Executive summary:

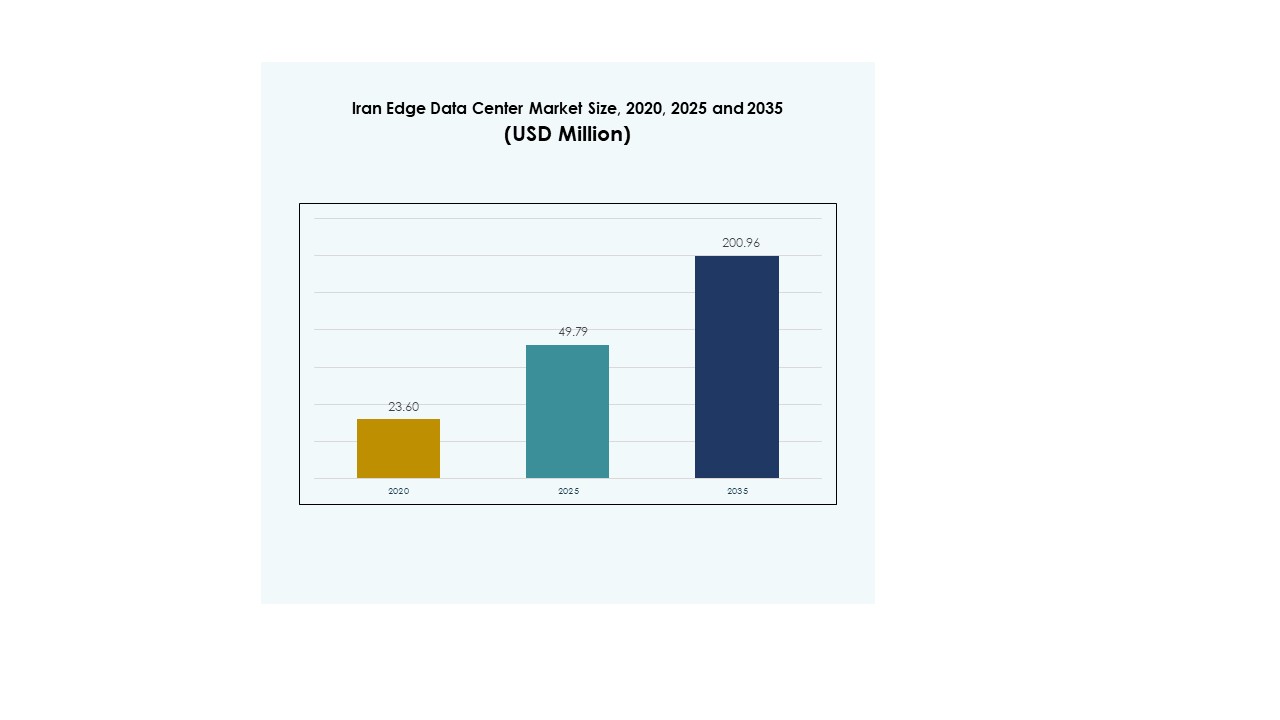

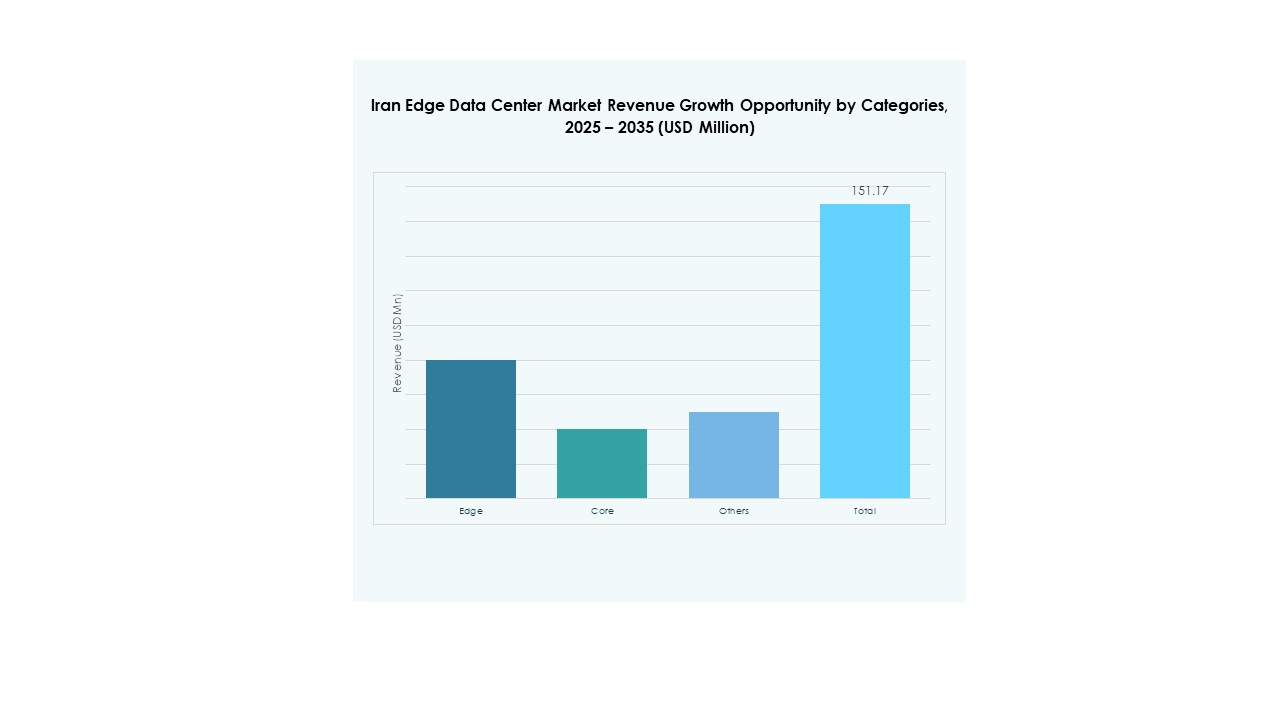

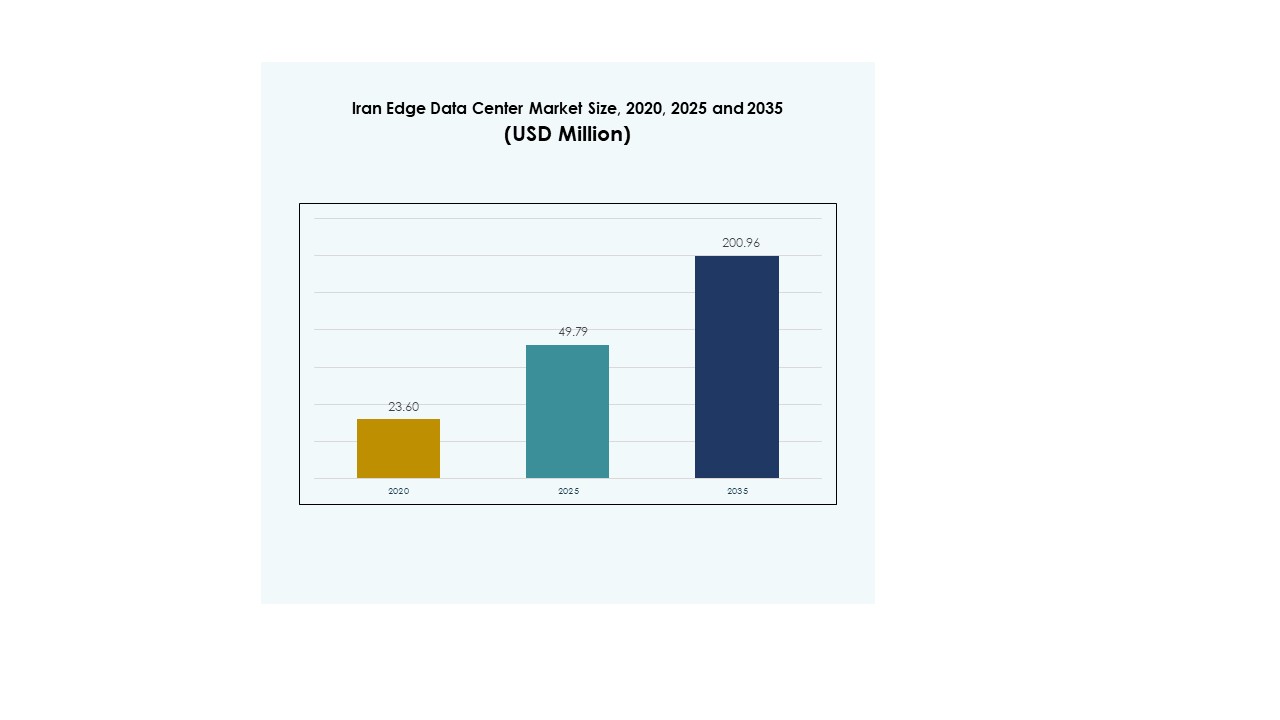

The Iran Edge Data Center Market size was valued at USD 23.60 million in 2020 to USD 49.79 million in 2025 and is anticipated to reach USD 200.96 million by 2035, at a CAGR of 14.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Iran Edge Data Center Market Size 2025 |

USD 49.79 Million |

| Iran Edge Data Center Market, CAGR |

14.84% |

| Iran Edge Data Center Market Size 2035 |

USD 200.96 Million |

Rising digital transformation and expanding enterprise IT infrastructure are driving significant demand for localized edge computing. Telecom operators and cloud providers are focusing on low-latency solutions to support real-time processing and critical applications. Strong investments in smart cities, automation, and hybrid computing models are reshaping infrastructure strategies. The Iran Edge Data Center Market holds strategic importance for businesses and investors seeking to capitalize on fast-evolving connectivity and technology ecosystems.

Northern and Central Iran lead the market due to robust connectivity, advanced infrastructure, and concentrated enterprise clusters. Southern Iran is rapidly emerging with strong industrial and energy sector expansion. Eastern and Western regions are developing as new edge hubs driven by rural connectivity programs and digital infrastructure investments. This balanced geographic spread enhances nationwide computing capacity and network resilience.

