Executive summary:

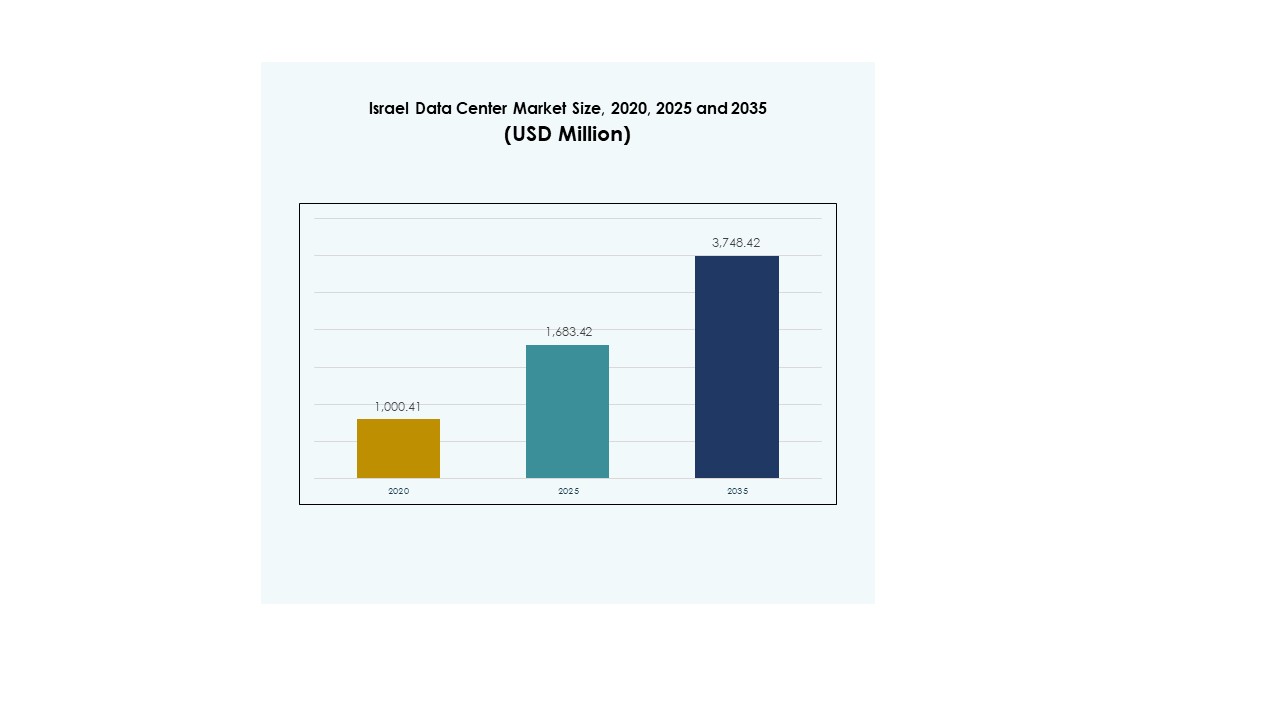

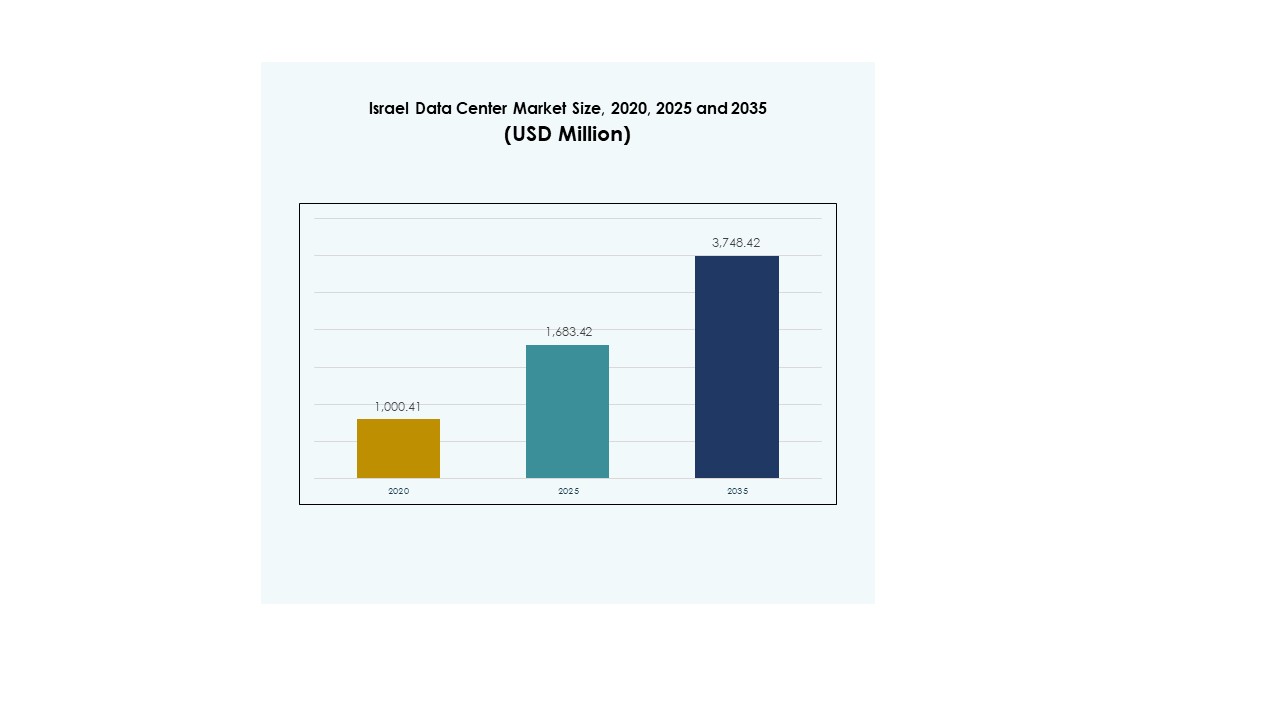

The Israel Data Center Market size was valued at USD 1,000.41 million in 2020 to USD 1,683.42 million in 2025 and is anticipated to reach USD 3,748.42 million by 2035, at a CAGR of 8.28% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Israel Data Center Market Size 2025 |

