Executive summary:

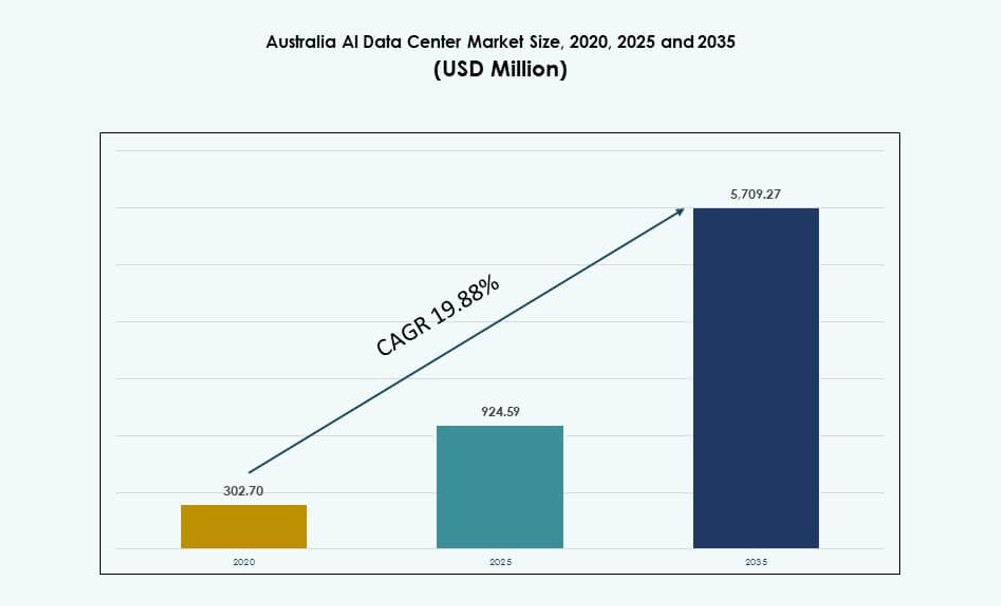

The Australia AI Data Center Market size was valued at USD 302.70 million in 2020 to USD 924.59 million in 2025 and is anticipated to reach USD 5,709.27 million by 2035, at a CAGR of 19.88% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Australia Pacific AI Data Center Market Size 2025 |

USD 924.59 Million |

| Australia Pacific AI Data Center Market, CAGR |

19.88% |

| Australia Pacific AI Data Center Market Size 2035 |

USD 5,709.27 Million |

Australia is witnessing a surge in demand for AI infrastructure driven by enterprise digital transformation, government investments, and sovereign AI mandates. Organizations are adopting high-density GPU clusters and liquid cooling to support advanced workloads across sectors like healthcare, finance, and logistics. Cloud providers and colocation operators are expanding AI-ready capacity to meet performance and compliance needs. Businesses view AI data centers as critical enablers of innovation, automation, and national digital competitiveness. The market offers long-term potential for technology vendors and infrastructure investors.

New South Wales and Victoria dominate the market due to existing hyperscale zones and strong enterprise demand. Sydney and Melbourne remain key locations for data center investments, connectivity, and power access. Queensland and Western Australia are emerging with edge infrastructure supporting mining, agriculture, and regional AI use cases. The spread of 5G and smart city initiatives expands geographic demand. National initiatives around digital sovereignty further strengthen local deployment momentum.

Market Dynamics:

Market Drivers

Rising AI Workload Demand from Public and Private Sector Investments Across Key Australian Cities

The Australia AI Data Center Market is growing rapidly due to escalating demand for AI processing infrastructure from both public and private sectors. Enterprises are deploying AI models for automation, cybersecurity, and decision support, requiring GPU-intensive compute power. Government agencies are pushing national AI strategies that prioritize local compute and data sovereignty. High-volume use cases in healthcare, logistics, and education continue to increase infrastructure load. Organizations seek dedicated AI capacity for model training and inference. This demand has pushed operators to build high-density, scalable data center campuses across key cities. Sydney and Melbourne remain primary targets due to existing connectivity and cloud availability zones. Edge and regional locations are gaining importance for latency-sensitive applications. The market supports national goals around digital capability and economic diversification.