Market Drivers

Accelerating Digital Transformation and Rising Demand for Low-Latency Infrastructure

The Iran Edge Data Center Market is gaining momentum due to strong digital transformation initiatives across industries. Enterprises are shifting workloads to edge infrastructure to process data closer to users. This shift helps reduce latency, enhance application performance, and optimize real-time decision-making. Telecom operators are expanding 5G coverage to support data-intensive applications and services. Industrial automation, e-commerce, and streaming platforms are major contributors to this demand. Investments in smart city projects further boost the requirement for distributed computing infrastructure. It provides businesses with faster and more reliable network capabilities. Investors view this as a strategic entry point into a rapidly scaling market.

- For example, Iran’s deputy minister Hossein Afshin announced in December 2024 plans to launch the country’s first GPU-based data center by 2025 to support national AI systems. The project aims to enhance high-speed data processing and strengthen local compute infrastructure in Tehran.

Growing Adoption of IoT and AI Technologies Across Industrial Verticals

The adoption of IoT and AI is driving a structural shift in infrastructure planning. Manufacturing, logistics, and energy sectors are embracing intelligent systems that require ultra-low latency. Edge data centers help manage real-time analytics from connected devices. It supports industrial efficiency, predictive maintenance, and automated production cycles. AI-driven workloads also need distributed architecture to handle massive volumes of data. These deployments increase computing reliability and reduce dependence on distant hyperscale facilities. This shift builds a strong foundation for advanced operational intelligence. It strengthens industry competitiveness while improving scalability and service uptime.

Increased Strategic Investments by Telecom and Cloud Service Providers

Telecom and cloud operators are leading investments in decentralized data center infrastructure. Their focus is on achieving high network resiliency and efficient traffic routing. Partnerships with technology vendors accelerate edge integration into existing networks. It allows operators to deliver new services such as AR/VR, video analytics, and secure edge computing. Localized infrastructure helps reduce bandwidth costs and improve data sovereignty. Enterprises gain faster service delivery and better performance for critical applications. This approach improves digital resilience and strengthens the market’s long-term investment potential. Stakeholders benefit from scalable and high-performance infrastructure.

