Executive summary:

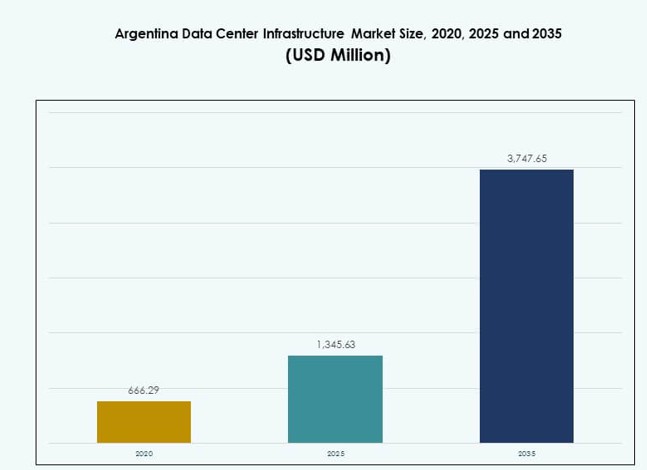

The Argentina Data Center Infrastructure Market size was valued at USD 666.29 million in 2020 to USD 1,345.63 million in 2025 and is anticipated to reach USD 3,747.65 million by 2035, at a CAGR of 10.71% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Argentina Data Center Infrastructure Market Size 2025 |

USD 1,345.63 Million |

| Argentina Data Center Infrastructure Market, CAGR |

10.71% |

| Argentina Data Center Infrastructure Market Size 2035 |

USD 3,747.65 Million |

Digital transformation across finance, telecom, and public sectors is driving robust infrastructure investments. Cloud adoption, AI deployment, and rising data localization needs push demand for scalable, high-availability facilities. Operators focus on modular builds, edge readiness, and smart power management. Businesses seek low-latency services and resilient systems, while investors find value in Argentina’s strategic position for serving Southern Cone markets. Energy efficiency, automation, and hybrid cloud capabilities remain top technology priorities in this evolving landscape.

Buenos Aires dominates the national market due to dense connectivity, reliable power supply, and strong commercial demand. Its concentration of enterprise users and fiber infrastructure supports large-scale builds. Córdoba and Mendoza are emerging as secondary hubs due to government incentives, growing IT demand, and availability of land. These regions attract new projects aimed at edge computing, disaster recovery, and local content delivery. Expansion beyond core metros is gaining steady investor interest.

Market Dynamics:

Key Market Drivers

Growing Enterprise Demand for Localized Cloud and Data Hosting Capabilities

Argentina’s expanding digital ecosystem is pushing enterprises to localize data hosting and adopt cloud-native solutions. Public cloud usage is growing across banking, e-commerce, and public services. This shift drives new demand for scalable, high-availability data center infrastructure. Local companies invest in private and hybrid cloud environments to meet latency and compliance requirements. The Argentina Data Center Infrastructure Market gains strength from increasing domestic workloads. Investors see long-term returns from edge-ready infrastructure and modular capacity expansion. Infrastructure operators also benefit from new partnerships with global cloud providers. Rising demand for local hosting reduces dependence on foreign interconnects.

- For instance, in 2025, Mercado Libre opened a 58,000 m² logistics and processing center in Buenos Aires, Argentina, with capacity to handle 100,000 products per day and significantly expand its storage and fulfillment operations.

Digital Transformation and Technology Adoption Across Key Industry Verticals

The push for digital transformation in government, healthcare, telecom, and retail fuels robust infrastructure investment. Local industries require more resilient data environments to handle growing volumes. AI, IoT, and real-time analytics adoption place more pressure on computing and storage systems. The Argentina Data Center Infrastructure Market responds with upgraded systems, software-defined infrastructure, and improved automation. Businesses prioritize energy-efficient and scalable architecture. AI-driven management software enables better uptime and predictive maintenance. This shift helps reduce OPEX and improve long-term system reliability. Argentina emerges as a testbed for operational innovation in Tier II Latin American markets.

