Executive summary:

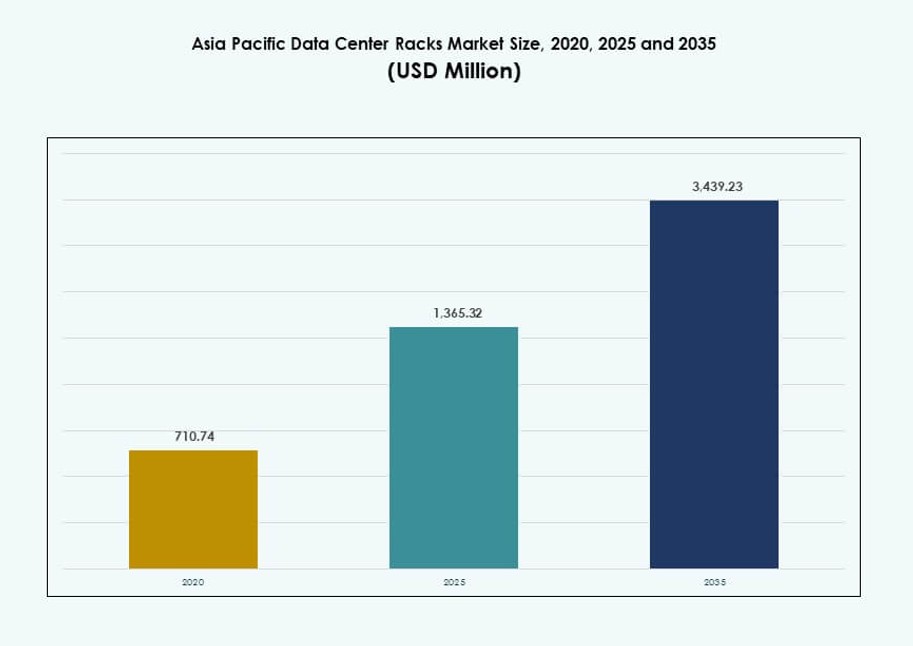

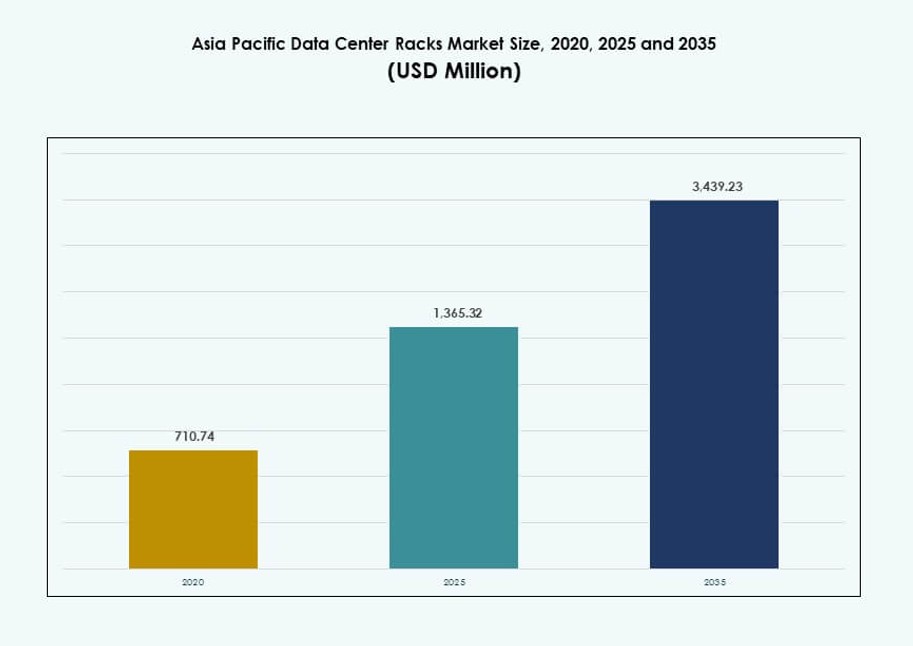

The Asia Pacific Data Center Racks Market size was valued at USD 710.74 million in 2020 to USD 1,365.32 million in 2025 and is anticipated to reach USD 3,439.23 million by 2035, at a CAGR of 9.61% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Asia Pacific Data Center Racks Market Size 2025 |

USD 1,365.32 Million |

| Asia Pacific Data Center Racks Market, CAGR |

9.61% |

| Asia Pacific Data Center Racks Market Size 2035 |

USD 3,439.23 Million |

The Asia Pacific Data Center Racks Market benefits from rapid cloud adoption and AI workload expansion. Enterprises upgrade facilities to support higher rack density and advanced cooling. Hyperscalers favor modular racks for faster deployment and scale. Edge computing growth increases demand for compact rack designs. Data sovereignty policies push local infrastructure investment. Innovation focuses on liquid cooling and smart rack monitoring. This market holds strategic value for operators seeking efficiency. Investors see long-term returns from digital infrastructure growth.

