Executive summary:

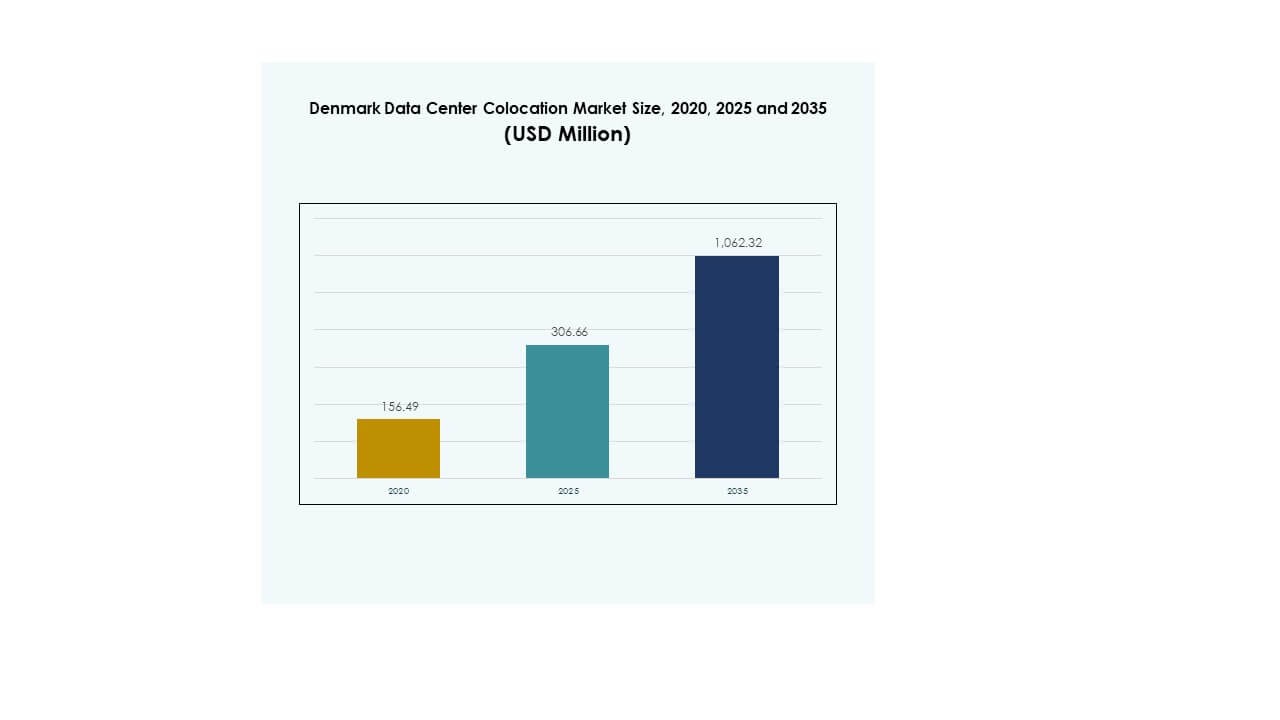

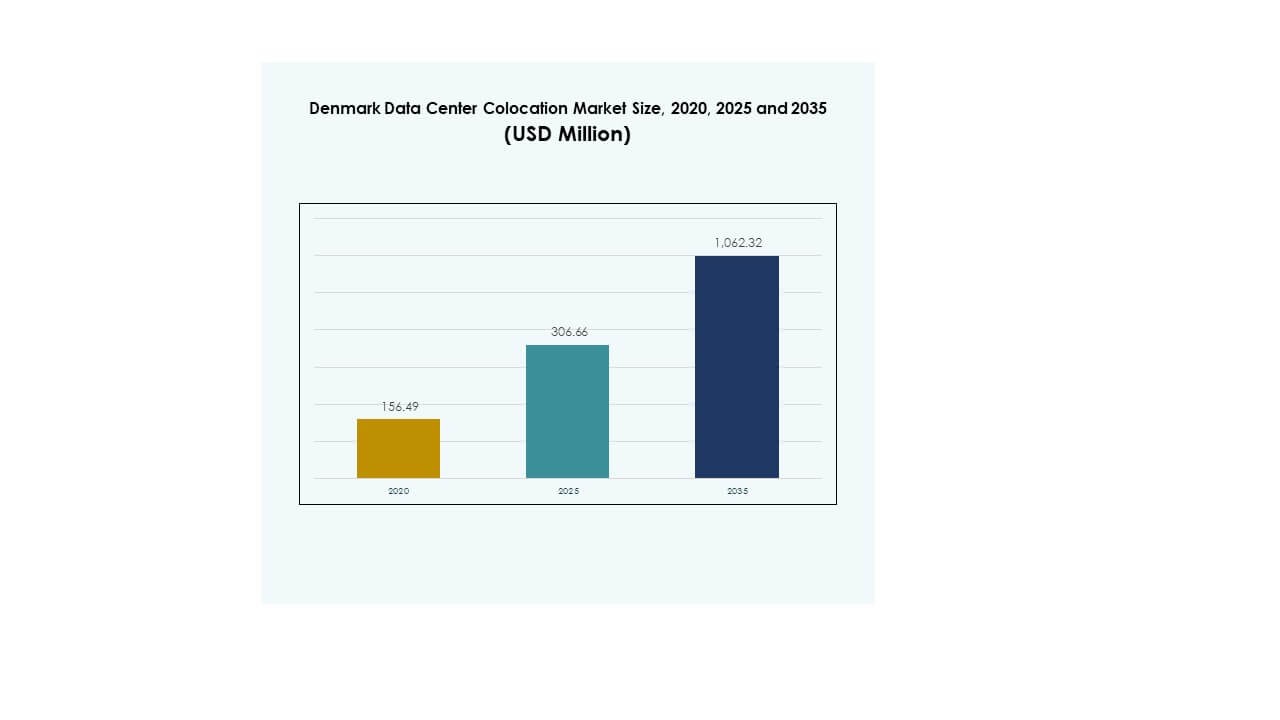

The Denmark Data Center Colocation Market size was valued at USD 156.49 million in 2020 to USD 306.66 million in 2025 and is anticipated to reach USD 1,062.32 million by 2035, at a CAGR of 13.17% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Denmark Data Center Colocation Market Size 2025 |

USD 306.66 Million |

| Denmark Data Center Colocation Market, CAGR |

13.17% |

| Denmark Data Center Colocation Market Size 2035 |

USD 1,062.32 Million |

Technology adoption, AI-driven infrastructure management, and sustainable energy integration are shaping the growth trajectory of the Denmark Data Center Colocation Market. Enterprises are focusing on scalable infrastructure to support advanced workloads and secure data operations. Rising demand for edge computing and interconnection services is attracting large global operators. This shift enhances operational flexibility, boosts investor confidence, and positions Denmark as a preferred location for critical IT infrastructure deployment.

The Capital Region leads the Denmark Data Center Colocation Market due to strong connectivity, power availability, and proximity to major enterprise clients. Southern Denmark is emerging as a key hub supported by renewable energy resources and strategic cable landing points. Central and Northern Denmark are gaining momentum through edge deployments and modular colocation facilities. This balanced regional distribution is creating a strong, interconnected ecosystem supporting diverse colocation demands.

Market Drivers

Rising Demand for Scalable Digital Infrastructure Supporting AI, Cloud, and High-Performance Workloads

The Denmark Data Center Colocation Market is expanding due to rising demand for scalable digital infrastructure. Enterprises require advanced facilities to support cloud computing, artificial intelligence, and real-time data processing. It enables companies to reduce capital expenditure while improving operational efficiency. Growing use of colocation services enhances data security and network resilience. Businesses are adopting hybrid cloud strategies to optimize workloads. Regulatory clarity and government incentives strengthen investment confidence. Denmark’s renewable energy supply enhances sustainability appeal. Strong connectivity to key European hubs drives rapid industry growth.

