Executive summary:

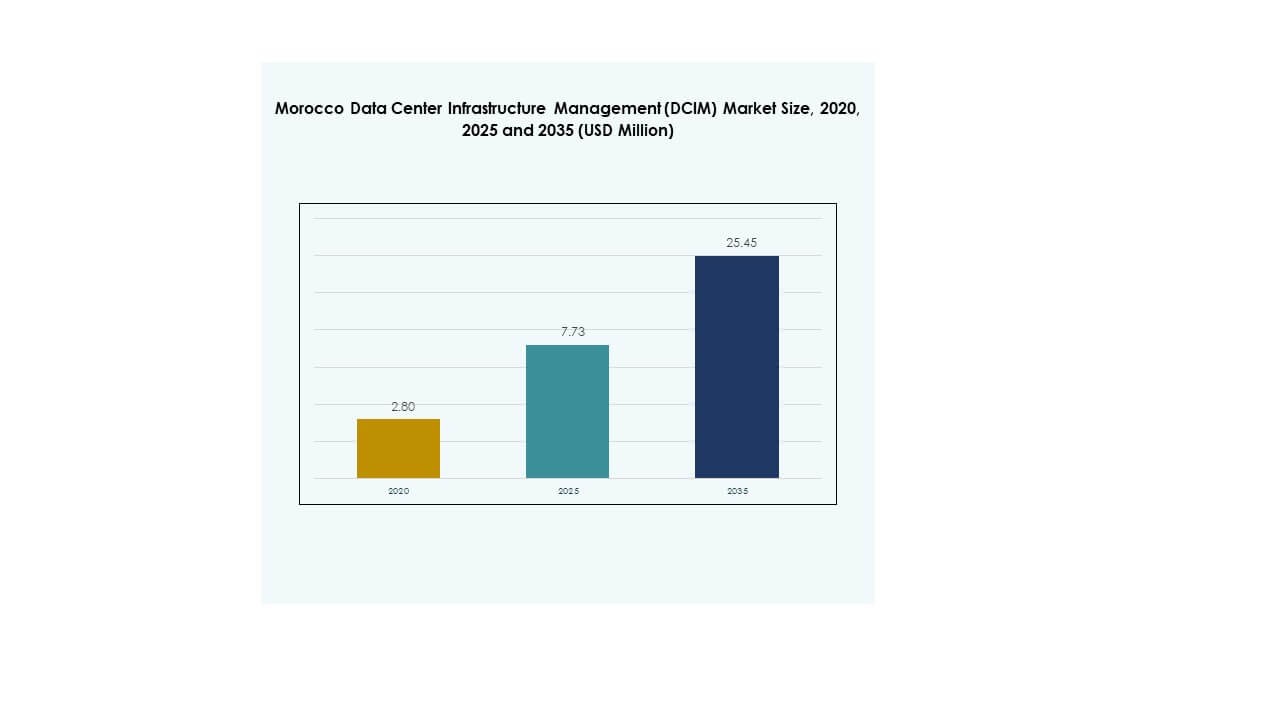

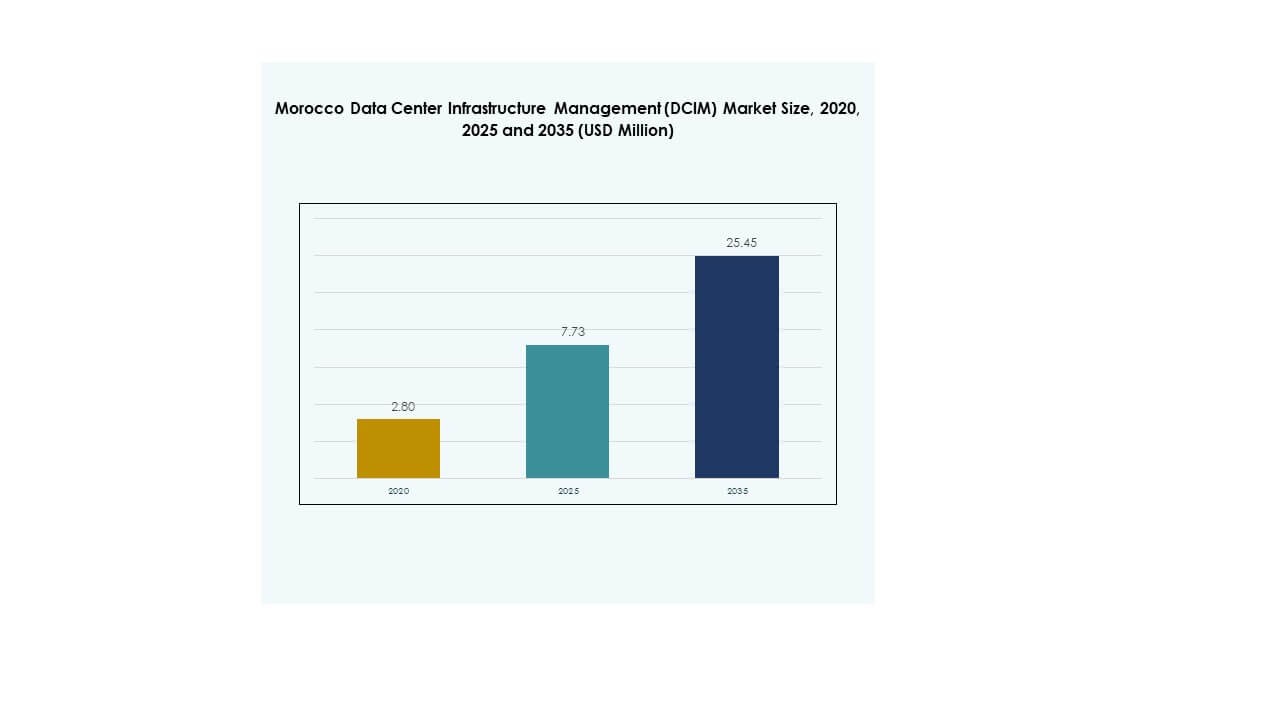

The Morocco Data Center Infrastructure Management (DCIM) Market size was valued at USD 2.80 million in 2020, reached USD 7.73 million in 2025, and is anticipated to reach USD 25.45 million by 2035, at a CAGR of 14.38% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Morocco Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 7.73 Million |

| Morocco Data Center Infrastructure Management (DCIM) Market, CAGR |

14.38% |

| Morocco Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 25.45 Million |

The Morocco DCIM market growth is driven by rising demand for digital transformation, cloud adoption, and AI-based automation. Companies are integrating intelligent infrastructure management platforms to improve operational visibility, enhance energy efficiency, and ensure real-time monitoring. The shift toward smart, sustainable data centers is shaping a modern IT ecosystem that attracts global investors. This market holds strategic importance for enterprises and investors aiming to strengthen Morocco’s digital competitiveness and support large-scale data-driven innovation.

Regionally, Northern Morocco led by Casablanca, Rabat, and Tangier dominates due to advanced connectivity, strong enterprise activity, and government-backed ICT initiatives. Central Morocco is emerging as a developing region, supported by industrial modernization and renewable energy integration. Southern Morocco, particularly Dakhla and Agadir, shows growing potential with renewable-powered data centers and smart infrastructure investments, reflecting the country’s commitment to balanced regional digital expansion.

Market Drivers

Rising Digital Transformation and Demand for Intelligent Infrastructure Management

The Morocco Data Center Infrastructure Management (DCIM) Market is driven by rapid digital transformation across industries. Enterprises in Morocco are deploying intelligent DCIM tools to streamline operations, improve energy efficiency, and ensure real-time infrastructure visibility. Cloud adoption by financial, telecom, and public sectors strengthens the need for automated monitoring and data-driven decision-making. It supports the transition from traditional facilities to hybrid IT environments. DCIM software enables predictive maintenance, reducing downtime and operational costs. Businesses view this market as vital for optimizing capacity utilization. Investors see it as a long-term growth enabler aligned with Morocco’s digital economy vision.

