Executive summary:

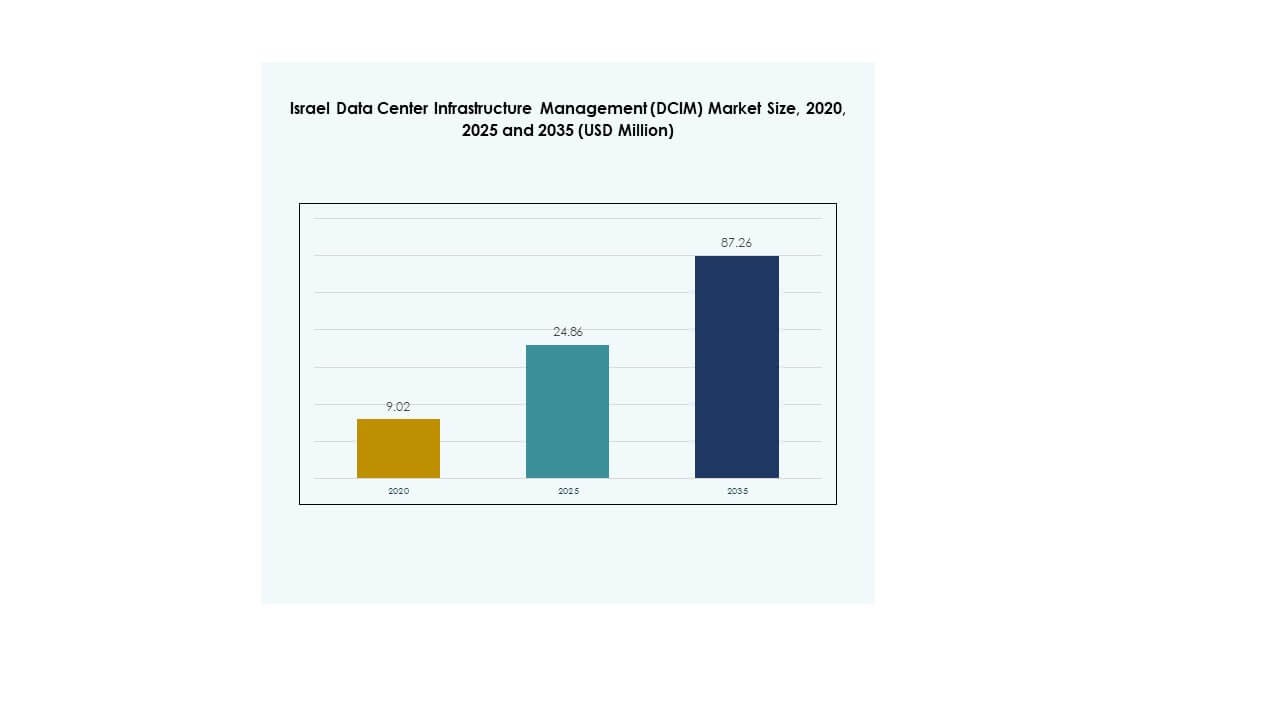

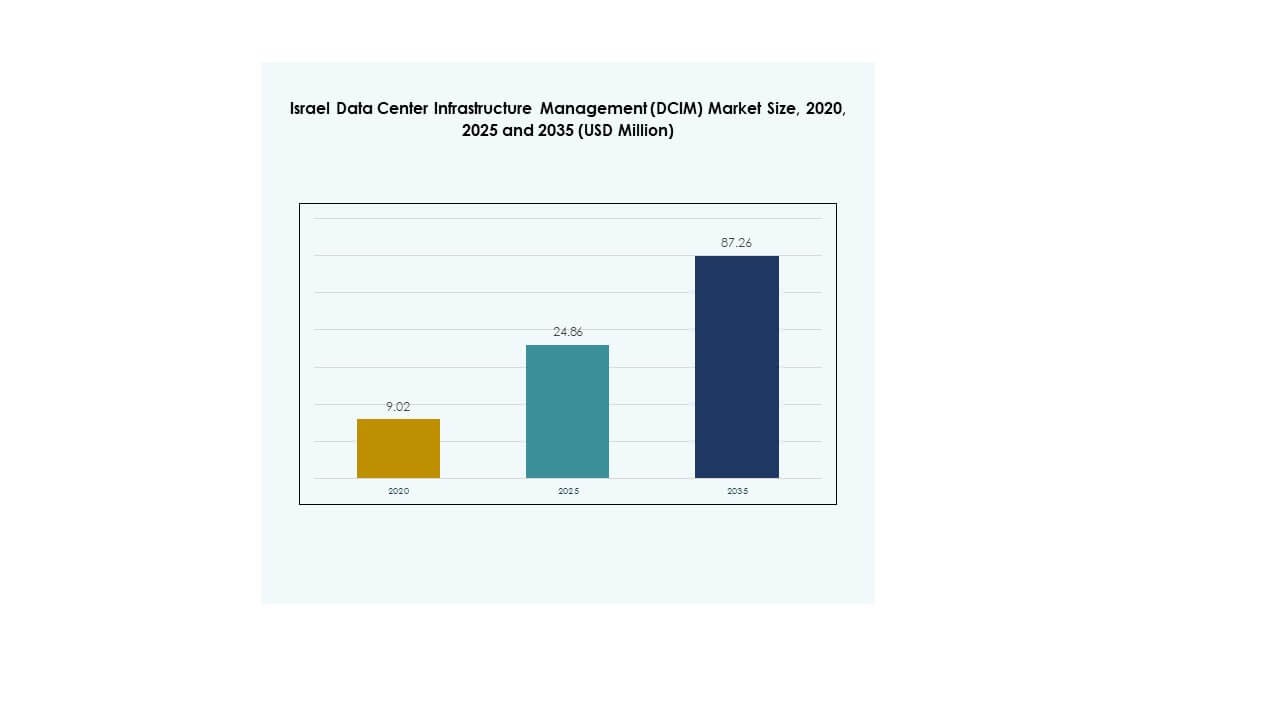

The Israel Data Center Infrastructure Management (DCIM) Market size was valued at USD 9.02 million in 2020, growing to USD 24.86 million in 2025, and is anticipated to reach USD 87.26 million by 2035, at a CAGR of 15.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Israel Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 24.86 Million |

| Israel Data Center Infrastructure Management (DCIM) Market, CAGR |

15.15% |

| Israel Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 87.26 Million |

Growing digital transformation, AI integration, and cloud adoption are driving the Israel Data Center Infrastructure Management (DCIM) Market. Enterprises are implementing advanced DCIM systems to enhance real-time monitoring, predictive maintenance, and power optimization. Increased focus on energy efficiency, sustainability, and automation supports the shift toward AI-enabled, modular data centers. The market’s strategic value lies in improving operational resilience, cost control, and scalability, making it an attractive opportunity for technology investors.

Tel Aviv and Central Israel lead in DCIM deployment due to strong connectivity and enterprise concentration. These regions benefit from advanced data infrastructure, global partnerships, and government-backed modernization initiatives. Northern and Southern regions are emerging with new facilities focusing on AI readiness and renewable energy integration. Together, these developments position Israel as a hub for high-performance, sustainable data center infrastructure management.

Market Drivers

Growing Adoption of AI-Driven and Cloud-Based DCIM Platforms

The Israel Data Center Infrastructure Management (DCIM) Market benefits from the strong adoption of AI and cloud technologies in managing complex data center environments. Businesses are integrating intelligent DCIM solutions to achieve predictive maintenance, optimize power consumption, and improve asset tracking accuracy. AI-powered monitoring allows early fault detection, reducing downtime risks. Cloud-based deployment increases accessibility and scalability across distributed networks. Enterprises prefer centralized management systems to control hybrid and edge facilities efficiently. The growing cloud ecosystem in Israel supports data-intensive applications. It strengthens operational continuity and transparency for businesses handling large data volumes.

