Executive summary:

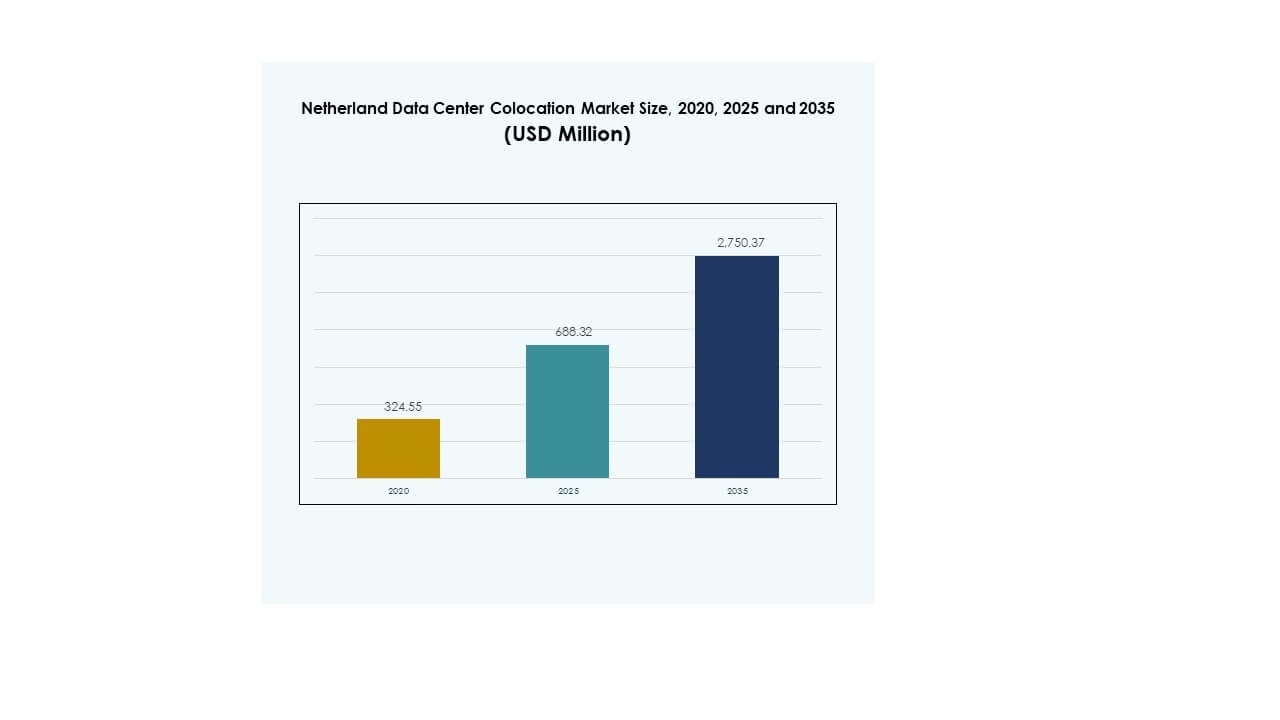

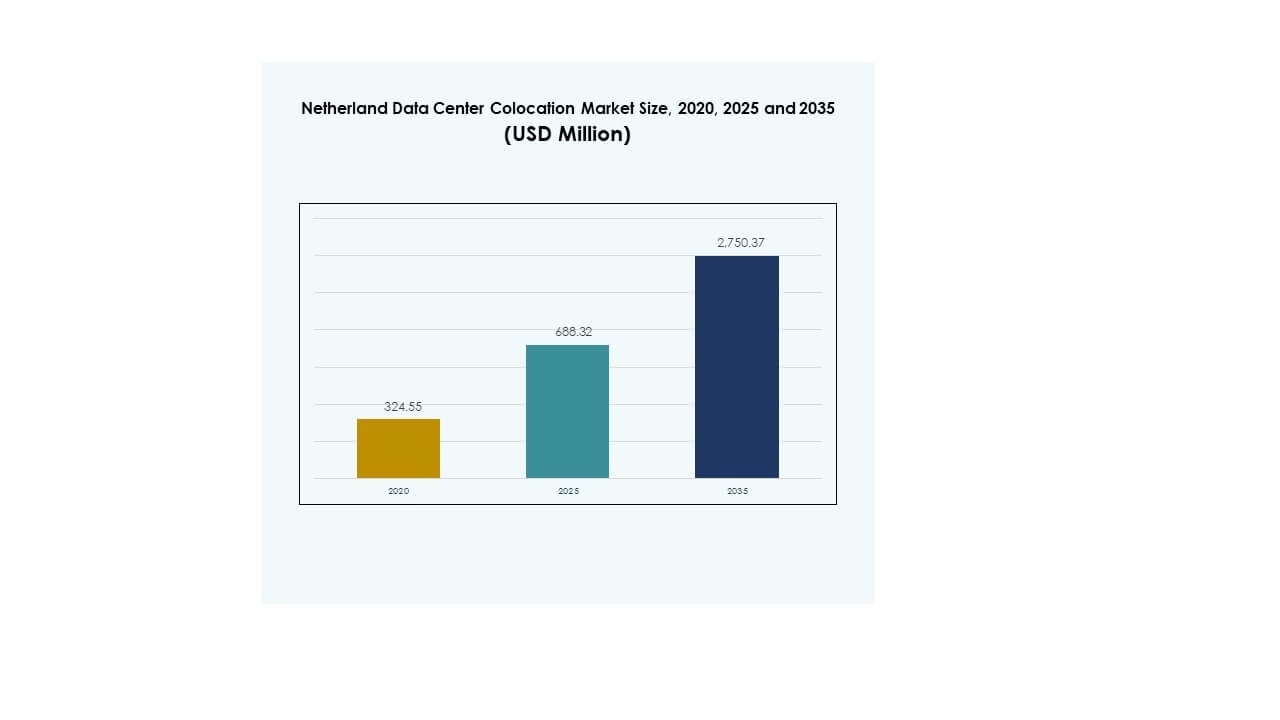

The Netherland Data Center Colocation Market size was valued at USD 324.55 million in 2020, reached USD 688.32 million in 2025, and is anticipated to reach USD 2,750.37 million by 2035, at a CAGR of 14.80% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Netherland Data Center Colocation Market Size 2025 |

USD 688.32 Million |

| Netherland Data Center Colocation Market, CAGR |

14.80% |

| Netherland Data Center Colocation Market Size 2035 |

USD 2,750.37 Million |

The market growth is driven by rapid cloud adoption, AI workload expansion, and edge computing infrastructure development. Companies are modernizing IT operations to achieve greater scalability, security, and efficiency. Colocation providers are expanding capacity and integrating renewable energy to address rising digital demand. The Netherlands plays a strategic role in Europe’s digital ecosystem, making it a key location for hyperscalers and enterprises seeking reliable infrastructure. Investors view the sector as a high-value opportunity due to long-term infrastructure stability and strategic connectivity advantages.

Amsterdam leads the market due to its strong network connectivity and presence of major IXPs. Secondary hubs such as Rotterdam and The Hague are emerging as key growth regions supported by expanding edge deployments. Strategic location, power availability, and regulatory stability strengthen the country’s position as a digital infrastructure hub. Regional diversification is helping balance capacity and ease pressure on Amsterdam’s grid, enabling broader infrastructure development across the Netherlands.

Market Drivers

Rising Cloud Adoption and Digital Transformation Accelerating Data Center Demand

The Netherland Data Center Colocation Market benefits from rapid cloud adoption across industries. Enterprises are migrating core operations to cloud platforms to improve agility and scalability. Hyperscalers and SaaS providers invest heavily in colocation facilities to expand capacity and ensure reliable uptime. Advanced fiber networks and low-latency connectivity make the Netherlands a prime location for strategic deployments. Data sovereignty and compliance with EU regulations further enhance its attractiveness for cloud migration. The expanding digital ecosystem drives investments in scalable and energy-efficient colocation infrastructures. Businesses view this infrastructure as a strategic asset for expansion. Investors see growing opportunities in advanced facilities with high availability and strong interconnection.

