Executive summary:

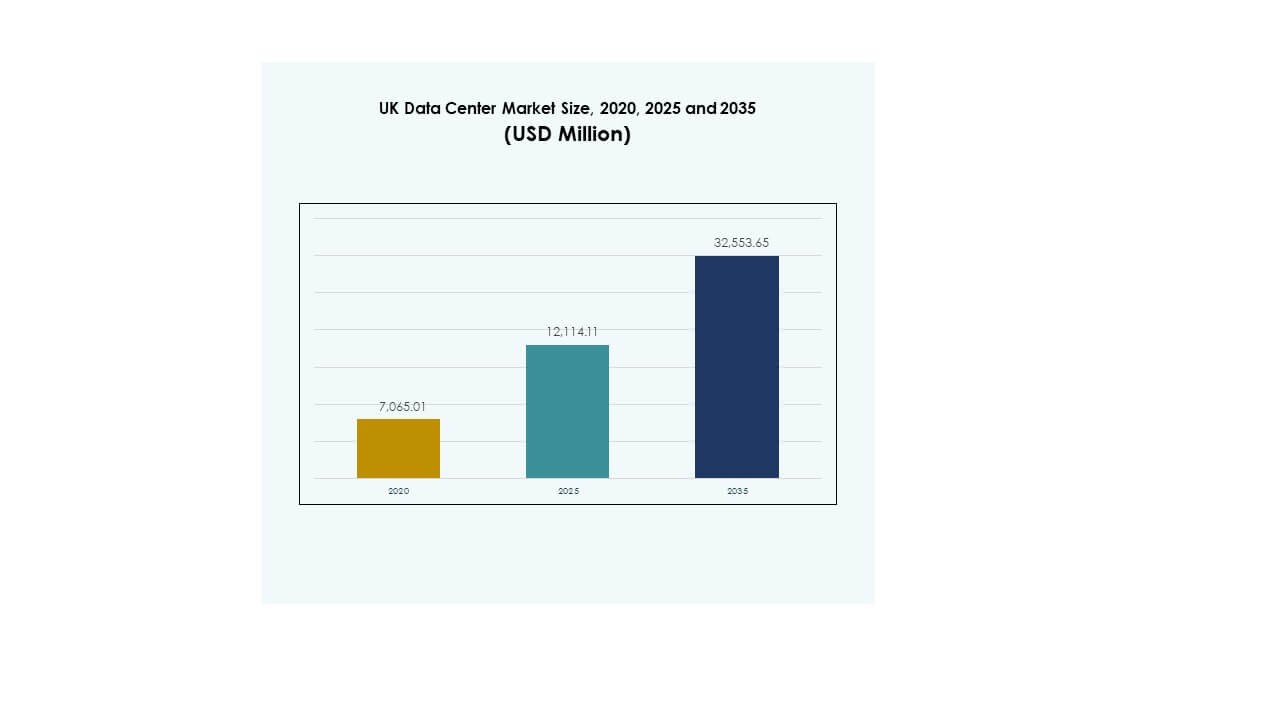

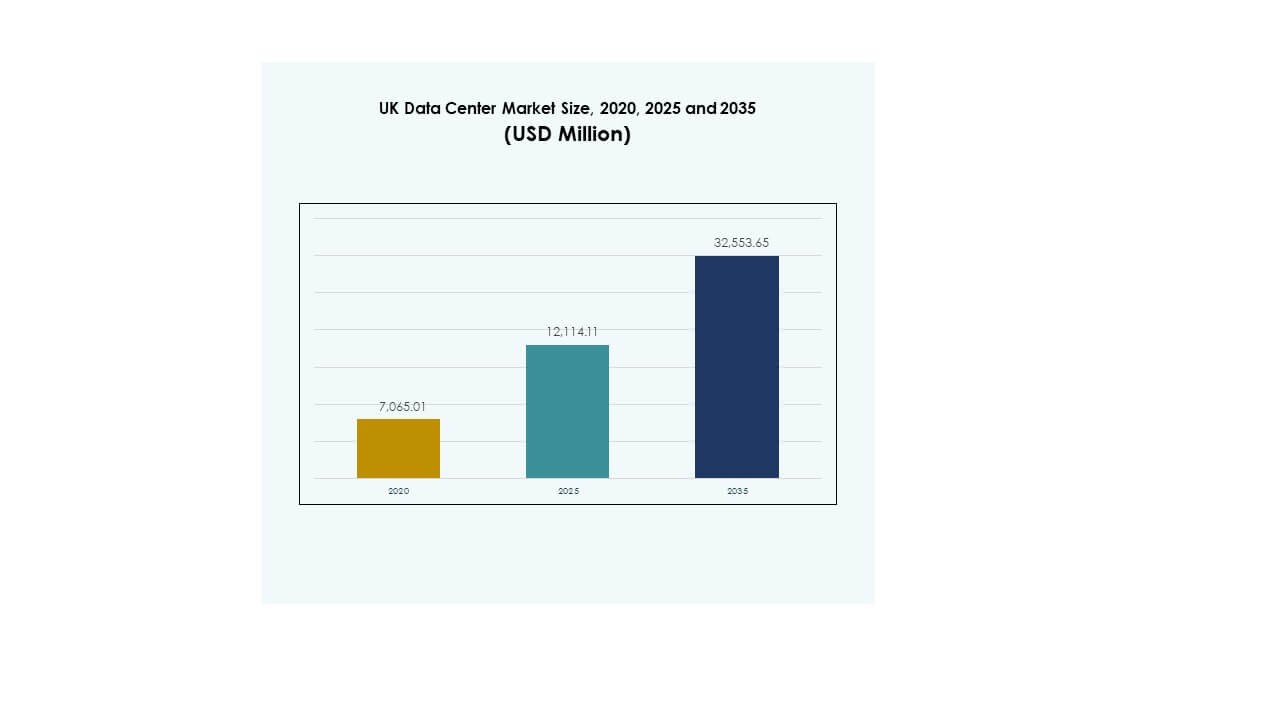

The UK Data Center Market size was valued at USD 7,065.01 million in 2020 to USD 12,114.11 million in 2025 and is anticipated to reach USD 32,553.65 million by 2035, at a CAGR of 10.33% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| UK Data Center Market Size 2025 |

