Executive summary:

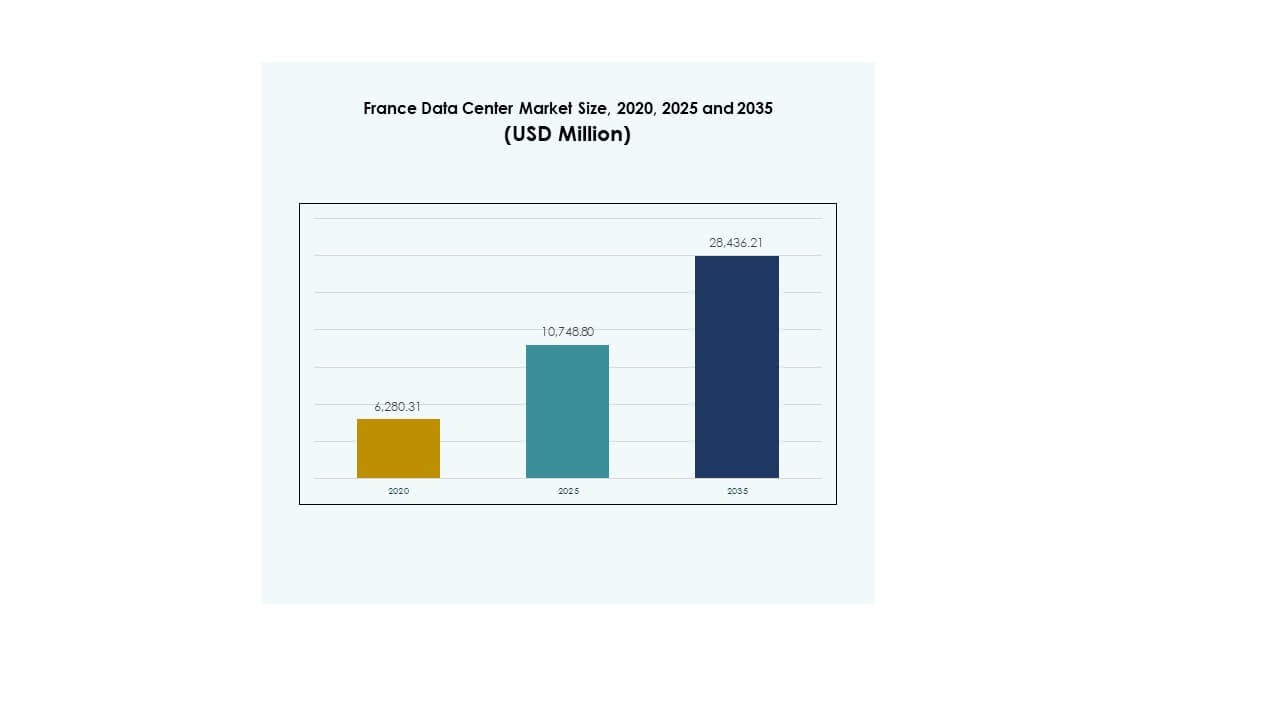

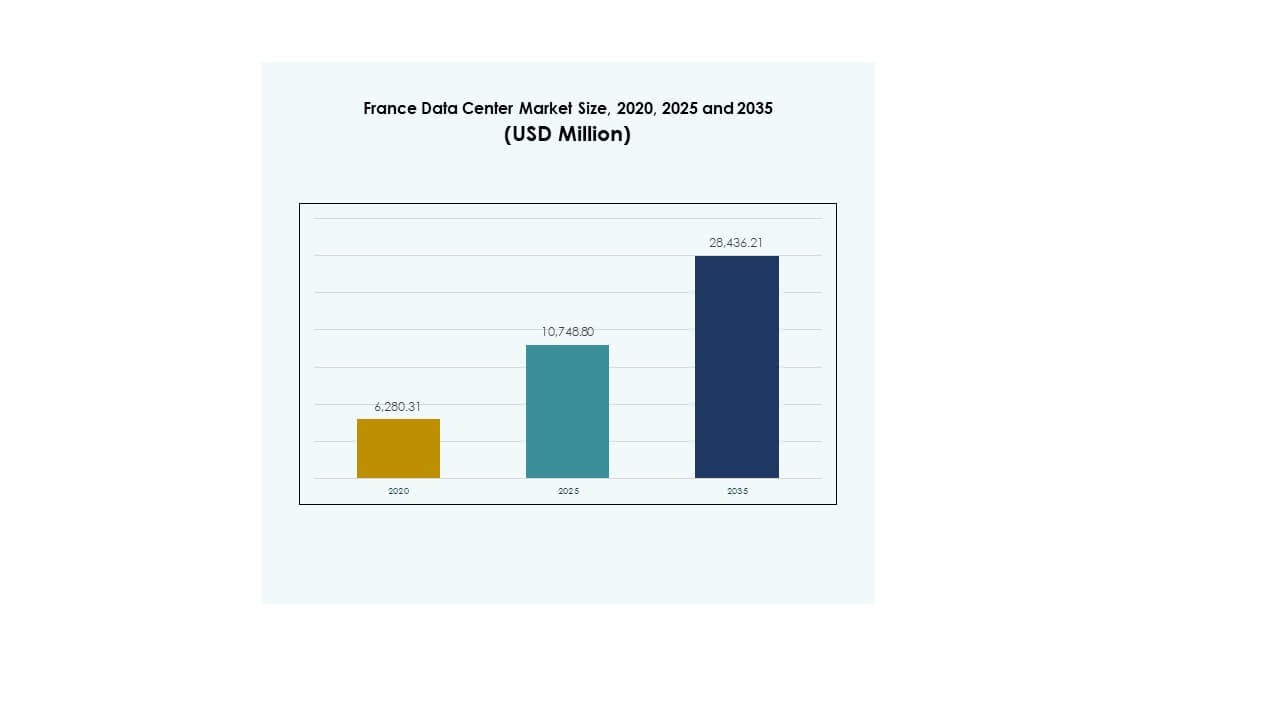

The France Data Center Market size was valued at USD 6,280.31 million in 2020 to USD 10,748.80 million in 2025 and is anticipated to reach USD 28,436.21 million by 2035, at a CAGR of 10.16% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| France Data Center Market Size 2025 |