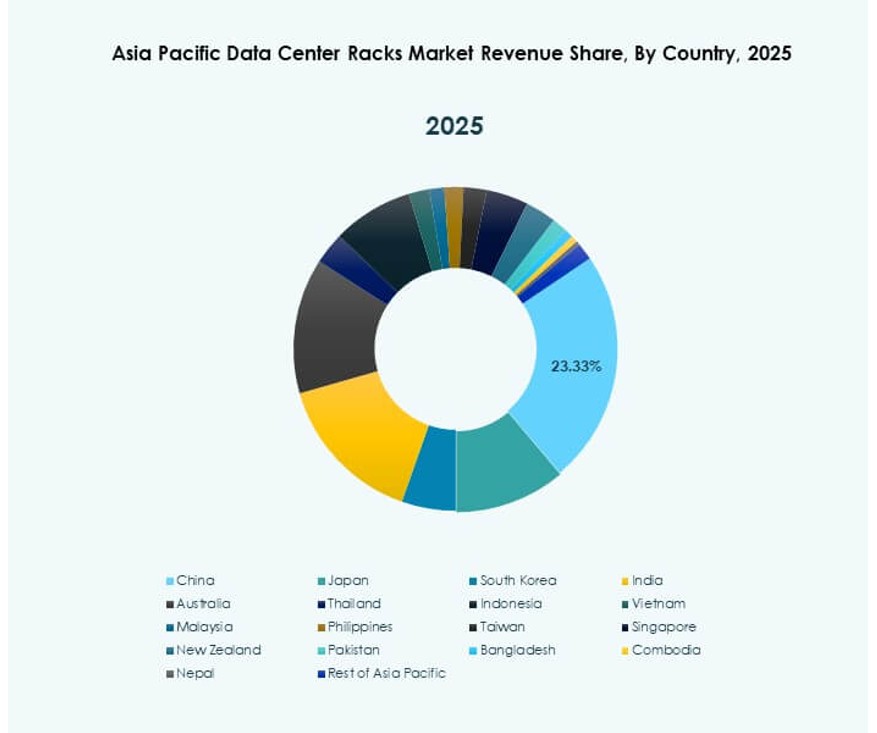

China, Japan, and India lead deployments due to hyperscale cloud growth and enterprise digitization. These countries host dense data center clusters and strong domestic demand. Singapore and Australia act as regional connectivity and colocation hubs. Southeast Asian countries like Indonesia and Vietnam are emerging markets. Growth there links to edge deployments and cable landings. The Asia Pacific Data Center Racks Market reflects diverse maturity levels across regions. This balance supports both scale and localized expansion.

Market Dynamics:

Market Drivers

Growing AI and Cloud Workloads Accelerate the Demand for High-Density Rack Architectures

The Asia Pacific Data Center Racks Market is expanding due to the rapid scaling of AI workloads and cloud services. Major enterprises and hyperscalers deploy racks that support 30–50 kW densities for GPU-intensive operations. Data-heavy sectors such as fintech, e-commerce, and telecom demand faster, scalable computing. Traditional racks no longer meet power and thermal needs for AI models. This shift is pushing liquid cooling adoption across high-density racks. Countries like China and India lead in local innovation for modular rack systems. Organizations also prioritize rack flexibility for hybrid cloud environments. The market supports long-term infrastructure planning for AI, big data, and 5G edge services.

- For instance, Supermicro’s NVIDIA GB200 NVL72 rack integrates 72 Blackwell GPUs and 36 Grace CPUs with 132 kW operating power in a liquid-cooled, 42U design for AI training.

Edge Computing and 5G Rollouts Drive Rack Deployments in Tier-2 and Remote Zones

Edge computing growth and 5G network expansion are fueling distributed rack deployment across non-metro regions. Telecom operators and cloud providers localize workloads near users to reduce latency. Compact rack systems designed for remote sites support IoT, gaming, and content delivery. Governments invest in rural digital infrastructure, increasing rack installations in underserved areas. Standard 42U and below-42U racks dominate edge deployments due to size and heat constraints. Prefabricated and micro data centers are gaining traction across Southeast Asia. The Asia Pacific Data Center Racks Market benefits from growing low-latency needs in edge computing. This trend unlocks new revenue channels for equipment vendors and integrators.

Digital Sovereignty and Local Regulations Prompt Investment in On-Premise Infrastructure

Governments across Asia Pacific enforce data residency laws that require local data storage and processing. This policy shift prompts enterprises to build or expand their own data centers. The demand for secure, localized rack systems is growing across finance, healthcare, and defense sectors. Domestic cloud providers and telcos invest in scalable rack designs to meet compliance needs. Integrated cable management, fire suppression, and modularity are essential features. The Asia Pacific Data Center Racks Market benefits from the rising importance of data protection. Rack vendors offer customized configurations aligned with each country’s regulatory framework. This legal environment drives a steady flow of private infrastructure investment.

Strategic Relevance for Hyperscalers, Colocation Firms, and Enterprise DC Operators

The market plays a vital role in regional digital transformation initiatives. Hyperscalers seek rack solutions with faster deployment cycles and built-in cooling systems. Colocation providers prioritize energy-efficient rack units to improve PUE scores and meet ESG targets. Enterprises look for future-ready rack solutions that support AI, hybrid IT, and cloud-native architectures. Rack design innovation helps reduce deployment time and optimize power and space usage. Investors see value in suppliers delivering adaptable, energy-efficient infrastructure. The Asia Pacific Data Center Racks Market underpins the region’s long-term strategy for digital leadership. This makes rack systems a critical link in the region’s IT growth chain.

