Market Research Services

Unparalleled Clarity & Foresight Our syndicated reports are the definitive industry benchmark. Built on a proprietary global data engine, they provide the exhaustive market sizing, competitive analysis, and five-year forecasting you need to act decisively. We don’t just report on the market; we define it.

Strategic Consulting Services

From Insight to Impact Navigate your most critical investment, expansion, and technology decisions with direct access to our senior experts. We act as a trusted extension of your team, providing the objective, data-driven counsel required to de-risk strategy and maximize returns.

Bespoke Solutions & Analytics

Your Questions, Answered. When off-the-shelf research isn’t enough, our bespoke solutions deliver intelligence tailored to your precise strategic needs. We design and execute custom projects to address your unique challenges, giving you a defensible, proprietary edge.

Data Center Ecosystem

Infrastructure

- Server Hardware

- Networking Equipment

- Storage Solutions

- Power & Cooling Systems

- Racks & Enclosures

Facilities

- Physical Buildings

- Redundancy & Reliability Systems

- Monitoring Systems

Key Stakeholders

- Operators

- Cloud Providers

- Colocation Providers

- Hardware Vendors

- Software Vendors

- Consultants & Integrators

- Energy Providers

- Security & Compliance Firms

Supporting Services & Technologies

- Virtualization & Cloud Management

- Monitoring & Management Tools

- Security & Backup

- Sustainability & Efficiency Tools

Market Segments in the Ecosystem

- Hyperscale Data Centers

- Enterprise Data Centers

- Edge Data Centers

- Colocation & Managed Services

- Others

Emerging Trends

- Green & Sustainable Data Centers

- Edge Computing Integration

- AI & Automation

- Hybrid & Multi-Cloud Environments

Ecosystem Value Chain

- Design & Engineering

- Construction & Deployment

- Operations & Maintenance

- Upgrades & Optimization

- Decommissioning & Recycling

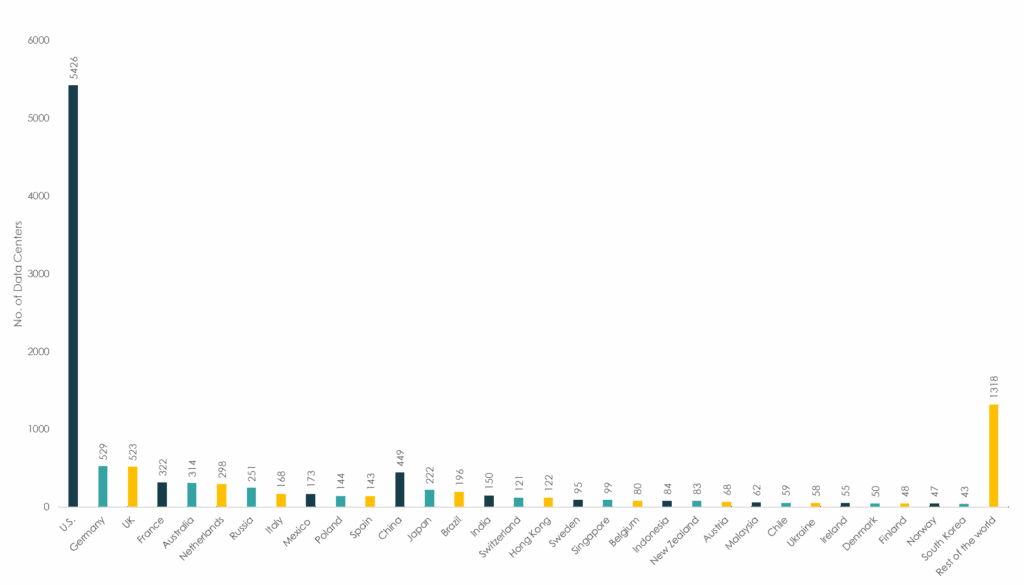

Global Data Center Market Research Report Coverage, 2025

100+ Number of Countries Covered in the Report

North America

Capacity ~ 60-70 GW

Number of Data Center: 5750+

Europe

Capacity ~ 15-20 GW

Number of Data Center: 1460+

Asia Pacific

Capacity ~ 30-40 GW

Number of Data Center: 1500+

Latin America

Capacity ~ 1-2 GW

Number of Data Center: 250+

Middle East

Capacity ~ 0.5-1.5 GW

Number of Data Center: 100+

Latin America

Capacity ~ 0.2- 0.7 GW

Number of Data Center: 100+

Global Data Center Market Snapshots, 2025

By Revenue, Size, Leading Countries, Global Data Giants, Regional Players, Operators and Providers