USD 10,748.80 Million |

| France Data Center Market, CAGR |

10.16% |

| France Data Center Market Size 2035 |

USD 28,436.21 Million |

Growth in the France Data Center Market is fueled by rapid cloud adoption, rising demand for AI-ready infrastructure, and innovation in energy-efficient operations. Enterprises focus on automation, advanced cooling systems, and hybrid IT models to optimize costs and performance. Investors prioritize France due to its regulatory stability, strong connectivity, and role as a strategic European hub, making the market vital for long-term digital transformation initiatives.

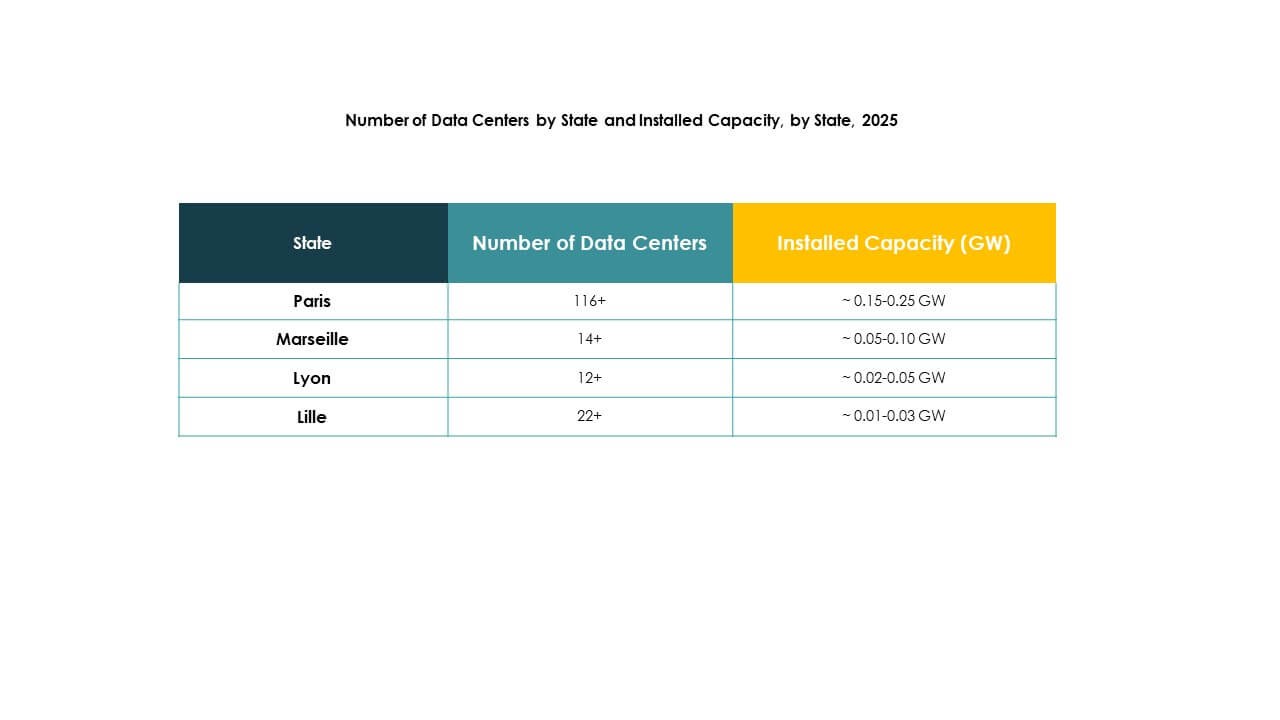

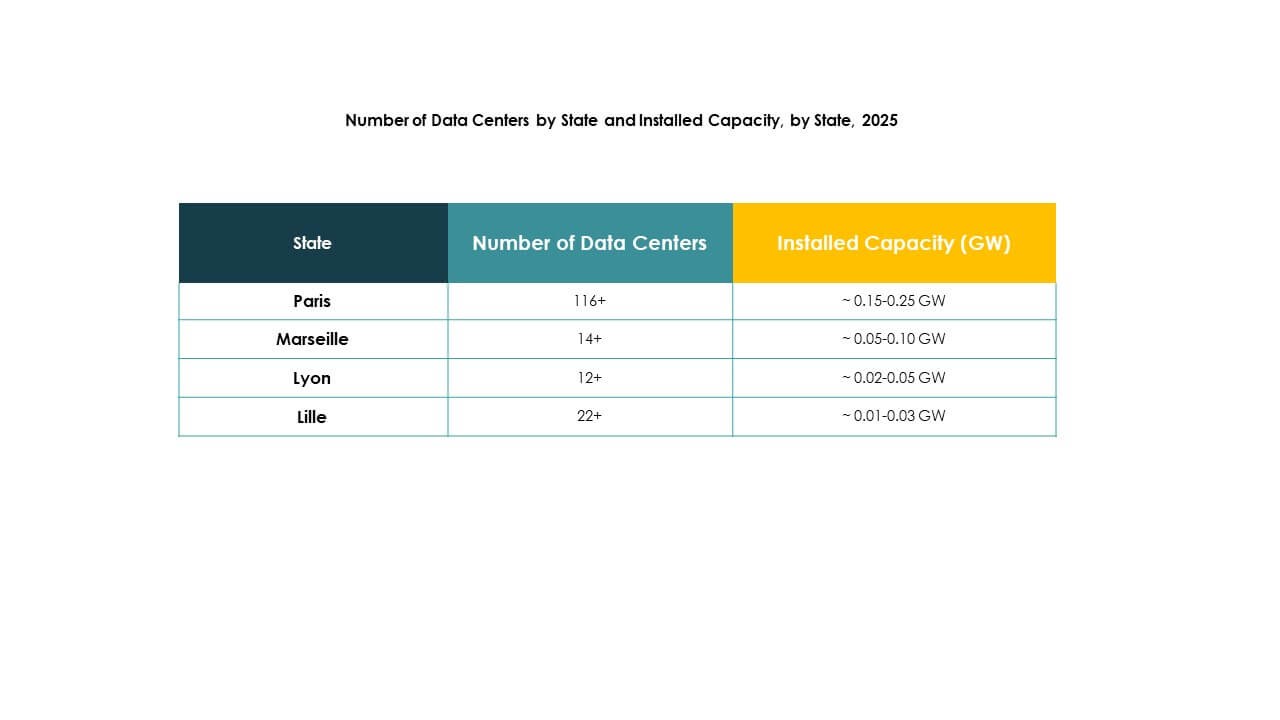

Paris leads the France Data Center Market, benefiting from its global connectivity and concentration of enterprises, while Marseille emerges as a critical gateway due to submarine cable systems linking Europe, Africa, and Asia. Secondary cities such as Lyon and

Lille gain momentum with infrastructure investments and edge deployments, supporting regional expansion. This geographic diversification enhances France’s position as both a domestic leader and international connectivity hub.

Market Drivers

Rising Demand for Digital Infrastructure to Support Enterprise and Cloud Expansion

The France Data Center Market is gaining momentum with strong demand from enterprise and cloud operators. Businesses seek scalable, secure, and resilient facilities to handle AI, IoT, and big data workloads. Cloud adoption accelerates as companies shift from legacy IT toward hybrid and cloud-native models. The market plays a central role in supporting financial services, telecom, and e-commerce digitalization. Innovation in modular construction and energy efficiency drives investor interest. Enterprises view it as a long-term infrastructure backbone. Hyperscale players expand presence to meet growing enterprise demand. This demand reinforces France’s strategic importance as a European digital hub.

Technological Innovations and Integration of Energy-Efficient Infrastructure Solutions

The France Data Center Market benefits from rapid adoption of advanced cooling, automation, and renewable integration. Operators focus on achieving lower power usage effectiveness through green technologies and optimized designs. AI-powered monitoring systems improve energy distribution and workload efficiency. Smart grids and renewable integration secure France’s role as a leader in sustainable data center operations. Enterprises invest in intelligent automation to streamline IT processes. These efforts position facilities as reliable and eco-resilient assets. For investors, technology adoption translates into higher returns and reduced operational risks. Energy efficiency further enhances global competitiveness.

- For instance, Equinix PA10 in Saint-Denis, Paris, debuted in 2024 as France’s first data center to export surplus heat to the Paris Olympic Village and Aquatic Centre, maintaining the competition pool at 28°C while being powered entirely by renewable energy.

Strategic Importance of Colocation and Hyperscale Facilities for Global Enterprises