- For instance, in March 2025, Compass Datacenters partnered with Schneider Electric to implement the EcoCare AI-powered platform that enabled predictive maintenance. This resulted in a 40% reduction in on-site maintenance interventions and a 20% reduction in operating expenses by leveraging AI and IoT sensors for real-time analytics and condition-based maintenance.

Integration of Smart Energy and Sustainability Practices in Data Centers

Israel’s rapid digitalization is driving data centers to adopt energy-efficient systems and renewable energy strategies. Organizations implement DCIM tools for real-time power monitoring and thermal optimization to meet sustainability goals. Energy-efficient hardware design and smart cooling solutions help operators maintain low PUE levels. It promotes green operations and compliance with government sustainability standards. Advanced analytics in DCIM platforms enable firms to track carbon emissions and energy footprints precisely. Businesses integrate renewable sources to reduce energy costs and improve reliability. The strategic focus on sustainable operations attracts international partnerships. It enhances Israel’s reputation as an eco-conscious data hub.

Accelerated Digital Transformation Across Strategic Sectors

The expanding digital infrastructure in Israel is fostering high DCIM adoption among banking, telecom, and healthcare sectors. Enterprises use these platforms to manage critical IT assets and ensure uninterrupted service delivery. The DCIM market’s strategic importance grows as sectors depend on reliable data-driven systems. It enables enterprises to respond faster to operational challenges. AI-enabled automation ensures infrastructure scalability and resilience. The rising deployment of 5G and IoT networks further drives demand. Businesses invest heavily to modernize legacy data centers. It strengthens Israel’s leadership in high-performance digital infrastructure.