Government Policies and Strategic Reforms Accelerating ICT Investment

Argentina’s government supports digital economy development with ICT incentives, data governance reforms, and spectrum allocations. Policies streamline approvals for fiber, 5G, and digital infrastructure expansion. Operators receive support for land acquisition and energy sourcing. The Argentina Data Center Infrastructure Market gains positive momentum from this regulatory clarity. International firms see potential in long-term local partnerships and incentives. Cross-border data policies encourage local deployment over offshore hosting. Infrastructure investors prioritize Argentina due to its regional leadership ambitions and urban tech readiness. Incentives reduce cost barriers, which helps drive project feasibility in underserved cities.

- For instance, Telecom Argentina’s Personal brand has been expanding its 5G network across major Argentine cities since its initial rollout, and by 2025 the carrier continued to increase active 5G sites nationwide to support mobile connectivity growth. The company leads 5G deployment efforts under licensed spectrum allocations to strengthen urban digital infrastructure.

Favorable Investment Climate for Colocation and Hyperscale Development

Rising demand for carrier-neutral colocation spaces draws interest from foreign and regional investors. Power access, fiber networks, and population density in Buenos Aires create prime development zones. Hyperscalers seek Argentina to serve Southern Cone markets and reduce reliance on Brazilian interconnects. The Argentina Data Center Infrastructure Market becomes strategic for regional latency-sensitive services. Land and labor cost advantages strengthen its appeal. Developers deploy large, modular facilities to support flexible expansion strategies. Colocation players attract fintech, streaming, and public sector clients. High rack density, redundancy, and connectivity options drive value for enterprise tenants.

Key Market Trends

Adoption of Liquid Cooling and High-Density Rack Solutions in Urban Zones

Urban data centers in Argentina face mounting space and power constraints. Operators integrate high-density racks with liquid and immersion cooling systems to increase capacity per square meter. This trend supports rack power densities above 15 kW in Tier III and IV builds. The Argentina Data Center Infrastructure Market sees this shift in response to AI and HPC adoption. Liquid cooling enhances thermal efficiency in edge and core environments. It also aligns with energy conservation goals in urban projects. Builders target efficient power-to-rack designs to stay competitive.

Rising Deployment of Modular and Prefabricated Data Center Facilities

Modular data center construction gains momentum across new and upgrade projects. It reduces build time, simplifies permitting, and lowers deployment costs. The Argentina Data Center Infrastructure Market uses modular builds to meet fast-growing cloud demand. These systems support phased expansion and relocation. Operators leverage containerized cooling and preassembled power systems to reduce onsite labor. Rural and secondary city deployments benefit most from this trend. Developers focus on 1–5 MW build blocks with flexible architecture. It improves disaster recovery and remote site viability.

Growth in Software-Defined Power and AI-Based Infrastructure Monitoring

Data centers in Argentina adopt software-defined infrastructure to optimize power usage and performance. AI-based tools predict component failure and suggest load balancing across power and cooling systems. The Argentina Data Center Infrastructure Market integrates these solutions to improve uptime and reduce OPEX. Real-time monitoring enhances SLA performance. Operators deploy digital twins for scenario simulation and maintenance planning. AI tools also streamline compliance reporting and energy audits. These smart systems support a move toward autonomous infrastructure operations.

Edge Data Center Expansion to Support 5G, IoT, and Rural Connectivity Goals

Edge data centers see increased traction with growing IoT and 5G deployments. Telecom operators and digital platforms push capacity closer to end-users. The Argentina Data Center Infrastructure Market responds with small-footprint edge facilities. These facilities enable faster content delivery and localized processing. They also reduce backhaul costs for operators. Public service digitization and rural connectivity initiatives further drive edge demand. Investors explore micro data center formats and tower-based edge integrations. This trend expands infrastructure growth beyond core metro zones.

