Executive summary:

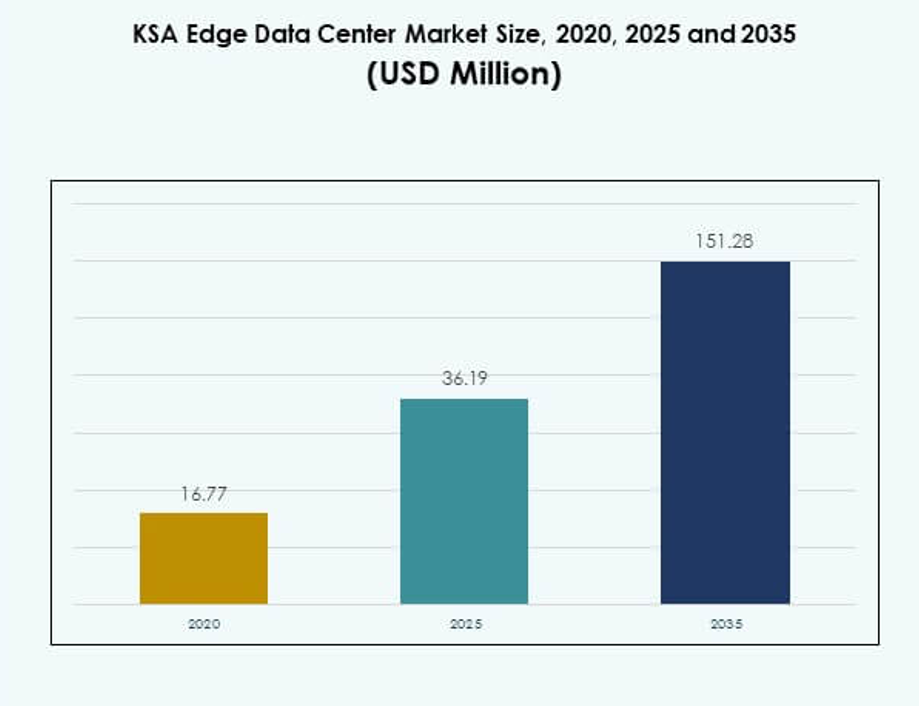

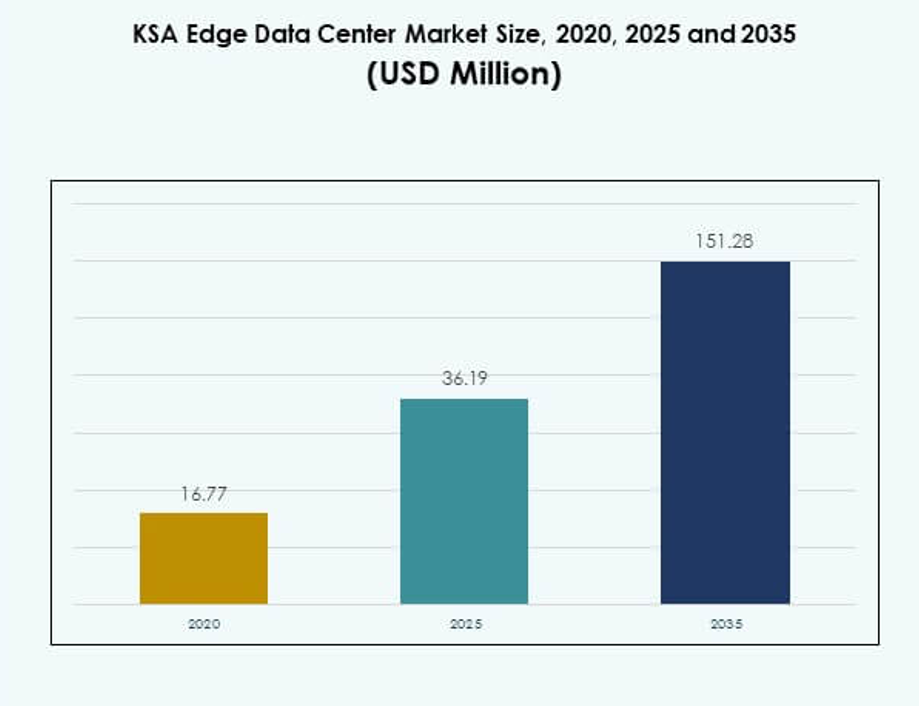

The KSA Edge Data Center Market size was valued at USD 16.77 million in 2020 to USD 36.19 million in 2025 and is anticipated to reach USD 151.28 million by 2035, at a CAGR of 15.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| KSA Edge Data Center Market Size 2025 |

