Executive summary:

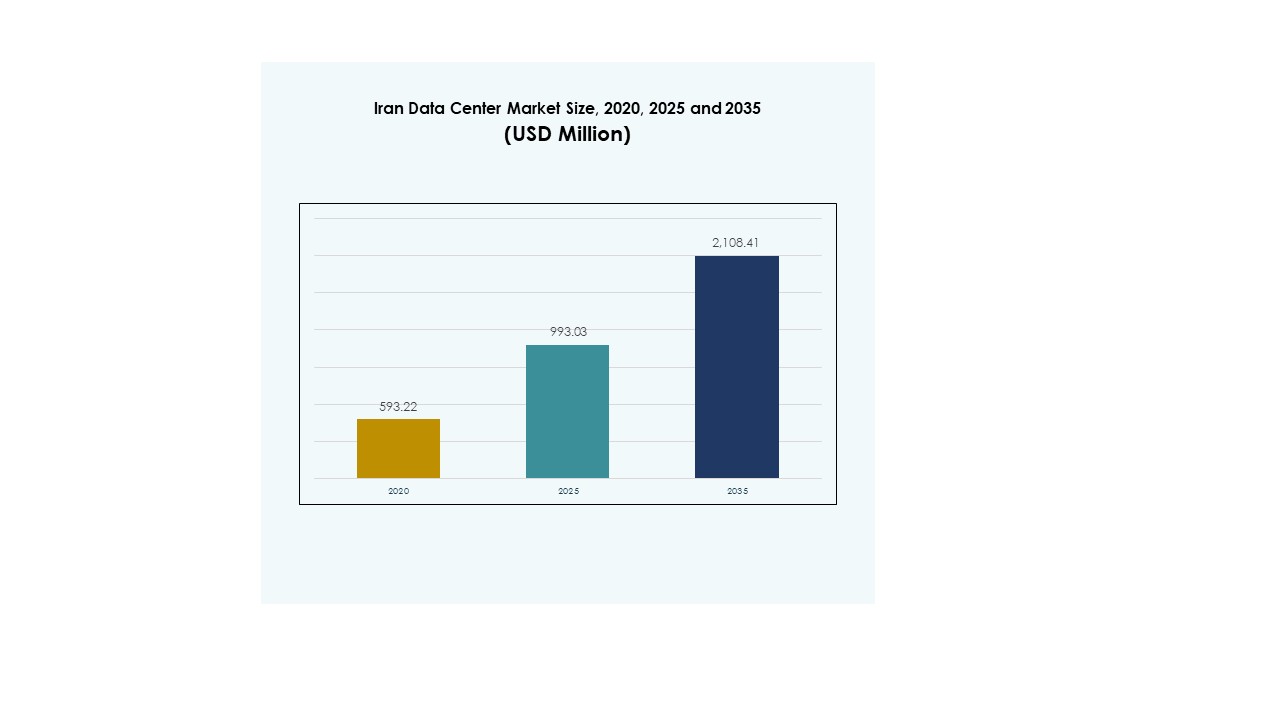

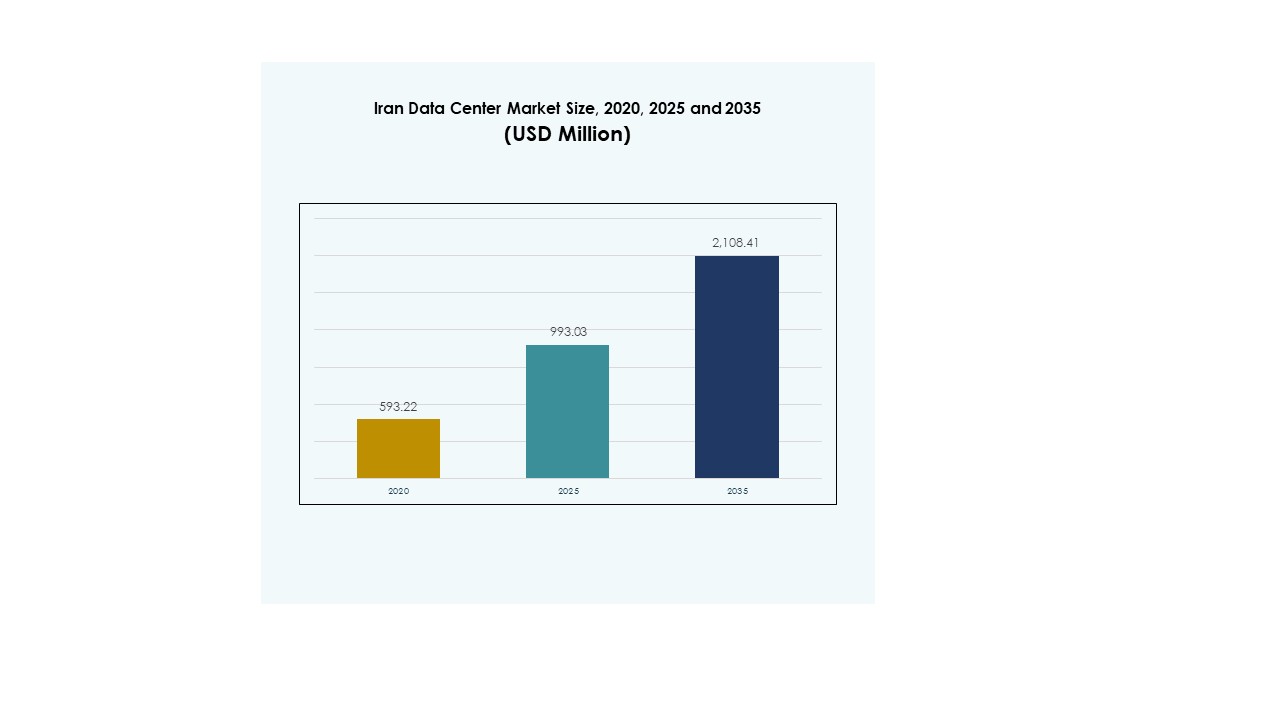

The Iran Data Center Market size was valued at USD 593.22 million in 2020 to USD 993.03 million in 2025 and is anticipated to reach USD 2,108.41 million by 2035, at a CAGR of 7.77% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Iran Data Center Market Size 2025 |

USD 993.03 Million |

| Iran Data Center Market, CAGR |

7.77% |

| Iran Data Center Market Size 2035 |

USD 2,108.41 Million |

Growth in the market is supported by rising cloud adoption, digital transformation, and increasing demand for high-performance computing. Enterprises are focusing on AI, big data, and automation to improve efficiency, while operators adopt modular designs and energy-efficient systems. It holds strategic importance for businesses seeking secure, scalable infrastructure and for investors aiming to capture opportunities in technology-driven expansion.

Regionally, the north dominates due to concentration of government projects, telecom hubs, and enterprise adoption. The central region is expanding with manufacturing and SME-driven demand, while the south is emerging with energy sector investments and port-related developments. It reflects a balanced landscape where established regions maintain leadership, and new hubs create future opportunities.

Market Drivers

Rising Demand For Cloud Services And Digital Transformation Across Enterprises

The Iran Data Center Market is growing due to the rapid adoption of cloud platforms by enterprises. Local businesses are focusing on shifting workloads from traditional infrastructure to cloud-hosted environments. It supports higher efficiency, scalability, and reduced operational costs for enterprises in competitive industries. The adoption of digital transformation strategies creates consistent demand for advanced storage and processing capabilities. Government projects encouraging digitization also strengthen the ecosystem for long-term growth. Investors are targeting this momentum to capture returns from scalable cloud environments. Technology vendors expand local partnerships to improve service availability and compliance alignment. This synergy makes the sector strategically vital for long-term economic modernization.

