Executive summary:

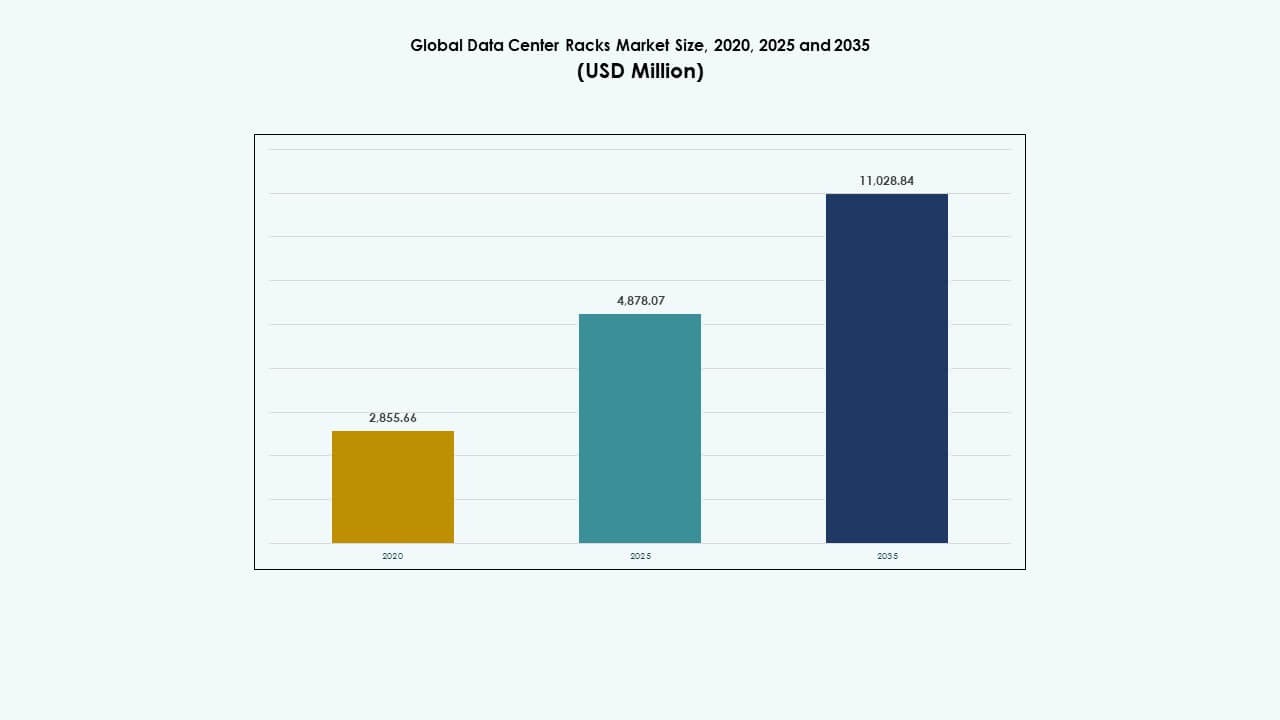

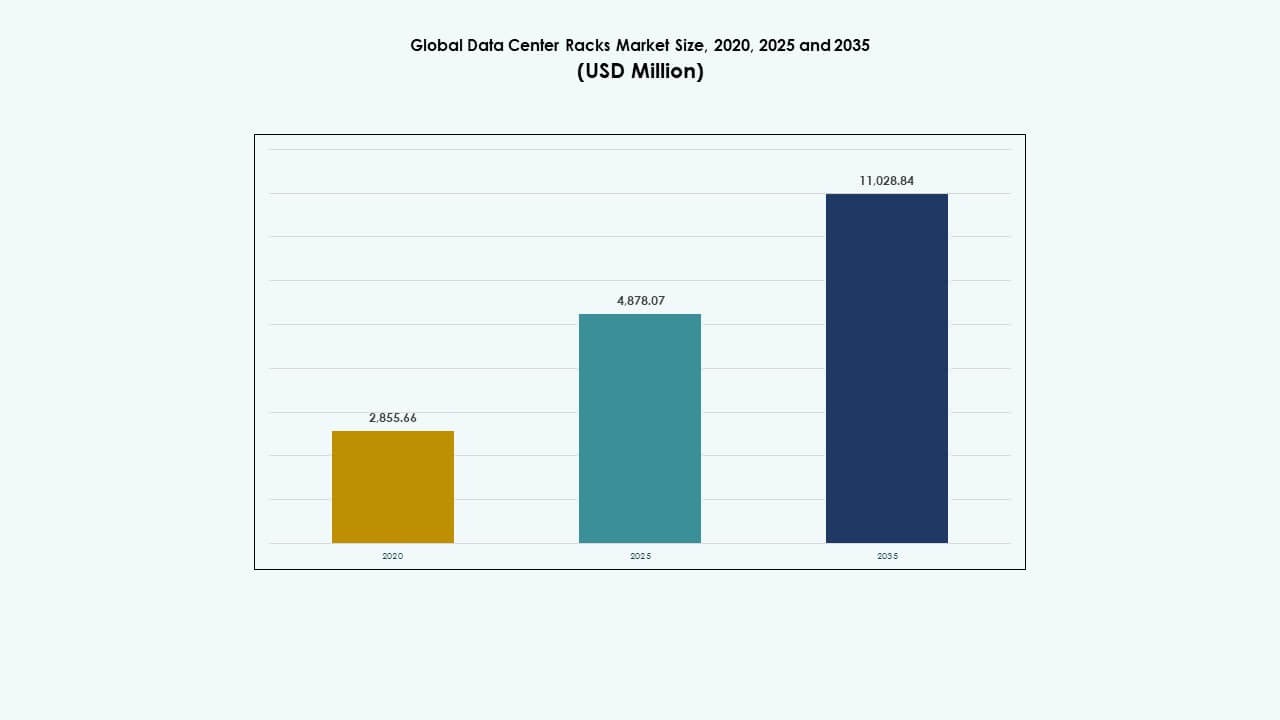

The Global Data Center Racks Market size was valued at USD 2,855.66 million in 2020 to USD 4,878.07 million in 2025 and is anticipated to reach USD 11,028.84 million by 2035, at a CAGR of 8.46% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Data Center Racks Market Size 2025 |

USD 4,878.07 Million |

| Data Center Racks Market, CAGR |

8.46% |

| Data Center Racks Market Size 2035 |

USD 11,028.84 Million |

The market grows due to rapid cloud adoption, rising AI workloads, and expanding hyperscale data centers. Enterprises upgrade infrastructure to support high-density compute and efficient cooling. Innovation in modular racks, smart monitoring, and liquid cooling improves performance and uptime. Edge computing drives compact and rugged rack demand. These shifts make the market strategic for businesses seeking scalable digital infrastructure and for investors targeting long-term data growth themes.

