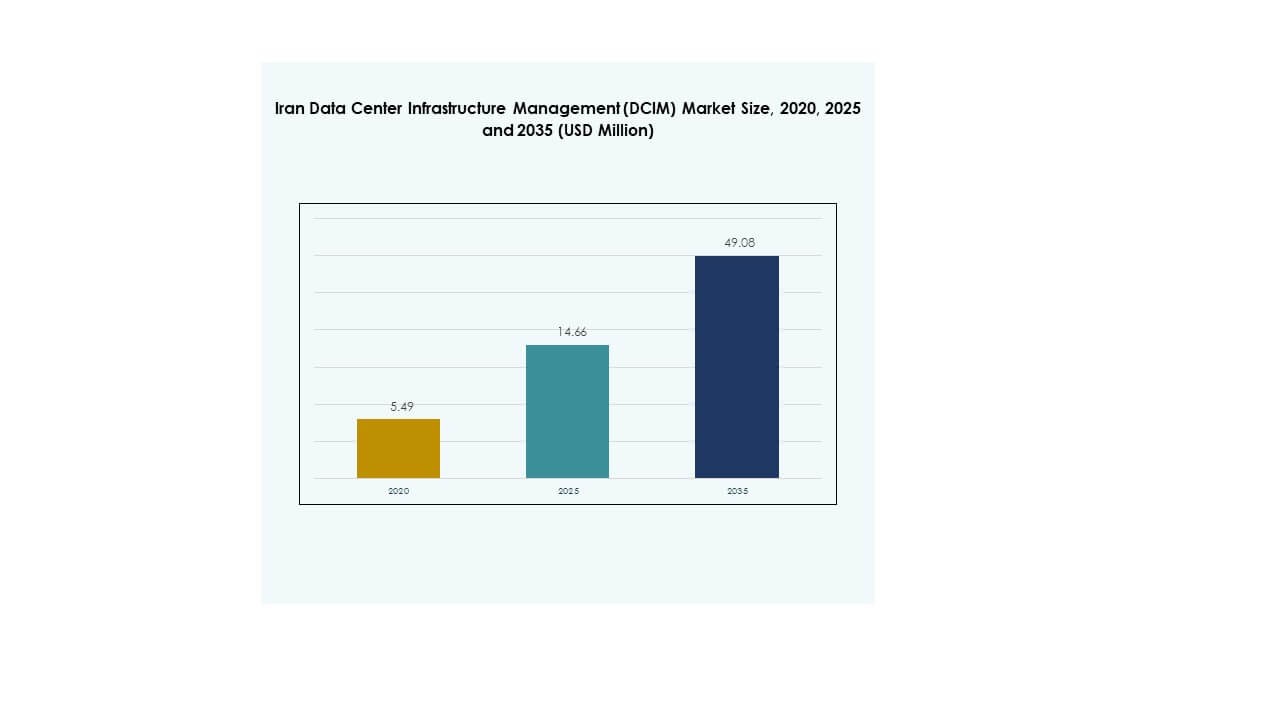

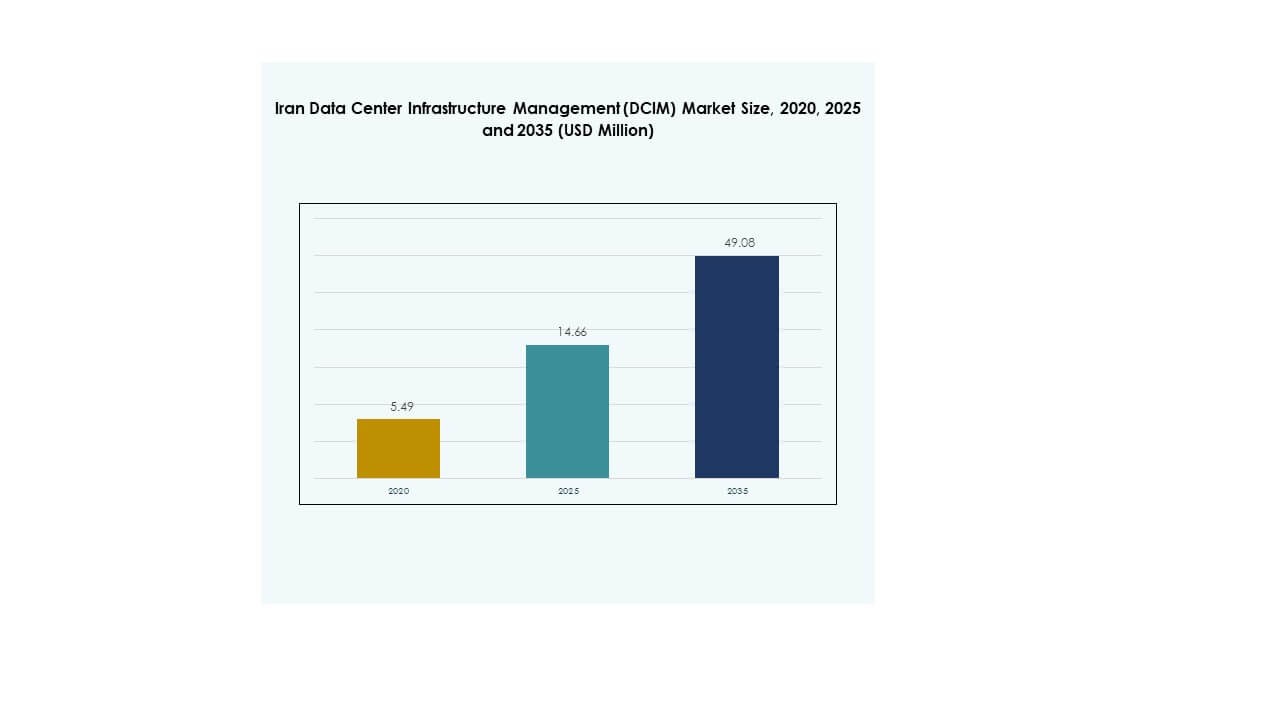

The Iran Data Center Infrastructure Management (DCIM) Market size was valued at USD 5.49 million in 2020, reaching USD 14.66 million in 2025, and is anticipated to achieve USD 49.08 million by 2035, growing at a CAGR of 14.61% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Iran Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 14.66 Million |

| Iran Data Center Infrastructure Management (DCIM) Market, CAGR |

14.61% |

| Iran Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 49.08 Million |

The market growth is driven by rapid digital transformation, the rise of cloud computing, and AI-integrated data management systems. Businesses are investing in DCIM solutions to enhance energy efficiency, predictive maintenance, and operational transparency. Integration of IoT and automation tools is reshaping data management, while government support for smart infrastructure accelerates modernization. The Iran Data Center Infrastructure Management (DCIM) Market plays a vital role in improving scalability, reliability, and sustainability for both enterprises and investors.

Tehran dominates the market due to concentrated enterprise operations and advanced connectivity infrastructure. Emerging regions such as Isfahan and Mashhad are witnessing growth driven by industrial development and smart city initiatives. The Iran Data Center Infrastructure Management (DCIM) Market benefits from regional collaboration, renewable energy integration, and increasing investment in digital transformation projects, strengthening Iran’s role as a key regional data management hub.

Market Drivers

Market Drivers

Rising Digital Transformation and Growing Data Volumes Driving Infrastructure Optimization

The Iran Data Center Infrastructure Management (DCIM) Market is expanding due to a nationwide shift toward digital transformation and cloud integration. Enterprises are increasing investment in automation tools that monitor, control, and optimize IT operations. Expanding data generation from e-commerce, telecommunications, and public sectors fuels demand for scalable DCIM systems. The focus on efficient energy management and uptime reliability also drives adoption. Government-led digitalization programs are strengthening data infrastructure, creating a favorable environment for DCIM deployment. Businesses are recognizing the strategic advantage of predictive analytics and IoT-based systems in reducing downtime. The integration of smart control platforms is reshaping data management standards.