- For instance, NVIDIA’s GB200 NVL72 rack-scale system integrates 72 Blackwell GPUs with advanced liquid cooling and NVLink high-speed interconnects, designed for large-scale AI training. Hyperscalers are expected to deploy these systems in next-generation data centers starting in 2025.

Market Trends

Rising Integration of Direct-to-Chip and Immersion Cooling Systems in High-Density Racks

Thermal management is becoming a key driver of rack design innovation across the region. Operators integrate direct-to-chip liquid cooling systems to support dense GPU clusters. Some facilities adopt immersion-cooled enclosures for AI workloads that exceed traditional heat thresholds. Rack vendors collaborate with cooling specialists to deliver turnkey thermal management solutions. These innovations reduce PUE levels and boost compute efficiency. Countries with hot climates like India and Indonesia benefit most from these solutions. The Asia Pacific Data Center Racks Market reflects the shift toward thermally optimized infrastructure. This trend enables rack manufacturers to target AI-first workloads in energy-constrained environments.

Accelerated Adoption of Prefabricated and Modular Rack Systems for Faster Deployment

Data center developers increasingly deploy prefabricated rack systems that shorten lead times. Modular racks arrive pre-assembled with integrated PDUs, cable management, and cooling units. This reduces setup time from weeks to days, enabling fast infrastructure scale-up. The demand grows stronger in urban hubs where labor and space are constrained. Local integrators partner with hyperscalers to deliver region-specific rack modules. The Asia Pacific Data Center Racks Market supports this trend with rising investments in edge zones and smart cities. This preference for factory-integrated solutions opens new revenue streams for OEMs and system integrators.

Growing Focus on AI-Specific Rack Designs with Enhanced Interconnectivity and Power Support

Rack vendors introduce designs built specifically for AI workloads and high-performance computing. These racks feature larger form factors, redundant power feeds, and optimized GPU slot layouts. AI training clusters demand higher interconnect speeds and distributed power densities. Cloud players deploy these specialized racks to support multi-GPU configurations and AI clusters. Cable management and airflow systems are upgraded to handle thermal and compute loads. This trend expands fastest in Japan, Singapore, and Australia. The Asia Pacific Data Center Racks Market responds by promoting AI-ready architectures with open compute compatibility. OEMs compete on speed, density, and adaptability for next-gen AI demand.

Hybrid Cloud Racks Gain Traction Across Mid-Market and Enterprise Segments

Mid-sized enterprises seek racks that can handle both on-premise and cloud workloads. These hybrid cloud-ready racks support dynamic scaling and enable secure integration with public cloud platforms. Vendors design such racks with multi-tenancy support, segmentation, and remote monitoring. The shift to hybrid IT boosts demand for rack-level flexibility in power, cooling, and connectivity. Integration of AI-driven monitoring tools becomes common in these rack systems. China, South Korea, and India see strong growth in hybrid cloud demand from finance, retail, and public sectors. The Asia Pacific Data Center Racks Market supports this hybrid shift with tailored solutions for emerging enterprise needs. These racks improve uptime, scalability, and asset visibility.

Market Challenges

Infrastructural and Power Limitations in Emerging Regions Restrain Rack Performance and Deployment

Emerging economies face challenges due to poor grid reliability, limited fiber connectivity, and space constraints. Power caps at facility level prevent high-density rack adoption, especially outside metro areas. Many data centers still operate with legacy cooling systems incompatible with newer rack designs. The lack of skilled personnel delays rack assembly and integration. Supply chain disruptions raise delivery lead times for imported components. Despite rising demand, rack upgrades in smaller facilities remain inconsistent. The Asia Pacific Data Center Racks Market encounters friction in balancing cost-efficiency with performance needs. Infrastructure gaps directly limit the growth of high-performance, scalable rack systems.

Complexity in Customization and Integration Across Diverse Compliance Standards

Rack vendors must cater to highly fragmented regulatory landscapes across Asia Pacific countries. Each nation enforces different safety, electrical, and data protection standards, complicating rack certification. Customizing racks for multi-region use adds cost, time, and engineering challenges. Enterprises also demand rack-level security, telemetry, and compliance monitoring. Interoperability across different systems becomes difficult without standardized frameworks. Procurement delays increase when custom builds don’t meet compliance deadlines. The Asia Pacific Data Center Racks Market faces rising technical and compliance burdens for OEMs and integrators. This complexity raises entry barriers for new players.

Market Opportunities

Expansion of AI and Edge Applications Unlocks New Revenue Streams for Rack Vendors

Demand for localized processing, AI model training, and high-speed content delivery creates strong rack growth potential. Compact edge racks and AI-optimized systems offer new monetization avenues. The Asia Pacific Data Center Racks Market benefits from this rising demand, especially in underserved urban and rural zones.

Public and Private Investments in Digital Infrastructure Fuel Long-Term Rack Deployment

Government-backed digitization plans and private cloud expansions drive large-scale rack procurement. Growth in smart cities, fintech hubs, and digital health ecosystems increases rack infrastructure needs. This investment environment creates sustainable demand across verticals.