USD 36.19 Million |

| KSA Edge Data Center Market, CAGR |

15.24% |

| KSA Edge Data Center Market Size 2035 |

USD 151.28 Million |

The KSA Edge Data Center Market is expanding rapidly due to strong demand for decentralized infrastructure and low-latency solutions. Growing 5G deployments, AI integration, and cloud-edge convergence are reshaping enterprise IT strategies. It plays a crucial role in enhancing operational efficiency, security, and scalability across industries. Businesses and investors view the market as a strategic enabler of digital transformation, supported by strong government initiatives and private sector investments driving technology modernization.

The Western region leads the KSA Edge Data Center Market due to advanced connectivity infrastructure and strong smart city initiatives. Central KSA is emerging as a key hub for digital transformation projects, supported by strong enterprise adoption and innovation programs. Eastern KSA is growing steadily, driven by its strong industrial base and operational requirements. These regions together create a balanced landscape for future expansion and infrastructure diversification.

Market Dynamics:

Rising Demand for Decentralized Infrastructure and Real-Time Data Processing

The KSA Edge Data Center Market benefits from increasing adoption of decentralized infrastructure. Enterprises are shifting away from centralized models to reduce latency and improve data processing speed. Real-time analytics is driving this shift, especially in sectors like manufacturing, logistics, and energy. Investors see strong potential in local processing nodes supporting IoT and AI applications. It helps enterprises cut dependency on distant cloud servers. Regulatory initiatives encourage technology localization and edge-based services. Reduced operational delays strengthen business continuity. These factors position edge data centers as critical enablers of digital transformation in the Kingdom.

Accelerating Adoption of Emerging Technologies Across Key Industry Verticals

Growing integration of 5G, IoT, and AI fuels market expansion. Enterprises require localized processing to manage high-volume data streams from connected devices. Edge infrastructure supports low-latency AI model execution, enabling faster decision-making. It is crucial in healthcare, smart transportation, and financial services. Deployment of 5G networks further enhances edge capabilities. Cloud-to-edge convergence also improves workload distribution. This technological evolution is attracting global and regional investors. Industry verticals increasingly depend on edge computing to achieve efficiency and responsiveness.

- For example, STC Group and Ericsson achieved a record 4 Gbps uplink speed during a live 5G Standalone (SA) demo in Saudi Arabia using Ericsson’s dual-mode 5G core system, directly proving the low-latency and high-throughput capabilities of localized edge nodes for next-gen networks.

Government-Led Digital Transformation and National Infrastructure Investments

Large-scale digital initiatives under Vision 2030 increase demand for edge infrastructure. Smart city projects, AI innovation hubs, and e-governance programs drive investment. Public sector funding accelerates edge deployment across urban and rural regions. It ensures strong connectivity and service reliability. Strategic public-private partnerships boost market confidence. Government incentives reduce financial barriers for infrastructure expansion. High focus on cybersecurity also strengthens ecosystem trust. These measures make the country a leading hub for digital edge innovation in the Middle East.

- For example, in February 2025, NEOM signed a $5 billion agreement with DataVolt to build a 1.5 GW data center campus in the Oxagon industrial zone. The project is positioned as one of the world’s largest next-generation data centers, designed to power AI workloads, IoT networks, and smart infrastructure. It will operate on renewable energy to support NEOM’s net-zero goals and Vision 2030 objectives.

Growing Strategic Relevance for Businesses and Global Investors

Edge computing plays a strategic role in driving competitiveness and business agility. Companies rely on localized processing to handle mission-critical operations. It supports seamless user experiences, secure transactions, and operational resilience. Investors consider edge deployments a key infrastructure asset. Global cloud service providers are partnering with local operators to strengthen presence. Competitive cost structures and advanced connectivity attract foreign investments. Technology vendors view the market as a growth accelerator in the region. This strategic relevance enhances long-term business confidence.