USD 12,114.11 Million |

| UK Data Center Market, CAGR |

10.33% |

| UK Data Center Market Size 2035 |

USD 32,553.65 Million |

Growth in the UK Data Center Market is driven by rapid adoption of cloud platforms, AI integration, and digital transformation across industries. Enterprises demand secure, scalable, and energy-efficient infrastructure to manage advanced applications and large datasets. Innovation in automation and sustainable energy sourcing strengthens operational efficiency. The market holds strategic importance for businesses and investors as it provides resilience, compliance, and opportunities to capitalize on growing digital services demand.

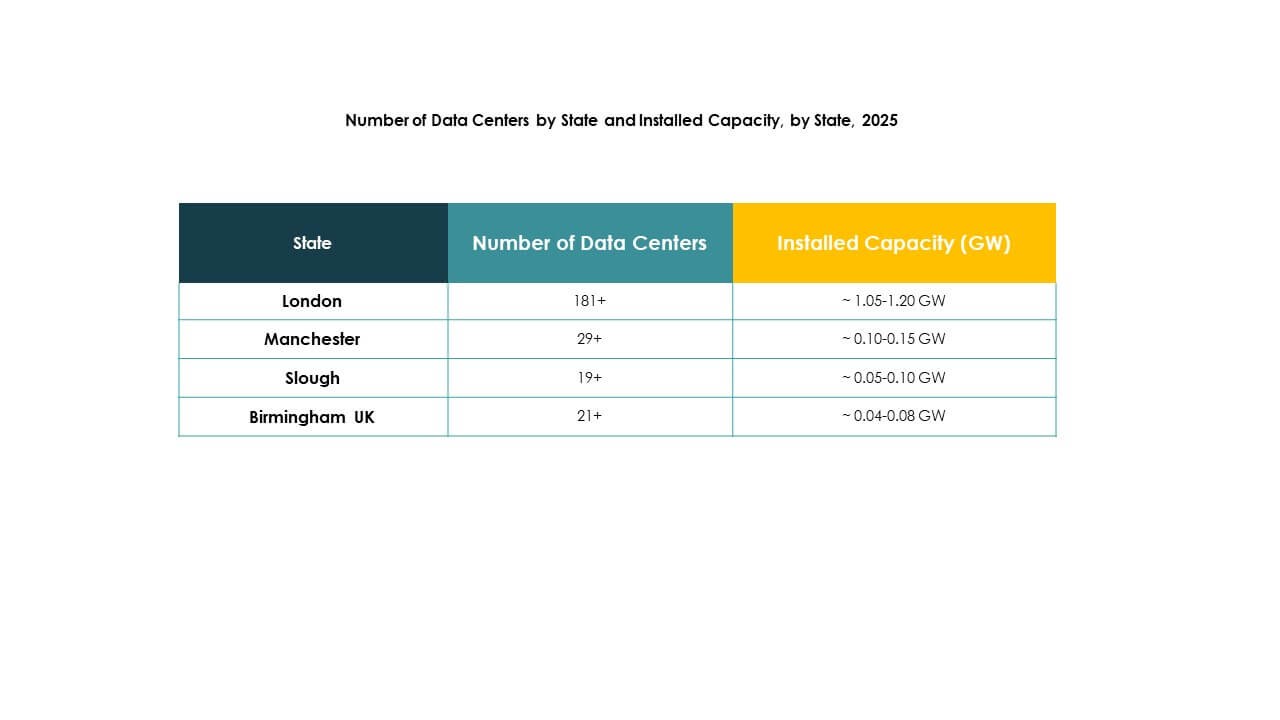

London remains the leading hub within the UK Data Center Market due to its financial ecosystem, global connectivity, and concentration of hyperscale operators. Manchester and Birmingham are emerging as secondary hubs, supported by urban development and enterprise demand. Scotland and Wales gain traction with renewable-powered facilities, reflecting sustainability commitments. This regional diversity enhances competitiveness and positions the UK as a prominent European digital infrastructure center.

Market Drivers

Rising Cloud Adoption and the Shift Toward Scalable Infrastructure

The UK Data Center Market is driven by accelerated adoption of cloud platforms that demand scalable, flexible, and secure digital infrastructure. Enterprises are increasingly shifting core operations toward hybrid and multi-cloud models, fueling demand for large hyperscale facilities. Investment in modern hardware and software platforms enables greater processing capacity and reduces latency for mission-critical applications. The strong reliance on digital transformation by BFSI, healthcare, and telecom players boosts growth. Investors view the market as a stable and high-yielding environment. It offers consistent returns due to recurring enterprise demand. Businesses gain strategic advantage from the ability to store and process massive datasets locally. The consistent growth of digital services strengthens the long-term foundation of the market.

Innovation in Energy-Efficient Systems and Sustainable Operations

The growing focus on sustainability reshapes operational practices and energy sourcing in the UK Data Center Market. Operators prioritize renewable energy procurement, efficient cooling systems, and advanced building designs that lower overall emissions. Power usage effectiveness metrics play a critical role in technology selection and facility upgrades. Data centers using solar, wind, and hydro projects for power secure long-term cost stability. It strengthens reputation among corporate clients seeking sustainable supply chains. Innovation in AI-driven cooling and energy automation delivers measurable operational savings. Energy security remains central for future expansion planning. The combination of sustainability and cost competitiveness makes the market attractive to global investors.

