Executive summary:

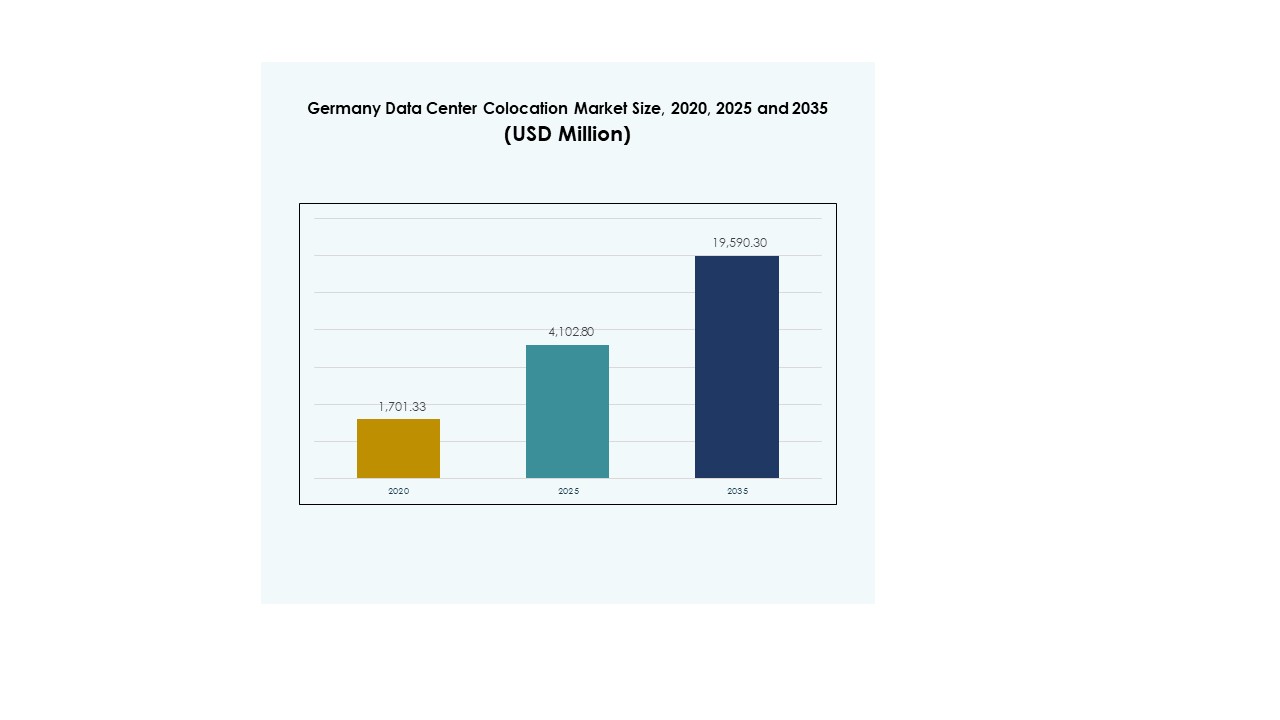

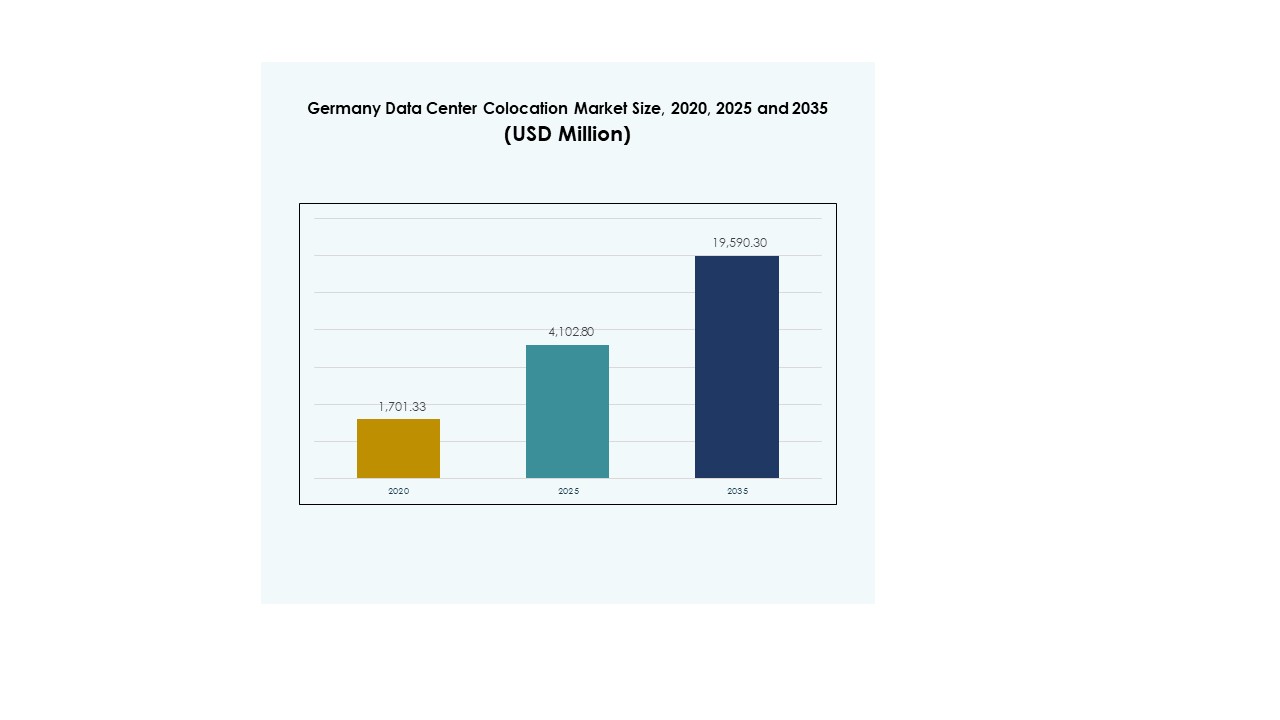

The Germany Data Center Colocation Market size was valued at USD 1,701.33 million in 2020 to USD 4,102.80 million in 2025 and is anticipated to reach USD 19,590.30 million by 2035, at a CAGR of 16.82% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Germany Data Center Colocation Market Size 2025 |

USD 4,102.80 Million |

| Germany Data Center Colocation Market, CAGR |

16.82% |

| Germany Data Center Colocation Market Size 2035 |

USD 19,590.30 Million |

Strong adoption of AI, edge computing, and cloud services drives rapid colocation growth. Enterprises focus on scalable infrastructure, data sovereignty, and secure interconnection. Sustainability goals accelerate the shift to energy-efficient facilities powered by renewables. The Germany Data Center Colocation Market holds strategic importance for businesses and investors seeking operational resilience, regulatory clarity, and access to critical European digital corridors.

Western Germany leads the market due to its dense interconnection hubs and strong digital infrastructure. Northern Germany is emerging as a green colocation hotspot driven by renewable energy integration. Southern and Eastern regions show steady growth supported by edge deployments, local enterprise demand, and 5G expansion.

Market Drivers

Rising AI Workloads, Cloud Expansion, and Edge Infrastructure Acceleration

Enterprises are deploying AI-driven applications and advanced analytics across critical industries, pushing colocation demand. It supports hyperscale and enterprise cloud adoption with resilient infrastructure. Edge computing nodes near urban hubs lower latency and optimize workloads. Global cloud service providers view the country as a prime location for European expansion. Strategic investment in connectivity and network resilience enhances service quality. The Germany Data Center Colocation Market benefits from rising demand for scalable and secure facilities. Businesses rely on efficient colocation to manage cost and complexity. Investors see stable long-term returns from capacity expansion.