Adoption of AI and IoT-Based Solutions Enhancing Predictive Maintenance Efficiency

AI and IoT integration are revolutionizing DCIM operations by enabling real-time asset tracking and predictive maintenance. Smart sensors and intelligent monitoring systems help operators detect equipment failures before disruptions occur. Enterprises are increasingly relying on automated analytics to improve performance and reduce operational risk. The Iran Data Center Infrastructure Management (DCIM) Market benefits from government initiatives supporting data modernization and energy efficiency. It is also driven by rising demand for secure, low-latency systems. Predictive insights improve asset utilization, while advanced control technologies optimize workloads. This innovation shift enhances overall network stability and lowers maintenance costs.

- For instance, in April 2024, Schneider Electric entered a global partnership with RF Code to integrate wire-free real-time environmental and asset monitoring technology into its EcoStruxure DCIM platform. The collaboration enhances data center efficiency by providing 99% accuracy in asset tracking and enabling improved automation and lifecycle management across global deployments.

Focus on Green Data Centers and Energy-Efficient Management Practices

Energy consumption is a key operational challenge, leading to investments in eco-efficient data center solutions. The Iranian government is encouraging sustainability and green technology adoption within IT infrastructure. Businesses are using renewable energy sources and efficient cooling technologies to lower carbon footprints. The Iran Data Center Infrastructure Management (DCIM) Market is witnessing strong momentum in implementing modular systems for energy optimization. It supports reduced total cost of ownership while improving power usage effectiveness. Enterprises deploying smart cooling and thermal management tools gain competitive advantages. This transition toward sustainability reflects a strategic move to meet environmental goals and regulatory standards.