Expanding Edge Computing and IoT Driving Infrastructure Modernization

The growing edge computing ecosystem is a key driver for infrastructure development in the Netherlands. Businesses seek proximity to users and real-time processing capabilities to support AI, IoT, and 5G use cases. Colocation providers are upgrading facilities with modular architectures and advanced interconnection solutions to meet these requirements. The country’s strong connectivity backbone supports ultra-low-latency networks, essential for critical applications. Edge deployments are transforming traditional data center strategies into distributed architectures. This shift positions the Netherlands as a central node in Europe’s digital infrastructure network. Investors prioritize facilities offering flexible and scalable edge integration. It strengthens the competitive edge of colocation operators in this market.

- For instance, in February 2025, NorthC Datacenters broke ground on a 4.5 megawatt expansion at its Aalsmeer facility near Amsterdam, responding to growing demand for scalable edge infrastructure with existing sites offering 14MW of IT capacity and 4,600 sqm of white space in the region.

Government Support and Regulatory Environment Strengthening Market Expansion

Government support plays a crucial role in accelerating infrastructure investments. Regulatory frameworks encourage sustainable growth and compliance with energy efficiency standards. The Netherlands provides favorable policies to attract international technology investors. Streamlined permitting processes and strong renewable energy integration foster infrastructure development. These policies enable the expansion of colocation capacity to meet rising demand. International firms view the Netherlands as a secure and stable gateway for European digital operations. This supportive environment lowers operational risk for investors. It creates a predictable and attractive investment climate for global colocation players.

- For instance, Digital Realty’s Amsterdam Science Park AMS17 Data Tower provides more than 5,000 square meters of data space and 9MW of customer power for strategic deployments, hosting over 200 network connections and benefiting from Dutch regulatory support for advanced digital infrastructure projects.

Sustainability Goals and Renewable Energy Integration Boosting Investor Confidence

The push for green infrastructure is reshaping colocation strategies. Operators are integrating renewable energy sources and advanced cooling technologies to cut carbon emissions. The Netherlands leads in implementing sustainable practices, supported by its strong renewable energy mix. Hyperscalers demand green power for data operations, driving infrastructure modernization. High energy efficiency ratings strengthen the reputation of Dutch data centers. These advancements attract environmentally conscious investors seeking long-term value. The country’s sustainability leadership enhances market stability and growth potential. It positions the Netherlands as a model for sustainable colocation infrastructure in Europe.

Market Trends

Rising Hyperscale Deployments Reshaping Colocation Ecosystem

The Netherland Data Center Colocation Market is experiencing a surge in hyperscale investments. Global cloud providers are expanding infrastructure to meet increasing enterprise demand for compute power. Hyperscale campuses drive network densification and interconnection growth across multiple regions. Providers are building large-scale, carrier-neutral facilities to handle AI and high-performance workloads. These facilities support flexible power configurations and scalable rack density. Investors focus on hyperscale-ready properties with low PUE ratings and renewable integration. Hyperscale expansion strengthens the country’s position as a core European data hub. It also accelerates ecosystem maturity and competitive differentiation among providers.

Growth of Interconnection Ecosystems Enhancing Network Resilience

Interconnection is emerging as a core trend in the country’s data center landscape. Enterprises prioritize facilities offering advanced peering and IXPs for global connectivity. Network resilience becomes a key differentiator for colocation operators. The Netherlands hosts some of Europe’s largest Internet exchange points, driving international traffic growth. Strong peering ecosystems enable direct, low-latency access to major cloud providers. This trend supports business continuity strategies for global enterprises. Investors are drawn to facilities offering high-density interconnection and robust carrier diversity. It ensures stable, secure, and scalable data flow for critical workloads.

Increasing Demand for AI-Optimized Infrastructure Supporting Innovation

AI and machine learning workloads are shaping the evolution of colocation facilities. Businesses require infrastructure optimized for high-performance computing and GPU clusters. Providers invest in advanced power and cooling solutions to support AI demand. New deployments include dense rack configurations and liquid cooling technologies. AI-driven industries such as healthcare, manufacturing, and fintech are driving facility upgrades. Investors view AI-ready sites as high-value assets with long-term demand stability. The market is transitioning toward purpose-built, AI-focused designs. It strengthens the Netherlands’ role in supporting next-generation computing workloads.