- For instance, Equinix achieved 96 % renewable energy coverage across its global data center portfolio in 2023, marking its sixth consecutive year above 90 %. The company also reported an improvement in its energy efficiency, with year-on-year gains in PUE performance documented in its sustainability report.

Digital Transformation Accelerating Data-Intensive Applications Across Industries

The adoption of data-heavy technologies, such as artificial intelligence, IoT, and 5G, drives the UK Data Center Market toward higher performance requirements. Enterprises and governments demand scalable infrastructure to handle advanced analytics and predictive workloads. Cloud-native platforms require robust storage and networking integration for efficiency. It supports faster development cycles and agile deployment across industries. Sectors such as media, healthcare, and manufacturing rely heavily on low-latency computing environments. Investors recognize the strategic importance of facilities that integrate next-generation compute capacity. The ability to meet future workload demands strengthens competitiveness. Growing data consumption aligns with broader national digital strategies.

- For instance, Telehouse South opened in London Docklands in 2022, spanning 31,000 sqm and offering up to 18 MW of power capacity across its full build-out. The facility connects via 7,000 dark fibres across diverse routes, providing access to over 900 partner networks.

Strategic Role of Colocation and Interconnected Ecosystems for Businesses

The expansion of colocation hubs underlines the UK Data Center Market’s importance as a digital ecosystem for enterprises and startups. Colocation providers deliver cost-effective, reliable, and interconnected solutions, enabling businesses to scale without heavy upfront investment. Strong demand from financial services and telecom companies continues to strengthen growth. It facilitates direct connectivity to multiple cloud and network providers within single facilities. The role of interconnectivity drives competitive differentiation and improves efficiency for end users. Enterprises benefit from stronger resilience and compliance across regulated industries. Colocation remains vital for businesses requiring security and scalability. The strategic role of these facilities ensures long-term investor confidence.

Market Trends

Expansion of Edge and Modular Data Center Deployments Across the UK

The UK Data Center Market is witnessing rapid adoption of edge and modular designs to address the needs of low-latency applications. These compact deployments serve localized demands in regions beyond London. It helps telecom operators meet requirements of 5G rollouts and IoT-driven services. Modular designs provide scalability and cost efficiency, reducing time to market for providers. Enterprises leverage these solutions for closer proximity to end users. The trend strengthens demand across industries like gaming, retail, and smart city projects. Investors see growth opportunities in distributed infrastructure. Edge facilities create a competitive ecosystem supporting digital innovation.

Rise of Artificial Intelligence and Automation Driving Operational Efficiency

The adoption of AI and automation technologies is reshaping operational models across the UK Data Center Market. AI-driven systems optimize cooling, power distribution, and predictive maintenance. Automation enables streamlined provisioning and orchestration, cutting operating costs for operators. It allows faster troubleshooting and reduces downtime, ensuring higher availability. Enterprises increasingly expect data centers to deliver intelligent monitoring and real-time analytics. The trend aligns with the rising importance of AI workloads that require robust infrastructure. Facility operators gain advantage by embedding automation into existing operations. It enhances both reliability and cost-effectiveness.

Interconnection Growth Through Carrier-Neutral Data Centers and Network Expansion

Carrier-neutral facilities are growing in importance across the UK Data Center Market, providing enterprises with multiple connectivity options. Businesses seek flexible interconnection to cloud platforms, telecom networks, and content providers. It supports digital transformation for enterprises operating across global and regional markets. Carrier-neutral facilities in London and Manchester are attracting significant enterprise tenants. Interconnection hubs foster collaborative ecosystems for financial services, media, and IT providers. Network expansions complement these hubs by enhancing cross-border connectivity. Enterprises benefit from lower latency and cost-efficient routing. Interconnection growth secures the UK’s position as a leading European hub.

Integration of Renewable Energy and Green Certifications Strengthening Competitiveness

Sustainability is emerging as a defining trend within the UK Data Center Market, with operators embedding renewable power into long-term strategies. Wind and solar projects are increasingly supplying facilities across different regions. It improves corporate reputation while meeting environmental standards set by regulators. Clients favor green-certified facilities that meet international benchmarks. Operators invest in liquid cooling and energy storage to support efficiency goals. Sustainability initiatives reduce exposure to future carbon taxes. Facilities that adopt energy innovation secure long-term demand from global enterprises. The transition reinforces investor trust in the sector’s resilience.

Market Challenges

High Energy Consumption and Pressure on Power Infrastructure

The UK Data Center Market faces significant challenges linked to energy consumption and pressure on existing power grids. Facilities require massive amounts of electricity to support high-density computing workloads. Operators are under scrutiny for sustainability and compliance with strict regulations. It raises costs and creates barriers for small and medium investors. Power shortages in urban hubs restrict expansion opportunities. Energy price volatility adds uncertainty for long-term planning. Integrating renewable sources requires large upfront capital. Rising operational expenses pressure margins and limit flexibility. Managing sustainable growth under constrained energy conditions remains a core challenge.

Data Sovereignty, Cybersecurity Threats, and Regulatory Complexity

Data sovereignty and compliance requirements increase complexity within the UK Data Center Market. Enterprises must ensure adherence to both domestic and EU-aligned frameworks. It creates demand for secure facilities but raises operational challenges for international players. The market also faces rising cybersecurity risks, with threats targeting critical digital infrastructure. Operators need constant upgrades in security technologies and skilled personnel. Compliance audits increase operational costs and slow expansion timelines. Regulatory fragmentation creates uncertainty for investors. Balancing security, compliance, and innovation remains a strategic barrier for long-term growth.