- For instance, in August 2024, Oracle launched its second public cloud region in Riyadh, Saudi Arabia, hosted by Center3, as part of a $1.5 billion investment. The new Riyadh region delivers more than 100 Oracle Cloud Infrastructure services, including AI, analytics, disaster recovery, and multi-cloud workload migration, strengthening Oracle’s MENA presence to eight cloud regions.

Expanding Role Of Energy-Efficient Infrastructure And Innovative Data Center Designs

Sustainability is a critical driver shaping investments in the Iran Data Center Market. Operators prioritize modular designs, precision cooling, and renewable energy adoption to reduce operating costs. It allows them to respond to growing regulatory pressure for energy-efficient infrastructure. Enterprises recognize green data centers as a way to improve brand value and reduce long-term risks. Investors show strong interest in facilities that integrate next-generation cooling and power efficiency technologies. These innovations help reduce carbon footprints while ensuring continuous uptime. Service providers gain competitive advantage by adopting flexible designs with quicker deployment models. This transition secures stronger positioning in regional and global markets.

- For instance, Pars Online Data Center is recognized as one of Iran’s first private operators, providing data hosting and cloud services through its established facilities in Tehran, supporting enterprises and government organizations with reliable connectivity and managed infrastructure.

Increased Adoption Of High-Performance Computing And Artificial Intelligence Workloads

Enterprises are deploying AI, analytics, and big data workloads, driving fresh demand in the Iran Data Center Market. High-performance computing requires advanced storage, networking, and processing solutions that traditional infrastructure cannot provide. It helps industries like finance, healthcare, and telecom operate faster with accurate decision-making. Cloud service providers integrate AI-ready platforms to attract corporate and public sector clients. Investors are focusing on AI-driven data centers to future-proof infrastructure portfolios. Technological adoption raises demand for GPUs, scalable clusters, and optimized network configurations. Service operators integrate orchestration software to simplify AI workload management. This makes advanced computing a central driver of growth.