Deployment of Modular and Scalable Facility Designs Gaining Traction

Modular designs are gaining momentum in colocation facility development. Providers adopt scalable modules to reduce deployment timelines and enhance capacity flexibility. Prefabricated designs enable faster market entry and cost-efficient expansion. This approach supports growing demand for edge and hybrid IT architectures. Enterprises prefer modular facilities for their adaptability to changing workload requirements. Investors favor modular projects due to lower risk and rapid time-to-revenue. This trend aligns with sustainable building practices and energy efficiency goals. It improves infrastructure agility and operational performance across the country.

Market Challenges

Rising Energy Costs and Power Availability Constraints Impacting Expansion Plans

The Netherland Data Center Colocation Market faces growing concerns over energy availability. Rising electricity prices and grid constraints are pressuring operators to manage power more efficiently. Demand growth for high-density racks increases stress on existing infrastructure. Renewable integration requires advanced planning to balance energy loads effectively. Power scarcity in certain urban hubs complicates capacity expansion strategies. Energy pricing volatility reduces financial predictability for operators and investors. Companies are forced to innovate with efficient cooling and energy-saving technologies. It drives the need for alternative power procurement strategies to maintain competitiveness.

Regulatory and Environmental Compliance Increasing Operational Complexity

Environmental compliance is tightening across the data center sector. Operators must align with evolving EU and national standards on carbon emissions. Meeting stringent sustainability requirements involves significant capital investment in green technologies. Environmental reviews can lengthen permitting timelines for new builds and expansions. Data centers must also address water usage and waste heat recovery challenges. The complex regulatory landscape creates delays for hyperscale and enterprise projects. This compliance burden increases operational costs and slows market response times. It creates additional barriers for new entrants and impacts strategic investment decisions.

Market Opportunities

Expansion of Edge and Hybrid Infrastructure Creating New Growth Pathways

The Netherland Data Center Colocation Market offers strong opportunities through edge and hybrid cloud adoption. Businesses are extending infrastructure to secondary cities for improved latency and resilience. This expansion strengthens coverage for 5G, IoT, and real-time data applications. Operators with edge capabilities attract enterprises seeking distributed architecture models. The country’s strong connectivity supports seamless integration with global networks. Investors view this segment as a promising area for high-return deployments. It positions providers strategically to capture emerging demand across vertical industries.

Green Infrastructure and Technology Innovation Unlocking Long-Term Value

Sustainability presents major growth opportunities in the market. Colocation operators are leveraging renewable energy and advanced cooling systems to lower emissions. Green data centers appeal to global hyperscalers aiming for net-zero targets. Energy-efficient technologies increase competitiveness in a crowded colocation landscape. Investors favor projects with strong ESG alignment and stable operational cost profiles. This shift accelerates market modernization and long-term infrastructure resilience. It enhances the global attractiveness of the Netherlands for data center investment.