- For example, Huawei unveiled its Atlas 950 SuperPoD and SuperCluster solutions at HUAWEI CONNECT 2025, featuring 8,192 Ascend NPUs designed for high-performance distributed AI workloads. The company also introduced super nodes to strengthen AI infrastructure and support advanced computing applications.

Strong Government Support for Digital Infrastructure Development

Government-led infrastructure programs are encouraging edge computing investments across the country. National strategies aim to strengthen data processing capabilities and support local cloud ecosystems. Public and private sector collaborations enable the creation of advanced digital backbones. It boosts the growth of local hosting providers and technology startups. Supportive regulations improve data security frameworks and compliance structures. Infrastructure upgrades enhance energy efficiency and power availability. Strategic investments in connectivity help bridge regional gaps and improve accessibility. This policy environment gives investors confidence in sustainable market expansion.

Market Trends

Market Trends

Emergence of Hybrid and Distributed Computing Models in Edge Deployments

Hybrid computing architectures are becoming a preferred choice for enterprises. Many businesses integrate edge capabilities with on-premise and cloud resources. This setup provides flexibility, resilience, and optimized data flow across critical operations. It also supports industries requiring strict compliance and security measures. The Iran Edge Data Center Market is seeing rising demand for solutions that balance performance and control. Enterprises rely on hybrid networks to scale operations and manage costs effectively. It creates new opportunities for service providers offering integrated edge-cloud frameworks. This trend enhances the overall digital infrastructure maturity.

Increased Focus on Energy-Efficient and Sustainable Edge Infrastructure

Sustainability is a growing priority for operators building modern data centers. New deployments emphasize energy-efficient cooling, renewable integration, and modular construction. It supports operational cost reduction and aligns with global green standards. Enterprises are adopting advanced power management and thermal optimization systems. This shift enhances infrastructure resilience and lowers environmental impact. The Iran Edge Data Center Market reflects this global transition through sustainable investment strategies. Operators are reconfiguring legacy systems to meet new efficiency benchmarks. Green solutions are becoming key to securing long-term infrastructure competitiveness.

Adoption of Edge AI and Automation for Operational Optimization

Edge AI is transforming how data centers manage operations and service delivery. Automation tools support predictive maintenance, resource allocation, and energy optimization. It enables facilities to operate with higher efficiency and reduced human intervention. Real-time AI insights improve application uptime and infrastructure utilization. Advanced monitoring tools enhance visibility across distributed networks. The Iran Edge Data Center Market benefits from this shift toward intelligent infrastructure. Companies are integrating AI at the edge to gain competitive advantages. This evolution accelerates digital maturity and operational agility across industries.

Rising Deployment of Industry-Specific Edge Use Cases

Industry-tailored edge solutions are gaining momentum in healthcare, retail, manufacturing, and energy. Businesses demand application-optimized infrastructure for fast processing and secure data handling. It strengthens operational reliability for critical workflows such as telemedicine, factory automation, and retail analytics. Flexible infrastructure helps enterprises adapt to sector-specific compliance and performance needs. The Iran Edge Data Center Market is witnessing rapid diversification of industry applications. This trend encourages partnerships between operators, software providers, and enterprises. It drives more targeted investment in sectoral edge deployments.

Market Challenges

High Capital Investment and Complex Infrastructure Modernization Requirements

The Iran Edge Data Center Market faces significant barriers due to heavy capital requirements. Edge deployments demand investment in advanced hardware, cooling systems, and network backbone. Many enterprises hesitate to commit large budgets to new distributed infrastructure. It also requires modernization of legacy networks, which increases operational complexity. Power and connectivity availability remain inconsistent in some areas, slowing rollouts. Interoperability between different edge platforms adds integration challenges for operators. Skill shortages in infrastructure engineering make scaling projects more difficult. These factors delay project timelines and impact return on investment for stakeholders.