Integration of IoT, AI, and Automation in Data Center Operations

The growing adoption of IoT and AI is transforming how data centers function in Morocco. Operators integrate intelligent sensors and AI analytics for power management, environmental control, and energy optimization. It improves real-time monitoring and predictive analytics across infrastructure layers. Automation also enhances efficiency by minimizing manual intervention in capacity and asset management. Companies deploy AI-driven DCIM systems to enhance sustainability and reduce operational complexity. This shift aligns with the national strategy for digital competitiveness. Businesses benefit from reduced energy waste and operational transparency. Investors are increasingly prioritizing AI-driven infrastructure capabilities in their portfolios.

- For instance, during the Huawei Digital Morocco Summit held in Marrakech in April 2025, Huawei highlighted its latest AI-powered and IoT-integrated data center solutions, emphasizing intelligent monitoring, energy efficiency, and digital infrastructure optimization. The event underscored Huawei’s commitment to supporting Morocco’s digital transformation and advancing smart data center management through collaboration with regional technology and infrastructure partners.

Government Support and Regulatory Push for Sustainable Infrastructure

Government-led programs promoting digitalization and green energy are key market catalysts. Morocco’s national data infrastructure initiatives and renewable energy policies encourage sustainable data center design. It drives enterprises to implement DCIM solutions for compliance, monitoring, and resource optimization. The market benefits from favorable regulatory frameworks focused on data security and energy efficiency. Public-private collaborations enhance local data center investments. The integration of renewable energy sources with DCIM platforms supports Morocco’s carbon neutrality goals. Businesses leveraging these systems gain both regulatory and cost advantages. Investors view this sector as a gateway to Morocco’s growing digital economy.

- For instance, in July 2025, Morocco’s Ministry of Digital Transition announced plans for a 500-megawatt data center powered entirely by renewable energy sources as part of a national strategy to enhance energy-efficient, compliant data storage and digital infrastructure, marking a major step toward sustainability goals for the country’s data center ecosystem.