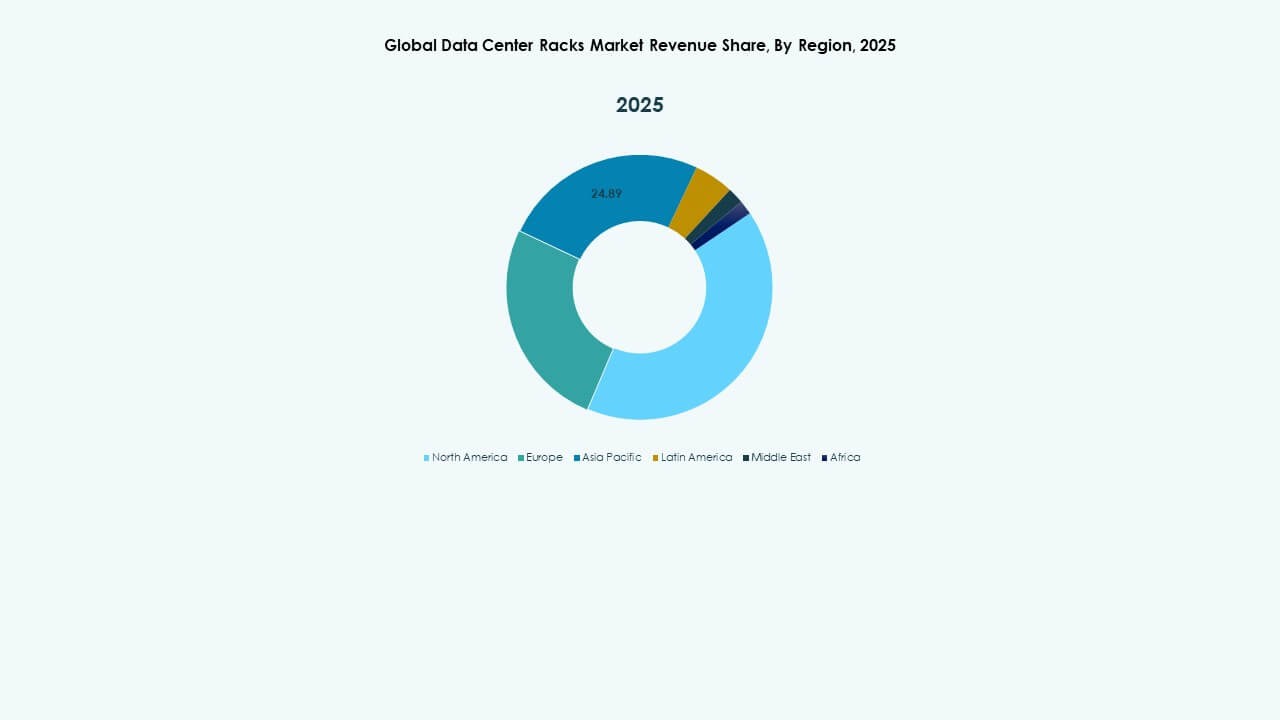

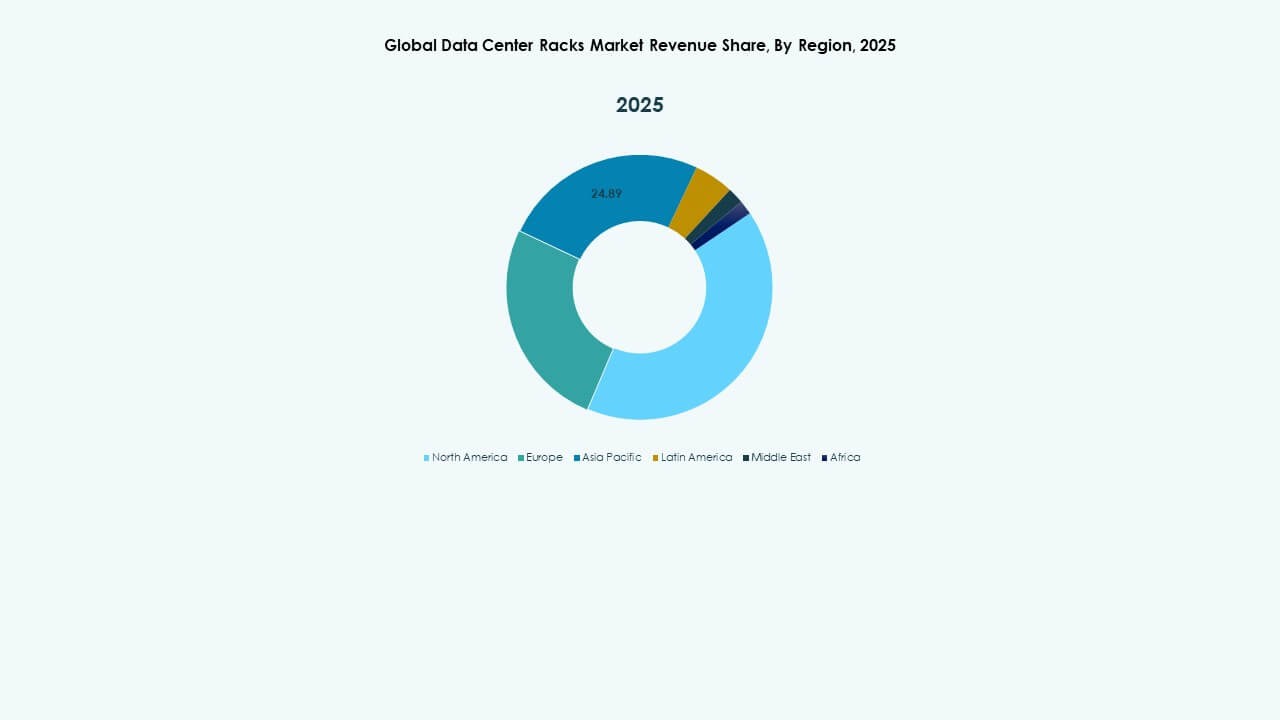

North America leads due to mature cloud ecosystems and strong hyperscale investments. Europe follows with demand shaped by data sovereignty and sustainability goals. Asia-Pacific emerges quickly, led by China, India, and Southeast Asia, driven by internet growth and data localization. Latin America and the Middle East show gradual expansion as colocation projects rise. Regional momentum reflects digital adoption, policy support, and infrastructure modernization.

