Executive summary:

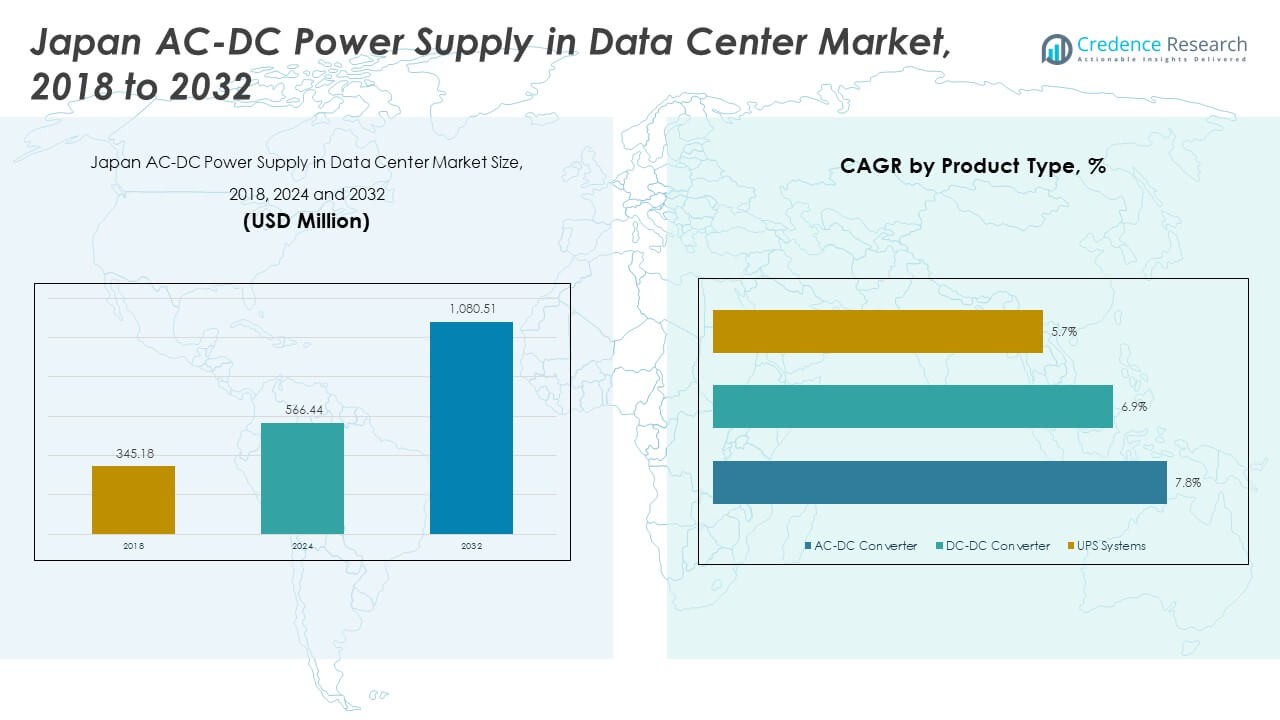

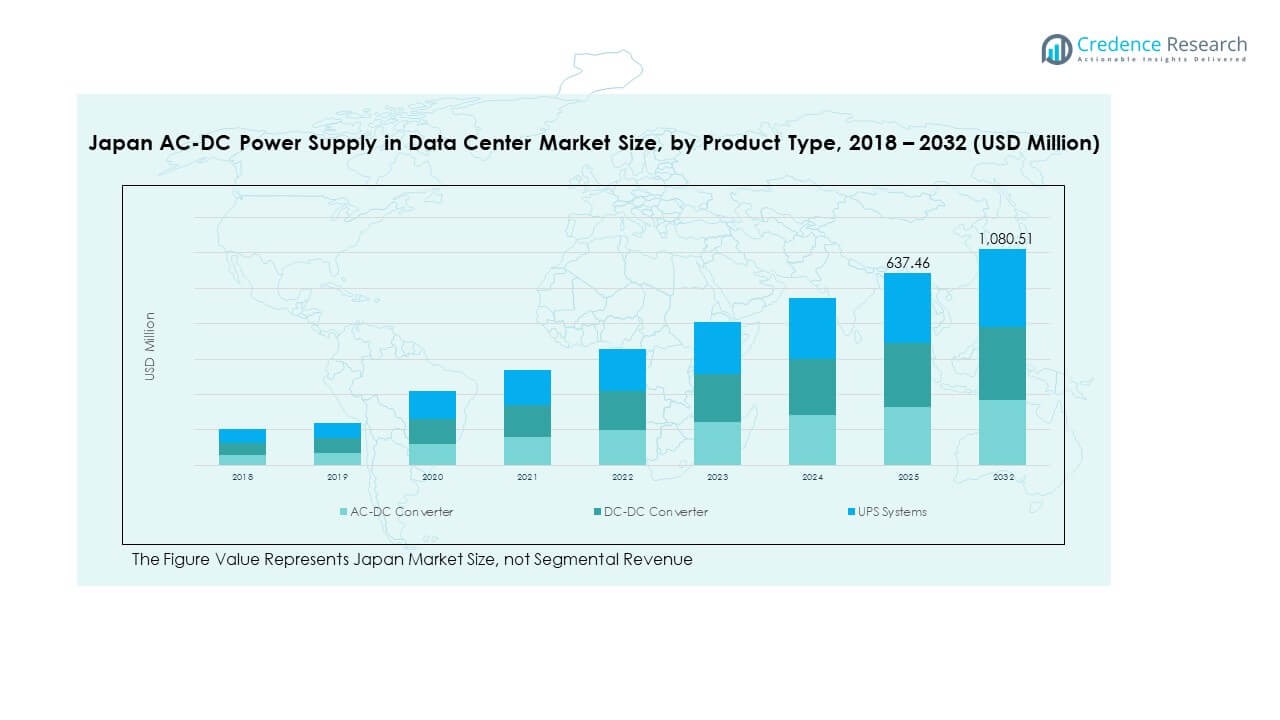

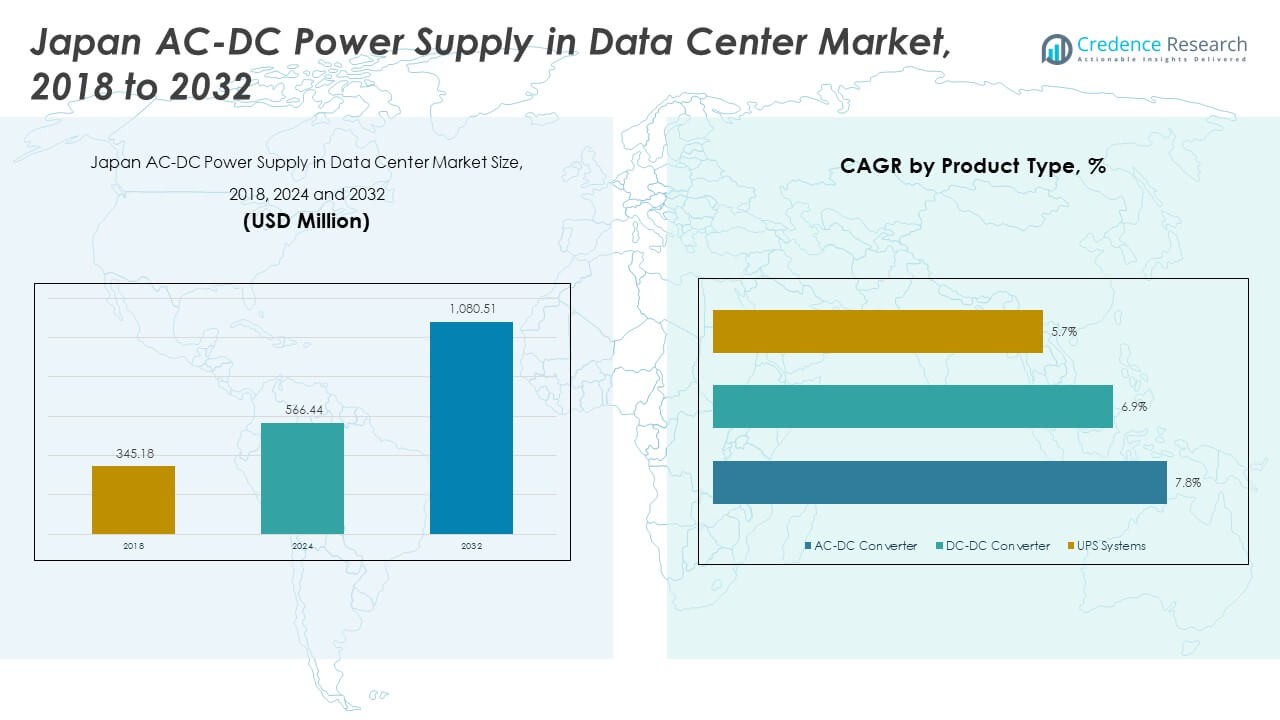

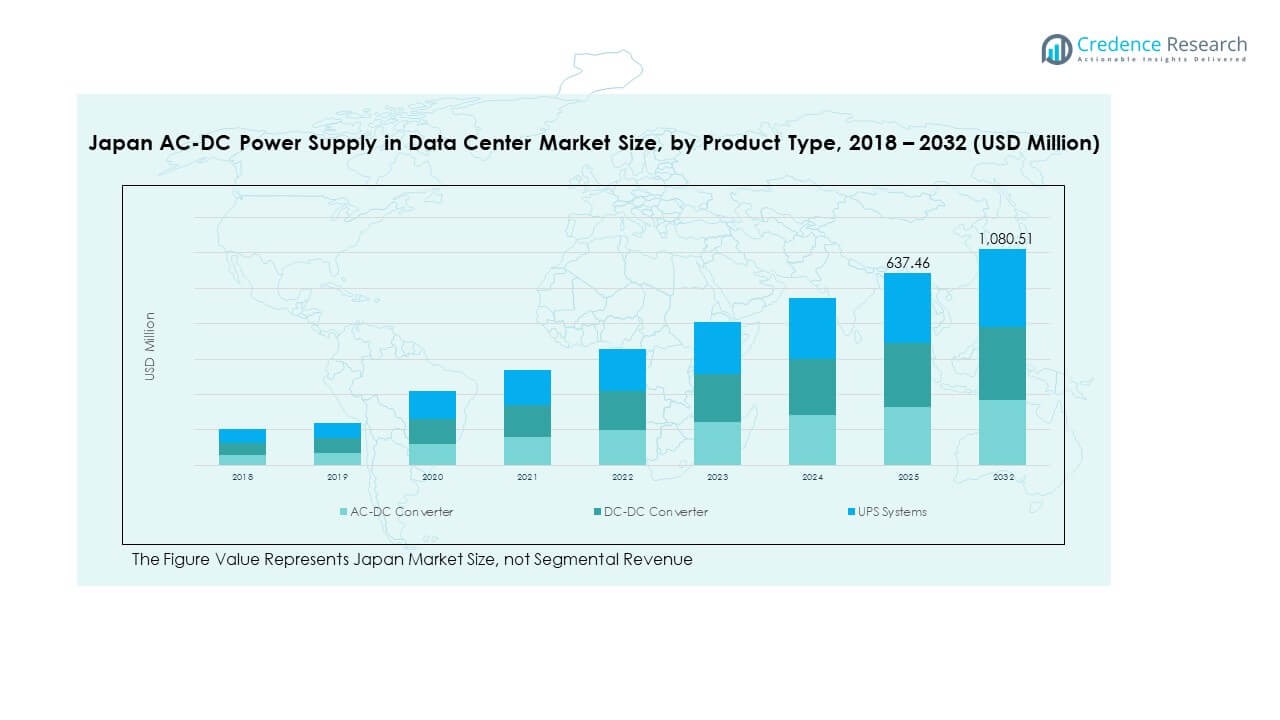

The Japan AC-DC Power Supply in Data Center Market size was valued at USD 345.18 million in 2018, reached USD 566.44 million in 2024, and is anticipated to reach USD 1,080.51 million by 2032, at a CAGR of 7.83% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan AC-DC Power Supply in Data Center Market Size 2024 |

USD 566.44 Million |

| Japan AC-DC Power Supply in Data Center Market, CAGR |

7.83% |

| Japan AC-DC Power Supply in Data Center Market Size 2032 |

USD 1,080.51 Million |

The market is driven by the rapid expansion of data centers, strong focus on energy efficiency, and adoption of advanced conversion technologies. Businesses are investing in intelligent power management systems and modular designs that support renewable energy integration. Growing digitalization and automation in Japan’s IT and telecom sectors strengthen the strategic importance of this market for investors seeking long-term infrastructure stability and energy optimization.