Strategic Importance Of Market For Enterprises And Long-Term Investor Confidence

The Iran Data Center Market has strategic importance due to its role in regional digital transformation. Enterprises depend on local infrastructure for secure data storage and reduced latency. It allows businesses to serve customers effectively across multiple industries. International investors recognize Iran’s emerging role in the regional technology ecosystem. They see opportunities for growth through joint ventures and technology transfer agreements. Government policies encourage local data hosting, supporting sovereignty and compliance needs. Businesses benefit from stronger reliability and operational control compared to legacy systems. This strategic environment creates a foundation for strong investor confidence and sustainable expansion.

Market Trends

Rise Of Colocation Services And Hybrid Deployment Models Among Enterprises

The Iran Data Center Market is witnessing growth in colocation services and hybrid deployment models. Enterprises prefer colocation facilities to reduce capital expenditure while gaining secure, scalable environments. It allows businesses to host workloads across shared infrastructure with reliable connectivity. Hybrid models are growing as enterprises combine on-premises systems with cloud solutions. Colocation providers offer better power efficiency, advanced cooling, and compliance features. Enterprises adopt this trend to manage evolving business demands more efficiently. Service providers compete by offering flexible service-level agreements and multi-region coverage. The trend highlights strong growth prospects for colocation operators across the region.

Growing Integration Of Edge Computing To Support Low-Latency Applications

Edge computing adoption is becoming a major trend in the Iran Data Center Market. Enterprises rely on edge nodes to process data close to the source and reduce latency. It supports real-time applications like IoT, smart cities, and video analytics. Edge facilities improve service delivery in healthcare, manufacturing, and transportation industries. Businesses view this model as essential to manage increasing data volumes effectively. Operators expand edge deployments near urban centers to support rapid user growth. Cloud providers also introduce modular edge centers to enhance service reach. The trend establishes edge computing as a key enabler of next-generation digital services.

Shift Toward Software-Defined Infrastructure And Automation For Efficiency Gains

Operators are adopting software-defined infrastructure and automation in the Iran Data Center Market. Enterprises require orchestration, monitoring, and automation to handle complex workloads. It improves scalability while reducing manual intervention in critical operations. Software-defined models enhance flexibility in managing storage, networking, and computing resources. Vendors integrate automation tools for predictive maintenance and performance optimization. These shifts allow service providers to manage high-performance environments at lower costs. Enterprises value the reduced downtime and greater agility from automation adoption. This trend positions software-driven ecosystems as central to future competitiveness.

Expansion Of Data Localization Policies And Regulatory-Driven Investments

Data localization policies are shaping the Iran Data Center Market, with enterprises required to store data locally. It drives investments in domestic infrastructure by global and regional service providers. Enterprises adopt local data centers to ensure compliance with evolving regulations. This policy creates demand for secure facilities that protect sensitive financial and personal data. Service providers invest in stronger cybersecurity features to meet compliance standards. It creates a competitive edge for operators with advanced security certifications. Investors see localization rules as a long-term driver of infrastructure expansion. The trend underscores the regulatory influence on shaping market growth strategies.

Market Challenges

Infrastructure Limitations And High Barriers To Technology Modernization

The Iran Data Center Market faces infrastructure limitations that restrict the pace of modernization. Legacy power and cooling systems limit scalability in older facilities. It forces operators to spend heavily on upgrades to meet rising workloads. Supply chain restrictions also create delays in importing advanced equipment. Limited domestic manufacturing capacity increases dependency on external suppliers. Enterprises encounter higher costs while upgrading to modular or hyperscale systems. Investors find project risks elevated due to regulatory and operational hurdles. This challenge slows adoption of next-generation data center capabilities across key industries.

Cybersecurity Risks And Skills Shortage Across The Digital Ecosystem

Cybersecurity threats remain a major challenge in the Iran Data Center Market. Enterprises face increasing risks from ransomware, phishing, and advanced malware attacks. It compels operators to invest in robust security infrastructure and certifications. A shortage of skilled cybersecurity professionals limits the effectiveness of defense strategies. Service providers struggle to maintain continuous monitoring and response capabilities. Enterprises remain vulnerable due to fragmented awareness and limited training programs. Investors view cybersecurity risks as critical factors influencing project sustainability. These barriers make cybersecurity and talent acquisition key concerns for the sector.

Market Opportunities

Expansion Of Cloud Adoption Among Small And Medium Enterprises Across Industries

The Iran Data Center Market presents opportunities through rising cloud adoption by SMEs. Enterprises in retail, healthcare, and manufacturing seek scalable and cost-effective platforms. It enables them to access advanced IT infrastructure without heavy capital investments. Cloud adoption expands competitiveness for SMEs by enhancing agility and reducing operational risks. Service providers benefit by offering tailored solutions for smaller enterprises. Investors recognize the role of SMEs in driving sector growth. This opportunity highlights the importance of targeted services in sustaining momentum.

