Executive Summary:

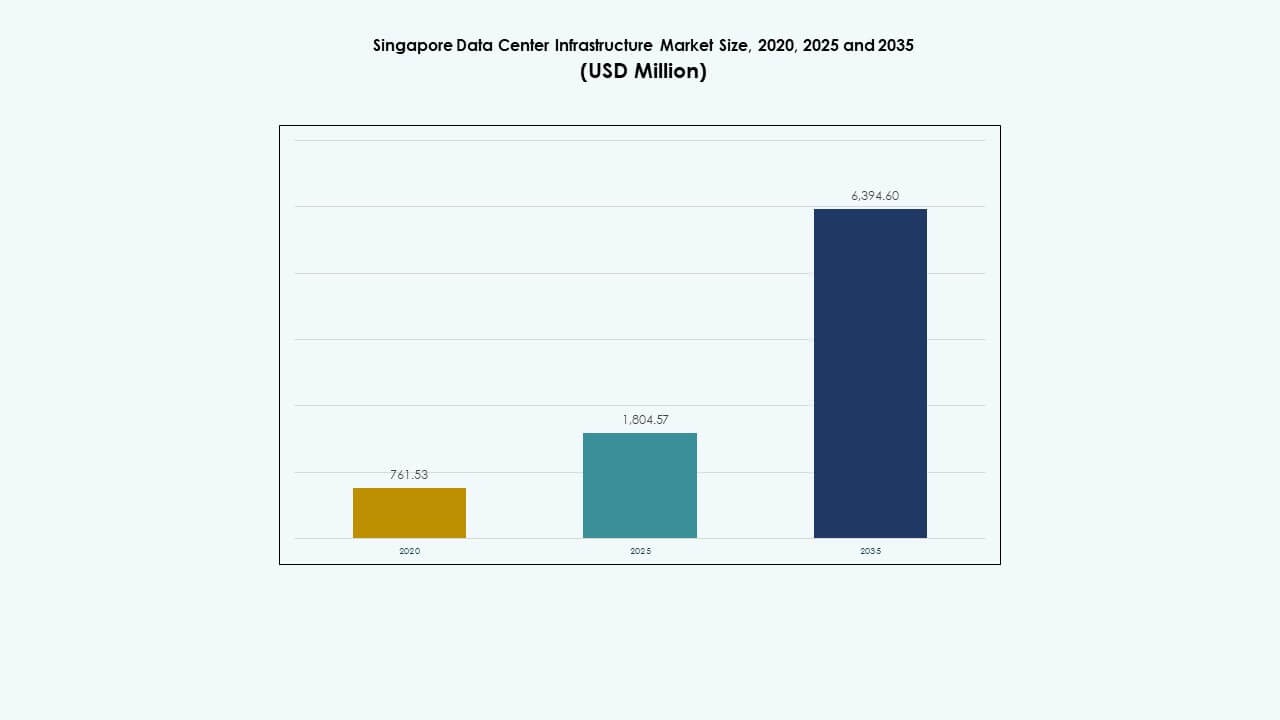

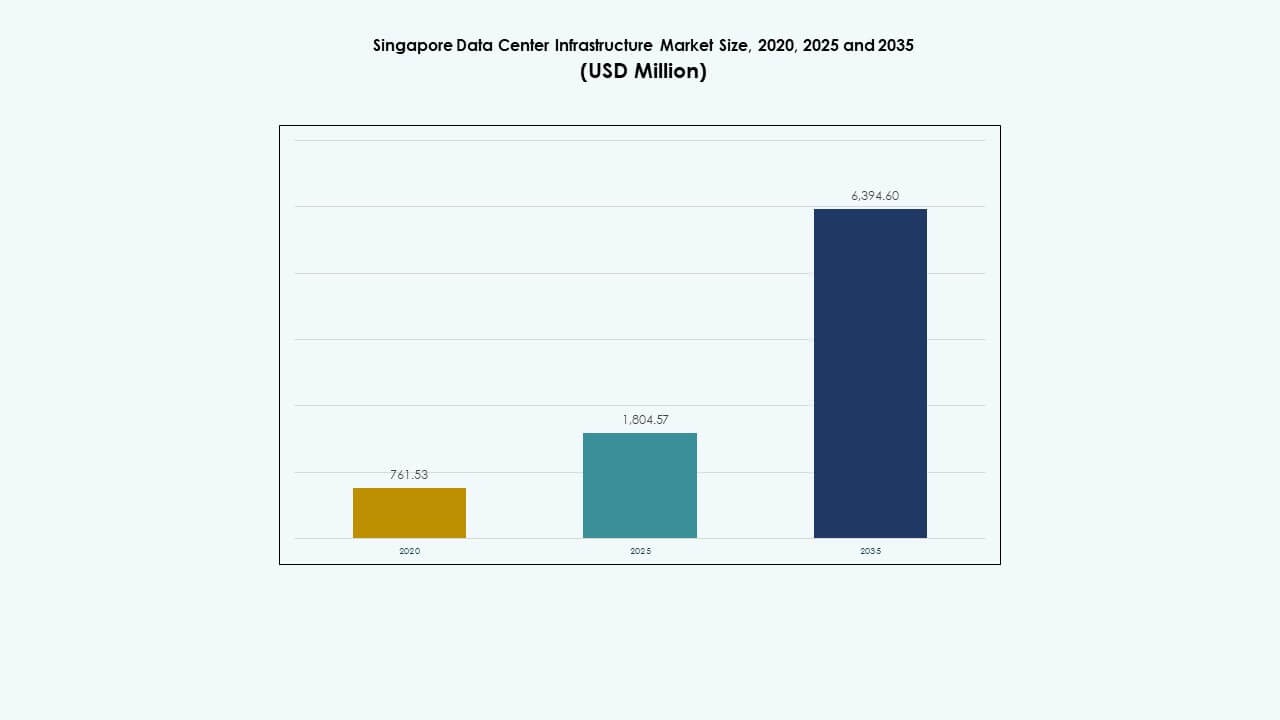

The Singapore Data Center Infrastructure Market size was valued at USD 761.53 million in 2020, reached USD 1,804.57 million in 2025, and is anticipated to reach USD 6,394.60 million by 2035, at a CAGR of 13.37% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Singapore Data Center Infrastructure Market Size 2025 |

USD 1,804.57 Million |

| Singapore Data Center Infrastructure Market, CAGR |

13.37% |

| Singapore Data Center Infrastructure Market Size 2035 |

USD 6,394.60 Million |

The Singapore Data Center Infrastructure Market benefits from rising AI workloads, green infrastructure mandates, and digital transformation across sectors. Smart nation initiatives and edge computing expansion require scalable and efficient data center systems. Operators deploy modular, high-density infrastructure to support hyperscale demands. Liquid cooling, automation, and battery storage adoption are increasing across facilities. These shifts make Singapore a preferred hub for hyperscalers and digital enterprises. Infrastructure upgrades also align with ESG investment goals.

Central Singapore leads the market due to its mature interconnectivity, high fiber density, and presence of major colocation hubs. Western Singapore is emerging as a hyperscale cluster with industrial zoning and new power capacity. Northern and Eastern parts support edge deployments and government-linked nodes. The Singapore Data Center Infrastructure Market reflects a concentrated but expanding regional footprint driven by infrastructure readiness and network proximity.

Market Drivers

Strong Growth Backed by Cloud Expansion, AI Workloads, and Demand for High-Density Infrastructure

Singapore’s data center market is expanding due to rising cloud adoption, AI deployment, and smart city goals. Businesses are investing in high-density, scalable IT infrastructure to support real-time analytics and machine learning. AI-ready data centers are being designed to support GPU-intensive tasks across finance, e-commerce, and manufacturing. Government support for digital transformation drives hyperscale deployments. The Singapore Data Center Infrastructure Market enables low-latency access to Southeast Asia’s growing digital economy. Investors are attracted to the stable regulatory framework and access to renewable energy. Operators upgrade facilities with 2N+1 power redundancy and liquid cooling systems. These shifts increase infrastructure demand and set new industry benchmarks.