The France Data Center Market attracts hyperscale cloud providers and colocation leaders due to strong connectivity and regulatory support. Colocation growth stems from SMEs and enterprises outsourcing IT to reduce costs and improve agility. Hyperscale expansion ensures capacity for global players entering European markets. Data centers in Paris strengthen links with London, Frankfurt, and Amsterdam, reinforcing the FLAP market dominance. Global enterprises view France as a gateway into Europe and Africa. Investors prioritize large-scale facilities with strong fiber connectivity. Edge and modular centers provide complementary support. This shift underscores the market’s centrality to international business strategies.

Shift Toward Hybrid IT Architectures and Growing Enterprise Digital Transformation Needs

The France Data Center Market witnesses rising adoption of hybrid IT models combining on-premises, cloud, and edge. Enterprises implement hybrid systems to manage sensitive workloads while optimizing cost efficiency. Demand for private cloud solutions grows alongside public cloud usage. Industries including healthcare, finance, and government emphasize compliance and secure data management. Digital transformation accelerates adoption of AI, automation, and IoT, creating demand for scalable centers. Hybrid solutions also allow faster disaster recovery and resilience planning. Businesses view it as a competitive advantage to secure future-ready IT ecosystems. Hybrid infrastructure adoption makes France a leading hub for innovation.

- For instance, in November 2023, OVHcloud opened its third SecNumCloud-certified data center in Gravelines and introduced a new Paris region with three availability zones spaced 10–30 km apart, enhancing resiliency, disaster recovery, and compliance for critical workloads.

Market Trends

Expansion of Edge and Modular Data Centers to Support Low-Latency Applications

The France Data Center Market sees a rise in edge and modular deployments to meet localized needs. Enterprises require low-latency solutions for AI, gaming, and real-time analytics. Edge infrastructure supports 5G rollouts, autonomous mobility, and IoT services. Modular facilities enable rapid deployment in urban and semi-urban areas. This trend reshapes how enterprises plan workloads, focusing on distributed infrastructure. Investors back modular solutions for quick returns. Businesses prioritize edge to improve user experience and system efficiency. The trend positions France as a leader in emerging low-latency ecosystems.

Focus on Renewable Energy Adoption to Align with Sustainability Targets

The France Data Center Market demonstrates a strong push toward renewable energy integration in operations. Operators increasingly partner with local utilities to secure clean power purchase agreements. Renewable-based operations align with European Union decarbonization goals. Energy mix diversification includes solar, wind, and hydropower resources. Data center operators integrate innovative battery storage to balance loads. Green infrastructure adoption attracts multinational enterprises with sustainability commitments. Facilities with strong renewable credentials gain competitive advantage in client acquisition. This shift accelerates the transition toward greener digital ecosystems in France.