Market Dynamics:

Market Dynamics:

Surging Data Volume and Need for Optimized Infrastructure Across Hyperscale and Colocation Facilities

Global enterprises are generating large volumes of structured and unstructured data every day. This growth demands scalable, modular, and high-density storage infrastructure. The Global Data Center Racks Market plays a central role in organizing, protecting, and powering server environments. Hyperscale providers prefer racks that support dense server stacking, cooling optimization, and cable management. Colocation players seek flexible rack designs to serve diverse customer requirements. Increased enterprise digitization also fuels rack deployments across retail, healthcare, and BFSI sectors. The market addresses demands for real-time data access, uptime, and performance. It enables rapid equipment installation and configuration, which lowers operational delays and cost. Strategic investments in rack systems support long-term scalability and infrastructure lifecycle extension.

Rapid Shift Toward Edge Computing and High-Performance Computing (HPC) Environments

Rising IoT usage and latency-sensitive applications are shifting compute needs to the edge. Compact, ruggedized racks are critical to deploying servers at edge locations like factories, telecom towers, and branch offices. The Global Data Center Racks Market addresses this shift by offering integrated cooling and power designs suited for distributed environments. AI training, HPC clusters, and content delivery networks also require rack systems that handle high heat loads and large cable volumes. Rack-level intelligence supports monitoring of thermal, power, and security parameters. Businesses demand infrastructure that supports mobility, configurability, and redundancy. The market supports these requirements by offering precision-engineered enclosures for diverse compute environments. It plays a key role in decentralizing compute and reducing cloud latency.

- For instance, Schneider Electric’s APC NetShelter SX AR3100 racks offer 42U height, a 600mm width, 1364 kg static load capacity, and adjustable mounting rails, making them suitable for high-density IT and edge deployments.

Technology Advancements in Rack Design, Power Distribution, and Remote Monitoring Capabilities

Modern racks integrate intelligent power distribution units (iPDUs), access control, and environmental sensors. These technologies enable IT teams to monitor rack status remotely and respond proactively to issues. The Global Data Center Racks Market is evolving with features such as airflow optimization, sliding rails, and cable trays to support faster maintenance. Rack manufacturers are investing in lighter materials, reusable frame systems, and seismic-rated enclosures. Tool-less mounting options accelerate server installation in dynamic cloud setups. The integration of smart locking systems supports compliance and operational security. Rack vendors also offer customization services for depth, width, and height based on customer layout needs. These technical upgrades enhance uptime, space utilization, and energy efficiency.

- For instance, Rittal’s TS IT racks support a 1500 kg static load, offer adjustable depth from 600 mm to 1200 mm, and feature tool-less mounting rails, making them ideal for flexible, high-density data center deployments.

Growing Emphasis on Sustainability, Energy Efficiency, and Green Data Center Standards

Organizations are prioritizing energy savings and carbon footprint reduction across their IT infrastructure. Racks that support liquid cooling and airflow containment are gaining adoption. The Global Data Center Racks Market is influenced by green building certifications like LEED, BREEAM, and Green Grid standards. Data centers increasingly use hot-aisle/cold-aisle containment strategies supported by rack design. Eco-friendly coatings, recycled materials, and optimized logistics are part of vendor sustainability programs. Efficient rack layouts reduce the total square footage needed, lowering real estate and cooling costs. Energy-efficient racks also support power-dense equipment such as GPUs and AI servers. This shift aligns rack design with enterprise ESG goals and energy compliance mandates.

Market Trends

Market Trends

Rising Demand for Modular Rack Systems to Support Scalability and Rapid Deployment

Companies are deploying data centers faster to meet expanding digital workloads. Modular racks are becoming standard due to ease of installation, expandability, and cost-effectiveness. The Global Data Center Racks Market is seeing a shift toward configurable enclosures tailored to site constraints and cooling methods. Modular units reduce lead times, improve floor planning, and minimize integration issues. Enterprises favor racks with field-adjustable rails, pre-installed cable managers, and fast assembly systems. Standardization across modular designs also enhances supplier consistency and component compatibility. These racks are especially useful in containerized or prefabricated data centers. The trend allows quicker response to new business demands while maintaining rack performance.

Integration of Artificial Intelligence and IoT for Real-Time Monitoring and Predictive Maintenance

Rack systems now embed IoT sensors for thermal, humidity, airflow, and vibration monitoring. AI tools analyze sensor data to predict hardware failure and optimize power and cooling. The Global Data Center Racks Market includes intelligent rack offerings that enhance data center management via automation. Real-time dashboards display rack-level metrics, improving visibility across multi-site operations. Predictive analytics help avoid costly outages and extend equipment life. These systems also support automated alerts, fault detection, and usage insights. AI-driven rack intelligence reduces manual intervention and operational costs. This convergence of hardware and software strengthens rack value beyond mechanical functions.

Higher Adoption of Open Compute Project (OCP) Standards and Open Architecture Designs

OCP-compliant racks are gaining popularity in hyperscale and cloud environments. Open rack architecture promotes interoperability, airflow efficiency, and optimized cable paths. The Global Data Center Racks Market is seeing increased demand for vendor-neutral, standards-based designs. OCP racks support higher power density and tool-less maintenance features. Cloud providers adopt these racks to simplify procurement and streamline operations across global facilities. Open rack adoption reduces integration time and allows greater customization. It also improves inventory control through modular, swappable components. This trend supports long-term operational agility and supplier independence.