Market Opportunities

Growth of Hyperscale Investments and Emerging Regional Expansion

The UK Data Center Market offers significant opportunities through large-scale hyperscale projects and regional diversification. Global cloud providers are expanding their footprint in London and secondary cities like Birmingham and Manchester. It creates new demand for advanced infrastructure, supporting industries across BFSI, healthcare, and media. Investors benefit from stable returns in both primary and emerging hubs. The ability to capture regional demand offers competitive advantage. Hyperscale expansion creates opportunities for local suppliers and contractors. Growth in interconnection services strengthens regional digital ecosystems.

Sustainability Integration and AI-Driven Facility Innovation

Opportunities in the UK Data Center Market are increasingly linked to green energy adoption and advanced technologies. Facilities implementing AI-driven monitoring and automation enhance operational efficiency. It ensures higher reliability for enterprise clients and reduces maintenance costs. Renewable integration strengthens long-term competitiveness by aligning with corporate sustainability goals. Investors are attracted to facilities that combine efficiency with environmental responsibility. Enterprises prefer green-certified providers to meet their own ESG commitments. This opportunity positions the UK as a leader in sustainable data infrastructure.

Market Segmentation

By Component

The hardware segment dominates the UK Data Center Market, holding the largest share due to high demand for servers, storage, racks, and power systems. Continuous upgrades in high-performance computing and advanced cooling solutions support its growth. Software solutions such as DCIM and virtualization tools are gaining adoption to optimize operations. Services including consulting and managed support provide recurring revenue streams. Hardware remains the backbone for large-scale infrastructure, making it the leading segment by value.