Increased Investment in Edge Data Centers and AI Workloads

Investments in hyperscale and edge data centers are growing to support AI and analytics workloads. The Israel Data Center Infrastructure Management (DCIM) Market gains traction through AI-ready facilities requiring precise performance control. Edge computing supports low-latency operations vital for defense, fintech, and smart city projects. It enables real-time data analysis across distributed networks. DCIM solutions manage complex hybrid ecosystems with seamless integration. Investors view these advancements as key to improving competitiveness and technological leadership. Enterprises prioritize automation for workload balancing. It ensures reliability while maintaining cost efficiency and energy savings.

- For instance, NVIDIA announced plans in early 2025 to invest over $500 million in expanding its AI infrastructure in Israel, including the construction of a 10,000-square-meter technology campus to advance AI research and high-performance computing development. The facility strengthens Israel’s role as a global hub for AI innovation and semiconductor engineering, supported by Nvidia’s local R&D operations.

Market Trends

Shift Toward Automation and Predictive Intelligence in DCIM Systems

The Israel Data Center Infrastructure Management (DCIM) Market is evolving with predictive automation integrated into infrastructure operations. AI and machine learning models automate equipment diagnostics and predictive failure detection. It enhances service continuity and operational safety. Vendors introduce adaptive analytics dashboards for real-time visualization. Automated alerts optimize workflow and reduce manual intervention. DCIM tools are becoming vital in predictive maintenance strategies. Organizations increasingly prioritize intelligent automation for mission-critical workloads. It supports scalable and cost-efficient infrastructure management.

Rising Demand for Modular and Scalable Data Center Designs

Growing AI workloads and cloud expansion are boosting demand for modular DCIM architectures. Israel’s operators design scalable frameworks supporting fast capacity upgrades. It allows enterprises to adapt to rapid digital demand changes. Modular systems simplify expansion while maintaining performance consistency. Vendors integrate modular DCIM software with energy monitoring tools. These features improve operational flexibility and reduce downtime during expansion. Scalability becomes a strategic advantage in high-density environments. It supports future-ready and adaptable data infrastructure.

Integration of Cybersecurity Features into DCIM Platforms

The increasing cybersecurity threats to data centers drive strong focus on secure DCIM frameworks. The Israel Data Center Infrastructure Management (DCIM) Market emphasizes encryption, identity control, and anomaly detection within management systems. It ensures critical infrastructure protection across connected environments. Vendors integrate AI-driven threat analytics for real-time monitoring. Secure access protocols prevent unauthorized control of assets. Businesses seek unified platforms combining operations and cybersecurity. Enhanced system visibility strengthens compliance across industries. It reinforces trust among regulated sectors such as finance and healthcare.

Expansion of Hybrid and Multi-Cloud Ecosystems

Hybrid deployment models dominate Israel’s digital transformation efforts. Organizations use DCIM tools to manage on-premise and cloud-based operations effectively. The integration across multi-cloud environments boosts flexibility and workload distribution. It enables better cost control and resource utilization. Service providers launch DCIM-as-a-Service offerings to simplify management. Businesses gain visibility into hybrid environments through centralized dashboards. Hybrid infrastructure strengthens business agility under increasing data demands. It supports high scalability and operational transparency.

Market Challenges

High Capital Expenditure and Integration Complexity

The Israel Data Center Infrastructure Management (DCIM) Market faces cost challenges linked to infrastructure modernization. Upgrading legacy systems to smart, connected environments demands significant investment. Integrating new DCIM software with existing systems requires high technical expertise. It slows adoption among small enterprises with limited budgets. Complex IT ecosystems increase configuration errors and downtime risks. Operators must invest in staff training and cybersecurity upgrades. Regulatory compliance adds further cost layers for certification and reporting. These financial and technical barriers delay widespread DCIM implementation.

Skill Gaps and Cybersecurity Vulnerabilities in Advanced Systems

The fast adoption of AI-powered DCIM solutions exposes workforce capability gaps. Many enterprises lack professionals skilled in automation, data analytics, and IoT integration. It limits efficient system operation and maintenance. Increasing interconnectivity between IT and OT systems introduces cybersecurity risks. DCIM platforms become potential targets for data breaches and ransomware. Continuous monitoring is vital to prevent vulnerabilities across networks. Regulatory frameworks demand stringent compliance for data protection. The need for advanced technical training and skilled staff remains critical to market growth.

Market Opportunities

Rising Investments in Green and AI-Optimized Infrastructure

Sustainability and artificial intelligence create new business opportunities for Israel’s DCIM ecosystem. The Israel Data Center Infrastructure Management (DCIM) Market benefits from data centers integrating renewable power and AI-powered management systems. Green energy alignment supports corporate ESG goals. AI-based optimization enhances performance and predictive maintenance. Investors focus on funding energy-efficient, AI-ready facilities. These advancements attract collaborations with international hyperscalers. It positions Israel as a regional hub for eco-smart digital infrastructure.