- For example, in February 2025, Microsoft announced a €3.2 billion investment to expand its AI and cloud infrastructure in Germany. The initiative focuses on boosting capacity in Frankfurt and North Rhine-Westphalia, strengthening the country’s digital foundation. This investment supports the growing demand for advanced cloud and AI services.

Strong Regulatory Environment and Data Sovereignty Standards

Stringent compliance with GDPR and national cybersecurity frameworks drives demand for localized hosting. Organizations prioritize secure colocation environments to comply with regional laws. High regulatory standards attract global hyperscalers seeking trusted operational zones. Enterprise clients leverage colocation to ensure data remains under strict jurisdictional control. Government incentives support sustainable infrastructure development. The Germany Data Center Colocation Market gains momentum through high trust levels in its regulatory ecosystem. Strategic alignment with EU data strategies strengthens its regional position. Investors view regulatory clarity as a growth enabler.

Growing Focus on Green Data Centers and Renewable Energy Integration

Data center operators invest in renewable energy sources and advanced cooling methods. Colocation providers deploy energy-efficient systems to lower operational costs and emissions. It strengthens sustainability credentials and aligns with national climate goals. Power Purchase Agreements with renewable producers stabilize long-term energy prices. Germany’s strong renewable ecosystem supports large-scale green deployments. The Germany Data Center Colocation Market aligns with ESG objectives driving enterprise strategy. Investors prioritize facilities demonstrating measurable carbon reductions. The market reflects a growing shift toward sustainable digital infrastructure.

