Executive summary:

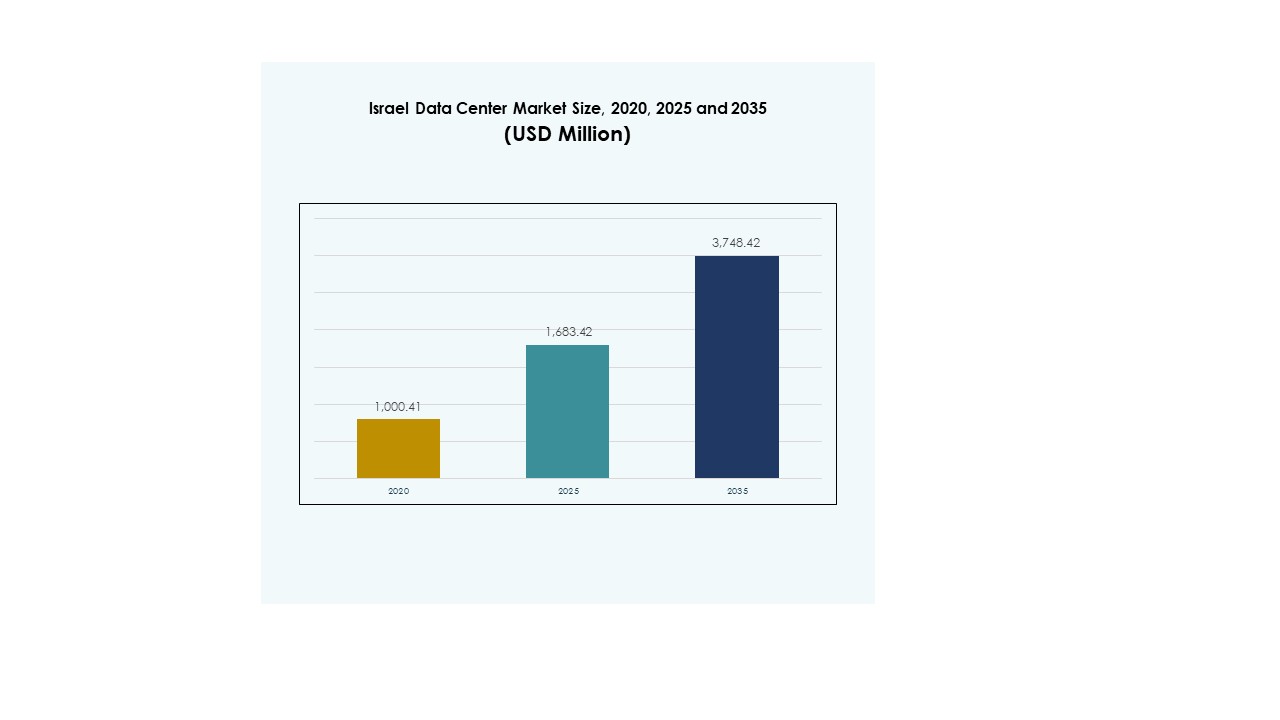

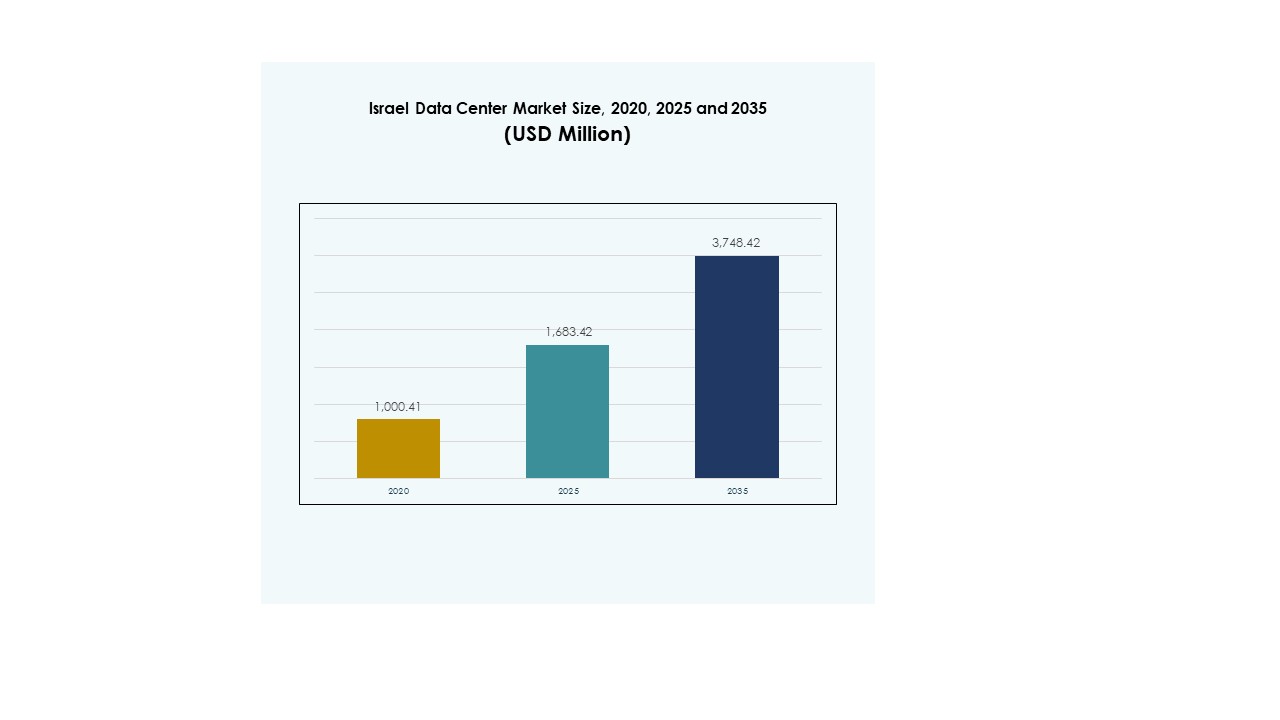

The Israel Edge Data Center Market size was valued at USD 38.78 million in 2020, reached USD 84.40 million in 2025, and is anticipated to hit USD 357.28 million by 2035, at a CAGR of 15.39% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Israel Edge Data Center Market Size 2025 |

USD 84.40 Million |

| Israel Edge Data Center Market, CAGR |

15.39% |

| Israel Edge Data Center Market Size 2035 |

USD 357.28 Million |

Rising demand for low-latency infrastructure, 5G expansion, and rapid digital transformation is driving strong investment momentum. Edge deployments support AI and IoT applications, enabling businesses to operate with speed, security, and efficiency. The market holds strategic importance for investors seeking growth opportunities in connectivity and data infrastructure. It also strengthens Israel’s position as a regional technology hub.

Central Israel, particularly Tel Aviv, leads the market due to its advanced infrastructure and concentration of enterprises. Northern Israel is emerging as a key growth region with industrial development and smart city projects. Southern Israel shows steady expansion supported by renewable integration and strategic investments, strengthening national network capacity.

Market Drivers

Strong Digital Transformation Driving Advanced Infrastructure Development

The Israel Edge Data Center Market is expanding due to rapid digital transformation across industries. Telecom operators, financial institutions, and tech companies are modernizing operations to reduce latency and secure real-time data access. Edge infrastructure improves data processing near users, enabling faster decision-making. Demand for real-time services in smart cities and industry 4.0 projects continues to rise. Businesses rely on robust networks to maintain competitive agility and operational resilience. It supports AI-driven applications, autonomous systems, and immersive technologies. This growth enhances infrastructure reliability and scalability. Investors view it as a strong enabler of long-term digital strategies.

- For instance, MedOne operates four underground data centers in Israel, including facilities in Petah Tikva and Tirat Carmel, with power capacities of 15 MW and 5 MW respectively. These sites support colocation services for enterprise clients and global hyperscalers, reinforcing the country’s edge infrastructure.

5G Network Expansion Strengthening Demand for Edge Deployments