Market Segmentation

By Rack Type

Cabinet racks dominate the Asia Pacific Data Center Racks Market due to their security, airflow control, and high-density support. They enable efficient cable management and integrated power solutions in large facilities. Open-frame racks remain popular in test environments and edge nodes for easier access. The “Others” category includes custom or hybrid frames used in non-standard deployments.

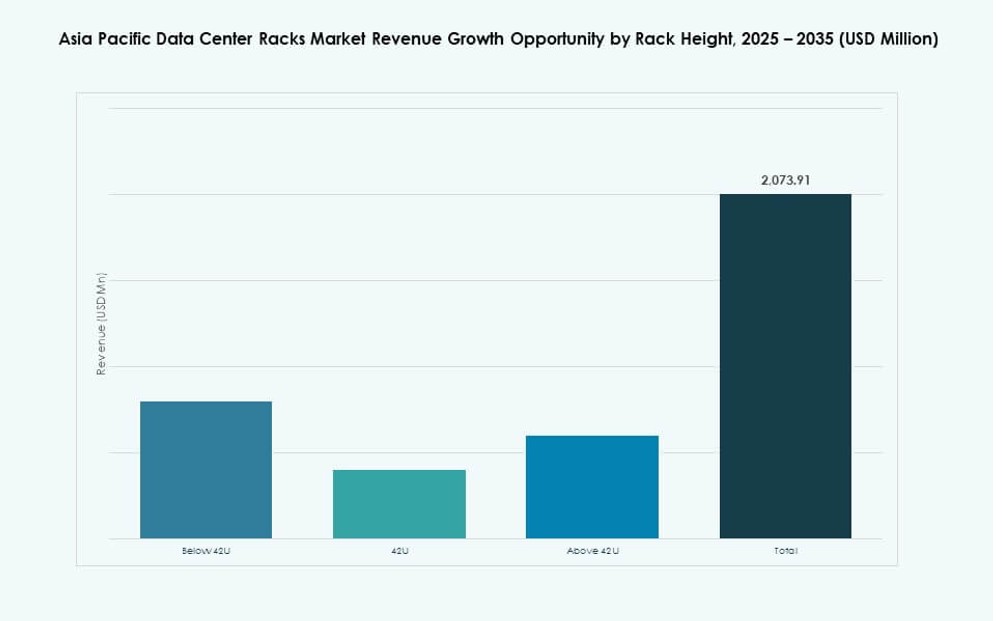

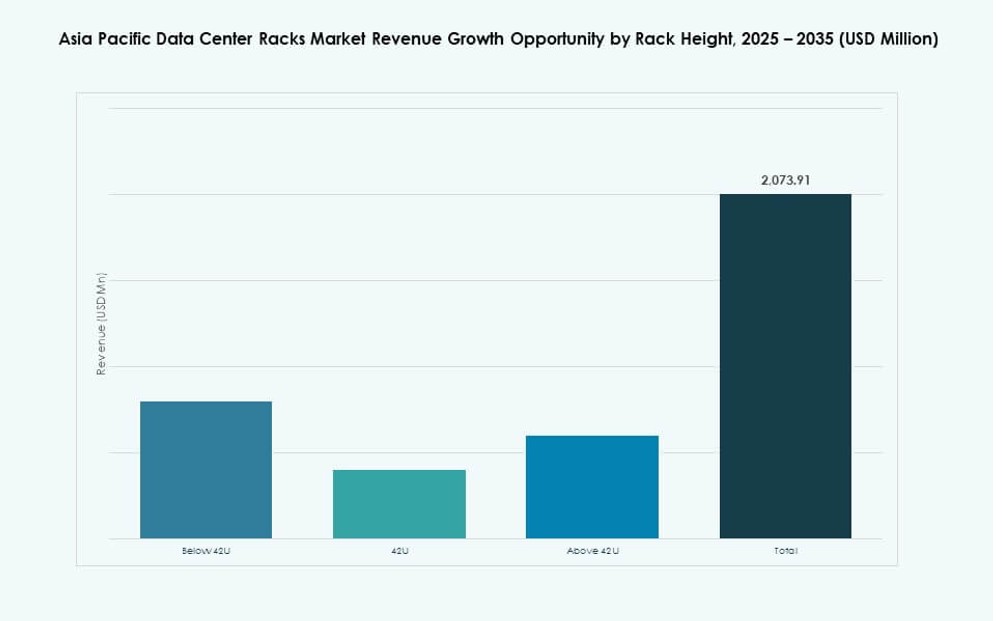

By Rack Height

42U racks hold the largest market share due to their balance of capacity, footprint, and cooling compatibility. These racks suit enterprise and hyperscale setups alike. Below 42U racks see demand in edge environments where space and power are limited. Above 42U racks are preferred in facilities pushing high-density or HPC clusters.

By Width

19-inch racks dominate the Asia Pacific Data Center Racks Market due to global standardization and component compatibility. They are widely adopted across data center tiers. 23-inch racks find use in telecom and energy applications that require wider cable pathways. Other widths are deployed in custom setups for military, research, or industrial workloads.