Growing Importance of Data Sovereignty and Business Continuity

Data localization laws and rising cybersecurity concerns strengthen demand for DCIM systems in Morocco. Enterprises prioritize local data hosting and continuous monitoring to ensure compliance and resilience. It supports business continuity during power fluctuations and connectivity challenges. Local colocation providers invest in advanced DCIM platforms to guarantee uptime. Organizations use centralized DCIM dashboards for asset tracking and performance benchmarking. The focus on business resilience drives modernization across data centers. Companies gain operational control, risk reduction, and higher productivity through DCIM integration. Investors recognize this transformation as critical for Morocco’s evolving digital landscape.

Market Trends

Expansion of Edge and Colocation Data Centers Across Key Cities

The Morocco Data Center Infrastructure Management (DCIM) Market is witnessing expansion in edge and colocation data centers. Growing internet usage and latency-sensitive applications increase demand for local processing power. It leads to new facilities in Casablanca, Tangier, and Rabat equipped with modern DCIM systems. Edge computing enables better connectivity and service reliability for enterprises. Colocation providers deploy DCIM software to manage multi-tenant facilities efficiently. Businesses prefer flexible and scalable hosting models for cloud and enterprise workloads. This infrastructure shift enhances Morocco’s role as a North African data hub. The trend boosts investment from both regional and global players.

Increased Focus on Energy-Efficient and Green Data Centers

Sustainability has become a defining trend in Morocco’s data center ecosystem. The integration of renewable energy sources such as solar and wind supports cleaner operations. It drives the adoption of DCIM tools for precise energy monitoring and resource optimization. Operators target lower Power Usage Effectiveness (PUE) through advanced automation and analytics. Companies emphasize sustainable infrastructure aligned with ESG objectives. Businesses that adopt green DCIM systems gain a competitive reputation in responsible digital operations. The trend also aligns with Morocco’s renewable energy leadership. Government-backed incentives further accelerate eco-friendly technology investments.

Emergence of Cloud-Based DCIM Solutions for Operational Flexibility

The shift toward cloud-based management platforms is reshaping operational practices. Cloud-enabled DCIM allows centralized control across distributed facilities, improving visibility and scalability. It supports hybrid deployments integrating on-premises and cloud workloads. Businesses use cloud-based solutions for remote performance monitoring and cost management. It helps data center managers make real-time capacity adjustments without physical intervention. The model appeals to SMEs seeking cost-effective deployment without infrastructure expansion. This trend promotes agility and resilience across Morocco’s growing data ecosystem. Vendors continue enhancing integration features to strengthen market adoption.

Growing Role of AI-Driven Analytics and Predictive Maintenance

Artificial intelligence is becoming central to DCIM modernization strategies. Predictive analytics improve decision-making for capacity planning and thermal management. It enables real-time alerts and anomaly detection across infrastructure components. AI tools help optimize energy consumption and cooling efficiency. Operators leverage machine learning to forecast performance patterns and prevent outages. Businesses rely on data-driven insights to achieve consistent uptime. The trend signifies a transition toward smarter, self-regulating facilities. It enhances the reliability and sustainability of Morocco’s expanding digital infrastructure network.

Market Challenges

High Implementation Costs and Limited Technical Expertise Among Operators

The Morocco Data Center Infrastructure Management (DCIM) Market faces challenges linked to high installation and integration costs. Many small and medium enterprises struggle to afford advanced DCIM platforms due to capital constraints. It limits adoption among non-enterprise users despite clear operational benefits. The shortage of skilled professionals also delays full-scale deployments. Local data center operators often depend on external consultants for technical configuration. Maintenance and system upgrades require specialized expertise not widely available. These constraints slow market scalability and innovation adoption. Businesses must invest in workforce training and partnerships to overcome this barrier.

Complex Integration With Legacy Systems and Cybersecurity Concerns

Legacy IT infrastructure poses integration challenges for DCIM platforms in Morocco. Older systems lack compatibility with modern sensors and software tools. It increases deployment time and operational risks during migration phases. Cybersecurity threats also remain a concern due to rising connectivity between cloud and on-premise facilities. Unsecured interfaces and unpatched firmware create potential vulnerabilities. Companies must prioritize layered security in DCIM implementation strategies. Balancing modernization and risk mitigation requires strong IT governance. These factors restrict seamless adoption across hybrid environments and delay modernization timelines.

Market Opportunities

Expansion of Local Cloud Ecosystem and Government Digitalization Plans

The Morocco Data Center Infrastructure Management (DCIM) Market offers strong opportunities through cloud ecosystem growth. Government digital programs promote cloud-first policies and e-governance solutions. It encourages investments in scalable, intelligent DCIM platforms for state and private infrastructure. Enterprises deploying hybrid architectures will benefit from improved visibility and performance control. The alignment of national initiatives with private cloud services opens multi-sector collaboration. Businesses that integrate DCIM with local cloud providers gain competitive resilience. Investors find growth potential in Morocco’s strategic digital transformation roadmap.