Widespread 5G network expansion fuels the adoption of low-latency infrastructure across the country. Businesses deploy edge nodes to improve content delivery and minimize network congestion. Telecom operators invest in advanced data routing and processing platforms to support emerging connectivity needs. Real-time applications such as AR, VR, and IoT benefit from distributed processing architecture. It improves responsiveness for mission-critical applications across healthcare, finance, and defense. The rise in connected devices accelerates the deployment of edge infrastructure. Enterprises prioritize speed and performance in digital operations. Strategic network buildouts enhance Israel’s position in next-generation connectivity.

Rising AI and IoT Integration Transforming Data Management Practices

The growing integration of AI and IoT technologies is reshaping data handling and storage patterns. Enterprises adopt intelligent systems to process massive data streams at the network edge. This approach enhances security, operational accuracy, and application responsiveness. Edge computing supports predictive analytics, machine learning, and real-time automation. It helps reduce dependency on centralized cloud models, creating a more distributed ecosystem. The integration supports advanced monitoring and autonomous decision-making. Businesses leverage these capabilities to improve agility and service reliability. The market gains strategic relevance for high-tech sectors seeking performance optimization.

Government Support and Investment Driving Edge Infrastructure Growth

Government-backed digital initiatives accelerate infrastructure upgrades across industries. Policy frameworks encourage private sector participation and investment in edge facilities. Strategic collaborations between public agencies and enterprises strengthen data network capabilities. It supports national security priorities and economic competitiveness. Data sovereignty policies drive localization of processing infrastructure. The emphasis on cybersecurity and critical infrastructure protection increases investment momentum. Digital infrastructure modernization aligns with Israel’s innovation-led growth model. Strong policy support encourages investors to expand regional edge capacity.

- For example, government initiatives drive advancements in edge tech infrastructure. For example, in April 2025, the Israel Innovation Authority selected new deep tech incubators, such as Square One Labs Build and Edge Medical Ventures, to invest up to NIS 40 million (over $10 million) per incubator over five years, focusing specifically on supporting dozens of startups in fields like energy, advanced infrastructure, and medical technology.