Increasing Private and Public Sector Investments Strengthening Infrastructure Expansion

Continuous investments from telecom, finance, and government sectors are supporting infrastructure modernization. The need for secure and compliant data environments encourages widespread adoption of DCIM systems. The Iran Data Center Infrastructure Management (DCIM) Market benefits from both domestic and foreign funding in digital infrastructure projects. It is gaining momentum due to increasing partnerships among technology providers and enterprises. Hybrid and cloud deployments enhance flexibility and scalability for large organizations. This investment wave fuels innovation and strengthens Iran’s digital ecosystem. Businesses view DCIM as a strategic tool for operational transparency, risk control, and long-term profitability.

- For instance, in July 2025, Iran’s Information Technology Organization (ITOI) published a call for cloud computing service providers to support government agency digitization. The initiative prioritizes data centers offering public, private, hybrid, or community cloud solutions that meet ISO standards, marking a formal regulatory-driven expansion of compliant data environments across Iran’s public sector.

Market Trends

Integration of Hybrid DCIM Platforms Transforming Enterprise Data Operations

Organizations are adopting hybrid models combining cloud-based and on-premises DCIM platforms to enhance flexibility. These systems provide integrated visibility across distributed environments, improving scalability and performance. The Iran Data Center Infrastructure Management (DCIM) Market is aligning with global trends favoring hybrid infrastructure. It supports real-time control, asset tracking, and predictive analytics across multi-location facilities. Enterprises are deploying these solutions to balance regulatory compliance with operational autonomy. This hybrid approach enables seamless migration between platforms while ensuring cost efficiency. It promotes agility in handling dynamic workloads and aligns with long-term sustainability goals.

Rising Demand for Edge Data Centers Supporting Low-Latency Applications

The demand for edge computing is growing rapidly, driven by IoT, AI, and 5G adoption. Edge data centers offer localized data processing to minimize latency and improve speed. The Iran Data Center Infrastructure Management (DCIM) Market is witnessing increasing use of edge monitoring tools to ensure performance reliability. It enables real-time response for industries such as telecom and finance. Businesses rely on DCIM solutions to optimize network efficiency and maintain uptime at edge locations. The trend enhances end-user experience while supporting high-density workloads. This evolution creates opportunities for micro data center innovation and decentralized control systems.

Expansion of Cloud-Based DCIM Platforms Enabling Remote Management Capabilities

Cloud-based DCIM platforms are gaining traction for their scalability and remote accessibility features. They allow centralized monitoring across multiple sites and facilitate instant issue detection. The Iran Data Center Infrastructure Management (DCIM) Market is influenced by rising cloud adoption across enterprises. It enables remote collaboration, flexible integration, and rapid deployment. These platforms support AI-driven analytics to streamline energy and capacity management. The shift toward cloud operations reduces infrastructure costs and increases adaptability. Businesses adopting these platforms gain visibility into performance metrics, improving reliability and service delivery across data centers.

Growing Emphasis on Cybersecurity and Regulatory Compliance Integration

Cybersecurity integration within DCIM systems is becoming a critical market trend. Organizations are implementing end-to-end encrypted frameworks to protect data integrity. The Iran Data Center Infrastructure Management (DCIM) Market is responding to strict regulatory standards in data protection. It drives companies to adopt systems that combine security analytics with operational intelligence. Advanced authentication and access control are embedded within DCIM platforms. The trend enhances trust among users and investors by ensuring transparency. This movement aligns with global cybersecurity norms while strengthening Iran’s digital infrastructure resilience.

Market Challenges

Limited Infrastructure Modernization and High Implementation Costs Restricting Market Expansion

The Iran Data Center Infrastructure Management (DCIM) Market faces constraints due to outdated legacy systems and high capital requirements. Many enterprises struggle to replace traditional management frameworks with modern, integrated solutions. It limits scalability and delays automation adoption across small and medium enterprises. The absence of specialized technical expertise also hinders effective DCIM deployment. Energy infrastructure inefficiencies further increase operational costs, affecting competitiveness. Strict regulatory approvals add complexity to data center expansion. Investors often face prolonged timelines due to limited financial incentives and restricted technology imports. These barriers collectively slow down the market’s modernization rate.

Cybersecurity Risks and Inconsistent Regulatory Framework Affecting Industry Growth

Cyber threats remain a persistent concern within Iran’s growing data infrastructure landscape. The Iran Data Center Infrastructure Management (DCIM) Market must address increasing incidents of data breaches and system vulnerabilities. It is further challenged by varying data protection laws and inconsistent enforcement. This uncertainty affects investor confidence and international collaboration. Enterprises need stronger policy alignment to ensure operational reliability. Limited access to advanced global cybersecurity technologies also impacts risk management. Achieving regulatory harmony and standardized compliance remains critical for long-term sustainability and security.