Rapid Digital Transformation Across Key Industry Verticals

Industries such as banking, telecom, and manufacturing require high-capacity colocation facilities. Enterprises modernize IT infrastructure to support automation, IoT, and AI adoption. Digital-first strategies drive investment in interconnected, scalable environments. Colocation enables rapid deployment without building in-house infrastructure. It improves operational efficiency and business continuity for critical sectors. The Germany Data Center Colocation Market serves as a foundation for digital innovation. Businesses rely on its stable infrastructure to support expansion. Investors capitalize on digitalization trends fueling demand.

- For example, the German Datacenter Association’s Outlook 2025/26 report stated that Berlin’s data center market reached 152 MW of installed IT capacity. This capacity reflects rapid regional infrastructure growth and increasing enterprise demand. The market plays a key role in supporting Germany’s broader digital transformation efforts.

Market Trends

Expansion of Hyperscale and Interconnection Ecosystems

Hyperscale operators are establishing multi-megawatt facilities in key German cities. Interconnection-rich campuses support low-latency services and dense peering. It enables faster access to cloud, AI, and edge applications. Data traffic from financial, manufacturing, and telecom sectors drives growth. The Germany Data Center Colocation Market strengthens its role as a core European interconnection hub. Carriers and enterprises prefer strategic locations with diverse connectivity. Dense ecosystems reduce network costs and increase operational agility. Investor interest grows around scalable, carrier-neutral campuses.

Deployment of Liquid Cooling and Next-Generation Efficiency Systems

Operators are investing in liquid and direct-to-chip cooling to handle AI-intensive workloads. It lowers energy use and enhances data center performance. Facilities equipped with advanced cooling attract enterprise and hyperscale clients. Integration of monitoring tools enables optimal energy management. The Germany Data Center Colocation Market is adopting next-generation efficiency standards. This trend aligns with carbon neutrality goals and regulatory pressure. Investors favor assets with long-term operational efficiency. These deployments support sustainable infrastructure growth.

Integration of Automation, AI, and Digital Twins in Facility Operations

Operators are embedding AI-powered management systems to automate critical tasks. Digital twins simulate performance scenarios and improve risk management. It enhances uptime and predictive maintenance efficiency. Automation reduces human error and operating costs. The Germany Data Center Colocation Market reflects a broader shift toward intelligent infrastructure. Real-time analytics supports energy optimization and workload balancing. Investors see value in operational transparency. Facilities adopting these tools gain competitive differentiation.

Strategic Role of Secondary Cities and Edge Deployments

Secondary hubs like Berlin and Munich are attracting new deployments. Edge nodes support 5G, IoT, and content delivery networks. It helps distribute workloads beyond traditional Frankfurt clusters. Proximity to end users enhances service performance. The Germany Data Center Colocation Market diversifies its geographic footprint. Localized deployments address regulatory and latency demands. Investors explore opportunities in underserved metros. This trend strengthens overall infrastructure resilience.

Market Challenges

Rising Energy Costs and Power Availability Constraints in Key Hubs

Operators face increasing pressure from high energy costs and limited grid capacity. It creates complexity in planning large-scale expansions near Frankfurt. Electricity supply delays slow down new project timelines. The Germany Data Center Colocation Market must balance growth with energy stability. Regulatory approvals for new connections require significant time and investment. High operational costs reduce margins for smaller providers. Power grid modernization efforts are progressing slowly in some regions. Investors closely monitor energy market volatility before committing capital.

Talent Shortage and Infrastructure Development Bottlenecks

A shortage of skilled workforce affects construction timelines and operations. High demand for specialized technical staff intensifies competition among operators. The Germany Data Center Colocation Market faces growing pressure to upskill and attract global talent. Construction lead times extend due to strict permitting and local regulations. Supply chain issues increase costs for equipment and critical components. These factors affect project delivery schedules. Investors seek long-term partnerships to navigate workforce challenges. Accelerated training programs and strategic collaborations aim to ease the bottlenecks.

Market Opportunities

Rising AI Integration, Interconnection Expansion, and Regional Edge Growth

AI workloads and high-speed interconnection demand create new revenue streams. It enables providers to target hyperscalers and enterprise clients. The Germany Data Center Colocation Market benefits from strategic European positioning. Growth in secondary cities strengthens service coverage. Investors target edge nodes that lower latency for real-time applications. Advanced interconnection services increase customer retention. AI adoption drives colocation modernization. This opportunity supports sustained infrastructure investment.

Accelerating Green Investments and Sustainability-Linked Financing

Green bonds and ESG-linked financing drive expansion of low-carbon facilities. Operators are investing in renewables to attract enterprise clients with net-zero goals. The Germany Data Center Colocation Market aligns with national decarbonization strategies. Investors favor facilities that deliver measurable sustainability outcomes. Energy efficiency improvements enhance competitiveness. This opportunity supports scaling green data center portfolios. It positions Germany as a leader in sustainable colocation infrastructure.

