Executive summary:

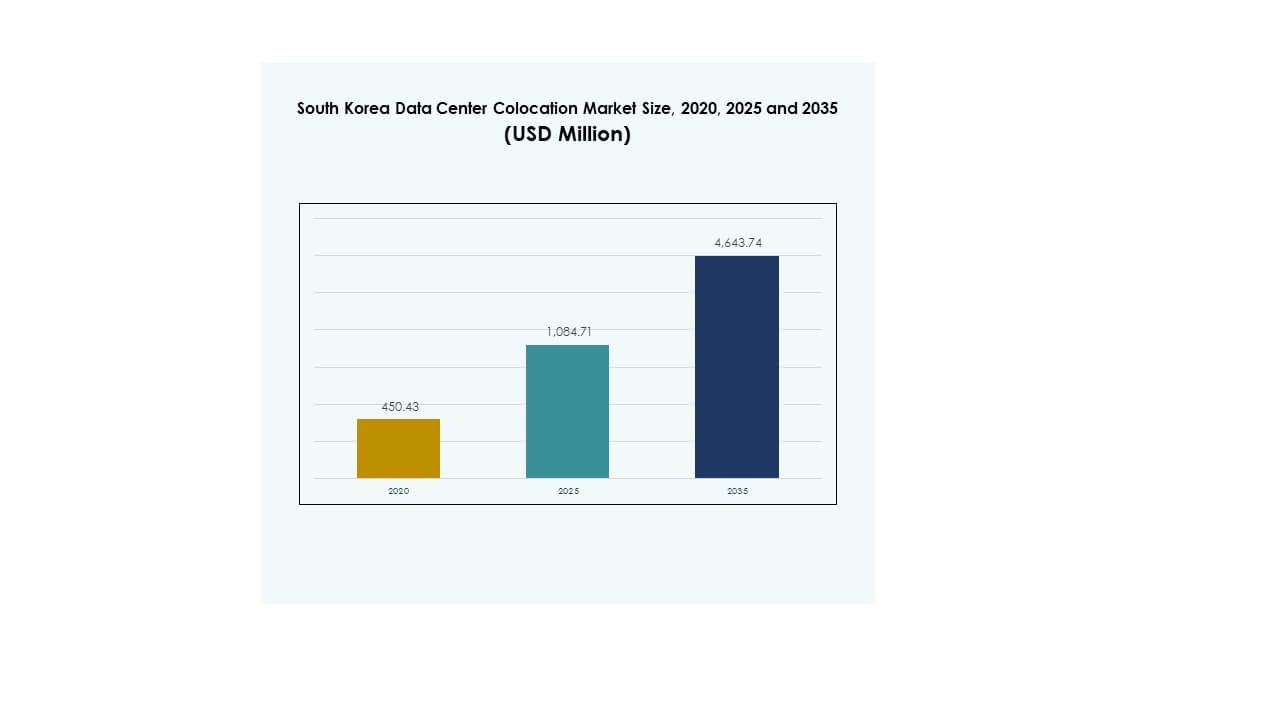

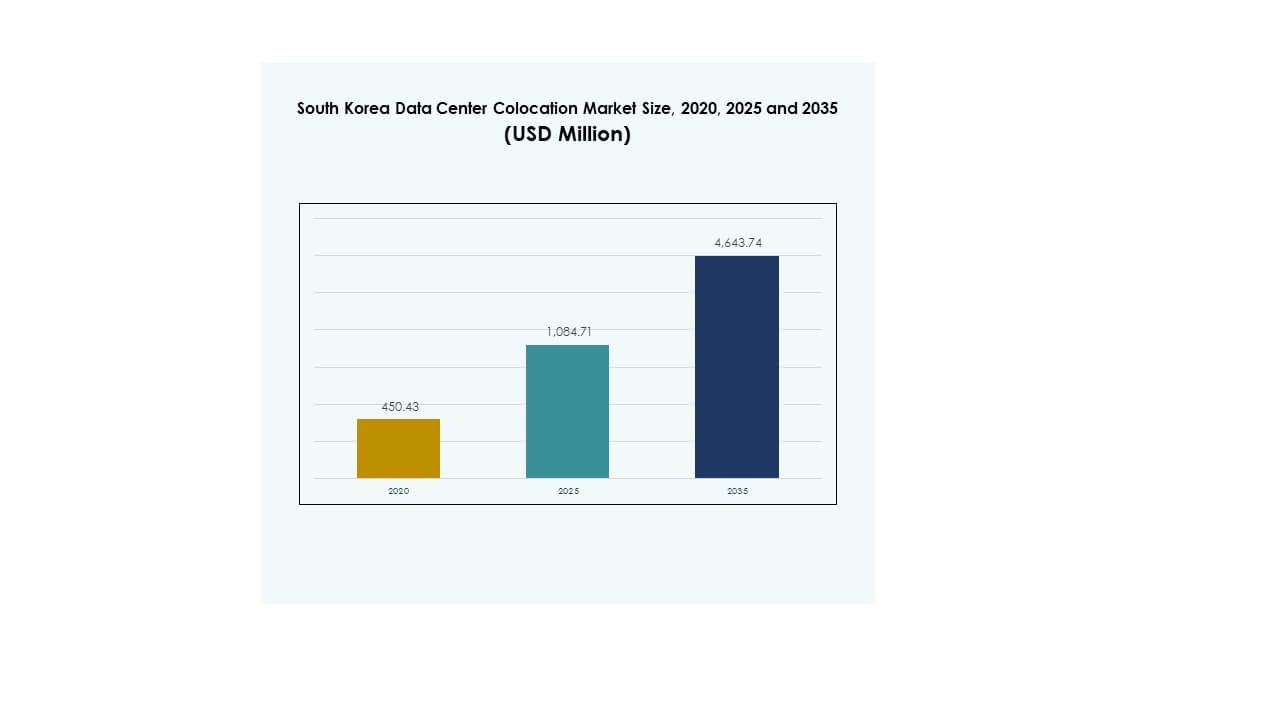

The South Korea Data Center Colocation Market size was valued at USD 450.43 million in 2020 to USD 1,084.71 million in 2025 and is anticipated to reach USD 4,643.74 million by 2035, at a CAGR of 15.56% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| South Korea Data Center Colocation Market Size 2025 |

USD 1,084.71 Million |

| South Korea Data Center Colocation Market, CAGR |

15.56% |

| South Korea Data Center Colocation Market Size 2035 |

USD 4,643.74 Million |

Rising digital transformation across industries, AI adoption, and rapid cloud expansion are driving strong demand for colocation infrastructure. Enterprises are shifting to hybrid and multi-cloud strategies, creating new capacity requirements. Advanced cooling, edge deployments, and AI-optimized facilities highlight a wave of infrastructure modernization. The market holds strategic importance for investors seeking stable, long-term growth through high-density and hyperscale projects that support regulated and commercial workloads.

Seoul leads with the largest share, supported by strong connectivity and hyperscale presence. Gyeonggi and Incheon are emerging as major secondary hubs due to available land and infrastructure expansion. Southern and eastern regions show growing interest from operators focused on edge and sustainable builds. This geographic diversification strengthens network resilience and improves coverage across the nation.

Market Drivers

Rising Digital Transformation and Rapid Cloud Adoption Across Core Industries

The South Korea Data Center Colocation Market benefits from rapid digital transformation across finance, manufacturing, and e-commerce sectors. Strong cloud migration strategies among enterprises push demand for scalable colocation services. Companies adopt hybrid and multi-cloud architectures to reduce latency and enhance service delivery. AI workloads, 5G applications, and edge computing create further capacity needs. Strong local connectivity infrastructure accelerates deployments across Seoul and other key hubs. Investors view the sector as a long-term digital infrastructure asset. It strengthens strategic resilience for businesses expanding digital operations. Strong adoption reinforces South Korea’s position as a leading data hub.

- For instance, in June 2025, SK Group and Amazon Web Services (AWS) announced a ₩7 trillion (US $5.1 billion) investment to build a 100 MW AI data center in Ulsan. The project will feature 60,000 GPUs and is scheduled to begin operations in 2027, marking the largest single data center investment in South Korea.