Market Opportunities

Expansion of AI-Driven Automation and Smart Infrastructure Integration Creating Growth Scope

AI and automation technologies are unlocking new opportunities in operational optimization and energy management. The Iran Data Center Infrastructure Management (DCIM) Market benefits from the integration of predictive analytics that improve system performance. It allows organizations to manage distributed assets efficiently while minimizing human intervention. Growing investment in intelligent monitoring and modular systems supports scalability. Businesses are expected to adopt automation for faster service delivery and cost reduction. These innovations position Iran as a rising technology-driven market in the regional data ecosystem.

Rising Demand for Renewable Energy-Powered Data Centers Promoting Sustainable Growth

The growing emphasis on sustainability and reduced emissions supports the rise of green data centers. The Iran Data Center Infrastructure Management (DCIM) Market is aligning with national renewable energy initiatives. It supports facilities using solar, wind, and hybrid power systems to improve energy efficiency. Enterprises investing in eco-efficient DCIM systems enhance brand value and regulatory compliance. This green shift creates investment opportunities across technology suppliers and service providers focused on environmental optimization.

Market Segmentation

By Component

Solutions dominate the segment due to growing preference for integrated software tools providing asset, energy, and network control. The Iran Data Center Infrastructure Management (DCIM) Market benefits from real-time monitoring and automation features that drive efficiency. Services are expanding steadily through managed offerings, including maintenance and consulting support for complex deployments.

By Data Center Type

Enterprise data centers lead the market due to high internal control and security requirements. Managed and cloud-edge data centers are witnessing strong growth, supported by scalability and hybrid deployment flexibility. The Iran Data Center Infrastructure Management (DCIM) Market is shaped by businesses investing in localized colocation and edge capabilities to reduce latency.