USD 1,683.42 Million |

| Israel Data Center Market, CAGR |

8.28% |

| Israel Data Center Market Size 2035 |

USD 3,748.42 Million |

Growth is fueled by rapid adoption of cloud services, AI, and digital transformation initiatives across industries. Enterprises invest in scalable and secure infrastructure to support data-intensive applications, while innovations in modular facilities, automation, and cybersecurity strengthen the sector. The market’s strategic importance lies in enabling global firms and investors to capitalize on Israel’s technology-driven economy and expanding digital ecosystem.

Central and Coastal regions lead the market with advanced infrastructure and strong enterprise presence, supported by robust telecom networks and high demand for hyperscale centers. Northern areas are emerging with sustainable data center projects, while the Southern region is gaining traction through government-backed initiatives and industrial expansion. This distribution highlights Israel’s balanced regional growth in digital infrastructure.

Market Drivers

Growing Cloud Adoption and Enterprise Digitalization Driving Advanced Infrastructure Development

The Israel Data Center Market is expanding with strong demand for cloud adoption and enterprise digitalization. Businesses are shifting workloads from traditional systems to hybrid and cloud models, creating demand for scalable centers. It benefits from Israel’s established tech ecosystem that drives infrastructure modernization. Organizations prioritize secure, high-capacity facilities to support mission-critical operations. Innovation in IT services strengthens this demand further. Investors view the market as a strategic gateway for digital growth. Enterprises across industries recognize the role of data centers in competitiveness. The trend secures its place as a central driver of national technology strategy.

- For example, Amazon Web Services (AWS) launched its Israel (Tel Aviv) infrastructure region in August 2023, featuring three Availability Zones. The investment plan includes about $7.2 billion in Israel through 2037 to support construction, operation, and cloud-enablement efforts.

Rising Importance Of Artificial Intelligence, Machine Learning, And Automation Across Industries

Artificial intelligence, machine learning, and automation enhance operations across industries and shape new data requirements. The Israel Data Center Market benefits from growing deployment of AI-focused applications requiring high-performance computing. It prompts demand for low-latency, energy-efficient designs. Organizations integrate automation tools to optimize workloads and reduce operational complexity. Enhanced monitoring and orchestration improve resiliency and service delivery. The drive toward intelligent operations fosters trust among global businesses. Companies use it to gain real-time insights and improve decisions. These shifts highlight the sector’s importance in enabling advanced digital services across critical sectors.

- For example, in January 2025, Nvidia began constructing a 10,000 m² AI research data center in Israel, expected to support its R&D and engineering efforts. The facility will utilize liquid-cooled systems and Blackwell-based compute hardware with a planned power capacity of up to 30 MW.

Rising Role Of Cybersecurity And Compliance Requirements In Modern Infrastructure Deployment

Cybersecurity challenges and compliance standards push enterprises toward secure, modern infrastructure investments. The Israel Data Center Market gains traction as organizations prioritize advanced security systems. It supports industries managing sensitive information, including BFSI, healthcare, and government. Strong encryption, firewalls, and multi-factor authentication systems become standard. Compliance with international regulations also drives demand for structured environments. The focus on robust protection enhances investor confidence. Enterprises choose providers that integrate resilience against cyber threats. Growing cyber awareness ensures the market remains central to Israel’s national and regional digital strategy.

Strategic Importance For International Connectivity And Regional Digital Expansion

The Israel Data Center Market holds strategic significance for businesses and investors seeking regional connectivity. Its location makes it a vital hub between Europe, Asia, and the Middle East. The market benefits from global players expanding to serve diverse enterprises. It supports cross-border trade, regional partnerships, and multinational investment opportunities. Enterprises leverage centers for improved data exchange and digital growth. Strong telecom infrastructure provides a competitive edge. Governments encourage its expansion to drive international presence. The market serves as a bridge for regional and global innovation.