Strategic Role of Green Energy Integration in Strengthening Global Investment Confidence

Green energy integration drives strong investment inflows into colocation infrastructure. Global hyperscale operators prefer sustainable data center locations for meeting emission reduction targets. It improves power efficiency and lowers long-term operational costs. Denmark’s large renewable power capacity provides a reliable energy source for large-scale deployments. The country’s favorable regulatory framework attracts technology-driven industries. Low carbon intensity aligns with global corporate sustainability goals. Enterprises see the location as an anchor for European expansion. This sustainable approach increases competitiveness in international markets.

- For instance, atNorth announced its DEN02 mega campus in Varde, Jutland, designed with 250 MW capacity and direct renewable energy integration. The site connects to onshore wind and reuses excess heat for district heating, setting a strong benchmark for sustainable large-scale colocation infrastructure in Northern Europe.

Accelerating Edge Deployment and Network Interconnectivity for Enhanced Latency and Performance

Rising edge deployment and network interconnectivity transform the operational landscape of colocation. It enables service providers to deliver lower latency and faster processing for critical applications. Advanced fiber networks support stronger regional and international traffic flow. Distributed edge facilities improve data delivery for IoT, 5G, and AI workloads. Enterprises adopt these solutions to meet the growing demands of digital transformation. Colocation providers are scaling facilities to ensure better capacity utilization. This shift strengthens network redundancy. Businesses gain improved agility and performance reliability.

- For instance, Penta Infra acquired a new data center site in Copenhagen in September 2024, with plans to deliver 20 MW of IT capacity. The project strengthens Denmark’s colocation footprint and supports low-latency infrastructure for enterprise and IoT workloads.

Growing Focus on Digital Sovereignty and Regulatory Compliance for Data Protection

Digital sovereignty is becoming a core driver in data center investments. Organizations prioritize colocation services that comply with strict EU data protection regulations. It supports secure data residency and strengthens trust among global clients. Enhanced cybersecurity frameworks mitigate risks from increasing digital threats. Regulatory clarity encourages multinational companies to expand operations. Colocation infrastructure provides better visibility and control over sensitive data. Governments view this sector as critical to national digital strategies. This emphasis enhances investor confidence and attracts strategic partnerships.

Market Trends

Rapid Expansion of AI-Optimized and High-Density Colocation Facilities

AI workloads are influencing how colocation facilities are built and managed. The Denmark Data Center Colocation Market is witnessing strong demand for high-density racks and advanced power distribution. It supports next-generation applications like large language models, analytics, and real-time computing. Operators invest in modular power systems to increase energy efficiency. Liquid cooling and intelligent thermal management systems are being deployed at scale. These upgrades ensure higher compute performance. AI-focused colocation design improves power utilization. This trend is shaping the next phase of infrastructure innovation.

Integration of Smart Automation and Digital Twin Platforms for Operational Excellence

Automation is driving operational transformation within colocation environments. Intelligent monitoring systems and digital twin platforms enable predictive maintenance and real-time visibility. It improves efficiency, reduces downtime, and extends asset life. Operators use AI-enabled platforms for capacity planning and fault detection. Integration of smart tools enhances cost optimization and service reliability. Data-driven operations improve service level agreements with enterprise customers. This shift reflects a broader industry move toward intelligent infrastructure. Facilities are becoming more resilient and adaptable to demand fluctuations.

Strengthening Interconnection Ecosystems and Carrier-Neutral Facilities to Support Ecosystem Expansion

The expansion of carrier-neutral facilities drives ecosystem collaboration across the region. It allows enterprises and service providers to exchange data more efficiently and securely. The Denmark Data Center Colocation Market benefits from multiple international connectivity routes. It strengthens links to European and global internet exchange points. Businesses leverage this interconnection fabric to enhance service delivery and expand reach. Neutral colocation hubs enable rapid scaling without heavy capital costs. This model improves flexibility for enterprises. Connectivity growth is driving stronger market integration.