Market Trends

Integration of Edge with 5G Networks and AI Workloads to Drive Low-Latency Applications

Telecom operators and cloud providers are merging edge deployments with 5G rollouts. The integration enables ultra-fast data transmission and near real-time processing. It supports advanced applications in autonomous mobility, telemedicine, and immersive media. Businesses prefer hybrid models that combine cloud scalability with edge speed. It reduces congestion in core networks and improves user experience. AI workloads also benefit from localized inference and minimal delay. It strengthens operational efficiency across industries. The convergence creates a robust foundation for next-generation digital services.

Rising Popularity of Modular and Prefabricated Edge Data Centers

Companies are investing in modular edge infrastructure to accelerate deployment timelines. Prefabricated units enable scalable and flexible installations in urban and remote locations. It reduces construction costs and improves operational agility. Demand is growing in retail, healthcare, and manufacturing sectors. Compact modular solutions meet sustainability and energy-efficiency goals. The flexibility to expand capacity quickly attracts mid-size enterprises. It also aligns well with the national vision for technology decentralization. These trends support rapid and cost-effective infrastructure scaling.

Increasing Adoption of AI-Powered Management and Monitoring Platforms

Edge data centers are integrating AI to optimize power, cooling, and security systems. Intelligent automation enables predictive maintenance and energy efficiency improvements. It enhances visibility across distributed assets and supports uptime reliability. AI systems detect faults faster, reducing operational disruptions. Enterprises are shifting to centralized dashboards for real-time monitoring. It helps improve asset performance and cost control. The adoption of these tools reflects growing focus on operational intelligence. AI-based control layers are becoming standard in advanced deployments.

Expanding Ecosystem of Strategic Partnerships and Joint Ventures

Global hyperscalers, telecom operators, and local technology firms are forming alliances. These partnerships accelerate deployment and expand service reach. It allows companies to pool resources and enhance infrastructure coverage. Industry collaboration creates integrated solutions that meet varied enterprise needs. Joint ventures bring financial strength and technical expertise. Such strategic alignment boosts competitiveness and service innovation. It also supports localization targets set under national strategies. These partnerships strengthen the overall ecosystem and market depth.

Market Challenges

High Capital Expenditure and Infrastructure Deployment Complexities

Edge data center infrastructure demands significant upfront investment. Real estate costs, advanced cooling systems, and high-capacity networks raise financial barriers. It remains challenging for small and mid-sized enterprises to fund large deployments. Energy efficiency goals require costly specialized equipment. The KSA Edge Data Center Market faces delays from site acquisition and permitting processes. Network integration with legacy systems further complicates expansion. It also requires skilled technical staff for smooth operation. These financial and structural hurdles limit rapid adoption.

Regulatory Constraints and Shortage of Skilled Workforce

Complex regulatory requirements slow down deployment speed. Companies must meet strict data localization, security, and compliance standards. It increases planning and operational costs for operators. A shortage of skilled edge computing professionals creates capacity gaps. Limited technical training programs affect scaling efficiency. The market also faces longer project execution timelines. It must balance innovation with security and regulatory frameworks. Addressing these issues is critical to sustaining growth momentum.

Market Opportunities

Strategic Expansion Through Localization and Sustainable Infrastructure Development

Government policies support localization of edge infrastructure through incentives. It creates opportunities for partnerships between international providers and local operators. Rising demand for sustainable, energy-efficient data centers drives new investment channels. It enables vendors to design eco-friendly systems meeting ESG standards. The KSA Edge Data Center Market benefits from its central location as a digital hub. Expansion aligns with broader goals of technological leadership in the region. This localization strategy attracts private and institutional capital.

Accelerating Growth in Industry-Specific Edge Use Cases

Industries such as healthcare, energy, and retail are adopting edge solutions to support digital transformation. It allows faster and more secure handling of sensitive operational data. Growing interest in industrial automation creates demand for customized solutions. Vendors can develop vertical-specific offerings to strengthen market position. Cloud-edge integration also enables new revenue models and service innovations. These opportunities make the market attractive for global and regional players.

Market Segmentation

By Component

Solution dominates the segment with 67% share, driven by rising demand for edge servers, storage, and network infrastructure. Companies prioritize robust, scalable solutions to support AI, IoT, and real-time analytics. It enables faster deployments and secure data handling at local levels. Service segment grows steadily with increasing need for maintenance, monitoring, and system upgrades. The KSA Edge Data Center Market benefits from enterprise demand for end-to-end solution suites that integrate hardware and software effectively.