Market Trends

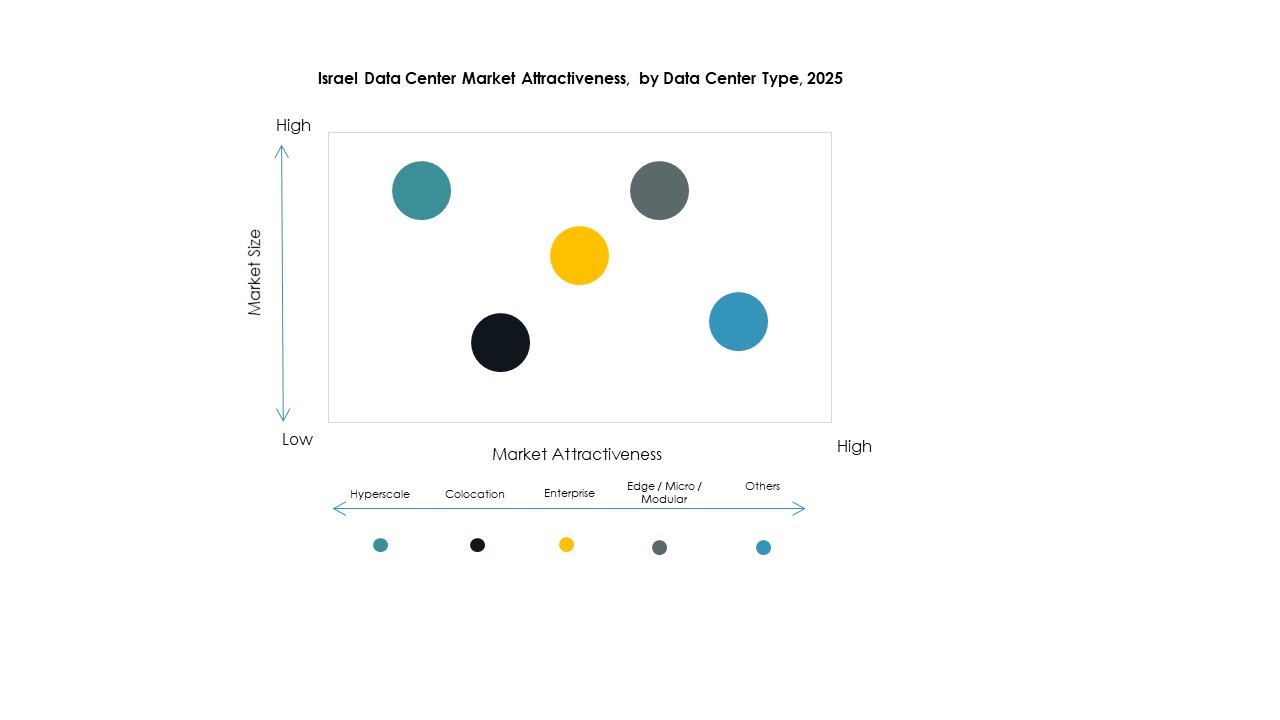

Emergence Of Edge And Modular Facilities Supporting Next-Generation Applications

The Israel Data Center Market is witnessing rapid adoption of edge and modular facilities. Enterprises rely on modular systems to scale efficiently and reduce deployment time. Edge sites support next-generation applications like autonomous systems and smart city projects. This trend shortens latency and improves user experiences in real time. Energy-efficient modular centers align with sustainability goals. Investors favor these solutions for flexibility and cost efficiency. It allows quicker market entry for enterprises and service providers. Growth in IoT applications fuels further demand for localized processing infrastructure.

Integration Of Renewable Energy And Sustainable Operations Across Facilities

Sustainability initiatives are reshaping facility design and operational standards. The Israel Data Center Market emphasizes renewable energy integration to reduce carbon footprint. Operators focus on solar, wind, and hybrid sources to power facilities. Cooling systems are redesigned to minimize water and energy use. Green certifications strengthen the reputation of local providers. Enterprises prefer providers with transparent sustainability practices. Investors also support eco-friendly designs, boosting funding for sustainable projects. It makes the sector more resilient against regulatory changes. This trend secures environmental responsibility as a competitive advantage.

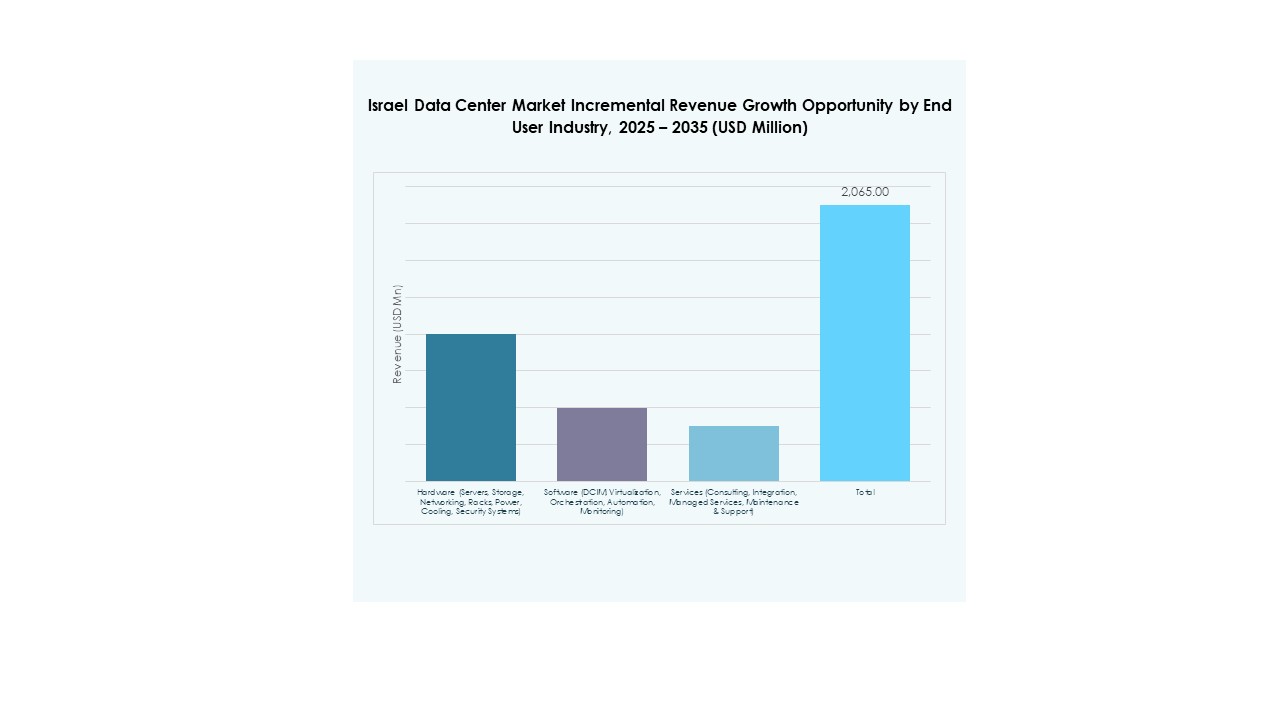

Adoption Of Advanced Data Center Software For Enhanced Performance And Automation

Advanced software solutions transform how facilities are managed and optimized. The Israel Data Center Market embraces DCIM, orchestration, and monitoring platforms for efficiency. Automation reduces downtime and operational costs. Virtualization enhances resource utilization while strengthening workload agility. Orchestration tools provide better control across hybrid environments. Real-time monitoring improves service reliability and customer trust. Providers implement intelligent analytics for predictive maintenance. It enables greater resilience against operational risks. Enterprises view software innovation as essential to future-proof infrastructure investments.