Growth in 48U and 52U Rack Units to Maximize Vertical Space Utilization

Growth in 48U and 52U Rack Units to Maximize Vertical Space Utilization

With rising compute density, operators are adopting taller racks to accommodate more servers per footprint. 48U and 52U enclosures are replacing traditional 42U racks in high-density deployments. The Global Data Center Racks Market is shifting to vertical expansion for better space efficiency. Taller racks reduce real estate costs and support AI, GPU, and HPC workloads with higher power needs. They also improve thermal management with more controlled airflow channels. Structural stability and cable support are key design enhancements in taller rack models. Vendors offer reinforced frames and seismic compliance for these high-rise enclosures. The trend helps hyperscale and enterprise data centers scale within existing facilities.

Market Challenges

Thermal Management Complexity and Rising Cooling Demands Across High-Density Deployments

High-power workloads generate more heat per rack, requiring advanced thermal solutions. Rack designs must align with airflow strategies across rows, aisles, and entire rooms. The Global Data Center Racks Market faces challenges in balancing rack capacity with cooling efficiency. Improper airflow causes thermal hotspots and reduces hardware performance. Integration of liquid or rear-door cooling systems adds cost and complexity. Space constraints in edge or retrofitted sites also limit cooling options. Coordinating rack design with CRAC units, in-row cooling, and containment becomes critical. Failure to maintain proper temperatures impacts uptime, service life, and energy efficiency.

Infrastructure Compatibility, Supply Chain Disruptions, and Cost Pressures on Custom Rack Solutions

Custom racks tailored to unique site needs may create integration hurdles with existing components. Compatibility with cable trays, power systems, and mounting accessories varies across vendors. The Global Data Center Racks Market must address these compatibility gaps while meeting lead time expectations. Global supply chain issues impact steel, aluminum, and component availability. Freight delays and inflation increase rack production and delivery costs. Smaller facilities may struggle to justify investment in high-end rack features. Rapidly changing requirements challenge product standardization efforts. Ensuring long-term rack compatibility across IT refresh cycles requires planning and support coordination.

Market Opportunities

Market Opportunities

Expansion of Edge Data Centers, Telecom Hubs, and AI Training Facilities in Underserved Regions

The growing need for low-latency processing is expanding edge deployments in remote and Tier II locations. Compact, rugged, and pre-configured racks are in demand for outdoor and telecom cabinet environments. The Global Data Center Racks Market can serve telecom, smart city, and industrial edge applications. Rack vendors are also gaining traction in AI training facilities requiring high heat tolerance and optimized cable routing. These emerging setups need scalable racks that integrate with containerized, modular, or micro data center formats.

Rising Investments in Hyperscale Infrastructure and Green Data Center Programs Worldwide

Hyperscale cloud and colocation providers are increasing investments in large-scale data center campuses. These projects need high-density racks that support power-intensive computing and environmental goals. The Global Data Center Racks Market can offer energy-efficient, smart, and space-saving enclosures to address this shift. Green data centers adopting renewable power and liquid cooling require compatible rack formats. Vendors that align with sustainability, safety, and smart monitoring standards will tap into global hyperscale expansion plans.

Market Segmentation:

By Rack Type

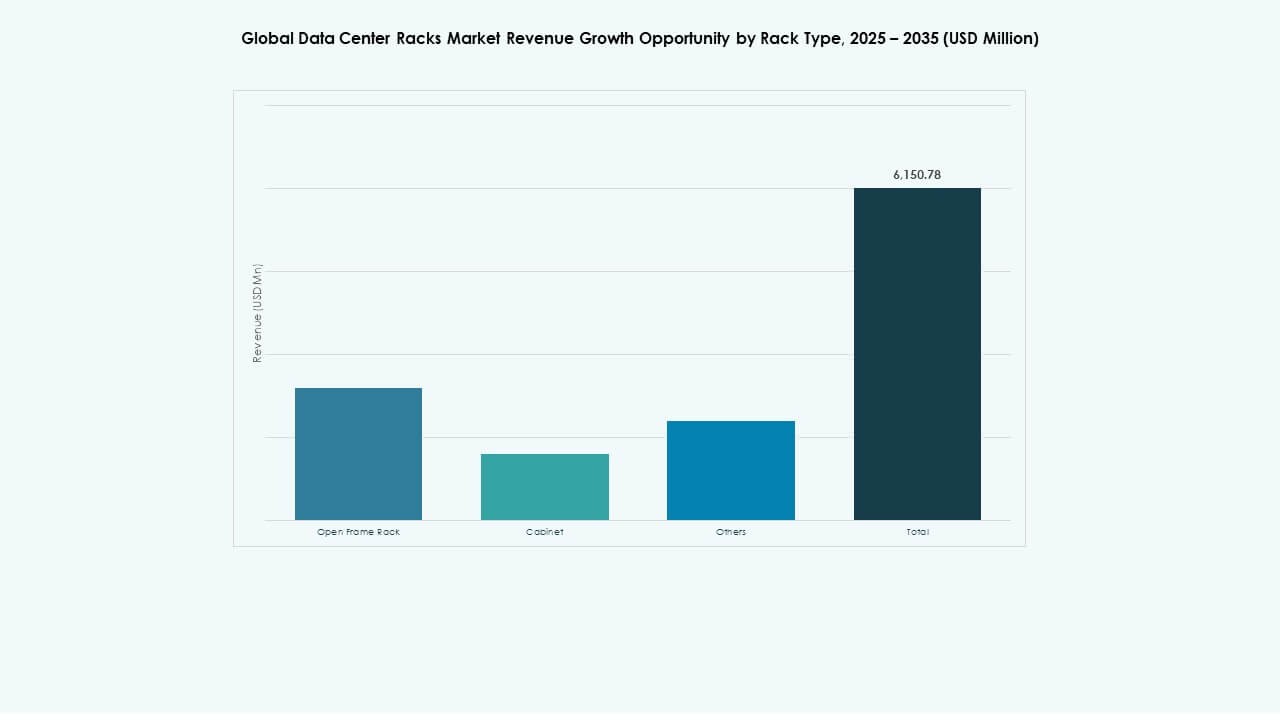

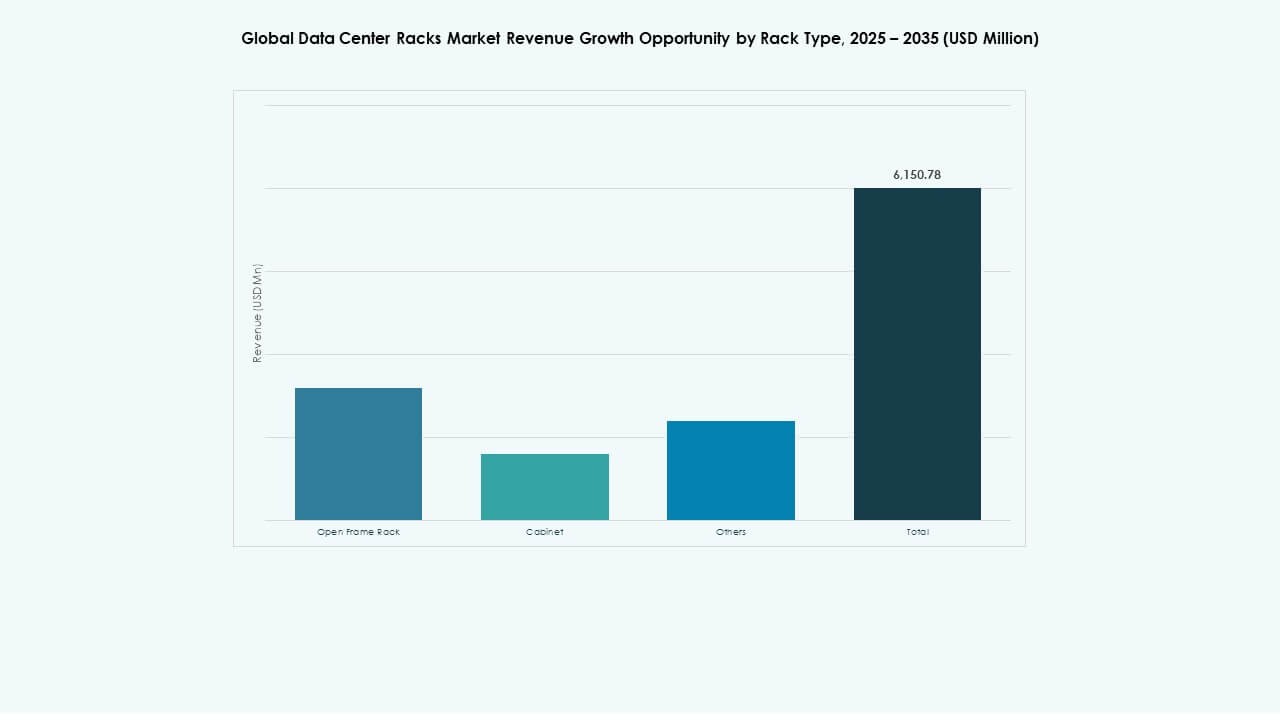

The Global Data Center Racks Market shows that Cabinet racks hold the largest share due to strong demand for enclosed, secure environments that support high‑density servers and better cooling control. Open Frame Rack units follow, preferred in space‑constrained and cost‑sensitive deployments where airflow matters more than enclosure. Others include custom and specialized enclosures for niche needs. Growth in modular data centers and rising demand from colocation providers drive adoption of varied rack types. Cabinets lead with stability, while open frame units expand in edge and SMB settings.

By Rack Height

In the Global Data Center Racks Market, 42U racks are dominant, balancing capacity and floor space efficiency for most enterprise and cloud facilities. Above 42U models show rapid growth due to hyperscale and high‑density computing needs that demand vertical expansion. Below 42U units serve edge, branch, and SMB data centers seeking compact solutions. Height choices reflect performance, cooling, and scalability demands. Taller racks gain traction where real‑estate costs are high, while mid‑range units remain standard for general IT deployments.

By Width

The Global Data Center Racks Market sees 19 Inch width as the most widely adopted standard, given its compatibility with most servers and networking gear. 23 Inch racks gain traction in specialized segments requiring higher equipment breadth or legacy system support. Others include variable widths tailored to telecom cabinets and custom enclosures for industrial edge. Standardization around 19 Inch drives procurement efficiency and interoperability. Wider options grow where unique infrastructure designs or non‑standard hardware shapes demand flexibility. Market preference leans toward standardized widths for easier integration and maintenance.

By Application

In the Global Data Center Racks Market, Server Racks dominate due to widespread server proliferation across cloud, enterprise, and hyperscale facilities. These racks support compute infrastructure that underpins digital transformation and critical workloads. Network Racks grow steadily as network equipment density increases with SD‑WAN, 5G, and IoT expansions. Server rack demand reflects broader IT modernization and virtualization trends. Network racks expand where connectivity and bandwidth demands rise. Both applications benefit from design improvements that enhance airflow, cabling, and power distribution.

By End‑User

The Global Data Center Racks Market shows Large Data Centers as the leading end‑user segment, driven by cloud operators and hyperscale facilities investing in high‑density, redundant rack infrastructure. Small and Mid‑sized Data Centers grow as SMBs adopt digital services, edge computing, and hybrid cloud strategies, creating demand for modular, cost‑effective racks. Large centers benefit from economies of scale and advanced cooling designs. Smaller facilities favor flexible and rapid‑deployment rack solutions. Investment patterns reflect diverging needs: scalability and performance at scale versus agility and footprint optimization.