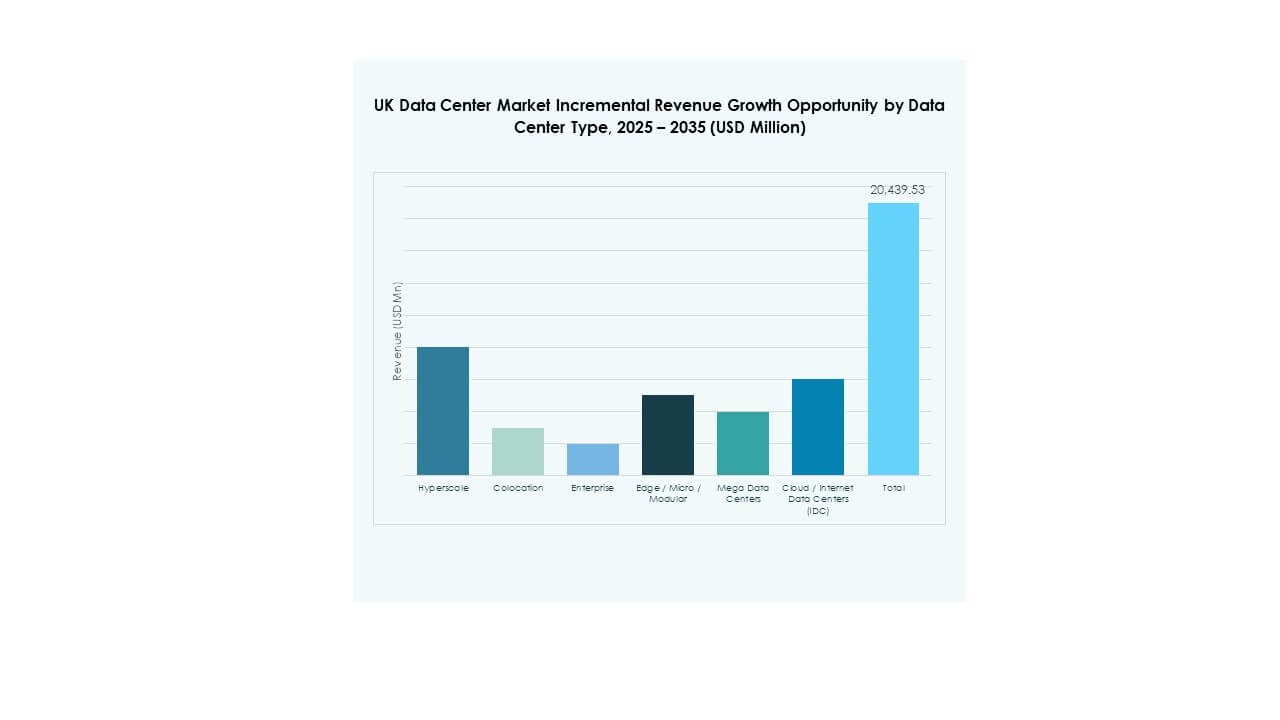

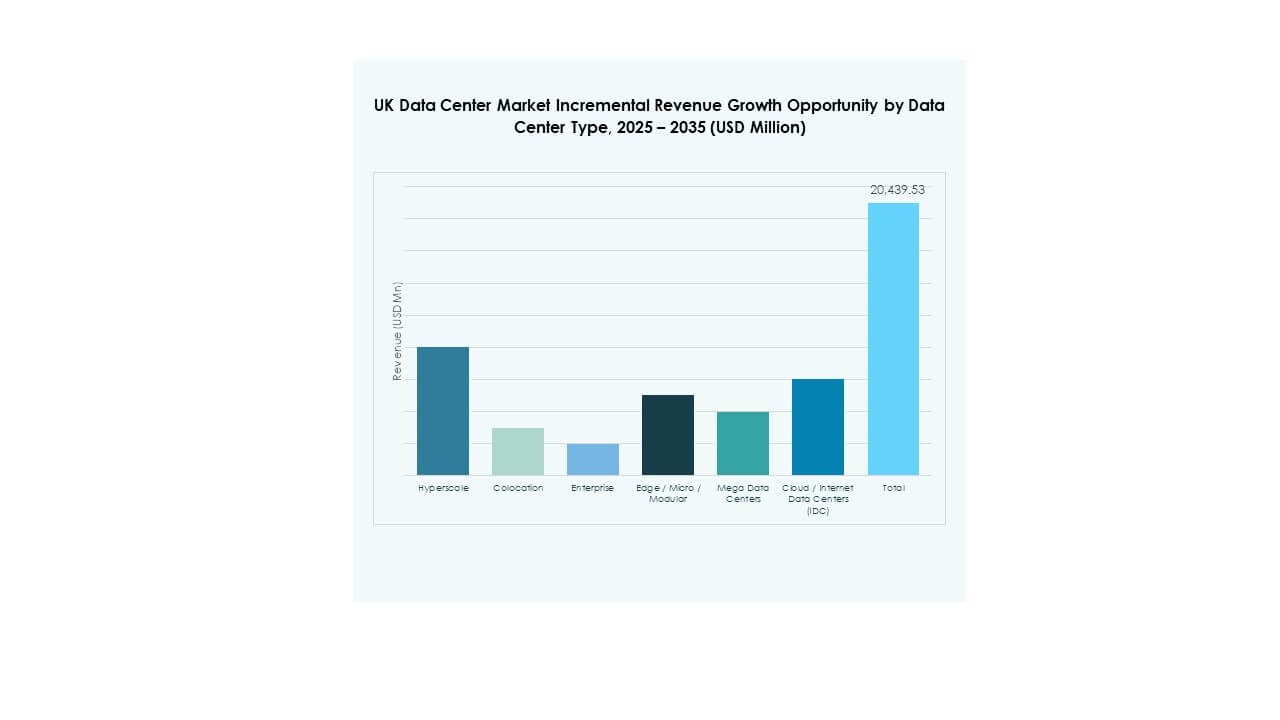

By Data Center Type

Hyperscale data centers dominate the UK Data Center Market, driven by strong investment from global cloud service providers. Colocation facilities also hold significant share due to cost-efficient solutions for enterprises. Edge and modular data centers are growing rapidly to meet low-latency needs. Enterprise and cloud/IDC models continue to serve specific workloads for regulated industries. Mega data centers reinforce scalability for international players. Hyperscale remains the fastest-growing type with continuous capacity additions.

By Deployment Model

Cloud-based deployment leads the UK Data Center Market, supported by adoption of hybrid and multi-cloud strategies across industries. On-premises models retain importance for organizations with strict regulatory needs. Hybrid models are gaining traction as they balance flexibility with control. Enterprises rely on cloud-based solutions for scalability and lower upfront costs. It drives rapid expansion of regional cloud zones. Cloud adoption continues to outpace other models due to enterprise digital transformation.

By Enterprise Size

Large enterprises dominate the UK Data Center Market, leveraging advanced facilities to manage vast datasets and mission-critical workloads. SMEs increasingly adopt cloud and colocation services to reduce costs. It drives steady growth in managed and hybrid models. SMEs benefit from pay-as-you-go models and shared infrastructure access. Large enterprises continue to lead investment volume due to financial strength. Growth in SME demand ensures diversification of end-user base.

By Application / Use Case

The IT & telecom segment dominates the UK Data Center Market, driven by demand for digital connectivity and advanced applications. BFSI remains a strong vertical due to strict compliance and data sovereignty requirements. Healthcare and government also adopt modern infrastructure for secure data management. Retail and media industries grow due to e-commerce and content delivery needs. Manufacturing and energy sectors increase usage of AI-driven analytics. IT & telecom remains the leading use case in revenue terms.