Market Segmentation

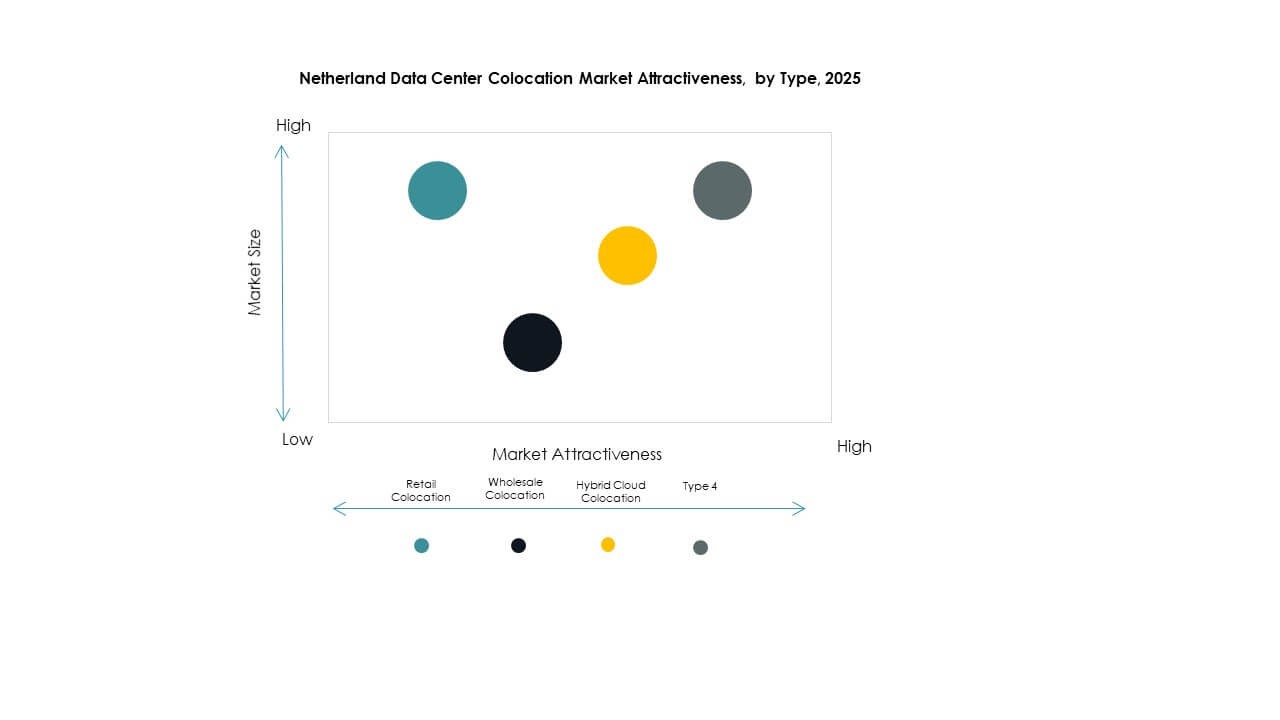

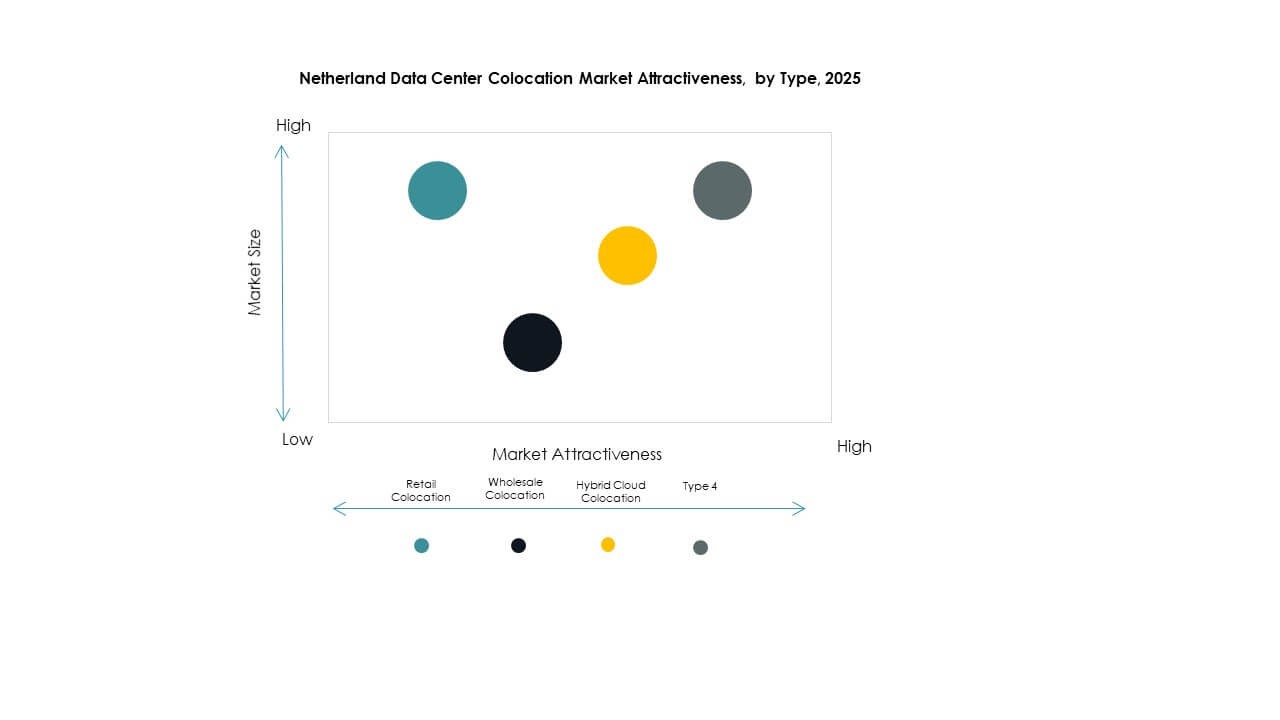

By Type

Retail colocation dominates the Netherland Data Center Colocation Market with the largest market share. Enterprises prefer retail solutions for flexibility, scalability, and cost control. Wholesale colocation is expanding rapidly due to hyperscale and large enterprise demand. Hybrid cloud colocation is emerging as businesses adopt hybrid IT strategies. Retail colocation supports multiple tenants and offers rapid deployment options. The strong presence of service providers in Amsterdam drives retail segment growth. Wholesale solutions focus on long-term contracts with large capacity needs. Hybrid models address evolving workload distribution and multi-cloud strategies.