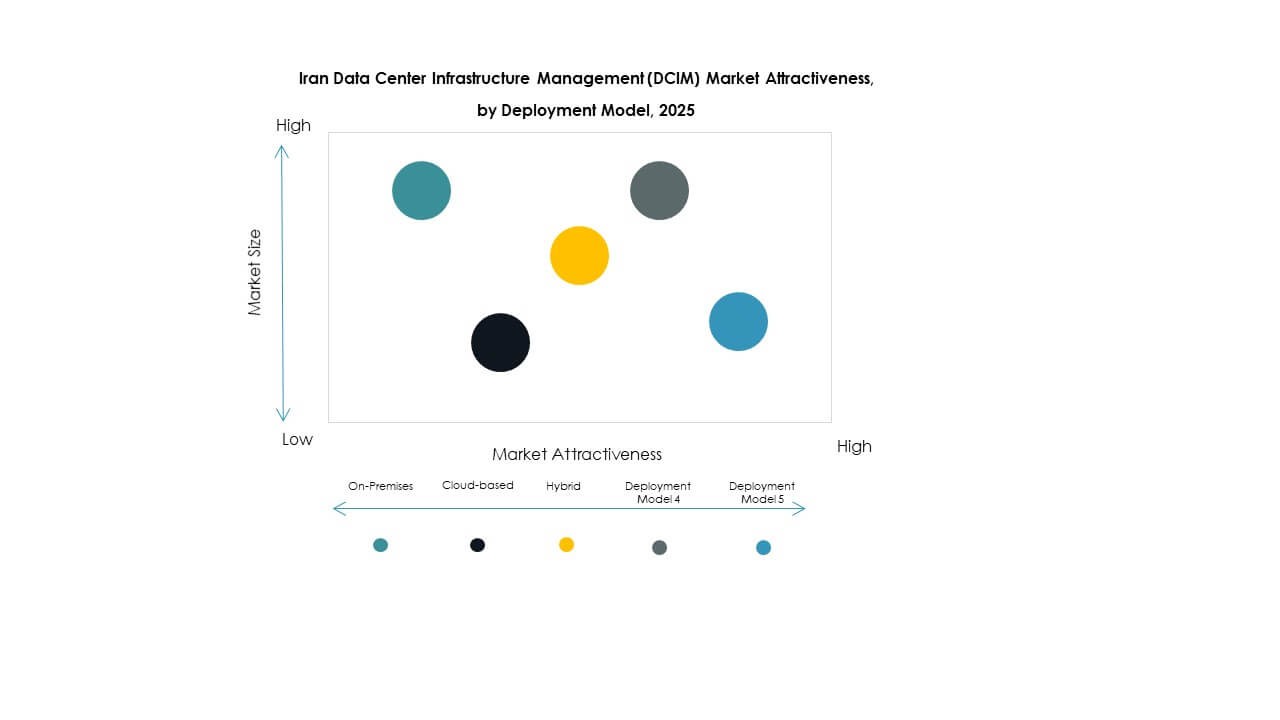

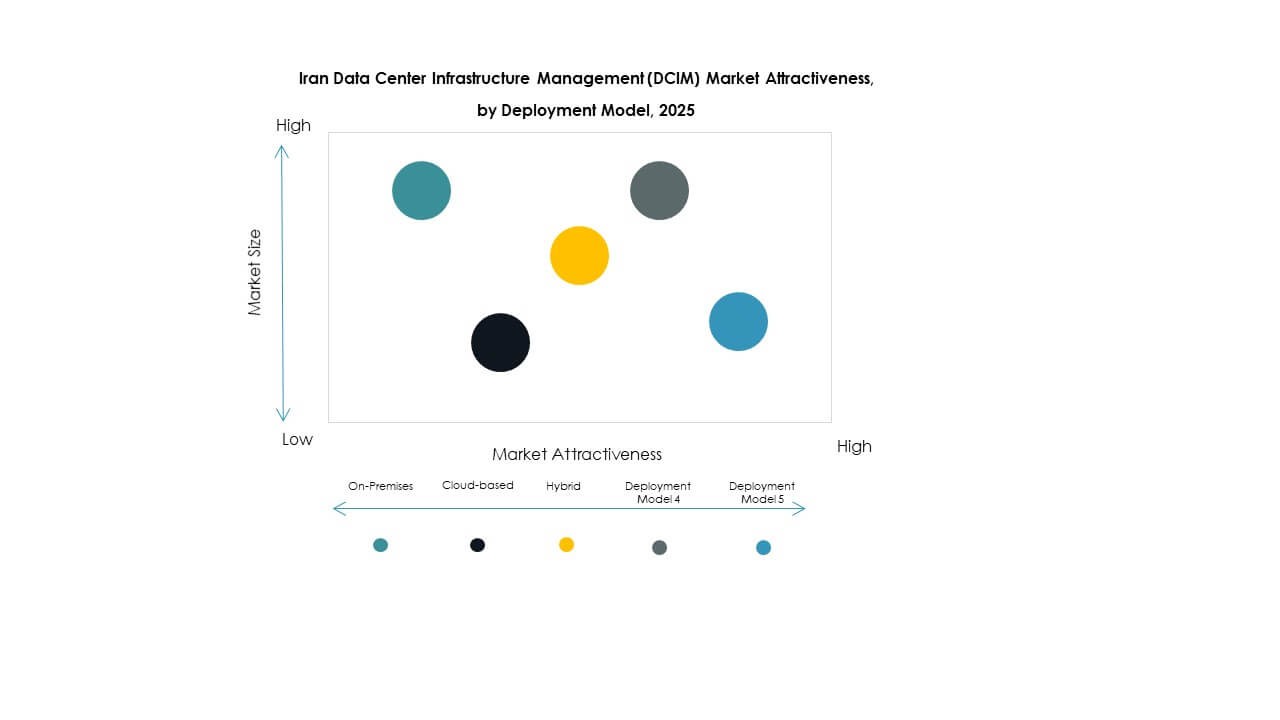

By Deployment Model

On-premises models dominate among government and financial institutions seeking data sovereignty. Cloud-based deployments are expanding for their cost efficiency and scalability benefits. The Iran Data Center Infrastructure Management (DCIM) Market is seeing hybrid setups gain traction, enabling seamless data migration and operational resilience across diverse workloads.

By Enterprise Size

Large enterprises hold a major share due to their advanced IT infrastructure and budget capacity. Small and medium enterprises are adopting flexible, cloud-based DCIM solutions for affordability and ease of integration. The Iran Data Center Infrastructure Management (DCIM) Market benefits from digital transformation policies encouraging SME modernization.

