Executive summary:

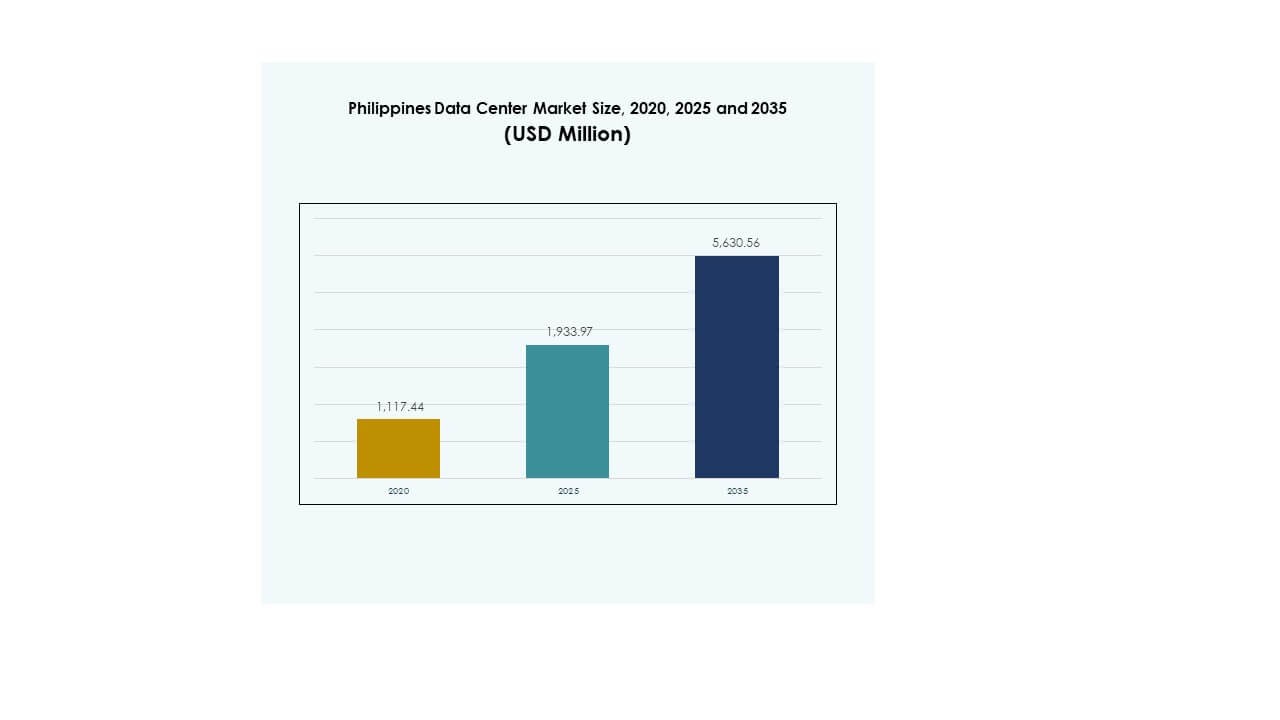

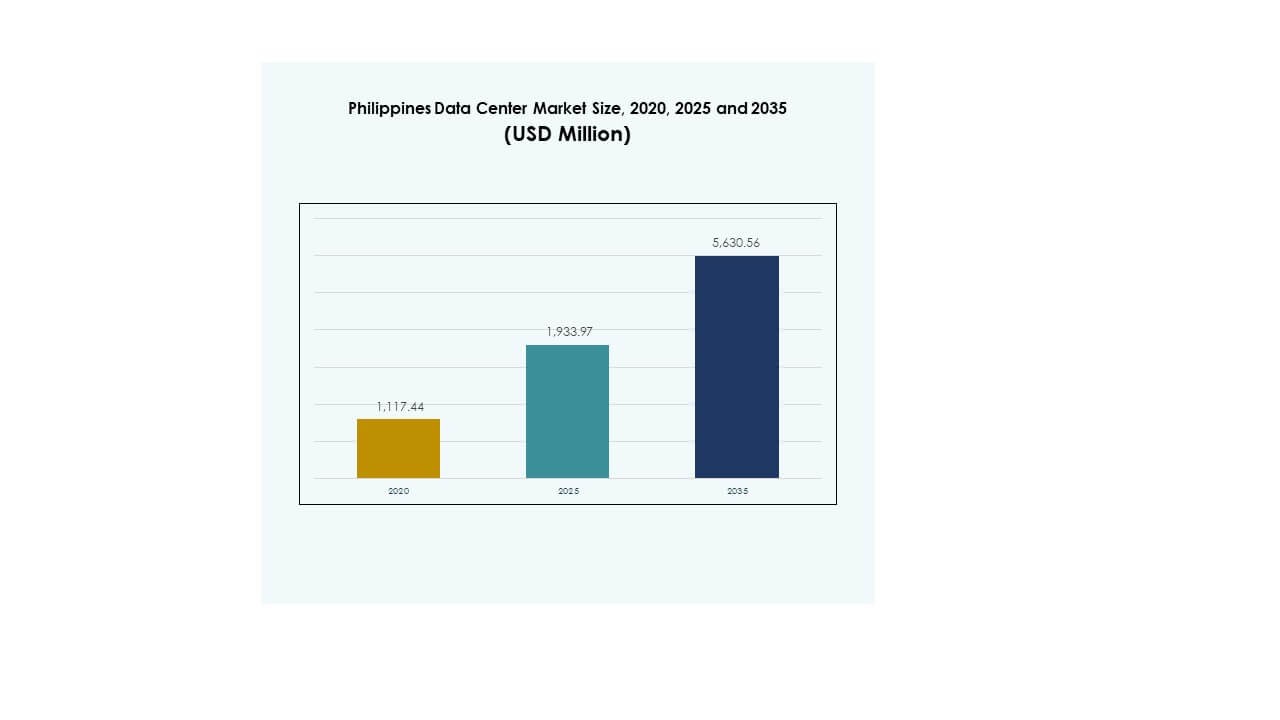

The Philippines Data Center Market size was valued at USD 1,117.44 million in 2020 to USD 1,933.97 million in 2025 and is anticipated to reach USD 5,630.56 million by 2035, at a CAGR of 11.20% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Philippines Data Center Market Size 2025 |