Expansion Of Hyperscale And Colocation Centers Catering To Global Enterprises

Hyperscale and colocation centers are becoming central pillars in infrastructure development. The Israel Data Center Market benefits from strong interest by multinational cloud providers. Colocation services allow enterprises to expand without heavy upfront investments. Hyperscale sites cater to large-scale data requirements across industries. Operators focus on capacity, interconnectivity, and scalability to meet global standards. Growing demand from IT and telecom fuels rapid development. Investors see hyperscale hubs as long-term assets with high growth potential. It strengthens Israel’s role as a key regional provider of data services.

Market Challenges

High Energy Consumption And Infrastructure Costs Strain Long-Term Profitability

The Israel Data Center Market faces rising concerns over energy consumption and infrastructure costs. Facilities require extensive electricity, advanced cooling, and reliable backup systems. Power availability remains a critical issue, raising operational expenses for providers. Land and construction costs also weigh heavily on expansion projects. Limited space in urban areas creates barriers for large-scale sites. Providers struggle to balance sustainability goals with high energy demand. Rising costs affect competitive pricing for small enterprises. It creates challenges for new entrants aiming to capture market share.

Regulatory Complexities And Shortage Of Skilled Workforce Limit Sector Expansion

Regulatory complexities and workforce shortages limit the smooth growth of facilities. The Israel Data Center Market operates under strict compliance frameworks tied to data privacy and cybersecurity. Frequent updates to these standards demand constant adaptation. Enterprises face difficulty in securing talent with specialized technical expertise. The shortage of engineers and IT professionals delays project execution. Providers rely on training programs to address skill gaps. This dependency increases costs and affects operational efficiency. It restricts the pace at which providers can expand capacity in line with demand.

Market Opportunities

Rising Cross-Border Investments And Strategic Alliances Strengthening Regional Positioning

The Israel Data Center Market offers opportunities through cross-border investments and alliances. Global firms partner with local providers to expand regional presence. These alliances enhance capacity, connectivity, and reliability. It attracts multinational clients from IT, telecom, and BFSI sectors. Joint ventures bring advanced technologies and capital to the region. The collaborations increase competitiveness against neighboring countries. Strong investor interest further accelerates innovation and modernization. Providers leverage this momentum to expand international networks.

Growing Demand From Emerging Sectors Creates Room For Service Diversification

Emerging sectors such as healthcare, retail, and entertainment drive diverse demand. The Israel Data Center Market benefits as industries digitize services and adopt real-time analytics. Enterprises seek reliable infrastructure for secure and seamless operations. Providers expand services with industry-specific solutions to address this demand. Growing interest in AI, blockchain, and big data applications further expands scope. It ensures resilience against market fluctuations by broadening customer base. Tailored solutions improve customer retention and business growth. Providers achieve differentiation through specialized offerings.