Strong Expansion of Hyperscale and Enterprise Demand for High-Density Deployments

Hyperscale operators and domestic enterprises are fueling new investments in next-generation facilities. High-density racks, advanced cooling, and low-latency interconnections drive design preferences. Demand for wholesale capacity increases as digital service providers expand core operations. The South Korea Data Center Colocation Market aligns with evolving hyperscale strategies to meet growing storage and compute needs. It also supports critical workloads for AI training and large-scale analytics. Investors see stable returns driven by long-term leasing models. Strong regional connectivity supports faster adoption of cloud-native services. This shift drives sustained demand for carrier-neutral colocation spaces.

- For instance, in November 2023, Naver Corporation inaugurated its GAK Sejong data center in Sejong, covering 294,000 m² with capacity for 600,000 servers and 65 exabytes of storage. The facility is powered by 270 MW and supports advanced cloud and AI workloads through the Naver Cloud platform.

Government Digital Policies and Strategic Infrastructure Investments

Government-led digital infrastructure programs and energy policy reforms support data center growth. Public initiatives encourage the deployment of green energy and sustainable cooling solutions. National digital transformation strategies strengthen data sovereignty and security priorities. The South Korea Data Center Colocation Market gains from clear regulatory frameworks that improve investor confidence. It creates predictable conditions for operators expanding large facilities. Energy-efficient systems align with government decarbonization targets. Public-private partnerships accelerate construction of critical facilities across multiple regions. Clear policy direction enhances long-term planning for operators and investors.

Enterprise Security Demands and Edge Network Evolution

Enterprise customers prioritize security, uptime, and compliance in colocation strategies. Rising cyber threats increase the demand for physically secure and resilient facilities. The South Korea Data Center Colocation Market supports strict compliance needs for regulated industries. Low-latency edge architectures reduce performance bottlenecks for real-time applications. Interconnection services create competitive advantages for both providers and tenants. Strong partnerships between carriers and data center operators improve service quality. Enterprises integrate colocation to meet rapid application growth. This shift enhances operational flexibility while strengthening network performance at the edge.

Market Trends

Shift Toward High-Density and Liquid Cooling Infrastructure for AI Workloads

AI and machine learning workloads drive the need for advanced facility designs. High-density rack deployments are becoming a standard among hyperscale tenants. Advanced cooling solutions such as direct-to-chip and liquid cooling enable higher power usage efficiency. The South Korea Data Center Colocation Market is adopting advanced cooling infrastructure to support power-intensive AI models. Operators redesign existing halls to handle heat-intensive equipment efficiently. These shifts create more sustainable energy usage patterns across sites. Cooling efficiency becomes a key differentiator in competitive service offerings. This transition aligns with global data infrastructure modernization trends.

Accelerated Development of Edge Zones to Support Low-Latency Applications

The increasing role of edge computing influences data center design and location strategy. Distributed mini data centers support applications requiring low latency, such as autonomous mobility and smart manufacturing. The South Korea Data Center Colocation Market shows a growing trend toward edge infrastructure deployment outside traditional hubs. Secondary cities host modular facilities to meet rising digital service demand. Telecom carriers expand edge networks to strengthen service coverage. Enterprises favor local edge nodes to minimize response times. New edge architectures complement hyperscale cores and create hybrid topologies. This change accelerates new service development across industries.

Rapid Integration of Renewable Energy and Green Data Center Operations

Sustainability targets reshape power sourcing strategies for operators. Companies prioritize renewable power purchase agreements to meet carbon reduction goals. The South Korea Data Center Colocation Market embraces sustainable design standards for both existing and new facilities. Operators adopt advanced energy monitoring systems to optimize consumption. Certification schemes such as LEED and ISO strengthen sustainability credibility. Efficient energy usage lowers operational costs while supporting ESG commitments. Investors favor green-certified facilities for long-term returns. Renewable energy integration enhances both environmental and financial performance.

Expansion of Carrier-Neutral Interconnection Ecosystems

Interconnection plays a vital role in creating flexible data center environments. Carrier-neutral campuses enable enterprises to connect with multiple network service providers. The South Korea Data Center Colocation Market experiences rising demand for rich interconnection capabilities. These ecosystems improve latency, redundancy, and service flexibility. Strong peering agreements strengthen international connectivity. Enterprises favor multi-carrier strategies to enhance resilience. Operators expand network fabrics to support emerging technologies. This trend enhances market competitiveness and improves service scalability.

