Executive summary:

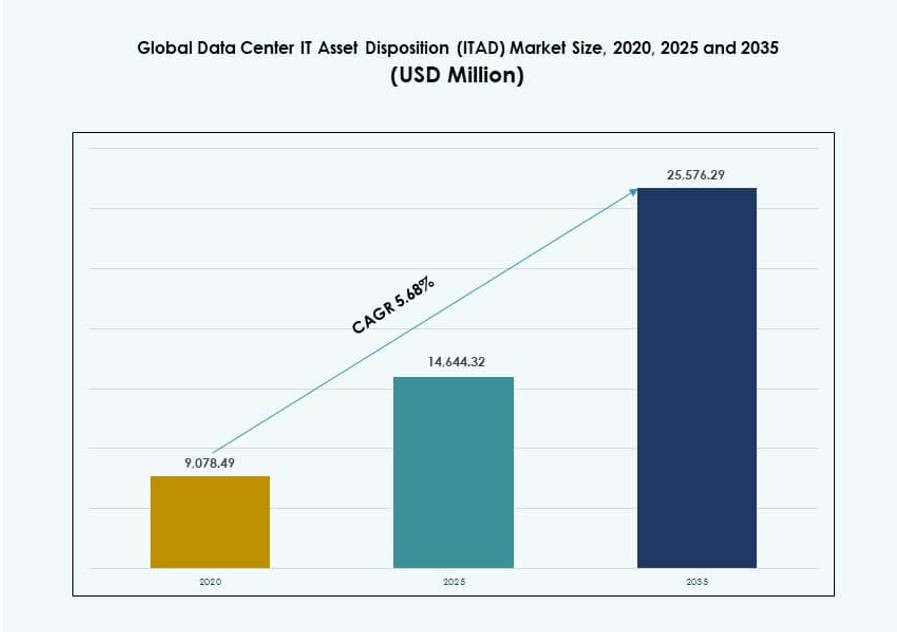

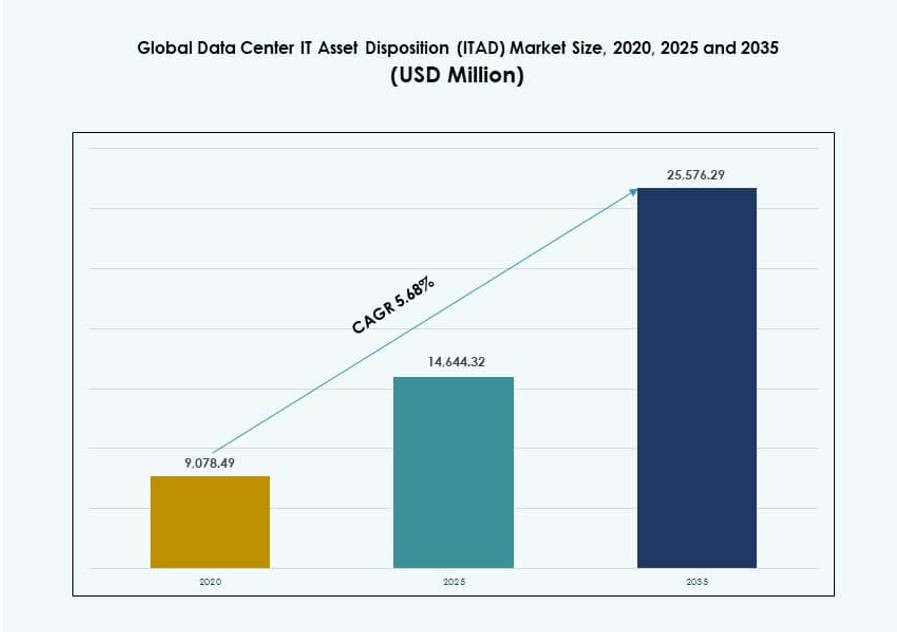

The Global Data Center IT Asset Disposition (ITAD) Market size was valued at USD 9,078.49 million in 2020 to USD 14,644.32 million in 2025 and is anticipated to reach USD 25,576.29 million by 2035, at a CAGR of 5.68% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Data Center IT Asset Disposition (ITAD) Market Size 2025 |

USD 14,644.32 Million |

| Data Center IT Asset Disposition (ITAD) Market, CAGR |

5.68% |

| Data Center IT Asset Disposition (ITAD) Market Size 2035 |

USD 25,576.29 Million |

Market growth stems from rapid cloud adoption and frequent hardware refresh cycles. Enterprises replace servers to support AI, edge, and high-density workloads. Secure data destruction and compliance drive service demand. Innovation improves tracking, automation, and value recovery. Businesses use ITAD to reduce risk and recover costs. Investors value predictable demand tied to infrastructure upgrades.