Rising Foreign Investment and Regional Data Hub Potential

Increasing international investments strengthen Morocco’s position as a data hub for North Africa. Global players are partnering with local operators to expand energy-efficient infrastructure. It drives demand for advanced DCIM software enabling resource and power optimization. The country’s geographic proximity to Europe supports cross-border data exchange. Businesses deploying DCIM tools in this ecosystem ensure high operational reliability. Enhanced connectivity and energy supply improvements create scalable growth pathways. Investors view Morocco’s infrastructure modernization as a long-term regional opportunity.

Market Segmentation

By Component

Solutions dominate the Morocco Data Center Infrastructure Management (DCIM) Market, accounting for a major share due to their role in real-time asset tracking and performance monitoring. Organizations prefer integrated platforms offering automation and data visualization features. Services segment grows steadily as demand for consulting, maintenance, and integration support increases. Managed services providers leverage this trend to assist clients in optimizing operational workflows. The growing complexity of hybrid environments reinforces the adoption of comprehensive DCIM solutions across enterprises.

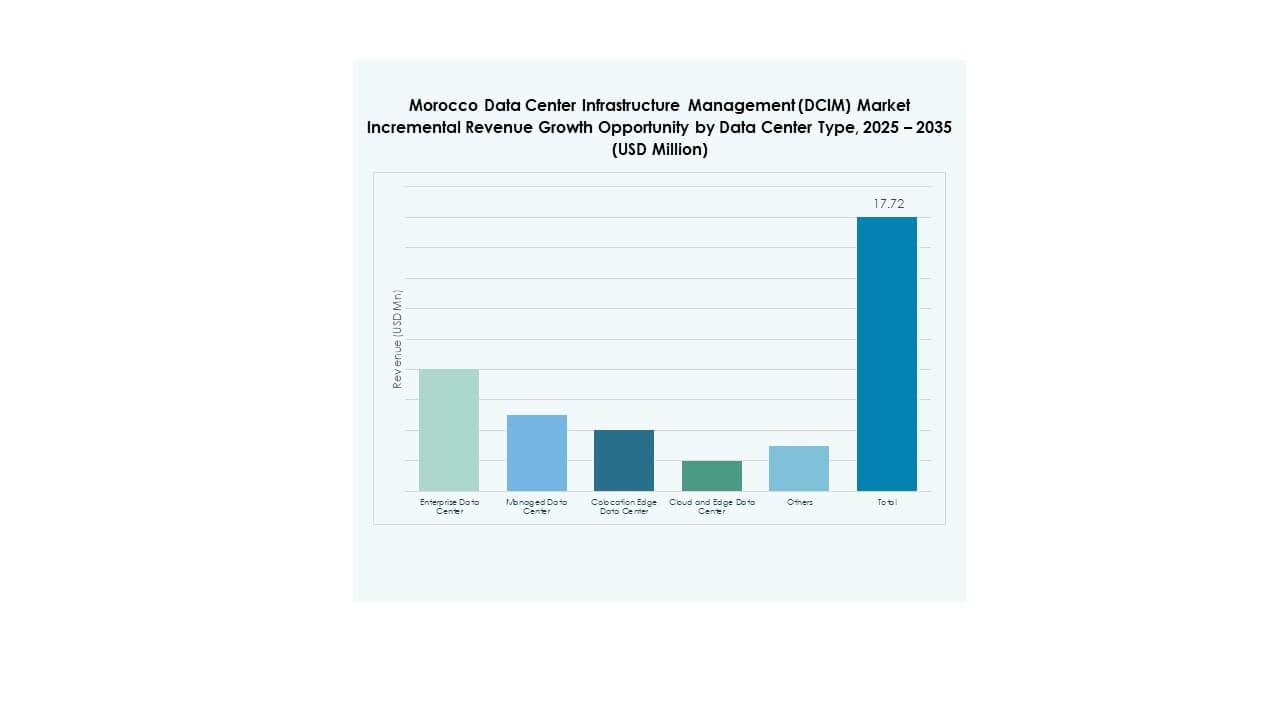

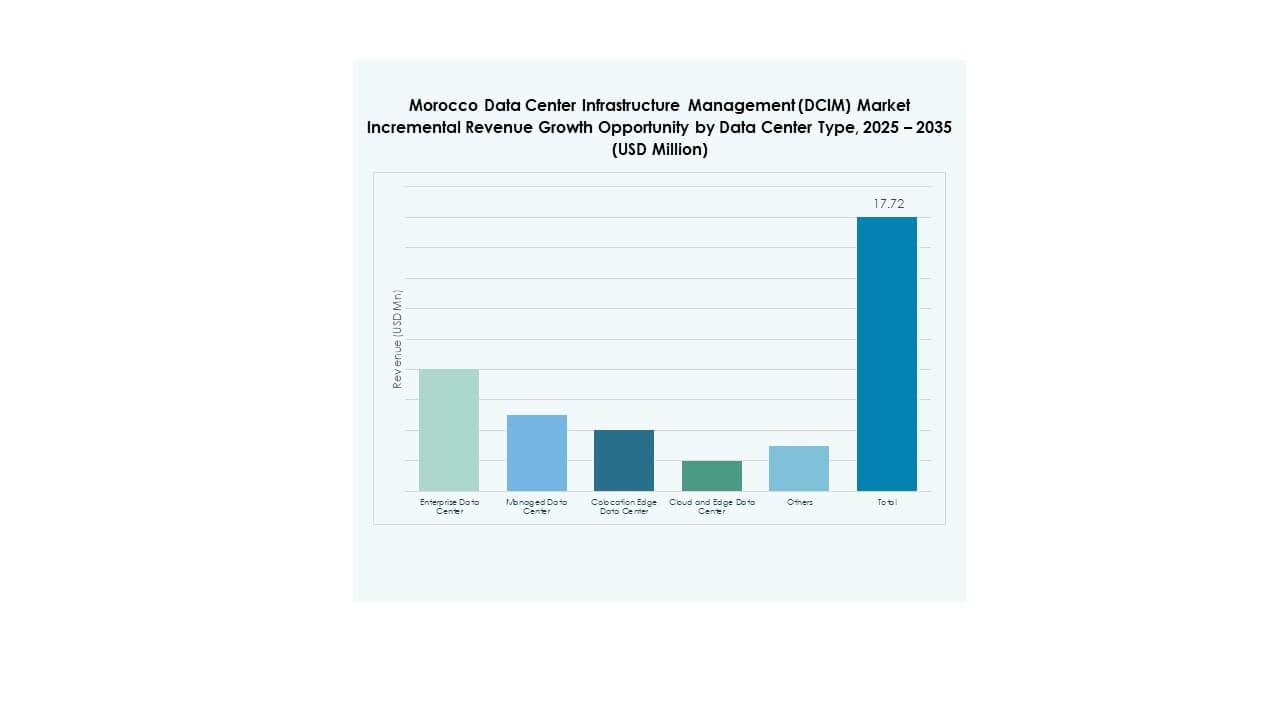

By Data Center Type