Market Challenges

Power Reliability Issues and Energy Cost Volatility Affecting Long-Term Planning

Argentina faces grid instability and regional energy pricing volatility, challenging data center uptime and cost forecasts. Operators depend on backup systems and battery storage, raising CAPEX. The Argentina Data Center Infrastructure Market must address these risks to remain attractive for global deployments. Unplanned outages force operators to overengineer power redundancy. It strains project timelines and operational budgets. Renewable integration remains uneven across regions. Rising diesel costs for generators add financial pressure. These constraints limit hyperscaler interest in remote sites lacking grid reliability.

Regulatory Uncertainty, Import Barriers, and Bureaucratic Delays in Equipment Procurement

Strict import controls and foreign exchange restrictions delay procurement of critical infrastructure equipment. This affects delivery timelines for PDUs, UPS, cooling systems, and racks. The Argentina Data Center Infrastructure Market faces bureaucratic challenges in permits and customs clearance. These delays slow project go-live timelines. Local sourcing options are limited for advanced systems. Project risk increases for global developers with tight schedules. Market participants navigate changing trade rules, which adds cost and uncertainty. Long procurement cycles hinder technology upgrades and competitive delivery.

Market Opportunities

Rise of Localized Cloud Hosting, Financial Digitalization, and AI Workloads

Argentina’s growing digital economy opens opportunities for high-availability cloud hosting and data sovereignty solutions. The financial sector digitizes at scale, and AI workloads emerge in healthcare, retail, and logistics. The Argentina Data Center Infrastructure Market becomes central to this evolution. Infrastructure demand will rise in parallel with domestic digital innovation. Investors see long-term value in secure, compliant, and scalable builds tailored for local content and critical workloads.

Green Data Center Projects and Renewable Power Integration in New Facilities

Operators shift toward renewable energy sourcing and PUE optimization. This shift opens room for green-certified data center builds in urban and rural locations. The Argentina Data Center Infrastructure Market attracts attention for solar-hybrid microgrid designs and water-efficient cooling solutions. Investors prefer assets with sustainable performance indicators. Developers use this positioning to secure green funding and meet ESG expectations.

Market Segmentation

By Infrastructure Type

The Argentina Data Center Infrastructure Market is dominated by IT & network infrastructure, followed by electrical systems. Server, storage, and rack solutions see high demand due to enterprise digitalization and cloud migration. Civil and mechanical infrastructure segments grow with new builds and upgrades, but they lag behind core IT deployment in overall share. Structural modularity and prefabrication improve efficiency in construction timelines, adding traction to civil infrastructure. Mechanical infrastructure demand is tied to the shift toward advanced thermal management.

By Electrical Infrastructure

Uninterruptible Power Supply (UPS) systems lead Argentina’s electrical infrastructure market due to the need for continuous power. Power Distribution Units (PDUs) and Battery Energy Storage Systems (BESS) follow due to rising power density and backup requirements. Utility grid upgrades remain inconsistent, making UPS systems critical. Transfer switches and switchgears also see demand from Tier III/IV operators. Renewable integration creates scope for smart grid-connected solutions. Investors focus on power reliability and efficiency metrics across deployments.

By Mechanical Infrastructure

Cooling units like CRAC and CRAH dominate mechanical infrastructure demand due to high-density deployments. Chillers, both air- and water-cooled, support thermal stability in urban zones. Containment systems are gaining popularity for energy conservation and airflow optimization. Pumps and piping systems follow demand from custom cooling loop designs. Data center operators prioritize modular and energy-efficient cooling strategies to meet environmental regulations. Mechanical infrastructure will grow with increased AI and HPC hosting loads.

By Civil / Structural & Architectural

Superstructure components lead this segment, supported by raised floors and suspended ceilings. Site preparation is vital for greenfield projects, while modular systems gain traction in brownfield expansions. Building envelope upgrades improve thermal insulation and operational lifespan. Prefabricated designs accelerate rollout and standardize construction costs. Developers aim for flexible structural frameworks that support scaling and retrofits. The Argentina Data Center Infrastructure Market gains from improved civil design practices focused on speed and efficiency.