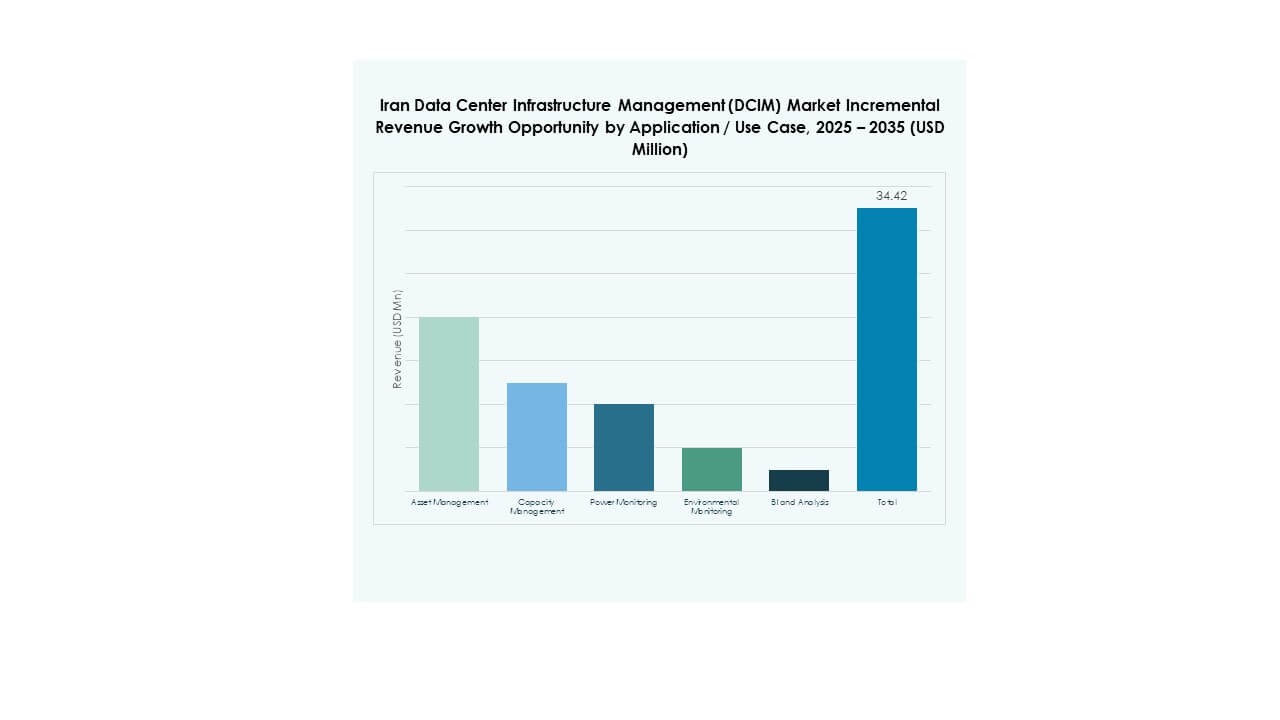

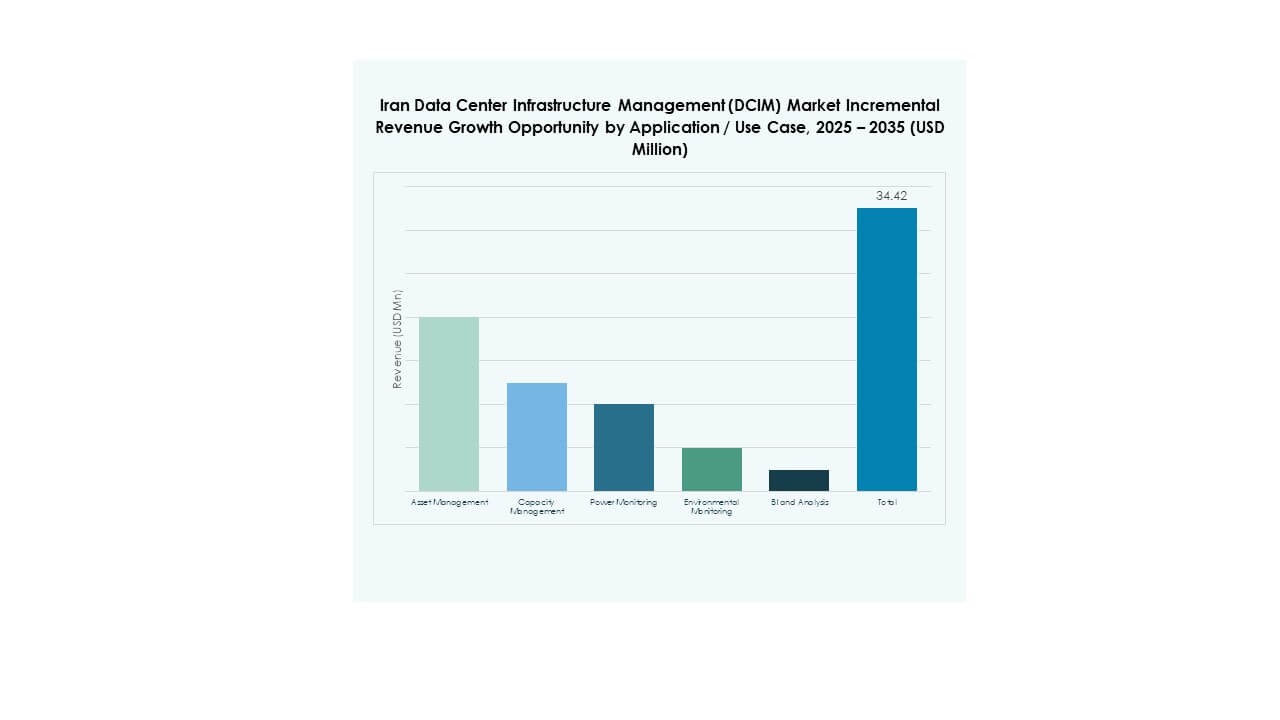

By Application / Use Case

Power and environmental monitoring applications dominate due to growing focus on energy efficiency and thermal control. Asset and capacity management are expanding with demand for predictive maintenance and analytics. The Iran Data Center Infrastructure Management (DCIM) Market gains from AI-based monitoring tools that enhance transparency and reliability.