Potential Of AI, IoT, And Industry 4.0 Solutions To Drive Data Center Growth

Emerging technologies present fresh opportunities in the Iran Data Center Market. AI, IoT, and Industry 4.0 create massive demand for secure data processing. It drives adoption of high-density servers, optimized networking, and advanced analytics platforms. Enterprises integrate these solutions to improve decision-making and operational efficiency. Investors target data centers capable of supporting these workloads at scale. Service providers gain growth prospects by aligning with digital industries. This opportunity secures the role of advanced technology as a growth catalyst.

Market Segmentation

By Component

The Iran Data Center Market shows strong dominance of hardware, with servers and networking holding the largest share. Demand for advanced storage and power solutions is rising with enterprise workloads. Software adoption, including DCIM and virtualization, supports efficiency gains. Service segments such as managed services and integration drive continuous support needs. Hardware leads due to its fundamental role in capacity expansion.

By Data Center Type

Colocation and cloud data centers dominate the Iran Data Center Market, supported by enterprise adoption. Hyperscale centers are growing with demand for AI-driven workloads and e-commerce growth. Edge and modular facilities expand in urban areas for low-latency applications. Enterprise and government projects also contribute to steady demand. Cloud data centers gain traction due to compliance and flexibility advantages.

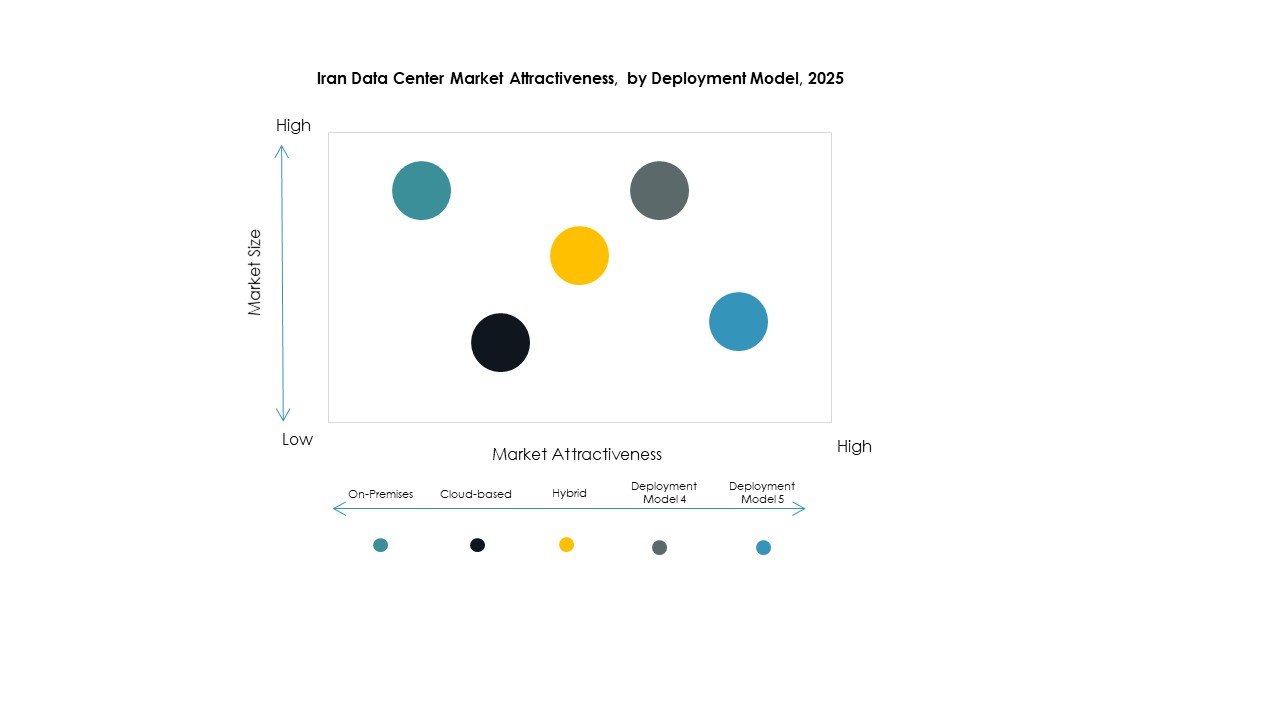

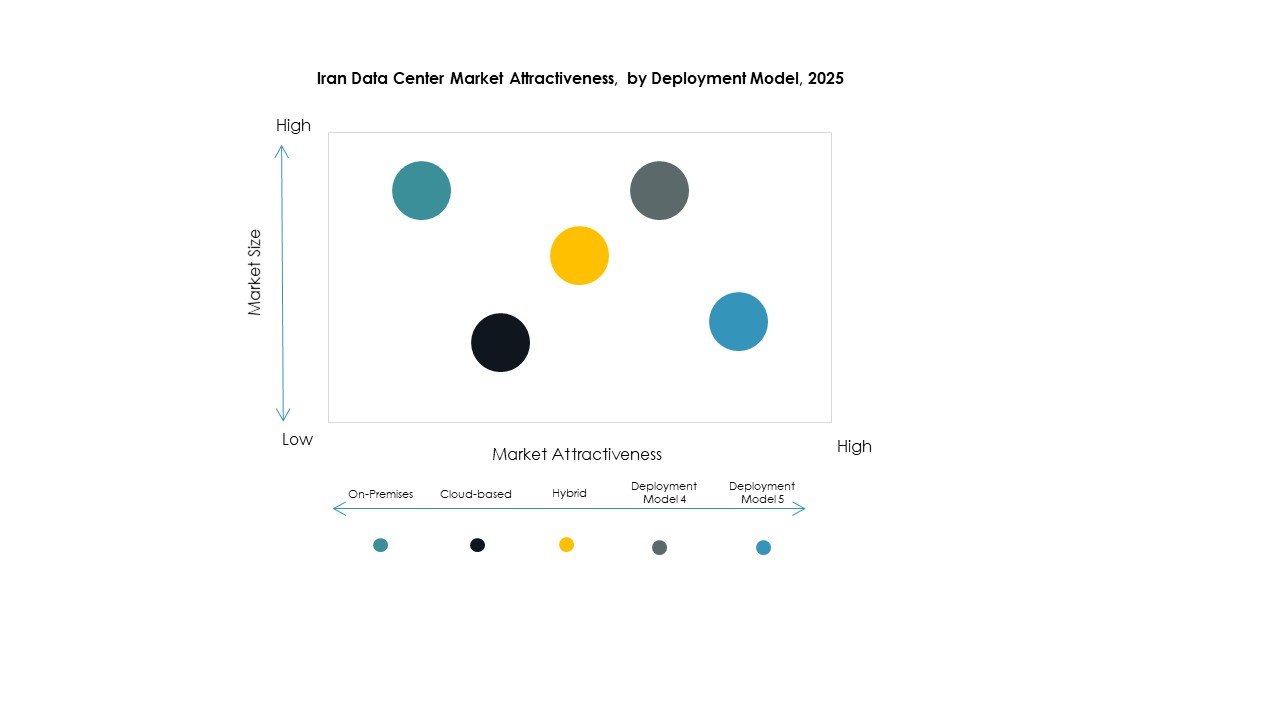

By Deployment Model

Hybrid deployment dominates the Iran Data Center Market as enterprises balance control and scalability. On-premises models remain relevant for government and defense sectors requiring sovereignty. Cloud-based models are rising due to growing SME adoption. Enterprises prefer hybrid to optimize cost, flexibility, and compliance. This segment leads due to its ability to meet multiple organizational requirements.

By Enterprise Size

Large enterprises lead the Iran Data Center Market with higher capacity needs. SMEs are growing rapidly with increased cloud adoption. Large enterprises drive demand for hyperscale and colocation facilities. SMEs prefer cost-effective and flexible cloud solutions. Growth opportunities exist across both segments, though large enterprises hold the dominant share.

By Application / Use Case

IT & Telecom leads the Iran Data Center Market with strong reliance on digital networks. BFSI and government sectors drive adoption for secure processing and compliance needs. Healthcare and retail adopt cloud for real-time analytics and efficiency. Media and manufacturing sectors contribute to steady demand for advanced IT environments. Education and energy sectors create opportunities for expansion into diversified industries.