Increased Adoption of AI and Automation for Data Center Operations

The France Data Center Market experiences growing integration of AI tools for predictive maintenance and resource optimization. AI enhances cooling efficiency, reduces downtime, and increases workload management. Automation supports predictive analytics and improves SLA performance. Enterprises leverage machine learning to manage cybersecurity risks. Investors view AI-led optimization as a driver of long-term cost savings. Automated orchestration simplifies scaling workloads across hybrid infrastructures. Businesses adopt intelligent systems for proactive issue resolution. These advancements transform how facilities operate in a competitive landscape.

Rising Importance of Connectivity Ecosystems and Interconnection Services

The France Data Center Market evolves with a growing emphasis on interconnection hubs. Paris and Marseille act as central gateways linking Europe, Africa, and the Middle East. Subsea cables enhance international connectivity, making France attractive to hyperscale providers. Enterprises prioritize colocation sites with strong interconnection ecosystems. Telecom operators expand partnerships to extend reach. Investors fund fiber network expansions to support cloud adoption. Strong connectivity reinforces regional competitiveness. This interconnection trend elevates France as a global data routing hub.

Market Challenges

High Energy Consumption and Pressure to Meet Sustainability Standards

The France Data Center Market faces growing concerns around rising electricity demand and sustainability compliance. Operators must balance performance needs with EU energy efficiency regulations. Energy-intensive cooling systems create high operational costs. Businesses face pressure to adopt renewable solutions while ensuring continuous uptime. Infrastructure upgrades demand significant capital investment. Sustainability audits add complexity for operators managing multinational clients. It becomes critical to align with carbon-neutral targets to remain competitive. These challenges increase barriers for new entrants with limited capital reserves.

Rising Regulatory Complexity and Data Sovereignty Requirements

The France Data Center Market encounters hurdles due to strict data protection laws and compliance frameworks. GDPR and local sovereignty policies require operators to manage sensitive workloads within national boundaries. This creates challenges for global providers aiming for cross-border service models. Security certifications and audits add cost burdens. Complex approval processes slow deployment timelines for hyperscale and colocation projects. Enterprises demand high standards of compliance, increasing operational challenges. It remains vital for operators to align with regulatory authorities. These requirements reshape competitive dynamics across regional and international providers.

Market Opportunities

Expansion of AI, Cloud, and High-Performance Computing Workloads

The France Data Center Market creates strong opportunities with increasing adoption of AI and HPC workloads. Enterprises need advanced facilities for complex computing applications. Cloud adoption fuels demand for scalable and flexible infrastructure. Hyperscale players expand regional capacity to capture enterprise workloads. HPC-driven sectors such as healthcare, defense, and finance generate significant opportunities. Businesses consider France a key European hub for next-generation computing. For investors, it offers stable and high-growth potential. This opportunity reinforces its strategic global relevance.

Strengthening Role of Edge Infrastructure and Regional Connectivity Hubs

The France Data Center Market offers growth opportunities through the rise of edge facilities and connectivity expansion. Edge adoption enables faster digital services delivery for SMEs and enterprises. Marseille and Paris strengthen roles as global gateways, supported by submarine cable systems. Secondary cities gain investments due to urban growth and strategic positioning. Edge deployments attract telecom and IoT ecosystems. Enterprises view regional hubs as essential for performance and cost optimization. Investors support edge networks for fast evenue scaling. This shift opens a diversified opportunity landscape.

Market Segmentation

By Component

The France Data Center Market is dominated by hardware, holding the largest share due to demand for servers, storage, and cooling solutions. Enterprises invest in robust infrastructure to handle AI, cloud, and IoT workloads. Software segments grow steadily with automation, virtualization, and monitoring tools. Services such as consulting and managed operations provide recurring revenue streams. Hardware upgrades remain central for operators. Rising demand for secure storage boosts hardware prominence. The segment demonstrates long-term growth resilience.

