Executive summary:

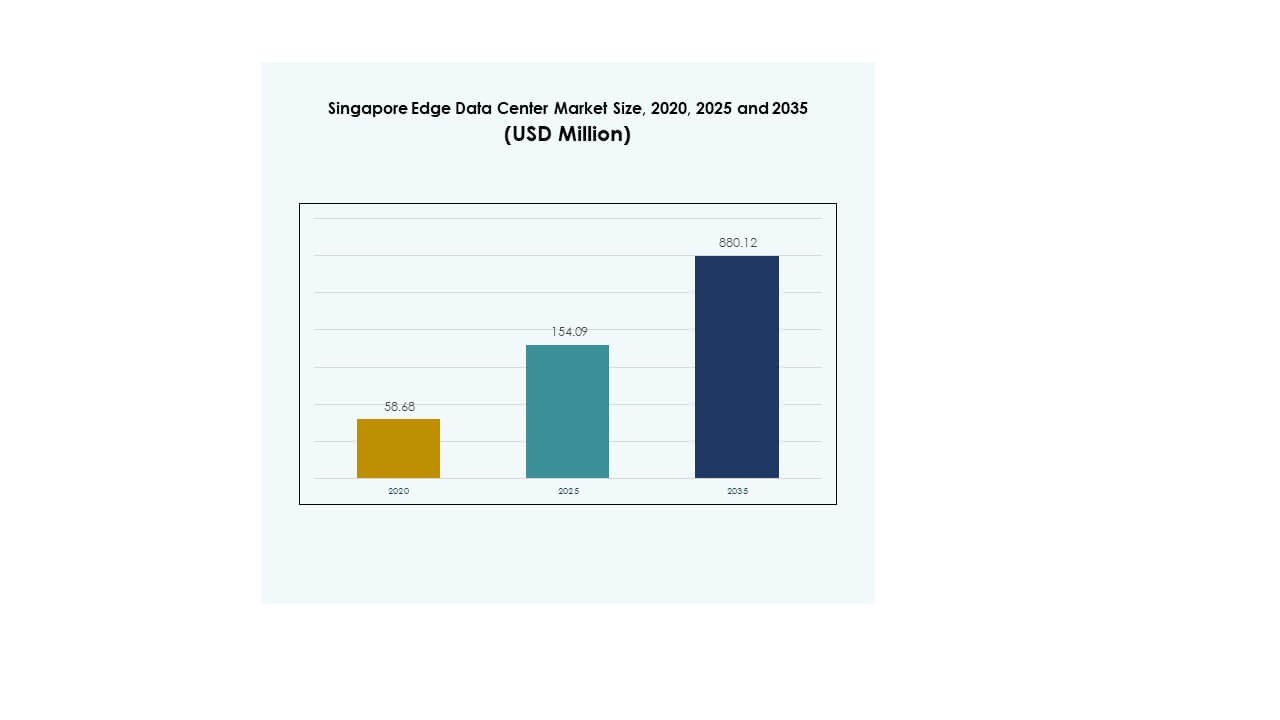

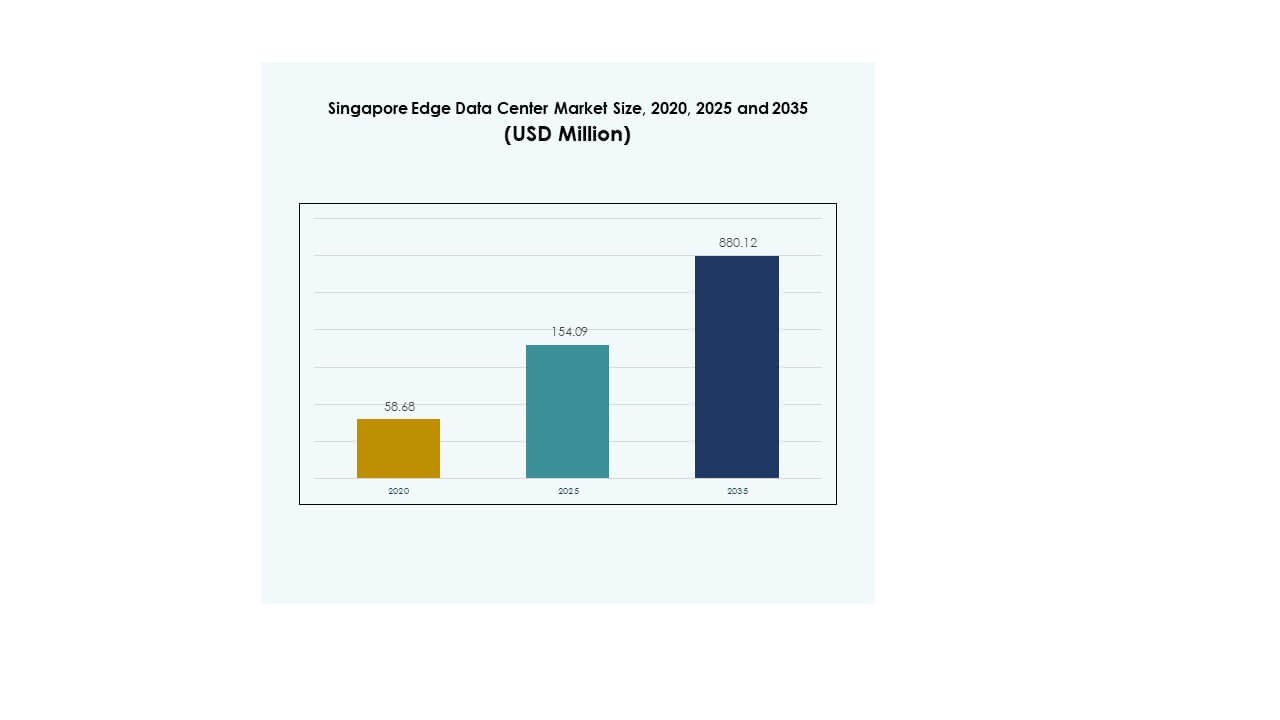

The Singapore Edge Data Center Market size was valued at USD 58.68 million in 2020 to USD 154.09 million in 2025 and is anticipated to reach USD 880.12 million by 2035, at a CAGR of 18.86% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Singapore Edge Data Center Market Size 2025 |

USD 154.09 Million |

| Singapore Edge Data Center Market, CAGR |

18.86% |

| Singapore Edge Data Center Market Size 2035 |

USD 880.12 Million |

Growing demand for low-latency networks, rising AI and IoT adoption, and rapid digital transformation are accelerating infrastructure development. Advanced edge facilities help businesses process data closer to the source, improving efficiency and service reliability. Strong government support, robust connectivity, and innovation-driven investments make the market strategically important for technology providers and investors seeking stable, high-growth opportunities.

Central Singapore leads the market with strong connectivity, advanced fiber networks, and proximity to key business hubs. West Singapore is expanding with industrial clusters and scalable edge deployments, while East Singapore is strengthening its role in global connectivity through strategic access to cable landing stations. This subregional distribution supports balanced infrastructure growth and strong market positioning.

Market Drivers

Accelerating Digital Transformation Across Industries and Strengthening Strategic Infrastructure

Rapid adoption of digital technologies is reshaping industries. Businesses in manufacturing, finance, healthcare, and retail are shifting operations toward real-time data processing. The Singapore Edge Data Center Market supports this change by enabling fast data exchange closer to end users. It enhances operational reliability for critical applications. Enterprises view this infrastructure as a key element for scaling their digital strategies. Strategic positioning near business hubs increases network efficiency. Strong government policies support infrastructure expansion and innovation. This growing demand signals long-term stability for investors.