USD 1,933.97 Million |

| Philippines Data Center Market, CAGR |

11.20% |

| Philippines Data Center Market Size 2035 |

USD 5,630.56 Million |

Market growth is fueled by increasing cloud adoption, digital transformation across industries, and the surge in data traffic from e-commerce, BFSI, and telecom sectors. Enterprises are prioritizing AI, IoT, and big data applications, requiring scalable and reliable infrastructure. Investors see strong potential in the Philippines Data Center Market due to favorable government initiatives, modernization of IT systems, and expanding demand for secure, high-capacity facilities.

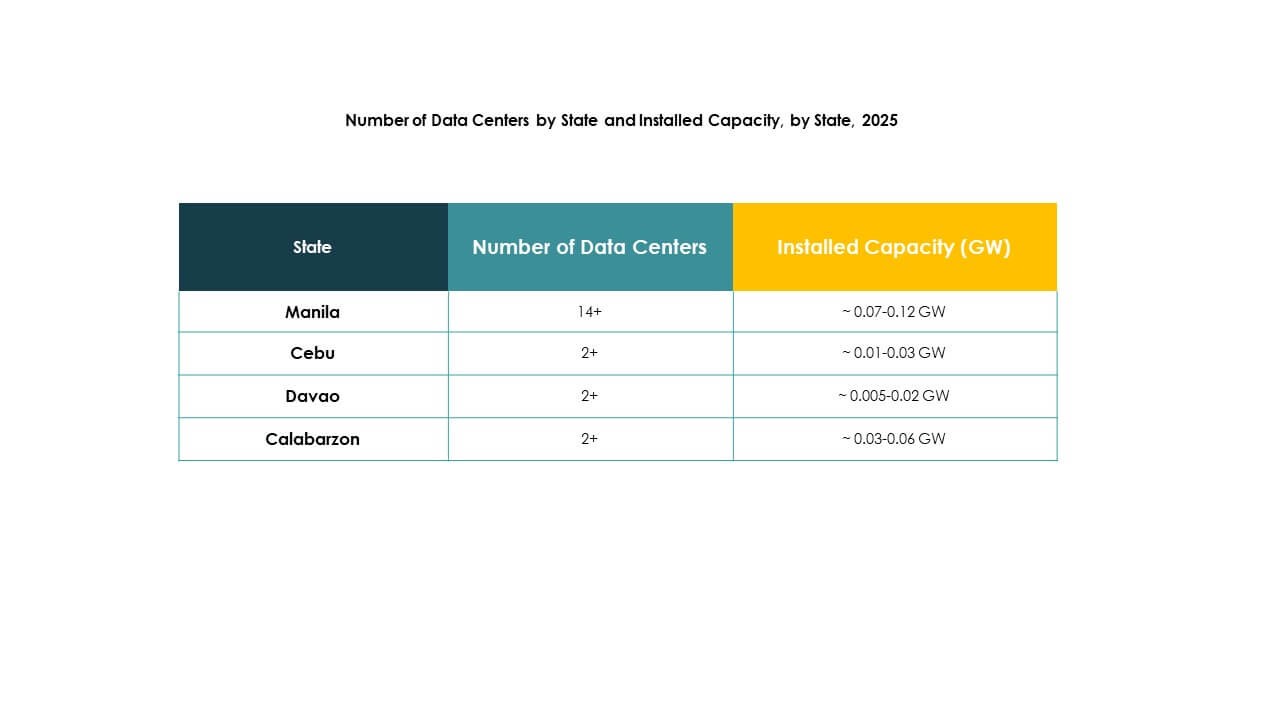

Regionally, Metro Manila leads the market due to dense enterprise presence, advanced infrastructure, and strong connectivity. Luzon outside the capital is emerging as a secondary hub driven by industrial zone expansion and affordable land availability. Visayas and Mindanao show gradual progress with modular and edge deployments, supported by cable projects and digital inclusion programs, making them key future growth regions.

Market Drivers

Rapid Expansion of Cloud Services and Digital Infrastructure Modernization

The Philippines Data Center Market is driven by the rising demand for cloud services and modernization of digital infrastructure across enterprises. Multinational corporations and local firms are shifting workloads to the cloud, creating strong demand for scalable and resilient facilities. Cloud adoption is reinforced by digital transformation initiatives across banking, telecom, and e-commerce. Government policies promoting digitalization further strengthen the momentum. Investors view the market as a high-growth opportunity due to evolving IT ecosystems. The market supports operational agility and secure data handling. It plays a vital role in enabling enterprise resilience.