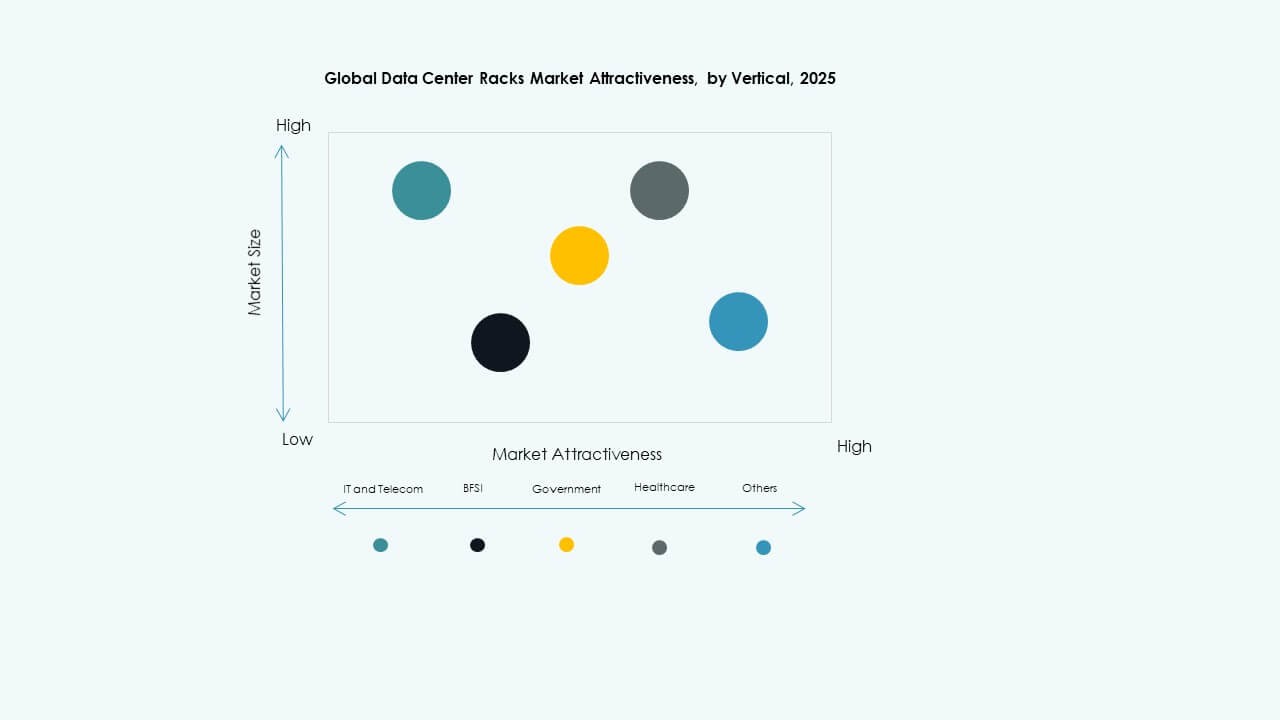

By Vertical

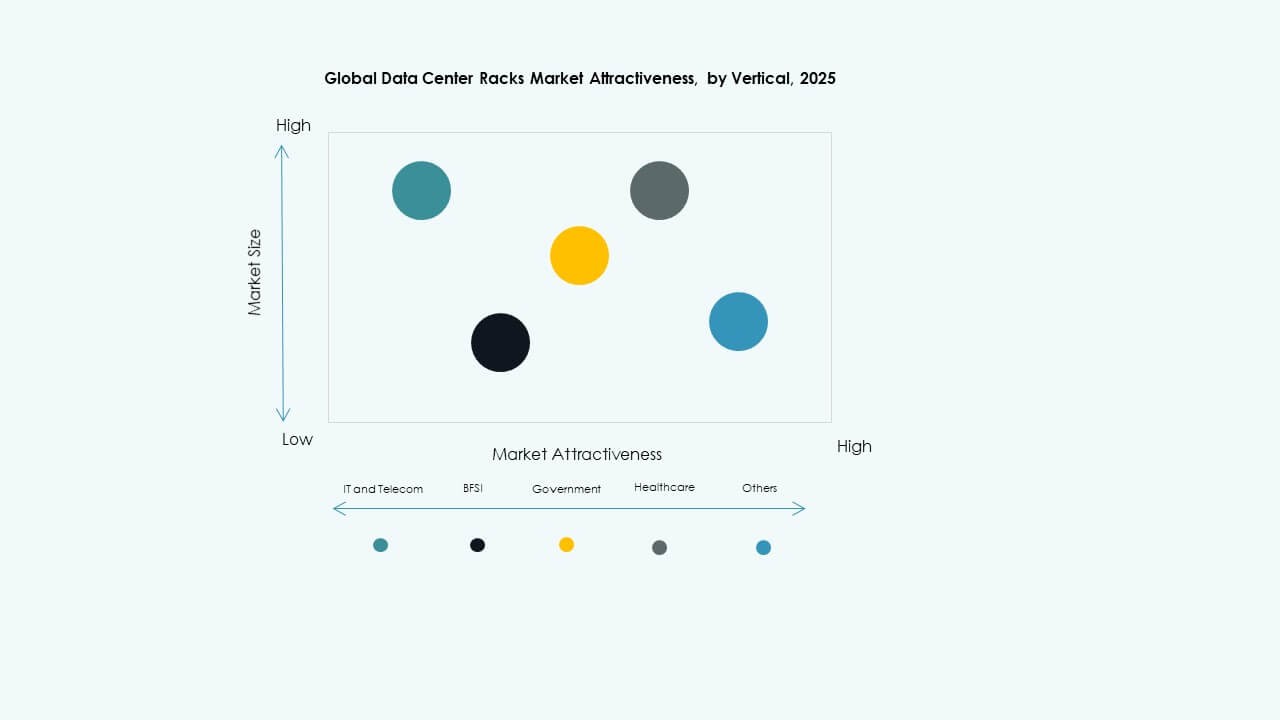

In the Global Data Center Racks Market, IT & Telecom lead due to continued expansion of cloud services, 5G infrastructure, and digital transformation initiatives. BFSI and Healthcare sectors follow, driven by data security, compliance, and analytics needs. Government & Defense demand secure and resilient racks for sensitive workloads. Energy and Retail show steady uptake as digital grid systems and e‑commerce platforms expand. Others cover manufacturing and education, adopting data centers for automation and remote services. Vertical growth ties closely to digital service reliance and sector‑specific regulatory priorities.

Regional Insights:

North America holds the largest share in the Global Data Center Racks Market, accounting for approximately 34.5% of global revenue in 2025. The U.S. leads this growth due to strong investments from hyperscale providers like Amazon, Google, and Meta, along with increasing colocation demand. High adoption of AI, 5G, and cloud-native services further accelerates rack deployments. Canada and Mexico follow with government-supported digital infrastructure plans and rising enterprise cloud usage. The region favors enclosed cabinets and high-density rack systems that integrate power and cooling optimization. It benefits from strong vendor presence, regulatory clarity, and advanced IT ecosystems.

- For instance, Meta has outlined plans for AI data center infrastructure totaling around 2 GW of power capacity and over 1.3 million Nvidia GPUs, with about 1 GW of AI compute expected to be online in 2025.

Europe accounts for nearly 27.8% of the Global Data Center Racks Market. Countries like Germany, the UK, the Netherlands, and France lead due to high data center density, sustainable infrastructure targets, and demand for sovereign cloud services. Data protection regulations such as GDPR drive localized deployments and modular rack design adoption. European providers emphasize liquid cooling, energy efficiency, and scalable enclosures to align with carbon neutrality goals. Eastern Europe shows potential as a growing hub for IT infrastructure, backed by lower land and power costs. The region is evolving toward smart rack integration and Open Compute adoption across multi-tenant facilities.