Market Segmentation

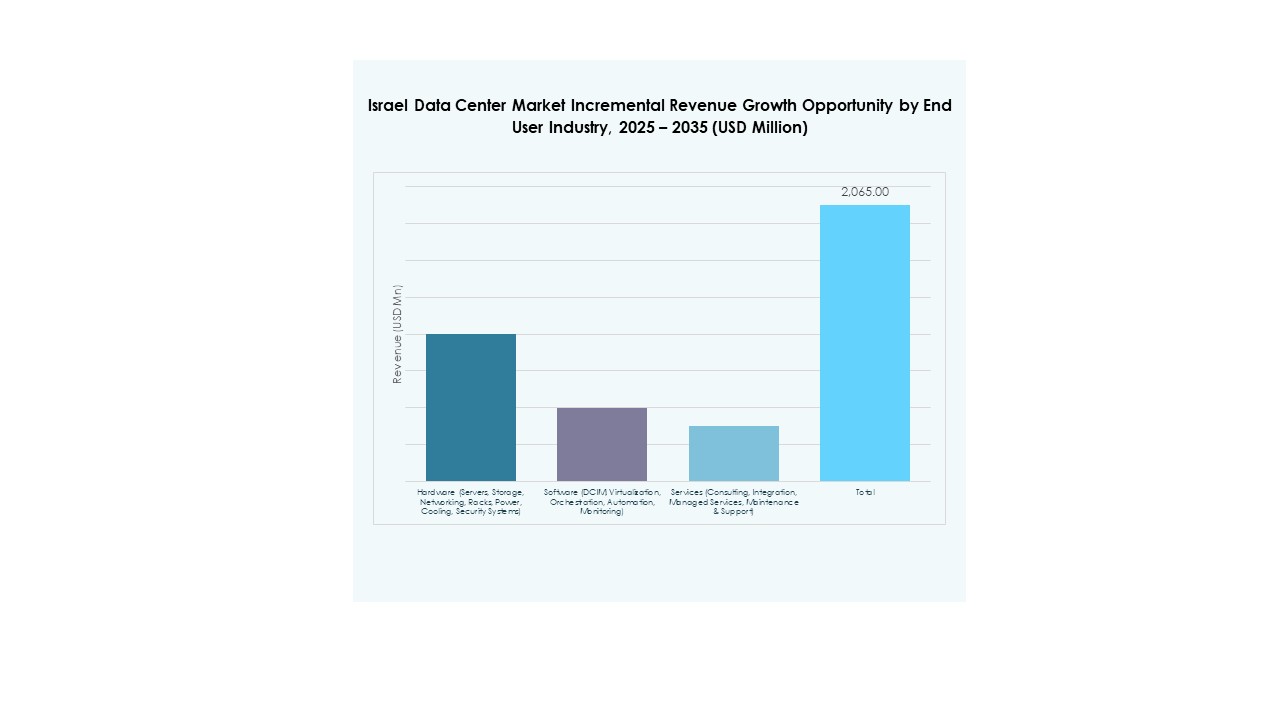

By Component

Hardware dominates the Israel Data Center Market with servers, racks, cooling, and power systems holding the largest share. Hardware drives demand due to scalability, reliability, and integration with advanced networking. Storage solutions are gaining traction with the rise of big data. Software grows through DCIM and automation tools enhancing efficiency. Services expand with consulting and managed services aiding enterprises. Hardware remains critical for capacity building. It sets the foundation for software and services innovation. Strong hardware demand secures its leading position.

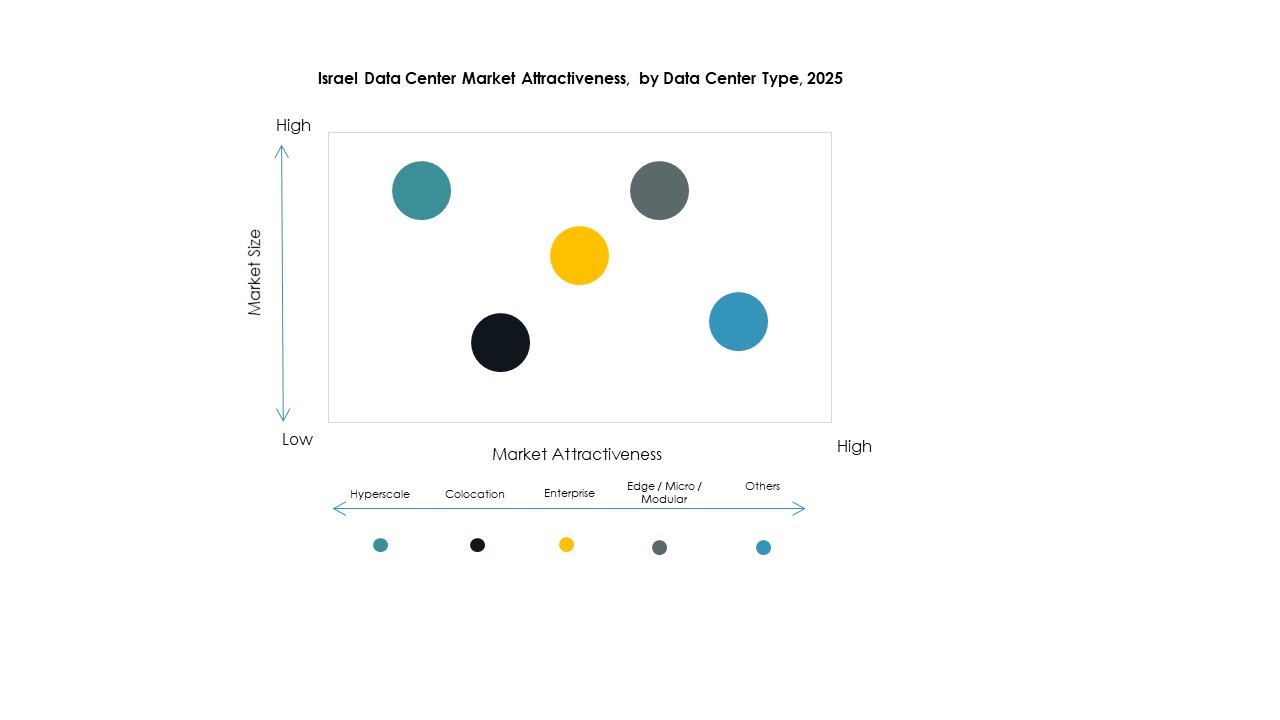

By Data Center Type

Hyperscale centers dominate the Israel Data Center Market, driven by demand from cloud giants and large enterprises. Colocation centers follow with strong adoption by SMEs seeking scalable infrastructure. Enterprise centers serve business-specific needs with tailored capacity. Edge and modular sites grow steadily, supporting IoT and real-time applications. Mega centers are rare but gaining attention for high-capacity operations. Cloud and IDC sites align with growing cloud-first strategies. Hyperscale leadership reflects its importance in global-standard infrastructure. It continues to attract investments for expansion.

By Deployment Model

Cloud-based models dominate the Israel Data Center Market, reflecting enterprises’ shift to flexible and scalable infrastructure. On-premises remains relevant for sensitive data in government and BFSI. Hybrid deployment is growing, bridging control with scalability. Cloud-based leads due to agility, cost-effectiveness, and rapid adoption across industries. Providers enhance cloud integration to attract enterprises. It remains the backbone of digital transformation strategies. Hybrid continues to expand in balancing data sovereignty. On-premises retains demand but cloud-based stays dominant.