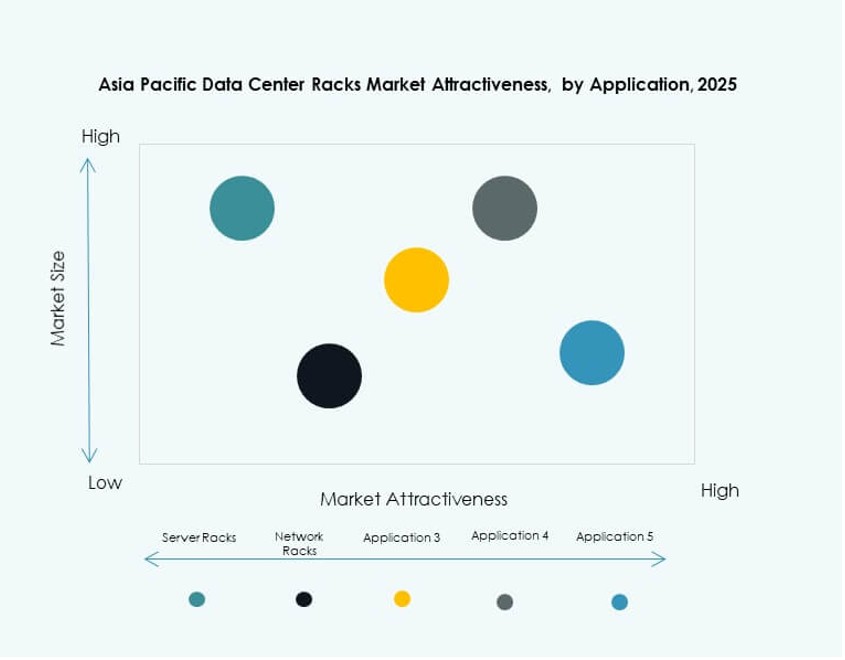

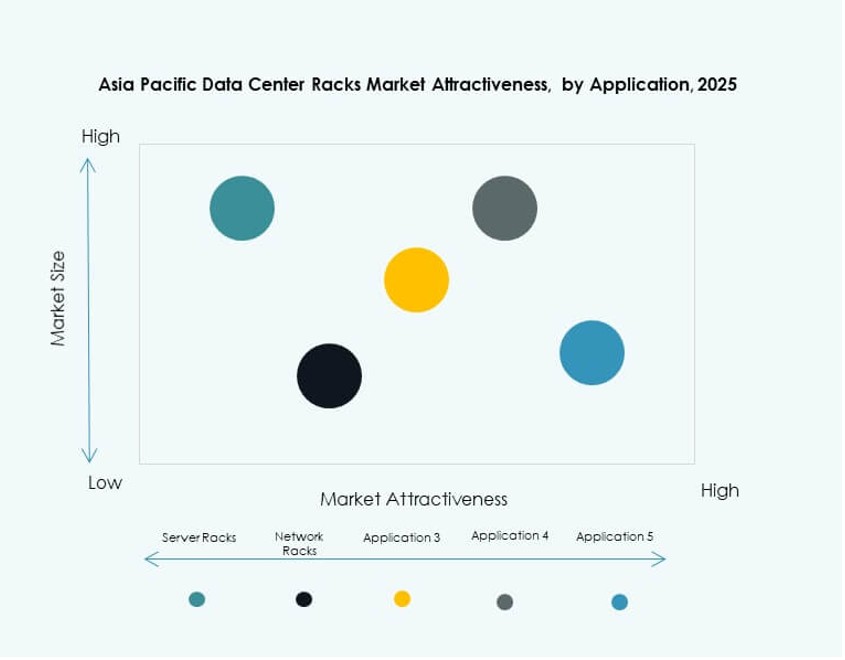

By Application

Server racks account for the largest share as they house core compute infrastructure. Enterprises and hyperscalers prioritize thermal and airflow management in these systems. Network racks support switching and routing gear and grow in demand alongside distributed edge buildouts. Both rack types are critical to scalable IT environments.

By End-user

Large data centers lead demand due to hyperscale and colocation expansions. These operators require energy-efficient and modular rack solutions at scale. Small and mid-sized data centers adopt flexible, hybrid racks with integrated monitoring features. Both segments contribute to regional growth in rack shipments.

By Vertical

IT & Telecom dominates the vertical segmentation due to continued cloud growth and 5G deployments. BFSI follows with demand for secure, redundant racks that meet compliance mandates. Government, defense, and healthcare sectors deploy high-security racks for sovereign cloud. Retail and energy segments adopt edge racks for decentralized operations. Others include education and media use cases with customized infrastructure needs.