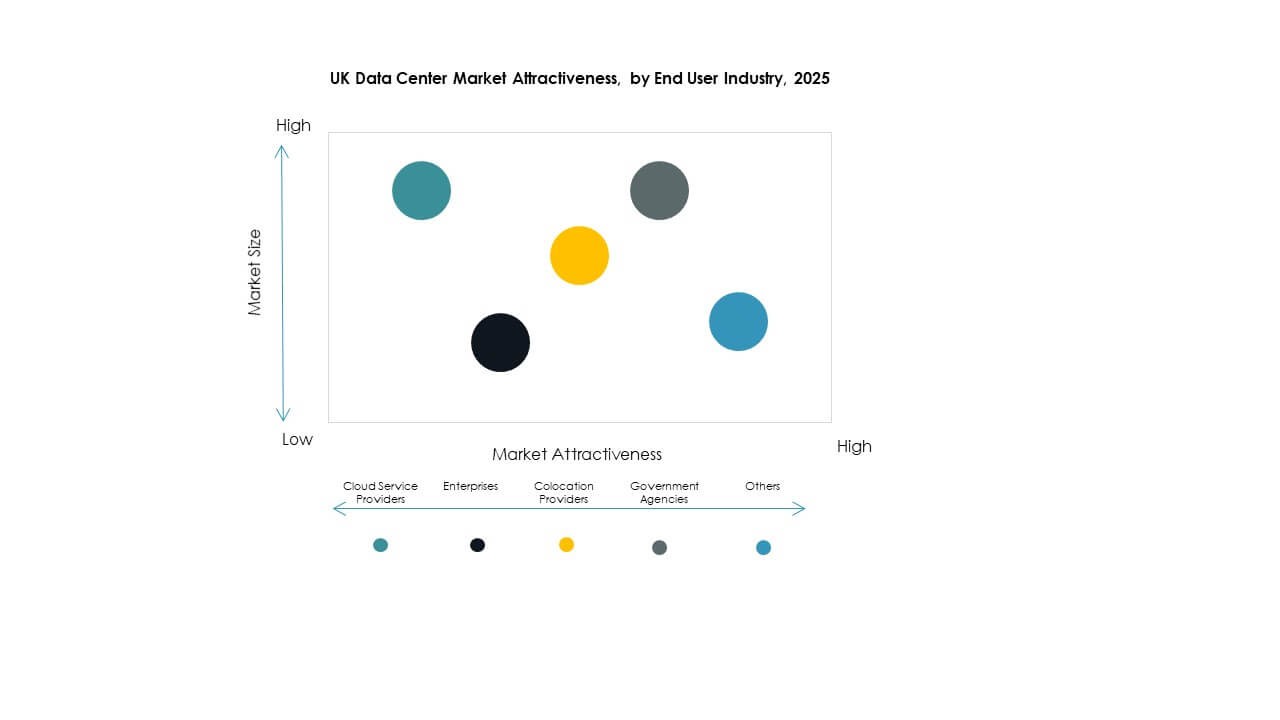

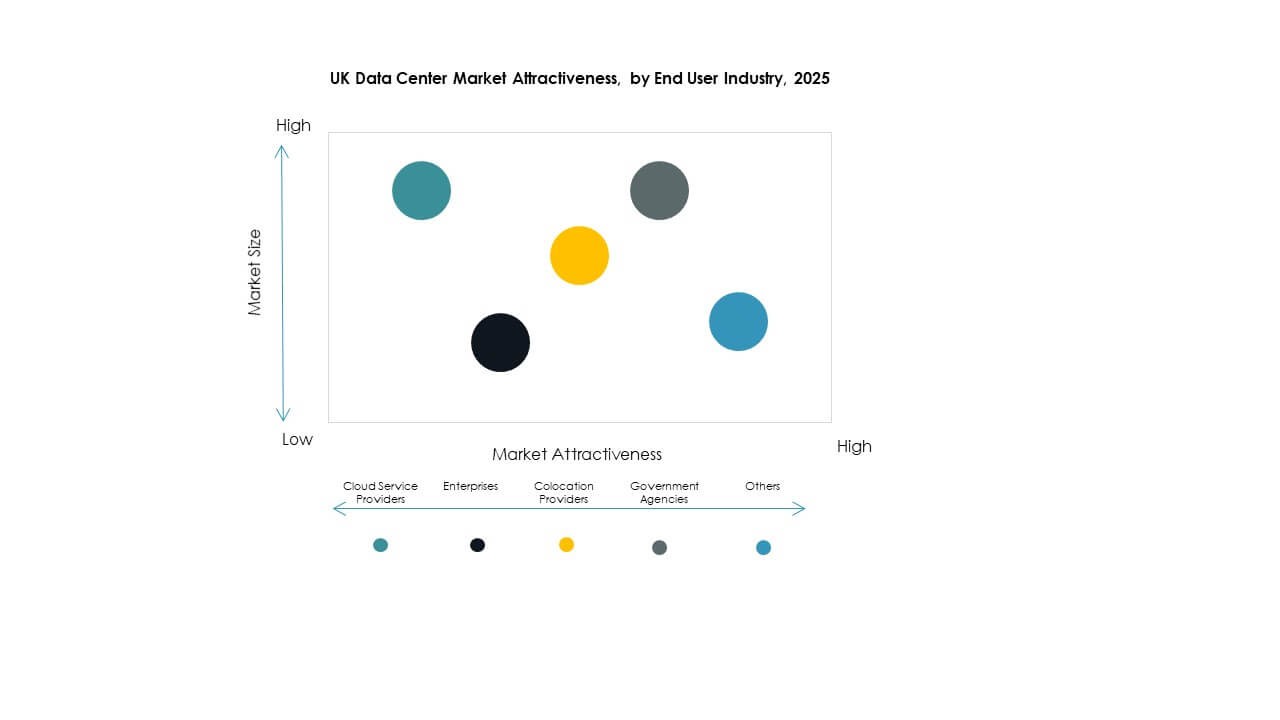

By End User Industry

Cloud service providers dominate the UK Data Center Market by securing large hyperscale and colocation facilities. Enterprises represent a strong share with ongoing digital transformation initiatives. Colocation providers deliver cost-effective solutions for mid-sized businesses. Government agencies invest in secure infrastructure to manage sensitive national data. Other industries such as education and utilities strengthen demand diversity. Cloud providers continue to anchor overall market growth.