By Data Center Type

Colocation edge data center holds 34% share, making it the dominant type. Enterprises prefer colocation to reduce capital expenditure and achieve flexibility. It offers scalable space, high-speed connectivity, and strong physical security. Managed and cloud-based edge data centers are also expanding rapidly. The market benefits from rising demand for hybrid architectures. Flexible leasing models attract SMEs and large corporations seeking cost control. It strengthens adoption across sectors including telecom, BFSI, and retail.

By Deployment Model

Cloud-based deployment leads the segment with 46% share. Enterprises adopt cloud models to gain flexibility, scalability, and efficient cost management. It supports rapid workload distribution and remote operations. Hybrid models are gaining traction due to their balanced performance and security. On-premises models remain relevant for sectors with strict data sovereignty needs. The KSA Edge Data Center Market reflects growing preference for flexible, scalable architectures meeting evolving digital requirements.

By Enterprise Size

Large enterprises account for 62% share due to higher IT budgets and complex operational demands. They deploy advanced edge infrastructure to support AI, IoT, and mission-critical workloads. SMEs show steady growth driven by modular and colocation-based solutions. It reflects increasing affordability and flexibility in deployment models. Larger firms influence technology adoption trends, strengthening the overall ecosystem. Edge computing enables better performance, reliability, and operational cost control.

By Application / Use Case

Power monitoring holds 28% share, making it the leading use case. High energy efficiency goals drive adoption of edge-based monitoring systems. These systems help optimize power usage and reduce operational costs. Capacity management and asset tracking follow closely, supported by automation needs. The KSA Edge Data Center Market experiences growth through AI integration in critical monitoring applications. It helps enterprises maintain operational efficiency and sustainability targets.