Growing Adoption of Emerging Technologies and Advanced Applications

The market is benefiting from rapid adoption of advanced technologies such as IoT, AI, and big data analytics. Businesses across sectors deploy these technologies to improve efficiency, customer experience, and competitive advantage. The growth in connected devices and real-time data requirements has created heavy reliance on advanced data processing. Enterprises seek facilities capable of managing complex workloads and higher density requirements. It enhances opportunities for hyperscale and modular deployments. The Philippines Data Center Market gains strategic relevance for technology-driven growth. It allows companies to scale operations efficiently while maintaining regulatory compliance.

- For instance, in September 2025, ePLDT, in partnership with Dell Technologies and Katonic AI, launched Pilipinas AI, the country’s first sovereign AI solutions stack, hosted at VITRO Sta. Rosa Data Center with a 50-megawatt capacity and GPU-as-a-Service for enterprise AI adoption.

Strong Investment Momentum From Global and Local Players

The expansion of the market is fueled by rising investments from international hyperscalers and domestic telecom operators. Global technology firms are entering strategic partnerships with local providers to strengthen infrastructure capacity. These investments improve quality standards and increase availability of sustainable data centers. Local telecom and IT firms also expand footprints to address surging demand for digital services. The Philippines Data Center Market creates opportunities for long-term revenue streams. It provides investors with attractive returns through scalable colocation and managed service offerings. This trend highlights strong confidence in the country’s digital infrastructure ecosystem.

- For instance, ST Telemedia Global Data Centres Philippines topped out its STT Fairview 1 hyperscale data center facility in Quezon City in December 2024, set to deliver 12MW of capacity in the first building and ultimately aiming for 124MW across the campus, with four interconnected carrier-neutral data centers supporting advanced AI workloads.

Government Support, Digital Policies, and Regulatory Push

The government’s national digital transformation agenda accelerates the adoption of advanced infrastructure. Policies aimed at improving connectivity, cybersecurity, and cloud integration reinforce market growth. National programs encourage foreign and local investors to expand digital ecosystems. Enhanced regulatory frameworks ensure data security and compliance with global standards. It strengthens trust among enterprises and consumers relying on secure platforms. The Philippines Data Center Market emerges as a key enabler of a resilient digital economy. It provides businesses with critical support for scaling operations securely and efficiently.

Market Trends

Shift Toward Renewable Energy Integration and Sustainable Operations

Operators are focusing on sustainability by adopting renewable energy sources for power consumption. Green data centers are becoming a strong trend as enterprises prioritize environmental, social, and governance goals. Solar, wind, and hybrid systems are integrated to reduce carbon footprints. This move aligns with global corporate sustainability mandates. It encourages partnerships with energy providers and government agencies for reliable supply. The Philippines Data Center Market gains attention as an eco-friendly investment hub. Operators focus on efficiency by optimizing energy use and cooling innovations. This trend ensures long-term competitiveness.

Rising Role of Edge and Modular Data Centers for Connectivity Needs

Edge and modular facilities are gaining traction to meet the demand for low-latency services. Telecom operators and enterprises deploy smaller, decentralized facilities closer to end-users. Growth of online gaming, video streaming, and 5G services creates opportunities for edge expansion. Modular centers allow flexibility in scaling capacity based on evolving workloads. It ensures cost-effective deployment across regions with limited infrastructure. The Philippines Data Center Market reflects a rising demand for these models. This trend enhances accessibility for underserved areas. It bridges digital gaps across industries.

Growing Emphasis on Colocation Services and Flexible Leasing Models

Colocation providers are offering more customized and flexible leasing options to enterprises. Demand for scalable space and efficient cooling drives expansion of colocation footprints. Enterprises seek shared infrastructure to reduce capital expenditure while ensuring reliability. Growth in start-ups and SMEs creates demand for cost-effective hosting solutions. It also supports businesses expanding digital operations without heavy upfront investment. The Philippines Data Center Market shows rising adoption of colocation due to affordability and flexibility. Operators provide bundled services, including managed security and connectivity. This trend ensures steady growth.

Integration of Artificial Intelligence for Operational Optimization

Operators are increasingly integrating AI and automation for improved operational efficiency. AI-driven tools optimize power consumption, cooling, and predictive maintenance. Intelligent monitoring enhances uptime and reduces service disruptions. Automation ensures seamless resource allocation across workloads. It also improves customer experience through faster provisioning and management. The Philippines Data Center Market highlights the adoption of AI for performance efficiency. It strengthens competitiveness by reducing operational costs. This trend underlines the transformation toward smart infrastructure systems.

Market Challenges

Infrastructure Gaps, Power Constraints, and Connectivity Limitations

The Philippines Data Center Market faces challenges from infrastructure gaps and limited power supply. Reliability of electricity grids in some regions creates risks for large-scale operations. Rising demand puts pressure on stable energy delivery. Connectivity remains inconsistent in remote provinces, limiting equitable expansion. It raises costs for operators to ensure redundancy and backup power. Enterprises face barriers in scaling workloads efficiently. These gaps hinder the speed of development and limit service availability.

Regulatory Complexities and Rising Operational Costs for Providers

Regulatory compliance and taxation frameworks create complexities for global entrants. Different approval processes delay construction timelines for new facilities. Cybersecurity and data sovereignty requirements add extra investment needs. Rising real estate costs in urban centers also increase financial pressures. Operators struggle with balancing service affordability and high infrastructure costs. The Philippines Data Center Market requires supportive policies for sustained growth. It faces the challenge of addressing cost concerns while maintaining global competitiveness.

Market Opportunities

Expansion of Hyperscale and International Cloud Investments

Strong opportunities lie in hyperscale development driven by international cloud providers. Enterprises shifting workloads to the cloud strengthen demand for large-scale facilities. International firms are expanding partnerships with local operators for regional dominance. The Philippines Data Center Market attracts investments that ensure long-term infrastructure resilience. It opens opportunities for revenue growth through hosting and managed services. Demand for secure, scalable, and compliant hosting drives global attention.