Market Challenges

High Energy Consumption and Power Supply Constraints for Large Facilities

Power availability remains a critical challenge in the South Korea Data Center Colocation Market. High-density AI and cloud deployments require stable power delivery across multiple locations. Electricity grid constraints create capacity planning challenges for large operators. Energy pricing fluctuations increase operational costs and impact profitability. Advanced cooling systems demand further optimization to balance energy efficiency. Delays in renewable energy integration slow progress toward sustainability targets. Urban power limitations restrict site selection for future builds. These factors pressure operators to rethink energy strategies while maintaining competitive service levels.

Regulatory Complexities and Rising Environmental Compliance Requirements

Complex environmental regulations add operational and financial challenges for new developments. The South Korea Data Center Colocation Market faces strict approval processes tied to carbon reporting and energy usage. Environmental impact assessments extend construction timelines in urban zones. Growing pressure to meet zero-emission goals intensifies investment planning. Operators need advanced compliance frameworks to address evolving environmental laws. Unclear zoning rules in some regions create permitting delays. Regulatory unpredictability increases project risks for international investors. These issues slow expansion plans and demand stronger government-industry coordination.

Market Opportunities

Rising Demand for AI Infrastructure and Cross-Border Digital Services

The South Korea Data Center Colocation Market offers strong opportunities in AI-driven infrastructure development. Growing adoption of AI workloads creates demand for high-density rack space and specialized interconnections. Strong cross-border connectivity supports international service delivery. Operators can leverage this advantage to attract global hyperscale customers. Expansion of submarine cable routes enhances inter-regional traffic flows. Investors can tap stable returns from AI infrastructure-focused colocation projects. This opportunity strengthens the nation’s strategic role in regional digital trade.

Growth of Green Data Centers and Energy-Efficient Design Models

Sustainability investments present significant growth opportunities for colocation providers. The South Korea Data Center Colocation Market benefits from demand for facilities powered by renewable energy. Energy-efficient infrastructure supports enterprise ESG commitments and government targets. Green facilities enhance competitiveness in tenant selection processes. Operators adopting carbon reduction technologies gain an early-mover advantage. These opportunities align with the shift toward responsible digital infrastructure. Sustainable builds strengthen investor confidence and long-term asset value.