Market Segmentation

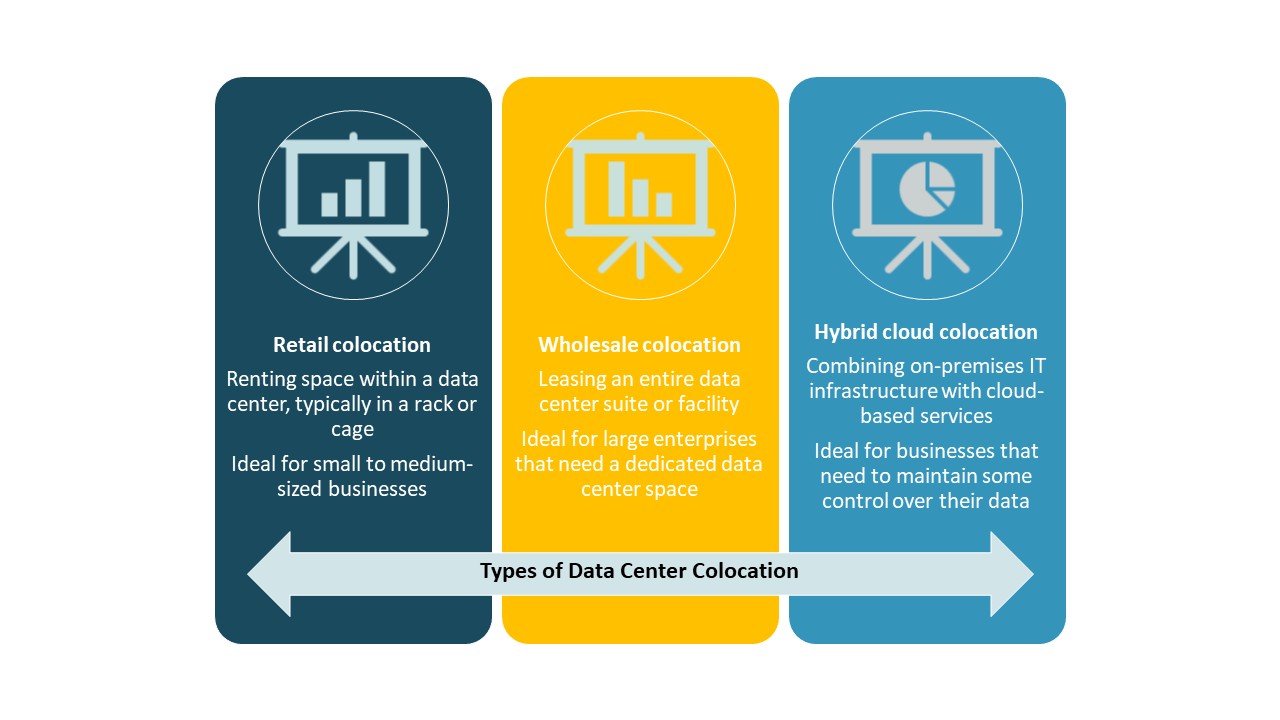

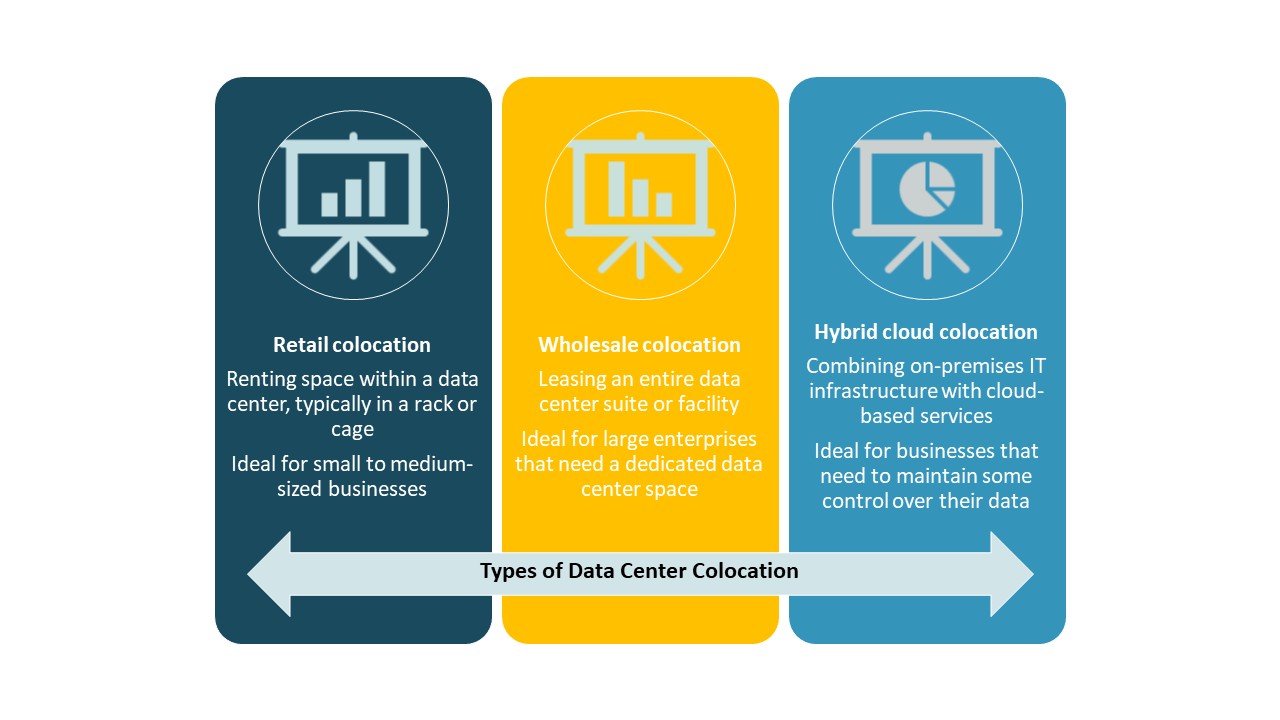

By Type

Retail colocation holds the largest share driven by demand from enterprises seeking scalable and secure hosting. It allows clients to control infrastructure without building in-house facilities. Wholesale colocation attracts hyperscalers expanding their European footprint. Hybrid cloud colocation grows steadily through flexible deployment models. The Germany Data Center Colocation Market benefits from the strong retail presence, supported by digital transformation strategies across multiple industries.