Digital Transformation Across SMEs and Public Sector Growth

Opportunities also stem from SMEs and public sector initiatives adopting digital-first strategies. SMEs require affordable colocation and cloud-based solutions to compete effectively. Public agencies focus on modernizing systems, driving demand for secure facilities. It encourages greater collaboration between private and public sectors. The Philippines Data Center Market positions itself as an enabler of inclusive digital growth. Expansion into smaller enterprises and government partnerships creates strong opportunities for providers.

Market Segmentation

By Component

Hardware dominates the Philippines Data Center Market with servers, storage, networking, and cooling systems driving investments. Demand for efficient power and rack systems supports expansion. Software adoption grows due to DCIM and automation platforms improving operational efficiency. Services including consulting, managed, and integration offerings are expanding rapidly, fueled by SMEs and enterprises seeking expert support. Hardware maintains the largest share due to infrastructure requirements, while software and services reflect rising adoption trends.

By Data Center Type

Hyperscale facilities hold the largest share, driven by global cloud providers’ entry. Colocation is growing quickly due to SMEs’ demand for shared and cost-effective infrastructure. Enterprise data centers remain relevant for firms requiring in-house control. Edge and modular facilities address regional connectivity gaps. Cloud/IDC models are surging with digital services growth, while mega data centers are emerging slowly. The Philippines Data Center Market sees hyperscale and colocation as the most dominant categories shaping growth.

By Deployment Model

Hybrid deployment dominates the Philippines Data Center Market as firms balance flexibility, cost, and security. Cloud-based models are expanding quickly with start-ups and digital-first businesses. On-premises facilities still serve regulated industries requiring strict compliance. Hybrid adoption grows as enterprises leverage cloud scalability while maintaining control over critical workloads. It offers resilience and adaptability. This model ensures enterprises optimize resources while managing risks.