Government Support for Digital Infrastructure Modernization

Public initiatives promoting cloud computing and smart infrastructure drive new growth opportunities. Government-backed R&D investments enhance local innovation. The Israel Data Center Infrastructure Management (DCIM) Market supports digital transformation goals outlined in national tech policies. Financial incentives encourage private sector participation in infrastructure expansion. Startups receive grants to develop AI-driven monitoring tools. Strategic partnerships between public agencies and enterprises improve resilience. It enhances Israel’s global competitiveness in digital ecosystem management.

Market Segmentation

By Component

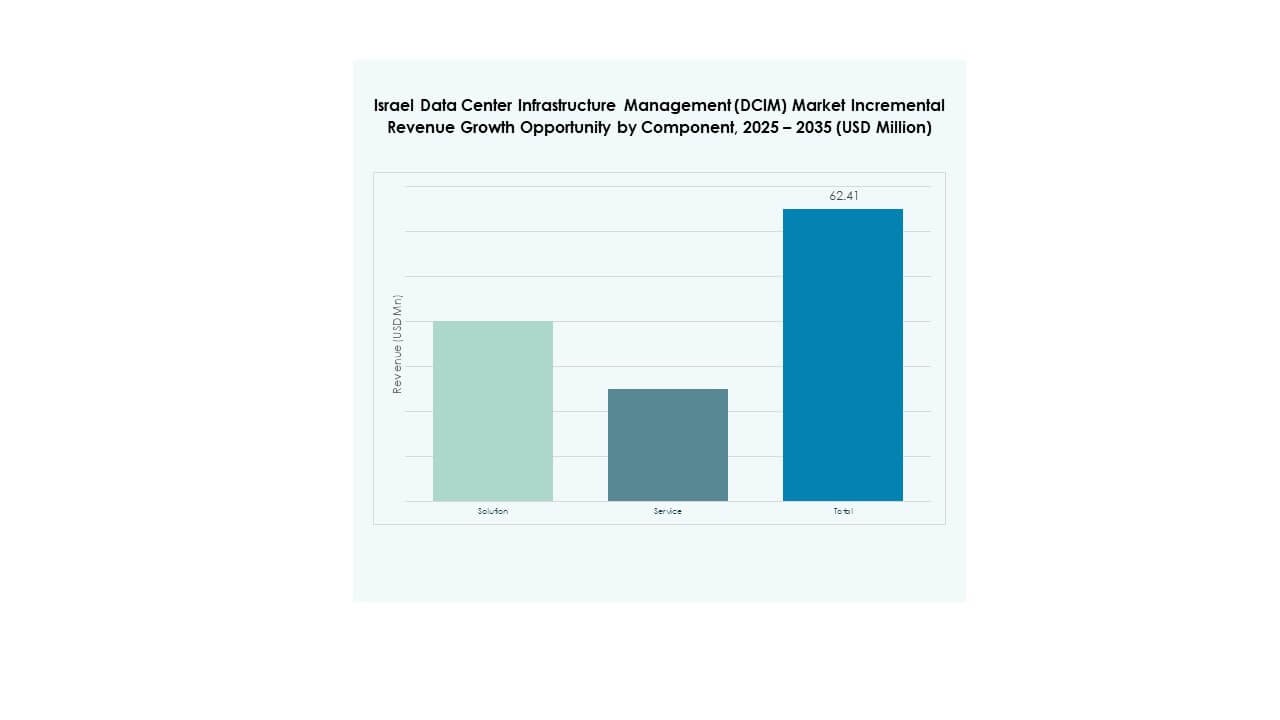

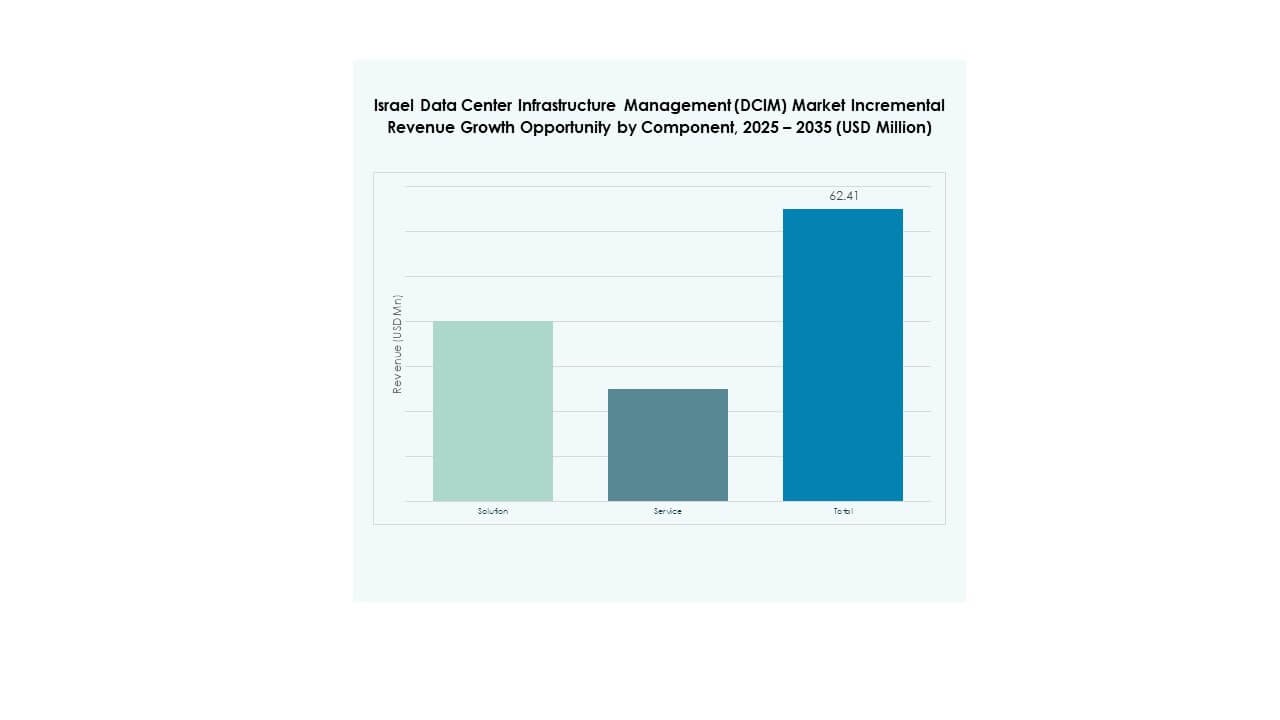

Solutions dominate the Israel Data Center Infrastructure Management (DCIM) Market due to rising automation adoption and demand for integrated management platforms. These tools offer real-time visibility across energy, power, and assets. Services, including installation and consulting, gain traction as businesses seek customized optimization strategies. Strong vendor partnerships enhance service delivery. It strengthens long-term operational efficiency and client retention in high-performance facilities.

By Data Center Type

Cloud and Edge Data Centers hold the largest share in the Israel Data Center Infrastructure Management (DCIM) Market. The growth aligns with expanding AI workloads and hybrid deployments. Colocation centers follow due to enterprise outsourcing trends. Managed and enterprise data centers adopt advanced monitoring to control multi-site operations. Edge facilities grow rapidly with IoT applications. It reinforces national connectivity and real-time processing.