By End User Industry

IT and telecommunications lead due to rising digital connectivity and data consumption. BFSI and healthcare sectors are adopting secure DCIM systems to manage sensitive data. The Iran Data Center Infrastructure Management (DCIM) Market benefits from adoption across retail, defense, and energy sectors focusing on performance and compliance.

Regional Insights

Northern and Central Iran Holding the Leading Market Share

Northern and Central Iran dominate with a 43% market share due to Tehran’s concentration of enterprise hubs and technology centers. The Iran Data Center Infrastructure Management (DCIM) Market benefits from high connectivity, strong telecommunications networks, and major infrastructure projects. It is supported by advanced power grids and government-backed industrial modernization programs.

- For instance, Asiatech operates the Milad Tower Data Center in Tehran, listed on DatacenterMap as comprising 16 slices and 2 zones. The facility supports high-security colocation and connectivity services, positioning it as a key site in Iran’s growing digital infrastructure network.

Western and Southern Iran Emerging as Strategic Development Zones

Western and Southern regions collectively account for 34% of the market, supported by expanding industrial bases and logistics corridors. The Iran Data Center Infrastructure Management (DCIM) Market gains from increasing data center investments in cities like Ahvaz and Shiraz. It supports manufacturing and oil-based industries through data optimization and energy control.

- For instance, Arya Hamrah System, an IT solutions provider, managed the design and implementation of managed service data centers for MTN Irancell in Western Iran, delivering scalable infrastructure used by major telecom operators and supporting industrial demands in the region since September 2006.

Eastern Iran Showing Gradual Growth Driven by Renewable Energy Adoption

Eastern Iran holds a 23% market share, driven by growing adoption of renewable energy-powered facilities and emerging industrial projects. The Iran Data Center Infrastructure Management (DCIM) Market benefits from rising investments in energy-efficient digital infrastructure. It supports long-term national goals for sustainable technology and data localization initiatives.

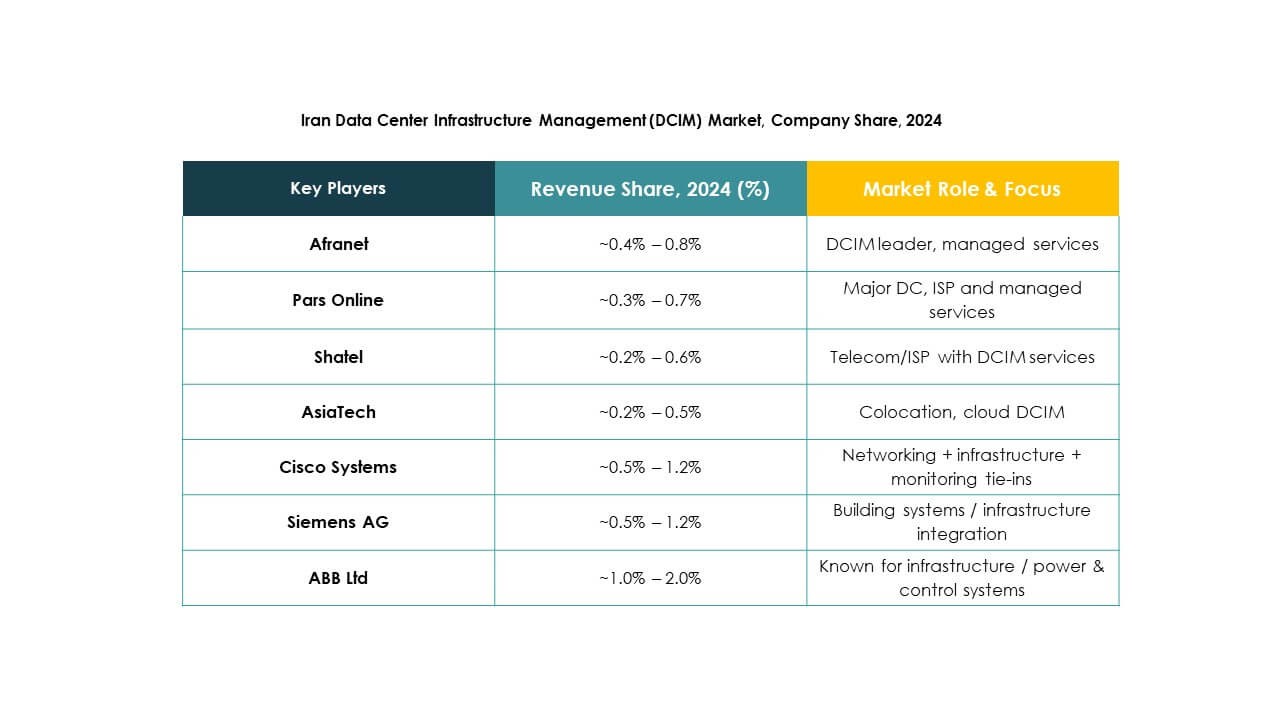

Competitive Insights:

- Afranet

- Pars Online

- Shatel

- AsiaTech

- HiWeb

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd.