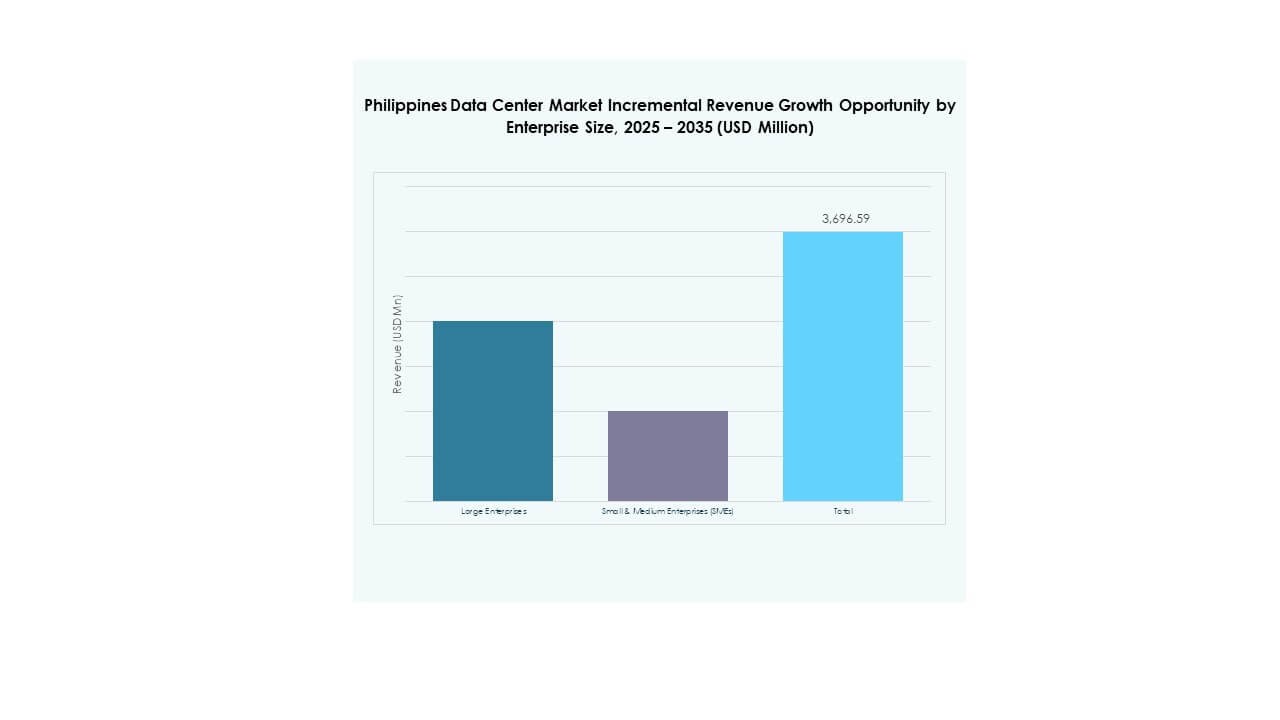

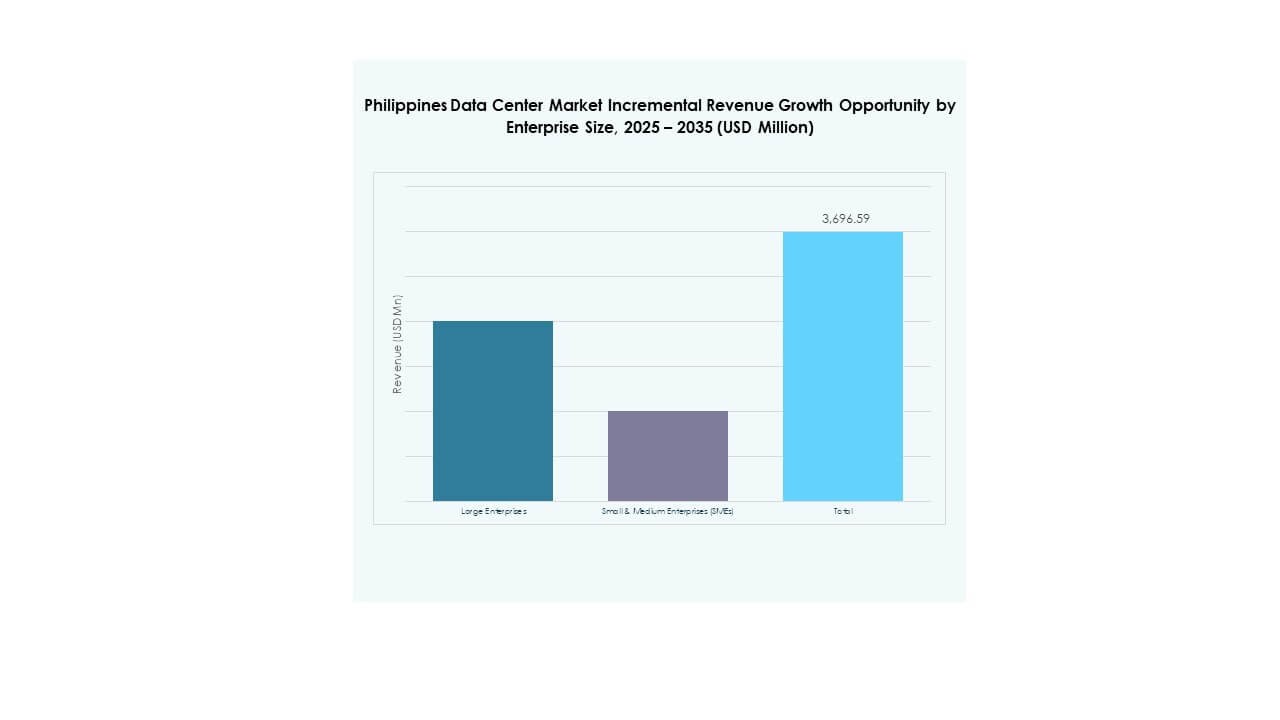

By Enterprise Size

Large enterprises account for the largest market share due to complex workloads and high data storage needs. SMEs show rapid adoption of colocation and cloud-based solutions for affordability and scalability. Hybrid strategies enable SMEs to modernize infrastructure without large upfront investment. The Philippines Data Center Market reflects balanced opportunities across both categories. Large firms sustain dominance, while SMEs drive diversification and accessibility of services.

By Application / Use Case

IT and Telecom dominate the Philippines Data Center Market due to high data processing demand and 5G rollouts. BFSI holds a strong share due to strict compliance and digital transaction growth. Healthcare, retail, and e-commerce are rising segments adopting secure storage and cloud-based applications. Media and entertainment expand with streaming demand, while manufacturing and government modernize through secure workloads. Education and utilities reflect emerging opportunities for infrastructure adoption.