Rising AI and IoT Integration Driving Edge Infrastructure Expansion

AI and IoT integration across enterprises is creating strong demand for localized computing power. Real-time data processing improves decision-making speed. It also reduces latency for mission-critical applications. Businesses rely on low-latency networks to support advanced services like predictive maintenance and autonomous operations. Edge facilities improve performance by reducing data transfer distance. This strengthens competitiveness and operational efficiency. AI-driven automation also attracts new investment streams. This wave of integration positions the region as a key innovation hub.

- For instance, in March 2025, ST Telemedia Global Data Centres (STT GDC) Singapore 6 became the first facility in Singapore certified under the NVIDIA DGX-Ready Data Center program, ensuring enterprise-grade facilities equipped for high-density AI workloads and the latest GPU technologies.

Growing Cloud and Hybrid Deployments Boosting Network Optimization

Cloud adoption continues to reshape enterprise infrastructure models. Many companies now favor hybrid models that combine cloud and edge computing. This strategy improves control, flexibility, and speed. The Singapore Edge Data Center Market provides the connectivity backbone needed to support this shift. It enables businesses to deploy scalable solutions with lower latency. Demand for high-speed connectivity is rising among large enterprises. Investments in hybrid networks strengthen resilience and reliability. These deployments drive both innovation and long-term revenue growth.

Strong Government Support and Strategic Location Encouraging Investment

Government-backed digital initiatives are improving infrastructure quality and market accessibility. Strategic geographic location makes the country a preferred connectivity hub in Asia-Pacific. It attracts foreign investment in edge facilities. Clear regulatory frameworks reduce operational uncertainty for investors. Government programs focus on sustainable technology and data security. Edge deployments help optimize urban infrastructure and smart city development. The presence of a mature digital ecosystem supports rapid scaling. This strong foundation increases investor confidence and market expansion potential.

- For instance, Singapore’s Infocomm Media Development Authority (IMDA) launched the Green Data Centre Roadmap in May 2024, committing at least 300 megawatts of additional sustainable data center capacity, targeting advanced energy-efficiency benchmarks and enabling further growth through green energy utilization.

Market Trends

Rising Adoption of Containerized and Modular Edge Infrastructure

Modular edge deployments are gaining traction among enterprises. These solutions offer flexible capacity expansion and cost efficiency. The Singapore Edge Data Center Market benefits from growing demand for scalable and relocatable facilities. It allows companies to deploy infrastructure quickly in high-demand areas. Containerized designs improve energy efficiency and reduce construction time. This supports dynamic scaling for enterprise workloads. The trend aligns with strategic moves toward flexible network architectures. It positions the region as a leader in infrastructure innovation.

Focus on Renewable Energy and Energy-Efficient Edge Deployments

Sustainability has become a key operational priority. Data centers are shifting toward renewable energy integration and energy-efficient designs. It reduces operational costs and improves compliance with environmental standards. The push for carbon-neutral operations is influencing design strategies. Operators invest in energy storage and advanced cooling solutions. Green certifications strengthen brand credibility. Demand for sustainable data center operations is increasing among global enterprises. This environmental focus shapes investment patterns and technology selection.

Expansion of Edge Connectivity Supporting 5G Rollouts

Edge infrastructure is aligning with rapid 5G expansion. Low-latency connectivity supports advanced applications like AR, VR, and autonomous systems. It enables faster service delivery and enhanced user experiences. The Singapore Edge Data Center Market benefits from early 5G adoption in key sectors. Integration with telecom networks improves coverage efficiency. Businesses leverage this network strength for innovation. Strong connectivity infrastructure makes the region attractive to technology developers. This creates opportunities for new service models.

Increased Deployment of AI-Driven Automation for Operational Efficiency

Automation is becoming central to operational strategies. AI tools optimize energy use, workload management, and predictive maintenance. It helps operators improve uptime and reduce resource waste. Intelligent monitoring allows faster response to system anomalies. Edge facilities integrate AI to ensure seamless operations. This shift enhances cost control and service reliability. Strong automation capabilities attract tech-driven enterprises. The trend reinforces the country’s position as a regional technology hub.