Market Trends

Shift Toward Decentralized Architectures to Support Real-Time Applications

The Israel Edge Data Center Market is witnessing a strong shift toward decentralized network architectures. Organizations are moving away from centralized models to improve speed and reduce latency. Real-time applications in finance, telehealth, and logistics drive this evolution. Edge nodes are placed closer to user locations, creating high-performance processing zones. It enhances reliability and supports mission-critical workloads. Companies design infrastructure to handle distributed operations more efficiently. The decentralized trend aligns with the needs of AI-driven and 5G-enabled industries. This structural change shapes future investments in data infrastructure.

Adoption of Energy-Efficient and Sustainable Edge Data Infrastructure

Sustainability has become a core priority in new edge deployments. Operators are integrating energy-efficient systems to reduce operational costs and environmental impact. Innovations in liquid cooling, modular design, and power optimization increase infrastructure efficiency. It aligns with national green technology goals and global ESG commitments. Data center operators focus on optimizing energy use without reducing performance. Demand for renewable energy integration within edge environments continues to grow. This trend attracts investors interested in sustainable infrastructure assets. Energy-efficient strategies enhance long-term operational resilience.

Integration of AI-Based Network Automation and Predictive Management

Automation technologies are reshaping how edge networks are managed and maintained. Operators deploy AI-driven platforms for predictive maintenance and capacity forecasting. It improves uptime and resource utilization across distributed sites. Automated orchestration enables faster deployment and better performance control. Intelligent monitoring helps identify risks before they escalate. Businesses gain efficiency and cost advantages by integrating AI into infrastructure operations. The growing role of AI fosters a more scalable and adaptive ecosystem. These advancements strengthen market confidence among global investors.

Rise of Edge Colocation Facilities to Serve Multi-Industry Demand

Demand for flexible and scalable infrastructure is driving the growth of edge colocation models. Businesses prefer shared facilities to reduce capital costs and improve operational agility. Colocation sites support industries like retail, healthcare, telecom, and BFSI. It enables faster network rollouts and easier scalability across regions. Providers offer tailored services that meet diverse enterprise needs. This model attracts both domestic and foreign investments. Strategic placement of colocation centers enhances service availability and network coverage. The expansion of shared facilities supports future digital growth.

Market Challenges

High Infrastructure Costs and Limited Skilled Workforce Impacting Expansion

The Israel Edge Data Center Market faces major cost pressures during deployment phases. Establishing advanced facilities requires substantial capital for equipment, energy, and network systems. Many enterprises face challenges in securing cost-effective power sources. It also depends on a skilled workforce that is not widely available in the region. Talent shortages delay implementation timelines and increase operational risks. Operators must invest in specialized training programs to meet technical demands. Regulatory complexities further extend project lead times. These barriers make market entry challenging for smaller firms.

Regulatory Constraints and Cybersecurity Risks Slowing Network Scalability

Strict compliance requirements create hurdles in deploying distributed infrastructure. Operators must align with cybersecurity standards and data protection rules. It requires complex system designs to ensure security and resilience. Cyber threats pose significant risks due to increasing attack surfaces. Data localization rules demand stronger governance frameworks. It increases operational complexity for multinational operators. Aligning infrastructure with evolving regulations strains project budgets and timelines. Addressing these issues is critical to sustaining market momentum.

Market Opportunities

Rising Demand for Real-Time Applications Creating Investment Opportunities

The Israel Edge Data Center Market presents strong investment potential due to surging demand for real-time applications. Enterprises require faster processing to support AI, IoT, and 5G ecosystems. Edge deployments reduce latency and improve application performance for critical sectors. It strengthens the foundation for digital transformation initiatives. Investors target scalable and energy-efficient facilities with strong long-term growth prospects. New business models centered on performance and connectivity gain traction. These developments encourage infrastructure expansion and innovation.

Strong Potential for Regional Integration and Global Collaboration

Strategic geographic positioning supports stronger connectivity between Europe, the Middle East, and Asia. Businesses view Israel as a gateway for cross-border network expansion. It attracts partnerships and joint ventures from global cloud and telecom players. Technology collaborations increase capacity and enhance resilience across the region. Regional integration fosters new service offerings and platform innovation. Investors find stable conditions to support scalable infrastructure growth. This opportunity supports long-term market leadership and network influence.