By Enterprise Size

Large enterprises dominate the Israel Data Center Market with extensive investment capacity. They lead in adoption of hyperscale and cloud deployments. SMEs contribute steadily, favoring colocation and cloud services for cost efficiency. Large enterprises drive demand for global connectivity and advanced security. SMEs gain flexibility through managed services. It ensures both segments remain active growth contributors. Large enterprises hold stronger influence due to high resource availability. Their investments anchor overall market direction.

By Application / Use Case

IT and telecom dominate the Israel Data Center Market, driven by high connectivity and data demand. BFSI follows with reliance on secure, compliant infrastructure. Healthcare grows rapidly due to digital health and telemedicine services. Retail and e-commerce also expand usage, demanding low-latency systems. Media and entertainment rely on streaming growth and gaming platforms. Manufacturing and education diversify demand further. Government and defense remain critical for sovereign data storage. IT and telecom leadership reflects the sector’s digital core.

By End User Industry

Cloud service providers dominate the Israel Data Center Market, driven by strong enterprise reliance on cloud. Enterprises follow with increasing hybrid deployments. Colocation providers serve SMEs and businesses seeking scalability. Government agencies secure demand with public sector digital projects. Other industries also contribute to steady expansion. Cloud service providers lead due to global integration and advanced offerings. It anchors the market’s strategic growth path. Their dominance signals future expansion toward hybrid and edge ecosystems.