Deployment of Advanced Cooling and Energy Efficiency Solutions to Support Sustainability Goals

Sustainability is shaping technology adoption in colocation infrastructure. Operators deploy advanced liquid cooling systems, smart power usage optimization, and efficient airflow designs. It supports higher compute loads while minimizing energy waste. Use of renewable power enhances operational efficiency and lowers emissions. Enterprises value energy-efficient colocation as part of their ESG strategies. Denmark’s clean energy infrastructure accelerates this trend. Continuous innovation improves performance while meeting regulatory standards. Sustainability-focused technology integration is becoming a major competitive differentiator.

Market Challenges

Rising Energy Costs and Supply Constraints Affecting Long-Term Operational Sustainability

Energy cost volatility creates major operational challenges for colocation operators. The Denmark Data Center Colocation Market faces risks from fluctuating electricity prices and grid pressure. It limits pricing flexibility for operators managing large power requirements. High energy use intensifies cost sensitivity, especially for hyperscale deployments. Capacity expansion requires guaranteed access to stable and affordable power. Renewable integration helps but does not eliminate exposure to grid dynamics. Operators need advanced energy procurement strategies. Balancing growth with cost efficiency becomes increasingly complex. This challenge influences long-term investment decisions.

Growing Infrastructure Complexity and Skills Gap Slowing Technology Deployment

Increasing infrastructure complexity creates difficulties in scaling operations efficiently. Integration of AI systems, edge deployments, and automation tools requires advanced technical expertise. The Denmark Data Center Colocation Market faces a shortage of specialized talent in network, power, and cooling domains. It slows technology deployment and increases operational costs. Managing hybrid environments with high-density workloads adds another layer of difficulty. Operators must invest heavily in training and workforce development. Failure to address this gap could delay critical infrastructure projects. Industry players are rethinking workforce strategies to sustain growth.

Market Opportunities

Rising Foreign Investments and Hyperscale Expansion Creating Strong Market Entry Potential

Growing hyperscale activity is opening new investment avenues. The Denmark Data Center Colocation Market benefits from its strategic location and renewable energy advantage. It attracts international cloud providers seeking sustainable expansion. High-speed connectivity makes Denmark a preferred hub for cross-border data flows. Global investors see strong returns in advanced colocation facilities. Government support enhances market entry confidence. Rising capacity demand creates space for new partnerships. This investment flow strengthens the overall ecosystem.

Growing Edge and AI-Driven Workloads Supporting Specialized Facility Development

Edge computing and AI adoption create opportunities for building specialized colocation sites. The Denmark Data Center Colocation Market is positioned to lead in low-latency deployments. Enterprises prefer locations that offer both interconnection and energy efficiency. AI-ready colocation supports next-generation applications across multiple industries. Regional players can collaborate with hyperscalers to expand capabilities. Customized power and cooling designs support complex workload demands. This creates new revenue channels. Advanced facility design is becoming a key strategic advantage.

Market Segmentation

By Type

Retail colocation dominates the Denmark Data Center Colocation Market, holding a significant market share due to flexible deployment models and cost control benefits. It supports SMEs and enterprises needing scalable and secure infrastructure. Wholesale colocation is expanding due to hyperscale investments, while hybrid cloud colocation is gaining traction for its workload flexibility. Strong demand for integrated infrastructure and connectivity is driving this segment mix. Retail facilities remain the preferred option for businesses seeking rapid deployment and better control.

By Tier Level

Tier 3 facilities dominate the Denmark Data Center Colocation Market with a strong market share driven by high uptime and reliability. These facilities balance cost and operational efficiency, making them attractive to both enterprises and cloud providers. Tier 4 is growing in demand due to advanced fault tolerance requirements. Tier 1 and Tier 2 maintain niche roles for smaller deployments. Strong focus on uptime and power redundancy drives Tier 3 leadership. Enterprises prioritize Tier 3 for mission-critical operations.

By Enterprise Size

Large enterprises lead the Denmark Data Center Colocation Market, supported by strong digital transformation strategies. They prefer colocation for data control, regulatory compliance, and security. SMEs are also adopting colocation to avoid heavy capital investment and gain flexibility. Large players dominate capacity usage due to hyperscale workloads and AI adoption. SMEs fuel steady growth through demand for modular services. Tiered service offerings cater to both segments effectively, maintaining a balanced ecosystem between scale and flexibility.