By IT & Network Infrastructure

Servers and storage solutions dominate, driven by enterprise IT upgrades and government digital platforms. Networking equipment demand rises with hybrid cloud and edge connectivity. Racks and enclosures also hold a significant share due to high-density buildouts. Cabling and fiber investments follow as operators prioritize speed and latency. The Argentina Data Center Infrastructure Market sees constant refresh cycles in this segment to match evolving workloads. Investors see IT infrastructure as the key value layer in colocation and hyperscale projects.

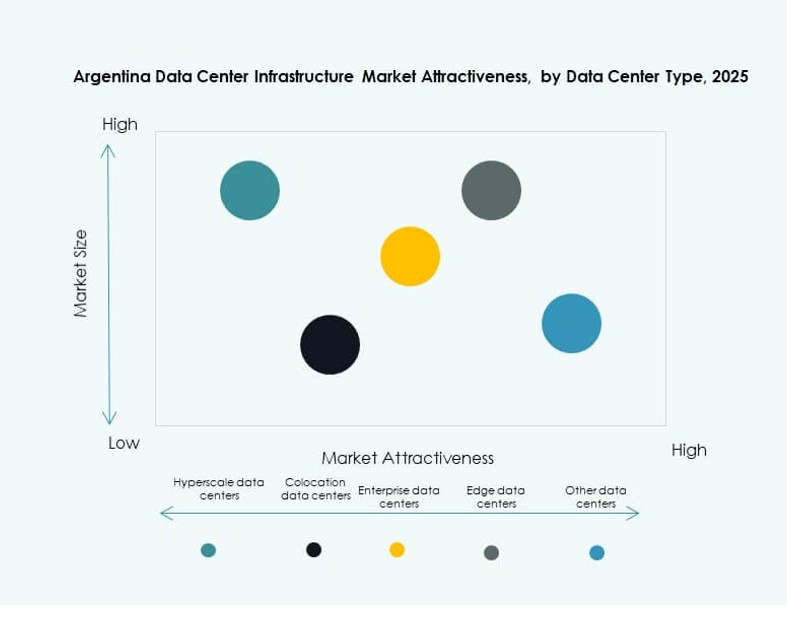

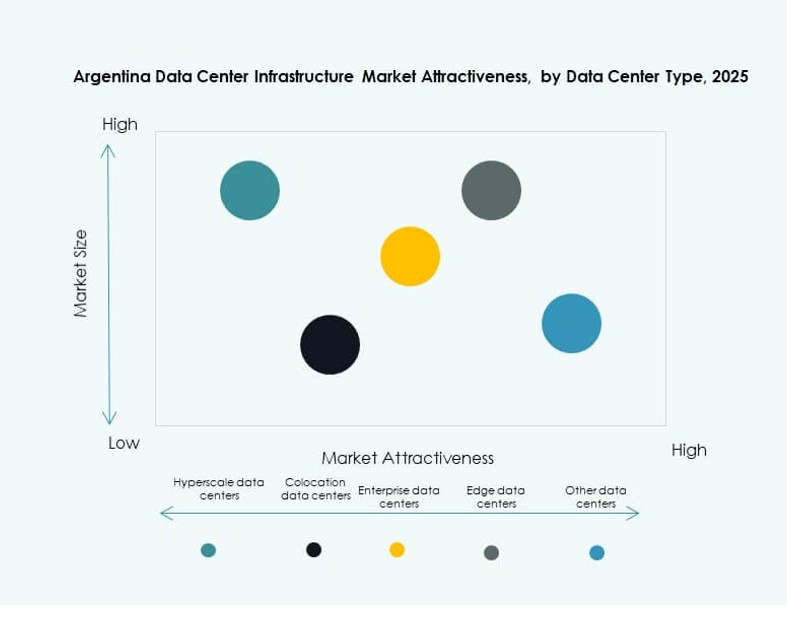

By Data Center Type

Colocation data centers hold the largest market share due to growing enterprise outsourcing and shared infrastructure preference. Hyperscale deployments are emerging as global players assess Argentina’s potential. Edge and enterprise data centers show steady traction, supported by remote workload growth. The Argentina Data Center Infrastructure Market becomes more diversified by type, reflecting both metro core and rural edge strategies. Investors see flexibility and hybrid capacity options as key value differentiators.