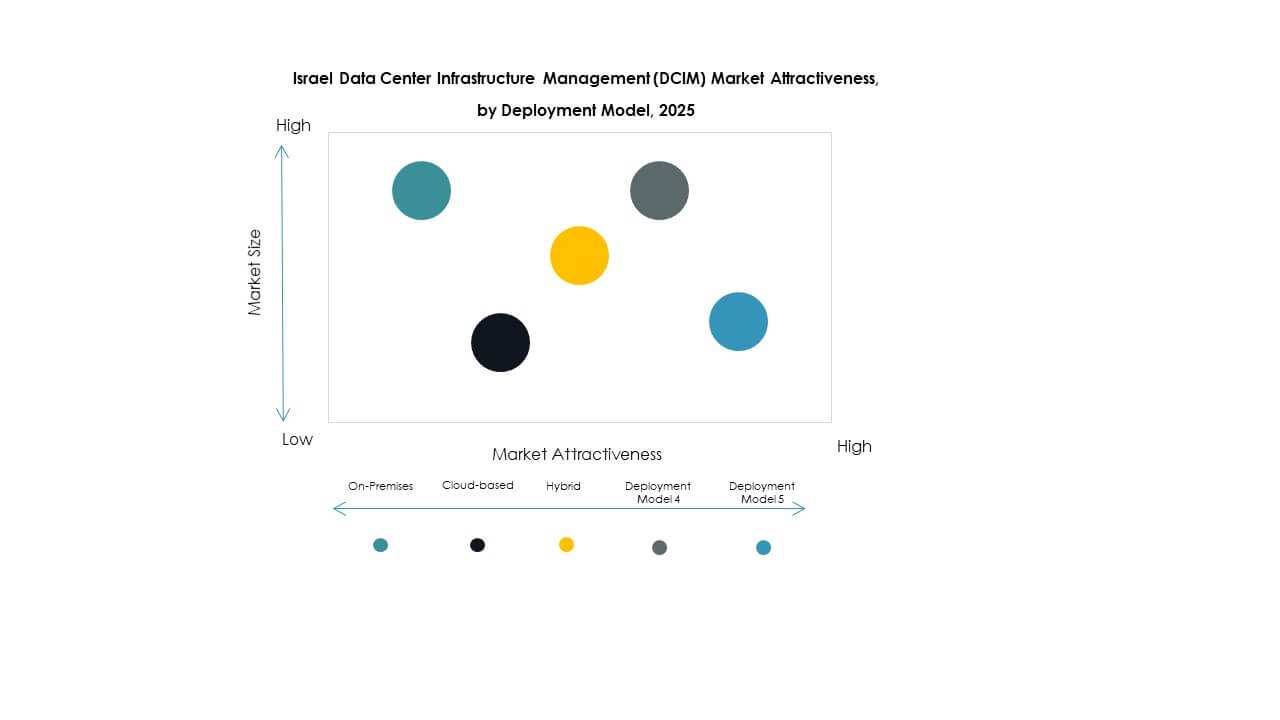

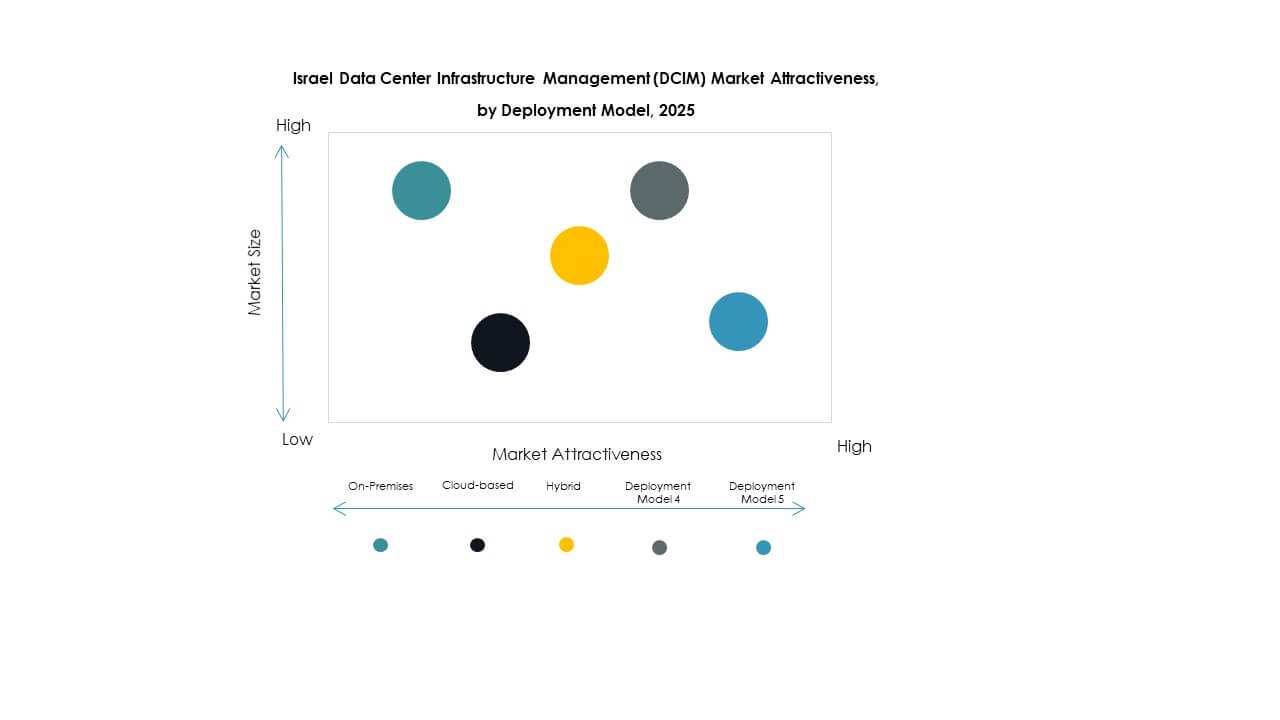

By Deployment Model

Cloud-based deployment dominates due to scalability and cost advantages. The Israel Data Center Infrastructure Management (DCIM) Market favors cloud-first strategies for hybrid network integration. On-premises models retain importance for regulated sectors like defense and finance. Hybrid frameworks bridge the flexibility gap between security and scalability. It ensures operational resilience while minimizing infrastructure risks.

By Enterprise Size

Large enterprises lead the Israel Data Center Infrastructure Management (DCIM) Market due to early digital transformation adoption. They deploy multi-site monitoring systems for predictive analytics. SMEs are gradually investing in affordable DCIM platforms. Cost-effective cloud-based tools enable easier integration. It expands DCIM adoption beyond major corporations.

By Application / Use Case

Power Monitoring dominates as energy management becomes critical to sustainability. The Israel Data Center Infrastructure Management (DCIM) Market also sees strong adoption in capacity and asset management modules. BI and analytics applications rise with AI integration. Environmental monitoring ensures thermal stability and safety compliance. It supports intelligent facility control and resource allocation.