Market Segmentation

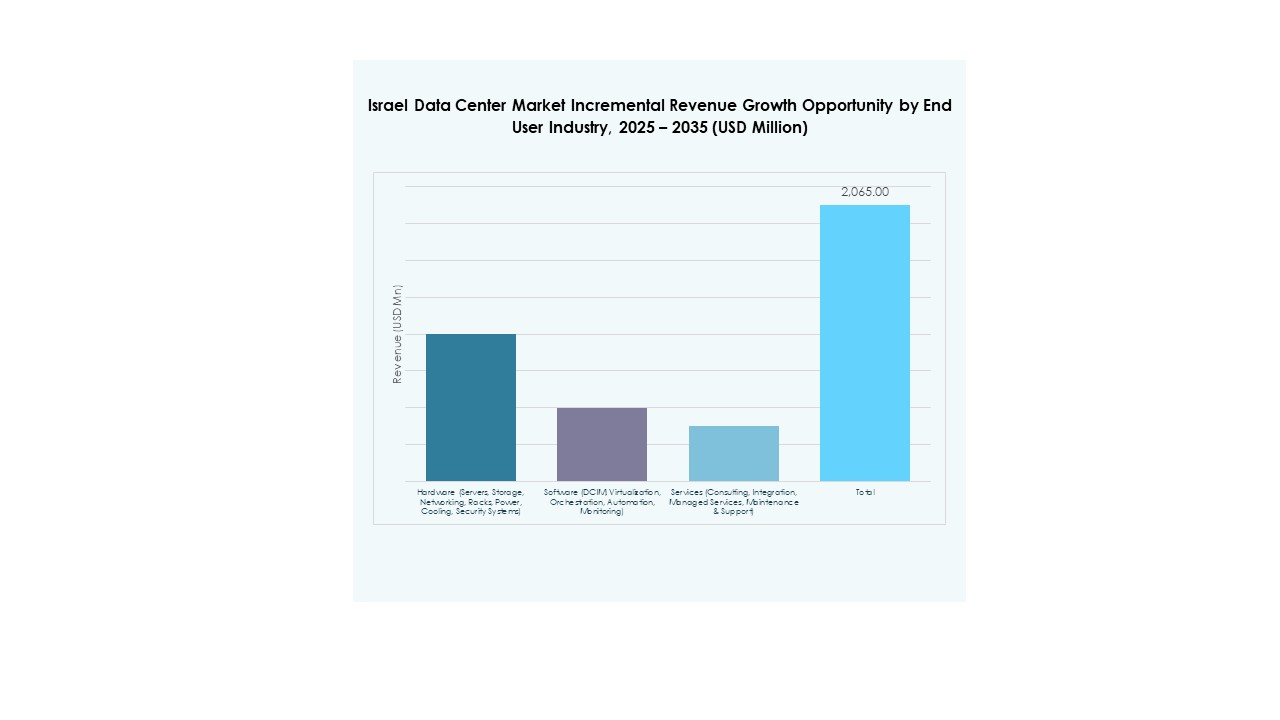

By Component

The solution segment dominates the Israel Edge Data Center Market, supported by rising investment in scalable and modular infrastructure. It holds the largest share due to demand for efficient data routing, storage, and analytics. Services complement these deployments by enabling integration, monitoring, and security management. Companies focus on flexible solutions to optimize performance and reduce costs. Managed service models gain traction among mid-sized enterprises. Growth is supported by strong demand for hybrid infrastructure models.