Market Segmentation

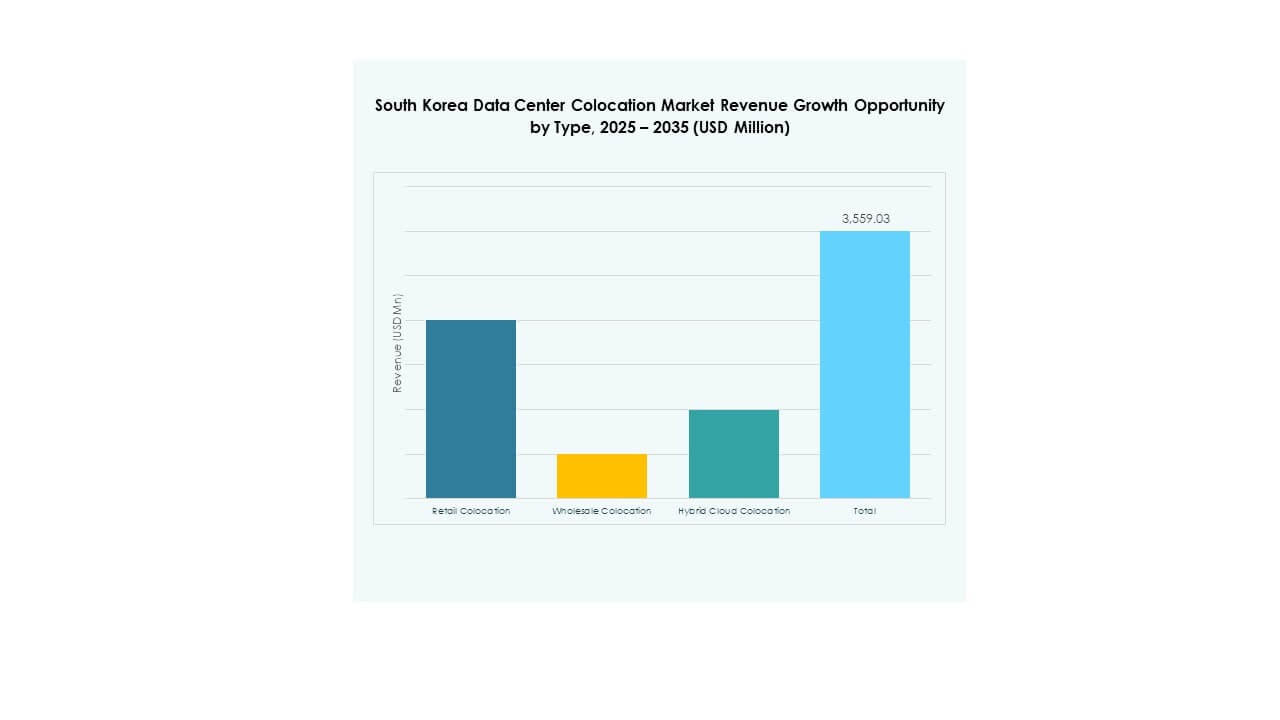

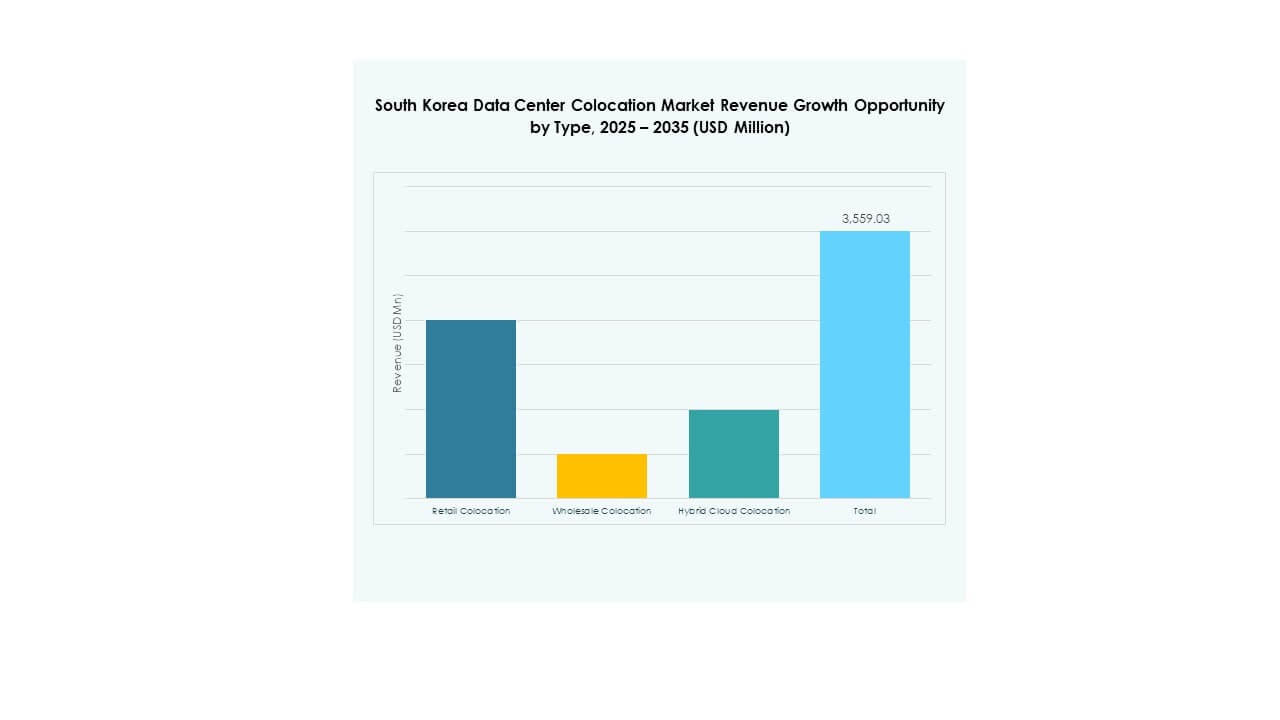

By Type

Retail colocation dominates the South Korea Data Center Colocation Market due to flexible capacity and easy scalability. It supports a broad base of enterprises seeking lower upfront costs. Wholesale colocation also grows strongly, driven by hyperscale and cloud service providers. Hybrid cloud colocation adoption increases as enterprises blend on-premise control with public cloud flexibility. Retail maintains the largest share due to its broad accessibility and fast deployment cycles. This segment remains the preferred option for cost-sensitive businesses and mid-tier IT workloads.