By End User Industry

The IT and Telecommunications sector dominates due to growing cloud service demand. The Israel Data Center Infrastructure Management (DCIM) Market sees increasing adoption in BFSI and healthcare for data compliance and uptime reliability. Retail and energy firms deploy DCIM tools for cost and power efficiency. Aerospace and defense sectors invest in secure monitoring platforms. It ensures uninterrupted mission-critical operations.

Regional Insights

Dominance of Tel Aviv and Central Israel in Data Center Growth

Tel Aviv leads the Israel Data Center Infrastructure Management (DCIM) Market with 48% share, driven by dense enterprise presence and robust connectivity. The region hosts hyperscale facilities supporting AI, fintech, and cybersecurity applications. It benefits from superior fiber networks and proximity to international subsea cables. Central Israel attracts most foreign direct investments due to policy support. It remains the hub for cloud innovation and high-density data traffic.

- For instance, Global Technical Realty’s Tel Aviv IS One facility operates with a built power capacity of approximately 10.5 MW, providing carrier-neutral connectivity linked to multiple international subsea cables and supporting AI, fintech, and cybersecurity workloads.

Emerging Data Center Development in Northern and Southern Regions

Northern Israel accounts for 32% share, led by industrial and academic collaborations in Haifa and Yokneam. These hubs focus on R&D and energy-efficient computing. Southern Israel, including Be’er Sheva, contributes 20% share, supported by defense projects and government initiatives promoting smart city ecosystems. It hosts several new facilities powered by renewable sources. The expansion reflects Israel’s strategy to balance regional capacity.

Growing Strategic Position in the Middle East Data Network

The Israel Data Center Infrastructure Management (DCIM) Market strengthens its regional influence through connectivity with Mediterranean and Gulf networks. It acts as a bridge for data exchange between Europe and Asia. Government policies encourage cross-border partnerships for cloud hosting and digital trade. Israel’s cybersecurity expertise ensures operational trust. It positions the nation as a regional leader in resilient, technology-driven infrastructure management.

- For instance, the Eilat Ashkelon Pipeline Company is installing a 254-km fiber optic cable from Ashkelon to Eilat, linking Mediterranean subsea cables to Gulf and Asian networks, enhancing Israel’s connectivity.

Competitive Insights:

- MedOne

- Bezeq International Ltd. (Bezeq Int’l)

- Partner Communications Company Ltd.

- Cellcom Israel Ltd.

- ABB Ltd.

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd.