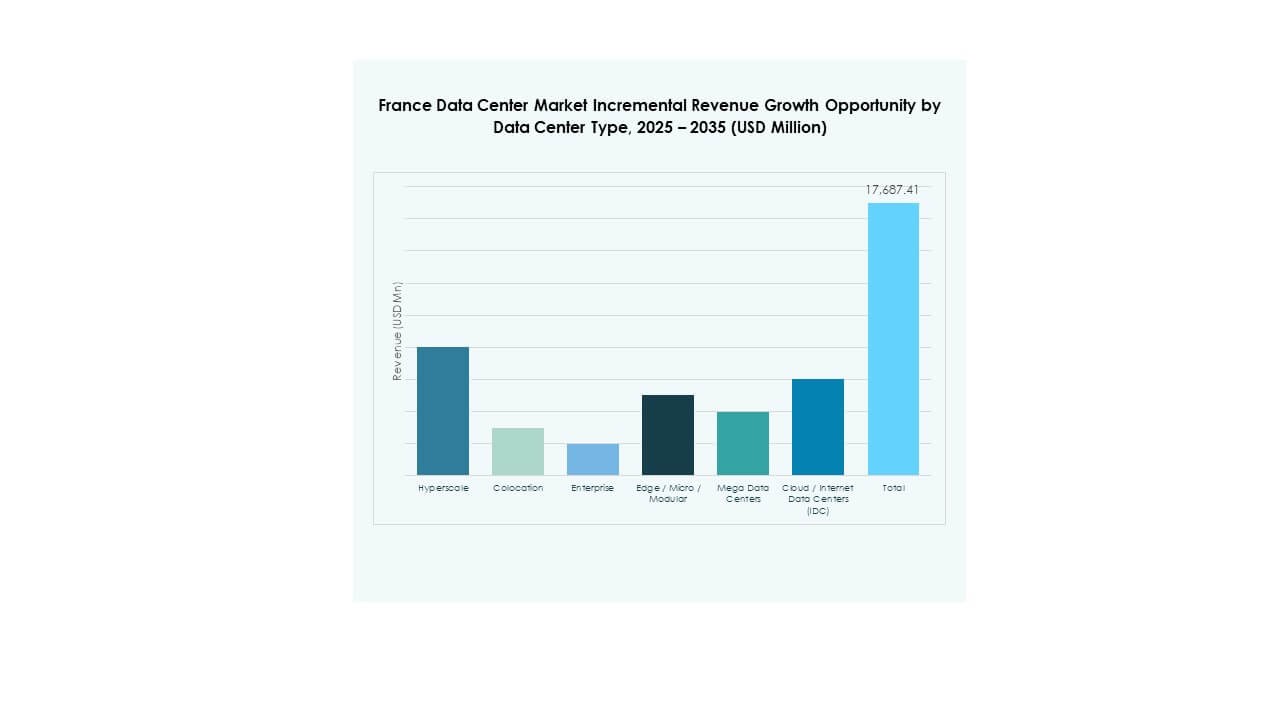

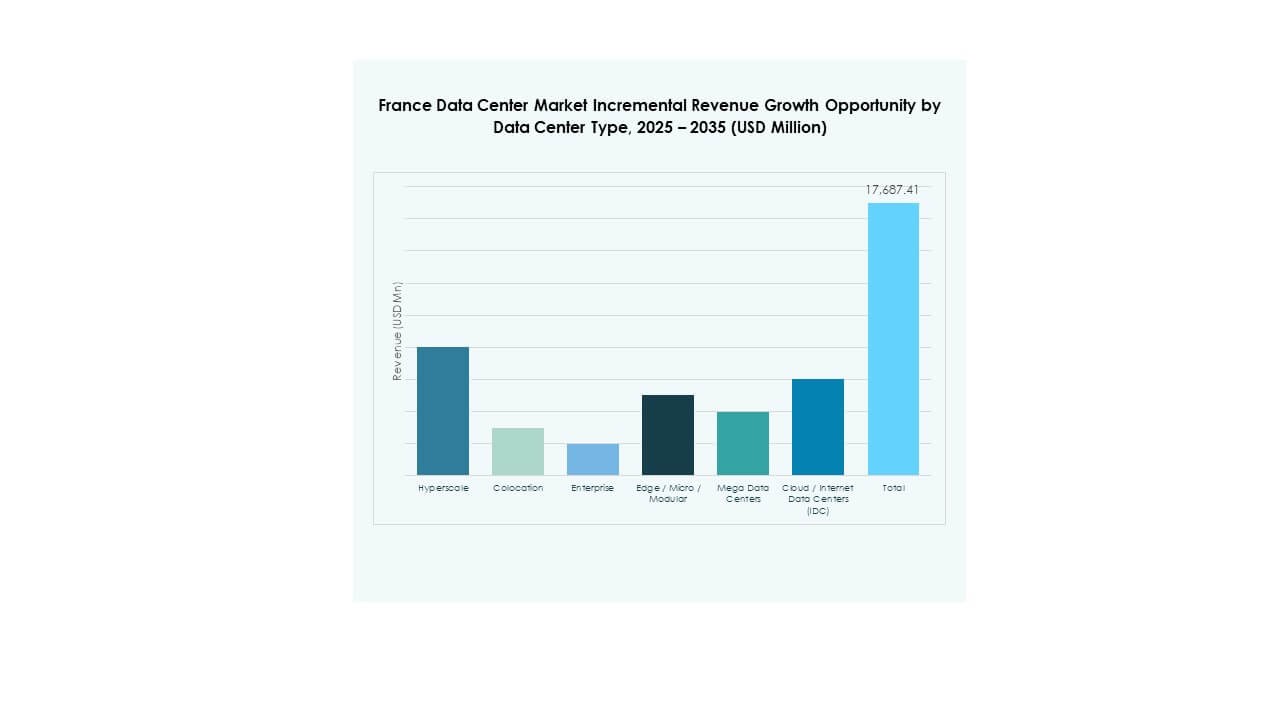

By Data Center Type

The France Data Center Market is led by hyperscale centers, driven by global cloud providers and large enterprises. Colocation facilities hold a significant share, meeting SME outsourcing needs. Enterprise centers remain relevant for specific workloads requiring in-house management. Edge and modular deployments expand rapidly, supporting localized low-latency needs. Cloud and IDC facilities increase with high demand from digital businesses. Mega centers attract global investments due to economies of scale. This segmentation highlights hyperscale dominance and rising edge importance.

By Deployment Model

The France Data Center Market sees cloud-based deployments leading due to enterprise migration and scalability demands. Hybrid models grow as firms balance compliance and cost efficiency. On-premises retain value for regulated industries with sensitive data requirements. Enterprises prioritize cloud-native services for innovation. Hybrid strategies support resilience and disaster recovery needs. Large firms adopt hybrid to optimize workloads. Cloud providers expand presence to meet national and cross-border demand. This dynamic positions hybrid and cloud models as growth accelerators.

By Enterprise Size

The France Data Center Market is dominated by large enterprises, which drive investments in scalable infrastructure. These firms seek advanced capacity for AI, big data, and digital transformation initiatives. SMEs adopt colocation and managed services for cost efficiency. Demand for flexible infrastructure from startups supports colocation growth. Large enterprises maintain leadership through consistent spending power. SMEs create diversification and long-term adoption potential. Both segments sustain balanced growth in the ecosystem. This structure drives robust demand across industries.