Regional Insights

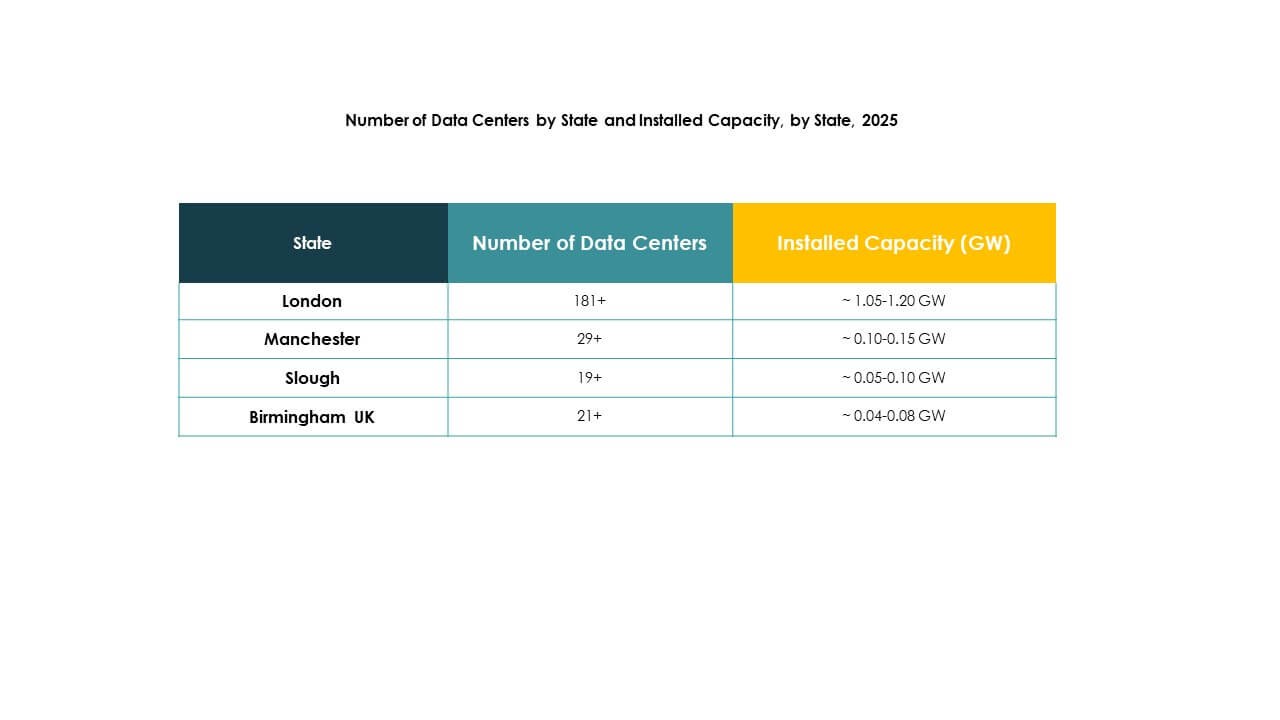

London and the South East Leading with Strongest Market Share

London and the South East dominate the UK Data Center Market, holding 48% share in 2024. The region’s financial hub status and presence of hyperscale investments create strong demand. It attracts international players due to connectivity, skilled workforce, and established infrastructure. Colocation and carrier-neutral facilities expand rapidly to serve enterprise clients. The South East strengthens its role as the gateway for European digital traffic. Investors prioritize this subregion for sustained growth.

Midlands and Northern England Emerging as Secondary Hubs

The Midlands and Northern England account for 32% share of the UK Data Center Market, supported by regional urbanization and industrial growth. Manchester, Leeds, and Birmingham lead investment activity, driven by lower costs and strategic positioning. Telecom operators and hyperscale firms are expanding edge deployments across these cities. It enhances local connectivity and strengthens regional ecosystems. Enterprises benefit from improved access to cloud services outside London. Investors view these hubs as high-growth areas.

- For instance, Kao Data broke ground in 2024 on a £350 million data center in Stockport, Greater Manchester. The facility aims for a PUE of 1.2, nine data halls, and will support advanced computing and AI workloads.

Scotland, Wales, and Other Regions Expanding with Renewable Integration

Scotland, Wales, and other regions collectively hold 20% share of the UK Data Center Market. Growth is driven by renewable energy integration and government support for digital infrastructure. Facilities in Scotland use wind and hydro sources, attracting sustainability-focused clients. Wales leverages its strategic position for edge and modular projects. Regional diversity strengthens resilience and reduces dependency on London. It positions the UK as a balanced and competitive data center environment across subregions.

- For instance, DataVita announced plans to expand its central Scotland data center to 40 MW, adopting hydrotreated vegetable oil for backup generators and supporting high-density workloads of up to 400 kW per rack, highlighting its commitment to sustainable operations.