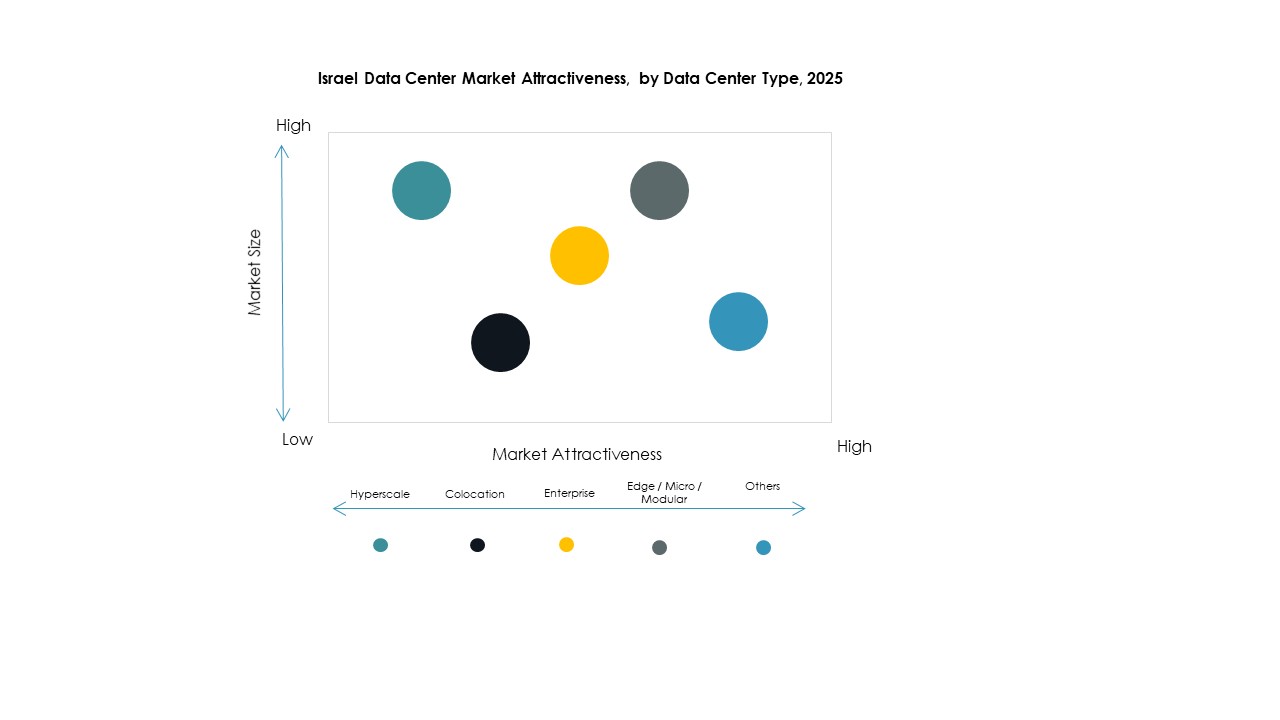

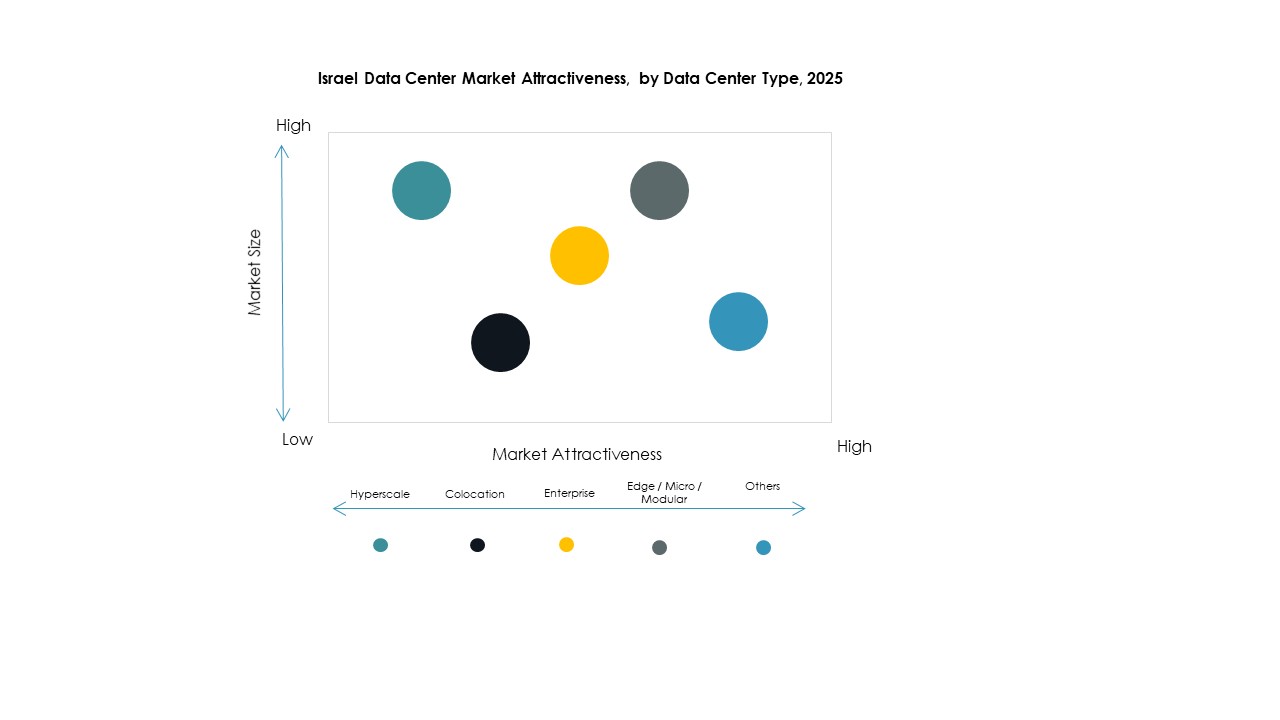

By Data Center Type

The colocation edge data center segment leads the Israel Edge Data Center Market with a significant share. Enterprises prefer shared infrastructure to reduce capital costs and improve flexibility. Managed data centers and cloud-based models are growing steadily due to demand for real-time applications. Enterprise-owned centers remain relevant for high-security workloads. The shift to colocation enables broader coverage, lower operational expenses, and faster scaling. This segment is critical for multi-industry digital transformation.

By Deployment Model

Hybrid deployment holds the largest share in the Israel Edge Data Center Market. Businesses favor hybrid models to combine on-premises control with cloud scalability. This model supports flexible resource allocation and security compliance. On-premises deployments remain essential for critical applications, while cloud-based models support distributed workloads. Hybrid strategies allow enterprises to manage data traffic more efficiently. The growing need for agility and cost optimization drives this segment’s dominance.

By Enterprise Size

Large enterprises dominate the Israel Edge Data Center Market due to higher technology budgets and operational scale. These organizations prioritize advanced computing infrastructure for real-time analytics and security. SMEs are increasing adoption through managed services and cost-efficient colocation solutions. Flexible models help smaller businesses access edge capabilities without heavy capital investment. Rising digital adoption across industries expands the SME share gradually. Large-scale investments continue to define market leadership.

By Application / Use Case

Power monitoring holds the leading share in the Israel Edge Data Center Market. Enterprises prioritize real-time power usage visibility to optimize operational efficiency. Capacity management and environmental monitoring follow closely, supporting sustainability and performance goals. Asset management and BI tools enhance decision-making through intelligent data use. The demand for integrated monitoring solutions grows steadily across industries. Strong emphasis on efficiency drives this segment’s expansion.

By End User Industry

IT and telecommunications lead the Israel Edge Data Center Market with the highest share. This sector drives demand through heavy reliance on low-latency networks and high data throughput. BFSI follows due to strict data compliance and real-time transaction needs. Healthcare, retail, and defense sectors increase adoption to support digital transformation. Energy and utilities contribute through smart grid and automation initiatives. IT and telecom remain the backbone of infrastructure expansion.