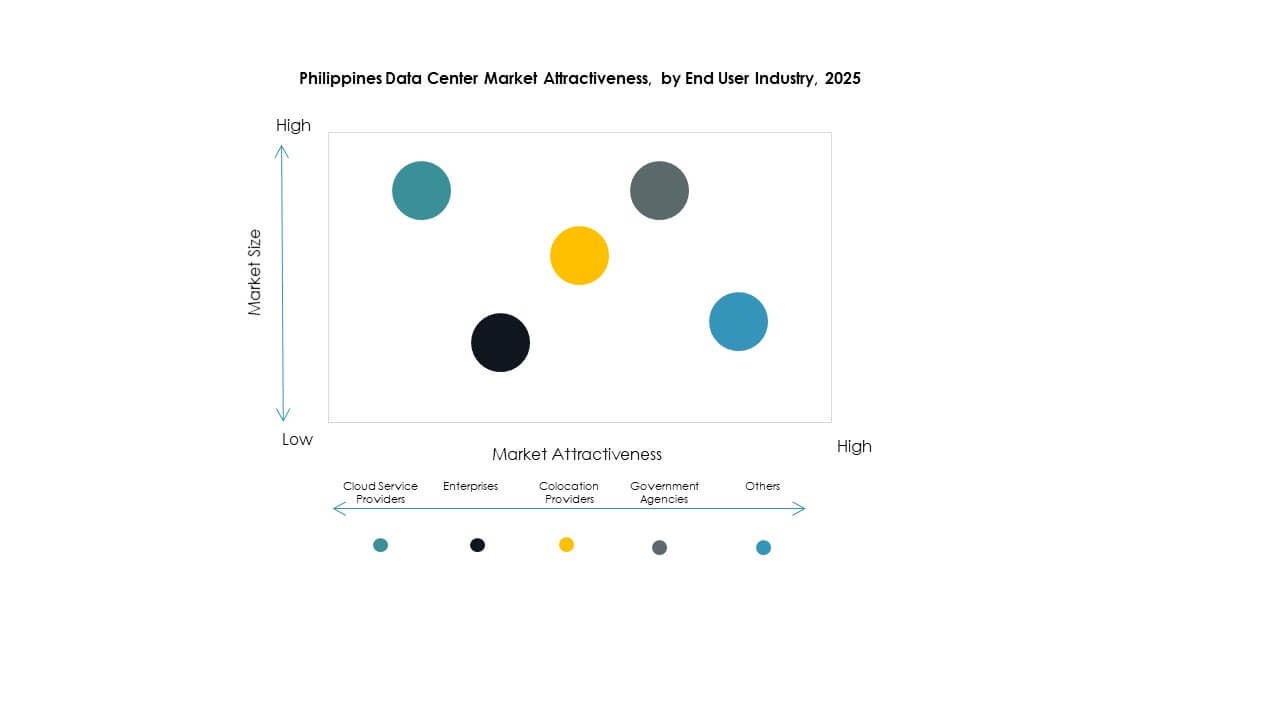

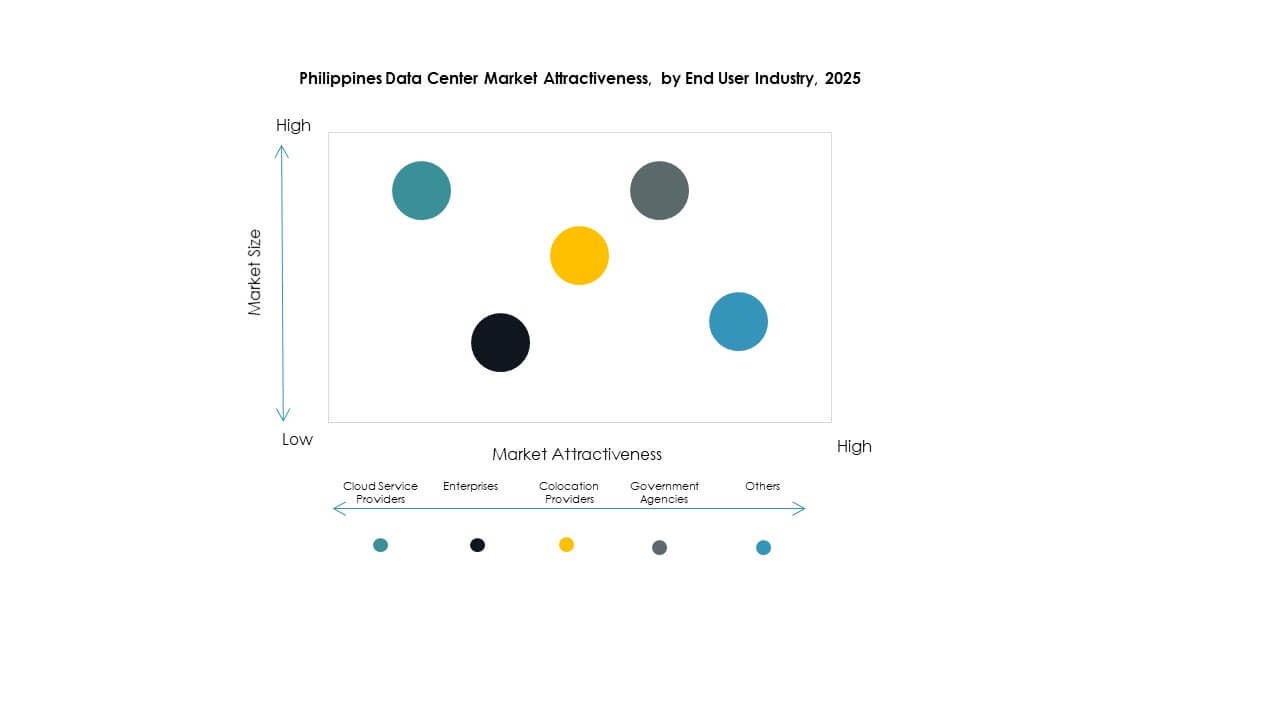

By End User Industry

Cloud service providers lead with the largest share in the Philippines Data Center Market. Enterprises adopt colocation and hybrid services to modernize infrastructure efficiently. Colocation providers strengthen their role by offering flexible leasing models. Government agencies drive secure and compliant facility adoption. Others including education and NGOs create smaller but consistent demand. Cloud providers dominate growth, supported by enterprises seeking resilient and scalable infrastructure services.