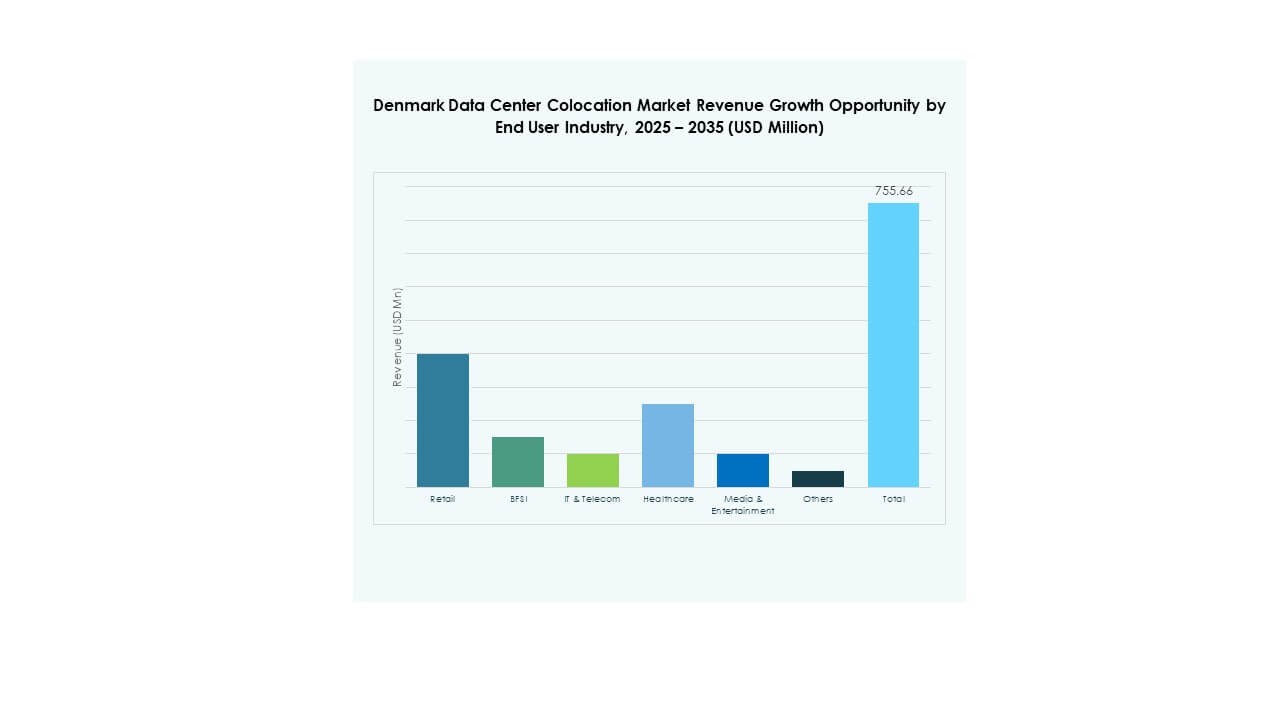

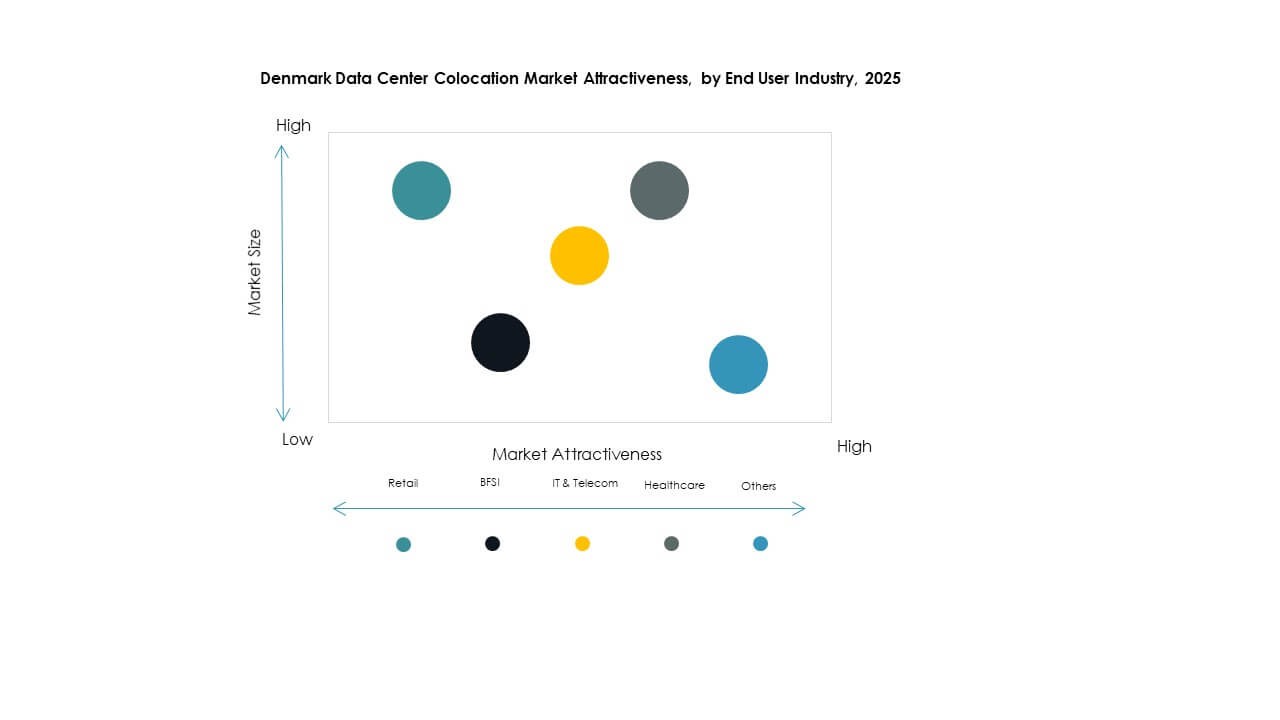

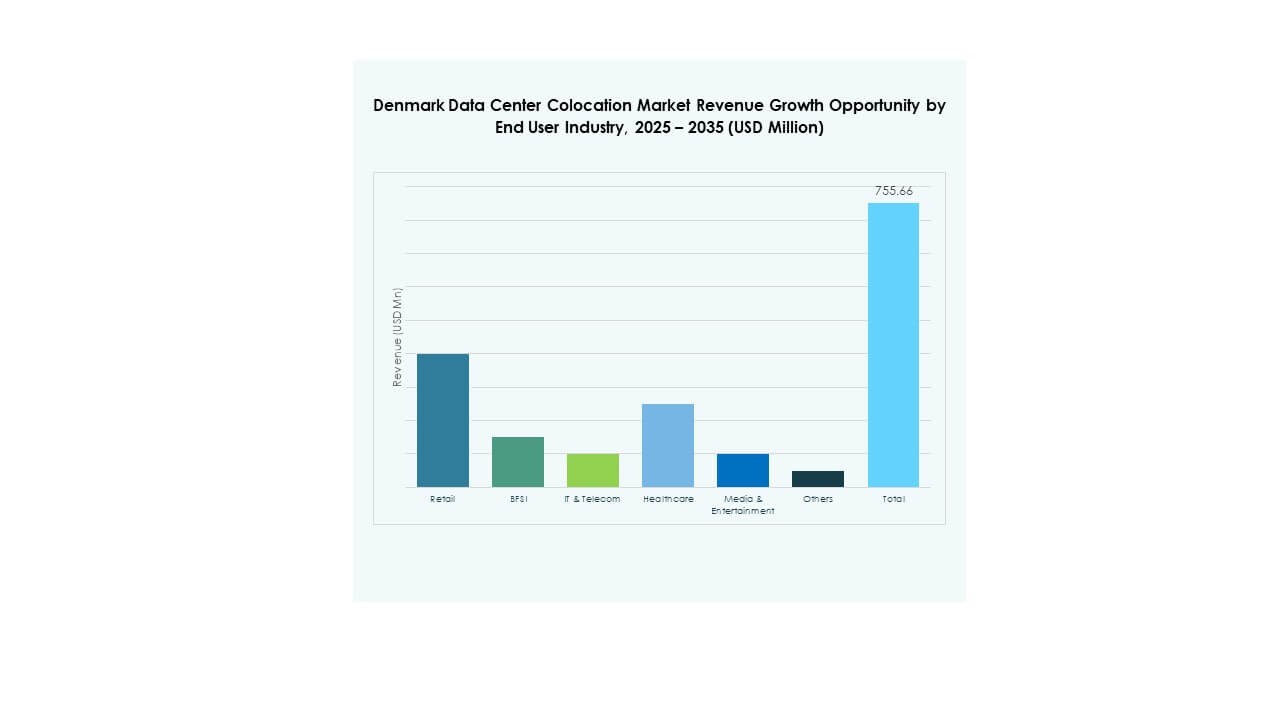

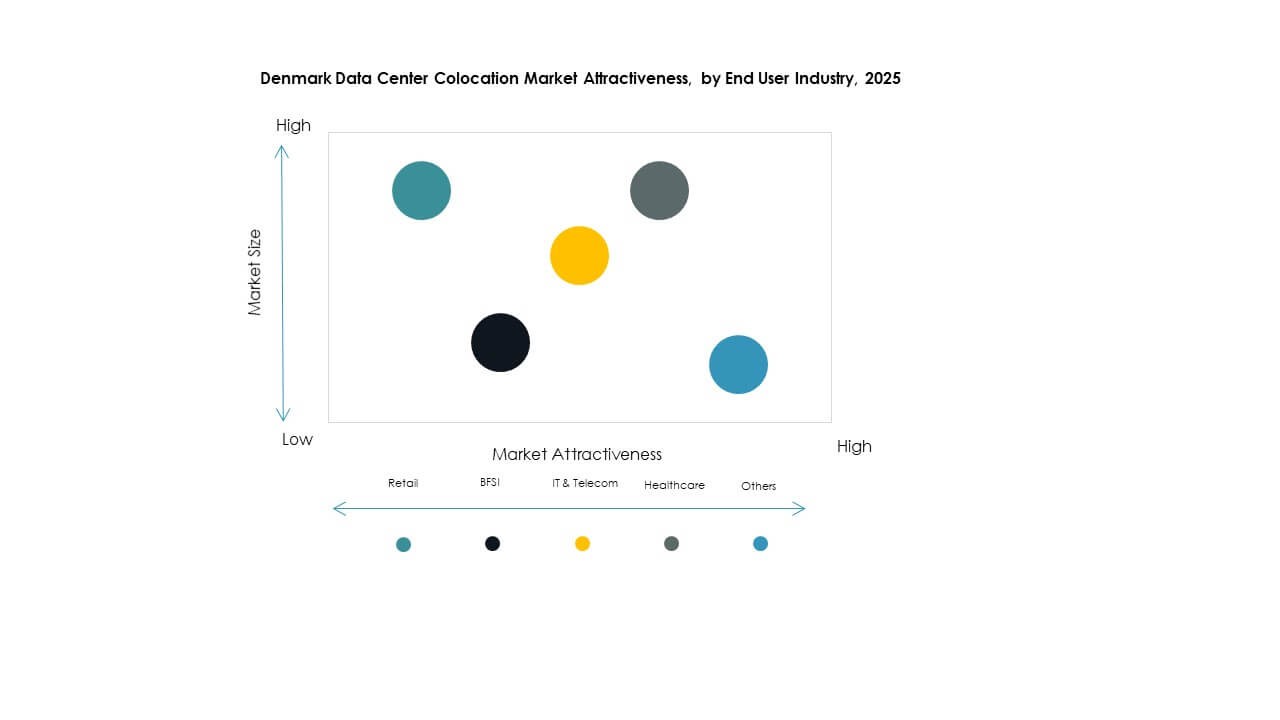

By End User Industry

IT & Telecom dominates the Denmark Data Center Colocation Market with the highest share, supported by rapid data traffic growth and 5G adoption. BFSI remains a strong contributor, focusing on compliance and secure infrastructure. Media and entertainment are expanding rapidly with streaming and content delivery. Healthcare and retail show rising demand for secure and scalable storage. The sector mix reflects strong digitalization across industries. IT & Telecom remains the anchor segment for colocation operators in the region.