- Schneider Electric SE

- Siemens AG

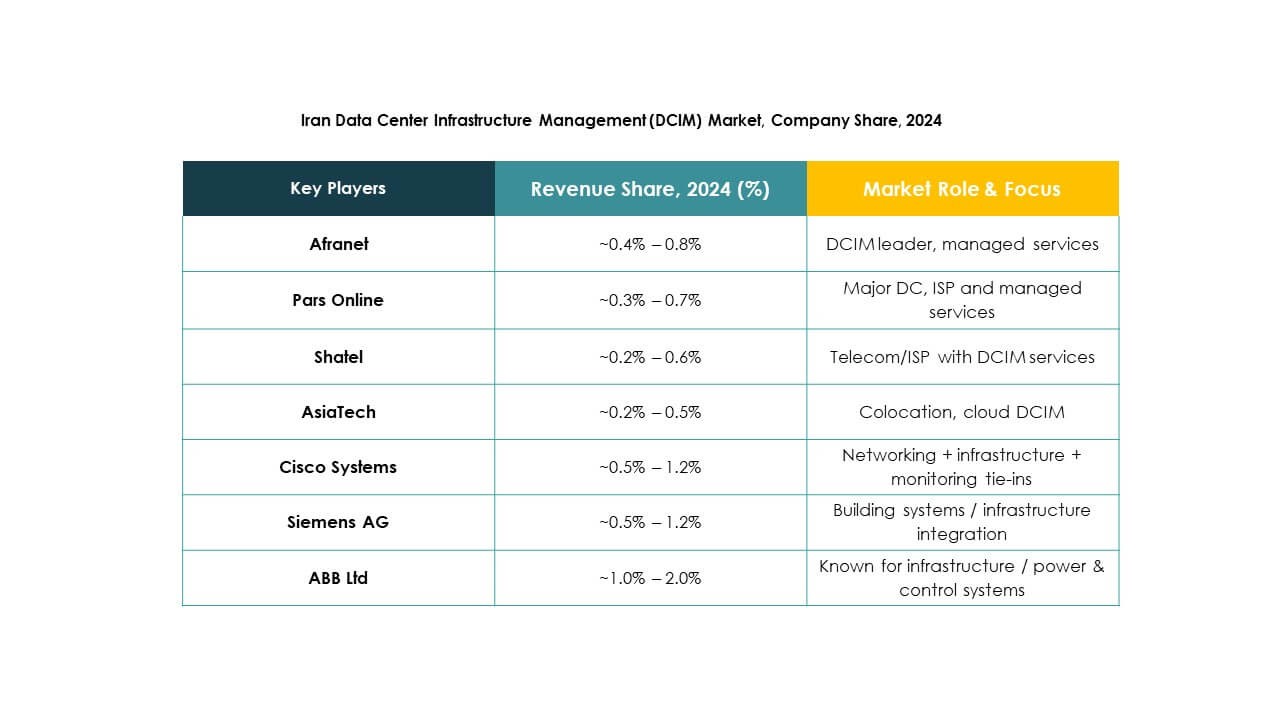

The Iran Data Center Infrastructure Management (DCIM) Market features a mix of domestic telecom operators and global technology providers competing across automation, energy efficiency, and scalability domains. Local firms such as Afranet, Pars Online, and Shatel strengthen their market position through managed hosting and cloud-based solutions. Global leaders like Schneider Electric, Huawei, and Cisco provide AI-driven DCIM platforms with advanced monitoring and energy optimization features. It benefits from the collaboration between international technology vendors and regional players, fostering innovation and infrastructure upgrades. The competition focuses on sustainability, automation, and cost-effective deployment models to enhance operational transparency and efficiency across enterprise and colocation environments.

Recent Developments:

- In August 2025, Daikin acquired DDC Solutions, a high-density cooling cabinet manufacturer, which will help Daikin integrate advanced cooling technologies with DCIM platforms for improved efficiency in data center operations—including those in Iran. The integration of these technologies is anticipated to drive further innovations in infrastructure management for Iranian data centers and support energy-efficient operations tailored to regional compliance requirements.

- In April 2025, Eaton Corporation completed the acquisition of Fibrebond, a company renowned for designing and building pre-integrated modular power enclosures that serve data center, fiber, industrial, and utility markets, thereby expanding Eaton’s capabilities in the data center infrastructure management market.

- In February 2025, Cisco Systems, Inc. announced a landmark partnership with Nvidia to develop unified architectures for AI-ready data center networks, focusing on integrating Cisco’s Silicon One chip into Nvidia’s Spectrum-X Ethernet platform and accelerating the adoption of AI-powered solutions by enterprise clients.

Market Drivers

Market Drivers