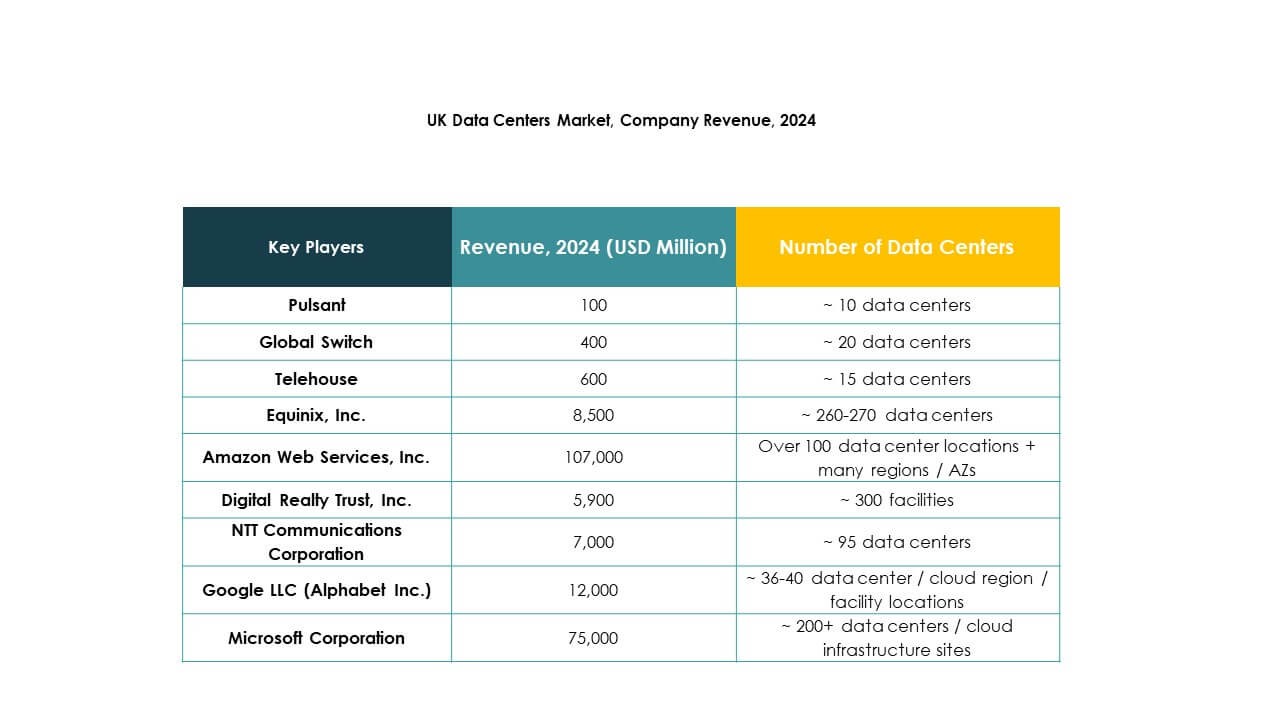

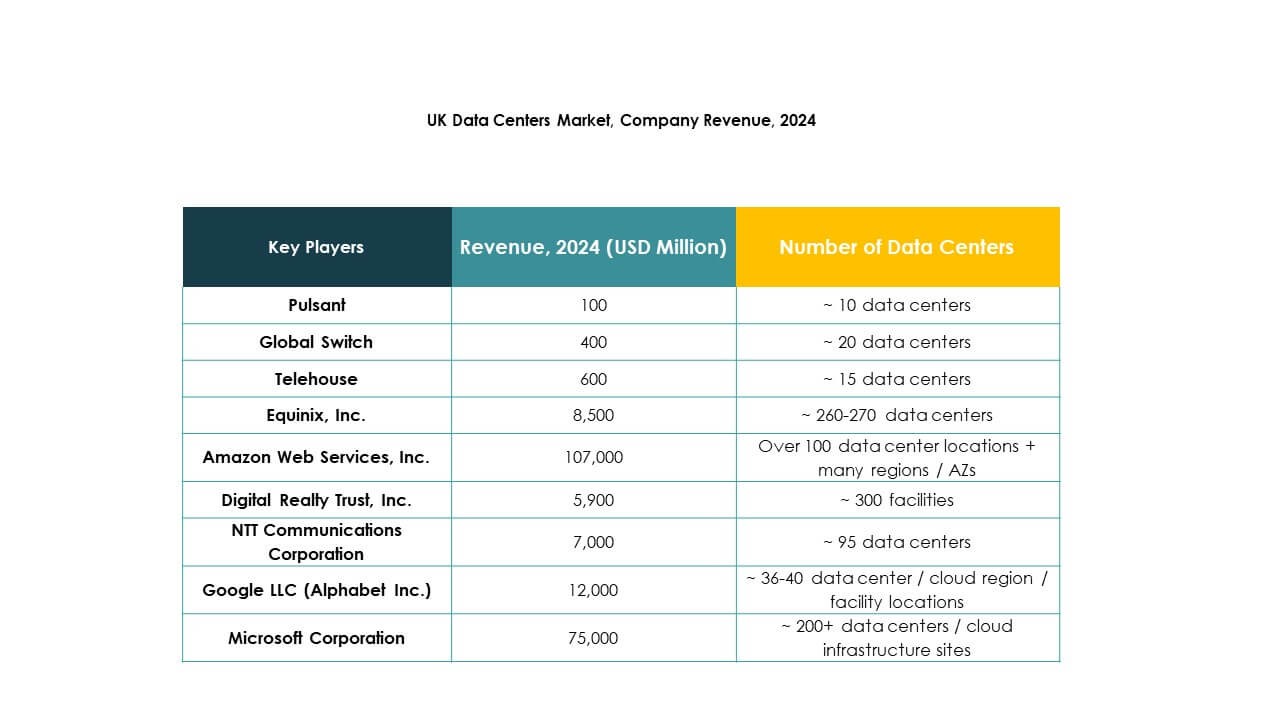

Competitive Insights:

- Pulsant

- Equinix, Inc.

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

- Global Switch

- Telehouse

The competitive landscape of the UK Data Center Market is defined by strong participation from global hyperscale providers and established colocation operators. Equinix, Digital Realty, and Telehouse anchor the colocation ecosystem, offering high-capacity interconnected facilities in London and regional hubs. Global cloud leaders such as Microsoft, AWS, and Google expand hyperscale campuses, focusing on scalable infrastructure and sustainability commitments. NTT and Global Switch leverage global footprints to attract enterprise clients seeking reliable hybrid solutions. Pulsant strengthens its position by targeting regional mid-market businesses through edge-ready infrastructure. It demonstrates high rivalry, with providers investing heavily in renewable energy integration, AI-enabled automation, and network expansions to secure long-term enterprise demand. Competitive differentiation hinges on sustainability, interconnection ecosystems, and ability to serve multi-cloud strategies.

Recent Developments:

- In September 2025, BlackRock revealed a major acquisition and partnership by investing £500 million (about $679 million) in UK data centers through a joint venture with Digital Gravity Partners. The initiative, branded as Gravity Edge, started with the acquisition of a West London data center with plans to modernize its facilities, improve energy efficiency, and expand its rack capacity to service enterprise clients and financial institutions.

- In August 2025, Equinix announced agreements with next-generation energy providers like Oklo and Bloom Energy, aiming to power its UK and global data centers with innovative, sustainable energy solutions. This supports the expansion and scaling of AI-capable data center infrastructure in the UK.