By Delivery Model

Design-build/EPC models lead delivery due to their cost predictability and faster timelines. Turnkey and modular factory-built solutions follow, favored by hyperscale and edge projects. Retrofit and upgrade models support existing legacy facilities, especially in Buenos Aires. Construction management is used selectively for custom builds. The Argentina Data Center Infrastructure Market reflects a shift toward modularization, with phased deployments lowering risk and improving capital efficiency.

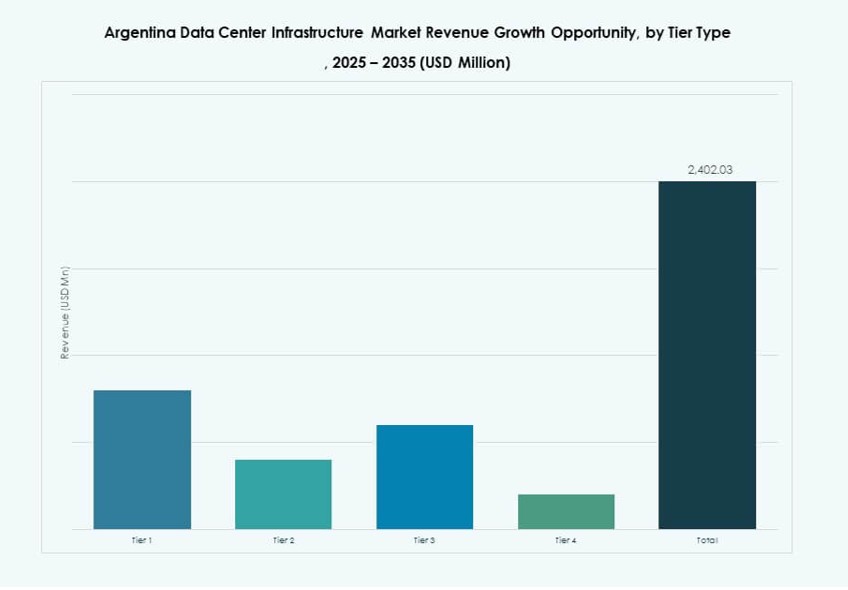

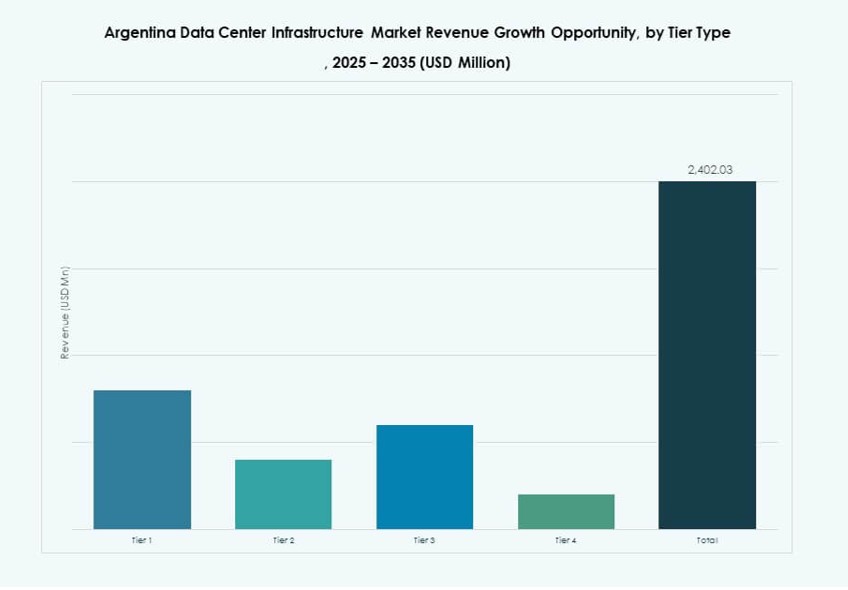

By Tier Type

Tier III data centers dominate the Argentina Data Center Infrastructure Market due to demand for high availability and fault tolerance. Tier II serves mid-sized enterprise and legacy builds. Tier IV sees limited deployments, but interest is rising from hyperscalers and fintechs. Tier I facilities remain relevant in remote zones with basic needs. Investment momentum supports a gradual shift toward Tier III+ capabilities. Reliability and uptime are becoming key competitive metrics in new builds.