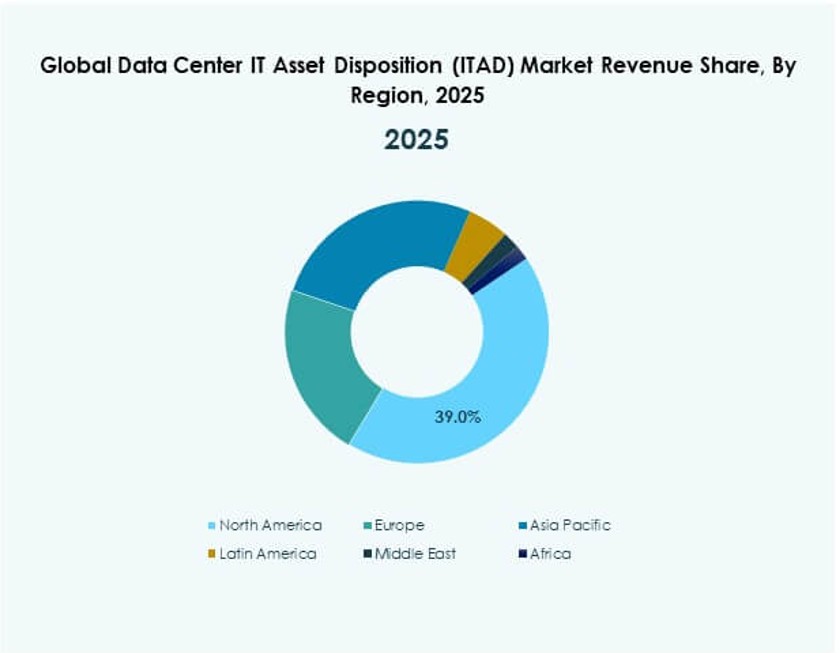

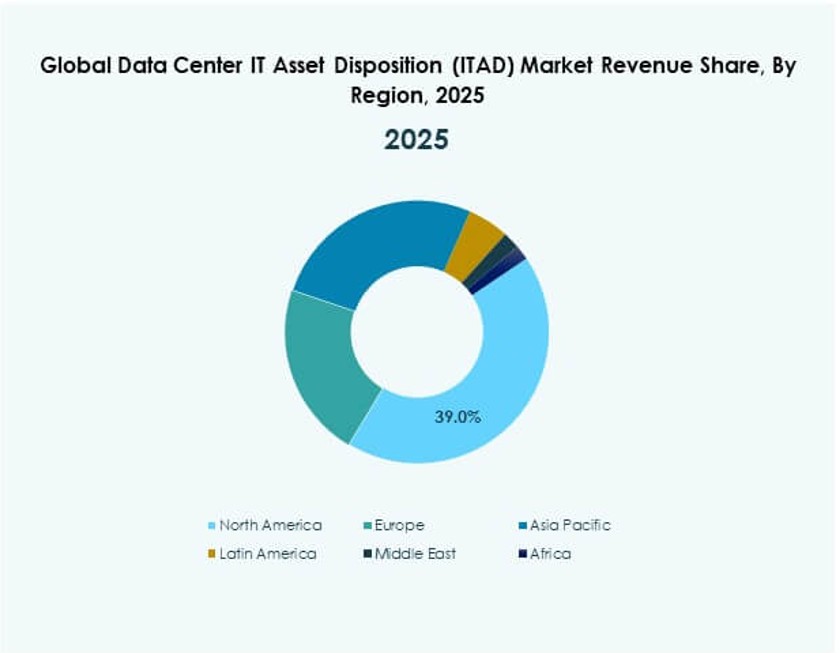

North America leads due to hyperscale data centers and strict data laws. Europe follows with strong sustainability rules and recycling mandates. Asia Pacific is emerging fast with new builds in China, India, and Southeast Asia. Regional growth links to digital transformation and cloud investment. Local compliance frameworks raise demand for certified providers. Expansion remains broad-based across regions.

Market Dynamics:

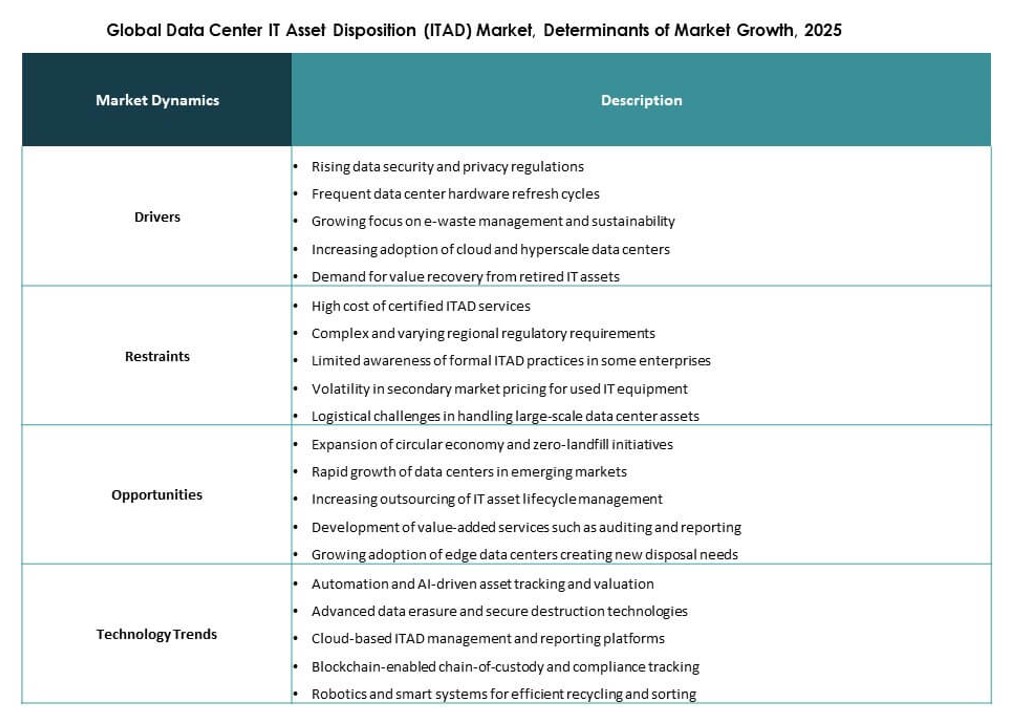

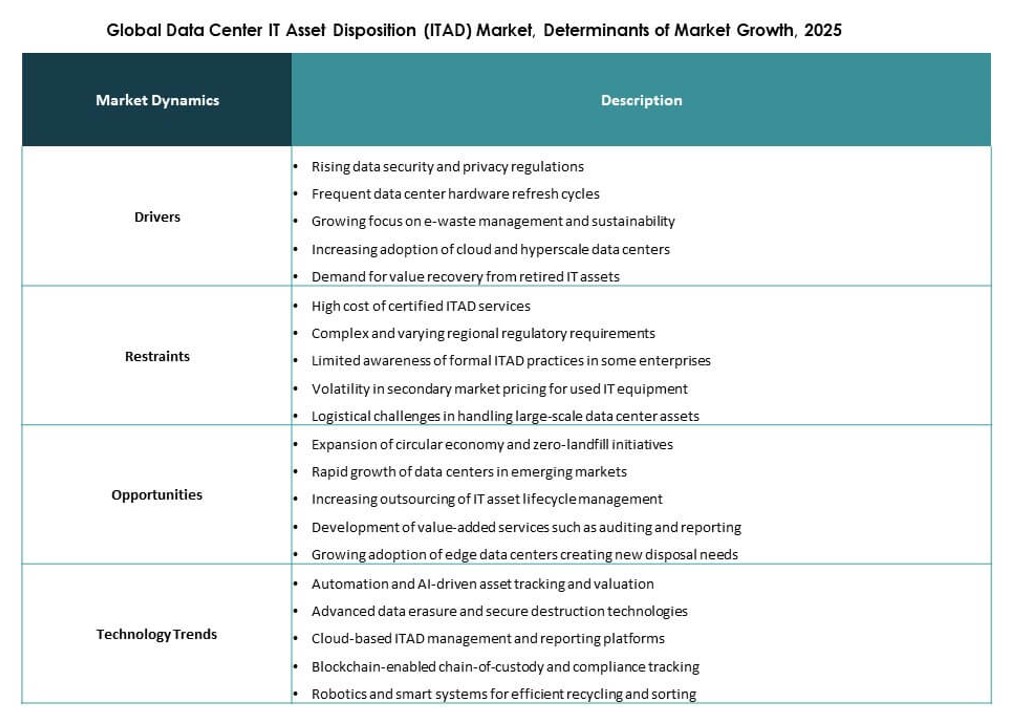

Market Drivers:

Rising Data Center Refresh Cycles And Secure Decommissioning Needs

The Global Data Center IT Asset Disposition (ITAD) Market gains momentum from faster hardware refresh cycles across hyperscale and enterprise facilities. Data centers replace servers and storage systems to support AI, cloud, and high-density workloads. This shift increases volumes of retired IT assets that require controlled handling. Secure decommissioning protects sensitive enterprise and customer data. ITAD providers deliver certified data destruction and audit trails. Businesses treat these services as risk management tools. Investors value the steady demand tied to infrastructure upgrades. It supports predictable service revenue streams. The market strengthens long-term asset lifecycle governance.