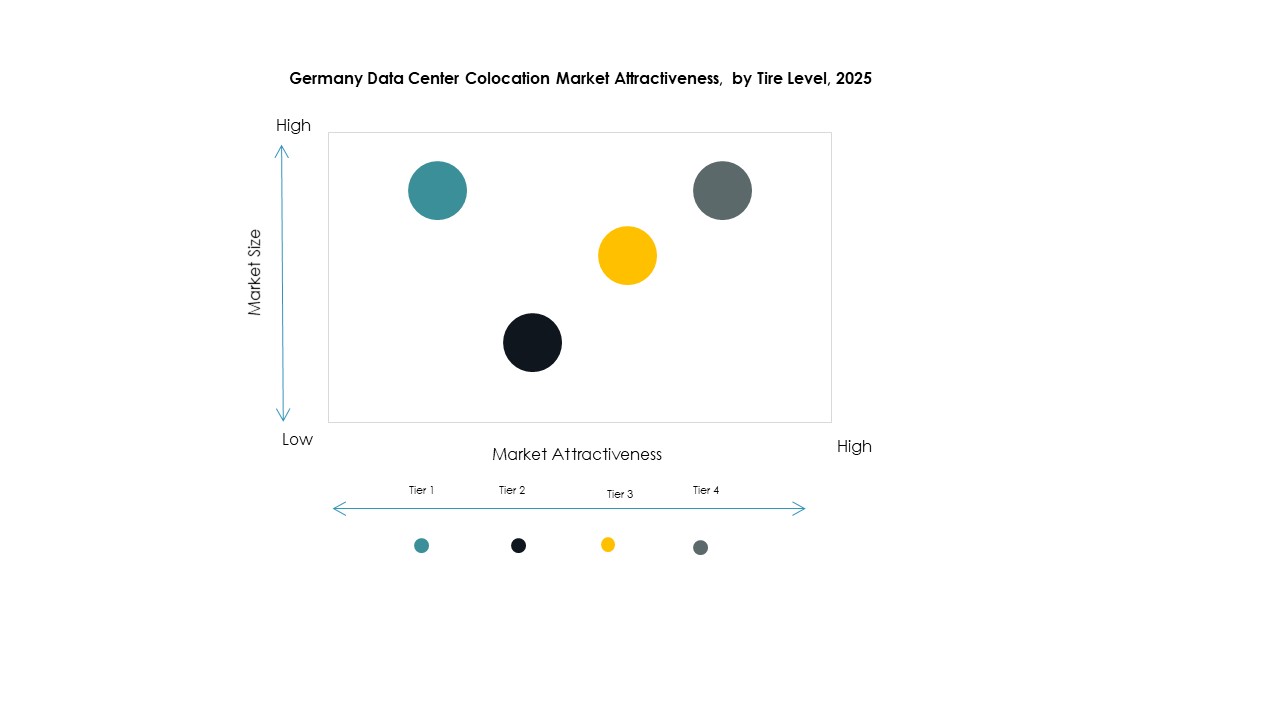

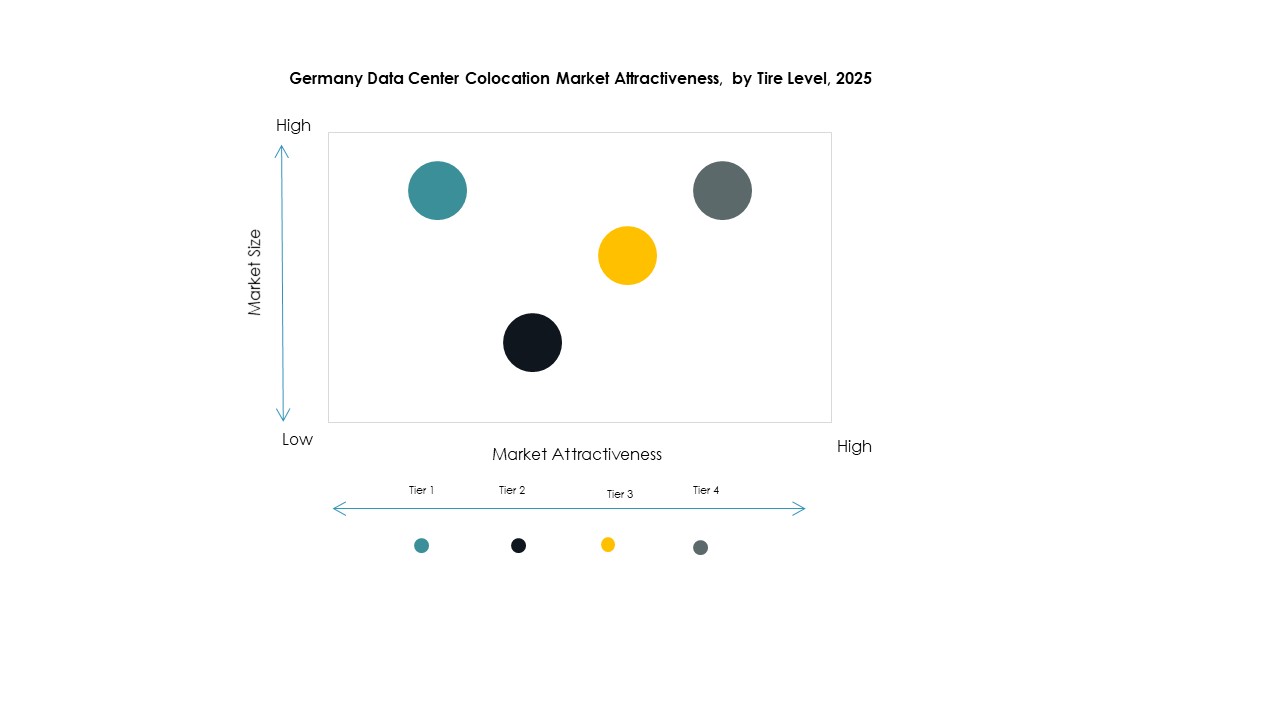

By Tier Level

Tier 3 dominates the market with high reliability and efficient power management. It balances cost with availability and uptime standards. Tier 4 adoption grows for mission-critical applications requiring maximum redundancy. Tier 1 and Tier 2 serve smaller workloads but face slower growth. The Germany Data Center Colocation Market reflects strong enterprise preference for Tier 3, aligning with operational resilience and regulatory expectations.