Regional Insights

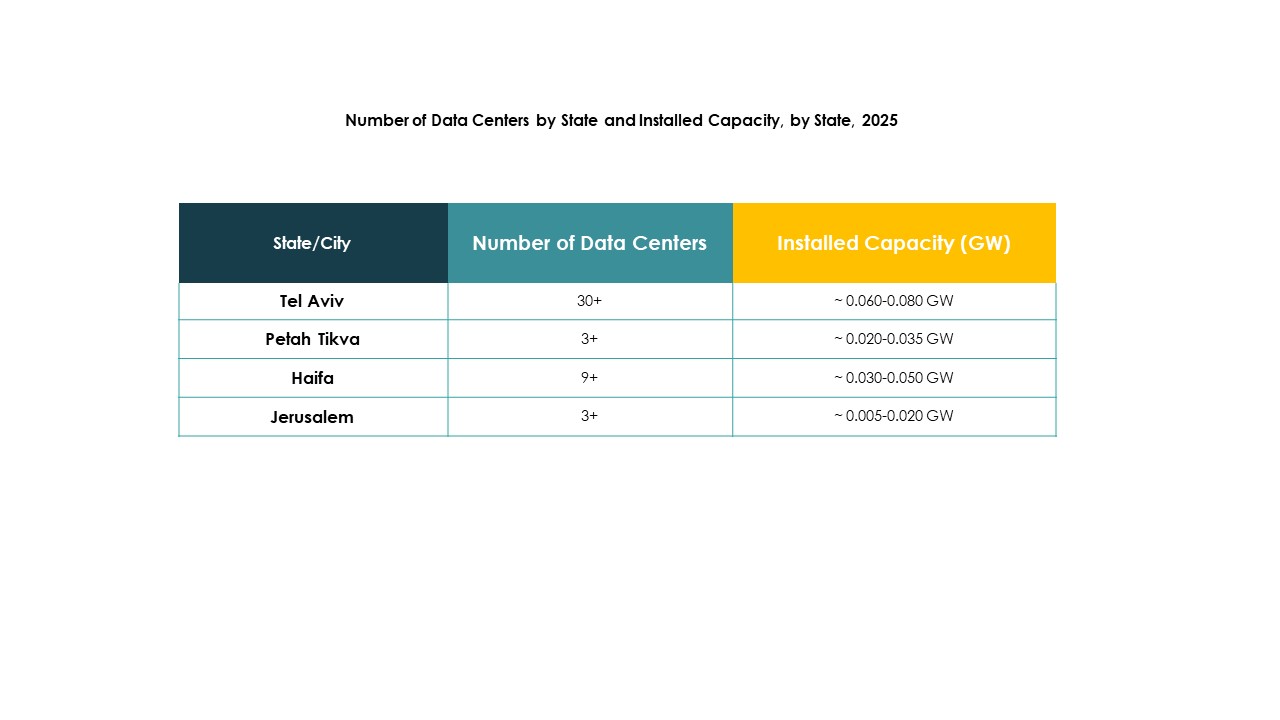

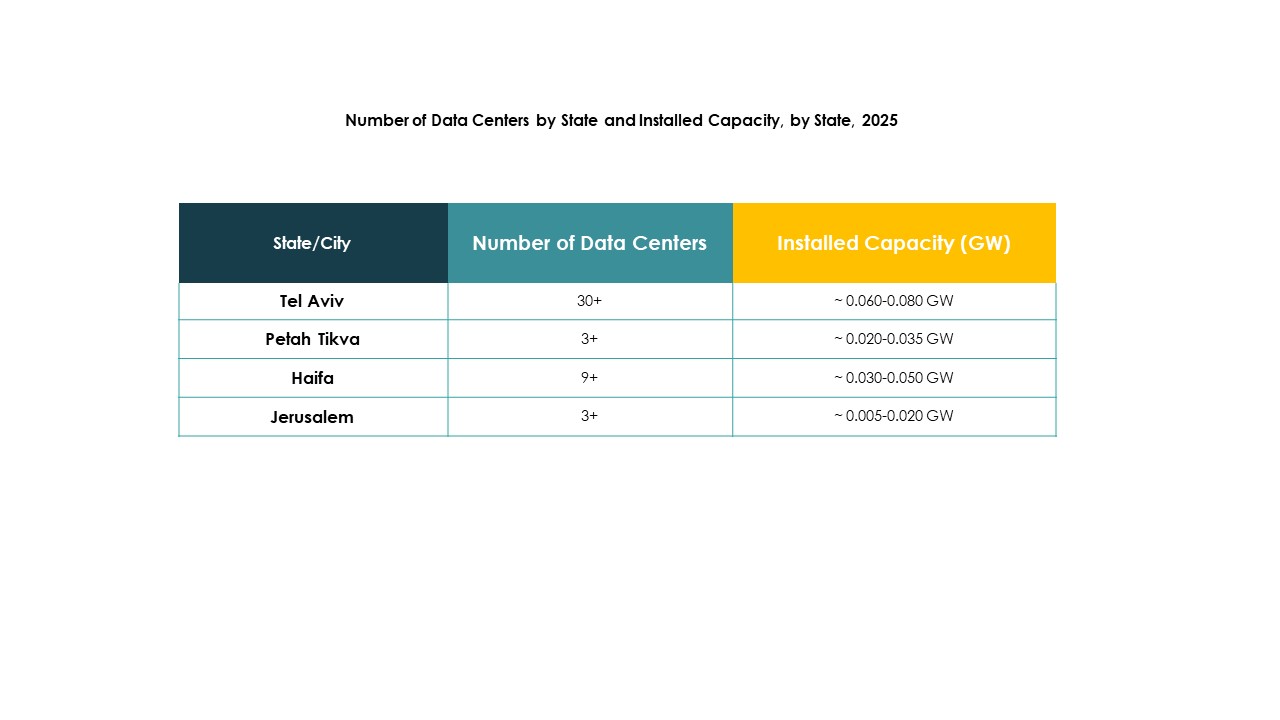

Central And Coastal Regions Driving Market Expansion With Strong Infrastructure Investment

The Israel Data Center Market sees Central and Coastal regions leading with a 58% share. These areas benefit from advanced infrastructure, strong telecom connectivity, and concentration of enterprises. High demand for hyperscale centers supports rapid development. Providers focus on expanding capacity in these regions due to high digital activity. It secures dominance through established technology hubs and strong global partnerships. The concentration of resources makes these regions attractive for foreign investments. Their role ensures they remain the backbone of national digital infrastructure.

- For instance, MedOne is constructing two new underground data centers north of Tel Aviv at Kfar Yona, spanning 30,000 sqm across three floors, with the first facility set to open in 2026 and the second in 2027, featuring real-time full backup for continuity and resilient infrastructure against grid disruptions.

Northern Region Emerging With Focus On Specialized Data Facilities And Renewable Energy Integration

The Northern region holds a 24% share, gaining recognition through specialized facilities. Providers in this area emphasize renewable energy adoption for sustainable operations. It supports industries requiring secure and low-cost data processing. Universities and research institutions contribute to regional demand. Northern growth reflects rising interest in eco-friendly designs. Investors support expansion projects aligned with national sustainability goals. Its role strengthens through increasing adoption of green infrastructure models.

Southern Region Developing With Strategic Projects And Government Backing For Growth

The Southern region captures 18% share, driven by strategic projects and government backing. It gains importance as industries expand digital capabilities in logistics and energy. Government initiatives attract foreign investors to underdeveloped areas. It benefits from growing connectivity infrastructure linking to Central hubs. Providers explore modular and edge facilities for industrial use. This region becomes a focal point for balanced national development. Its share reflects the growing efforts to expand beyond major urban centers.

- For example, Enlight Renewable Energy announced a $1.1 billion investment to develop a solar-powered data center complex in southern Israel, integrating renewable energy and storage solutions to support facility operations.