Regional Insights

Buenos Aires Dominates with Over 70% Market Share Due to Connectivity and Demand Density

Buenos Aires leads the Argentina Data Center Infrastructure Market with over 70% share due to superior fiber backbone, population density, and enterprise activity. It hosts major cloud nodes, government data, and carrier hotels. This region offers proximity to tech hubs, skilled labor, and energy resources. Developers prioritize Buenos Aires for hyperscale and colocation builds. Urban zoning policies favor multi-tenant data center clusters. It remains the core for digital infrastructure expansion in the country.

- For example, Cirion Technologies’ BUE1 facility in Buenos Aires offers about 7 MW of installed power and supports around 788 racks for enterprise and cloud workloads. It hosts major cloud nodes and interconnects with global providers like Google, Oracle, and Amazon to strengthen Argentina’s digital infrastructure.

Secondary Cities Like Córdoba and Mendoza Are Emerging With Supportive Policies

Córdoba and Mendoza follow with emerging roles in edge and disaster recovery deployments. These cities benefit from regional data needs, available land, and energy incentives. Government programs promote tech investments outside Buenos Aires. The Argentina Data Center Infrastructure Market sees developers expanding modular facilities in these zones. Demand from universities, public institutions, and small enterprises supports growth. These locations also reduce strain on core metro networks and improve latency for local users.

Patagonia and Northern Provinces Show Long-Term Potential with Infrastructure Upgrades

Patagonia and northern provinces such as Salta and Tucumán show low current share but long-term strategic relevance. Infrastructure gaps and lower digital maturity delay large deployments. However, renewable energy potential and regional development incentives attract early interest. The Argentina Data Center Infrastructure Market could see greenfield data parks in these regions in coming years. Government support for remote connectivity, coupled with national digitalization goals, creates an enabling environment. Investments in undersea cables and cross-border links may boost market activity over time.

- For instance, OpenAI and Argentine energy firm Sur Energy signed a letter of intent to advance the “Stargate Argentina” data center project in Patagonia, aiming for a 500 MW capacity facility powered by renewable energy under a major investment incentive program. The initiative represents one of the largest AI infrastructure investments planned in Argentina.

Competitive Insights:

- Scala Data Centers

- ODATA Data Centers

- MDC Data Centers

- Ascenty

- Equinix, Inc.

- Vertiv Group Corp.

- Schneider Electric

- Cisco Systems, Inc.

- IBM

- Dell Inc.

The Argentina Data Center Infrastructure Market features a blend of regional leaders and global technology providers. Local operators like Scala, ODATA, and MDC are scaling investments in colocation and edge-ready designs to meet enterprise and cloud-native workloads. Global vendors such as Vertiv, Schneider Electric, Cisco, and Dell provide essential backbone technologies across power, cooling, and IT systems. Multinational hyperscalers explore partnerships or service tie-ups with domestic players to reduce latency and gain regulatory compliance. The market remains fragmented, with infrastructure competition concentrated around Buenos Aires. It prioritizes energy efficiency, modular scalability, and resilient architecture. International firms offer advanced solutions, but localization and cost efficiency give regional players a competitive edge in design-build and operations.

Recent Developments:

- In August 2025, Cirion Technologies expanded its BUE1 data center in Buenos Aires, adding over 2MW of capacity and 160 racks to support AI workloads and regional connectivity. This infrastructure upgrade, emphasizes energy efficiency, scalability, and renewable energy use.