Market Challenges

Rising Energy Demand and Infrastructure Constraints Creating Capacity Pressure

High power consumption remains a core challenge for operators. Energy-intensive workloads increase strain on the national grid. The Singapore Edge Data Center Market faces limitations in available land and energy capacity. It restricts large-scale expansion in high-demand zones. Operators must optimize existing facilities for higher efficiency. Rising energy costs add pressure on profitability. Infrastructure upgrades require significant capital. This challenge is pushing companies to rethink deployment strategies. Efficient energy management is becoming a competitive necessity.

Regulatory Complexity and Cybersecurity Risks Affecting Market Expansion

Strict compliance requirements increase operational complexity. Cybersecurity concerns continue to rise with growing data traffic. It raises the need for advanced threat monitoring and protection systems. Regulatory differences between regions complicate cross-border expansion plans. The Singapore Edge Data Center Market must align with international security standards. High investment in security technologies impacts cost structures. Companies face reputational risks from potential breaches. Addressing these issues requires continuous innovation in cybersecurity architecture.

Market Opportunities

Rising Demand for AI and Cloud Edge Solutions Creating Strong Investment Potential

Enterprise reliance on AI and cloud services is rising steadily. Businesses seek localized processing power for better performance. The Singapore Edge Data Center Market offers an ideal environment for new deployments. Strategic location supports global and regional connectivity. This attracts technology firms and investors. Edge computing also enables new digital services and platforms. Investors find long-term growth opportunities in this segment. This growing demand will accelerate infrastructure development.

Strategic Partnerships and Ecosystem Integration Driving Service Innovation

Collaboration between cloud providers, telecom companies, and enterprises is expanding. It improves service delivery speed and coverage. Strategic alliances enable shared infrastructure and reduced operational costs. The Singapore Edge Data Center Market gains strength from these partnerships. Integration with cloud platforms supports seamless scaling. Partnerships also enhance security, automation, and service reliability. This ecosystem approach creates opportunities for diversified services. It builds a competitive and resilient digital infrastructure base.

Market Segmentation

By Component

Solution dominates the segment with strong demand for network optimization and storage systems. Enterprises seek high-speed data transfer, strong security, and automation capabilities. The Singapore Edge Data Center Market benefits from scalable solutions that support AI-driven workloads. Service offerings are growing as companies demand management, monitoring, and integration support. Solution-based deployments attract large investments from cloud providers and telecom firms. This dominance is supported by demand for flexibility and performance. High scalability ensures long-term infrastructure value.

By Data Center Type

Colocation edge data centers hold the largest market share. These facilities offer cost savings, low latency, and strategic connectivity. The Singapore Edge Data Center Market relies on this model to meet enterprise demand. Enterprises prefer shared facilities to reduce capital expenses. Managed and cloud-edge facilities follow closely, supporting hybrid deployments. Strong network infrastructure makes colocation the preferred option. Its flexible design supports evolving business needs. This segment continues to attract global players expanding their regional footprint.

By Deployment Model

Hybrid deployments lead the segment with their operational flexibility. Many enterprises combine on-premises and cloud resources for better control. The Singapore Edge Data Center Market thrives on hybrid models for scalable operations. It improves performance and reduces network congestion. Cloud-based solutions support rapid service delivery. On-premises remains relevant for security-sensitive industries. Hybrid networks deliver optimal balance between cost and performance. This dominance is expected to continue as digital operations grow.

By Enterprise Size

Large enterprises dominate this segment with higher investment capacity. They deploy advanced edge solutions to manage complex workloads. The Singapore Edge Data Center Market supports these large-scale deployments effectively. SMEs are growing rapidly as edge computing becomes more affordable. Large firms lead in adoption due to their strong digital infrastructure. They also drive innovation in deployment strategies. SMEs leverage managed services for cost-effective integration. Both segments contribute to growing ecosystem diversity.