| Key Players | Revenue, 2024 (USD Million) | Number of Data Centers |

|---|---|---|

| Equinix, Inc. | 8,500 | ~ 260-270 data centers |

| Digital Realty Trust, Inc. | 5,900 | ~ 300 facilities |

| NTT Communications Corporation | 7,000 | ~ 95 data centers |

| CyrusOne Inc. | 1,200 | ~ 55 data centers |

| Amazon Web Services, Inc. | 107,000 | Over 100 data center locations + many regions / AZs |

| Microsoft Corporation | 75,000 | ~ 200+ data centers / cloud infrastructure sites |

| Google LLC (Alphabet Inc.) | 12,000 | ~ 36-40 data center / cloud region / facility locations |

| Rank | Data Center Name | Location | Power Capacity (MW) | Area (sq. meters) | Cost ($) | |

|---|---|---|---|---|---|---|

| 1 | China Telecom – Inner Mongolia Information Park | Hohhot, Inner Mongolia, China | ~150 | ~1,000,000 | ~$2,800–3,000 Million | Ke Ruiwen |

| 2 | The Citadel – Switch | Tahoe Reno, Nevada, USA | ~650 | ~675,000 | ~$1,300 Million | Rob Roy |

| 3 | Harbin Data Center | Harbin, Heilongjiang Province, China | ~200 | ~665,000 | N/A | No public CEO listed |

| 4 | Range International Information Hub | Langfang, Hebei Province, China | ~150 | ~585,000 | ~$2,900–3,000 Million | Arvind Krishna |

| 5 | Switch SuperNAP | Las Vegas, Nevada, USA | ~315 | ~325,000 | ~$1,100+ Million | Rob Roy |

| 6 | Google Data Center | Council Bluffs, Iowa, USA | ~100 | ~269,000 | ~$5,500 Million | Sundar Pichai |

| 7 | CWL1 Data Centre | Newport, Wales, UK | ~148 | ~185,806 | ~$1,300 Million | Sureel Choksi |

| 8 | Utah NSA Data Center | Bluffdale, Utah, USA | ~65 | ~130,064 | ~$1,500 Million | General Paul M. Nakasone |

| 9 | QTS Metro Data Center | Atlanta, Georgia, USA | ~70-130 | ~90,000 | N/A | Chad Williams |

| 10 | Apple Mesa Data Center | Mesa, Arizona, USA | ~50 | ~120,000 | ~$2,000+ Million | Tim Cook |

| Group 1 – Global Data Giants | Group 1 – Global Data Giants | Group 1 – Global Data Giants | Group 1 – Global Data Giants |

|---|---|---|---|

| 1 | Amazon Web Services (AWS) | Cloud | Global |

| 2 | Microsoft Azure | Cloud | Global |

| 3 | Google Cloud Platform (GCP) | Cloud | Global |

| 4 | Meta Platforms (Facebook) | Internal Use | Global |

| 5 | Equinix | Retail | Global |

| 6 | Digital Realty | Wholesale | Global |

| 7 | NTT Global Data Centers | Wholesale | Global |

| 8 | CyrusOne | Wholesale | North America, Europe |

| 9 | GDS Holdings | Wholesale | Asia Pacific |

| 10 | KDDI / Telehouse | Retail | Global |

| Group 2 – Major Regional Players | Group 2 – Major Regional Players | Group 2 – Major Regional Players | Group 2 – Major Regional Players |

| 1 | Corporate Office Properties Trust | Powered Shell | North America |

| 2 | CloudHQ | Wholesale | North America, Europe |

| 3 | Vantage Data Centers | Wholesale | Global |

| 4 | STACK Infrastructure | Wholesale | Global |

| 5 | DataBank | Retail | North America, Europe |

| 6 | Flexential | Retail | North America |

| 7 | Evoque Data Center Solutions | Retail | North America |

| 8 | Iron Mountain | Hybrid | North America, Europe |

| 9 | Aligned Data Centers | Wholesale | North America, Latin America |

| 10 | Sabey Data Centers | Wholesale | North America |

| Group 3 – Mid-Scale Operators | Group 3 – Mid-Scale Operators | Group 3 – Mid-Scale Operators | Group 3 – Mid-Scale Operators |