Stricter Data Security Regulations And Compliance Enforcement

Regulatory pressure drives adoption of professional ITAD services across industries. Governments enforce strict data protection laws covering storage media disposal. The Global Data Center IT Asset Disposition (ITAD) Market supports compliance through verified sanitization methods. Enterprises seek partners that reduce legal and reputational exposure. Certified destruction processes meet audit and reporting standards. This compliance focus elevates ITAD from optional service to core requirement. Vendors invest in advanced tracking systems. Investors favor firms with strong compliance credentials. Regulation-driven demand improves market stability.

Sustainability Mandates And Circular Economy Adoption

Corporate sustainability goals push organizations toward responsible asset disposition. Data center operators aim to reduce landfill waste and carbon impact. The Global Data Center IT Asset Disposition (ITAD) Market enables reuse, refurbishment, and material recovery. Circular economy models extend asset value beyond first deployment. Enterprises integrate ITAD into ESG reporting frameworks. Service providers improve recovery yields and recycling accuracy. This driver aligns environmental goals with cost control. Investors track ESG-linked revenue growth closely. Sustainability enhances long-term market relevance.

- For instance, AWS reports that it diverts the majority of decommissioned server materials from landfills by using certified reuse and recycling programs across its global operations. The company focuses on recovering value from retired IT hardware while meeting environmental compliance and waste reduction goals. This approach supports broader sustainability commitments within its infrastructure lifecycle management.

Cost Optimization And Value Recovery From Retired Assets

Rising capital intensity in data centers forces tighter cost discipline. ITAD services unlock residual value from decommissioned equipment. The Global Data Center IT Asset Disposition (ITAD) Market supports resale and remarketing channels. Enterprises offset upgrade costs through asset recovery programs. Transparent valuation builds trust between clients and providers. Technology platforms improve pricing accuracy and inventory visibility. Financial returns strengthen procurement decisions. Investors view value recovery as margin expansion lever. This driver reinforces recurring service demand.

- For instance, Equinix refurbishes and resells retired IT assets through certified channels to recover value, supporting client upgrades and extending equipment life. This practice appears in its ESG Impact Reports and aligns with broader sustainability and circular economy goals in data center operations.

Market Trends:

Integration Of Automation And Asset Tracking Platforms

Digital platforms transform how IT assets move through disposition cycles. The Global Data Center IT Asset Disposition (ITAD) Market adopts automation for chain-of-custody control. RFID and software dashboards improve visibility across locations. Clients demand real-time status updates and reporting. Automated workflows reduce manual errors. Service providers scale operations more efficiently. This trend supports multi-site data center portfolios. Transparency builds long-term client relationships. Technology-led differentiation shapes competition.

Growth Of Certified Refurbishment And Secondary Markets

Refurbished IT equipment gains acceptance across emerging markets. The Global Data Center IT Asset Disposition (ITAD) Market supports this shift through quality assurance programs. Buyers seek cost-effective enterprise-grade hardware. Vendors expand testing and certification capabilities. Refurbishment extends product life cycles. Enterprises benefit from stronger resale returns. Secondary markets absorb surplus inventory efficiently. This trend supports circular supply chains. It improves overall asset utilization.

- For instance, Iron Mountain sanitized 3.4 million hard disk and solid-state drives while refurbishing 765,300 servers in 2022 under certified standards for secondary markets.

Consolidation Among Global ITAD Service Providers

Market participants pursue scale through mergers and partnerships. The Global Data Center IT Asset Disposition (ITAD) Market favors providers with global reach. Large clients prefer single-vendor solutions across regions. Consolidation improves logistics efficiency and compliance coverage. Providers expand service portfolios through acquisitions. This trend raises entry barriers for small operators. Standardized processes improve service quality. Investors favor platforms with global contracts. Scale strengthens competitive positioning.

- For instance, Iron Mountain supports operations in 32 countries with over 3,000 secure logistics trucks, enabling unified chain-of-custody for large-scale clients post its ITAD expansions.

Rising Demand For End-To-End Lifecycle Management Services

Clients seek unified solutions beyond disposal alone. The Global Data Center IT Asset Disposition (ITAD) Market evolves toward full lifecycle support. Services now cover inventory tracking and redeployment. Integrated offerings reduce vendor complexity. Enterprises improve internal governance through single dashboards. Providers invest in consultative service models. Long-term contracts replace transactional engagements. This trend increases revenue visibility. Strategic partnerships gain importance.

Market Challenges:

Complex Regulatory Variation Across Global Markets

Regulatory diversity creates operational complexity for service providers. The Global Data Center IT Asset Disposition (ITAD) Market must align with regional data and waste laws. Rules differ across countries and jurisdictions. Compliance failures expose providers and clients to penalties. Service firms require localized expertise and certifications. This raises operating costs and limits scalability. Smaller vendors face higher compliance burdens. Clients demand proof of adherence across regions. Regulatory complexity slows market entry.