The Kanto region, led by Tokyo, remains the primary hub for data center infrastructure, supported by high connectivity and government initiatives promoting sustainable energy. Kansai and Chubu regions are emerging as secondary growth centers due to lower operational costs and improved energy infrastructure. Regional diversification enhances Japan’s capacity to handle increasing cloud workloads and supports balanced national digital growth.

Market Drivers

Growing Data Center Infrastructure Expansion and Digital Transformation Across Japan

Japan’s growing data center infrastructure supports the rising need for efficient power conversion. Rapid digital transformation in sectors such as finance, e-commerce, and manufacturing drives higher computing loads and energy demands. The Japan AC-DC Power Supply in Data Center Market benefits from large-scale projects in Tokyo, Osaka, and regional cities. Government-led initiatives promoting digital economy growth further strengthen energy system upgrades. Companies adopt scalable AC-DC systems to meet reliability and uptime standards. Advanced power architectures help minimize losses and improve sustainability metrics. Investors view this sector as a stable, long-term growth field aligned with digital infrastructure expansion. The ongoing focus on modernization ensures continued development across the power ecosystem.

Adoption of High-Efficiency and Intelligent Power Conversion Technologies

Manufacturers focus on intelligent power supplies that enhance monitoring, reliability, and flexibility. Integration of wide-bandgap semiconductors such as GaN and SiC improves conversion efficiency and thermal performance. This trend supports compact, high-power-density designs that reduce space and cooling needs. The Japan AC-DC Power Supply in Data Center Market witnesses steady growth due to the push toward energy-efficient technologies. Intelligent control systems and digital interfaces offer real-time diagnostics for predictive maintenance. Companies invest in automation-enabled testing systems to optimize operational safety. The shift to software-defined power systems supports dynamic load management. It also aligns with sustainability targets across the data center sector.

- For instance, in September 2025, TDK-Lambda, a TDK Corporation group company, expanded its CUS-M AC-DC power supply series to 1200 W models achieving up to 95.5% efficiency, designed for compact installations with reduced internal heating, as confirmed in the company’s official product release.

Rising Demand for Renewable-Integrated and Sustainable Power Systems

The shift toward renewable energy integration drives adoption of adaptive AC-DC power supplies. Businesses prefer modular and scalable systems that support hybrid and renewable energy sources. The market grows through innovations enabling direct DC integration for solar-backed data centers. The Japan AC-DC Power Supply in Data Center Market leverages these advancements for greater resilience. Power supply designs now focus on energy reuse and low standby losses. Companies develop systems with intelligent power factor correction and eco-mode operation. The emphasis on sustainability influences investment strategies and R&D directions. It strengthens Japan’s role in promoting energy-efficient technologies for global data center use.

- For instance, Fuji Electric commercialized the world’s first three-level power conditioning module for solar inverters using advanced RB-IGBT technology, resulting in a conversion efficiency of 98.5% (for 1,000 V DC product), which is among the highest globally and officially detailed on the company’s product page and specifications.

Strategic Industry Collaborations and Government Support Driving Technological Growth

Collaboration between technology firms and energy specialists accelerates product innovation. Partnerships with semiconductor producers and grid operators enhance performance reliability and compliance. The Japan AC-DC Power Supply in Data Center Market gains from regulatory incentives for energy efficiency and smart grid readiness. The government’s focus on decarbonization and digitalization supports market expansion. Industry players align strategies to meet global standards for safety and performance. Businesses invest in localized production to ensure supply chain stability. Investors find opportunities in companies offering advanced control and digital optimization systems. These collective efforts establish Japan as a regional hub for data center power innovation.

Market Trends

Transition Toward Modular and Scalable Power Supply Architectures

Data centers in Japan increasingly adopt modular AC-DC configurations to achieve operational flexibility. Modularization supports phased expansion and quick maintenance without full system downtime. The trend ensures efficiency under varying load conditions while improving fault isolation. The Japan AC-DC Power Supply in Data Center Market experiences rising demand for compact, scalable modules. Manufacturers introduce hot-swappable units for faster service response. Modular power design also supports distributed computing models and edge data facilities. Energy management systems integrate seamlessly with modular units for real-time control. It enables higher uptime, reduced operating costs, and better energy optimization.