Rapid Adoption of Advanced Cooling, Rack Densification, and Renewable Energy Infrastructure

Operators in the Australia AI Data Center Market are adopting liquid cooling and high-density rack architectures to support GPU-intensive workloads. The shift from traditional air-based systems is critical for energy efficiency and performance. Providers deploy direct-to-chip and rear door cooling to manage thermal loads from 50–100 kW racks. Enterprises increasingly demand rack-level modularity to scale AI clusters as compute needs grow. Data center developers integrate renewable energy sources like solar and wind to reduce operational emissions. Sustainability goals influence site selection, architecture, and utility agreements. Australia’s favorable solar resource potential supports long-term green power use. Policy frameworks such as NABERS and CEFC-backed initiatives drive sustainability compliance. These innovations help maintain operational resilience and future readiness.

Strategic Integration of Sovereign AI Compute and Compliance with Data Residency Regulations

Sovereign AI compute is a strategic priority in the Australia AI Data Center Market, driving localized infrastructure deployment. Enterprises and public institutions require in-country AI processing to meet data residency, security, and latency needs. Regulatory policies push cloud and colocation providers to offer regionally compliant AI services. AI-driven sectors like healthcare, finance, and defense require infrastructure aligned with ISO, IRAP, and ASD guidelines. Major hyperscalers and local operators align offerings with sovereign frameworks to win public contracts. Government demand influences facility location and interconnection priorities. The market supports sensitive AI workloads like patient data, financial transactions, and national research projects. This integration of compliance with infrastructure makes Australia a critical sovereign AI node in the region. Strategic alignment with national standards drives institutional investor confidence.

- For instance, NEXTDC’s S2 Sydney achieved Uptime Tier IV certification with 30MW capacity and 2,800 racks, supporting IRAP-compliant government AI workloads.

Enterprise Shift Toward Hybrid AI Workloads and Edge Inference Integration

A growing number of enterprises in the Australia AI Data Center Market are adopting hybrid deployment models to optimize AI performance and cost. Hybrid models allow inference to run at the edge while training remains centralized. Industries like logistics, mining, and agriculture use edge inference for real-time decision-making. Data center providers offer hybrid colocation, private cloud, and AI-as-a-Service bundles to meet demand. Telecom operators enable 5G-connected edge data centers that handle distributed AI workloads. Partnerships between infrastructure providers and AI platforms are expanding, improving orchestration and data pipeline integration. Hybrid adoption reduces bandwidth strain and enhances data privacy. Organizations choose flexible deployment to balance operational efficiency with sovereignty needs. This evolution is reshaping facility designs and service-level offerings across Australia.

- For instance, NEXTDC’s NE1 Newman Edge data center in the Pilbara is a confirmed edge facility designed to support low‑latency workloads. The site offers around 560 m² of technical space and 1.5 MW of IT capacity, targeting industries such as mining that require localized compute and reliable connectivity.

Market Trends

High-Density GPU Clusters Redefining Rack Design, Interconnection, and Facility Planning

The Australia AI Data Center Market is witnessing a sharp increase in demand for high-density GPU clusters, influencing facility design and interconnection needs. Enterprises deploying models like large language transformers require racks with 30–100 kW power capacity. Operators modify layouts to accommodate immersion and direct liquid cooling. Facilities add dedicated AI zones for high-power loads with segregated airflow and cooling modules. Interconnection becomes critical to feed large datasets between AI servers and storage arrays. Operators upgrade to 400G+ network fabrics to support AI traffic volume. Metro zones like Sydney are seeing tighter network rings to ensure AI performance. New facilities reserve significant rack capacity for GPU clusters from vendors like NVIDIA and AMD. Operators are forming design alliances with chipmakers to meet AI workload specs.

Growing Focus on AI-Native Facilities Purpose-Built for Next-Gen Models and Custom ASICs

AI-native data centers are emerging as a distinct trend in the Australia AI Data Center Market. These facilities are not retrofits but built from the ground up for AI workloads. They feature high ceilings, reinforced flooring, and efficient airflow for dense AI clusters. Builders focus on power-to-space ratios exceeding conventional benchmarks. Direct DC power, AI-specific BMS integration, and NVLink optimization are core design elements. Facilities are often zoned with liquid-ready pods to support custom ASICs and advanced AI chips. The trend is driven by enterprises and hyperscalers demanding consistent power, low-latency, and thermal control. It marks a shift from traditional compute toward workload-specific infrastructure. The design shift supports generative, inferencing, and training workflows across industries.