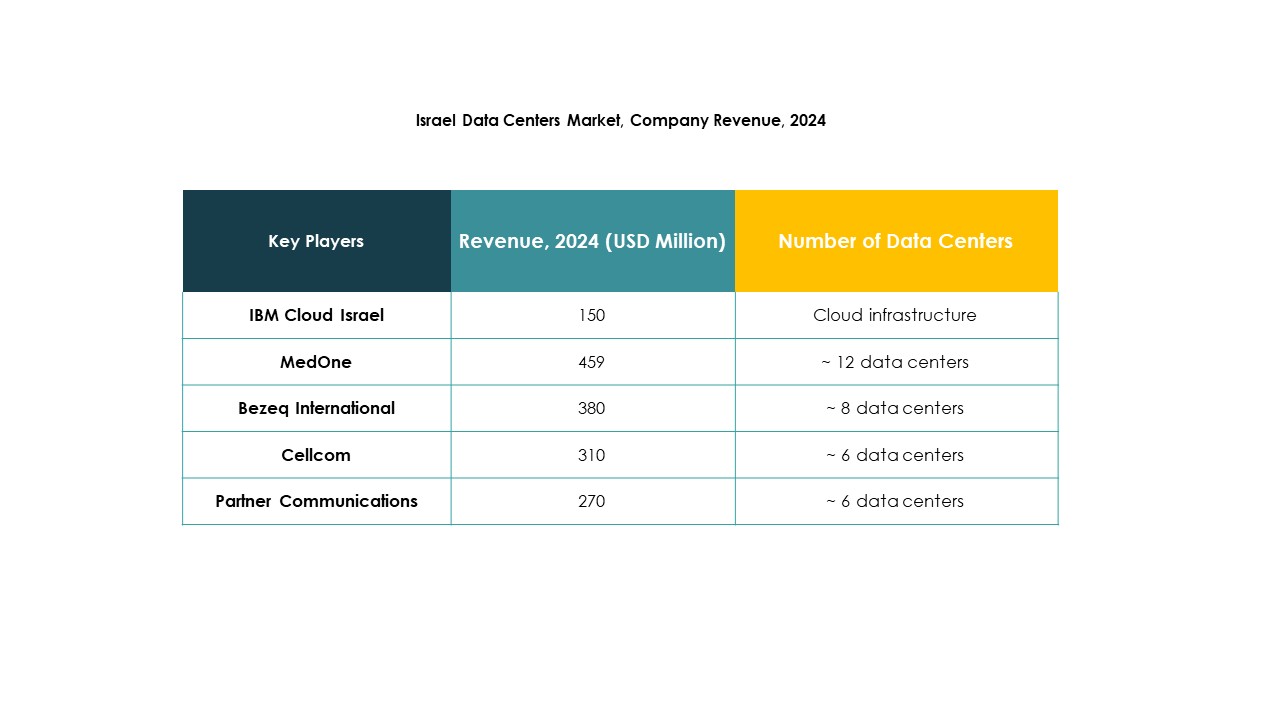

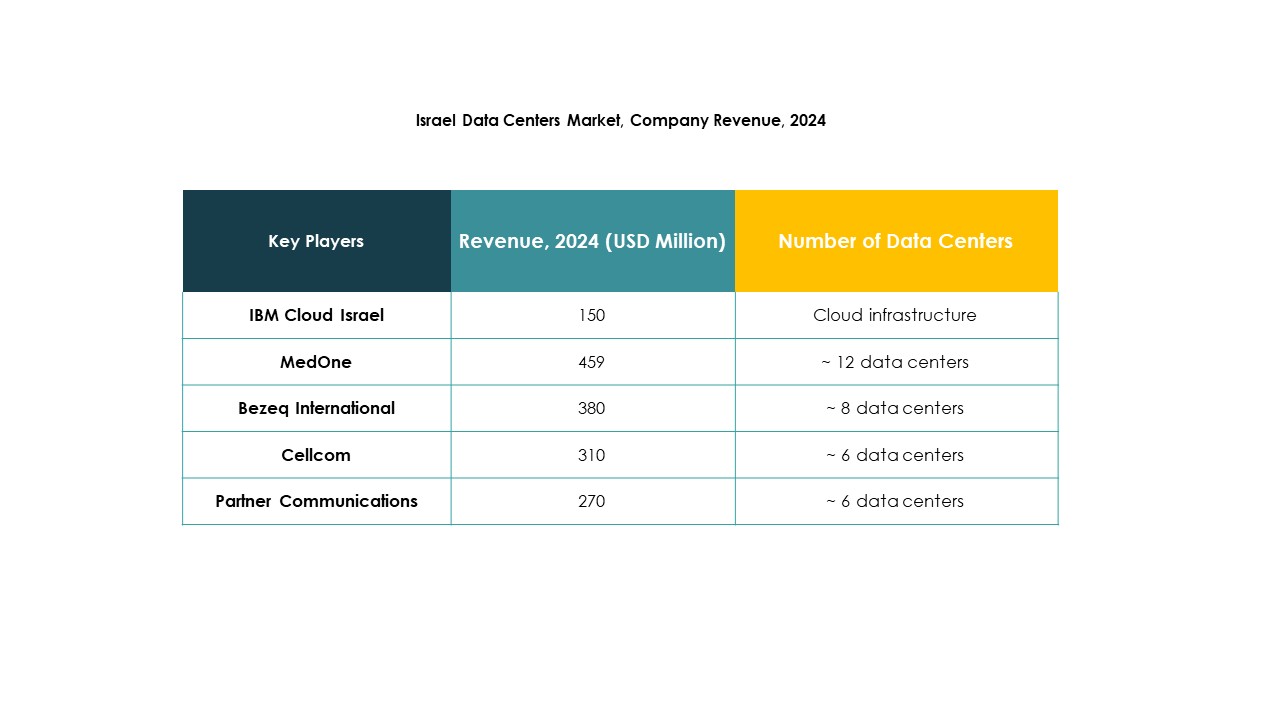

Competitive Insights:

- MedOne

- Bezeq International

- Cellcom

- Integrated Telecom Co.

- Partner Communications

- IBM Cloud Israel

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The Israel Data Center Market features a blend of local operators and global technology leaders. MedOne and Bezeq International anchor domestic infrastructure with strong colocation and enterprise solutions, while Partner Communications and Cellcom enhance regional connectivity. Global hyperscale providers such as AWS, Microsoft, and Google expand cloud dominance by leveraging scalable and hybrid models. IBM Cloud Israel strengthens enterprise-focused offerings with advanced AI and security integration. Digital Realty Trust and NTT Communications add global expertise and capital for hyperscale and colocation facilities. Integrated Telecom Co. broadens the competitive scope by targeting enterprise clients. It remains a market defined by intense competition, strategic partnerships, and high investment in cloud, AI, and sustainability initiatives, ensuring rapid growth and innovation.

Recent Developments:

- In September 2025, Radware introduced two new next-generation cloud application security centers in Tel Aviv, Israel and Bogotá, Colombia, aiming to enhance local cloud security infrastructure and provide improved service offerings to regional customers as part of its expanding data center footprint.

- In September 2025, Silicom secured a significant $2 million per year design win from an application delivery leader for its cryptography hardware acceleration solutions, specifically engineered to boost performance and efficiency in cloud and data center environments across Israel, marking a notable innovation milestone for the local market

- In April 2025, NED DC marked a major milestone by beginning construction of its debut Alpha Campus, a $350 million AI and cloud data center project in Tel Aviv, signaling further expansion in Israel’s data center capacity and technological capabilities.

- In Feb 2025, MedOne announced an investment of $270 million to build two new underground data centers near Tel Aviv, which will significantly expand its data center footprint in Israel with one opening in 2026 and another by 2027, aimed at serving both local and international customers with advanced business continuity solutions under extreme conditions.