Emergence of AI-Driven and Digitally Monitored Power Systems

Artificial intelligence and IoT tools are transforming data center power management in Japan. Operators deploy AI-powered platforms to analyze power flow, load balance, and fault prediction. Real-time analytics improves equipment longevity and energy efficiency. The Japan AC-DC Power Supply in Data Center Market benefits from integration of AI-based control features. Automated monitoring enhances predictive maintenance and lowers energy waste. AI tools assist in grid synchronization for renewable-based power sources. Data-driven dashboards give operators transparency and agility in energy planning. It ensures stable operations under fluctuating digital workloads and environmental conditions.

Focus on Compact Designs and Thermal Efficiency Enhancement

Manufacturers prioritize miniaturized, thermally optimized power supplies for better space utilization. High-density rack architectures demand systems capable of handling intense heat loads. The Japan AC-DC Power Supply in Data Center Market shows rising adoption of liquid-cooled and hybrid cooling designs. These advancements improve thermal stability and reduce downtime risks. Use of high-efficiency converters cuts waste heat generation. The focus on advanced materials enhances durability and performance consistency. Compact, high-efficiency models meet sustainability goals while reducing lifecycle costs. It positions Japanese data centers as models for efficient infrastructure design in Asia.

Increased Standardization and Regulatory Compliance Across Power Infrastructure

Compliance with global standards strengthens Japan’s data center power ecosystem. Regulations focus on reducing carbon emissions, improving energy security, and increasing redundancy. The Japan AC-DC Power Supply in Data Center Market aligns with frameworks like IEC and ISO. Compliance enhances international investment appeal and operational transparency. Companies upgrade products to meet emerging safety and cyber-resilience norms. Certification-driven competition accelerates technological refinement across the sector. Standardization also ensures interoperability across hybrid and edge data centers. It enhances global competitiveness of Japanese suppliers in the data center value chain.

Market Challenges

High Capital Investment Requirements and Integration Complexity Across Data Centers

Implementing advanced AC-DC power systems requires large upfront investment. Equipment, installation, and digital monitoring raise initial costs for operators. The Japan AC-DC Power Supply in Data Center Market faces budget constraints among small and medium enterprises. Complex integration across legacy systems limits upgrade adoption. Interoperability between old and new architectures requires skilled engineering resources. Investors demand faster ROI, yet infrastructure timelines extend over years. Supply chain disruptions delay component delivery and project completion. It creates financial pressure for both domestic and multinational developers aiming for energy efficiency.

Thermal Management, System Reliability, and Evolving Regulatory Constraints

Increasing data center density heightens thermal management challenges. Power efficiency improvements often conflict with cooling demands. The Japan AC-DC Power Supply in Data Center Market must balance compactness with safety margins. Equipment failure due to overheating can disrupt uptime commitments. Regulatory shifts related to emissions and renewable integration raise compliance burdens. Vendors must continuously redesign products to meet energy standards. Limited local manufacturing increases dependency on imported components. It makes consistent reliability and cost management difficult under competitive market conditions.

Market Opportunities

Rising Demand for AI-Enabled Energy Optimization and Smart Grid Integration

Opportunities arise from digital power management systems integrating AI and IoT capabilities. These systems enable automated control, adaptive load response, and predictive diagnostics. The Japan AC-DC Power Supply in Data Center Market benefits from utilities’ push toward smart grid expansion. AI-assisted algorithms help optimize consumption and balance renewable inputs. Local firms can partner with hyperscale operators for customized energy solutions. It creates new prospects for innovation-driven manufacturers. The demand for intelligent systems strengthens Japan’s position in advanced power technologies.

Expansion of Edge Data Centers and Renewable-Linked Infrastructure Deployment

Edge computing accelerates local data traffic and drives smaller, distributed power setups. Renewable-linked microgrids support these decentralized data nodes with efficient conversion systems. The Japan AC-DC Power Supply in Data Center Market offers opportunities for localized supply integration. Companies can develop modular, eco-friendly systems tailored for remote installations. Green data centers powered by solar and hydrogen fuel cells attract major investments. It promotes sustainable power infrastructure growth across multiple prefectures. These opportunities position Japan as a benchmark for efficient energy transition in data centers.