Regulatory Constraints and Limited Data Security Frameworks

Regulatory complexity creates additional hurdles for infrastructure development. The legal framework for data protection and sovereignty remains under development. It affects investor confidence and slows international partnerships. Operators must address compliance gaps while maintaining operational flexibility. The Iran Edge Data Center Market requires clear and harmonized regulations to support growth. Lack of standardization in security protocols increases operational risks. Data privacy concerns influence enterprise adoption strategies and vendor selection. These gaps make infrastructure planning more challenging for both local and foreign stakeholders.

Market Opportunities

Rising Digital Adoption and Strategic Expansion of Local Infrastructure

The Iran Edge Data Center Market presents strong opportunities through rapid digital transformation. Expanding connectivity and growing enterprise demand create ideal conditions for new deployments. Local players can build capacity in regional hubs to strengthen distributed networks. It encourages collaboration between telecoms, cloud operators, and software providers. Strategic investments in infrastructure modernization can deliver competitive advantages.

Strong Potential for Sector-Specific Edge Solutions and Emerging Use Cases

Industries such as retail, manufacturing, energy, and healthcare need tailored edge solutions. These verticals require secure and low-latency processing to support real-time applications. It opens growth avenues for specialized service providers and integrators. AI-enabled use cases, smart city deployments, and IoT adoption enhance market expansion potential. Investors can tap into evolving demand patterns for long-term growth.

Market Segmentation

By Component

Solution dominates this segment with a significant share due to increasing demand for advanced edge platforms and scalable IT infrastructure. Enterprises prefer pre-integrated modular systems for faster deployment and improved interoperability. Service offerings support lifecycle management, but hardware and software solutions drive most investments. The Iran Edge Data Center Market benefits from operators adopting high-performance servers, storage systems, and network solutions to handle real-time data processing efficiently.