Regional Insights

Capital Region Dominating Market Share with Strong Infrastructure Backbone and Strategic Connectivity

The Capital Region holds 41% of the Denmark Data Center Colocation Market share, driven by superior connectivity and energy infrastructure. It hosts the largest concentration of data center facilities. Strong fiber backbone and direct links to major European hubs strengthen its position. Proximity to Copenhagen enhances access to enterprise clients and hyperscale operators. Reliable power and renewable energy availability support growth. The region attracts both domestic and foreign investments. It continues to serve as the strategic anchor for data traffic flows.

- For instance, GlobalConnect is in the process of expanding its largest data center in Taastrup (Greater Copenhagen), as officially confirmed by its July 2025 corporate announcement and municipal partnership. The company operates a 244,000 km pan-Nordic fiber network and manages 17 data center sites totaling 35,000 sqm in Denmark and neighboring countries. These expansions enhance direct enterprise connectivity in Copenhagen and strengthen the city’s position as Denmark’s leading colocation hub.

Southern Denmark Region Emerging as a High-Growth Zone with Renewable Energy Strength

Southern Denmark holds 34% of the market share, supported by growing renewable energy projects and industrial investments. It benefits from strategic access to European subsea cable systems. Expanding green power generation makes it an attractive destination for hyperscale deployments. Local infrastructure projects are increasing regional capacity. Businesses view this region as a cost-effective alternative to the capital area. Government support for sustainable energy development strengthens its market position. Southern Denmark is evolving into a key colocation hub.

- For instance, GlobalConnect announced in July 2025 the expansion of its largest data center in Taastrup (Greater Copenhagen) through a municipal partnership. The company operates a 244,000 km pan-Nordic fiber network and manages 17 data center sites totaling 35,000 sqm, reinforcing Copenhagen’s position as Denmark’s primary colocation hub.

Central and Northern Denmark Gaining Momentum with Edge and Modular Facility Deployments

Central and Northern Denmark hold a combined 25% market share. These regions are witnessing rising interest in edge and modular colocation facilities. Growing regional industries create new demand clusters. Enhanced fiber connectivity supports distributed workloads efficiently. Lower operational costs compared to the capital region drive investor interest. These regions offer strong expansion potential for enterprises and colocation operators. Increasing edge deployments make them strategic growth zones. The regional spread reflects a balanced and sustainable market evolution.

Competitive Insights:

- GlobalConnect

- 3data

- CyrusOne

- Green Mountain

- Amazon Web Services (AWS)

- Google Cloud

- China Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The Denmark Data Center Colocation Market features strong competition between global hyperscale providers and regional operators. It is characterized by large-scale infrastructure investments, advanced connectivity, and sustainability-led differentiation. GlobalConnect and Equinix lead with extensive colocation footprints and strong interconnection ecosystems. Hyperscale players like AWS and Google Cloud drive capacity demand through enterprise cloud migration. Green Mountain leverages renewable energy to strengthen its competitive edge. Digital Realty and CyrusOne expand through modular builds and strategic partnerships. Regional players focus on high-efficiency operations and carrier-neutral facilities. Competitive strategies center on network expansion, energy efficiency, and value-added services to attract hyperscale and enterprise clients.

Recent Developments:

- In March 2025, GlobalConnect invested in a new AI-driven monitoring service platform from ScienceLogic to strengthen its Network Operations Center. The platform will unify operations, reduce downtime, and provide real-time insights into network and IT issues.

- In June 2025, GlobalConnect joined the Danish Quantum Community to support development of quantum-safe infrastructure, including participation in a 200 km quantum-secured fiber stretch between Copenhagen and Odense.