By Application / Use Case

Power monitoring leads the segment due to rising energy optimization needs. Enterprises focus on controlling energy use to reduce costs and increase efficiency. The Singapore Edge Data Center Market integrates smart monitoring to support sustainability goals. Capacity management and asset management follow closely. Real-time analytics improves resource allocation. Environmental monitoring gains importance with stricter sustainability regulations. Advanced use cases improve operational control. Strong analytics capabilities strengthen market competitiveness.

By End User Industry

IT and telecommunications dominate this segment with major infrastructure investments. Enterprises rely on edge facilities for real-time data processing. The Singapore Edge Data Center Market benefits from this sector’s high connectivity requirements. BFSI and retail sectors follow with increasing digital transactions. Healthcare and defense sectors integrate edge computing for secure operations. Energy and utilities adopt edge for grid optimization. Strong demand from IT and telecom ensures stable growth momentum. This segment drives the core digital ecosystem.

Regional Insights

Central Singapore Leading with Strong Infrastructure Backbone

Central Singapore holds a 54% market share, driven by a concentration of data hubs, financial institutions, and enterprise headquarters. The Singapore Edge Data Center Market benefits from advanced fiber networks, reliable power supply, and strong regulatory frameworks in this subregion. It serves as the core location for hyperscale and colocation deployments due to its proximity to key business districts. Centralized infrastructure supports high-density workloads with minimal latency. Government-backed digital initiatives further strengthen operational resilience. Strong demand from IT, BFSI, and telecom sectors ensures sustained capacity expansion.

- For instance, ST Telemedia Global Data Centres’ Defu Campus (Defu 1, 2, and 3) in northeast Singapore reached its full IT load capacity of 40 MW in August 2022, according to official company announcements and industry reporting. The facility achieved a 25% capacity increase compared to its original planning parameters. It directly supports mission-critical sectors, including financial services and major cloud providers. The campus plays a central role in Singapore’s digital infrastructure ecosystem, offering high-density workloads and strong interconnection capabilities.

West Singapore Expanding with Industrial and Technology Clusters

West Singapore accounts for a 28% market share, supported by large industrial zones and technology parks. It provides strategic space for scalable edge deployments and modular facilities. The subregion’s industrial base drives high power and connectivity requirements. It is witnessing steady investment in sustainable and energy-efficient infrastructure. Proximity to logistics and manufacturing clusters supports edge computing for real-time operations. Investors view this subregion as a cost-effective alternative to central hubs. Strong network coverage enhances its role in supporting enterprise applications and critical infrastructure.

East Singapore Strengthening Connectivity and Strategic Access

East Singapore represents an 18% market share, supported by its strong connectivity to cable landing stations and transport infrastructure. It plays a critical role in supporting international data flows and network routing. The Singapore Edge Data Center Market leverages this subregion’s geographic advantage for low-latency connections to global networks. Edge facilities here focus on optimizing network performance and supporting high-bandwidth applications. Strategic access to undersea cables strengthens its role as a regional gateway. Targeted infrastructure development attracts telecom operators, cloud service providers, and enterprise clients. This growing connectivity hub supports balanced market expansion across the island.

- For instance, Keppel DC Singapore 5 (SGP 5), located in Jurong, is the official cable landing site for the Bifrost subsea cable system, which directly links Singapore to the U.S. West Coast via Indonesia, as verified by Keppel’s regulatory and development announcements. The facility boasts a gross floor area of 208,096 square feet, has received the BCA-IMDA Green Mark Award (Platinum) for sustainability, and is certified to ANSI/TIA-942-B:2017 Rated-3 for operational resilience.