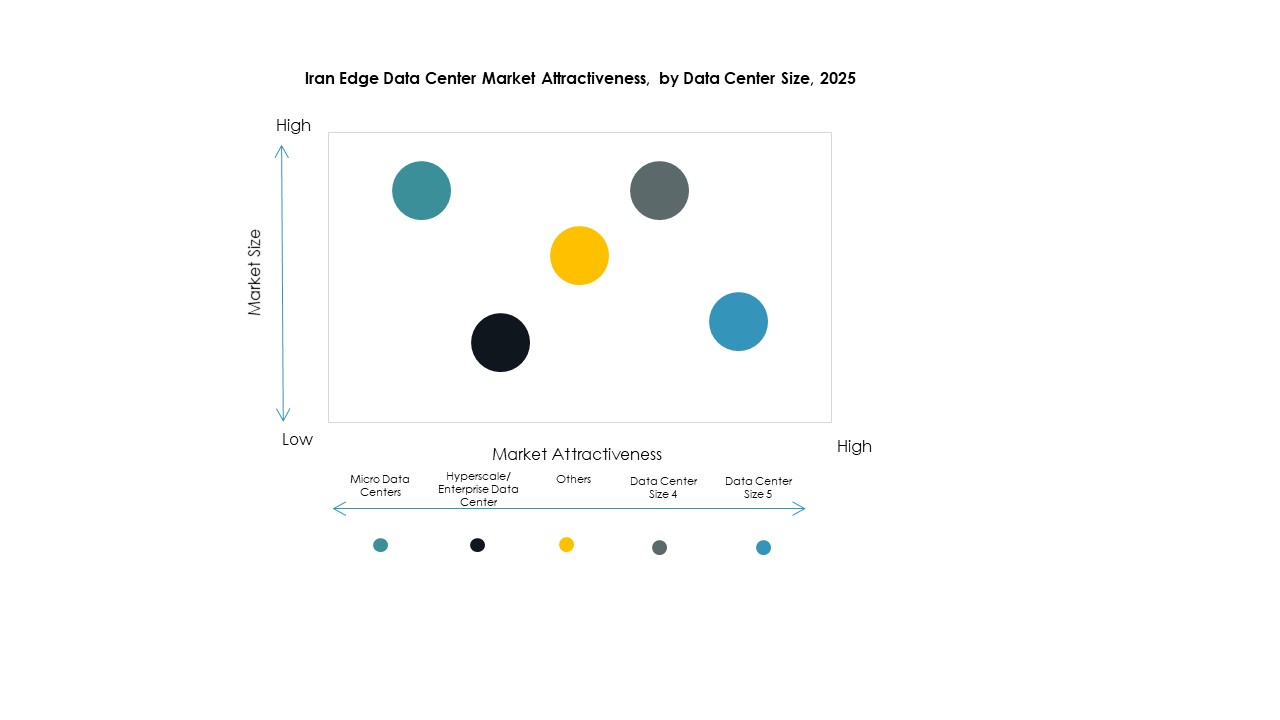

By Data Center Type

Cloud and edge data centers hold the largest share in this segment, driven by rapid cloud integration and hybrid infrastructure adoption. Enterprises seek flexibility, scalability, and low-latency computing, making these facilities critical for digital operations. Managed and colocation data centers also attract investments for their operational efficiency. The Iran Edge Data Center Market reflects this trend through strong ecosystem collaborations among operators, cloud vendors, and enterprises.

By Deployment Model

Cloud-based deployment leads this segment as enterprises move workloads closer to users through scalable infrastructure. It supports agility, cost efficiency, and high-performance computing needs across industries. Hybrid models are gaining traction for workloads needing greater security and control. The Iran Edge Data Center Market sees strong enterprise adoption of cloud-first strategies to optimize service delivery and accelerate modernization.

By Enterprise Size

Large enterprises dominate this segment due to their capacity to invest in distributed computing architecture. They rely on edge infrastructure to ensure business continuity, fast response times, and security compliance. SMEs are adopting cost-effective managed solutions to strengthen operational capabilities. The Iran Edge Data Center Market reflects a clear shift toward enterprise-led infrastructure growth supported by digital transformation programs.

By Application / Use Case

Power monitoring holds a major share in this segment because of its critical role in ensuring uninterrupted operations and energy efficiency. Capacity management and environmental monitoring also record strong demand across industrial and commercial sectors. The Iran Edge Data Center Market emphasizes infrastructure resilience, making these applications essential for maintaining performance reliability and reducing operational risks.

By End User Industry

IT and telecommunications lead this segment with a dominant share driven by large-scale network expansion and data traffic growth. BFSI and retail sectors are also adopting edge solutions for secure, real-time transactions. Healthcare is emerging as a strong adopter with telemedicine and AI diagnostics. The Iran Edge Data Center Market benefits from multi-sector participation, supporting widespread infrastructure growth.

Regional Insights

Northern and Central Iran: Strong Infrastructure Backbone and Major Investment Hub

Northern and Central Iran account for 41% of the Iran Edge Data Center Market, supported by strong connectivity and industrial presence. These regions host major data hubs and enterprise clusters. High demand for latency-sensitive applications drives large-scale deployments. Telecom and cloud operators focus on expanding regional capacity through modular edge facilities. It benefits from better power availability and network backbone, making it a priority investment zone. Strategic projects are enhancing digital service accessibility and network coverage.

- For instance, Asiatech operates the Milad Tower Data Center in Tehran, officially recognized as a top colocation and cloud facility, with 700 square meters of floor space supporting thousands of customers and enterprises, advanced security, and robust IT infrastructure.

Southern Iran: Rapid Growth Driven by Industrial and Energy Sector Expansion

Southern Iran holds 33% of the market share, supported by expanding energy, logistics, and manufacturing sectors. Port cities and industrial clusters are adopting edge infrastructure to support real-time operations. Rising investments in power infrastructure and fiber connectivity strengthen this region’s capabilities. It benefits from proximity to key industrial corridors, enabling faster edge deployment. Demand from energy and maritime industries creates stable growth opportunities. Government support for infrastructure modernization further accelerates adoption in this zone.