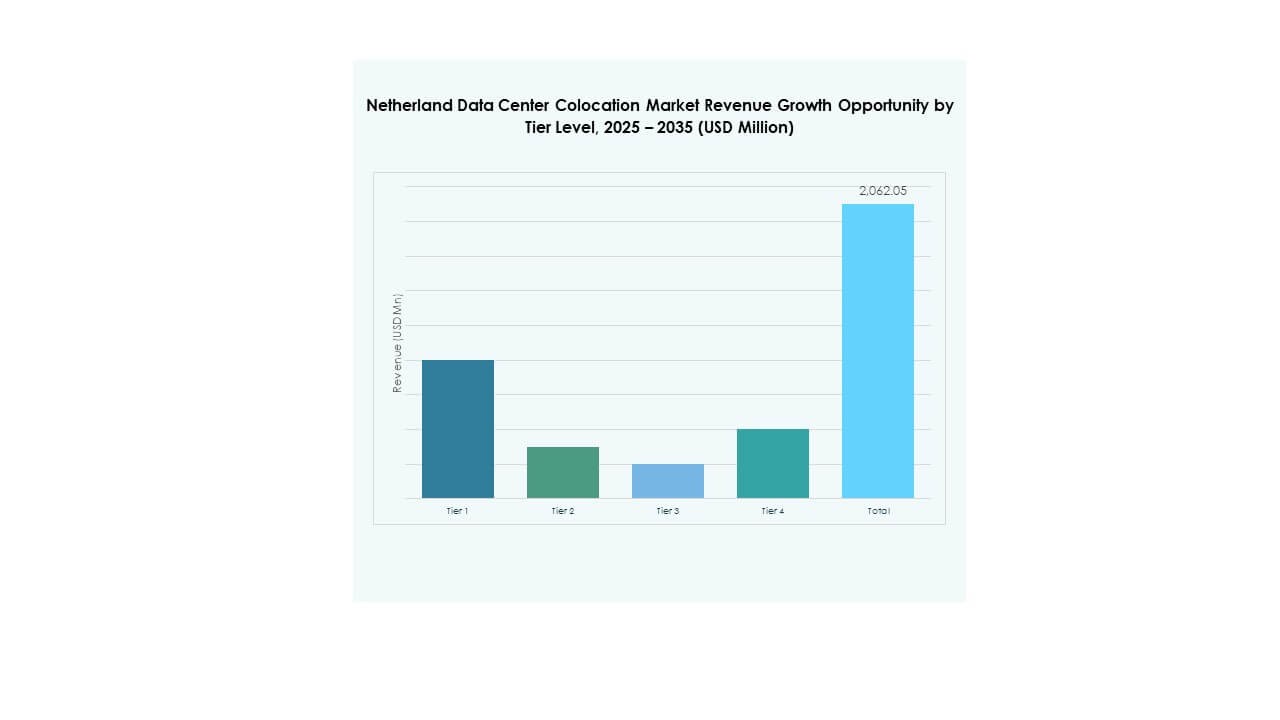

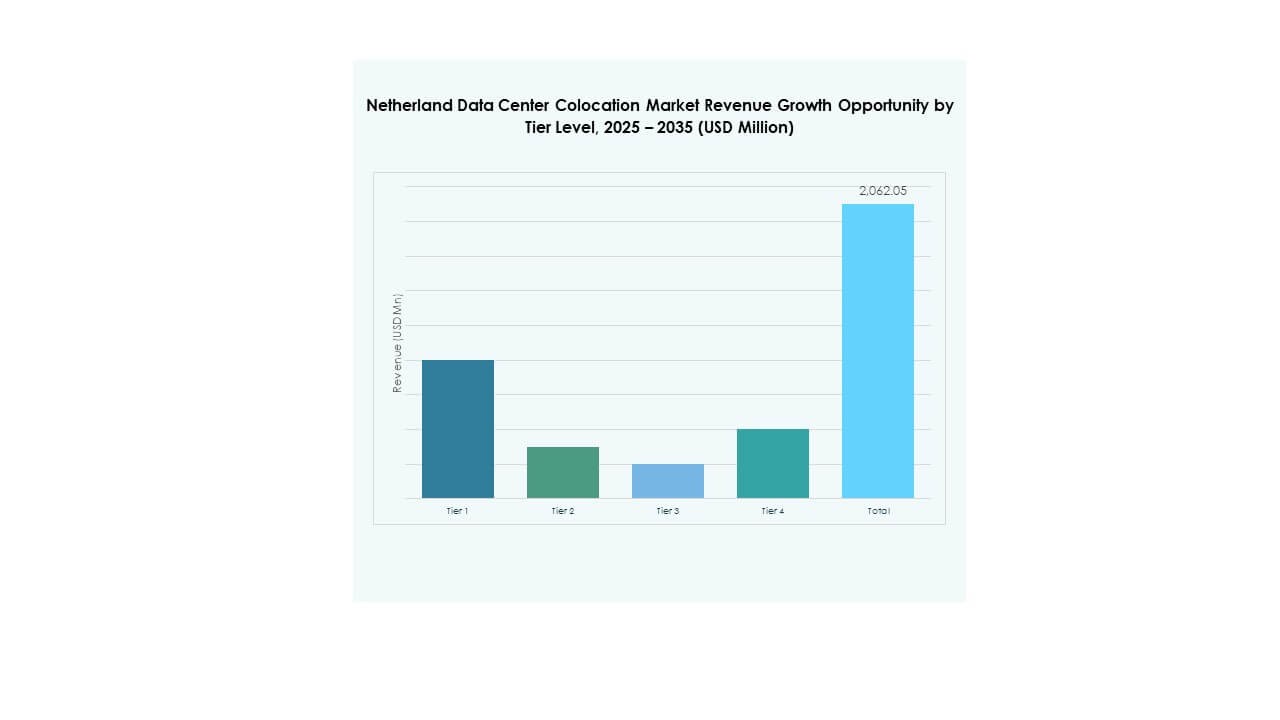

By Tier Level

Tier 3 facilities hold the largest share in the Netherland Data Center Colocation Market. These facilities offer high uptime and redundancy required by financial and technology sectors. Tier 4 is gaining traction with hyperscalers demanding maximum fault tolerance. Tier 1 and Tier 2 facilities serve smaller enterprises and regional deployments. Strong demand for Tier 3 stems from its cost-efficiency and performance balance. The country’s strategic location encourages global providers to build Tier 3 and Tier 4 centers. Regulatory compliance and high availability standards favor advanced tier adoption. This strengthens the country’s role as a leading European colocation hub.

By Enterprise Size

Large enterprises dominate the Netherland Data Center Colocation Market. Their investments drive demand for scalable, high-capacity facilities. SMEs are increasingly adopting colocation services to access advanced infrastructure at lower costs. Large firms prefer long-term contracts with hyperscale providers. SMEs benefit from flexible pricing and shared infrastructure options. High data processing demands from financial and telecom companies push capacity growth. Large enterprises prioritize security, compliance, and power redundancy. The SME segment presents emerging opportunities in edge and hybrid solutions.

By End User Industry

IT & Telecom leads the Netherland Data Center Colocation Market due to rapid digitalization. BFSI follows, driven by data security and uptime requirements. Retail, healthcare, and media industries adopt colocation to scale digital services. IT & Telecom dominates through cloud adoption, edge computing, and 5G network deployments. Healthcare increasingly relies on colocation to handle medical data and AI workloads. Media and entertainment use colocation for content delivery and streaming services. Retail benefits from scalable infrastructure supporting e-commerce and digital payments. The diverse industry adoption base supports long-term market growth.