Enterprise data centers lead the market, driven by large-scale digitalization in banking, telecom, and public sectors. These facilities adopt DCIM to improve operational control and compliance efficiency. Managed and colocation centers follow, supported by rising cloud demand among SMEs. It enhances scalability and performance in hybrid IT models. Cloud and edge data centers show strong growth potential due to improved connectivity infrastructure. Morocco’s ongoing modernization efforts foster investments in flexible, energy-optimized facilities across key regions.

By Deployment Model

Cloud-based DCIM models hold the largest market share, reflecting the country’s rapid cloud migration trend. They offer real-time monitoring, scalability, and reduced setup costs compared to on-premise solutions. Enterprises increasingly prefer hybrid models that blend control with flexibility. On-premise deployments persist in regulated sectors like finance and defense for compliance assurance. It creates balanced growth opportunities across all deployment types. The shift toward hybrid management enhances operational agility and disaster recovery readiness in Morocco’s expanding digital ecosystem.

By Enterprise Size

Large enterprises dominate the market due to extensive infrastructure footprints and data requirements. These organizations invest in high-end DCIM platforms for efficiency and compliance. SMEs show gradual adoption, driven by affordable cloud-based solutions. It allows smaller firms to achieve visibility and cost optimization. Vendors offering modular and subscription-based DCIM tools benefit from SME digital growth. The growing diversification of enterprise needs promotes innovation in scalable management architectures.