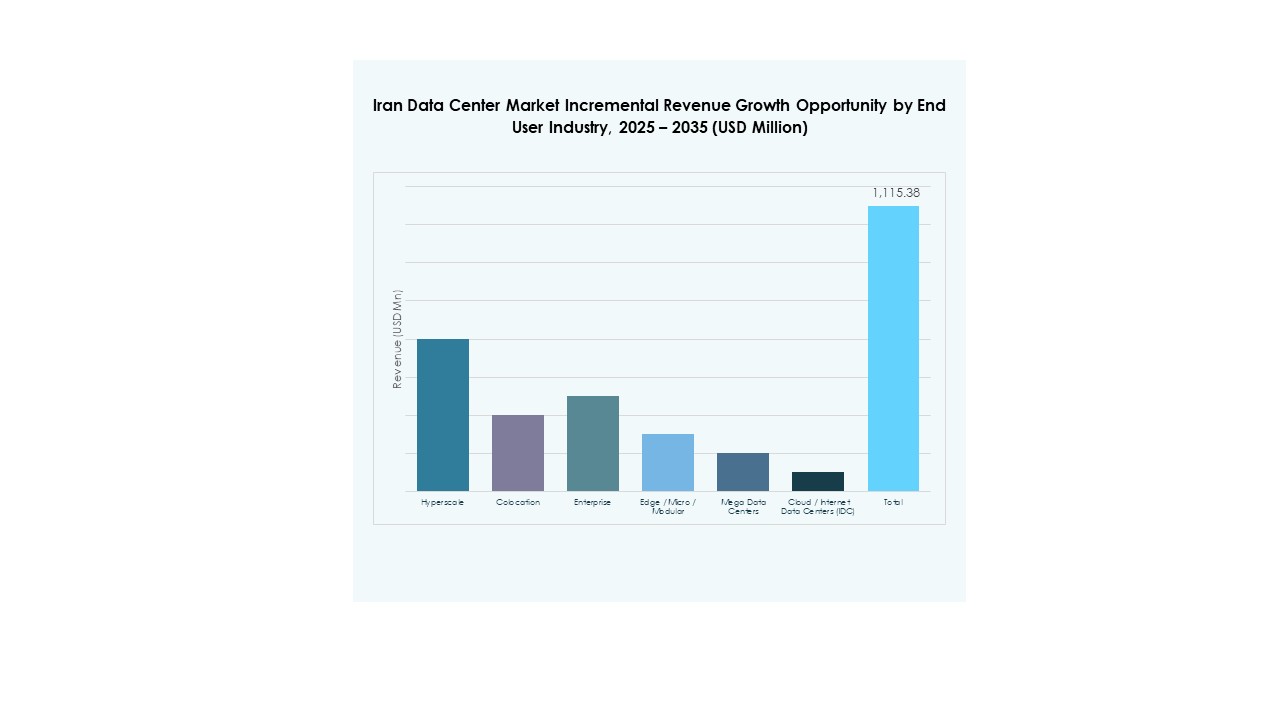

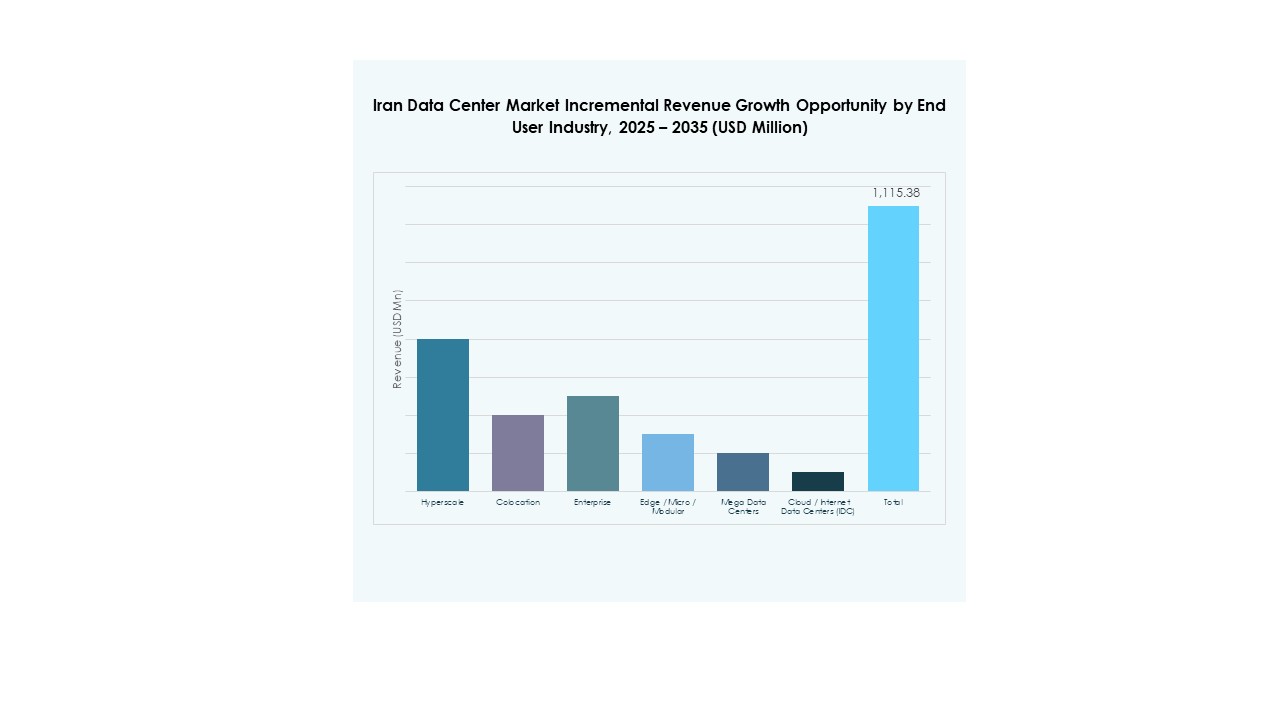

By End User Industry

Cloud service providers dominate the Iran Data Center Market by capturing high enterprise demand. Enterprises also hold significant share with hybrid deployments. Colocation providers expand to meet rising SME adoption. Government agencies support the market through compliance-driven projects. These end users highlight diverse demand sources supporting strong industry growth.