Regional Insights

Amsterdam Metropolitan Region Holding a Major Share

Amsterdam leads the Netherland Data Center Colocation Market with 64% share. The city hosts dense network connectivity, multiple IXPs, and hyperscale campuses. Its location near key submarine cables enhances international connectivity. Major cloud and telecom companies prefer Amsterdam for strategic deployments. Advanced infrastructure and strong power availability drive capacity expansion. This dominance reinforces Amsterdam’s role as the country’s primary data center hub. It remains the focal point for both retail and wholesale colocation activities.

- For instance, Digital Realty operates 12 data centers in Amsterdam, connecting directly to three major Internet Exchange Points AMS-IX, NL-IX, and DE-CIX and enabling direct links to more than 300 data centers globally through its interconnected platform, as confirmed by Digital Realty’s official portfolio and recent market listings.

Rotterdam and Hague Region Emerging as Secondary Growth Hubs

Rotterdam and The Hague collectively hold 23% share of the Netherland Data Center Colocation Market. The region benefits from proximity to major ports and strong fiber connectivity. Secondary hubs attract investments for edge computing and disaster recovery facilities. Infrastructure development supports enterprise expansion outside Amsterdam. Lower real estate costs and grid diversification make the area attractive. Operators are strategically expanding to balance load and reduce congestion. It strengthens the overall resilience of the national data center network.

Other Provinces Gaining Momentum Through Edge and Distributed Deployments

Other provinces represent 13% share of the Netherland Data Center Colocation Market. These regions see rising investments in edge facilities to support latency-sensitive applications. Growing IoT adoption and 5G rollout create new opportunities outside main hubs. Government initiatives encourage balanced regional development for digital infrastructure. These areas offer strategic advantages for localized workloads and distributed networks. Investors are targeting emerging markets to diversify portfolios. It strengthens national infrastructure and supports future expansion strategies.

- For instance, Eurofiber expanded its fiber-optic infrastructure to cover more than 40 business parks in the provinces in 2025 and renewed its strategic partnership with Odido, which supports efficient edge connectivity, as verified in published company news statements. In addition, seven Dutch firms, including Eurofiber and Asperitas, joined an EU-backed project for efficient edge data centers in late 2023, confirmed by news articles reviewing consortium membership and project goals.

Competitive Insights:

- Interxion (Digital Realty)

- EvoSwitch

- Nxtra Data

- Greenhouse Data

- Amazon Web Services (AWS)

- Google Cloud

- China Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The competitive landscape of the Netherland Data Center Colocation Market is shaped by a mix of global hyperscalers, established colocation providers, and regional specialists. Interxion (Digital Realty) and Equinix maintain strong positions with extensive network ecosystems and scalable capacity. AWS and Google Cloud expand their footprints to support enterprise and AI workloads. NTT Ltd. and Colt Technology focus on carrier-neutral connectivity and hybrid solutions. EvoSwitch and Greenhouse Data leverage sustainability-focused infrastructure to attract green-conscious clients. China Telecom and CoreSite strengthen international interconnection capabilities. It reflects a highly consolidated market, where competitive advantage depends on power availability, network density, sustainability, and hyperscale readiness. Strategic alliances, facility expansions, and renewable energy integration define leadership strategies.

Recent Developments:

- In October 2025, House of Data announced its launch with plans to develop two new data centers in the Netherlands. The company aims to establish a European infrastructure platform complemented by scalable data center capacities, targeting the accelerating demand for AI and cloud workloads. This marks a significant move to support both domestic and regional digital infrastructure growth.

- Ellada Holdings completed the acquisition of real estate for its Netherlands-based data center, located near Amsterdam, on September 10, 2024. Following this purchase, Data Facilities announced a 3.5 MW modular infrastructure expansion to be rolled out over two years. This milestone not only stabilizes their position in the retail colocation market but also responds proactively to the Netherlands’ constrained power supply environment, with new customer deployments scheduled as early as Q1 2025.