Executive summary:

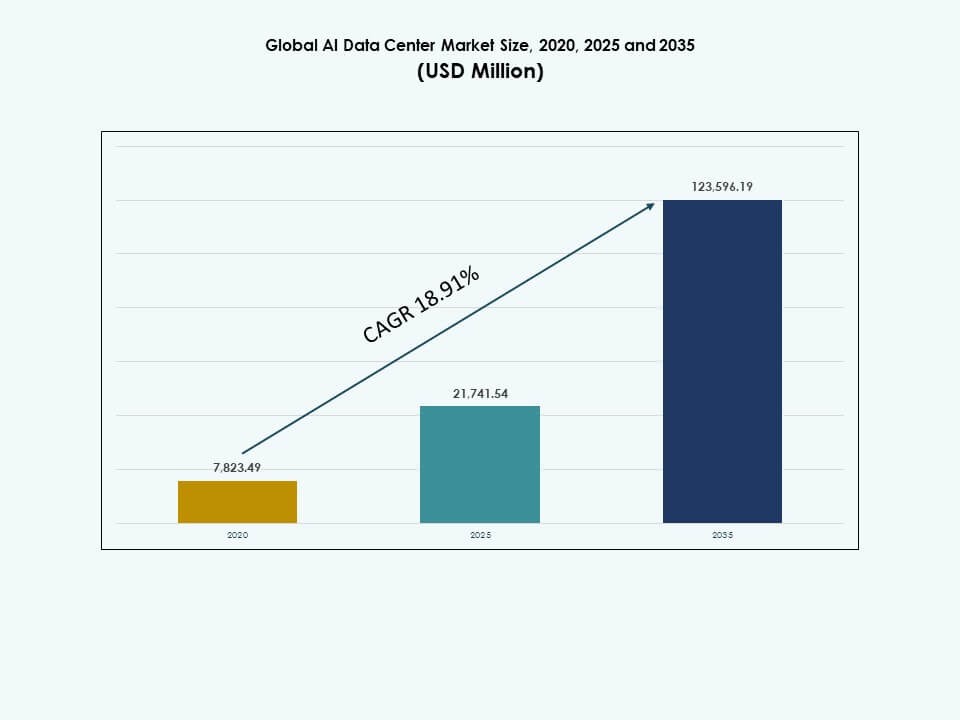

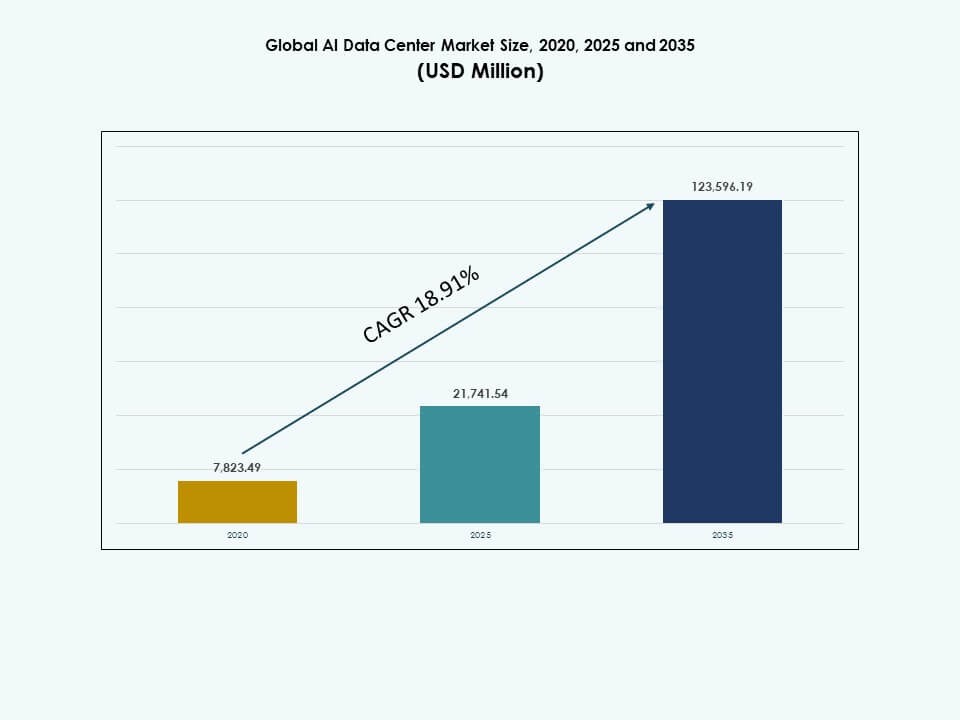

The Global AI Data Center Market size was valued at USD 7,823.49 million in 2020, increased to USD 21,741.54 million in 2025, and is anticipated to reach USD 123,596.19 million by 2035, at a CAGR of 18.91% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| AI Data Center Market Size 2025 |

USD 21,741.54 Million |

| AI Data Center Market, CAGR |

18.91% |

| AI Data Center Market Size 2035 |

USD 123,596.19 Million |

The Global AI Data Center Market expands due to rapid adoption of generative AI, machine learning, and advanced analytics across industries. Enterprises deploy high‑performance computing to support complex AI models and real‑time data processing. Innovation in GPUs, custom accelerators, and cooling systems improves efficiency and scale. Cloud platforms enable flexible AI deployment. These shifts make AI data centers critical assets for digital transformation, productivity gains, and long‑term investor value.

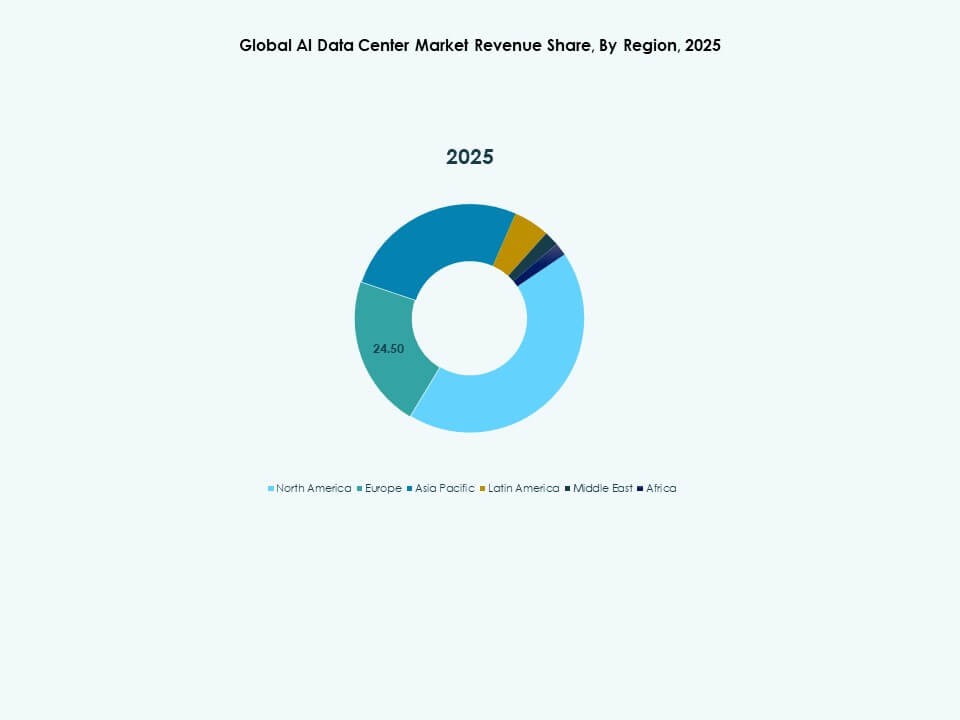

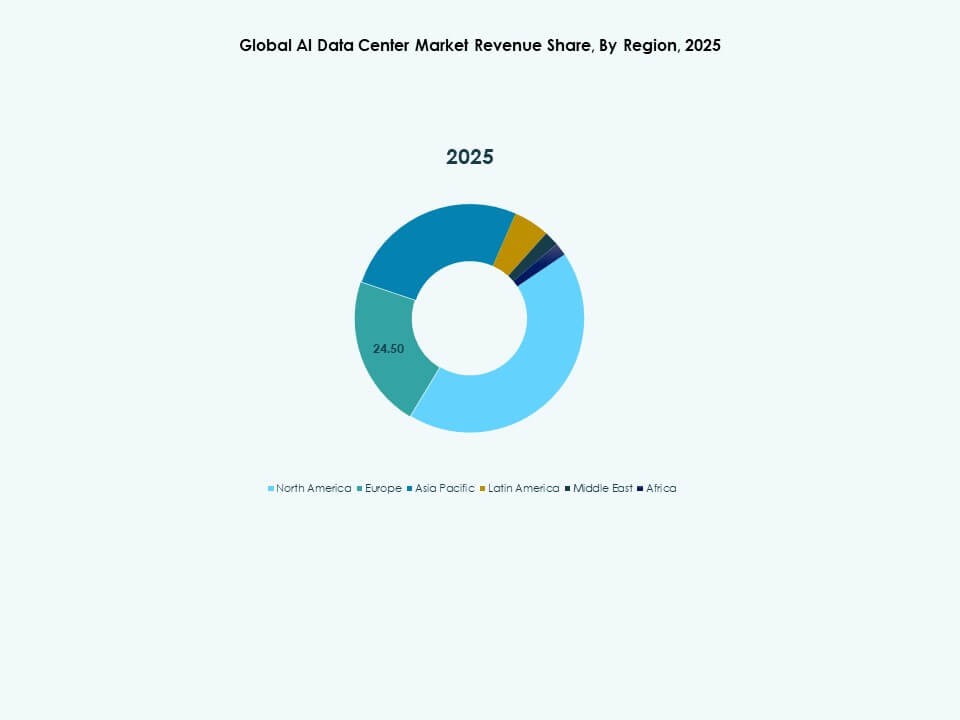

The Global AI Data Center Market shows strong regional concentration in North America, led by the United States due to hyperscaler presence and early AI adoption. Asia‑Pacific emerges quickly, driven by China, Japan, South Korea, and India investing in AI infrastructure and data localization. Europe follows with focus on sustainable and compliant AI facilities. Emerging regions gain traction through cloud expansion and digital economy initiatives.

Market Drivers

Market Drivers

Adoption of AI-Optimized Hardware and Accelerated Computing Infrastructure

The Global AI Data Center Market gains momentum through strong demand for GPU- and ASIC-based systems. High-performance processors enable low-latency AI training and inferencing. Companies replace legacy CPU infrastructure to scale deep learning tasks efficiently. Accelerators from NVIDIA, AMD, and Intel are reshaping compute architecture across AI-driven workloads. Hyperscalers invest in proprietary chipsets to reduce power usage and increase throughput. These trends enhance operational speed and support massive data volumes. The shift to purpose-built hardware enables better AI model performance. Industry verticals like healthcare, finance, and manufacturing rely on AI compute for real-time decisions. This evolution drives long-term investment in intelligent data centers.

- For instance, NVIDIA’s A100 GPU supports Multi-Instance GPU (MIG) partitioning into up to seven isolated instances, delivering deep learning throughput up to 2.5x higher than the V100 in benchmarks like language model training with FP16 Tensor Cores.

Expansion of Edge AI and Distributed Data Architectures

Edge AI integration pushes the Global AI Data Center Market toward decentralized processing. Enterprises deploy AI models closer to data sources to reduce latency and bandwidth costs. Real-time analytics at the edge supports autonomous systems, IoT, and industrial AI use cases. Data centers adapt by building regional and micro-facilities near major endpoints. Telcos and hyperscalers collaborate to create distributed AI-ready zones. These infrastructures optimize data flows, especially in high-traffic environments. Regulatory shifts around data sovereignty support regional infrastructure growth. Businesses with global footprints demand resilient and latency-sensitive AI processing. It creates value in sectors like smart cities, defense, and automotive.

Cloud-Native AI Platforms and Model Lifecycle Management

Cloud-native AI services transform how enterprises scale and manage model lifecycles. The Global AI Data Center Market benefits from demand for MLOps, AI orchestration, and containerized workloads. Providers focus on optimizing infrastructure for dynamic model versioning, training, and deployment. This shift supports agile development and real-time retraining for improved accuracy. Multi-cloud and hybrid environments enhance AI service continuity. Organizations rely on cloud-integrated pipelines to automate data ingestion, labeling, and inferencing. These operations require flexible, scalable, and secure compute ecosystems. Strategic cloud investments from major providers shape AI ecosystem maturity. AI lifecycle platforms strengthen competitive positioning across all enterprise tiers.

- For instance, NVIDIA’s H100 Tensor Core GPU offers 4x faster training than the A100 on large language models in MLPerf benchmarks.

Government-Led AI Infrastructure Funding and AI Sovereignty

Strategic policy and funding programs fuel national AI infrastructure pipelines. Countries allocate budgets to build sovereign AI clouds, national compute fabrics, and specialized data hubs. The Global AI Data Center Market aligns with these efforts to achieve independence in AI development. Regulatory bodies focus on securing AI-critical infrastructure from geopolitical and cybersecurity risks. Government investments extend into green compute, quantum AI, and public sector model training. Partnerships between public agencies and tech companies drive scale and localization. AI centers focused on defense, language processing, and scientific simulations gain top priority. These initiatives improve accessibility and performance of AI services at scale. National AI ambitions shape the design, location, and operation of data infrastructure worldwide.

Market Trends

Market Trends

Generative AI Workload Expansion Driving High-Throughput Compute Demand

The Global AI Data Center Market witnesses rapid scaling needs due to generative AI adoption. Large language models and image generators require extensive GPU clusters and massive memory bandwidth. These workloads consume more power and floor space than traditional applications. Providers invest in rack-dense architectures with advanced thermal solutions. Use of liquid and immersion cooling systems becomes widespread. Generative AI influences facility planning, with purpose-built zones for training and inferencing. The trend expands need for dedicated power distribution and high-speed networking. AI clusters now dominate new capacity planning, influencing real estate and capital allocation. Operators seek innovation to accommodate energy-hungry, data-heavy models.

Focus on Sustainable AI Data Center Design and Energy Optimization

Sustainability drives architectural change across AI data center planning. Operators aim to balance AI performance with reduced carbon footprints. Use of modular designs, waste heat reuse, and renewable energy sourcing expands. The Global AI Data Center Market reflects pressure to achieve near-zero emissions despite rising compute loads. Hyperscalers integrate software-defined power systems to optimize load distribution. AI workload scheduling aligns with renewable energy availability. Green building certifications become standard across Tier III and Tier IV builds. Power Usage Effectiveness (PUE) targets are lowered through advanced cooling. Sustainability commitments influence investor decisions and regulatory approvals.

Rise of AI-Specific Colocation and Hyperscale Partnerships

Colocation providers evolve their offerings to support AI workloads with tailored infrastructure. The Global AI Data Center Market benefits from facilities that offer higher power density, fast deployment, and flexible scaling. Enterprise clients seek ready-made environments for AI model development and deployment. Hyperscalers and chipmakers form strategic alliances to lease space with optimal cooling and networking. Multi-tenant AI zones with advanced interconnects reduce time-to-model deployment. Operators retrofit legacy sites with high-density racks to meet demand. Colocation expands from Tier I cities to regional hubs. These facilities offer long-term contracts with AI-ready features, attracting deep-tech startups and research labs.

Integration of Optical Interconnects and AI-Optimized Networking

Networking innovation is central to the evolution of the Global AI Data Center Market. AI clusters demand low-latency, high-throughput interconnects across nodes and data pools. Operators deploy optical fiber, silicon photonics, and 800G Ethernet to eliminate bottlenecks. Smart switches and programmable routers increase AI task efficiency. AI-driven traffic management enhances resource allocation across data centers. Use of AI for managing AI workloads—AI-for-AI—is on the rise. Optical backbones support model parallelism and faster data synchronization. Integration of next-gen networking reduces infrastructure lag and improves energy use. These innovations shape the layout, design, and cost models of AI-centric sites.

Market Challenges

Market Challenges

High Energy Consumption and Limited Grid Capacity in Key Regions

The Global AI Data Center Market faces growing scrutiny due to high energy demand from AI training. Dense GPU clusters can exceed 30kW per rack, straining legacy power infrastructure. Energy consumption patterns surpass those of traditional cloud applications. Power availability in urban centers becomes a limiting factor for new builds. Local grids in Europe, parts of Asia, and dense metros struggle with load balancing. Regulatory pressure increases as governments assess the carbon impact of AI compute. Project delays due to grid constraints affect scalability plans. Long lead times for electrical upgrades disrupt hyperscaler timelines. It forces operators to seek alternative siting in less congested zones.

Complexity of Thermal Management and Operational Reliability

AI-specific data centers encounter significant challenges in maintaining thermal stability. Traditional air cooling fails under extreme GPU workloads. Operators must invest in advanced cooling systems like direct-to-chip or immersion cooling. These systems require redesigns in layout, piping, and operational oversight. The Global AI Data Center Market adapts slowly to rapid changes in cooling technology. Risk of thermal runaway, reduced component lifespan, and system downtime increases. Continuous monitoring and adaptive control become critical. Engineers face rising operational complexity in managing hybrid environments. Reliability standards must evolve to ensure uninterrupted AI performance across regions and use cases.

Market Opportunities

AI Infrastructure Localization and Emerging Market Deployment Potential

The Global AI Data Center Market holds vast potential in emerging economies aiming to localize AI compute. Countries in Southeast Asia, Africa, and Latin America pursue sovereign AI infrastructure to support local models and reduce data export. Governments and private sectors align on building localized data hubs to boost AI innovation and digital skills. These regions offer low-cost land, skilled labor, and policy incentives. Investors find growth in greenfield deployments and regional clusters supporting government AI ambitions.

Specialization in Vertical-Specific AI Compute Zones

Operators can unlock new value by offering AI compute tailored for specific sectors. Data centers optimized for financial models, biotech simulations, or autonomous systems attract niche demand. The Global AI Data Center Market benefits from vertical AI zones that integrate sector expertise with custom infrastructure. This approach shortens time to value for domain-specific AI development. Healthcare, defense, logistics, and energy sectors lead demand for these purpose-built environments.

Market Segmentation:

Market Segmentation:

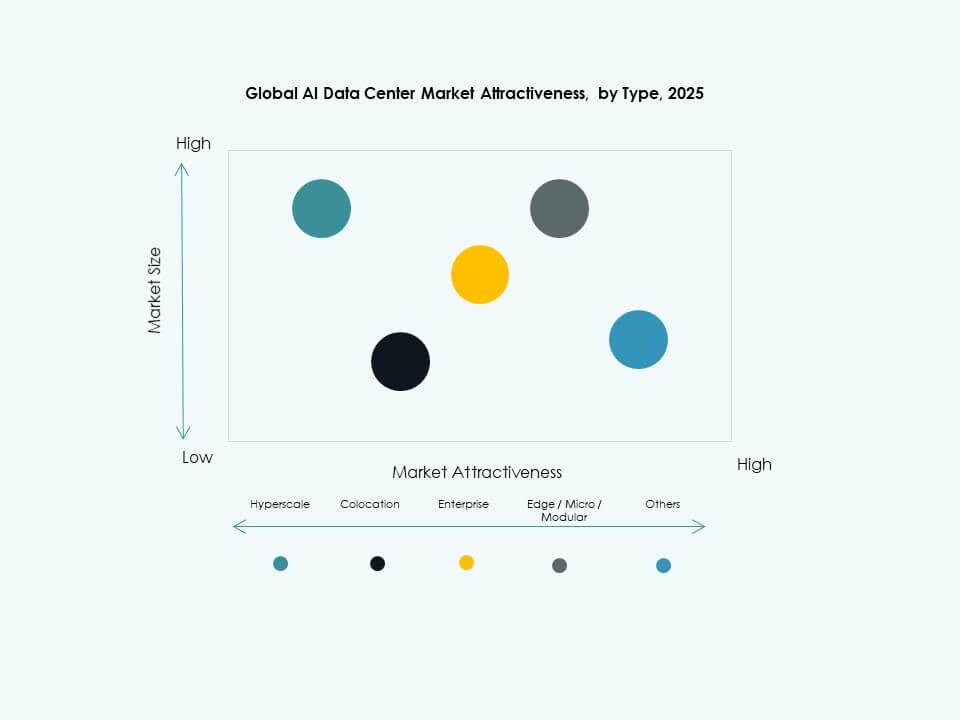

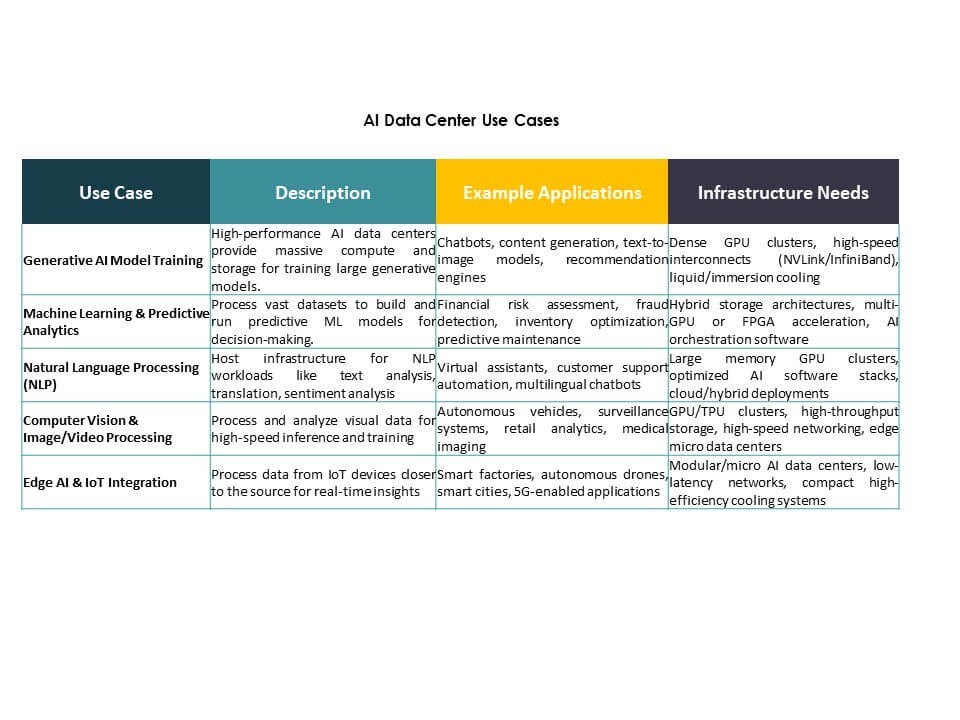

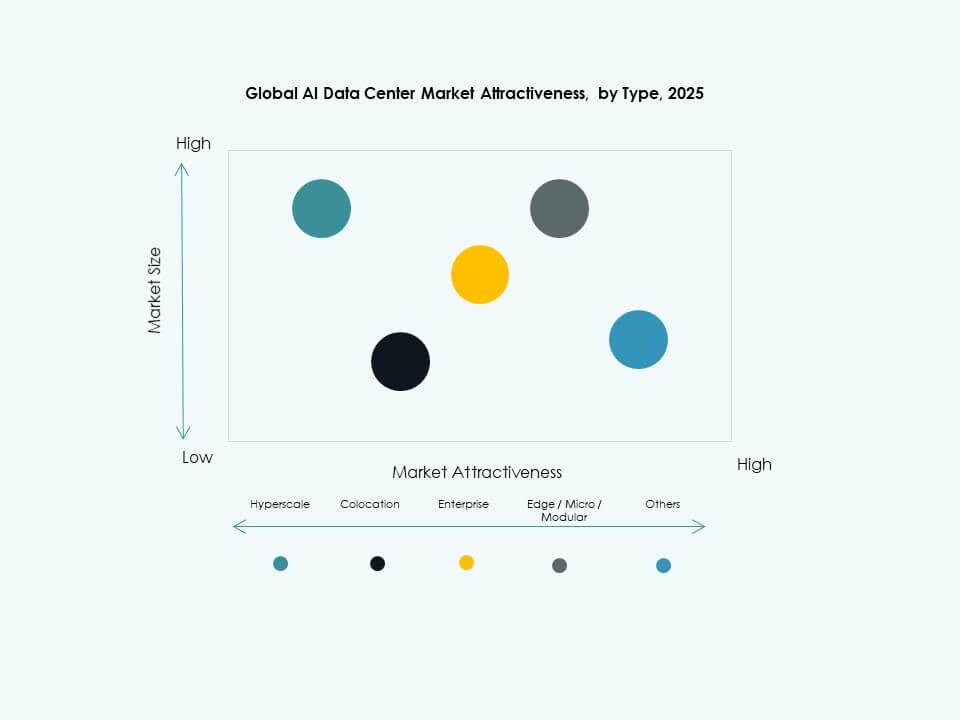

By Type Segment Analysis

In the Global AI Data Center Market, the Hyperscale segment dominates due to massive investments by cloud leaders in AI compute power. Hyperscale facilities capture the largest share by supporting deep learning, training clusters, and real-time data flows. Colocation & Enterprise follows, driven by enterprises seeking scalable AI infrastructure without full buildouts. Edge/Micro Data Centers show fast growth, driven by the need for low-latency AI at the network edge. Key growth factors include cloud adoption, distributed compute demand, and investments in high-performance servers tailored for AI workloads.

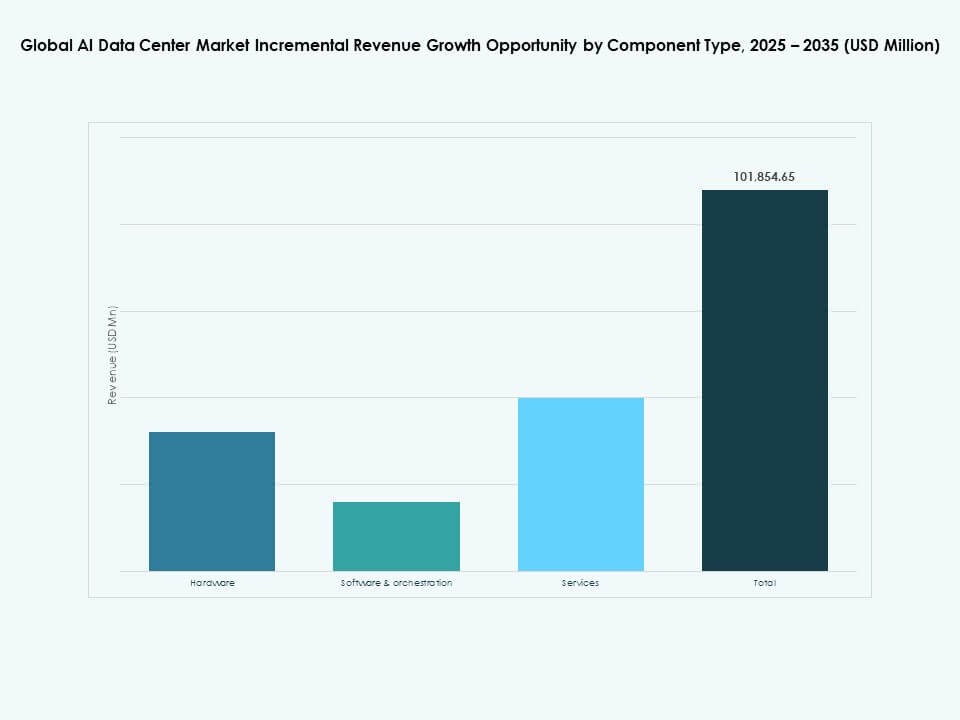

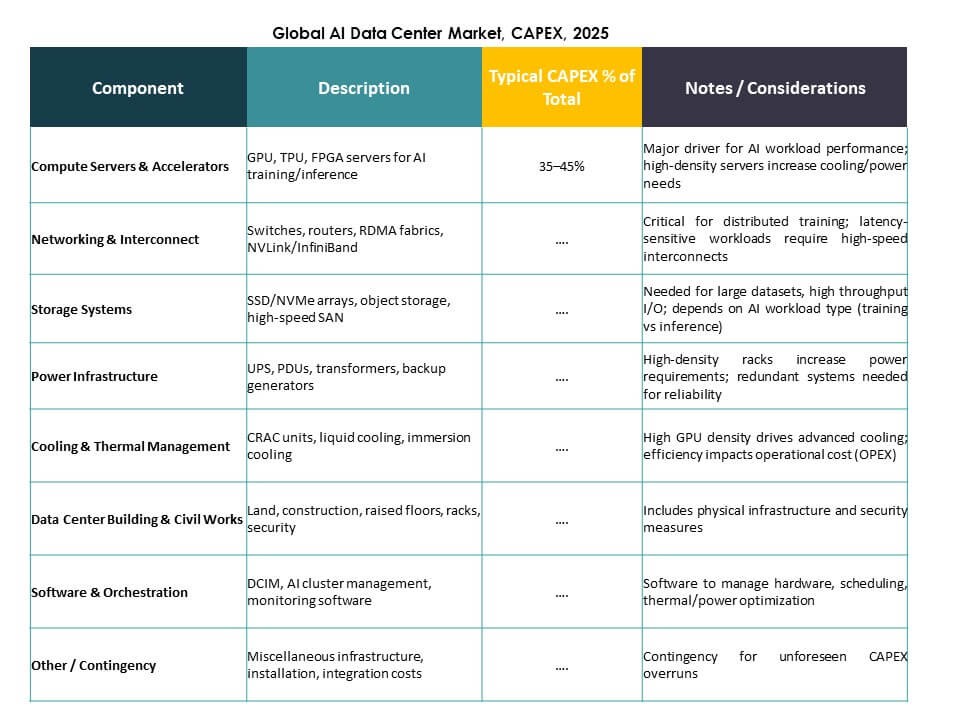

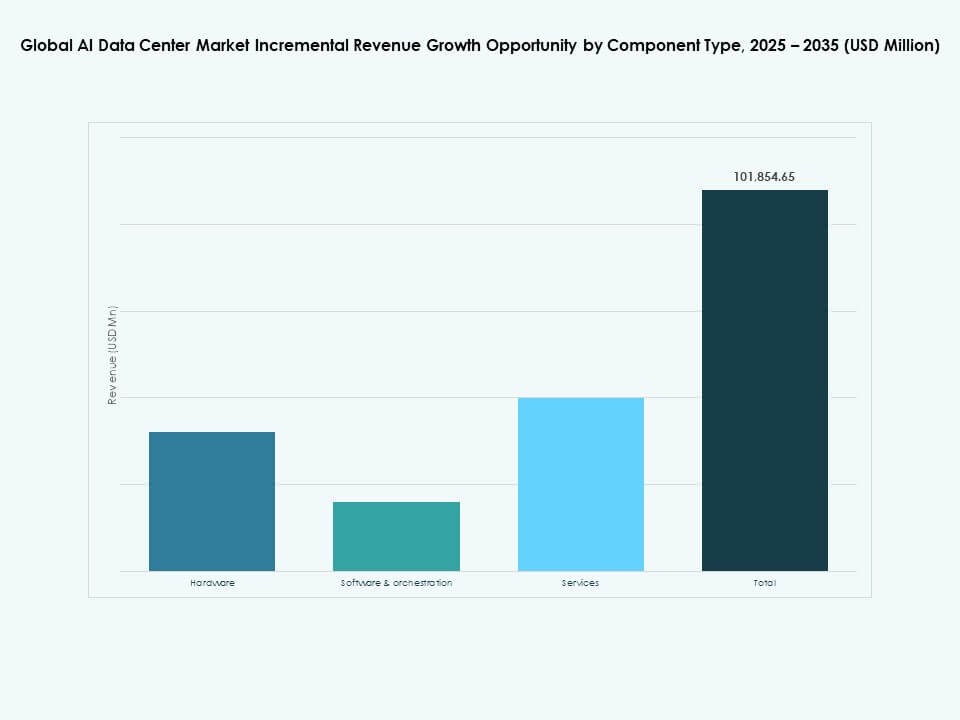

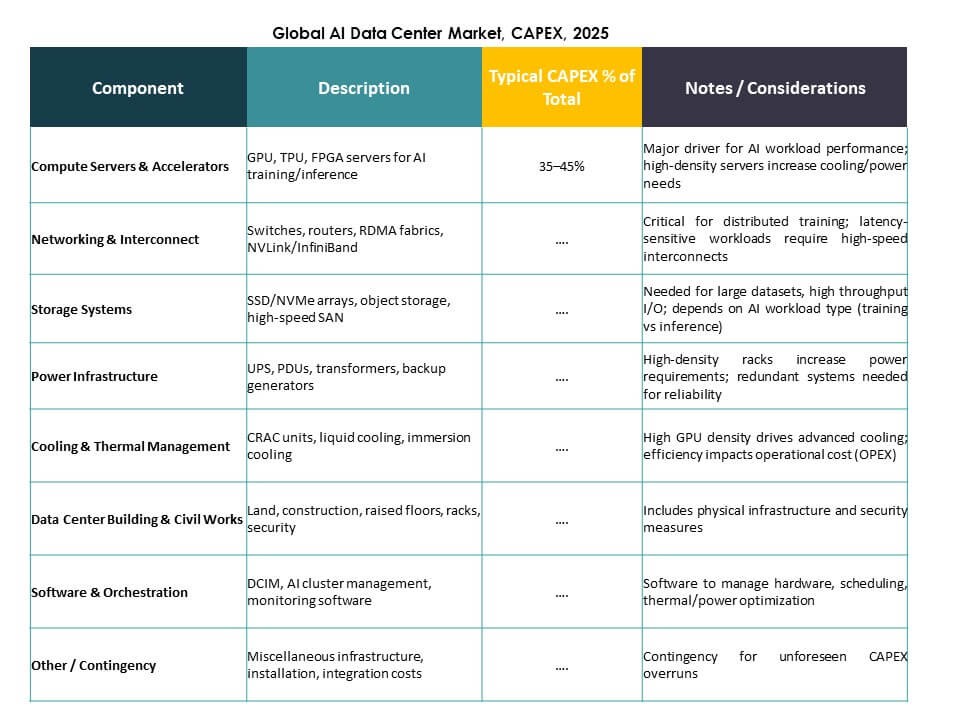

By Component Segment Analysis

The Hardware segment leads in the Global AI Data Center Market, driven by demand for GPUs, ASICs, storage arrays, and advanced networking gear. Hardware commands the largest share since physical compute remains critical for AI model training and inferencing. Software & Orchestration grows rapidly with tools for AI workflow automation and model management. Services also expand, supported by integration, maintenance, and consulting needs. Growth stems from accelerating AI workloads, rising infrastructure complexity, and the need for optimized stacks that connect hardware with AI software frameworks.

By Deployment Segment Analysis

In the Global AI Data Center Market, Cloud deployment holds the largest share due to scalable, on-demand AI compute offered by major providers. Cloud-based AI supports flexible capacity and global reach, attracting enterprises and developers. Hybrid deployments gain traction through balanced control and cloud scale, favored by regulated industries. On-premise remains vital for organizations requiring data control and security. Growth drivers include digital transformation, sensitive data regulations, and demand for seamless integration between local infrastructure and cloud AI services.

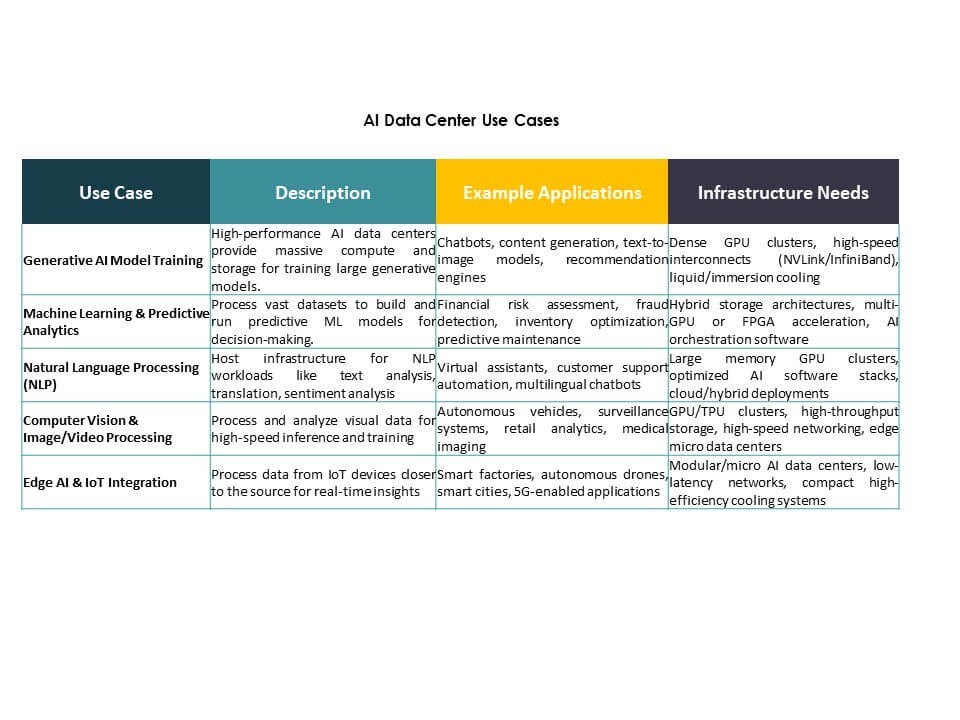

By Application Segment Analysis

Generative AI (GenAI) emerges as the fastest-growing and most dominant application in the Global AI Data Center Market, propelled by large language models and content generation demand. Machine Learning (ML) also keeps strong share as foundational AI workloads across sectors. NLP and Computer Vision (CV) segments expand with enterprise use cases in customer service and automated inspection. Others cover specialized AI applications. Increasing adoption of AI models, growth of conversational AI, and tailored solutions fuel expansion across these application segments, making them core drivers of AI data center usage.

By Vertical Segment Analysis

In the Global AI Data Center Market, the IT and Telecom vertical leads, supported by heavy AI data traffic and network optimization needs. BFSI follows, investing in AI for fraud detection and customer analytics. Healthcare and Retail show strong growth by adopting AI for diagnostics and personalized services. Automotive advances with autonomous systems, while Media & Entertainment uses AI for content creation. Manufacturing benefits through predictive maintenance. Demand for intelligent solutions, digital transformation, and automation drives vertical adoption, expanding AI data center deployments across industries.

Regional Insights:

North America dominates the Global AI Data Center Market with over 38% share in 2025. The United States leads investments in hyperscale AI infrastructure through tech giants like Microsoft, Google, Meta, and Amazon. These firms expand GPU-rich data centers to power generative AI and machine learning services. Canada supports growth with favorable AI innovation policies and strong digital infrastructure. Edge computing initiatives and cloud platform expansion reinforce regional dominance. Market maturity, strong private investment, and advanced ecosystem contribute to North America’s leadership. It remains the hub for AI training clusters and high-performance computing applications.

- For instance, Microsoft’s Fairwater AI datacenter in Mount Pleasant, Wisconsin covers 315 acres with 1.2 million square feet of floor space and 337.6 megawatts of capacity, featuring thousands of interconnected NVIDIA GB200 GPUs.

Asia-Pacific holds the second-largest share at around 30% and is the fastest-growing regional market. China invests in sovereign AI infrastructure and accelerates domestic chip development to reduce reliance on foreign technology. Japan, South Korea, and India deploy AI-ready cloud infrastructure, supported by national digital strategies. Southeast Asia contributes through growing demand for colocation and AI-driven enterprise services. Governments across the region prioritize data localization and energy-efficient builds. It benefits from large population centers, expanding cloud penetration, and an AI-first enterprise mindset. The region is positioned to scale through partnerships between hyperscalers and local operators.

- For instance, Huawei launched CloudMatrix 384 in 2025, integrating 384 Ascend 910C AI chips in a supernode architecture delivering 300 petaFLOPS of BF16 compute with 3.6x memory capacity over Nvidia’s GB200 NVL72.

Europe accounts for nearly 22% of the Global AI Data Center Market and focuses on sustainable, regulation-compliant AI infrastructure. Germany, the UK, and France drive demand through enterprise AI, edge computing, and public-private AI initiatives. Europe enforces strict carbon, data privacy, and sovereignty policies, influencing data center design and location. Investment flows into green AI data centers with LEED and BREEAM certifications. Emerging markets in Central and Eastern Europe grow through rising cloud adoption and regional expansion by major operators. The region emphasizes AI for industrial automation, healthcare, and finance. It presents long-term opportunity through energy-efficient, modular infrastructure development.

Competitive Insights:

Competitive Insights:

- Microsoft (Azure)

- Amazon Web Services (AWS)

- Google Cloud / Alphabet

- Meta Platforms

- NVIDIA

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- Lenovo

- IBM

- Equinix

Competitive Insights

Competitive Insights

The Global AI Data Center Market features a blend of hyperscale cloud providers, AI hardware leaders, and colocation operators. Microsoft, AWS, and Google Cloud lead through massive investments in AI-optimized infrastructure and global reach. Meta builds custom AI data centers to support proprietary models and immersive services. NVIDIA drives market influence through GPU leadership and partnerships with major operators. Dell, HPE, and Lenovo support enterprise demand with scalable AI-ready hardware and hybrid solutions. IBM focuses on AI workload integration, while Equinix and Digital Realty Trust expand global AI colocation capacity. CoreWeave and QTS specialize in high-density AI environments for model training. The market remains competitive, shaped by innovation in chipsets, cooling, and orchestration software. It favors players who align performance, sustainability, and AI scalability under strict time-to-market requirements.

Recent Developments:

- In November 2025, Microsoft formed a major cloud infrastructure partnership with Anthropic and Nvidia, involving $30 billion in Azure computing capacity commitments to bolster AI data center capabilities amid shifting alliances.

Market Drivers

Market Drivers Market Trends

Market Trends Market Challenges

Market Challenges Market Segmentation:

Market Segmentation: Competitive Insights:

Competitive Insights: Competitive Insights

Competitive Insights