Regional Insights

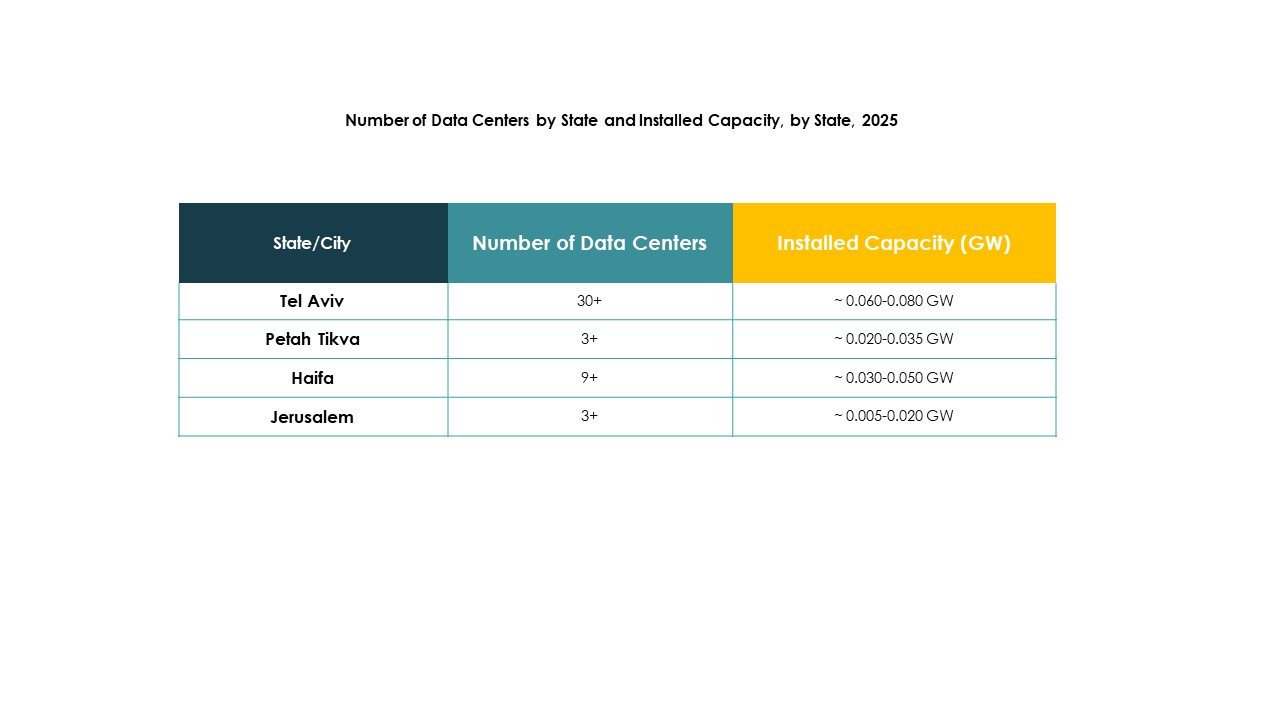

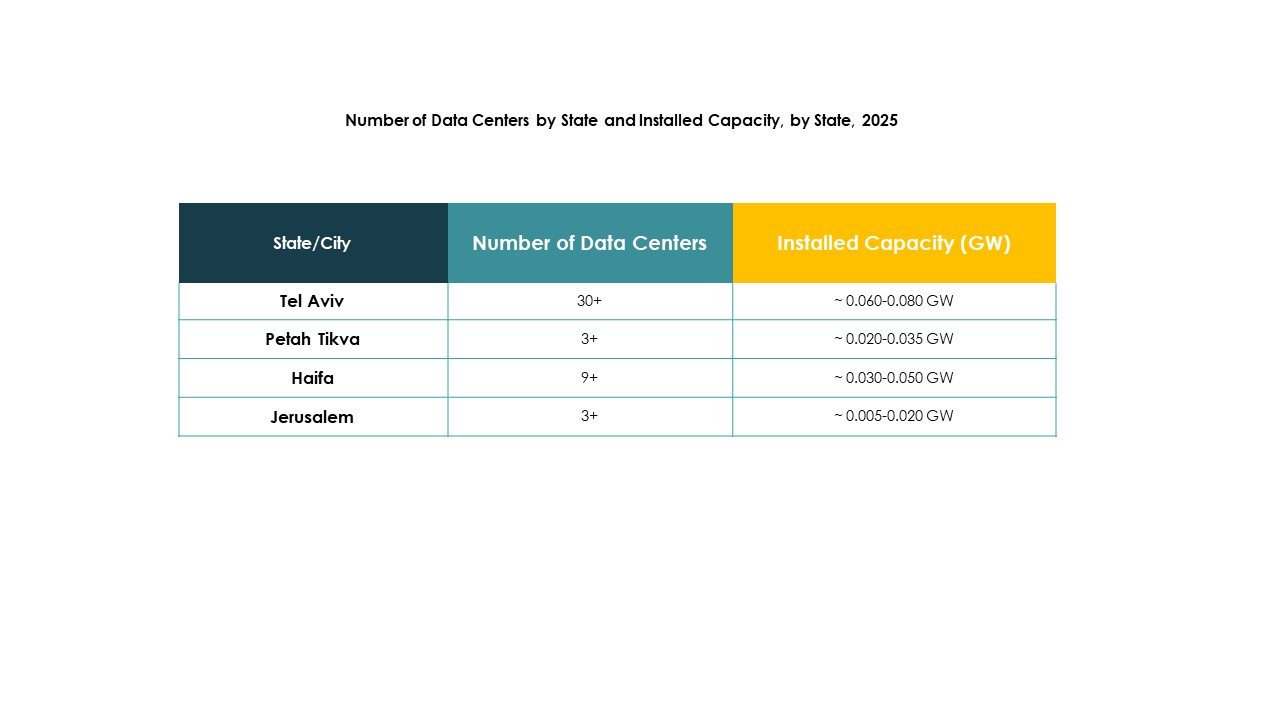

Central Israel and Tel Aviv Holding the Largest Market Share at 41.2%

Central Israel, led by Tel Aviv, dominates the Israel Edge Data Center Market with 41.2% share. The region benefits from strong connectivity infrastructure, proximity to major enterprises, and a thriving startup ecosystem. It attracts major telecom and cloud service providers seeking rapid deployment capacity. It also hosts a dense network of innovation hubs, driving demand for low-latency infrastructure. Government and private sector partnerships support ongoing infrastructure investments.

- For instance, Bezeq International operates multiple data centers in Tel Aviv and Petah Tikva using advanced Dell EMC and NetApp systems to ensure high-speed, resilient data services for enterprise and cloud applications, as publicly reported in sector investment analyses. It also hosts a dense network of innovation hubs, driving demand for low-latency infrastructure.

Northern Israel Emerging as a Growth Hub with 34.5% Share

Northern Israel is emerging as a strong secondary hub with 34.5% market share. Industrial expansion and smart city projects increase demand for advanced computing capabilities. Enterprises in manufacturing, healthcare, and logistics drive edge node deployments. It benefits from geographic diversification strategies aimed at reducing dependency on Tel Aviv. This growth encourages new investments from domestic and international operators.

- For instance, in January 2025, Nvidia announced a major project to launch a 30 MW AI research and engineering data center near Haifa, spanning 10,000 square meters, equipped with hundreds of liquid-cooled Blackwell systems to support local R&D and AI teams.

Southern Israel Expanding Gradually with 24.3% Market Share

Southern Israel accounts for 24.3% of the market, supported by infrastructure expansion and renewable energy integration. Data center projects in this region target industries like defense, aerospace, and utilities. It supports edge deployment closer to industrial zones, improving operational reliability. Strategic investments aim to boost connectivity and support national digital goals. The region’s growth reflects broader efforts to balance capacity distribution across the country.