- For instance, Mobin Net Communication Company (Mobinnet) provides nationwide connectivity as Iran’s largest WiMAX operator, integrating high-capacity fiber and wireless services for logistics, industrial, and energy clients throughout southern corridors such as Bandar Abbas; this deployment is verified through RIPE NCC’s public ASN records (AS47330) and Mobinnet’s official service documentation.

Eastern and Western Iran: Emerging Edge Hubs with Expanding Connectivity

Eastern and Western Iran collectively represent 26% of the market share. These regions are witnessing increased edge investments driven by rural connectivity programs and enterprise digitization efforts. Operators are building distributed infrastructure to reduce network latency in underserved areas. It is becoming a strategic location for secondary data center clusters and localized service delivery. Industrial diversification and infrastructure expansion create new commercial opportunities. The rising digital adoption across these regions supports sustainable long-term growth.

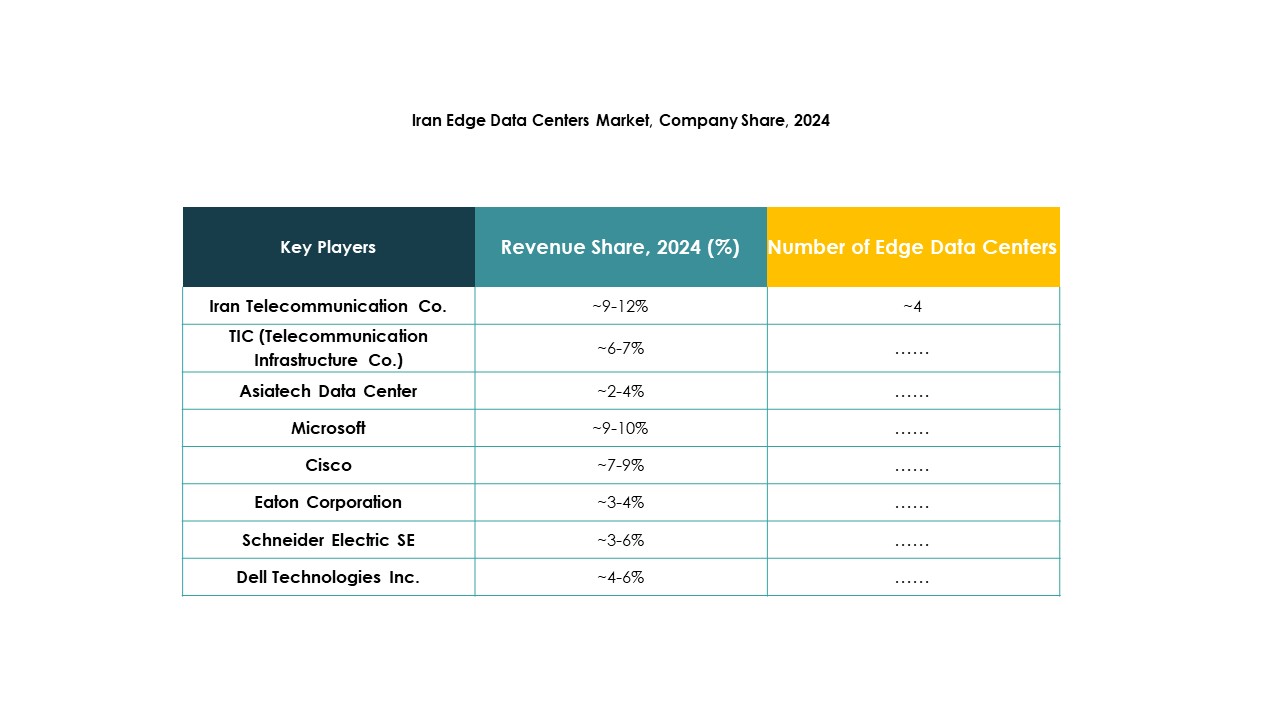

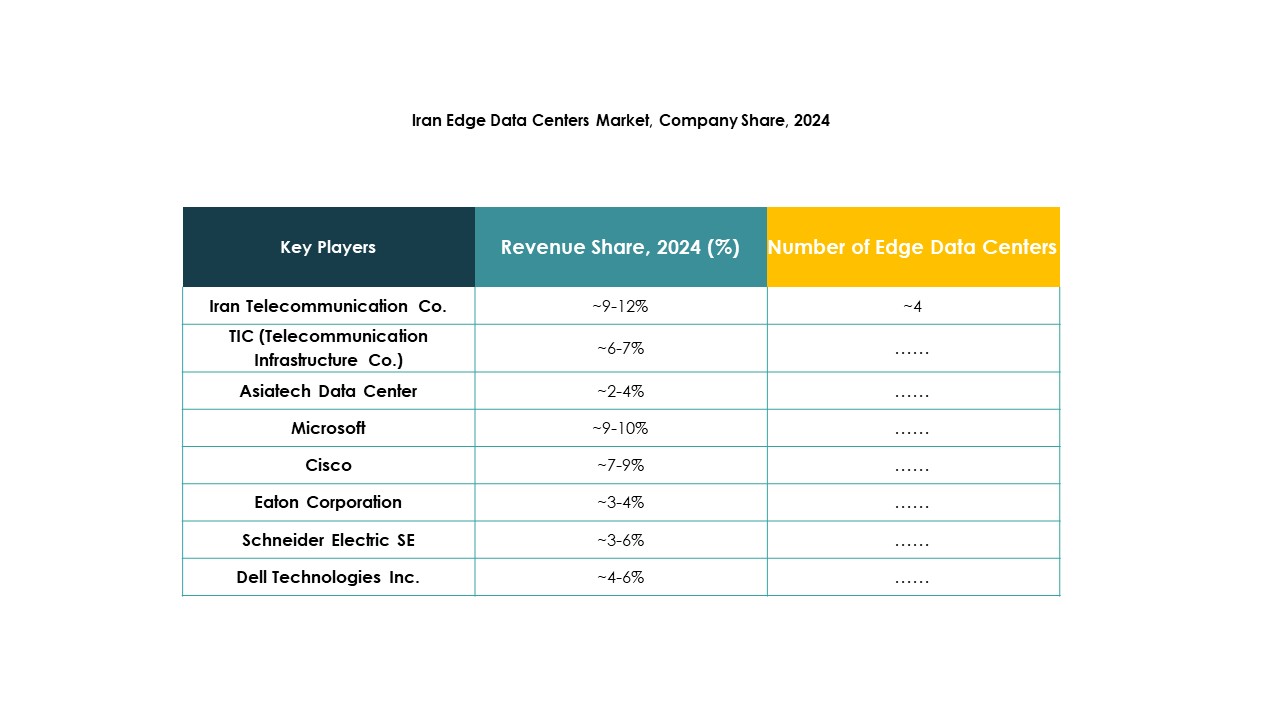

Competitive Insights:

- Iran Telecommunication Co.

- TIC (Telecommunication Infrastructure Co.)

- Asiatech Data Center

- Afranet

- EdgeConneX

- Eaton Corporation

- Dell Technologies Inc.

- Fujitsu

- Cisco

- SixSq

The competitive landscape of the Iran Edge Data Center Market reflects a mix of domestic telecom operators and global technology providers. Local companies focus on expanding infrastructure, improving network performance, and offering secure hosting services to meet rising demand. Global firms lead in advanced hardware, automation, and energy-efficient solutions that enhance operational efficiency. It is defined by strategic partnerships, capacity expansion, and innovation-led differentiation. Market leaders emphasize modular and scalable systems to support diverse workloads and edge computing applications. Strong competition encourages faster deployment of hybrid solutions and optimized service delivery. Players leverage technological strengths and strategic alliances to strengthen their positions in key urban and industrial zones. This environment creates a balanced mix of local presence and global expertise.

Recent Developments:

- In September 2025, EdgeConneX announced a global partnership initiative, including a new collaboration with industry organizations like iMasons and Hello World CS to support digital infrastructure development and training of future digital leaders.

Market Trends

Market Trends