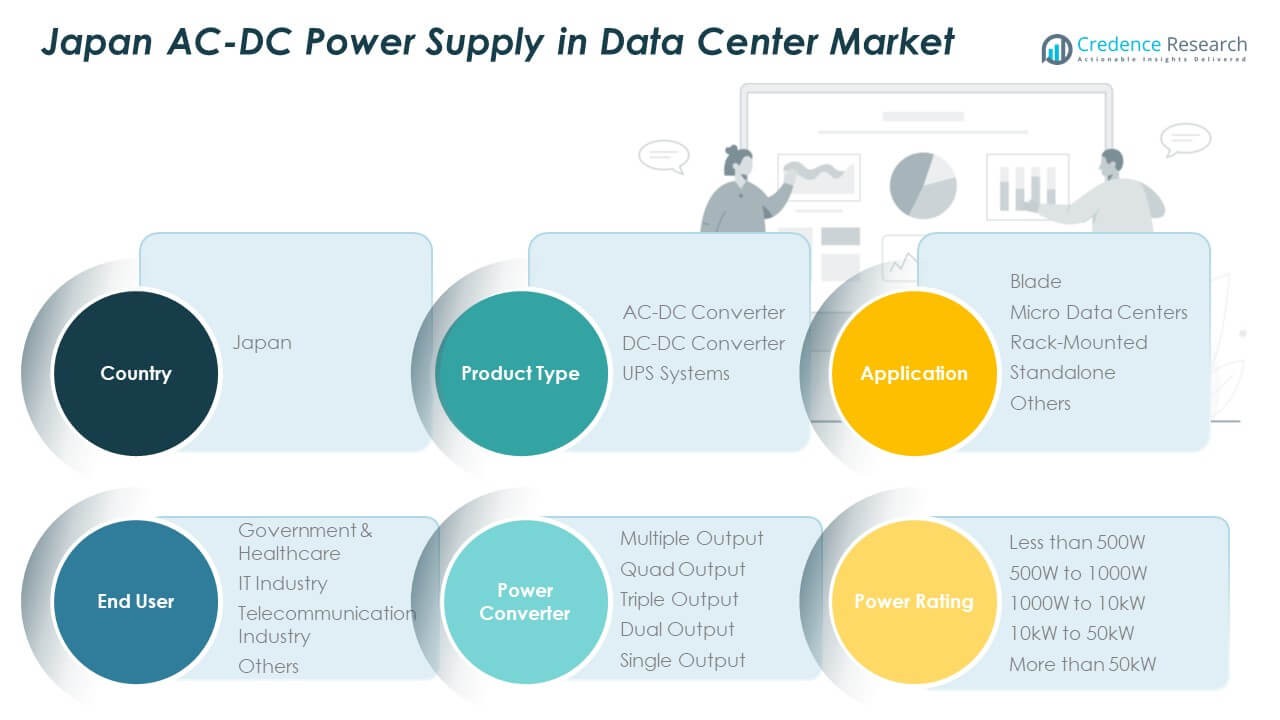

Market Segmentation:

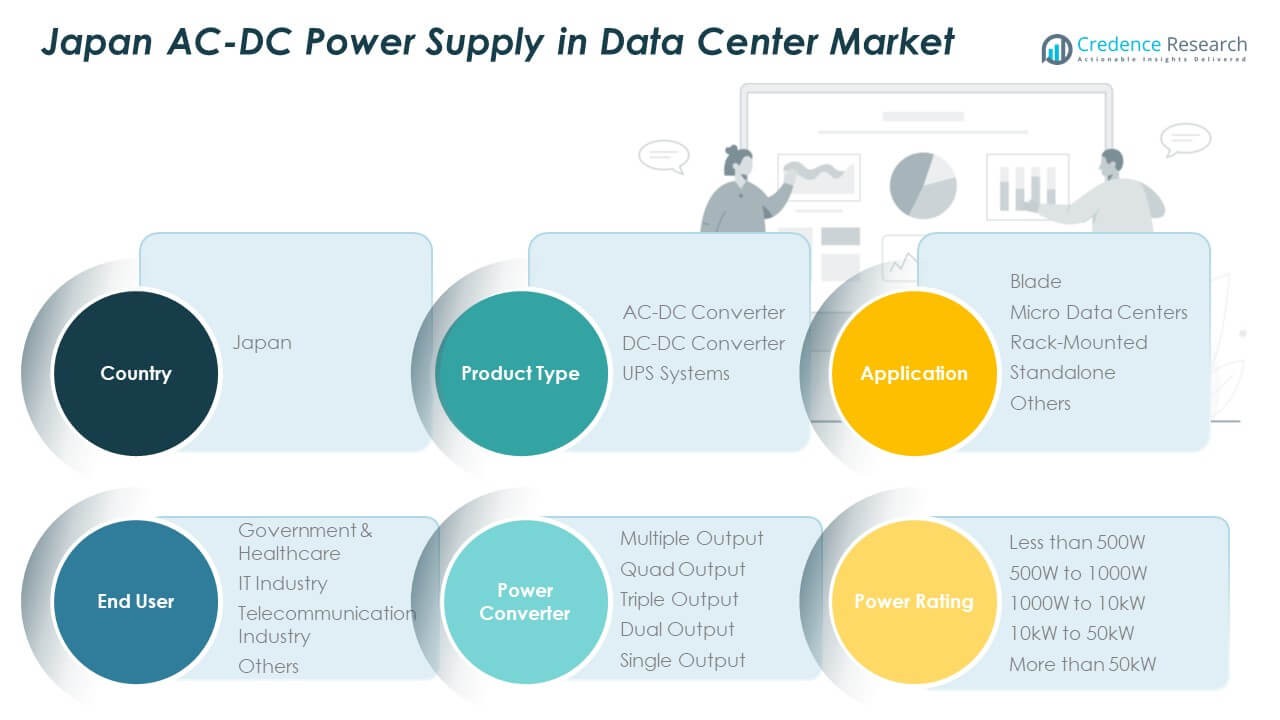

By Product Type

The AC-DC Converter segment dominates the Japan AC-DC Power Supply in Data Center Market, accounting for the largest market share due to its essential role in converting alternating current into stable direct current for IT loads. These converters ensure reliable, efficient, and low-noise power delivery to servers and networking equipment. The UPS systems segment follows closely, driven by growing needs for uninterrupted operations and power backup. Continuous innovation in energy-efficient conversion technologies and the integration of smart power management systems further accelerate growth across all product types.

By Application

The Rack-Mounted segment leads the Japan AC-DC Power Supply in Data Center Market, capturing a substantial market share due to widespread adoption in hyperscale and enterprise data centers. Rack-mounted units offer high-density power configurations and optimized cooling capabilities, making them ideal for scalable operations. The Micro Data Center segment is expanding rapidly, supported by edge computing deployment and localized data processing demand. Increased server consolidation and modular infrastructure investment strengthen the dominance of rack-mounted systems, enhancing reliability and energy optimization across Japan’s growing data infrastructure ecosystem.

By End User

The IT Industry segment holds the largest share in the Japan AC-DC Power Supply in Data Center Market, driven by rising cloud computing, data storage, and enterprise digitization initiatives. Telecom operators and hyperscale providers also contribute significantly, investing in resilient power architectures to support growing bandwidth and 5G connectivity. The Government and Healthcare segments show increasing adoption for secure and continuous data access. Ongoing expansion of colocation facilities and digital transformation projects reinforces market strength across end users, emphasizing reliability, performance, and compliance with Japan’s stringent efficiency standards.

By Power Converter

The Multiple Output segment dominates the Japan AC-DC Power Supply in Data Center Market due to its ability to provide efficient power distribution to multiple loads simultaneously. These converters enhance system flexibility and minimize conversion losses, making them vital for complex data center setups. Dual and triple output converters also gain traction, supporting compact and scalable rack configurations. Manufacturers focus on modular, high-density designs to meet energy efficiency mandates. The growing preference for power optimization, redundancy, and adaptable configurations sustains strong momentum for multi-output converter solutions.

By Power Rating

The 1000W to 10kW segment leads the Japan AC-DC Power Supply in Data Center Market, serving medium to large-scale data centers with balanced efficiency and performance. These power ratings support critical operations in enterprise and hyperscale environments requiring high uptime and power stability. The 10kW to 50kW segment shows significant growth potential due to high-density computing applications and AI-driven workloads. Demand for compact, high-capacity power systems aligns with Japan’s focus on space optimization, renewable integration, and advanced cooling solutions, ensuring continued dominance of mid-to-high power categories.