By Application / Use Case

The France Data Center Market is led by IT and telecom applications, accounting for the largest share due to cloud adoption and 5G rollouts. BFSI represents strong demand for secure and compliant hosting. Healthcare facilities require advanced solutions for data-intensive workloads. Retail and e-commerce demand scalability to manage seasonal surges. Media and entertainment generate demand for content delivery. Manufacturing uses advanced systems for automation. Government emphasizes compliance and defense requirements. This diversification supports a broad and resilient market base.

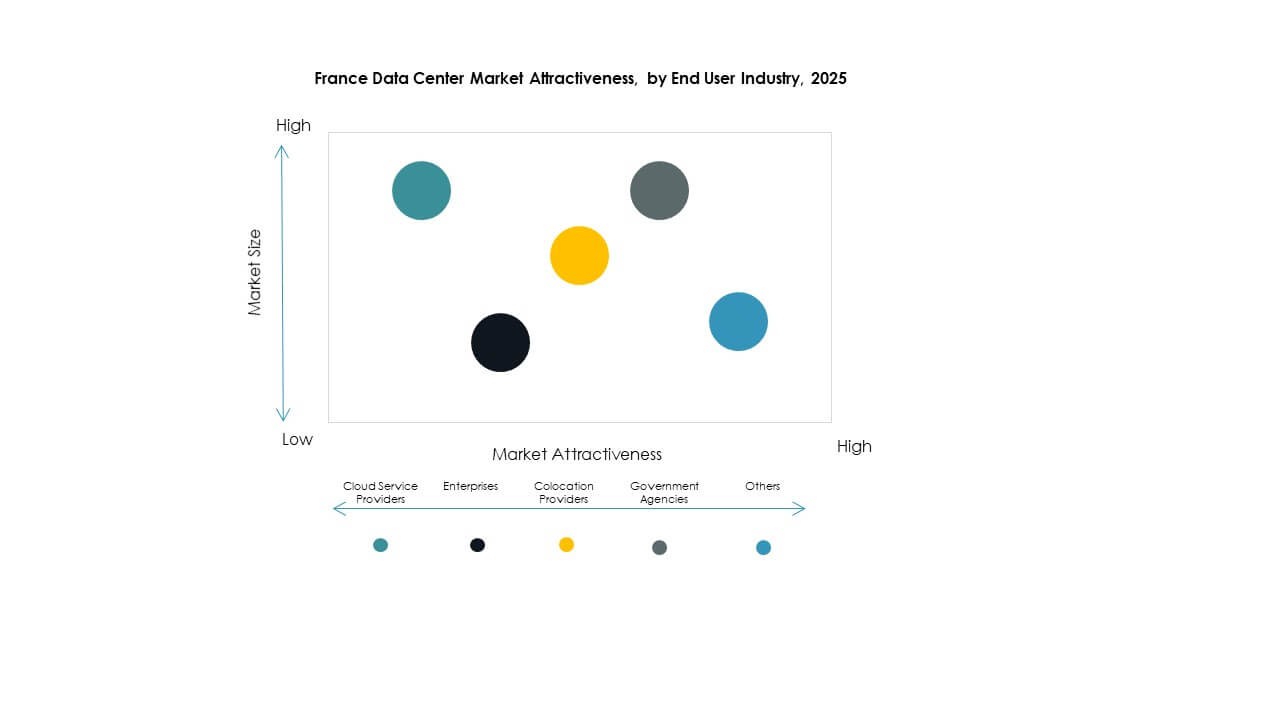

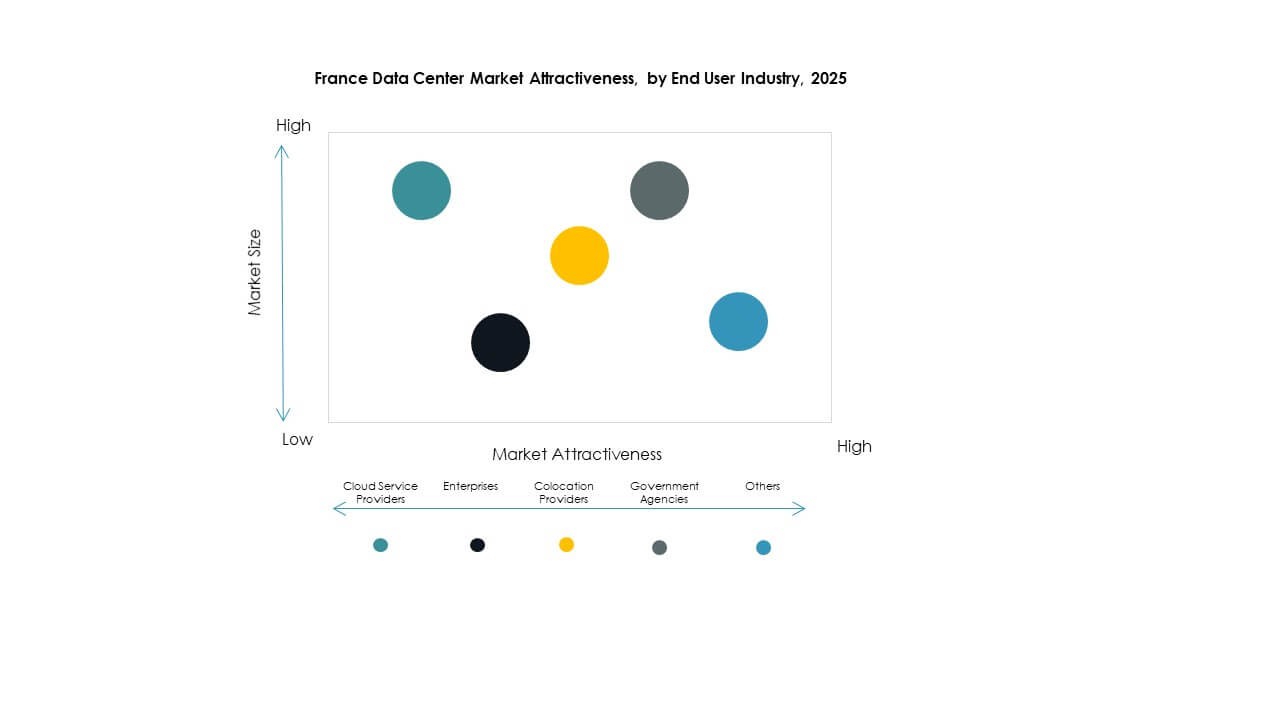

By End User Industry

The France Data Center Market is driven by cloud service providers, holding the dominant share with hyperscale deployments. Enterprises maintain significant demand for private hosting and hybrid solutions. Colocation providers see steady adoption by SMEs and startups. Government agencies prioritize secure and sovereign facilities. Other industries including utilities and education contribute to diversification. Cloud providers continue leading with expansion investments. Enterprises and colocation sustain long-term demand across verticals. This segmentation strengthens overall market depth.

Regional Insights

Paris and Île-de-France as the Leading Subregion with 56% Share

The France Data Center Market is led by Paris and Île-de-France, contributing 56% share in 2024. Paris benefits from being the central hub for finance, telecom, and hyperscale operators. Strong fiber connectivity and global interconnection attract enterprises and investors. The region secures dominance with regulatory support and enterprise concentration. Paris strengthens its role as part of the FLAP hubs. It remains the most significant region for scalability and cross-border services.