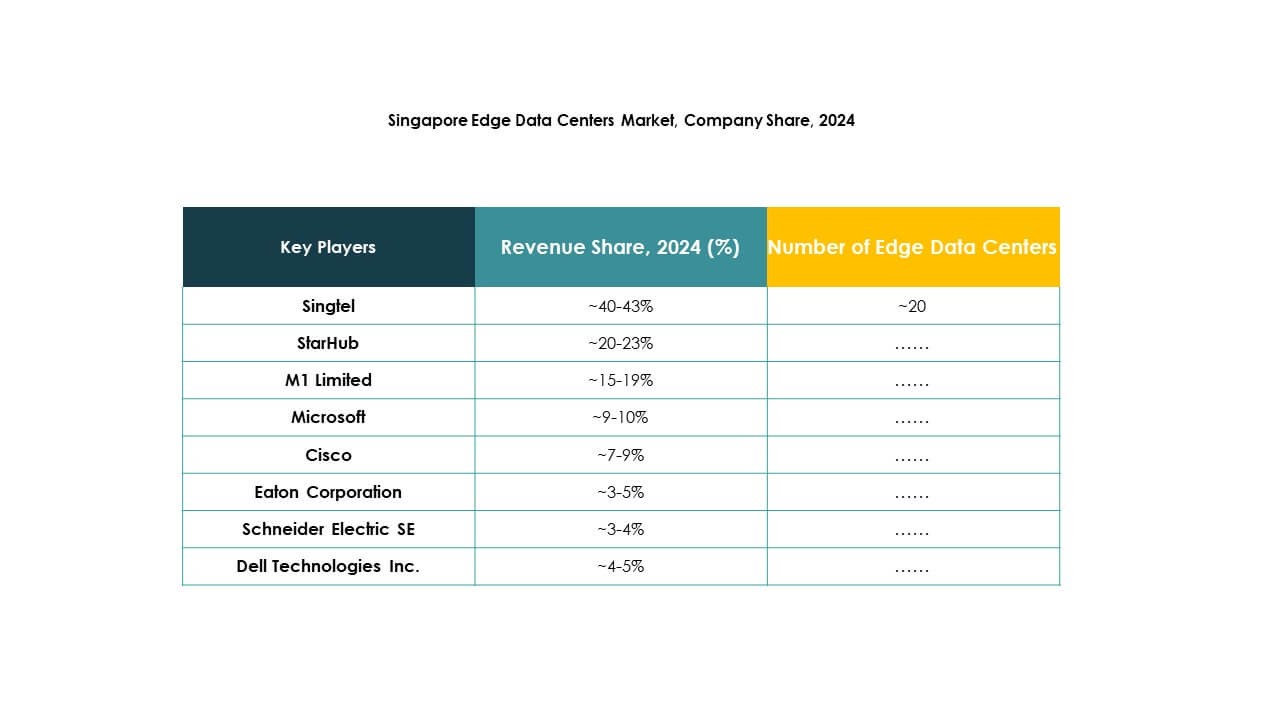

Competitive Insights:

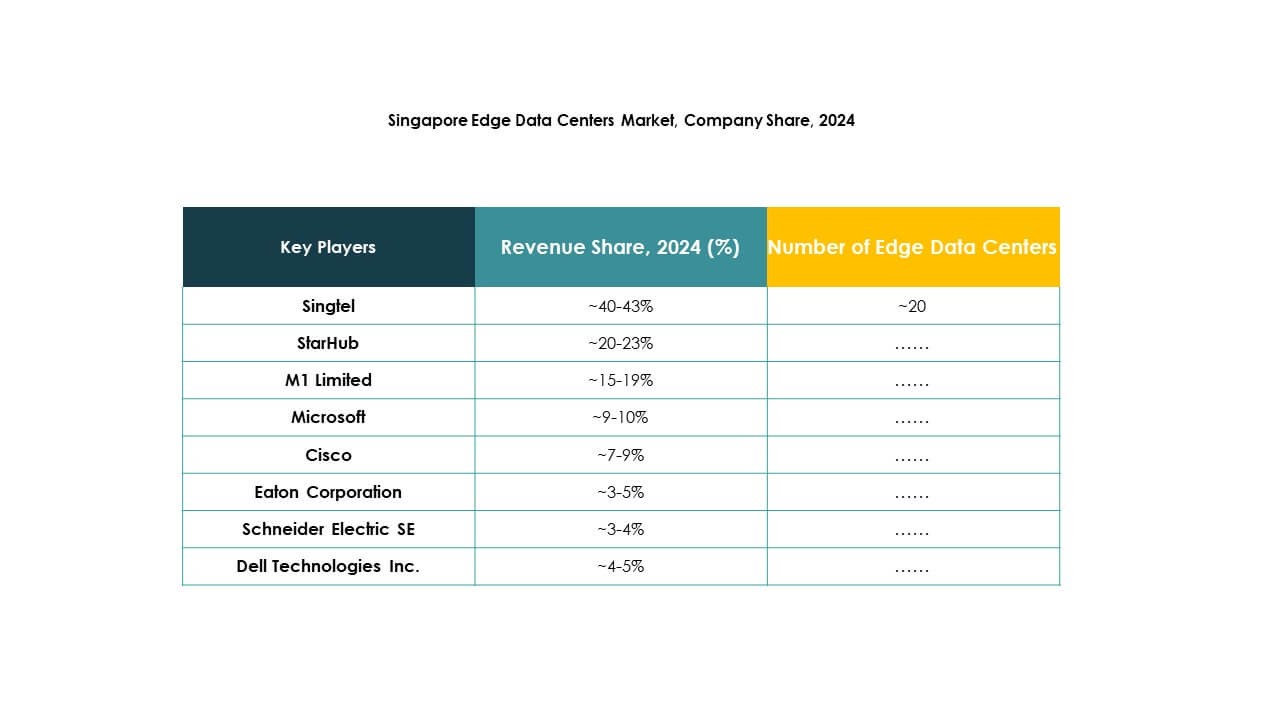

- Singtel

- StarHub

- M1 Limited

- MyRepublic

- ViewQwest

- Fujitsu

- Cisco

- Eaton Corporation

- Dell Technologies Inc.

- Microsoft

- VMWare

- Schneider Electric SE

- Rittal GmbH & Co. Kg

The competitive landscape of the Singapore Edge Data Center Market is shaped by strong infrastructure providers, telecom operators, and technology vendors. It is driven by innovation in connectivity, energy efficiency, and hybrid edge-cloud solutions. Leading players focus on expanding edge capabilities to support AI, IoT, and low-latency applications. Telecom operators strengthen network reach through partnerships with cloud service providers. Technology companies invest in modular and energy-efficient architectures to enhance scalability. Strategic alliances and joint ventures remain central to growth strategies. Continuous investment in automation, security, and renewable energy integration improves operational performance. This dynamic environment fosters rapid market evolution and intensified competition.

Recent Developments:

- In October 2025, LG Electronics, working alongside LG CNS and LG Energy Solution, unveiled its comprehensive “One LG Solution” portfolio at Data Center World Asia 2025 in Singapore. This launch marks LG’s initiative to provide integrated solutions focused on cooling, energy, and data center operations, specifically catering to next-generation AI-powered facilities.

- In October 2025, Johnson Controls introduced the Silent-Aire Coolant Distribution Unit platform at Data Centre World Asia in Singapore. This scalable solution is designed for high-density edge data centers, offering cooling capacities from 500kW to over 10MW. The CDU’s flexible design and built-in redundancy make it especially suited for Singapore’s space-constrained urban environment, supporting rapid deployment and optimized uptime for next-generation data center operations.

- In September 2025, StarHub formed a key partnership with Vectra AI to launch an advanced AI-driven threat detection platform, enhancing its cybersecurity offerings for Singapore’s enterprise data centers. This move reflects StarHub’s strategic response to growing cyber threats and its integration of sophisticated AI-driven monitoring and response capabilities.

- In August 2025, MyRepublic finalized the sale of its broadband business to StarHub, with StarHub now holding 100% ownership. This consolidation strengthens MyRepublic’s focus on digital transformation and specialized connectivity solutions, while StarHub assumes control over broadband operations.