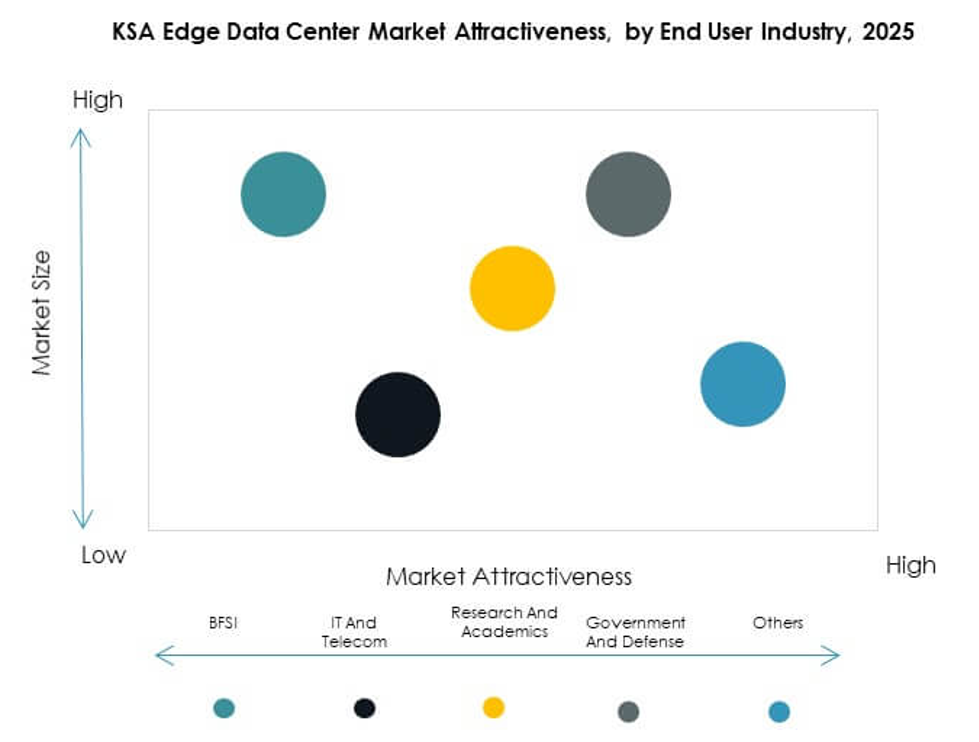

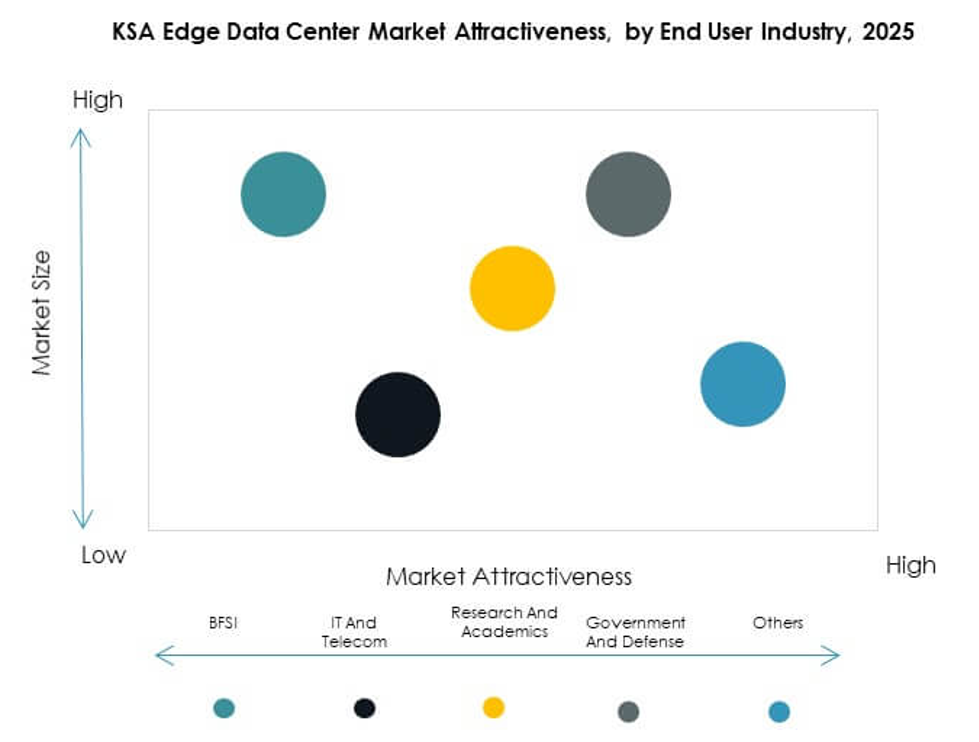

By End User Industry

IT and telecommunications lead the segment with 31% share, driven by 5G expansion and digital service delivery. The sector depends on edge infrastructure for low-latency applications and network efficiency. BFSI and healthcare industries also show strong growth due to security and compliance requirements. Retail, energy, and defense sectors increasingly adopt distributed infrastructure for real-time operations. These industries enhance the market depth and diversification, boosting future scalability.

Regional Insights

Western Region – Dominant Hub for Edge Infrastructure Deployment

Western KSA holds 39% share and leads in edge infrastructure investments. The region benefits from developed urban centers, strong connectivity, and ongoing smart city projects. Strategic hubs like Jeddah and Makkah drive large enterprise adoption. It attracts cloud and telecom operators seeking network expansion. Local authorities support infrastructure deployment through fast-track permitting and incentives. Industrial and logistics sectors also anchor demand in the region. This dominance strengthens its role as a digital hub.

Central Region – Rising Adoption Driven by Technology Integration

Central KSA accounts for 33% share and shows strong growth momentum. Riyadh acts as the core center for public and private technology initiatives. The region hosts major government projects focusing on AI, 5G, and IoT deployment. It benefits from concentrated financial services, retail, and telecom industries. It supports edge deployments to enhance service reliability and operational speed. Public-private partnerships encourage market expansion. The region is positioned as a key enabler of digital transformation.

- For example, Center3 announced in August 2025 its goal to achieve 1 Gigawatt of total installed data center capacity by 2030, with 300MW to be completed by 2027. This expansion supports hyperscale, AI, and cloud workloads, particularly focusing on new deployments and scaling in Riyadh to align with Saudi Vision 2030’s local digital services strategy.

Eastern Region – Strong Industrial Base Supporting Edge Growth

Eastern KSA holds 28% share and shows increasing interest in edge deployment for energy and manufacturing. The region is home to major oil and gas facilities driving demand for localized data processing. It focuses on operational resilience and real-time monitoring. Strategic investments in industrial automation support edge adoption. It benefits from high bandwidth availability and strong connectivity infrastructure. Collaboration between technology vendors and industrial operators strengthens ecosystem growth. This strategic focus reinforces the region’s industrial leadership.