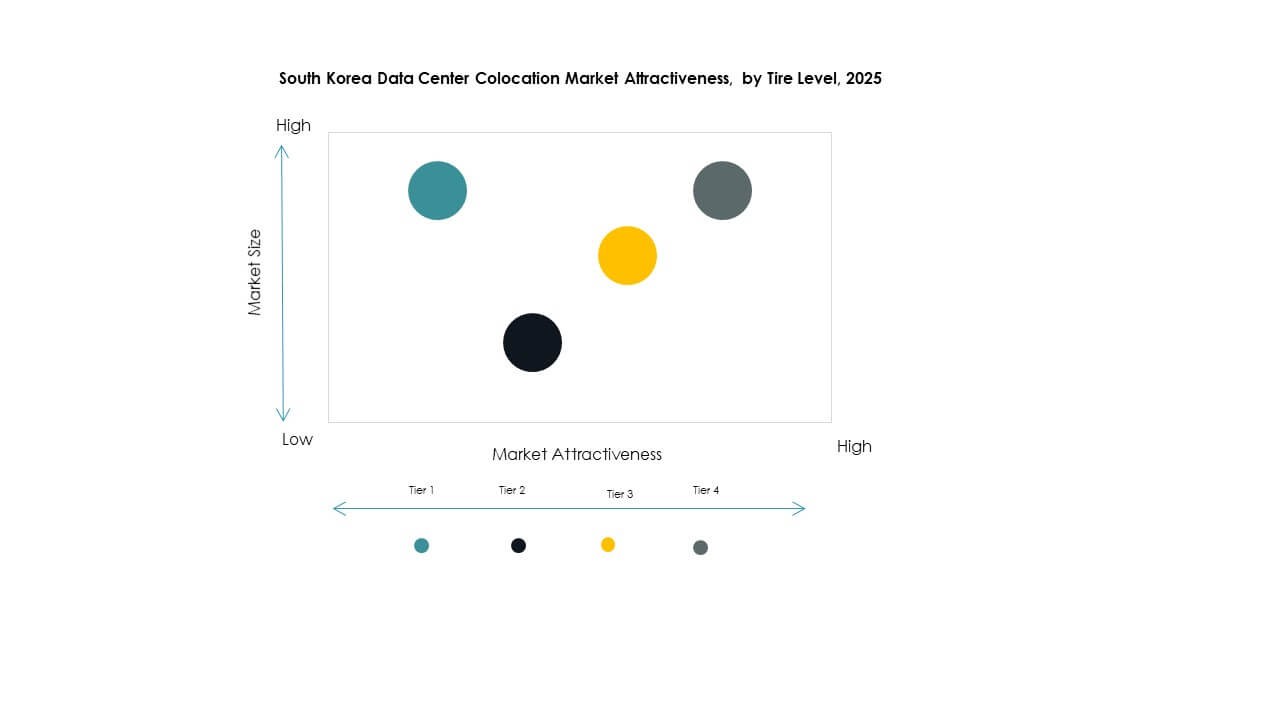

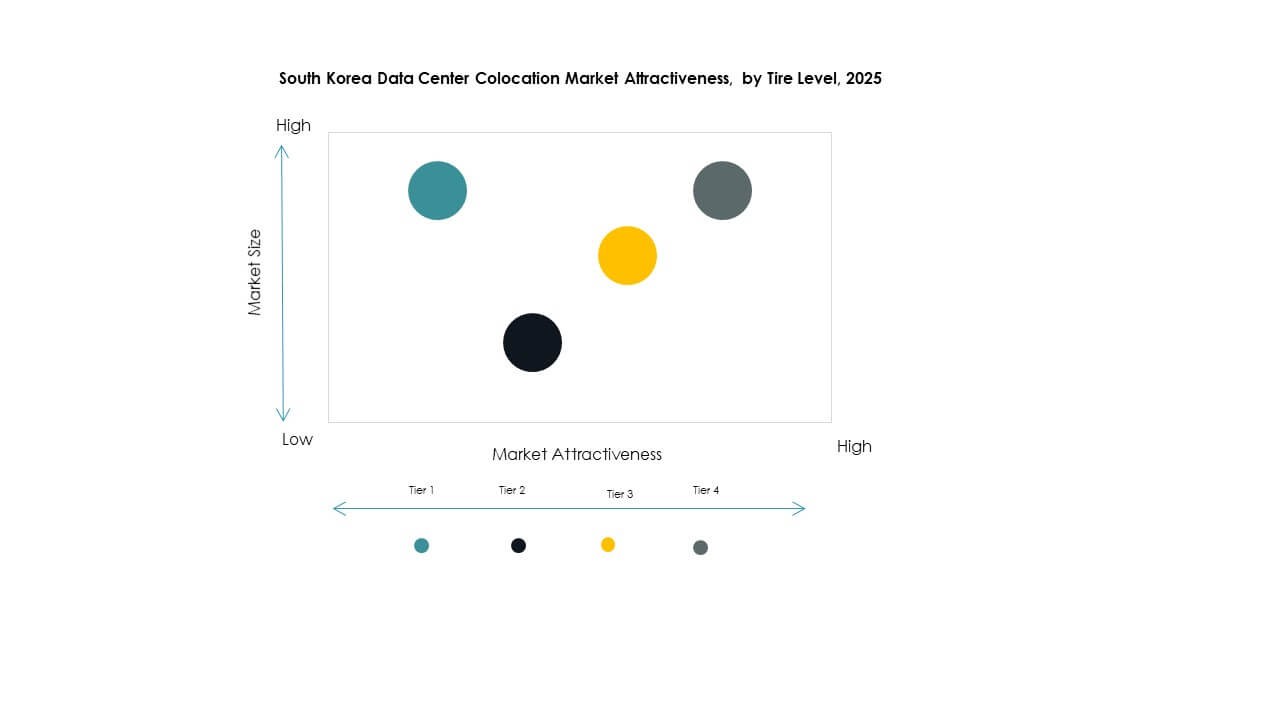

By Tier Level

Tier 3 holds the dominant share in the South Korea Data Center Colocation Market, supported by strong demand for reliable and redundant infrastructure. Enterprises prefer Tier 3 facilities for their balance between availability and operational efficiency. Tier 4 grows steadily, driven by mission-critical workloads and hyperscale adoption. Tier 1 and Tier 2 have smaller shares, serving edge and regional deployments. Tier 3 remains the backbone of enterprise deployments. Its widespread use reflects a focus on operational resilience and service stability.

By Enterprise Size

Large enterprises lead the South Korea Data Center Colocation Market due to high capacity needs and strong digital transformation initiatives. Their workloads demand advanced security, scalability, and network performance. SMEs show growing adoption as digitalization spreads across industries. Flexible pricing models and modular infrastructure make colocation more accessible to smaller businesses. Large enterprises dominate in market share due to their established IT strategies and greater investment capacity. Their adoption patterns influence infrastructure design and service models across the market.

By End User Industry

IT & Telecom holds the largest share in the South Korea Data Center Colocation Market. The sector drives high compute and connectivity demand for digital services. BFSI follows due to rising cloud banking and fintech solutions. Media & entertainment adopts colocation for streaming and gaming services. Retail and healthcare segments grow steadily through digital platforms and smart service models. IT & Telecom remains the dominant vertical, shaping market infrastructure strategies and service requirements.

Regional Insights

Seoul Metropolitan Region: Leading Digital Hub with 62% Market Share

Seoul dominates the South Korea Data Center Colocation Market with 62% share. Its strategic location, advanced network backbone, and strong enterprise concentration make it the preferred data center hub. Hyperscale and retail colocation facilities cluster around core business districts. Strong fiber connectivity supports low-latency services across industries. The presence of global cloud providers strengthens its digital ecosystem. High demand from IT, telecom, and BFSI sectors drives steady capacity expansion. Seoul remains the most mature subregion with established infrastructure advantages.