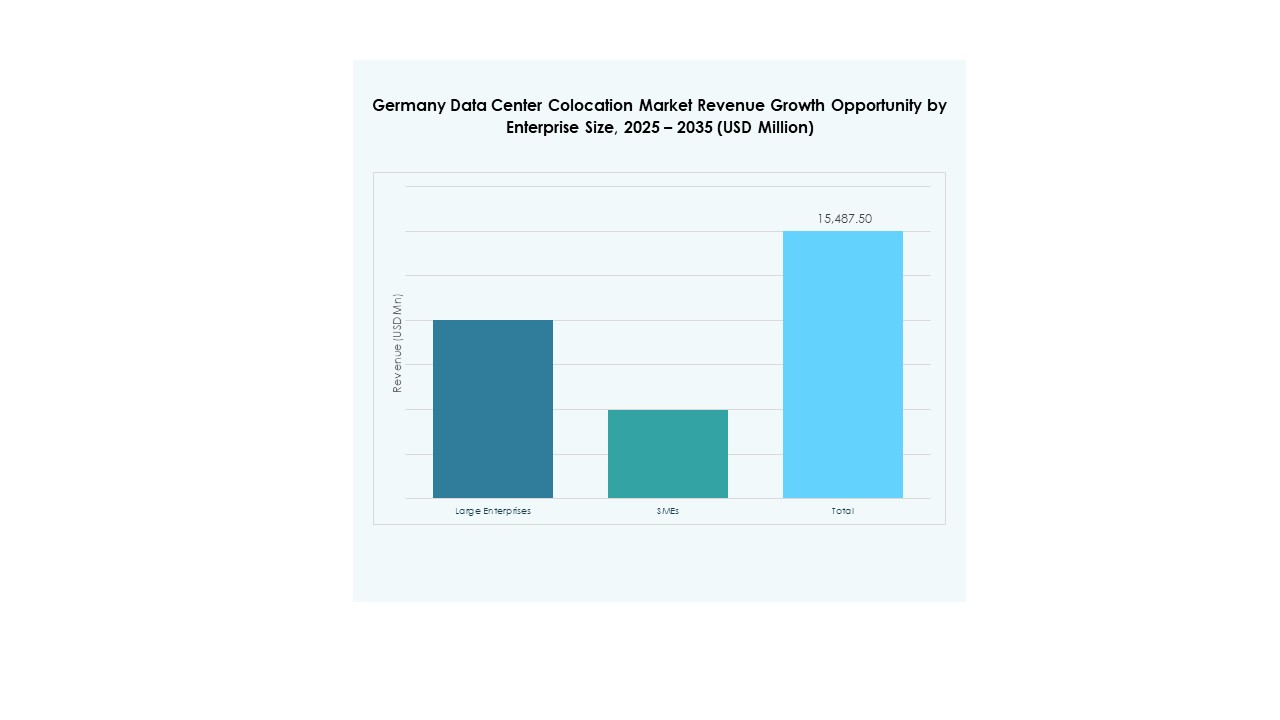

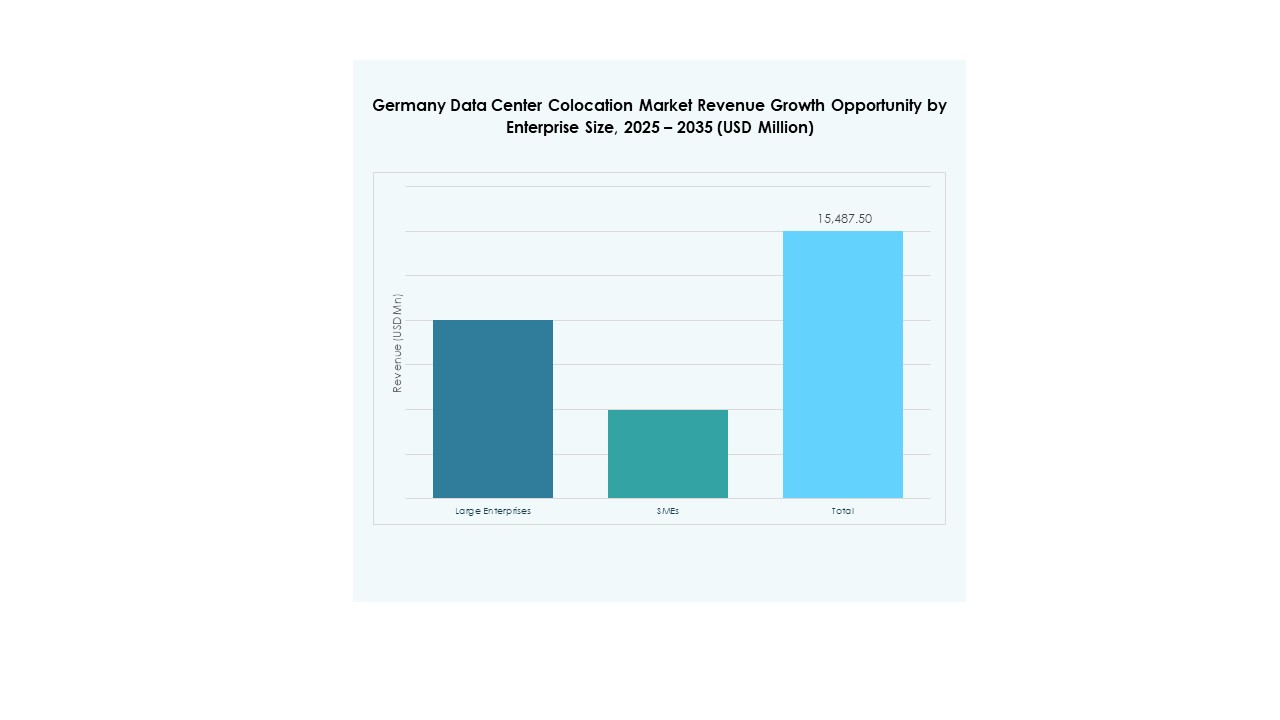

By Enterprise Size

Large enterprises account for the majority share driven by high-capacity requirements. Their global operations demand secure, scalable, and compliant colocation solutions. SMEs increase adoption with cost-efficient retail options. It supports hybrid deployment strategies for digital growth. The Germany Data Center Colocation Market benefits from rising enterprise modernization initiatives. Large-scale contracts strengthen market structure and investment confidence.