Logistics Risks And Data Security Exposure During Transit

Physical movement of retired assets introduces security risks. The Global Data Center IT Asset Disposition (ITAD) Market depends on secure logistics networks. Asset loss or tampering damages client trust. Providers must secure transport and storage facilities. Insurance and monitoring add cost pressure. Cross-border shipments increase documentation needs. Delays affect project timelines. Clients scrutinize logistics partners closely. Risk management remains a key challenge.

Market Opportunities:

Expansion Of ITAD Services In Emerging Data Center Regions

Rapid data center growth in emerging markets creates new demand. The Global Data Center IT Asset Disposition (ITAD) Market can scale services alongside new builds. Local enterprises seek compliant disposal partners. Early market entry builds long-term client loyalty. Providers can shape regulatory best practices. Partnerships with regional recyclers improve reach. Growth potential remains underpenetrated. Investors see strong upside in new geographies. Expansion supports revenue diversification.

Development Of ESG-Focused And Audit-Ready Service Offerings

Enterprises prioritize ESG-aligned vendors across supply chains. The Global Data Center IT Asset Disposition (ITAD) Market can lead with transparent reporting tools. Audit-ready documentation strengthens client governance. Providers can offer sustainability metrics dashboards. These services support corporate reporting needs. Premium pricing becomes viable for compliant solutions. ESG alignment attracts institutional investors. Differentiation improves contract retention. Opportunity centers on value-added services.

Market Segmentation:

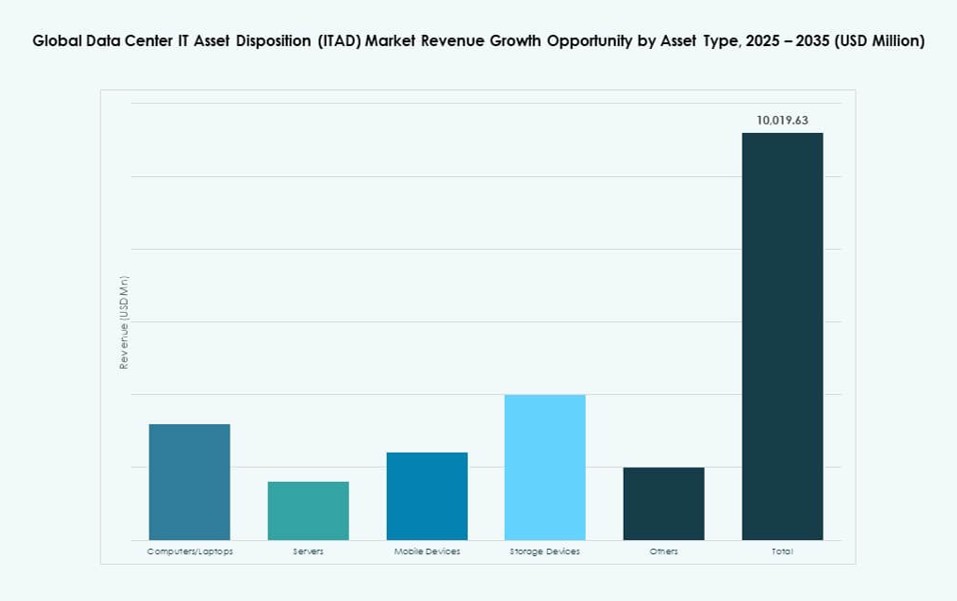

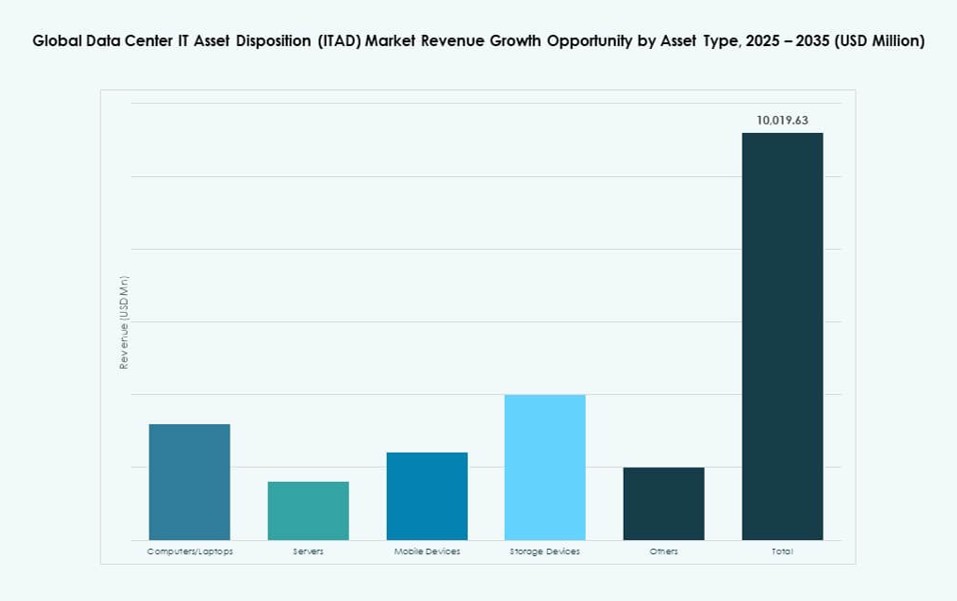

By Asset Type

The Global Data Center IT Asset Disposition (ITAD) Market shows strong demand across servers and storage devices, which hold the largest share due to frequent refresh cycles. Servers dominate asset volumes as hyperscale operators upgrade performance. Storage devices follow due to data security requirements. Computers and laptops contribute steadily from enterprise environments. Mobile devices form a smaller but growing segment. High residual value drives remarketing activity. Secure destruction needs support professional handling. Asset complexity shapes service pricing.

- For instance, Microsoft is advancing liquid and chip-level cooling technologies across Azure data centers to improve energy and water efficiency. Its sustainable infrastructure initiatives focus on reducing cooling-related resource use while supporting high-performance workloads.

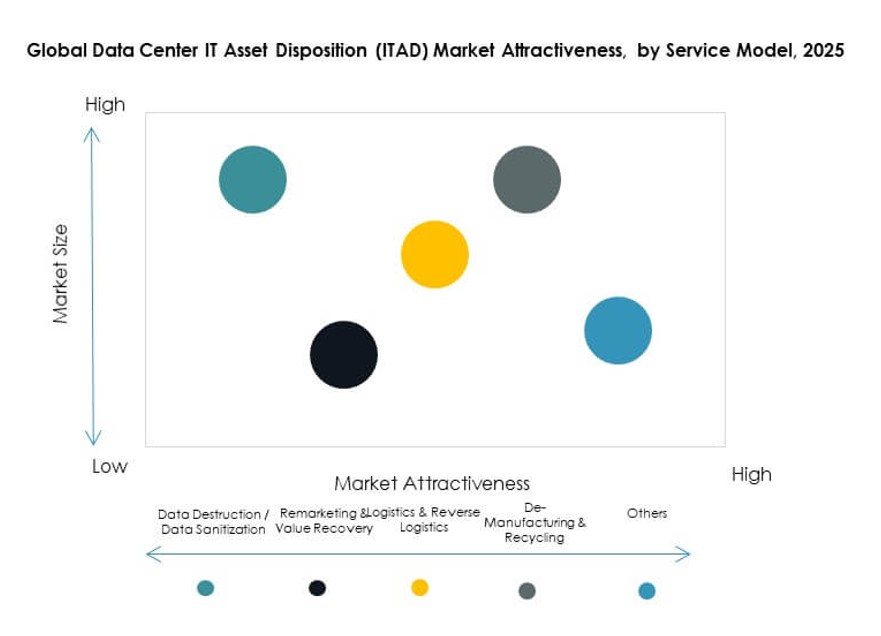

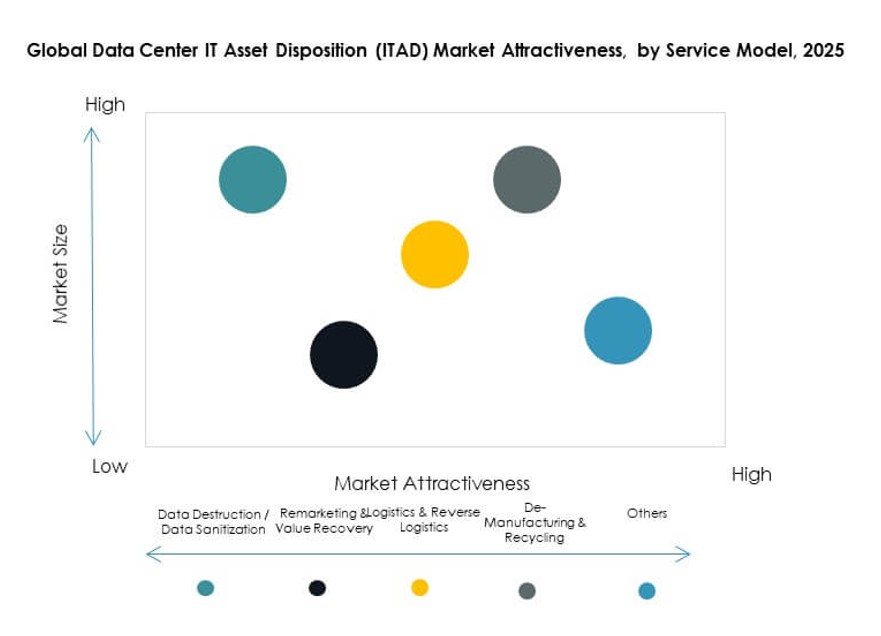

By Service Model

Data destruction and sanitization lead service adoption due to compliance needs. The Global Data Center IT Asset Disposition (ITAD) Market relies on certified wiping and shredding services. Remarketing and value recovery hold a strong secondary share. Logistics and reverse logistics support distributed data center estates. De-manufacturing and recycling address sustainability mandates. Integrated service bundles gain preference. Clients favor providers with end-to-end capabilities. Service diversity drives contract depth.