Regional Insights

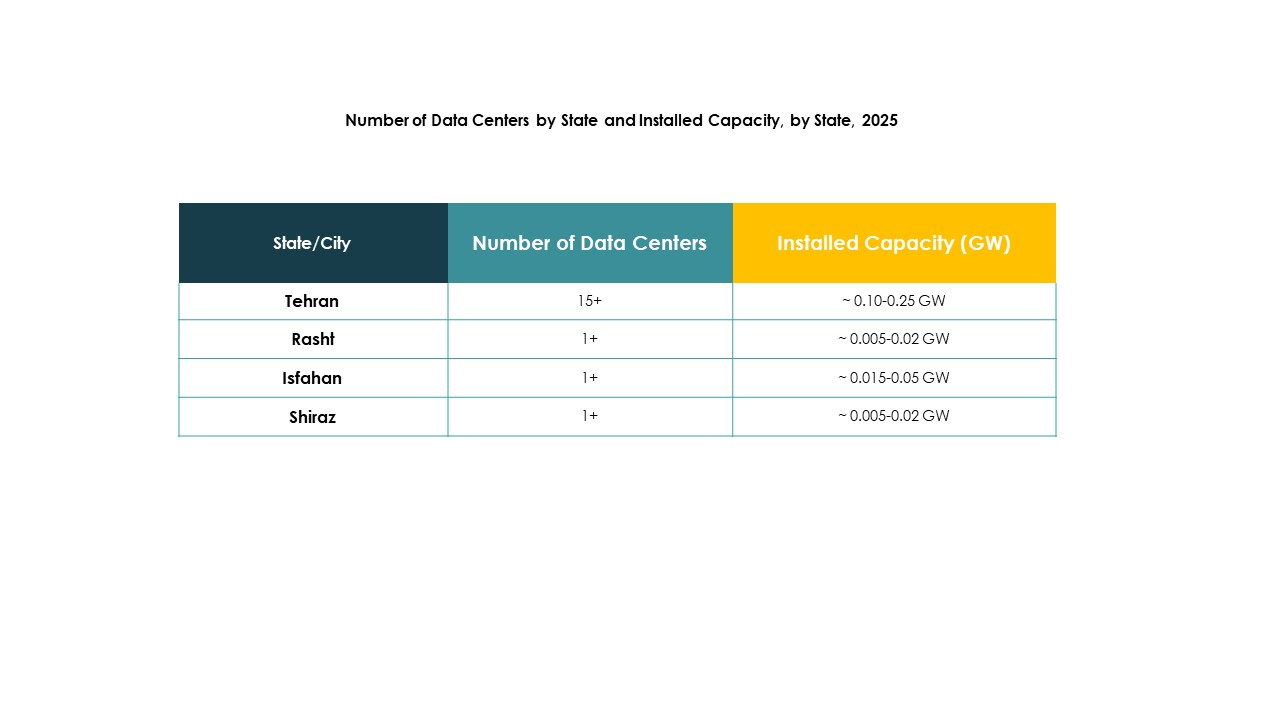

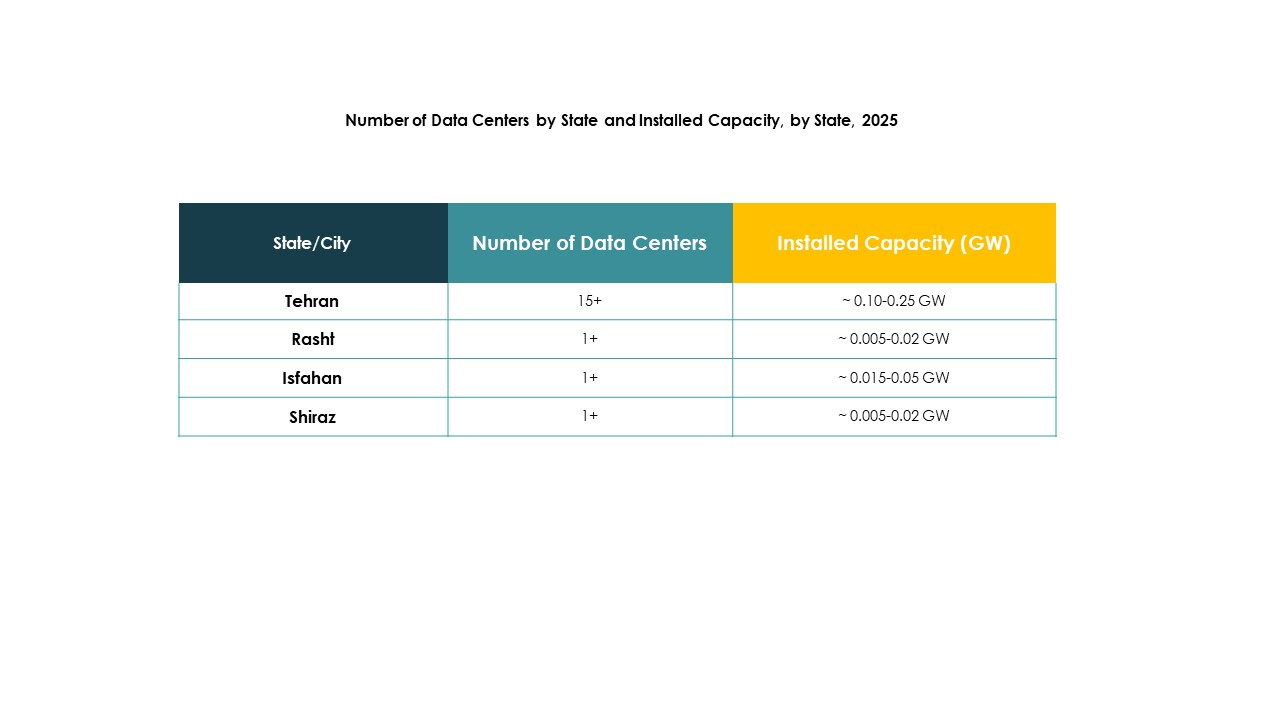

North Region Leading With Strong Market Share Backed By Government Initiatives

The north region leads the Iran Data Center Market with a 36% share. It benefits from government-backed technology initiatives and strong enterprise adoption in Tehran. The concentration of financial institutions and telecom hubs supports this dominance. It also attracts foreign investments due to better infrastructure availability. Enterprises in the north rely heavily on hybrid and colocation models. This region is expected to maintain leadership in the long term.

Central Region Expanding Through Enterprise And Manufacturing Sector Adoption

The central region holds 32% share of the Iran Data Center Market. Its growth is supported by industrial manufacturing hubs and SME-driven cloud adoption. It attracts data center expansions due to affordable land and power availability. Enterprises in the central region rely on colocation and managed services. Service providers view it as an emerging hub for cost-effective operations. This region is steadily increasing its importance within the market landscape.

- For instance, Afranet operates a data center in Tehran that offers colocation and dedicated server services, supporting enterprise and SME clients with secure hosting and cloud solutions. This facility is recognized as one of Iran’s earliest private cloud data centers, featuring 1,000 servers and 6 petabytes of storage capacity.

Southern Region Emerging With Infrastructure Investments And Energy Sector Demand

The southern region accounts for 22% share of the Iran Data Center Market. Its expansion is driven by energy sector enterprises and regional trade activities. Investments in port cities support demand for digital infrastructure. It serves as a hub for logistics and e-commerce industries. Enterprises in the south prefer cloud-based and modular facilities for flexibility. The region’s strategic location strengthens its role in future growth.