AI-Driven Operational Intelligence Driving Infrastructure Automation and Predictive Maintenance

AI is not only the workload but also the management layer across the Australia AI Data Center Market. Operators use AI to monitor temperature, airflow, humidity, and equipment health in real-time. Predictive models enable dynamic workload distribution and fault mitigation. BMS and DCIM platforms incorporate AI for risk scoring and uptime optimization. Facilities integrate digital twins to simulate energy, airflow, and failure points. This level of intelligence helps optimize energy efficiency and extend component lifespan. Operators rely on AI to reduce unplanned downtime and OPEX. The use of smart rack-level monitoring improves cooling load targeting. These capabilities are now expected features in competitive data center offerings.

M&A Activity and Strategic Partnerships Accelerating AI Infrastructure Deployment in Australia

Mergers, acquisitions, and partnerships are reshaping the Australia AI Data Center Market landscape. Global hyperscalers are partnering with regional operators to secure AI-ready capacity faster. Real estate investment trusts and sovereign wealth funds are backing large-scale AI data center campuses. Telecom operators are forming joint ventures to build 5G edge nodes with AI hosting capability. Strategic site acquisitions near renewable corridors are increasing. Cloud and colocation providers form AI infrastructure alliances with GPU vendors and platform companies. These collaborations allow faster deployment of AI services aligned with customer needs. Expansion plans increasingly include AI design readiness from phase one. The investment momentum shows confidence in long-term AI infrastructure demand.

Market Challenges

High Power Density Constraints and Grid Interconnection Delays Impact Facility Scalability

Power availability remains a primary challenge across the Australia AI Data Center Market. AI workloads require high-density racks that push electrical and cooling infrastructure limits. Power delivery timelines often delay facility readiness, especially in regions with grid bottlenecks. Substation approvals, transformer lead times, and utility coordination create uncertainty. Permitting delays further slow expansion efforts. Operators face difficulty aligning infrastructure delivery with customer AI deployment schedules. This mismatch affects ROI timelines and investor confidence. Developers increasingly require multi-year planning to secure future power access. The challenge intensifies in metro areas where demand growth outpaces grid upgrades.

Talent Shortage in AI Infrastructure Engineering and Operational Optimization Roles

The Australia AI Data Center Market also faces a growing talent gap in AI infrastructure operations. Specialized skillsets are needed to manage high-density GPU workloads, liquid cooling systems, and orchestration layers. Engineers with expertise in AI data center design, power management, and smart controls are limited. High competition among hyperscalers and platform vendors escalates hiring costs. Retaining skilled personnel becomes difficult with limited talent pipelines. Educational institutions are yet to produce sufficient graduates in infrastructure engineering disciplines. This limits scalability and slows the onboarding of next-generation AI data center models. The market must expand partnerships with universities and upskilling initiatives to resolve the talent gap.

Market Opportunities

Edge AI Deployment Opportunities Across Mining, Agriculture, and Smart Infrastructure Sectors

Edge AI presents strong growth potential in the Australia AI Data Center Market. Remote industries like mining and agriculture need real-time inference capabilities for automation and monitoring. Edge nodes reduce latency, improve safety, and lower bandwidth use. Smart infrastructure projects across urban and regional zones also require distributed AI processing. This creates opportunity for micro data centers and AI-integrated base stations. Operators can offer managed AI services at the edge to capture this growing demand.

Strategic Role of Sovereign AI in Defense, Healthcare, and Research Workloads

Sovereign AI continues to offer long-term opportunities across sensitive industries in Australia. Defense agencies, hospitals, and academic institutions need AI infrastructure that complies with national security and privacy mandates. Localized, high-performance infrastructure ensures control over critical workloads. Providers offering sovereign-compliant, AI-optimized data centers gain access to high-value, long-term contracts. This supports stable utilization and premium pricing opportunities.

Market Segmentation

By Type

The Australia AI Data Center Market is dominated by the hyperscale segment, which holds the largest share due to massive demand from cloud providers and AI platform vendors. Colocation and enterprise data centers follow, serving mid-sized firms and government agencies. Edge and micro data centers are emerging fast in mining, agriculture, and remote AI applications. Hyperscale investments in Sydney and Melbourne drive segmental growth with scalable and AI-ready campus builds.

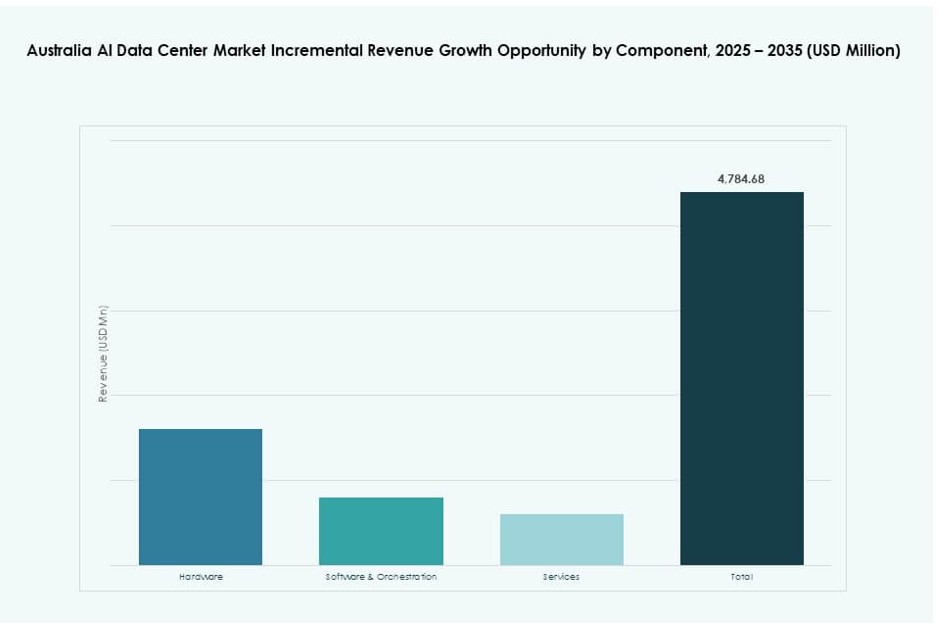

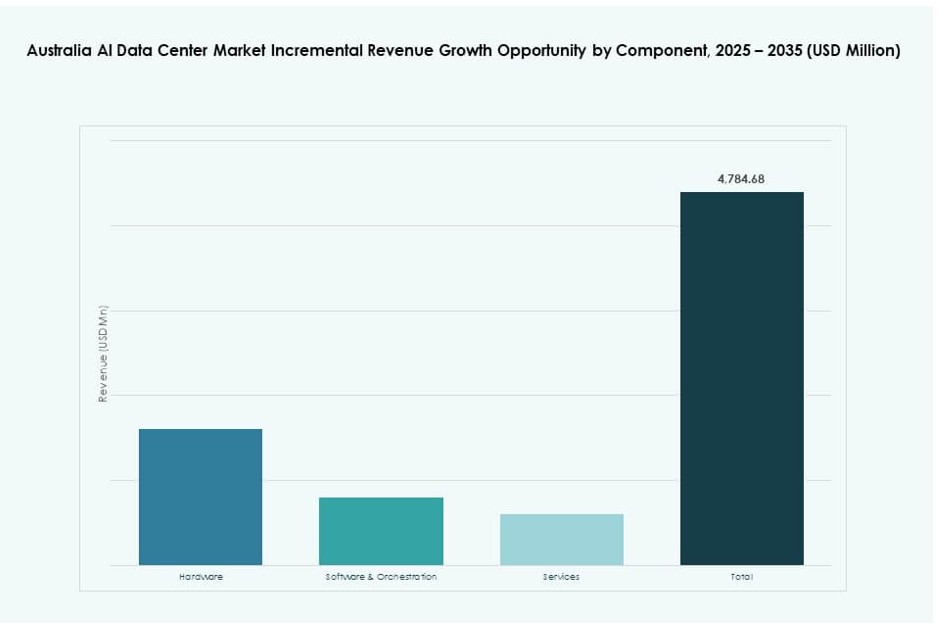

By Component

Hardware leads the Australia AI Data Center Market by component, driven by the deployment of high-performance GPUs, custom accelerators, and liquid-cooled racks. Software and orchestration platforms are growing due to the need for AI workload management, cluster scheduling, and security. The services segment gains traction from demand for infrastructure consulting, integration, and managed services. Hardware accounts for the largest capital spend per deployment.

By Deployment

Cloud deployment dominates the Australia AI Data Center Market, led by hyperscalers and SaaS companies. Hybrid models are growing fast, enabling edge inference and central model training. On-premise deployment remains relevant for government, defense, and regulated industries needing full control. Hybrid models support flexibility, lower latency, and data compliance, driving adoption across industries. Deployment models are becoming more customized by workload.

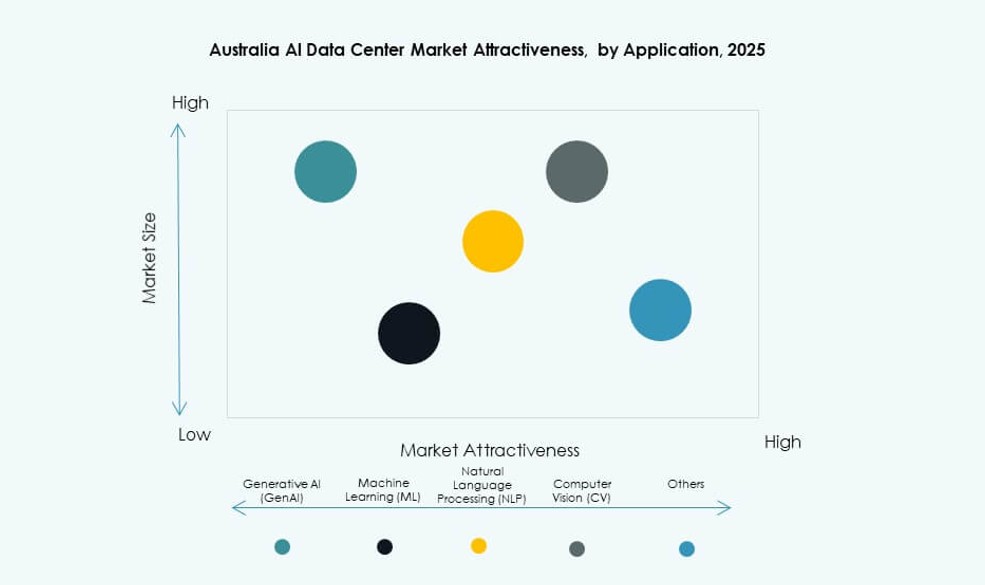

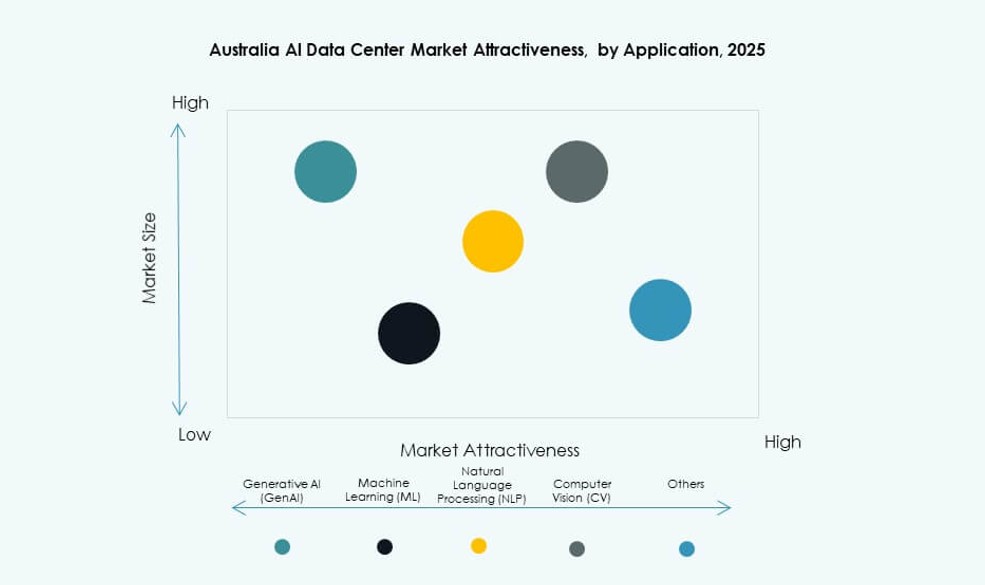

By Application

Machine Learning (ML) holds the largest share in the Australia AI Data Center Market, followed by Natural Language Processing (NLP) and Computer Vision (CV). Generative AI (GenAI) is growing rapidly with the adoption of large language models. ML-based inference dominates enterprise workloads across logistics, finance, and healthcare. CV finds demand in smart surveillance and autonomous systems. AI applications drive varied compute needs, influencing infrastructure design.

By Vertical

IT and Telecom is the leading vertical in the Australia AI Data Center Market, driven by platform vendors and infrastructure providers. BFSI, Healthcare, and Retail are significant users of AI data centers, demanding real-time processing, fraud detection, and personalized services. Manufacturing and Automotive sectors deploy AI for automation and defect detection. Media and Entertainment leverages AI for content generation and streaming optimization. Sectoral AI maturity defines infrastructure requirements and density.

Regional Insights

Eastern Region (New South Wales and Victoria) – Leading with Over 60% Market Share

New South Wales and Victoria dominate the Australia AI Data Center Market, accounting for over 60% of the total share. Sydney and Melbourne serve as central AI zones due to fiber availability, power access, and proximity to enterprise and cloud zones. These regions attract most hyperscale builds and colocation expansions. Strong government digital policies and enterprise concentration reinforce growth. Interconnection and energy reliability give them strategic AI workload advantage.

- For instance, Sharon AI deployed 160 NVIDIA H100 GPUs at NEXTDC’s Tier IV Melbourne M3 facility in November 2024, supporting enterprise AI model training.

Northern and Western Australia – Emerging Regions Driven by Edge and Industry Demand

Western Australia and Queensland contribute around 25% of the market, driven by mining, logistics, and government AI workloads. Perth and Brisbane host mid-scale data centers supporting edge compute for field deployments. Edge AI deployments in mining and agriculture are expanding, boosting regional importance. Data centers here serve latency-sensitive industrial applications. Demand is supported by infrastructure modernization and localized AI needs.

- For instance, Microsoft announced an Azure Extended Zone in Perth in December 2024 for low-latency mining workloads, serving clients like Northern Star Resources.

Southern and Central Australia – Niche Growth with Public Sector and R&D AI Workloads

Regions like South Australia and the ACT hold the remaining 15% market share. Canberra’s importance rises due to sovereign AI mandates and public sector focus. South Australia benefits from renewable integration and R&D partnerships. Growth in these areas is supported by academic AI use and public sector cloud policy. Though smaller in volume, they play a strategic role in the national AI infrastructure roadmap.

Competitive Insights:

- NEXTDC

- Macquarie Data Centres

- CDC Data Centres

- Microsoft (Azure)

- Amazon Web Services (AWS)

- Google Cloud / Alphabet

- Digital Realty Trust

- Equinix

- NVIDIA

- CoreWeave

The Australia AI Data Center Market features a highly competitive environment shaped by global hyperscalers and regional infrastructure providers. NEXTDC, CDC Data Centres, and Macquarie lead local operations with strong government, BFSI, and enterprise portfolios. AWS, Azure, and Google Cloud are expanding sovereign AI zones and hyperscale facilities in Sydney and Melbourne. Equinix and Digital Realty strengthen interconnection and edge capabilities. CoreWeave and NVIDIA target AI-focused infrastructure with GPU-based clusters and partnerships. It reflects a shift toward AI-native deployments, hybrid integration, and compliance-driven offerings. Colocation, cloud, and hardware providers compete across power density, sustainability, and orchestration features to support large-scale AI workloads.

Recent Developments:

- In December 2025, NEXTDC signed a memorandum of understanding with OpenAI to develop a hyperscale AI campus in Sydney. The partnership focuses on sovereign AI infrastructure and large GPU superclusters. The initiative supports domestic AI workloads for government, enterprise, and research users.

- In November 2025, NEXTDC entered a capacity expansion agreement with SHARON AI. The deal covers up to 50 MW of AI-ready data center capacity across Australia and Asia Pacific. The partnership supports sovereign GPU compute for advanced AI training and inference. It reflects strong demand from public sector and enterprise AI users.

- In November 2025, Data Centres Australia was formally launched with founding members including NEXTDC, CDC Data Centres, Amazon Web Services, and Microsoft. The new peak body aims to represent data center and AI infrastructure interests nationally. It focuses on policy engagement, energy planning, and digital growth.

- In June 2025, Amazon Web Services confirmed a long-term multi‑billion‑dollar investment program to expand cloud and AI data center infrastructure in Sydney and Melbourne. The expansion supports generative AI, machine learning, and sovereign cloud services.