Regional Insights

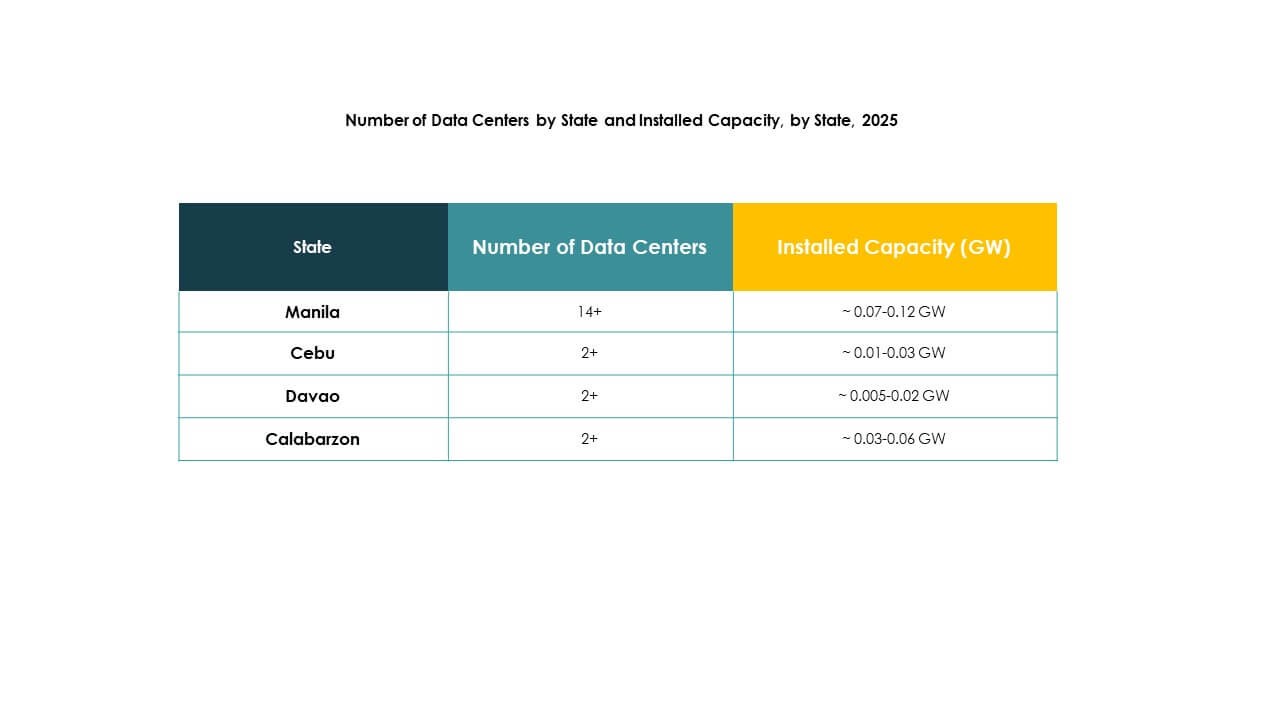

Metro Manila Leading With Dominant Market Share

Metro Manila accounts for nearly 58% share of the Philippines Data Center Market due to strong connectivity, urban demand, and concentration of enterprises. It benefits from major investments by global hyperscale providers and local telecom firms. Strong economic activities and government offices reinforce its dominance. It attracts the largest share of cloud adoption and colocation facilities. The capital region remains the focal point for large-scale data infrastructure expansion.

- For instance, PLDT Inc. inaugurated the VITRO Sta. Rosa data center with a 50 MW capacity and more than 4,500 racks, which secured a TIA-942 Rated 3 Design Certification in 2023, positioning it among the largest and most advanced facilities in the Philippines.

Luzon Region Emerging as a Key Growth Hub

Luzon outside Metro Manila contributes nearly 27% share, driven by infrastructure expansion and improved connectivity. Growth of industrial zones and expansion of telecom coverage support demand. Investors recognize Luzon as a cost-effective hub for expanding facilities outside the capital. It benefits from availability of land and renewable energy integration. The Philippines Data Center Market shows rising traction in Luzon as operators diversify operations.

- For instance, Bee Information Technology PH officially launched its HIVE Hybrid Data Center on March 18, 2025 with over 3,600 racks built to Tier 3+ standards in Laguna, and it incorporates green design features including LEED certification and energy-efficient infrastructure.

Visayas and Mindanao Showing Gradual Development

Visayas and Mindanao together hold nearly 15% share, reflecting slower but steady growth. These regions gain attention with initiatives to bridge digital divides. Telecom and enterprise expansion fuels demand for smaller modular facilities. Improved submarine cable projects strengthen regional connectivity. The Philippines Data Center Market identifies Visayas and Mindanao as long-term growth areas. It ensures more balanced national coverage and equitable access to infrastructure.