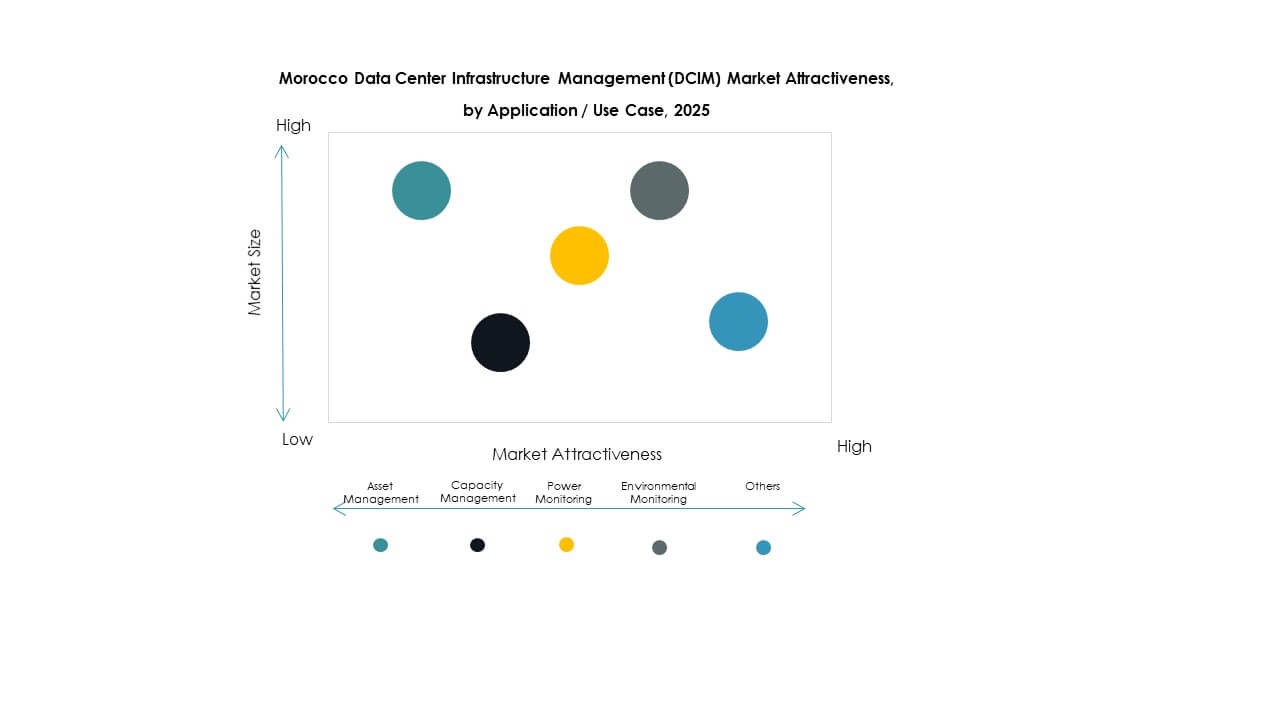

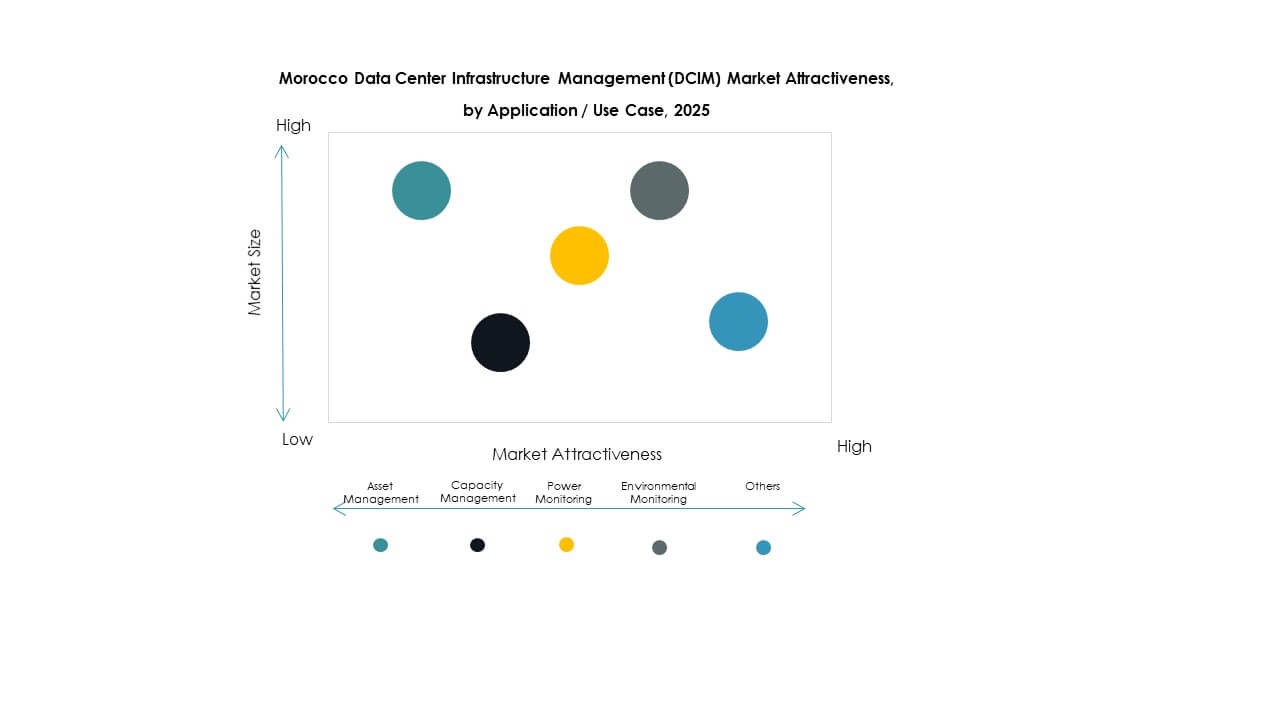

By Application / Use Case

Power monitoring leads among DCIM applications due to its role in improving energy efficiency and cost control. Capacity management and environmental monitoring follow as critical components in infrastructure optimization. It ensures uptime and balanced workloads across dynamic operations. Asset management applications gain traction in large facilities managing distributed assets. BI and analytics enhance predictive capabilities for better decision-making. These applications collectively strengthen data center reliability and performance management in Morocco’s digital landscape.

By End User Industry

The IT and telecommunications sector dominates the Morocco Data Center Infrastructure Management (DCIM) Market due to high digital infrastructure dependency. BFSI and healthcare follow with growing needs for security and compliance monitoring. Retail and e-commerce invest in scalable systems to support digital expansion. Energy and utilities benefit from optimized asset control and predictive maintenance. Aerospace and defense sectors integrate DCIM for security and operational continuity. It reflects broad cross-sector adoption of digital management platforms.