- For instance, Equinix operates the SG3 International Business Exchange data center in Singapore with 2N power redundancy and N+1 cooling architecture. The facility is designed to support high availability and resilient operations for enterprise and colocation customers.

Digital Economy Strategy and Green Data Center Policies Encourage Infrastructure Transformation

Singapore’s government promotes energy-efficient, sustainable data center development through regulatory support. The moratorium lifted in 2022 introduced new assessment frameworks focused on energy efficiency and emissions. Players like Equinix, Keppel, and STT GDC commit to green building certifications and PUE targets under 1.3. The rise of carbon-neutral goals forces innovation in power and cooling systems. Edge computing and AI inference workloads require new infrastructure flexibility. Operators pursue automation, remote monitoring, and modular systems. The Singapore Data Center Infrastructure Market is now a strategic lever for public digital services and commercial transformation. Developers seek partnerships to meet operational standards and demand scalability.

- For instance, Keppel DC Singapore 8 has achieved the BCA Green Mark Platinum Award for energy‑efficient design and operations, and the Keppel Data Centre Campus aims for a low power usage effectiveness that supports sustainable growth in Singapore’s digital ecosystem.

Increasing Regional Demand for Low-Latency Connectivity and Submarine Cable Integration

Singapore serves as a major subsea cable landing point, improving its global connectivity. New cable systems like SEA-H2X, Bifrost, and Apricot enhance redundancy and bandwidth. Enterprises view Singapore as a central interconnection hub due to its high fiber density. Colocation demand rises from CDNs, OTT platforms, and hybrid cloud providers. Interconnection ecosystems support cross-border workloads and AI data migration. Operators integrate subsea infrastructure with new campuses for high-capacity usage. The Singapore Data Center Infrastructure Market supports regional data mobility across Southeast Asia. This reinforces its status as a strategic site for global operators expanding in Asia-Pacific.

Integration of Edge, IoT, and 5G in Urban Infrastructure Elevates Infrastructure Complexity

Smart city initiatives and nationwide 5G rollout increase demand for edge computing nodes. Enterprises deploy micro data centers and network edge hubs to manage IoT data. The convergence of smart buildings, urban mobility, and energy systems creates dense data flows. Infrastructure providers deliver smaller, modular, and containerized units to support new use cases. Real-time applications such as traffic control, telemedicine, and AR/VR require high-performance nodes. The Singapore Data Center Infrastructure Market evolves to support distributed computing strategies. Investments now focus on agility, power scaling, and network efficiency. This drives new configurations in IT and mechanical infrastructure design.

Market Trends

Market Trends

Rise of Liquid Cooling Technologies to Support AI and High-Density Environments

Data centers in Singapore are adopting liquid cooling solutions to manage increasing rack power densities. AI workloads and HPC applications produce more heat, requiring efficient thermal management. Operators move toward immersion cooling and direct-to-chip technologies. Liquid-cooled racks enable energy savings while supporting future GPU deployments. Singapore’s limited land area encourages vertical rack expansion, intensifying the cooling challenge. Government support for green energy aligns with the adoption of efficient systems. The Singapore Data Center Infrastructure Market reflects this trend by shifting from traditional CRAC systems to hybrid cooling. Operators plan new builds with space-saving and energy-saving cooling strategies.

Growth of Modular and Factory-Built Data Centers to Reduce Deployment Timelines

Speed and cost control push Singapore operators toward modular construction techniques. Factory-built modules enable faster commissioning and scalability for edge and colocation providers. Operators adopt containerized power and cooling units that integrate with standard building shells. Projects reduce construction time by up to 50% compared to traditional builds. This approach supports phased expansion in land-constrained zones. The Singapore Data Center Infrastructure Market benefits from this trend by improving project ROI. Modular designs also support standardization across multiple sites. Large players prefer this model for replication and compliance in regulated environments.