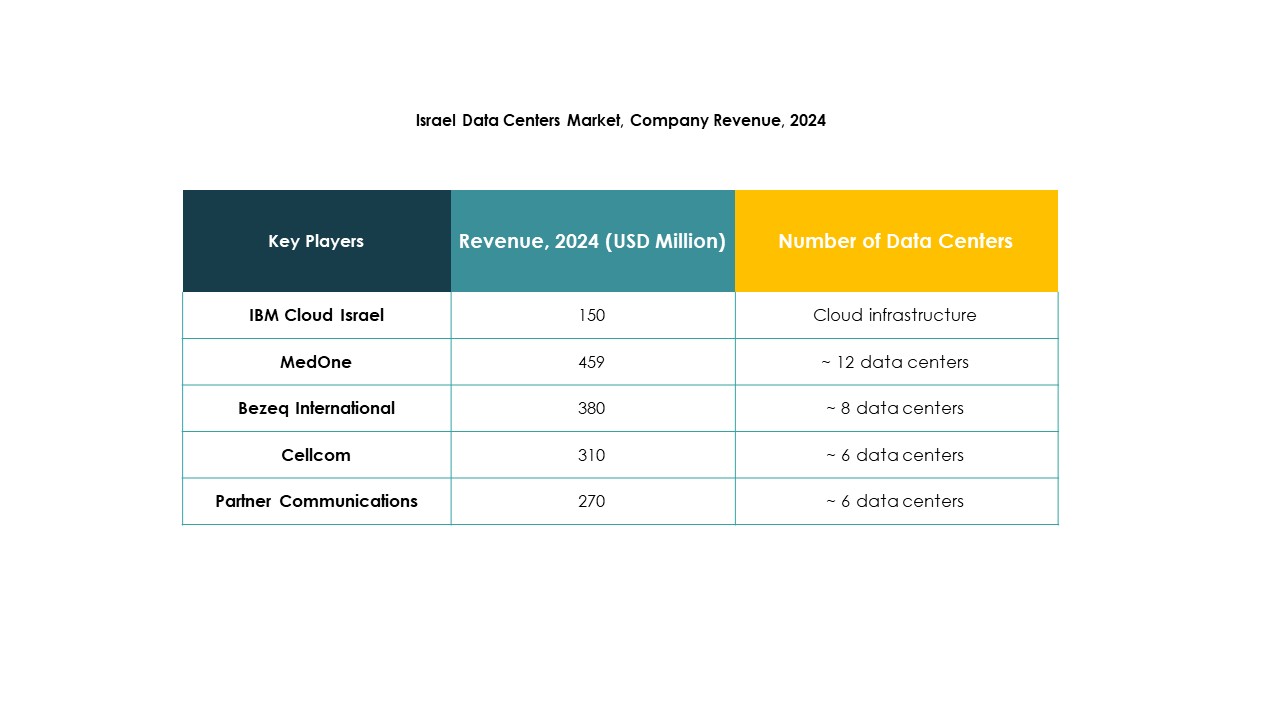

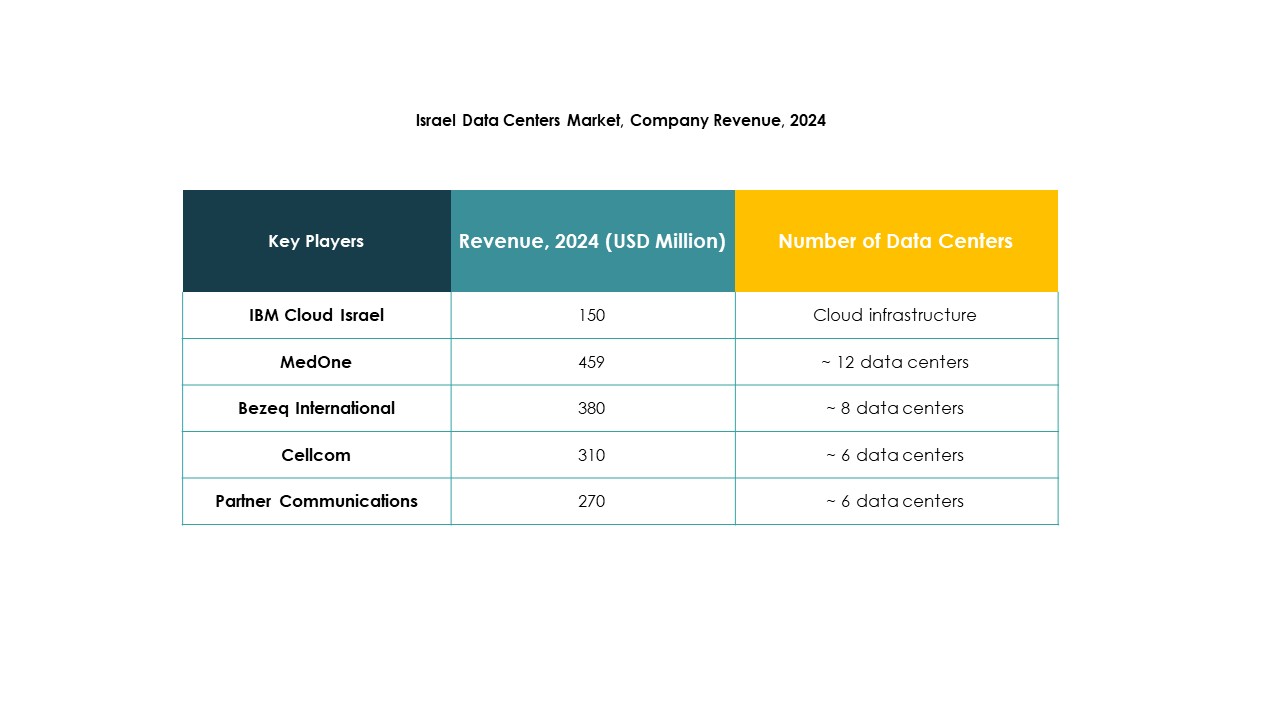

Competitive Insights:

- Bezeq

- MedOne

- Cellcom

- Bynet Data Communications

- EdgeConneX

- Eaton Corporation

- Dell Technologies Inc.

- Fujitsu

- Cisco

- SixSq

- Microsoft

- VMWare

- Schneider Electric SE

- Rittal GmbH & Co. KG

- Others

The competitive landscape of the Israel Edge Data Center Market is defined by strong participation from both domestic and global players. Local operators focus on expanding network capacity, improving latency performance, and securing enterprise contracts. Global technology providers strengthen their positions through strategic partnerships, advanced infrastructure solutions, and strong service portfolios. It shows a balance between infrastructure providers, cloud platforms, and connectivity enablers, creating a dynamic ecosystem. Mergers, acquisitions, and joint ventures support rapid expansion and technology transfer. Companies focus on energy-efficient designs, scalable architectures, and advanced security frameworks. Market leaders invest in intelligent monitoring and hybrid deployment capabilities to meet growing enterprise demand. This competitive environment encourages continuous innovation and operational excellence.

Recent Developments:

- In October 2025, Galaxy Digital Inc. revealed it had secured a strategic investment of $460 million from a leading asset management firm. Galaxy plans to use this funding to accelerate the buildout of its Helios data center campus, aiming to strengthen its infrastructure capabilities, particularly for AI and cloud deployments across Israel.

- In January 2025, NVIDIA announced the launch of a state-of-the-art research and engineering data center in Israel. This advanced facility, estimated to cost around $500 million and spanning 10,000 square meters, will focus on next-generation networking hardware, software, CPU architecture, and artificial intelligence applications.