- For instance, Google plans €5.5 billion investment over four years for computing resources in Germany, including two new data center campuses. Data protection regulations such as GDPR drive localized deployments and modular rack design adoption.

Asia-Pacific contributes around 29.2% and represents the fastest-growing region in the Global Data Center Racks Market. China, India, Japan, South Korea, and Australia drive market demand with hyperscale investments, growing internet users, and edge computing rollouts. China leads in rack volume due to large-scale expansions from Tencent, Alibaba, and China Telecom. India sees rapid demand from cloud services, startup ecosystems, and data localization mandates. Southeast Asian countries such as Malaysia, Indonesia, and the Philippines are emerging as attractive colocation destinations. Rack demand in this region favors scalable, seismic-rated, and power-dense configurations that support diverse workloads. It remains critical for vendors expanding global reach and regional customization.

Competitive Insights:

Competitive Insights:

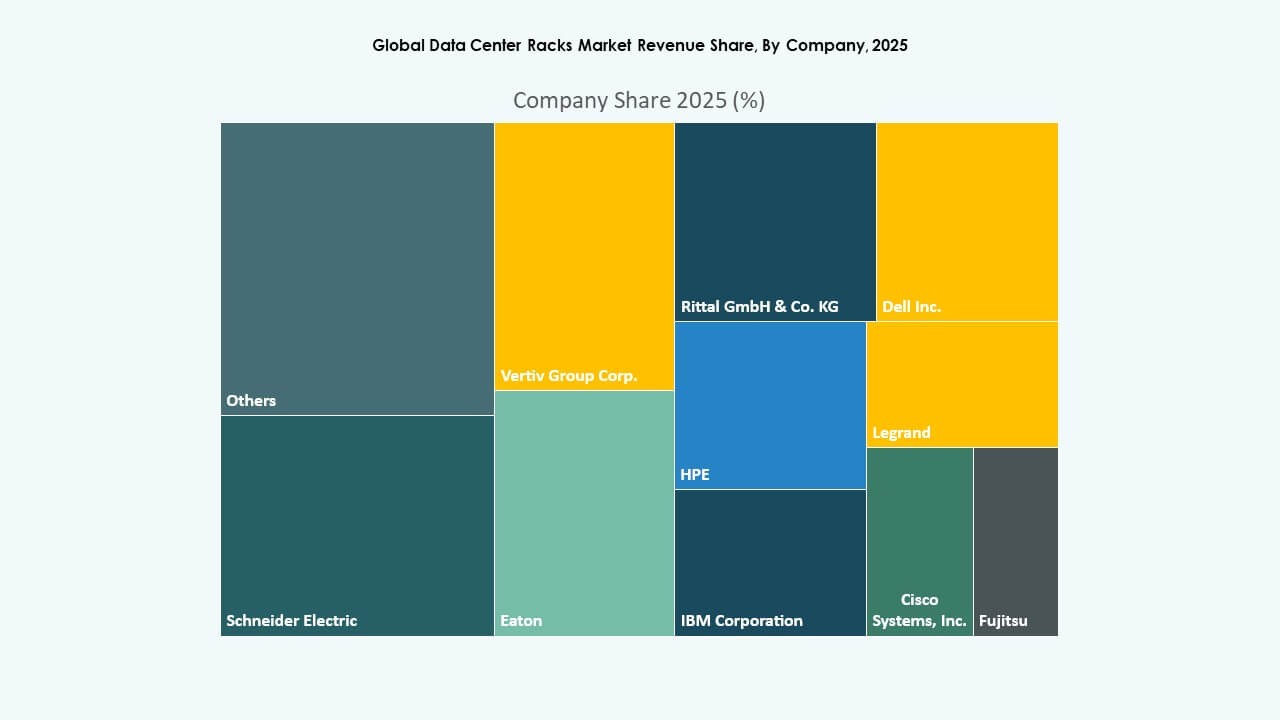

- Belden Inc.

- Chatsworth Products

- Cisco Systems, Inc.

- Dell Inc.

- Eaton

- Fujitsu

- Hewlett Packard Enterprise Development LP

- IBM (International Business Machines Corporation)

- Legrand

- nVent

- Panduit Corp.

- Rittal GmbH & Co. KG

- Schneider Electric

- Vertiv Group Corp.