Marseille and Southern France Emerging with 24% Share

The France Data Center Market records Marseille and Southern France with 24% share in 2024. Marseille emerges as a global gateway due to submarine cable systems linking Africa, Asia, and the Middle East. Enterprises expand presence here to optimize latency and access regional growth markets. Strategic coastal location strengthens competitiveness against other European hubs. Marseille’s growing ecosystem attracts hyperscale and telecom operators. Southern France cities also benefit from industrial expansion. It positions Marseille as an international connectivity leader.

- For instance, in November 2022, the 45,000 km-long 2Africa subsea cable, the world’s largest, landed in Marseille with Digital Realty (formerly Interxion) as the termination point, reinforcing the city’s role as a key global connectivity hub.

Lyon and Secondary Cities Gaining Momentum with 20% Share

The France Data Center Market shows Lyon and secondary cities contributing 20% share in 2024. These cities attract investments through urban growth, land availability, and strategic positioning. Lyon benefits from being a logistics and industrial hub with rising enterprise demand. Secondary cities support edge deployments to deliver local low-latency services. Enterprises diversify infrastructure beyond Paris and Marseille. Investors target these markets for scalable long-term projects. It creates balanced growth across multiple regions.

- For instance, in 2024, Data4 and Brookfield announced plans to triple their French data center capacity by 2030, expanding beyond the current 375 MW to meet rising AI and cloud infrastructure demand.