Regional Insights

Northern and Coastal Morocco – Casablanca, Rabat, and Tangier Leading with 52% Share

Northern Morocco represents the most developed data center region, led by Casablanca and Rabat. These cities host the majority of enterprise and colocation data centers with modern DCIM integration. It benefits from superior connectivity, energy infrastructure, and proximity to European data routes. Tangier’s growing tech ecosystem strengthens edge computing adoption. Government-backed investment zones attract international partnerships in ICT infrastructure. The region’s dominance stems from strong economic activity and strategic geographic positioning.

- For instance, in January 2024, N+ONE Datacenters signed a memorandum of understanding with Moroccan government ministries to build a new 2,000 sqm data center in Casablanca, scheduled to be operational later in 2024. The facility aims to enhance national digital transformation, offering state-of-the-art colocation and cloud services aligned with Morocco’s digital infrastructure strategy.

Central Morocco – Emerging Digital Ecosystem with 31% Market Share

Central Morocco shows steady growth in mid-tier cities such as Fes and Meknes. It benefits from rising industrial digitalization and enterprise IT adoption. Businesses in this region deploy DCIM systems to modernize internal data centers. It plays a growing role in national cloud expansion efforts. Improved internet penetration and renewable energy integration support local deployment. Educational and healthcare institutions also invest in monitoring systems to enhance operational resilience.

- For instance, Schneider Electric inaugurated its new Services Center in Casablanca in December 2024, spanning over 1,000 sqm, designed to support advanced data center operations and digital transformation for regional clients, with specialized training for DCIM and energy management offered to enterprise partners across central Morocco.

Southern Morocco – Developing Infrastructure with 17% Market Share

Southern Morocco remains an emerging area with increasing investment in edge and government data projects. Agadir and Laayoune are witnessing early infrastructure expansion supported by regional connectivity initiatives. It experiences growing demand from logistics, tourism, and public sector operations. Renewable energy projects, particularly solar, create opportunities for sustainable DCIM implementation. The region’s growth trajectory is supported by national digital inclusion policies. Businesses and investors recognize its potential in expanding Morocco’s data economy footprint.

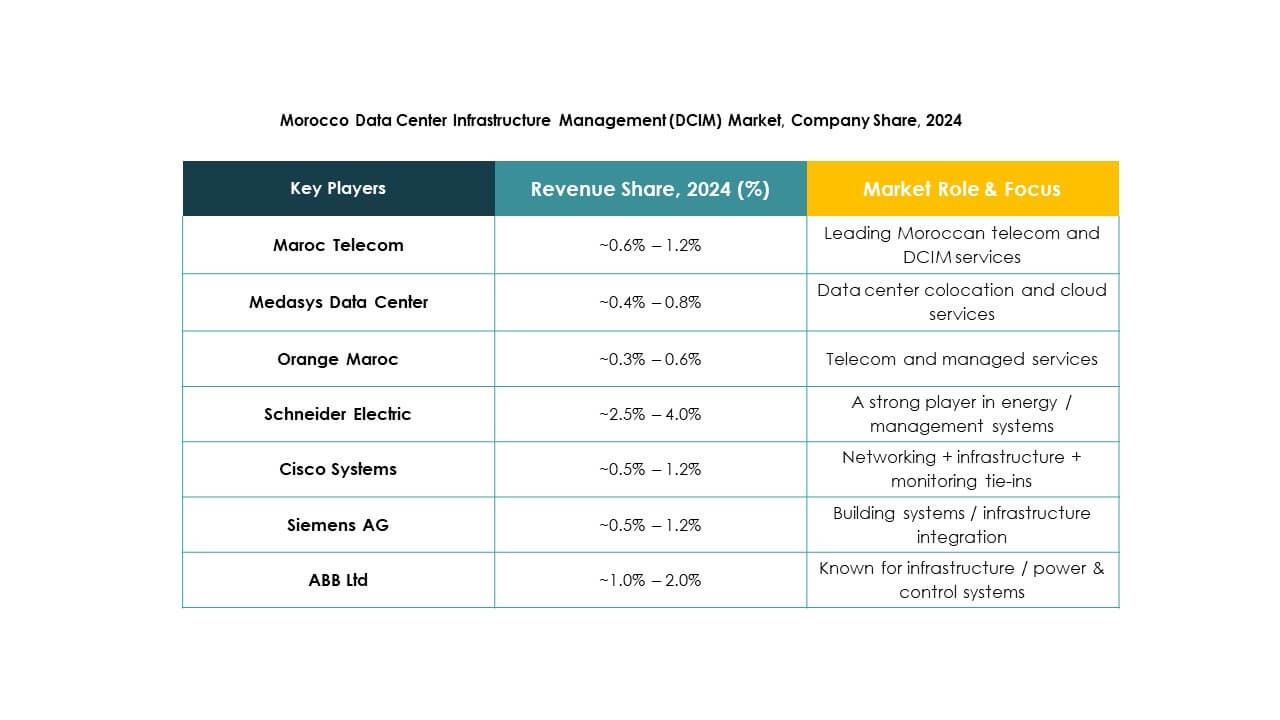

Competitive Insights:

- Maroc Telecom

- Medasys Data Center

- Orange Maroc

- INWI

- Cisco Systems, Inc.