- Schneider Electric SE

- Siemens AG

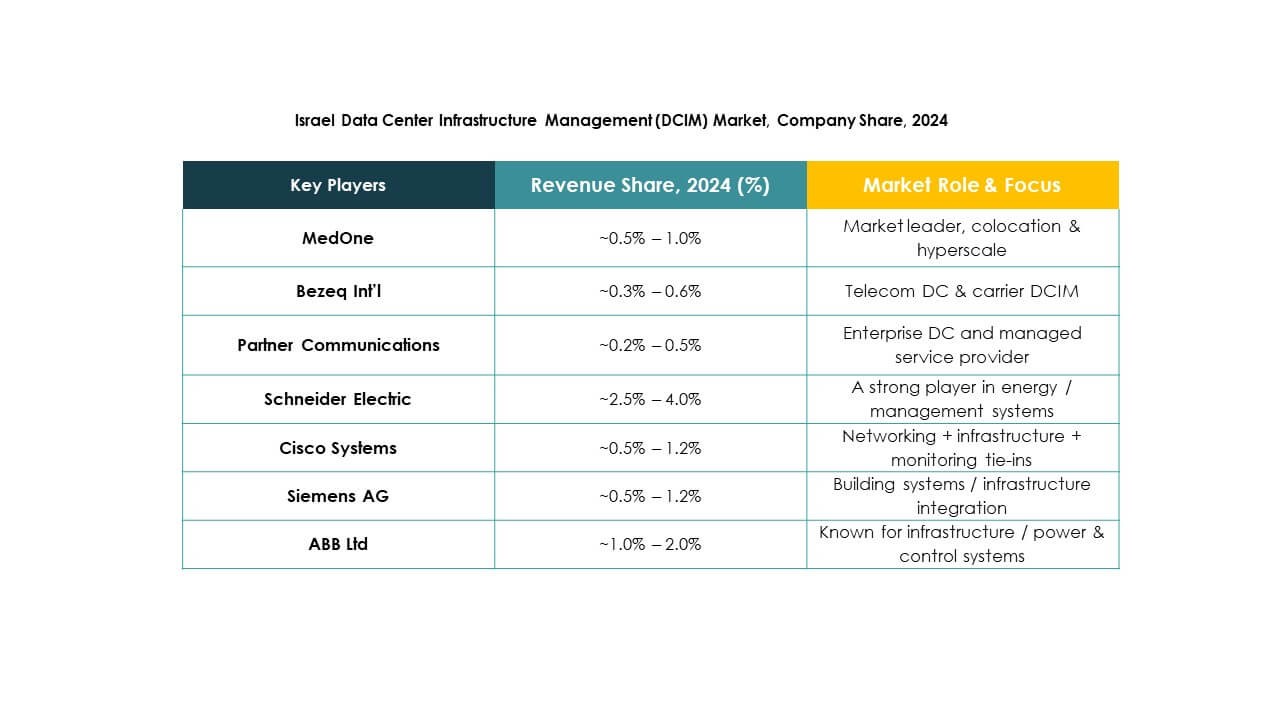

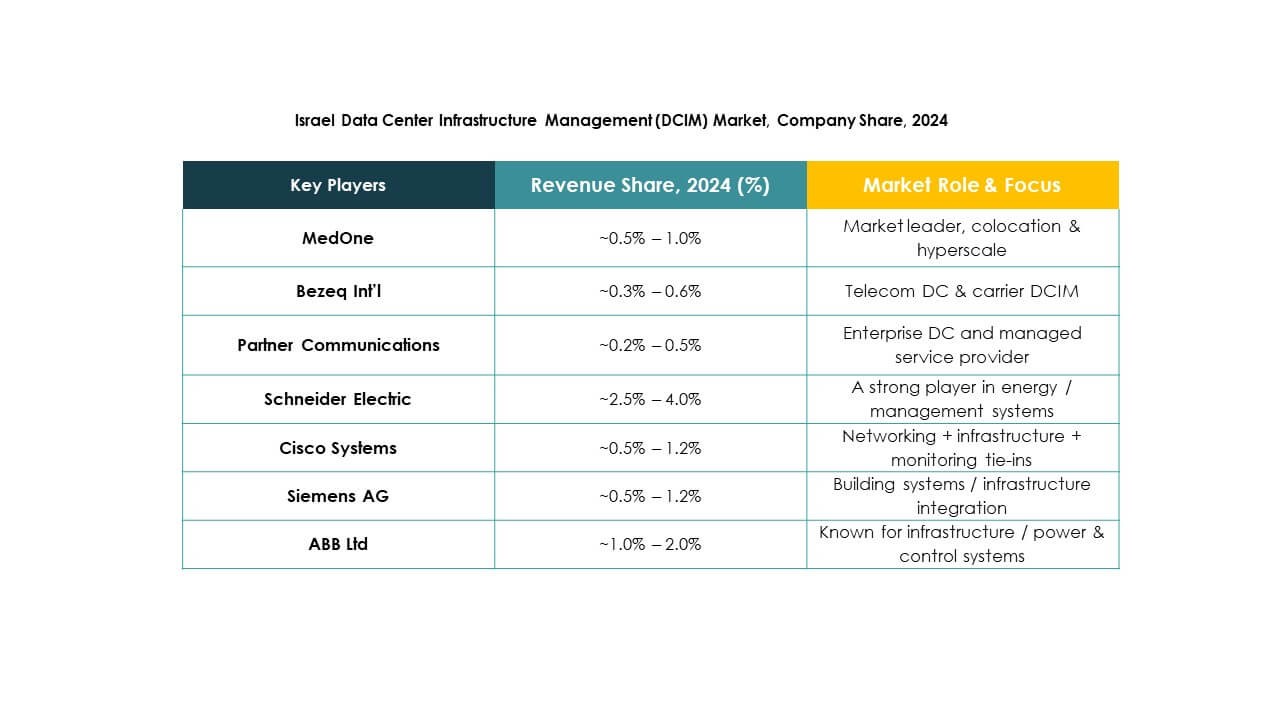

The Israel Data Center Infrastructure Management (DCIM) Market features a blend of domestic operators and global technology leaders competing on innovation, scalability, and service integration. Local firms such as MedOne and Bezeq International dominate colocation and connectivity infrastructure, while global vendors like Schneider Electric and Huawei drive technological modernization through AI-enabled monitoring and energy management systems. It exhibits increasing investment in modular, cloud-based, and hybrid DCIM architectures tailored to Israel’s expanding digital ecosystem. Partnerships between telecom providers and technology companies strengthen data resilience, sustainability, and automation. Global players focus on smart energy optimization, while regional firms emphasize data localization and compliance leadership.

Recent Developments:

- In September 2025, MedOne announced the continued development of two new underground data centers in Kfar Yona, Israel, representing an investment of approximately $270 million and highlighting its role as a leading provider of resilient, carrier-neutral infrastructure prepared to support the nation’s AI-driven data center expansion.

- In September 2025, Schneider Electric SE announced a collaboration with Compass Datacenters to deliver jointly engineered, prefabricated modular white space solutions, and launched Nvidia-enabled EcoStruxure Pod and Rack Infrastructure for rapid deployment and scalable power, cooling, and control systems in high-density AI data centers in Israel.