- For example, Aramco, in 2025, leveraged thousands of IoT sensors, drones, and AI-driven analytics at its Khurais oil field and Uthmaniyah Gas Plant. These technologies led to an 18% reduction in power consumption, approximately 30% reduction in maintenance costs, and up to 40% faster inspection times as part of Aramco’s fourth industrial revolution (4IR) digital transformation initiatives.

Competitive Insights:

- STC (Saudi Telecom)

- Mobily

- Zain KSA

- Salam

- EdgeConneX

- Eaton Corporation

- Dell Technologies Inc.

- Fujitsu

- Cisco

- SixSq

- Microsoft

- VMWare

- Schneider Electric SE

- Rittal GmbH & Co. Kg

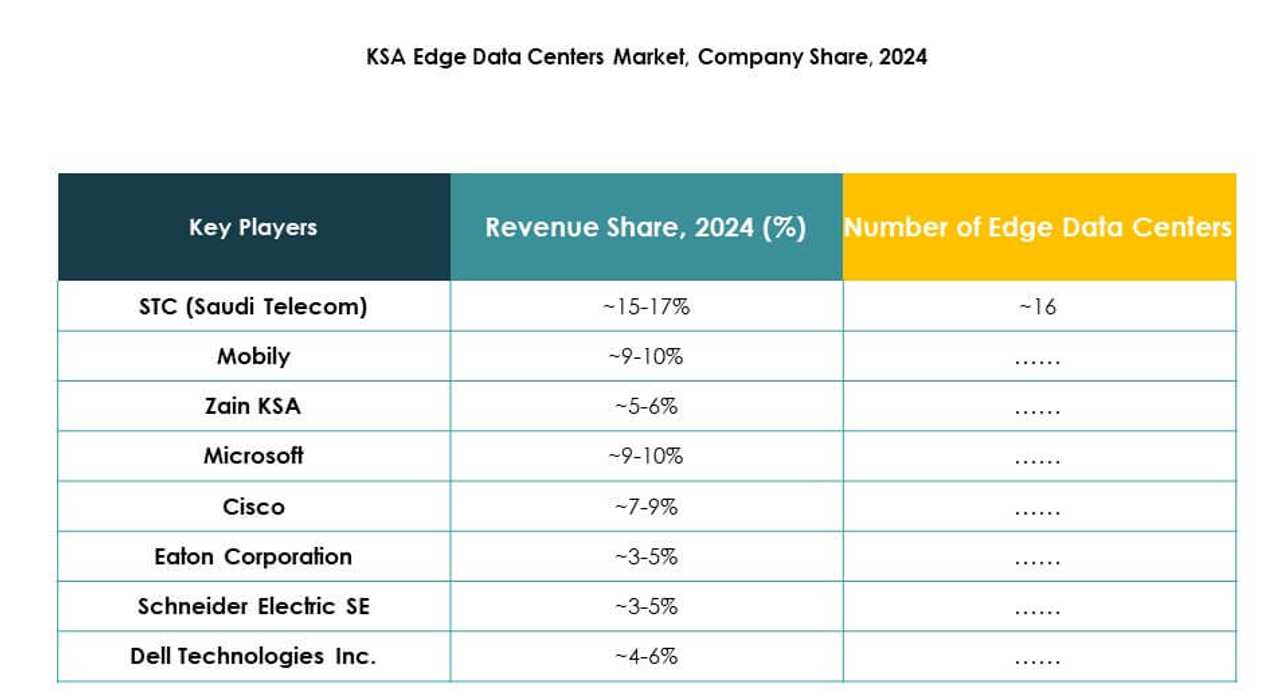

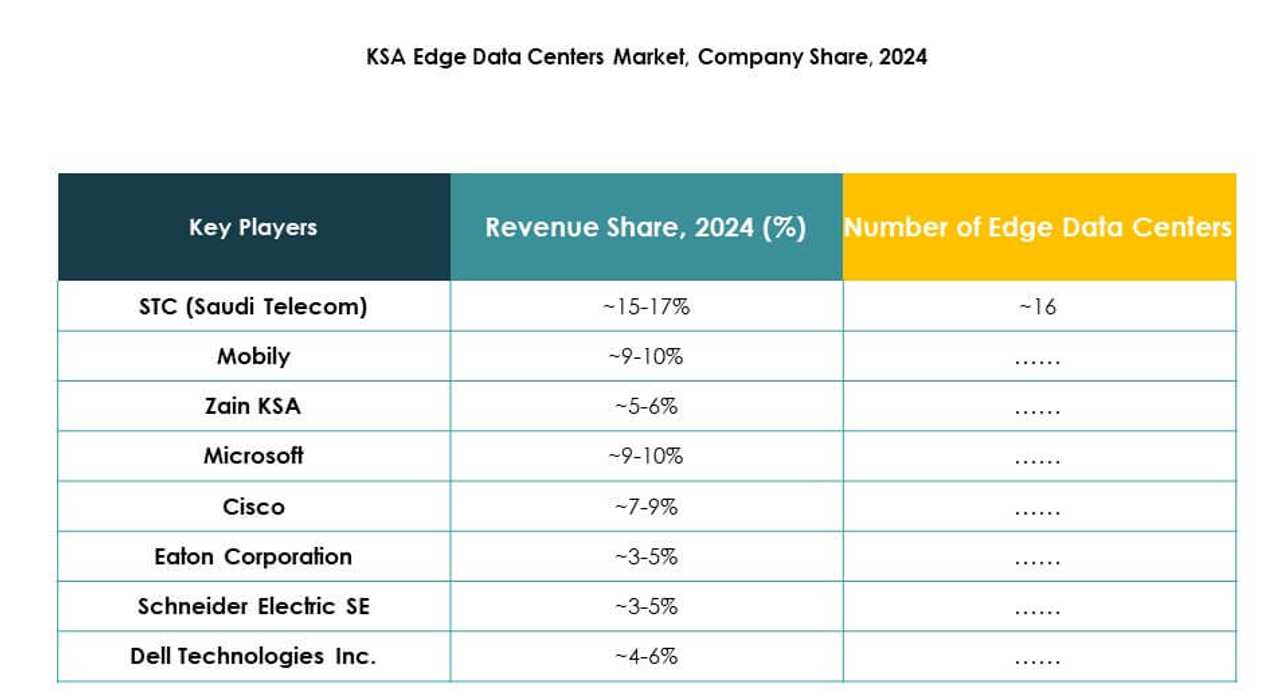

The KSA Edge Data Center Market is shaped by strong competition between domestic telecom leaders and global technology providers. It reflects a mix of infrastructure operators, cloud service vendors, and equipment manufacturers. STC, Mobily, and Zain KSA dominate local infrastructure investments through wide network coverage and edge deployment projects. Global players such as Dell Technologies, Cisco, and Microsoft focus on advanced computing, connectivity, and hybrid cloud solutions. EdgeConneX and Schneider Electric strengthen ecosystem development through modular and energy-efficient infrastructure. VMWare and Fujitsu provide virtualization and management platforms that enable enterprise flexibility. It benefits from alliances, mergers, and product launches that drive market expansion. Competitive intensity continues to rise with new entrants and strategic collaborations across multiple industries.