| 1 | 365 Data Centers | Retail | North America |

| 2 | Africa Data Centres | Wholesale | Africa |

| 3 | AIMS Data Centre | Retail | Asia Pacific |

| 4 | Ark Data Centres | Wholesale | Europe |

| 5 | Aruba Cloud | Retail | Europe |

| 6 | AtlasEdge Data Centres | Retail | Europe |

| 7 | atNorth | Hybrid | Europe |

| 8 | Big Data Exchange (BDx) | Hybrid | Asia Pacific |

| 9 | BlackChamber Group | Powered Shell | North America |

| 10 | Bulk Infrastructure | Wholesale | Europe |

| Group 4 – Niche Market Providers | Group 4 – Niche Market Providers | Group 4 – Niche Market Providers | Group 4 – Niche Market Providers |

| 1 | 1547 Critical Systems Realty (CSR) | Retail | North America |

| 2 | Adam Ecotech | Retail | Europe |

| 3 | Aptum Technologies | Retail | North America |

| 4 | AQ Compute | Wholesale | Europe |

| 5 | AT TOKYO | Retail | Asia Pacific |

| 6 | Atman | Retail | Europe |

| 7 | CapitaLand Ascendas REIT | Wholesale | Asia Pacific |

| 8 | CapitaLand India Trust (CLINT) | Wholesale | Asia Pacific |

| 9 | CleanArc Data Centers | Wholesale | North America |

| 10 | ClusterPower | Wholesale | Europe |

| Group 5 – Local Data Enterprises | Group 5 – Local Data Enterprises | Group 5 – Local Data Enterprises | Group 5 – Local Data Enterprises |

| 1 | 1623 Farnam | Retail | North America |

| 2 | 165 Halsey Street | Retail | North America |

| 3 | 4D Data Centres | Retail | Europe |

| 4 | Asanti Datacentres | Retail | Europe |

| 5 | Ascent Corp | Retail | North America |

| 6 | AtriaDC | Retail | Asia Pacific |

| 7 | AUBix | Retail | North America |

| 8 | Beyond.pl | Retail | Europe |

| 9 | Biznet Data Center | Retail | Asia Pacific |

| 10 | Bluebird Network | Retail | North America |

Published Report

-

Philippines Data Center Infrastructure Market

The Philippines Data Center Infrastructure Market size was valued at USD 360.14 million in 2020 to USD 816.35 million in 2025 and is anticipated to reach USD 2,701.01 million by 2035, at a CAGR of 12.61% during the forecast period.

-

South Korea Data Center Infrastructure Market

The South Korea Data Center Infrastructure Market size was valued at USD 1,083.70 million in 2020, grew to USD 2,321.37 million in 2025, and is anticipated to reach USD 6,949.52 million by 2035, at a CAGR of 11.49% during the forecast period.

-

Singapore Data Center Infrastructure Market

The Singapore Data Center Infrastructure Market size was valued at USD 761.53 million in 2020, reached USD 1,804.57 million in 2025, and is anticipated to reach USD 6,394.60 million by 2035, at a CAGR of 13.37% during the forecast period.

-

Vietnam Data Center Infrastructure Market

The Vietnam Data Center Infrastructure Market size was valued at USD 381.34 million in 2020 to USD 880.80 million in 2025 and is anticipated to reach USD 3,002.95 million by 2035, at a CAGR of 12.94% during the forecast period.

Why Us?

Why do industry leaders choose us?

Because in a world of generalists, our specialization is our strength.

100% Data Center Focus:

We don’t just cover this market; it is our entire world. Every analyst, every dataset, and every insight is dedicated exclusively to the data center ecosystem, ensuring unparalleled depth and expertise.

Proprietary Global Data Engine:

Our analysis is built on a foundation of constantly updated, proprietary data—not recycled information. We track supply, demand, pricing, and development pipelines in real-time, giving you the most current view of the market.

Direct Access to Senior Analysts:

Our clients don’t just buy reports; they build relationships with the experts who write them. Get the critical context and nuanced opinion behind the numbers, whenever you need it.

Actionable, Forward-Looking Intelligence:

We go beyond historical data to provide credible, five-year forecasts and strategic recommendations. We don’t just tell you what happened; we tell you what’s next and how to prepare for it.

Latest Blog

-

AI Is Straining The Grid: How Data Centers Will Power Up

The artificial intelligence revolution is consuming electricity at an unprecedented rate, and the infrastructure supporting it is approaching a breaking point. As ChatGPT, Gemini, and countless other AI models train on massive datasets and process billions of queries daily, data centers—the physical backbone of this digital transformation are projected to account for up to 9%

Build Your Strategic Advantage.

In a market where a single decision can be worth billions, clarity is the ultimate asset. Let’s discuss how our intelligence can empower your next move.