Regional Insights

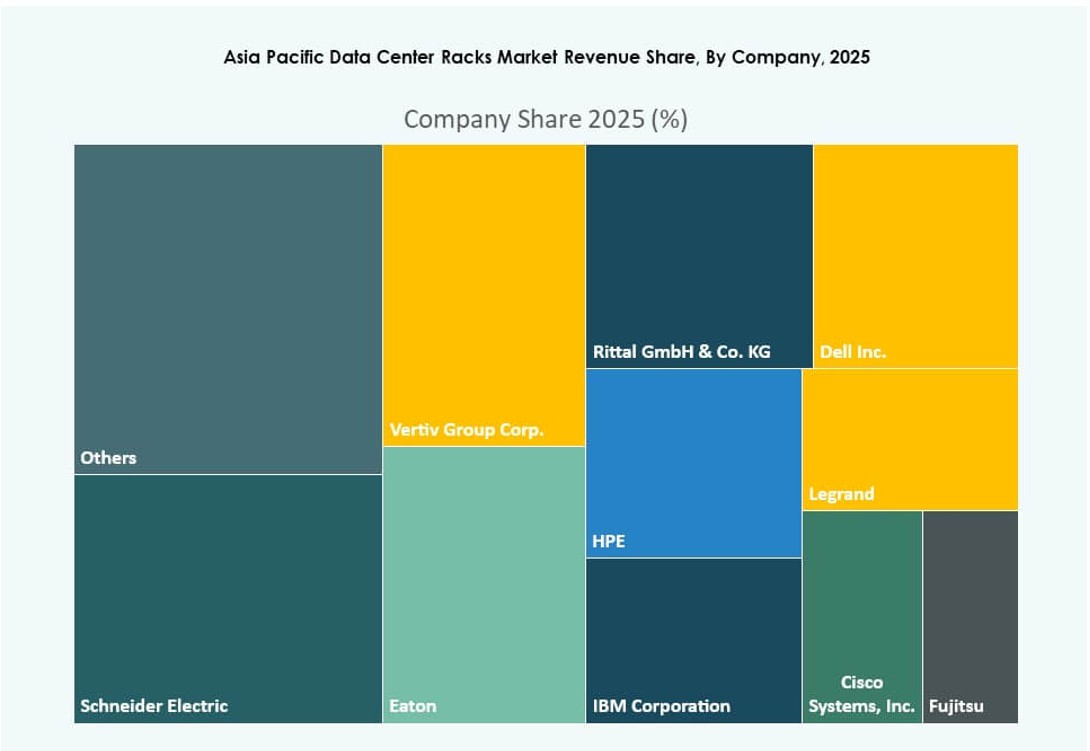

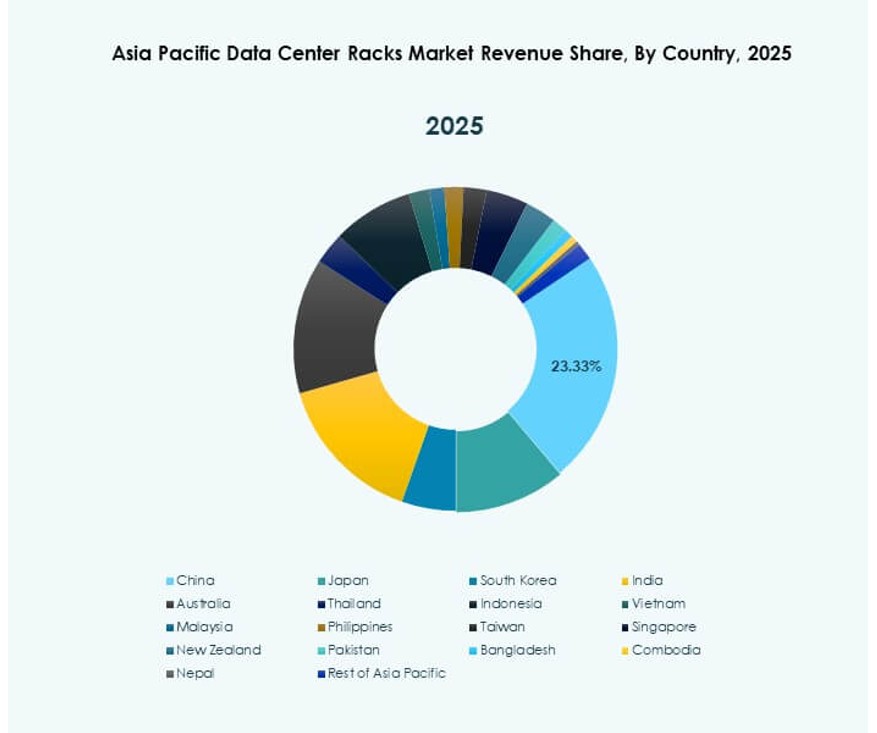

China and Japan Lead the Market with a Combined Share of Over 50%

China and Japan account for more than 50% of the Asia Pacific Data Center Racks Market. China’s hyperscale growth, local manufacturing, and data sovereignty laws drive rack procurement. Japan’s demand comes from its advanced cloud sector and AI cluster buildouts. Both countries invest in AI-optimized, liquid-cooled racks. These nations also influence regional standards and OEM innovation. Rack vendors benefit from strong infrastructure support and predictable policy frameworks.

India, South Korea, and Australia Emerge as Growth Hubs with Cloud and AI Expansions

India’s rapid digitalization, 5G rollout, and rising cloud adoption fuel demand for diverse rack sizes. South Korea drives rack growth through its AI-first government programs and telco edge initiatives. Australia’s data sovereignty policies and AI infrastructure investments support modular rack systems. These three countries contribute over 30% of the market. Rack vendors expand partnerships with colocation providers and integrators in these areas. It supports diverse rack deployments across hyperscale, edge, and hybrid zones.