- For instance, in Q1 2024, Equinix opened its second IBX facility, SL4, in Seoul. The site is directly connected to SL1 via low-latency dark fiber and integrates with domestic internet exchanges such as KINX and KRIX, expanding connectivity options for enterprises and cloud providers.

Gyeonggi and Incheon Region: Rapid Growth Zone with 25% Market Share

The Gyeonggi and Incheon region holds a 25% market share driven by large-scale greenfield projects. Lower land costs and proximity to Seoul make it attractive for data center expansion. Telecom carriers and hyperscale operators invest in energy-efficient campuses. Strong logistics and transport networks enhance site suitability. This subregion emerges as a secondary hub supporting overflow demand from Seoul. Strategic energy planning strengthens its role in regional network diversification. It accelerates capacity development for edge and wholesale deployments.

- For instance, in May 2024, LG Uplus announced it would invest KRW 615.6 billion to build a hyperscale AI-ready data center in Paju, Gyeonggi Province, on a 73,710 m² site. The facility will incorporate GPU infrastructure and advanced cooling technologies and represents the largest build in LG Uplus’s colocation network expansion.

Southern and Eastern Region: Emerging Markets with 13% Market Share

The southern and eastern region accounts for 13% of the South Korea Data Center Colocation Market. Secondary cities such as Busan and Daegu attract new investments with their expanding connectivity. Government incentives and local partnerships drive construction activity. These emerging hubs support edge services and disaster recovery sites. Strong renewable energy integration strengthens sustainability appeal. Their growth diversifies national colocation capacity beyond Seoul. These regions build the foundation for distributed data infrastructure development across the country.

Competitive Insights:

- KT Corporation

- LG Uplus

- SK Telecom

- SK Broadband

- Amazon Web Services (AWS)

- Google Cloud

- South Korea Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The South Korea Data Center Colocation Market features a strong mix of domestic telecom giants and global hyperscale operators. KT Corporation, LG Uplus, and SK Telecom hold large shares through extensive network infrastructure and enterprise partnerships. Global firms such as Equinix, AWS, and Digital Realty strengthen the ecosystem with high-capacity facilities and advanced interconnection services. It is shaped by aggressive expansion strategies, investments in green energy, and technology-driven differentiation. Companies focus on hybrid cloud solutions, edge deployments, and compliance-focused services to enhance their competitive edge. Strategic partnerships and infrastructure modernization remain central to sustaining growth in this fast-evolving landscape.

Recent Developments:

- In July 2025, Google Cloudlaunched a new AI data residency service in South Korea, allowing local enterprises to process AI workloads entirely within domestic borders. This initiative, announced during Google Cloud Day Seoul 2025, bolsters Korea’s sovereign cloud capabilities by enabling organizations in regulated industries to run generative AI systems like Gemini 2.5 Flash under strict data localization policies.

- In June 2025, SK Group, through affiliates SK Telecom and SK Broadband, announced a US$5.1 billion partnership with Amazon Web Services (AWS)to build an AI data center complex in Ulsan. Groundbreaking is scheduled for August 2025, with operations set to begin in 2027. The project, designed to scale up to 1GW capacity, will integrate AI-optimized hardware and hybrid cooling solutions, establishing the largest AI-dedicated data center in South Korea.

- In March 2025, SK Telecomunveiled its plan to develop the largest AI data center in Korea in collaboration with global technology partners. The facility, to be powered by 60,000 GPUs and capable of 100MW power, is part of SK Telecom’s strategy to lead South Korea’s hyperscale AI infrastructure development and enterprise AI services.

- In March 2025, Colt Technology Services Group Limitedexpanded its footprint into the South Korean market by establishing Points of Presence (POPs) in four major data centers across Seoul. The move enhances Colt’s Asia-Pacific IQ Network, providing up to 40G Ethernet connectivity and enabling low-latency, carrier-neutral datacenter interconnectivity for global enterprises.