Regional Insights:

Kanto Region (Tokyo and Surrounding Prefectures – 46% Share)

The Kanto region holds the largest 46% share of the Japan AC-DC Power Supply in Data Center Market, supported by Tokyo’s position as the country’s digital and financial hub. The presence of hyperscale data centers and global cloud operators drives continuous investments in advanced AC-DC power systems. It benefits from high connectivity infrastructure and strong government initiatives for green and energy-efficient data facilities. The growing adoption of AI and IoT workloads in this region demands robust, scalable power conversion systems. Major projects in Tokyo and Kanagawa emphasize modular power integration and grid stability. The region’s focus on sustainability and renewable-backed data centers enhances its leadership across Japan’s power supply landscape.

- For instance, in October 2024, Mitsubishi Electric announced a ¥10 billion investment for constructing a new facility in Fukuoka Prefecture devoted to power semiconductor module assembly and inspection, streamlining manufacturing and improving productivity for AC-DC power devices used in data centers. The integrated systems to automate process management will directly support stable power supply for hyperscale projects in Tokyo, strengthening Japan’s energy efficiency and grid reliability for critical digital infrastructure.

Kansai Region (Osaka, Kyoto, and Hyogo – 31% Share)

The Kansai region commands 31% of the Japan AC-DC Power Supply in Data Center Market, led by Osaka’s growing role as a data center and cloud service hub. Strategic location, lower operational costs, and strong electricity grid reliability make it ideal for backup and secondary data facilities. It witnesses expansion from domestic telecom and hyperscale operators adopting high-efficiency AC-DC conversion systems. Continuous investment in cooling efficiency and fault-tolerant infrastructure supports regional growth. The region also benefits from data localization initiatives by financial institutions. Its balanced industrial ecosystem ensures sustainable expansion in energy and IT infrastructure.

Chubu and Kyushu Regions (Combined 23% Share)

Chubu and Kyushu together account for 23% of the Japan AC-DC Power Supply in Data Center Market, driven by rising adoption of edge and enterprise data centers. Fukuoka and Nagoya are emerging as strategic nodes for localized data processing and hybrid cloud deployment. It reflects Japan’s national effort to decentralize digital infrastructure and improve regional connectivity. Increased investments in renewable power generation, including solar and wind projects, support energy-efficient operations. Local governments promote industrial digitalization, creating demand for compact and modular AC-DC solutions. These regions are positioned for steady expansion with growing focus on sustainable and cost-effective power systems.

- For instance, in July 2023, Kyocera and Kyudenko jointly formed a renewable energy service business, introducing on-site solar power solutions in Fukuoka that deliver improved energy management metrics for local enterprise and data center clients. These initiatives highlight the focus on integrating renewables and distributed AC-DC power solutions across emerging strategic nodes in the region.

Competitive Insights:

- ABB

- Caterpillar

- Cummins

- Delta Electronics

- Eaton

- Eltek

- Emerson

The Japan AC-DC Power Supply in Data Center Market is characterized by strong competition among global and domestic manufacturers focused on efficiency, reliability, and modular design. It shows growing emphasis on product innovation, digital integration, and power density enhancement. ABB, Eaton, and Delta Electronics lead through advanced conversion technologies and intelligent monitoring platforms. Caterpillar and Cummins strengthen their position with resilient backup and hybrid systems supporting large-scale data operations. Local firms such as Fuji Electric and Toshiba Energy Systems focus on compact, high-efficiency converters tailored for Japan’s urban data centers. Strategic partnerships, R&D investments, and government incentives for green infrastructure reinforce competitive differentiation and long-term sustainability across the sector.

Recent Developments:

- In August 2025, Caterpillar entered a long-term strategic collaboration with Hunt Energy Company to deliver highly efficient, independent energy solutions for data centers, including advanced AC-DC power generation, natural gas and diesel generator sets, and battery storage systems. This partnership is focused on enhancing reliability, uptime, and performance for “always-on” operations and is highly relevant for the energy-intensive AI and cloud workloads prevalent in Japanese data centers.

- In June 2025, Ares Management acquired GCP International (now Ada Infrastructure), leading to the launch of Japan DC Partners I LP, a data center development and investment fund with US$2.4 billion committed, aimed at delivering nearly 240MW of IT load across three campuses in Greater Tokyo and integrating advanced AC-DC power supply systems.

- In May 2025, Delta Electronics unveiled a comprehensive set of solutions for AI-era data centers, including an innovative 800V High Voltage Direct Current (HVDC) power architecture, specifically geared for meeting the advanced power delivery and efficiency needs of Japanese data center operators.