By End User Industry

The IT & Telecom sector leads due to cloud adoption, 5G deployment, and digitalization programs. BFSI invests in high-security colocation for regulatory compliance and operational stability. Healthcare and media sectors expand usage to support data-intensive workloads. Retail and other industries adopt flexible colocation to modernize IT strategies. The Germany Data Center Colocation Market reflects diversified demand across sectors.

Regional Insights

Western Germany Dominates with Frankfurt as the Core Interconnection Hub (52.4%)

Western Germany leads due to the presence of major connectivity hubs in Frankfurt. It serves as the primary interconnection point for hyperscalers and telecom operators. The Germany Data Center Colocation Market benefits from dense network ecosystems and carrier-neutral campuses. Frankfurt hosts the majority of Europe’s DE-CIX traffic, enhancing strategic relevance. Strong infrastructure attracts continuous investment. Energy demand management remains a priority to sustain future expansion.

- For example, Hetzner Online operates a long-established data center park in Nuremberg, Germany. The site hosts a large number of enterprise workloads and supports the company’s cloud and colocation services. It remains a key hub in Hetzner’s national infrastructure network.

Northern Germany Emerges with Strong Renewable Energy Integration (27.1%)

Northern Germany is gaining traction through renewable energy availability and low land costs. Hamburg and Bremen attract operators focused on sustainable operations. The Germany Data Center Colocation Market sees this region as ideal for green capacity expansion. Proximity to offshore wind resources supports efficient energy sourcing. Operators invest in high-capacity campuses aligned with net-zero goals. The region’s position near Nordic connectivity routes boosts strategic appeal.

Southern and Eastern Germany Experience Steady Growth through Edge Deployments (20.5%)

Southern and Eastern regions including Munich, Berlin, and Leipzig are witnessing steady market growth. Edge deployments support latency-sensitive applications and 5G expansion. The Germany Data Center Colocation Market diversifies geographically to meet regional demand. These areas attract investments from cloud providers targeting local enterprises. Government initiatives support balanced digital infrastructure development. Growing interconnection points strengthen their role in the national network fabric.

- For example, in October 2024, Envia Tel announced an expansion of its Leipzig 2 data center, adding 1,000 sqm of server space to host up to 20,000 additional servers, while planning to reuse waste heat to supply the nearby city of Taucha.

Competitive Insights:

- Hetzner Online GmbH

• PlusServer GmbH

• IONOS by 1&1

• IBE GmbH

• Amazon Web Services (AWS)

• Google Cloud

• China Telecom Corporation Limited

• Colt Technology Services Group Limited

• CoreSite

• CyrusOne

• Digital Realty Trust

• Equinix, Inc.

• Flexential

• NTT Ltd. (NTT DATA)

The Germany Data Center Colocation Market features strong competition among global hyperscalers, regional operators, and carrier-neutral providers. It is defined by large-scale facility investments, strategic interconnection hubs, and advanced sustainability programs. Equinix and Digital Realty lead with extensive colocation campuses and broad interconnection ecosystems. AWS and Google Cloud strengthen cloud-integrated colocation offerings, increasing competitive intensity. Hetzner, PlusServer, and IONOS leverage localized operations and pricing advantages to retain enterprise clients. NTT, Colt, and China Telecom focus on network reach and hybrid models. Strategic mergers, partnerships, and green data center expansions remain core competitive strategies. The market’s structure favors providers with scalable capacity, strong energy sourcing, and deep ecosystem integration.

Recent Developments:

- In September 2025, Penta Infra officially launched a new data center facility in Hamburg, Germany, expanding its regional colocation presence to support growing demand for high-performance and sustainable IT infrastructure in northern Germany. The opening event took place on September 11, emphasizing the company’s commitment to digitalization and energy efficiency in the German market.

- In June 2025, CyrusOne announced a strategic partnership with E.ON to address grid capacity constraints for its data centers in Germany and broader Europe. This collaboration aims to provide reliable access to grid infrastructure for large-scale colocation projects, supporting CyrusOne’s sustainability targets and long-term growth ambitions in the region.