- For instance, Reliance Jio expanded its JioCloud platform in 2024 by enhancing edge data center capacity across Navi Mumbai and other regions to support AI, 5G, and enterprise cloud workloads. The deployments align with India’s growing demand for sovereign cloud and low-latency infrastructure.

Southeast Asia Gains Momentum with Edge Growth and Regional Cloud Deployments

Southeast Asia, including Singapore, Indonesia, Malaysia, and the Philippines, holds nearly 20% share. Singapore leads due to its colocation density and smart city architecture. Indonesia and the Philippines see rising rack demand from edge and submarine cable landings. Malaysia invests in AI parks and digital transformation, boosting modular rack deployment. The Asia Pacific Data Center Racks Market benefits from regional initiatives and cross-border cloud strategies. Rack vendors capitalize on localization needs, compact systems, and flexible deployment models.

- For instance, Telkom Indonesia’s Palapa Ring project delivered nationwide fiber backbone coverage by connecting over 500 districts, enabling edge data center growth to support digital services and cloud expansion across rural and urban regions.

Competitive Insights:

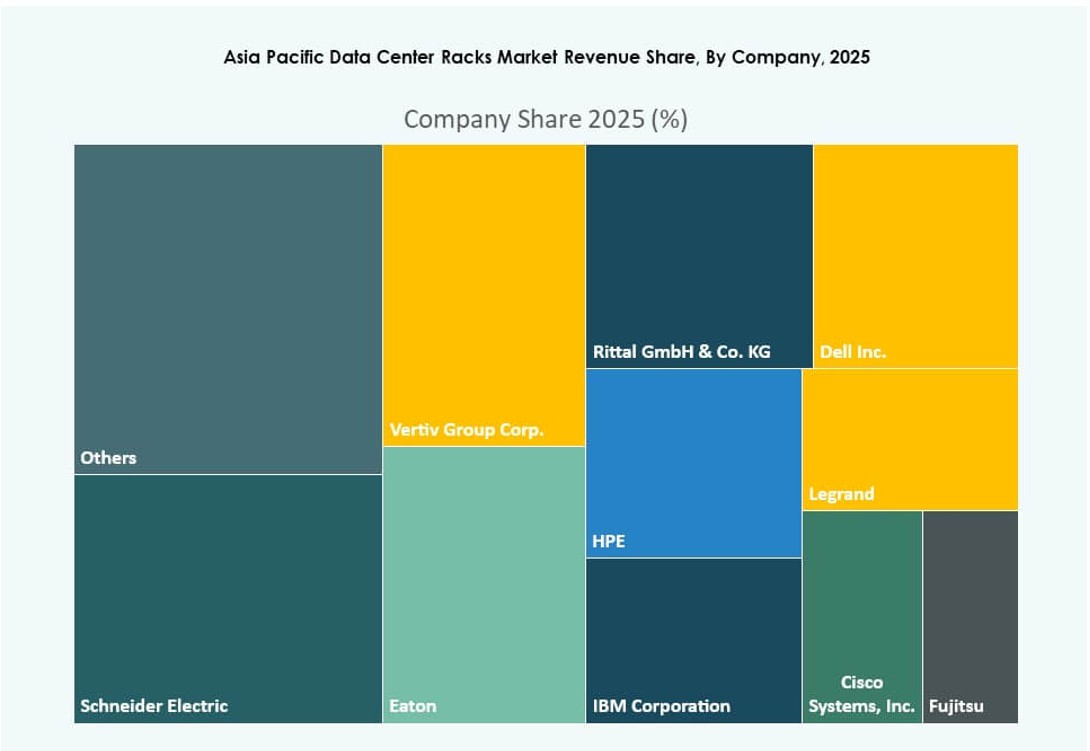

- Schneider Electric

- Vertiv Group

- Rittal

- Eaton

- Cisco Systems, Inc.

- Hewlett Packard Enterprise Development LP

- Dell Inc.