Recent Developments:

- In September 2025, STC (Saudi Telecom) and its subsidiary Solutions signed a $62 million contract to expand data center infrastructure across key regions in Saudi Arabia, including Khamis Mushait, Dammam, Qassim, and north Riyadh. This 36-month deal will upgrade internal and international networks, replace obsolete equipment, and support 5G services, aligning closely with the Kingdom’s digital transformation goals and strengthening its telecommunications ecosystem.

- In July 2025, Zain KSA and Cisco entered a Memorandum of Understanding focused on advancing Saudi Arabia’s AI infrastructure. This agreement, which is part of Zain’s strategy aligned with Vision 2030, will enable the development of GPU-as-a-Service offerings to support AI research and innovation initiatives within the country.

- In March 2025, Zain KSA completed a comprehensive digital transformation program in partnership with Netcracker Technology, replacing legacy infrastructure with advanced cloud-based BSS/OSS systems. This strategic move enhances customer experiences and diversifies Zain’s business into fintech, IoT, and cloud services.

- In February 2025, Mobily announced an investment of $905 million to develop new data centers and submarine cables, reinforcing Saudi Arabia’s status as a regional digital hub. This initiative supports the country’s Vision 2030 and includes the launch of advanced digital services, automation, and analytics for both public and private sectors.