Adoption of Renewable Energy Sources and On-Site Power Innovations

Singapore promotes clean energy integration in data centers to meet its Green Plan targets. Solar rooftop panels, waste heat recovery, and fuel cells gain traction across new facilities. Operators pursue green PPAs and carbon credit schemes to offset emissions. Technologies like lithium-ion and flow batteries enhance energy storage for backup. DCIM systems help track energy use in real time, optimizing sustainability. The Singapore Data Center Infrastructure Market includes several projects targeting net-zero emissions. Clean energy use becomes a differentiator for hyperscale customers. Long-term investment aligns with the country’s climate commitments and power import strategies.

Expansion of Interconnection and Software-Defined Infrastructure to Support Cloud Traffic

Digital transformation and multi-cloud adoption drive the need for flexible networking. Software-defined infrastructure (SDI) enables dynamic resource allocation across hybrid platforms. Interconnection density rises across campuses to support seamless data transfer. The Singapore Data Center Infrastructure Market integrates programmable networks and virtual routers. Platforms enable customers to provision bandwidth or edge services in real time. Network fabric innovation allows low-latency service chaining and data segmentation. This trend supports diverse workloads and business continuity. Infrastructure now combines hardware and software orchestration at the physical layer.

Market Challenges

Market Challenges

Land Scarcity and Regulatory Approvals Slow Down New Facility Development in Key Zones

Singapore faces severe land constraints, limiting space for greenfield data center development. High land prices and zoning restrictions increase the cost of new deployments. Securing permits and environmental approvals can take extended timeframes. The government mandates strict guidelines for power usage effectiveness and energy footprint. New entrants face difficulty finding space with sufficient grid connectivity. The Singapore Data Center Infrastructure Market contends with pressure to upgrade brownfield sites. Vertical expansion and retrofitting remain costly and complex. Existing industrial parks offer limited flexibility for hyperscale scaling.

High Operating Costs and Grid Power Constraints Limit Future Expansion Potential

Electricity in Singapore is among the costliest in the region due to limited domestic energy resources. Data centers consume significant power, and grid capacity planning becomes essential. Providers face increased utility bills, especially during peak loads. Cooling costs rise due to tropical climate, adding pressure on margins. Singapore’s carbon tax policy adds further operating costs for non-green facilities. The Singapore Data Center Infrastructure Market must balance performance with energy efficiency. Delays in renewable energy availability and import policies impact project feasibility. Operators face challenges optimizing both uptime and sustainability.

Market Opportunities

Next-Generation Green Data Centers and Energy-Efficient Solutions Drive Long-Term Investment

Operators in Singapore are deploying energy-efficient systems, targeting low PUE and net-zero emissions. Opportunities exist in lithium-ion backup, liquid cooling, and green energy procurement. Investors are attracted to government-backed sustainability frameworks. The Singapore Data Center Infrastructure Market enables climate-aligned projects that align with regional ESG mandates. Smart grid and on-site generation offer scalable energy models.

Regional Hub Position Supports Cross-Border Cloud, AI, and CDN Expansion

Singapore remains a gateway to Southeast Asia’s digital traffic, offering low-latency routing to nearby economies. Operators can leverage this status to build interconnection-rich hubs. Emerging technologies like edge AI and quantum computing create new use cases. The Singapore Data Center Infrastructure Market supports regional expansion plans of global hyperscalers. This opens opportunities for modular, scalable, and adaptive infrastructure design.