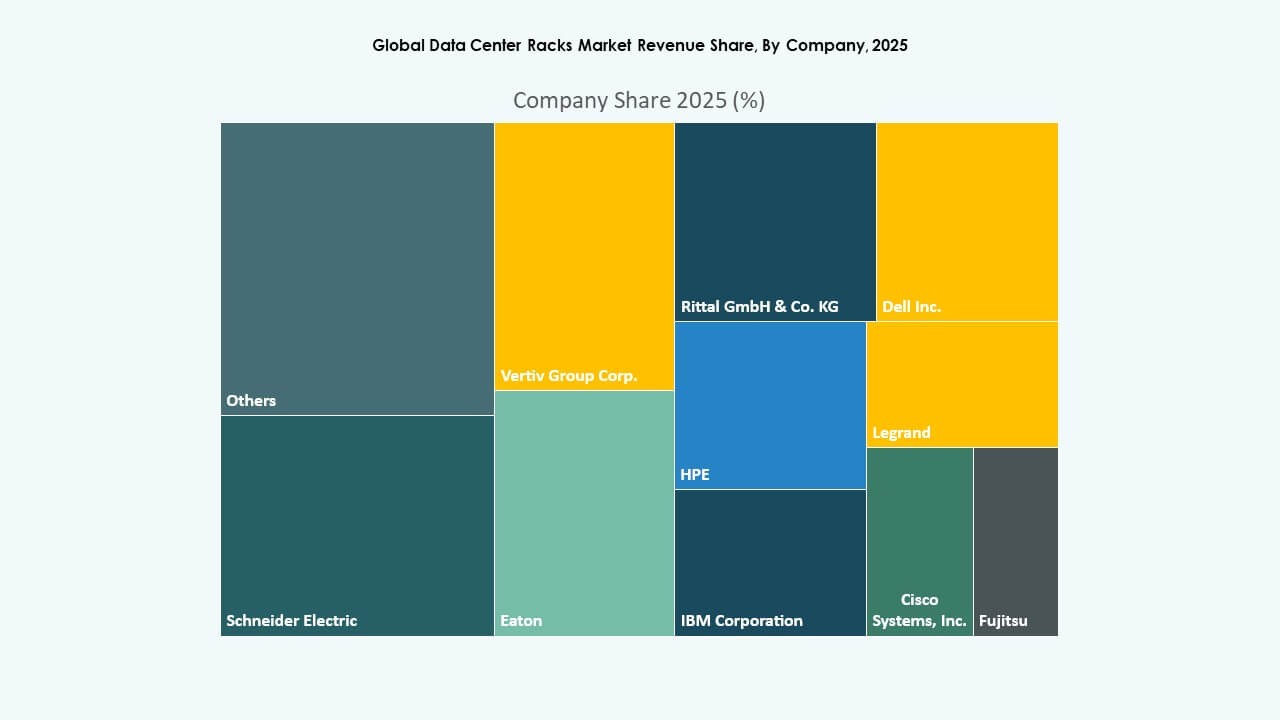

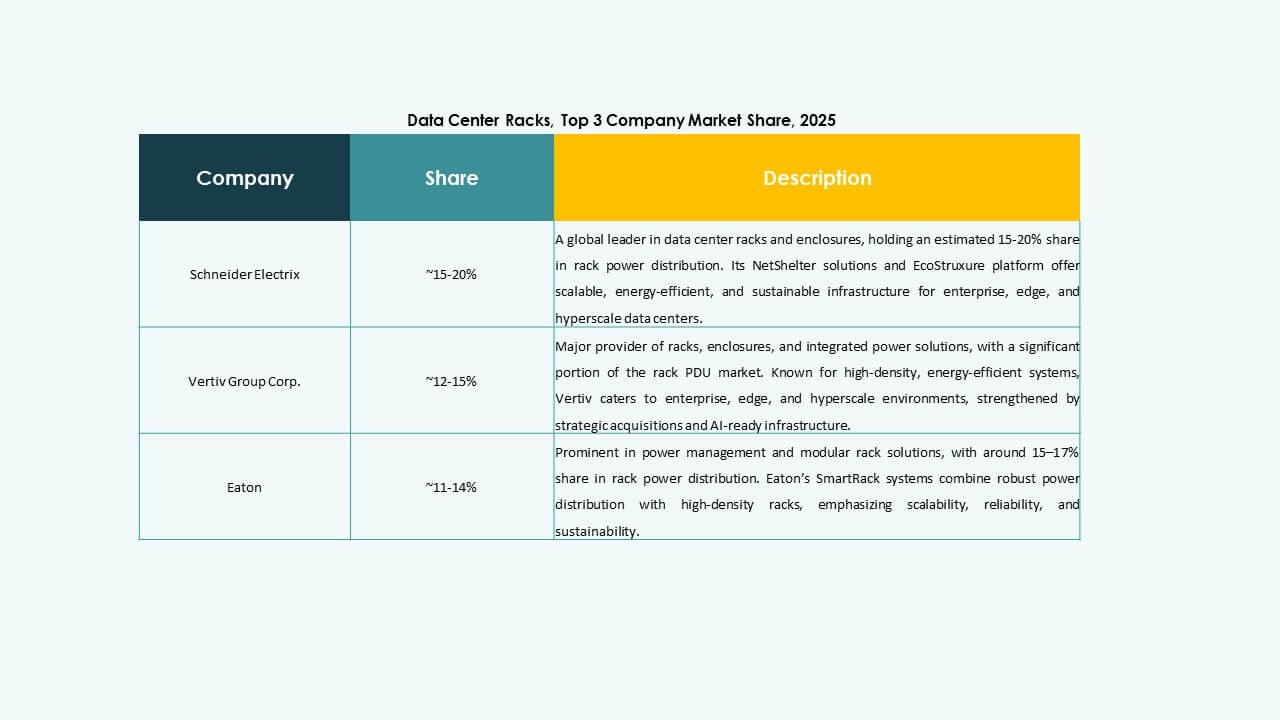

The Global Data Center Racks Market is highly competitive, shaped by global infrastructure vendors and specialized rack manufacturers. Vertiv, Schneider Electric, and Rittal dominate due to their integrated data center portfolios and global supply capabilities. Cisco, Dell, and HPE offer comprehensive IT infrastructure bundles that include rack systems, enhancing their enterprise reach. Chatsworth Products and Panduit serve niche needs with advanced cabling and airflow solutions. AMCO and nVent differentiate through modularity and custom engineering. Companies focus on innovation in rack design, thermal performance, and smart monitoring to capture market share. Strategic partnerships, regional expansions, and product differentiation remain key priorities in this evolving space. The market favors firms that align with sustainability standards and can deliver reliable, scalable rack solutions across diverse deployment models.

Recent Developments:

Recent Developments:

- In May 2025, Vertiv announced a USD 200 million acquisition of Great Lakes Data Racks & Cabinets, based in Edinboro, Pennsylvania, to bolster its pre-engineered rack solutions tailored for AI and edge computing, particularly enhancing high-density and liquid-cooled rack infrastructure.

- In June 2025, Schneider Electric launched new prefabricated modular EcoStruxure pod data center solutions, including high-density NetShelter Racks designed for liquid cooling and AI cluster architectures to meet growing demands for next-generation infrastructure.

- In April 2025, Legrand completed its acquisition of Computer Room Solutions (CRS), a Sydney-based provider of data center infrastructure specializing in white-space solutions like structural ceilings, aisle containment systems, mechanical walls, and racking, which generates about €30 million in yearly revenue and employs around 80 staff.

- In March 2025, Eaton announced an agreement to acquire Fibrebond Corporation, a Louisiana-based leader in pre-integrated modular power enclosures for data centers, for approximately $1.4 billion, with the deal expected to close in Q3 2025 and generate around $110 million in adjusted EBITDA annually.

Market Dynamics:

Market Dynamics: Market Trends

Market Trends Growth in 48U and 52U Rack Units to Maximize Vertical Space Utilization

Growth in 48U and 52U Rack Units to Maximize Vertical Space Utilization Market Opportunities

Market Opportunities Competitive Insights:

Competitive Insights: Recent Developments:

Recent Developments: