Executive summary:

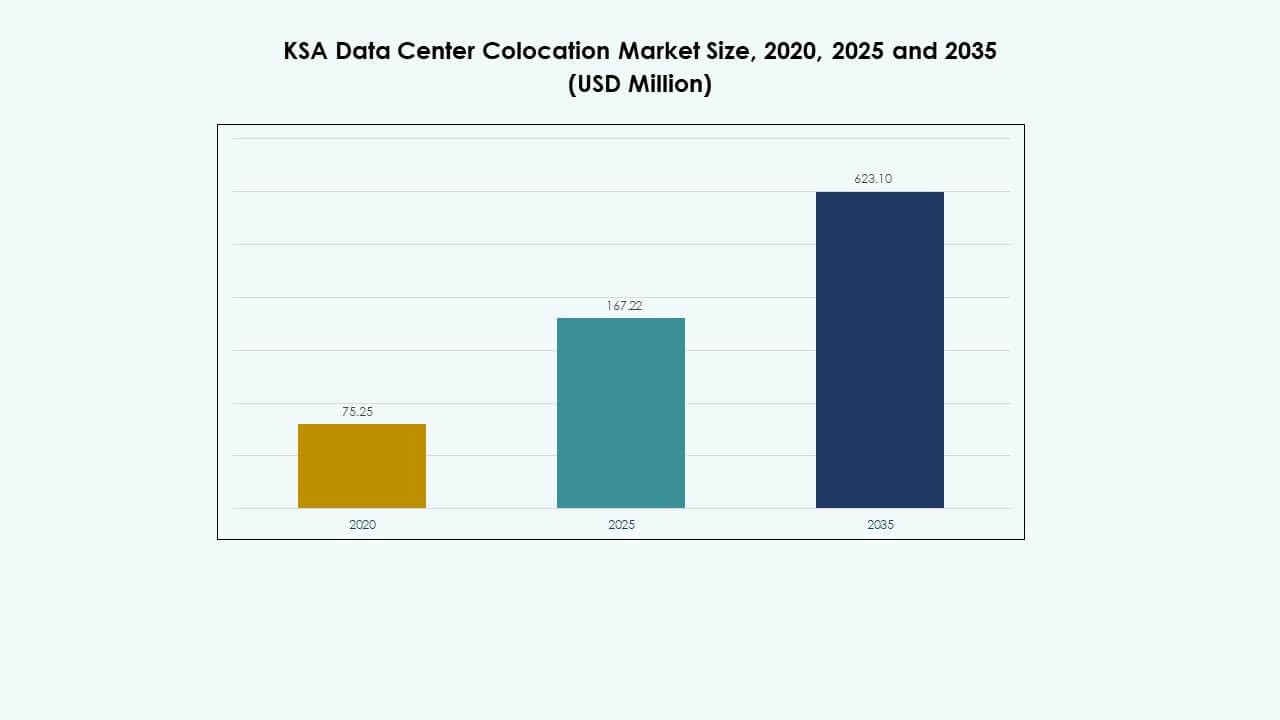

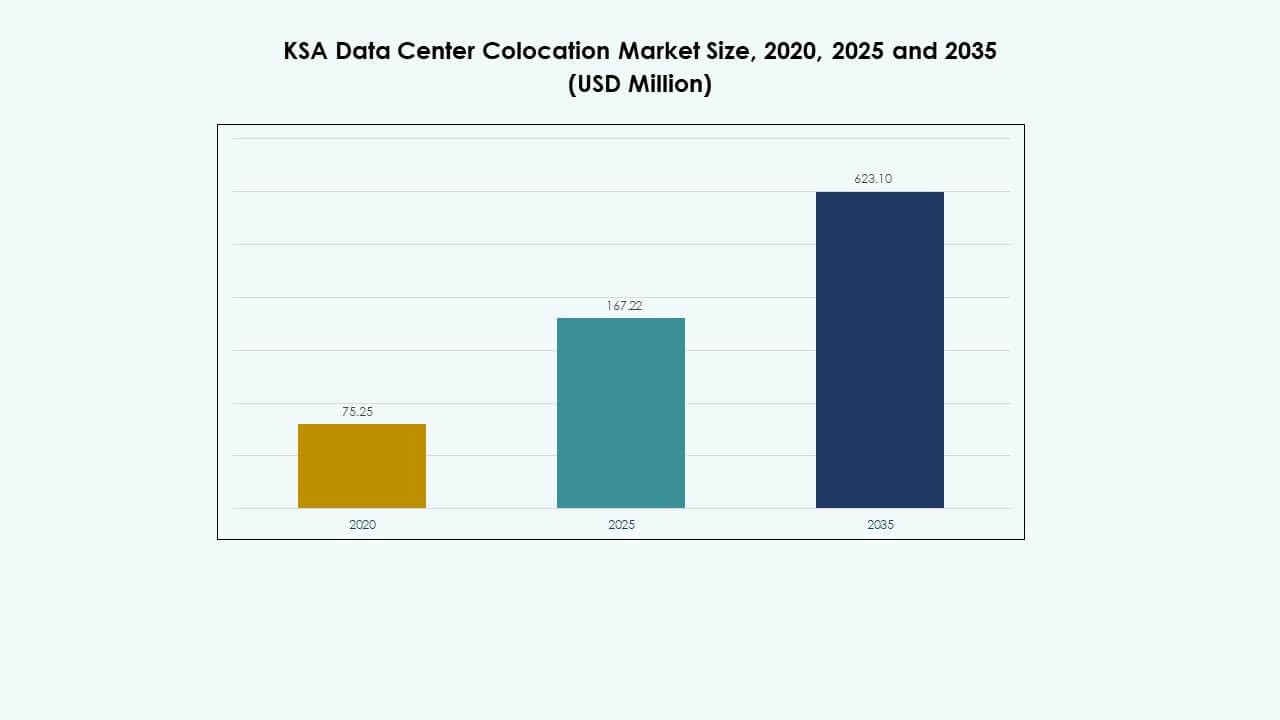

The KSA Data Center Colocation Market size was valued at USD 75.25 million in 2020 to USD 167.22 million in 2025 and is anticipated to reach USD 623.10 million by 2035, at a CAGR of 13.99% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| KSA Data Center Colocation Market Size 2025 |

USD 167.22 Million |

| KSA Data Center Colocation Market, CAGR |

13.99% |

| KSA Data Center Colocation Market Size 2035 |

USD 623.10 Million |

Strong technology adoption, cloud migration, and digital transformation initiatives drive market growth. Enterprises integrate edge computing, AI, and automation to modernize IT infrastructure and enhance network performance. It supports operational resilience and secure data handling, making colocation services strategically important for businesses and investors seeking scalable infrastructure with reduced capital expenditure.

Riyadh leads the market due to strong digital infrastructure and strategic government support. Jeddah and Dammam are emerging hubs, supported by submarine cable connectivity and increasing enterprise demand. Western and Eastern regions benefit from their geographic positioning and industrial base, making them critical zones for future data center expansion.

Market Drivers

Rapid Digital Transformation and Expansion of Cloud-First Strategies by Enterprises

The KSA Data Center Colocation Market benefits from a nationwide shift toward digital transformation. Enterprises are modernizing infrastructure to align with Vision 2030 goals. It supports high-speed connectivity, hybrid cloud models, and scalable computing power. Businesses rely on colocation to reduce capital expenditure and improve operational flexibility. Demand for low-latency applications drives new deployments across key cities. Investments in edge computing improve service delivery and resilience. The transition strengthens business continuity strategies. Investors view this sector as a stable, long-term asset class.

- For instance, in September 2025, STC and its subsidiary Solutions signed a SAR 313.4 million, 36-month contract to expand network and data center infrastructure in Khamis Mushait, Dammam, Qassim, and north Riyadh. The agreement focuses on strengthening connectivity and supporting 5G service growth across key regions.

Growing Technology Adoption with Advanced Infrastructure Modernization Across Industries

Technology adoption accelerates across telecom, banking, and healthcare sectors, pushing demand for colocation facilities. Companies integrate AI, IoT, and 5G to enhance operational efficiency. It allows enterprises to shift workloads to high-performance, secure environments. Data center operators deploy energy-efficient designs and modular systems to meet evolving needs. Increased automation reduces downtime and enhances service reliability. Enterprises favor colocation for its ability to handle fluctuating workloads. Innovation supports faster decision-making and customer experiences. Strategic investment in next-generation networks secures market growth momentum.

- For instance, Zain KSA, in partnership with Huawei, completed commercial deployment of 5G Standalone on the 600 MHz band in October 2025, achieving a 50% drop in latency and a 10× uplink speed improvement while enabling AI‑driven mobile services and advanced IoT integration for enterprises across Riyadh and Jeddah.

Rising Demand for Secure, Compliant, and Scalable IT Infrastructure Solutions

Demand for reliable infrastructure grows with rising cybersecurity threats and regulatory compliance requirements. The KSA Data Center Colocation Market aligns with strict data residency and security standards. Operators build facilities with advanced firewalls, biometric access, and tier certifications. It strengthens business confidence and reduces security risks. Enterprises prefer scalable colocation over on-premises setups. Compliance with global standards attracts multinational firms. Enhanced risk mitigation capabilities boost trust in data hosting solutions. The emphasis on secure digital environments supports sustained industry expansion.

Strategic Positioning of the Kingdom as a Digital Hub for the Middle East

Saudi Arabia’s location provides an advantage for interconnectivity and international expansion. The government’s strong digital vision drives infrastructure development and foreign investment. It enables enterprises to scale regionally with minimal latency. Colocation facilities connect global cloud providers, telecom carriers, and hyperscale firms. Riyadh becomes a preferred gateway for digital trade flows. International collaborations expand service capacity and network reach. Businesses view this as a way to future-proof operations. Strategic positioning boosts the country’s role in the regional data economy.

Market Trends

Rising Deployment of Hyperscale Facilities with Focus on Efficiency and Speed

The KSA Data Center Colocation Market is witnessing strong adoption of hyperscale infrastructure to meet cloud demand. Operators build large-scale facilities with advanced cooling and power systems. It supports high-density computing and massive data volumes. Providers focus on reducing energy usage through green technologies. Renewable energy integration aligns with national sustainability targets. Hyperscale deployments enable rapid scaling and cost optimization. These facilities attract global cloud providers and tech companies. The expansion reflects a maturing digital ecosystem.

Increased Focus on Edge Computing to Enable Low-Latency Data Delivery

The market shifts toward distributed edge deployments to support AI, IoT, and real-time applications. Edge facilities reduce latency and improve user experience for critical workloads. It strengthens service delivery for gaming, fintech, and telemedicine applications. Telecom operators expand partnerships to build edge-ready networks. Smaller modular sites near key cities support efficient data flow. This distributed model improves reliability and speed. Enterprises benefit from localized data processing and improved compliance. The trend accelerates network modernization across industries.

Integration of Automation and AI in Operational Workflows and Management

Data center operators embrace AI-driven automation to optimize performance, reduce human errors, and lower costs. It enhances predictive maintenance, load balancing, and security monitoring. Real-time analytics improves operational visibility and resource use. Intelligent management systems help scale services efficiently. AI reduces downtime and increases customer satisfaction. Automated systems align with sustainability goals through smart energy control. These capabilities enable providers to deliver consistent, reliable service. Innovation drives strong competitive differentiation in the colocation sector.

Growing Investments in Sustainable and Green Data Center Infrastructure

The KSA Data Center Colocation Market is moving toward energy-efficient, low-carbon designs. Providers adopt liquid cooling, smart power usage, and renewable energy sourcing. It aligns with the country’s clean energy vision and ESG commitments. Energy efficiency lowers operational costs and attracts global customers. Sustainable infrastructure improves brand reputation and investor appeal. Green certifications enhance customer confidence. This trend encourages partnerships between energy and IT providers. Environmental responsibility becomes a core part of growth strategies.

Market Challenges

High Capital Expenditure Requirements and Long Return on Investment Cycles

The KSA Data Center Colocation Market faces high capital requirements for land, equipment, and infrastructure development. Building advanced facilities with Tier III or Tier IV standards demands significant financial resources. It creates entry barriers for smaller operators and limits competition. Long payback periods extend ROI timelines for investors. High energy and cooling costs further pressure margins. It requires careful capacity planning and financial discipline. Market leaders secure funding through strategic partnerships and sovereign backing. The challenge intensifies during economic fluctuations.

Talent Shortages and Increasing Complexity of Regulatory Compliance

Rapid digitalization increases demand for skilled professionals in network management, security, and automation. Talent shortages slow deployment timelines and increase operational costs. The KSA Data Center Colocation Market must also align with evolving compliance frameworks. It faces complex data protection laws and strict cybersecurity regulations. Lack of specialized workforce affects service quality and innovation speed. Compliance requires investments in monitoring, documentation, and security certifications. These factors make operational scaling more difficult. Companies must focus on workforce development and compliance readiness.

Market Opportunities

Strategic Investments in Emerging Technologies and Digital Infrastructure Expansion

The KSA Data Center Colocation Market presents opportunities in advanced cloud integration and edge networks. Rapid 5G rollout and AI integration support demand for next-generation services. It attracts hyperscale providers seeking regional expansion. Businesses can invest in smart automation and hybrid cloud platforms. Digital growth plans encourage partnerships with global operators. Innovation boosts efficiency and competitiveness. The expansion enhances the region’s digital leadership. Market positioning strengthens its role as a strategic technology hub.

Strong Government Support and Incentives for Digital Ecosystem Development

Saudi Arabia’s Vision 2030 initiatives create favorable policies for data center expansion. Investors benefit from tax incentives, infrastructure grants, and supportive regulations. It improves ease of doing business for local and international operators. Government-backed projects enhance network connectivity across major cities. Policy stability increases investor confidence and speeds up approvals. Strategic alliances with global firms open new market segments. Public-private partnerships shape the future of digital infrastructure. These factors create strong growth opportunities in the coming years.

Market Segmentation

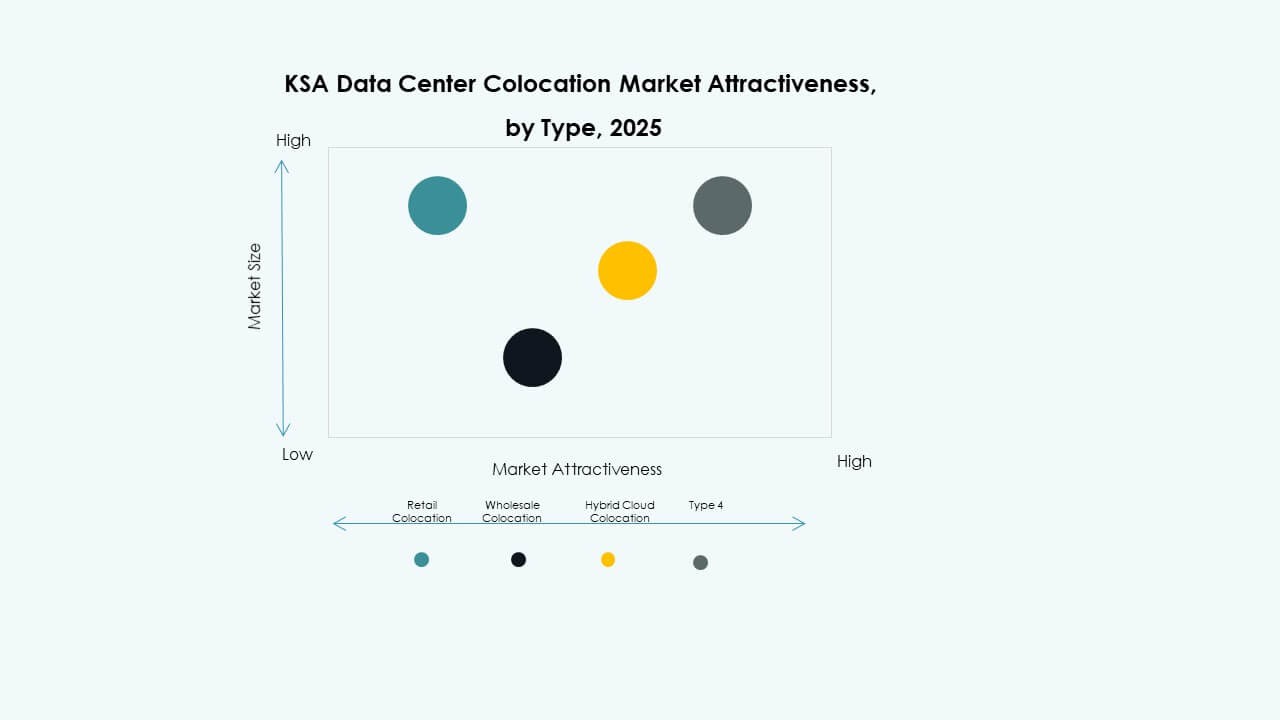

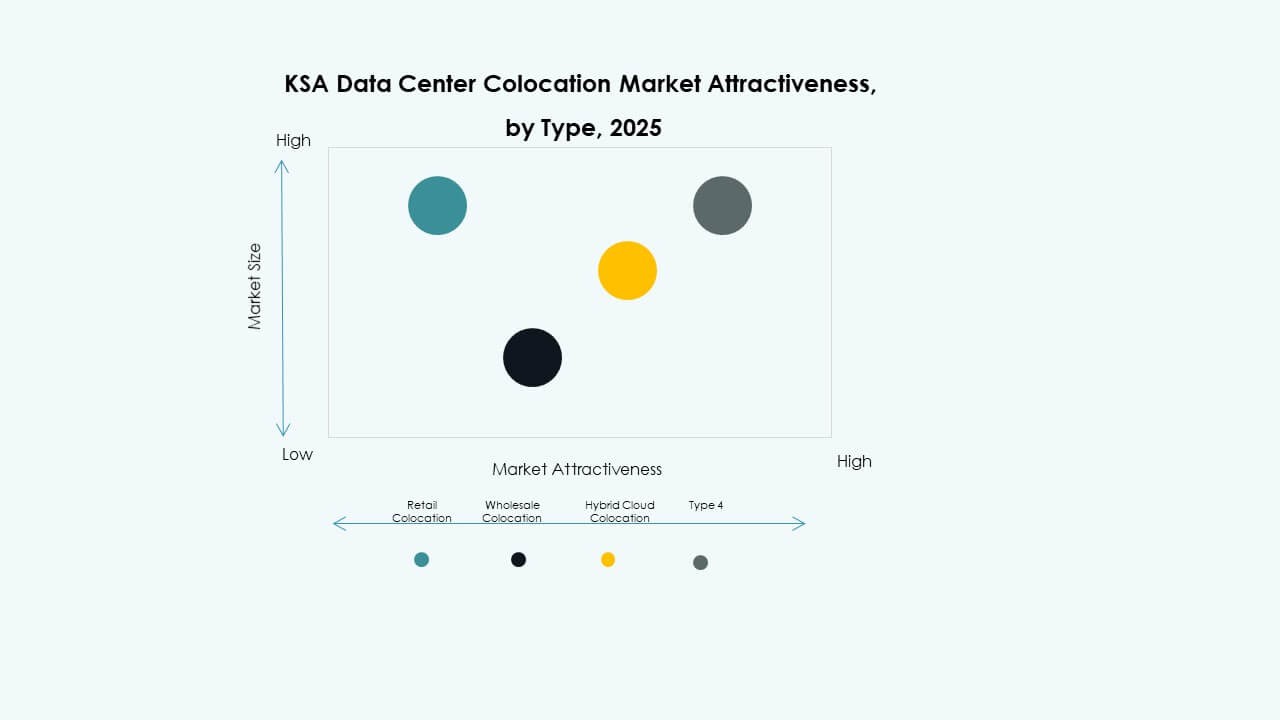

By Type

Retail colocation dominates the KSA Data Center Colocation Market due to strong enterprise demand for flexible infrastructure. SMEs and large enterprises prefer shared facilities to reduce capital costs. Wholesale colocation gains momentum through hyperscale deployments and long-term contracts. Hybrid cloud colocation attracts firms adopting multi-cloud strategies. Retail’s leadership stems from agility and cost efficiency. It supports rapid scaling and strong network integration. Demand intensifies with rising SaaS and IaaS consumption. Competitive pricing enhances adoption among diverse industry verticals.

By Tier Level

Tier 3 leads the KSA Data Center Colocation Market with the largest share, supported by its balance of cost, performance, and uptime. It offers 99.982% availability and redundant infrastructure. Tier 4 facilities gain traction in financial services and government sectors needing mission-critical uptime. Tier 1 and Tier 2 remain relevant for SMEs with lower redundancy needs. Growth of Tier 3 reflects demand for reliability and scalability. Operators invest in upgrades to meet evolving compliance. High service availability builds customer trust.

By Enterprise Size

Large enterprises account for the majority share in the KSA Data Center Colocation Market. Their need for high capacity, secure, and interconnected environments drives demand. SMEs increasingly adopt colocation for cost efficiency and flexibility. The enterprise segment leverages colocation to modernize IT strategies. Strong integration with hybrid and multi-cloud frameworks supports digital transformation. Large companies dominate due to global connectivity requirements. SMEs boost adoption through modular services. Both segments contribute to market diversification and steady growth.

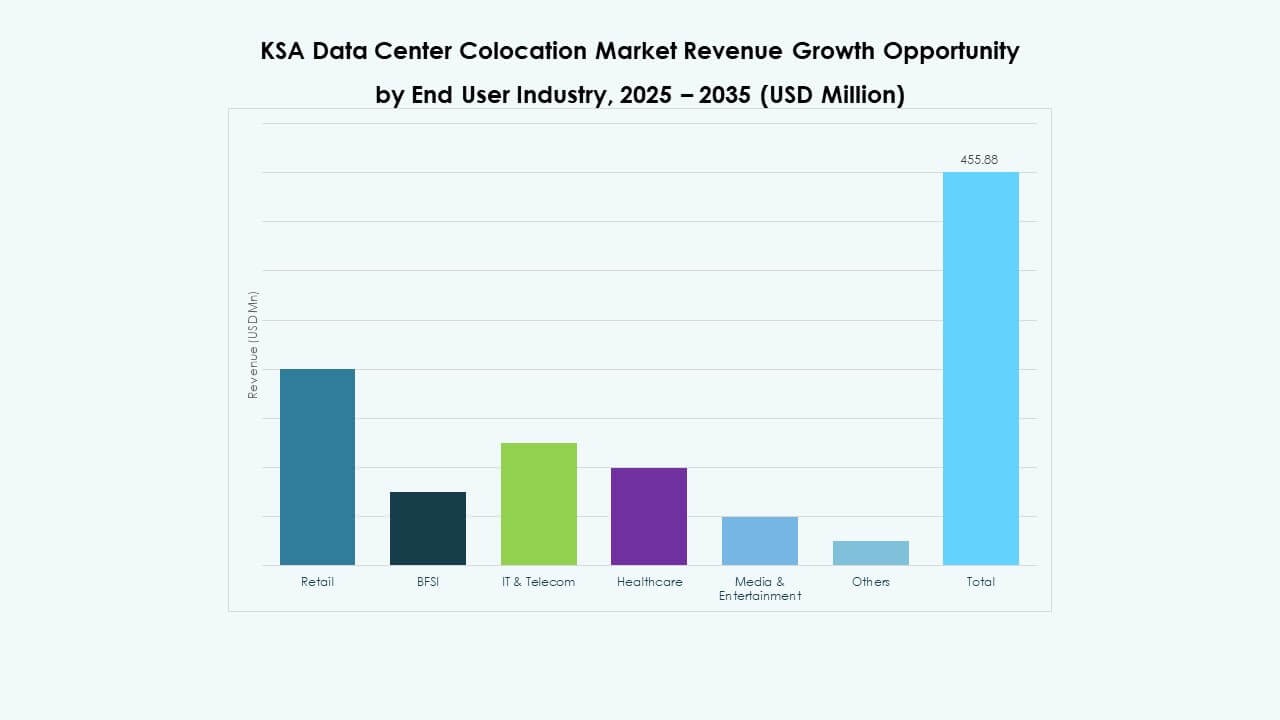

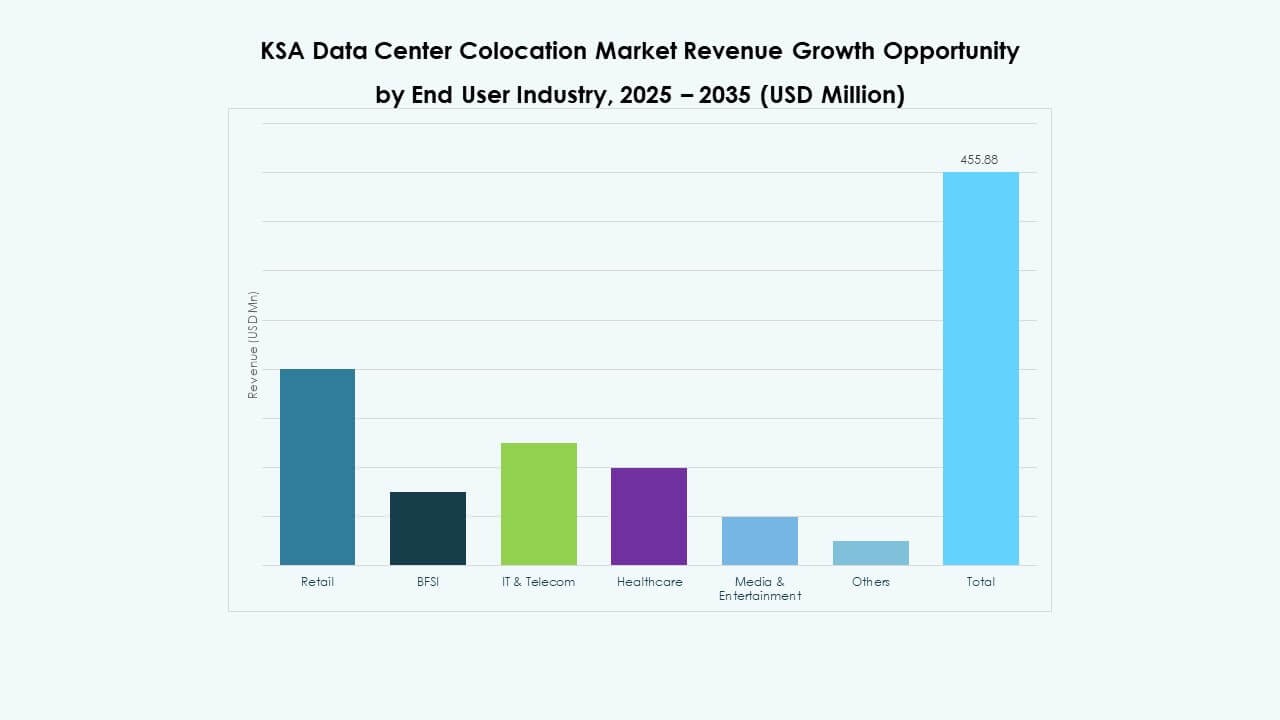

By End User Industry

IT & Telecom dominates the KSA Data Center Colocation Market due to heavy cloud usage and data traffic. BFSI follows with strong regulatory compliance and data security needs. Retail and healthcare sectors increase investments to support e-commerce and telemedicine growth. Media and entertainment leverage colocation for content delivery. Others adopt it for cost reduction and flexibility. IT & Telecom drives infrastructure modernization. High bandwidth demand and connectivity requirements sustain its leadership in the segment.

Regional Insights

Central Region – Riyadh Leading with 46.8% Market Share

The central region leads the KSA Data Center Colocation Market due to strong infrastructure development and strategic investments. Riyadh serves as the primary digital hub, hosting major hyperscale and colocation facilities. Government projects and telecom expansions strengthen its leadership. It benefits from advanced connectivity and a concentration of enterprise headquarters. Proximity to policy centers supports faster regulatory processing. The city’s strong fiber backbone enhances network resilience. This positioning cements its role as a core data ecosystem.

- For instance, Center3, a subsidiary of STC, expanded its Khurais data center in Riyadh by 9.6 MW as part of its plan to reach more than 300 MW of capacity by 2027. The project aligns with Center3’s national strategy to scale up to 1 GW of data center capacity by 2030.

Western Region – Jeddah and Mecca Emerging with 31.5% Market Share

The western region is emerging as a key growth zone, supported by its proximity to international cable landing points. Jeddah attracts investments for hyperscale expansion and content delivery networks. It supports low-latency applications and global connectivity. The region benefits from a growing enterprise base and strategic port access. Infrastructure modernization improves hosting capabilities. International partnerships boost capacity and resilience. This region positions itself as a gateway for global data traffic in the Kingdom.

Eastern Region – Dammam Gaining Momentum with 21.7% Market Share

The eastern region is gaining momentum due to its strong industrial base and energy sector demand. Dammam serves enterprises in petrochemical, manufacturing, and logistics. It connects to major telecom networks supporting secure colocation services. Proximity to energy infrastructure enhances its strategic value. Investors view this region as a complementary hub to Riyadh and Jeddah. Strong network upgrades increase reliability. The region builds capacity to support growing digital transformation in key industries.

- For instance, DAMAC Digital (formerly EDGNEX Data Centers by DAMAC) achieved Uptime Institute Tier III Certification for its Dammam Phase 1 data center, recognizing 5,150 kW of IT load capacity across multiple halls and meet-me rooms. The certification confirms concurrently maintainable operations and strengthens the company’s position in Saudi Arabia’s colocation market.

Competitive Insights:

- Mobily

- STC (Saudi Telecom Company)

- Zain KSA

- NourNet

- Digital Realty Trust

- Amazon Web Services (AWS)

- Google Cloud

- CoreSite

- CyrusOne

- Equinix, Inc.

- NTT Ltd. (NTT DATA)

The KSA Data Center Colocation Market features a strong mix of domestic telecom operators and global hyperscale providers. It is shaped by investments in edge infrastructure, cloud integration, and hybrid solutions. Mobily, STC, and Zain KSA expand their footprint through high-capacity facilities and carrier-neutral services. Global firms like Equinix, AWS, and NTT focus on strategic partnerships to strengthen their regional presence. Operators prioritize low-latency performance, security, and energy-efficient infrastructure to attract enterprise clients. Pricing competitiveness, service differentiation, and interconnection capabilities drive market positioning. Demand from finance, telecom, and cloud sectors accelerates network expansion. Leading players strengthen their advantage through new deployments and technology upgrades.

Recent Developments:

- In September 2025, Saudi Telecom Company (STC) and its subsidiary, Solutions by STC, finalized a SAR 313.39 million (approximately $62 million) agreement to expand data centers across Khamis Mushait, Dammam, Qassim, and north Riyadh. Signed on September 28, this 36-month deal focuses on modernizing infrastructure, enhancing 5G networks, and upgrading equipment to boost national connectivity.

- In July 2025, Zain KSA entered into a strategic memorandum of understanding with Cisco to develop artificial intelligence (AI) infrastructure and GPU-as-a-service solutions in Saudi Arabia. This collaboration aims to build robust, AI-ready colocation environments, enabling enterprise and government clients to access high-performance computing resources. The partnership further supports local talent development and innovation initiatives as part of Vision 2030’s digital transformation roadmap.

- In May 2025, DataVolt entered into a strategic $20 billion partnership with U.S.-based Supermicro to accelerate the development of Saudi Arabia’s National Data Center Strategy. This collaboration aims to enhance the Kingdom’s AI infrastructure and green energy integration by localizing high-performance computing systems and data center hardware production.

- In January 2025, Amazon Web Services (AWS) launched a new CloudFront Edge location in Jeddah, Saudi Arabia. This expansion, made official on January 24, enhances regional content delivery with low-latency performance and DDoS protection via AWS Shield. The development comes ahead of AWS’s forthcoming $5.3 billion hyperscale data center region in the Kingdom, expected to be operational by 2026.