- For instance, as of February 2025, Iran’s national initiatives included launching the first GPU-based data center to support domestic AI systems, announced by the deputy of science, technology, and knowledge-based economy. These projects are primarily concentrated in Tehran, not in the southern region.

Competitive Insights:

- Afranet Data Center

- Pars Online Data Center

- Shatel Data Center

- AsiaTech Data Center

- Telecom Infra Company

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The competitive landscape of the Iran Data Center Market reflects a mix of strong domestic providers and influential global players. Local operators such as Afranet, Pars Online, Shatel, and AsiaTech maintain dominance through localized infrastructure, affordable solutions, and compliance with regional regulations. It gives them an edge in serving government projects and small to mid-sized enterprises. International providers like Microsoft, AWS, Google, and NTT focus on cloud, AI-driven workloads, and scalable platforms that attract large enterprises. Competition centers on service reliability, cybersecurity, and energy-efficient operations. Strategic alliances, new facility launches, and modular expansions are strengthening positions. It is driving a market structure where domestic resilience meets global expertise, shaping a balanced yet competitive ecosystem.

Recent Developments:

- In August 2025, officials launched a national AI platform that builds on a four-tier architecture with a dedicated data center component. That infrastructure supports resource management, integration of language models, and provision of AI tools to public and private sectors. It shows the government is tightly linking the data center frontier to AI deployment in Iran.

- In December 2024, Iran’s government revealed it will roll out a GPU-based data center by 2025 to support its national AI system. The new facility aims to host advanced AI algorithms locally, strengthening data sovereignty and performance. This step underlines the Iran Data Center Market’s strategic role in enabling AI infrastructure domestically.