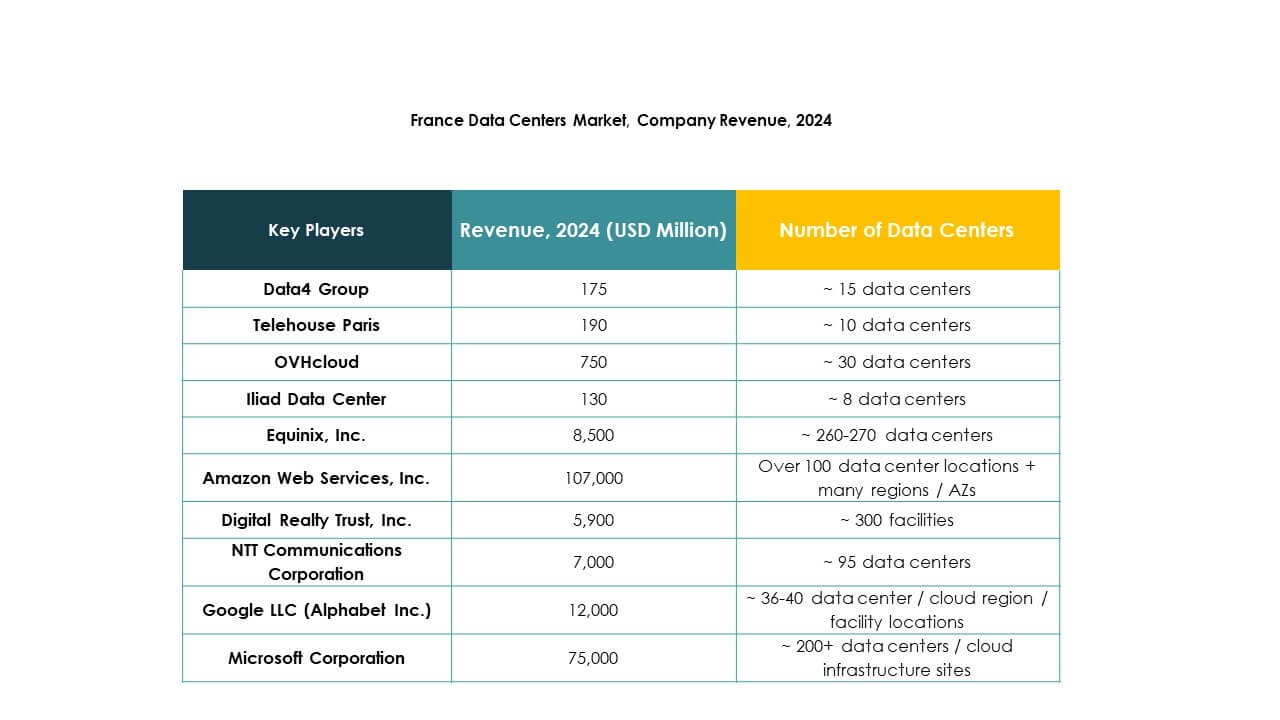

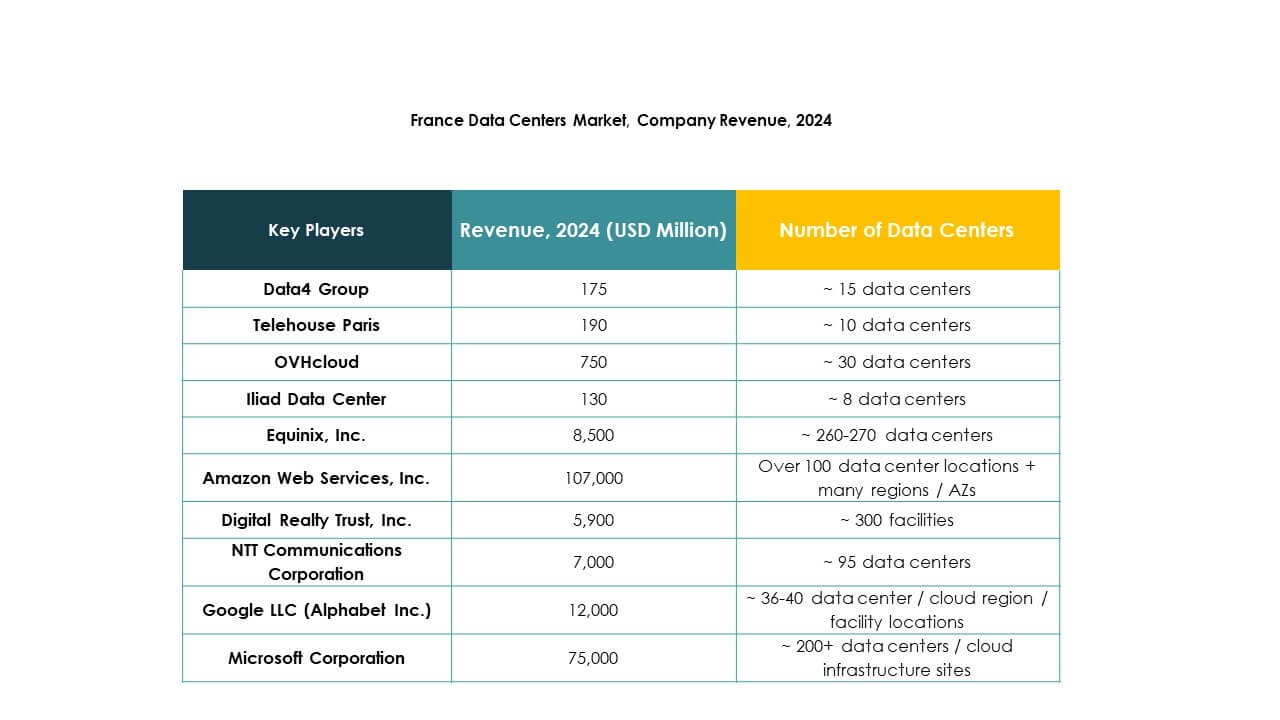

Competitive Insights:

- Data4 Group

- Telehouse Paris

- OVHcloud

- Equinix, Inc.

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc.

- Google LLC (Alphabet Inc.)

The France Data Center Market features intense competition between hyperscale cloud operators and carrier-neutral colocation leaders. Equinix, Digital Realty, and Telehouse anchor interconnection ecosystems in Paris and Marseille, while Data4 scales campus builds for enterprise and cloud tenants. OVHcloud defends share with sovereign hosting and vertical integration. Microsoft, Amazon, and Google expand capacity to support AI and high-density workloads. NTT strengthens presence through network depth and wholesale offerings. Players compete on power availability, land pipelines, and renewable procurement. Sustainability programs, liquid or advanced cooling, and automation raise operating efficiency. Partnerships with telecom carriers and subsea cable routes enhance reach. Buyers weigh latency, SLAs, and compliance posture. The market favors operators that secure scalable power, diverse connectivity, and rapid delivery.

Recent Developments:

- In February 2025, Equinix inaugurated its eleventh French data center (PA13x) in Meudon within the Île-de-France region, backed by a €350 million investment. The new site features AI-ready infrastructure with 12 data halls and integrates renewable energy and heat recovery systems through a partnership with Engie, supporting sustainability and digital innovation in France.

- In February 2024, NTT’s Global Data Centers division announced plans to build and operate its first Paris data center campus. Spanning 35.5 acres with capacity for 84 MW, this campus is part of NTT’s $10 billion global investment initiative through 2027 to accelerate high-performance cloud and AI infrastructure while focusing on 100% renewable energy sourcing by 2030.

- In April 2025, Telehouse Paris completed a major development phase at its Magny 2 data center by launching a new high-density, AI-ready hosting platform specifically designed for artificial intelligence workloads. This expansion incorporates innovative cooling technologies and supports up to 3 MW of IT load.

- In June 2025, OVHcloud announced a strategic partnership with Crayon, a global IT and innovation leader. This collaboration enables customers in more than 45 regions—including France to access and build on OVHcloud’s sovereign, sustainable cloud infrastructure with improved performance-price ratios and broader solution offerings for AI and hybrid cloud environments

- In July 2025, Data4 Group saw Arjun Infrastructure Partners and Interogo Holding acquire a significant stake in its StableCo data center portfolio, bolstering Data4’s investment capability and growth plans across France and Europe.