- Fujitsu

- Legrand

- Conteg Asia

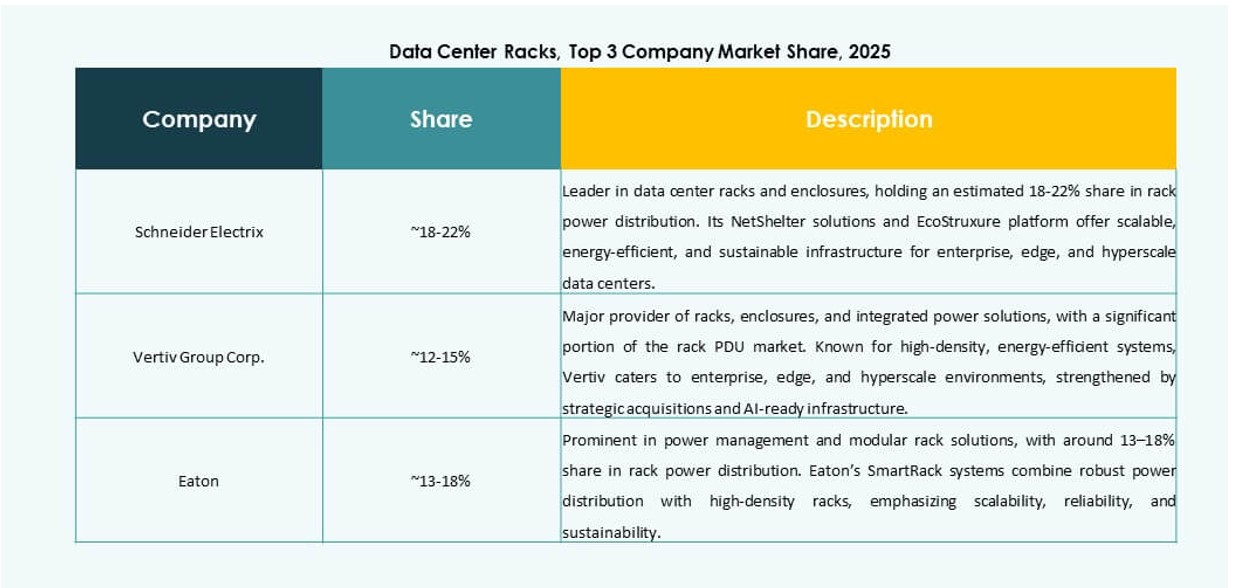

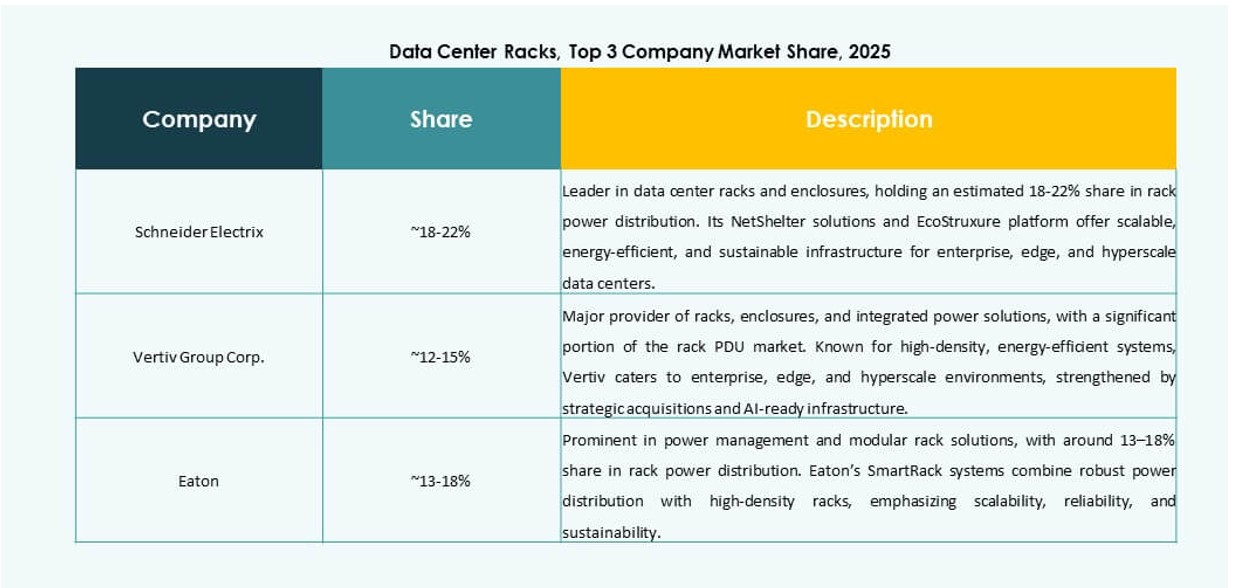

The Asia Pacific Data Center Racks Market features a mix of global giants and regional specialists competing across infrastructure, integration, and innovation. Schneider Electric, Vertiv, and Rittal dominate the high-density cabinet segment with strong thermal and power integration. Cisco, HPE, and Dell influence rack specifications through server and network hardware integration. Eaton and Legrand focus on power and connectivity within rack systems, while local players like Conteg Asia serve emerging markets with cost-optimized designs. Strategic alliances, such as OEM integrations and colocation partnerships, shape competitive positioning. It remains highly dynamic, with rising demand for modularity, cooling efficiency, and localized compliance. Vendors focus on turnkey rack ecosystems combining hardware, power, and software for monitoring and orchestration.

Recent Developments:

- In October 2025, Rittal launched the MGX™ Architecture Rack during the OCP Global Summit. The new rack system features flexible 19″ rail designs, adjustable cross-members, and high electrical capacity, addressing AI-ready and hyperscale deployments.

- In August 2025, Vertiv Group completed the USD 200 million acquisition of Great Lakes Data Racks & Cabinets to enhance its portfolio of high-density and liquid-cooled racks. The deal boosts Vertiv’s capabilities in pre-engineered rack systems tailored for AI and edge deployments

- In April 2025, Legrand acquired Computer Room Solutions (CRS), a Sydney-based provider of server racks and data center infrastructure. The acquisition expands Legrand’s presence in the Asia Pacific Data Center Racks Market by strengthening its white-space solution offerings across Australia and Oceania.