By Lifecycle Stage

Decommissioning accounts for the largest lifecycle stage share. The Global Data Center IT Asset Disposition (ITAD) Market supports structured asset retirement programs. Recycling follows due to environmental rules. Data sanitization remains critical across all stages. Inventory management improves tracking accuracy. Redeployment supports internal reuse strategies. Lifecycle integration reduces operational risk. Enterprises seek continuous visibility. Lifecycle services enhance governance.

- For instance, AWS has publicly shared its transition to custom Graviton3 processors across data centers to improve performance and energy efficiency, supporting broader infrastructure optimization efforts without specific decommission figures.

By Disposition Method

Resale and remarketing dominate disposition methods due to value recovery. The Global Data Center IT Asset Disposition (ITAD) Market benefits from strong secondary demand. Recycling addresses non-reusable assets. Donation plays a limited but strategic role. Scrapping applies to obsolete equipment. Method choice depends on asset condition. Compliance influences final disposition paths. Providers optimize returns through method mix.

By Regulatory Compliance

Data protection regulations drive the largest compliance segment. The Global Data Center IT Asset Disposition (ITAD) Market aligns services with privacy laws. Environmental compliance follows closely. Industry standards guide process design. Destruction certificates support audit needs. Compliance breadth influences vendor selection. Multinational clients demand coverage across regimes. Regulatory expertise strengthens market trust.

Regional Insights:

North America And Europe Market Leadership

North America holds around 38% market share due to large cloud operators. The Global Data Center IT Asset Disposition (ITAD) Market benefits from strict data laws in the U.S. Europe accounts for nearly 28% share driven by sustainability directives. Enterprises prioritize certified recycling and reporting. Mature data center ecosystems support stable demand. Strong regulatory enforcement shapes service standards. These regions favor integrated providers.

Asia Pacific Growth And Emerging Market Expansion

Asia Pacific represents about 22% share and shows rapid growth. The Global Data Center IT Asset Disposition (ITAD) Market expands with new data center builds. China, India, and Southeast Asia lead regional demand. Local regulations evolve toward stricter enforcement. Enterprises seek global-standard service partners. Rising digital transformation fuels asset turnover. Growth remains strong across developing economies.

Latin America, Middle East, And Africa Outlook

Latin America holds roughly 6% share driven by Brazil. The Global Data Center IT Asset Disposition (ITAD) Market grows with regional cloud investments. Middle East accounts for about 4% share supported by hyperscale projects. Africa represents nearly 2% share with early-stage adoption. Regulatory frameworks remain uneven. International providers partner with local firms. Long-term growth potential remains high.

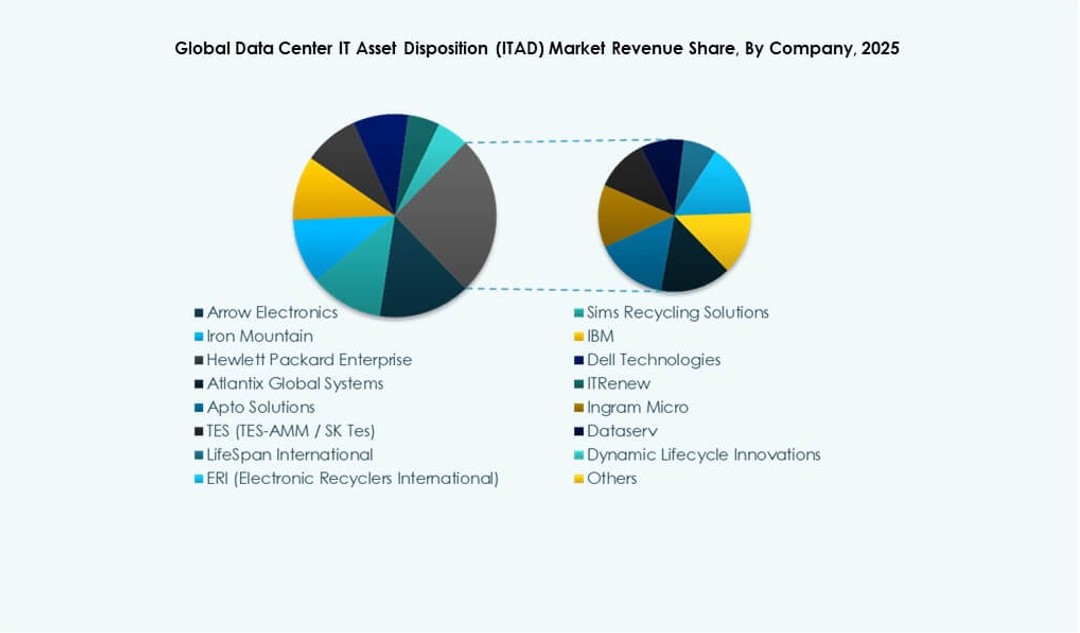

Competitive Insights:

- Arrow Electronics

- Sims Recycling Solutions

- Iron Mountain

- IBM

- Hewlett Packard Enterprise

- Dell Technologies

- ITRenew

- Apto Solutions

- Ingram Micro

- TES (TES-AMM / SK Tes)

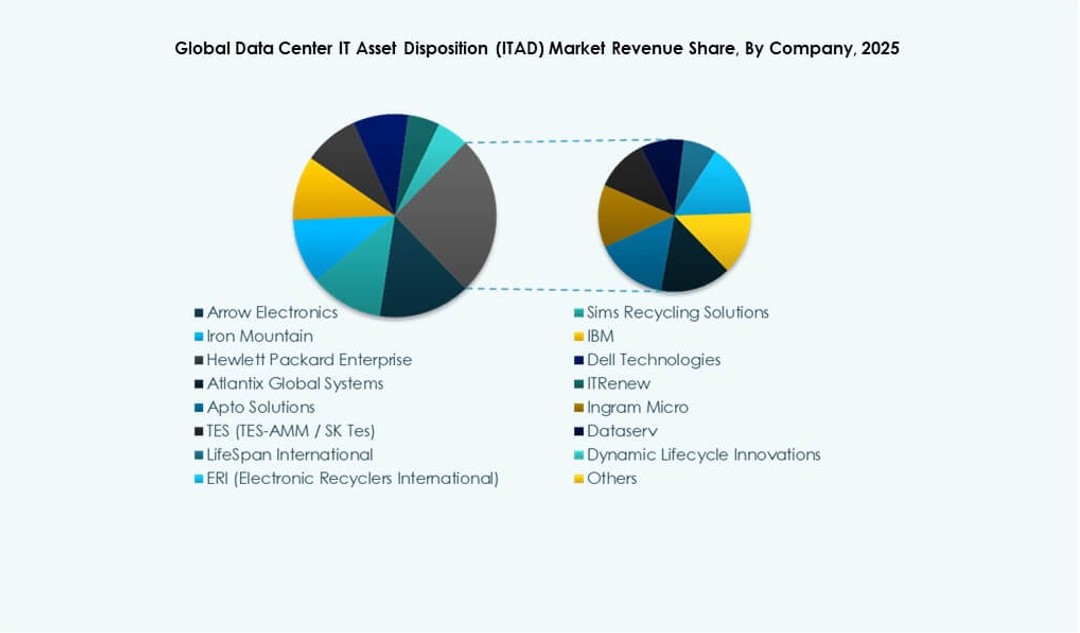

The competitive landscape of the Global Data Center IT Asset Disposition (ITAD) Market features a mix of global IT service providers, OEMs, and specialized recyclers. Leading companies focus on certified data destruction, sustainability reporting, and remarketing value recovery. Arrow Electronics and Sims Recycling Solutions maintain strong global logistics and compliance networks. Dell Technologies and Hewlett Packard Enterprise offer integrated lifecycle services aligned with hardware transitions. Firms like Iron Mountain and ITRenew deliver audit-ready sanitization tools to meet rising regulatory demands. Strategic alliances with hyperscale clients and cloud operators shape long-term contract portfolios. It continues to attract investors seeking ESG-aligned service models with predictable asset flow. Competitive strength hinges on secure logistics, service automation, geographic coverage, and regulatory certifications.

Recent Developments:

- In July 2025, Arrow Electronics launched its Engineering Solutions Center in Bangalore, India, to support tech innovation including edge computing relevant to data center ecosystems, though not exclusively ITAD-focused. The center aids manufacturers in adopting advanced technologies for faster product deployment.

- In July 2025, Paladin EnviroTech launched as a new ITAD firm backed by SER Capital Partners, acquiring Integrated Recycling Technologies in Minnesota and TechSmart International in Florida to expand data center asset disposition services globally.

- In January 2024, Iron Mountain Inc. acquired Regency Technologies to enhance its asset lifecycle management capabilities, particularly in IT asset disposition (ITAD) and electronics recycling for data centers. This move strengthens Iron Mountain’s position in sustainable IT asset recovery and remarketing.