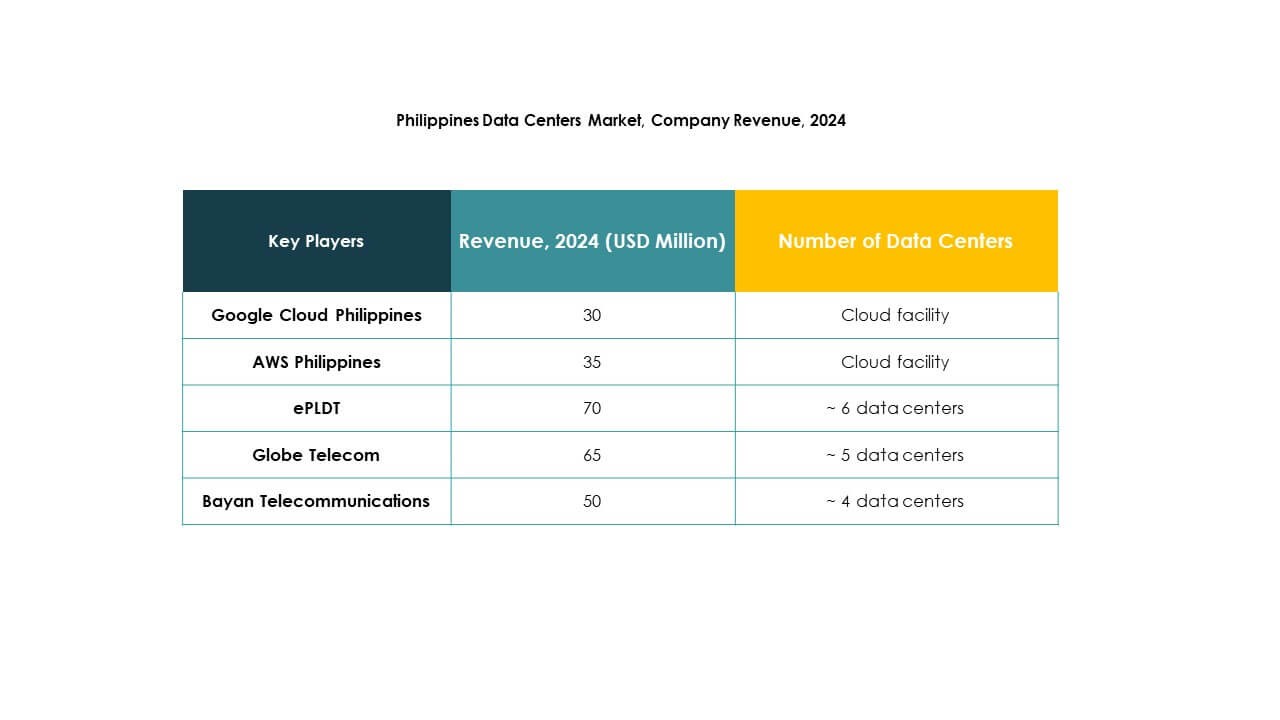

Competitive Insights:

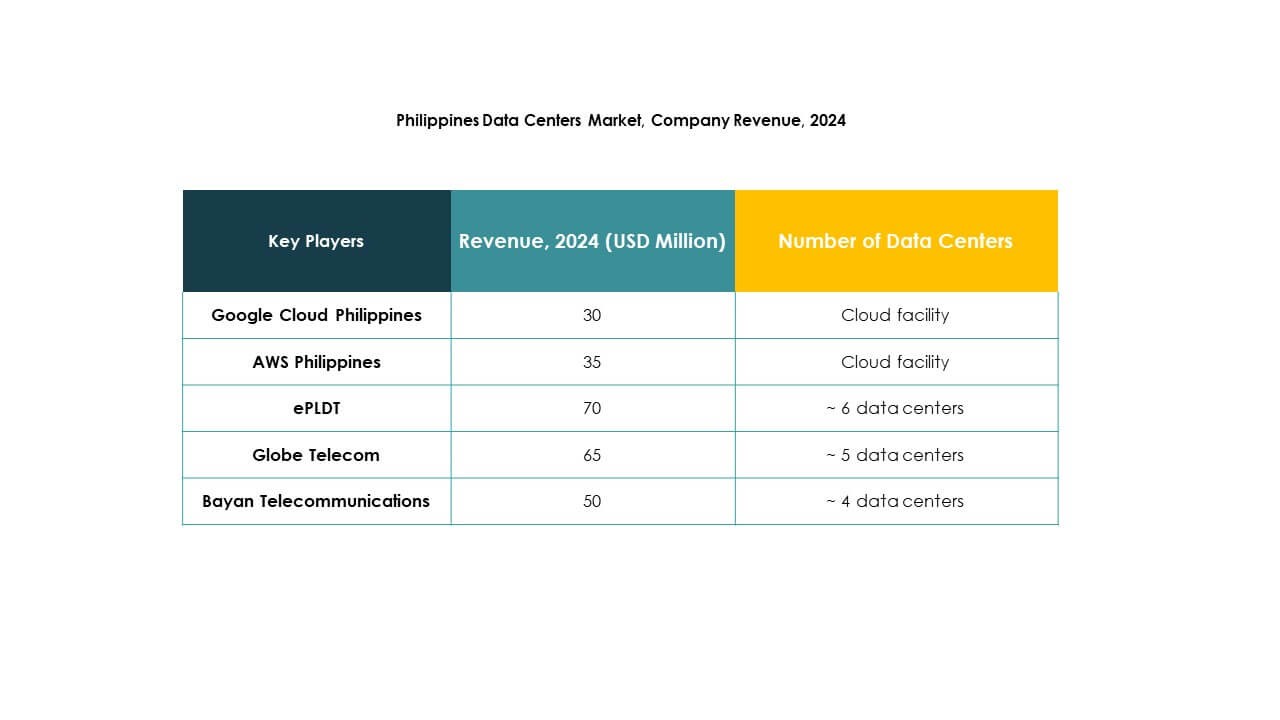

- ePLDT

- Globe Telecom

- Bayan Telecommunications

- Converge ICT

- Cellsite Network Services

- NTT Communications Corporation

- Digital Realty Trust, Inc.

- Microsoft Corporation

- AWS Philippines (Amazon Web Services)

- Google Cloud Philippines

The competitive landscape of the Philippines Data Center Market reflects a balance between established telecom operators, global hyperscale providers, and international colocation specialists. ePLDT and Globe Telecom strengthen their dominance through extensive local infrastructure and enterprise partnerships. Converge ICT and Bayan Telecommunications expand capacity to meet growing digital demand. Global firms like AWS, Microsoft, and Google Cloud enhance competition by offering hyperscale facilities and advanced cloud services. NTT Communications and Digital Realty diversify the market with global best practices and premium colocation offerings. It continues to attract strong investment due to rapid digital adoption, making competition more dynamic and innovation-driven.

Recent Developments:

- In October 2025, Alibaba Cloud is scheduled to launch its second data center in the Philippines, expanding its cloud and digital services presence and responding to the country’s surging demand for advanced digital infrastructure and scalable cloud solutions.

- In August 2025, NTT DATA and Google Cloud entered a global partnership focusing on industry-specific agentic AI and cloud modernization for enterprises, including dedicated efforts for Southeast Asia and the Philippines.

- In June 2025, Equinix completed the acquisition of three major data centers in Manila from Total Information Management Corporation, strengthening its footprint in the Philippines’ digital infrastructure sector and providing enhanced connectivity options for businesses and AI innovation within the country.