- Equinix

- Eaton Corporation

- Huawei Technologies Co., Ltd.

- Schneider Electric SE

- Siemens AG

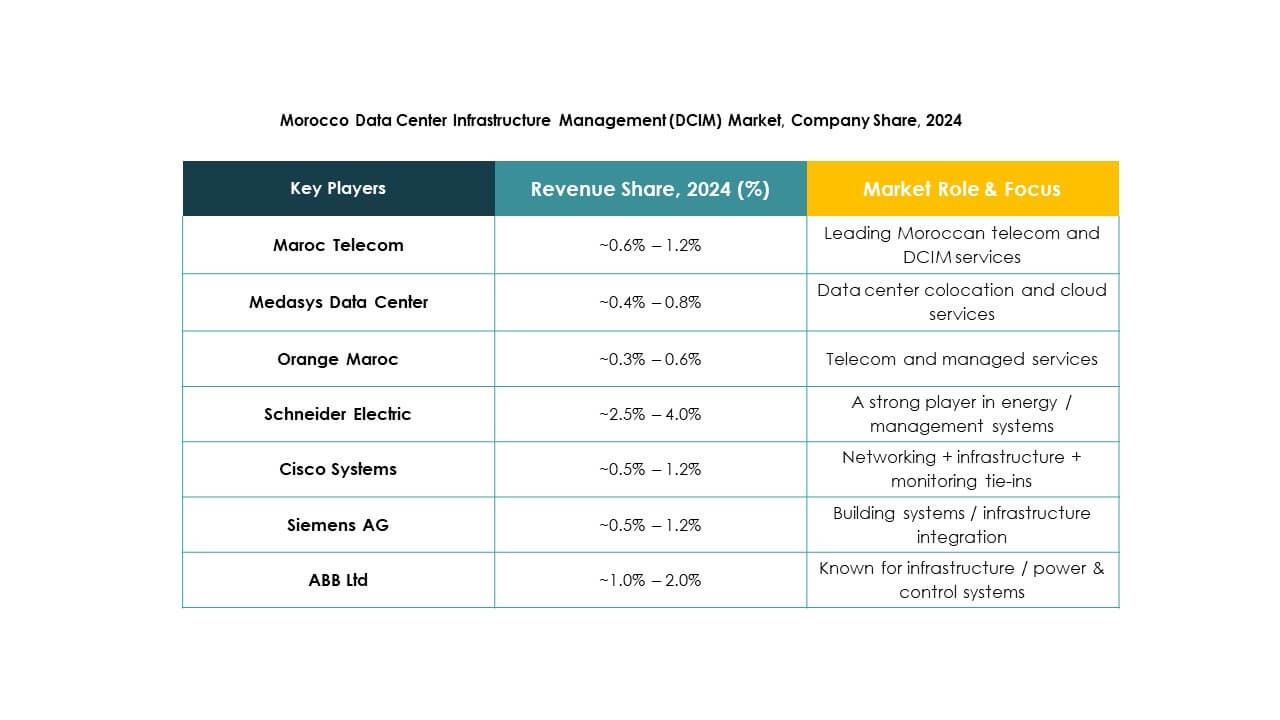

The Morocco Data Center Infrastructure Management (DCIM) Market is highly competitive, driven by strong participation from telecom operators, global technology firms, and infrastructure specialists. Local leaders such as Maroc Telecom, Orange Maroc, and INWI strengthen the country’s digital backbone through cloud connectivity and colocation services. Global players like Cisco Systems, Huawei Technologies, and Schneider Electric deliver automation, energy management, and real-time monitoring solutions tailored to Moroccan data centers. It shows growing collaboration between domestic operators and multinational providers to enhance operational resilience and energy efficiency. Continuous innovation in DCIM software, renewable integration, and AI-based analytics defines the current market focus, positioning Morocco as an emerging digital infrastructure hub in North Africa.

Recent Developments:

- In July 2025, the Moroccan Ministry of Digital Transition revealed plans to construct a 500MW renewable energy-powered data center in Dakhla, Western Sahara, as part of the Digital Morocco 2030 strategy to boost digital sovereignty and support national security for data storage.

- In July 2025, Maroc Telecom entered a strategic partnership with Google Cloud to establish a regional data storage hub in Morocco and North Africa, focusing on using renewable energy to power these facilities and enhance local cloud infrastructure with reduced latency and improved data sovereignty. This initiative aims to position Morocco as a key hub for cloud services in the region while supporting digital transformation and sustainability goals.

- In June 2025, Naver Cloud announced a partnership with Nvidia, Nexus Core Systems, and Lloyds Capital to build an AI-powered 500MW data center campus in Morocco, marking a significant infrastructure investment aimed at serving AI and digital workloads in the region.

- In May 2024, American company Iozera signed a $500 million agreement to establish a data center in Tetouan, Morocco, providing modern colocation and cloud services that further reinforce Morocco’s strategic hub status for North African digital infrastructure.