Market Segmentation

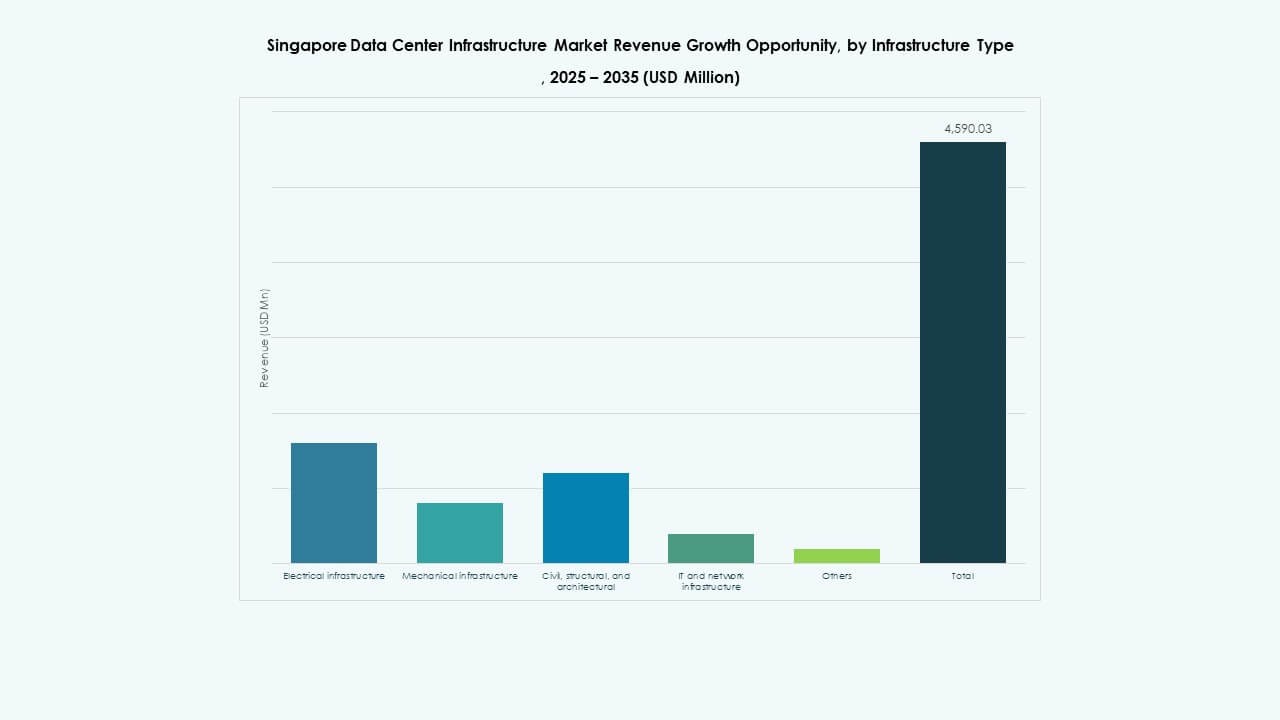

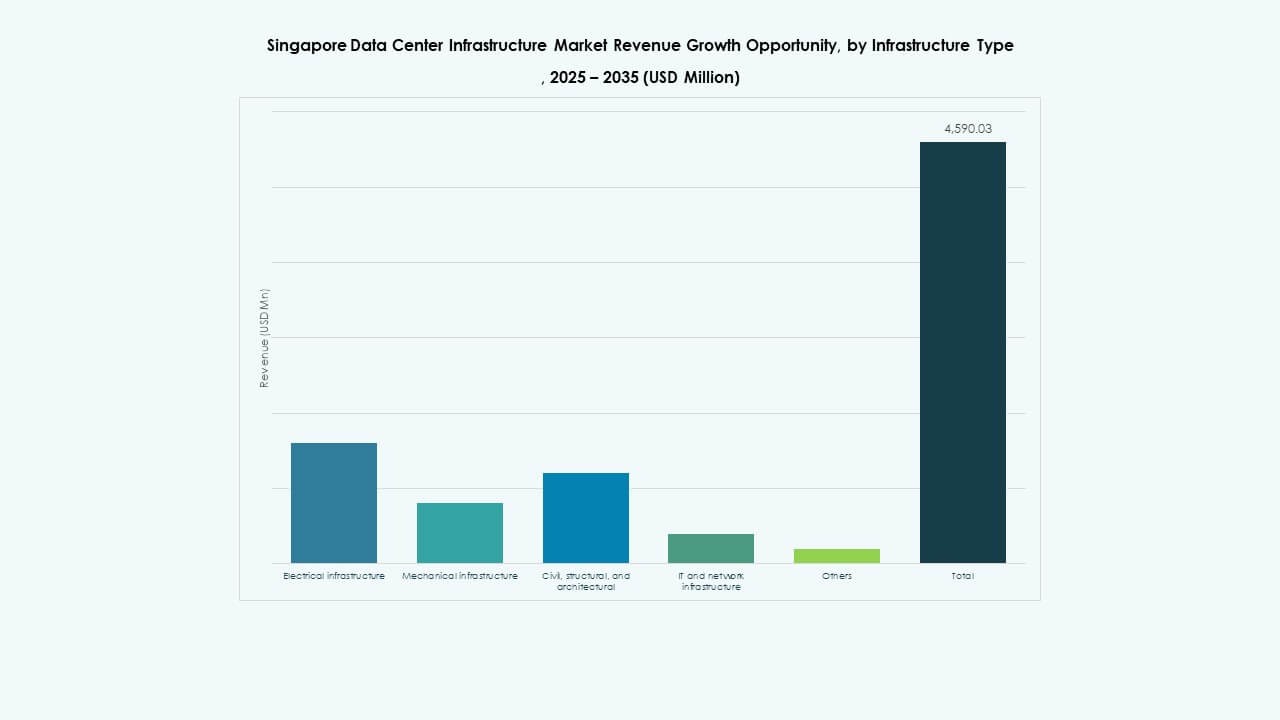

By Infrastructure Type

The Singapore Data Center Infrastructure Market is led by electrical infrastructure due to growing power demands from hyperscale and AI facilities. UPS systems, switchgears, and PDUs account for a significant share. Mechanical infrastructure also sees strong growth, with focus on liquid cooling and containment systems. IT and network infrastructure adoption rises with edge and SDI deployments. Structural and civil works scale with urban vertical builds.

By Electrical Infrastructure

Uninterruptible power supply and power distribution units dominate this segment. Operators invest in grid-resilient setups and battery energy storage systems for backup. Lithium-ion and modular power systems gain preference for space efficiency. Switchgear upgrades support load flexibility. The Singapore Data Center Infrastructure Market reflects a move toward scalable, redundant, and low-maintenance electrical setups.

By Mechanical Infrastructure

Cooling units and chillers lead mechanical infrastructure investments. AI and HPC workloads push cooling density beyond 20kW per rack in some sites. Operators explore hybrid systems with air and liquid solutions. Containment and in-row cooling enhance airflow management. Demand for compact, energy-efficient equipment grows as space constraints intensify.

By Civil / Structural & Architectural

Superstructure and modular building systems dominate due to high-rise designs and limited land. Operators prioritize raised flooring, envelope insulation, and seismic-ready foundations. Site optimization supports operational continuity. The Singapore Data Center Infrastructure Market relies on pre-engineered construction to meet project speed targets.

By IT & Network Infrastructure

Networking equipment and racks drive IT infrastructure investment. High-speed optical fiber, low-latency routers, and SDN-compatible hardware see demand. Storage and server units are built for scalability and automation. Smart cabling improves fault isolation and monitoring. The market supports hyperscale deployments with multi-tenant configurations.

By Data Center Type

Colocation and hyperscale segments dominate the Singapore Data Center Infrastructure Market. Enterprise and edge deployments grow steadily. Hyperscalers prefer Singapore for regional control centers. Colocation providers expand footprints with modular campuses. Edge facilities target IoT and 5G traffic in urban zones.

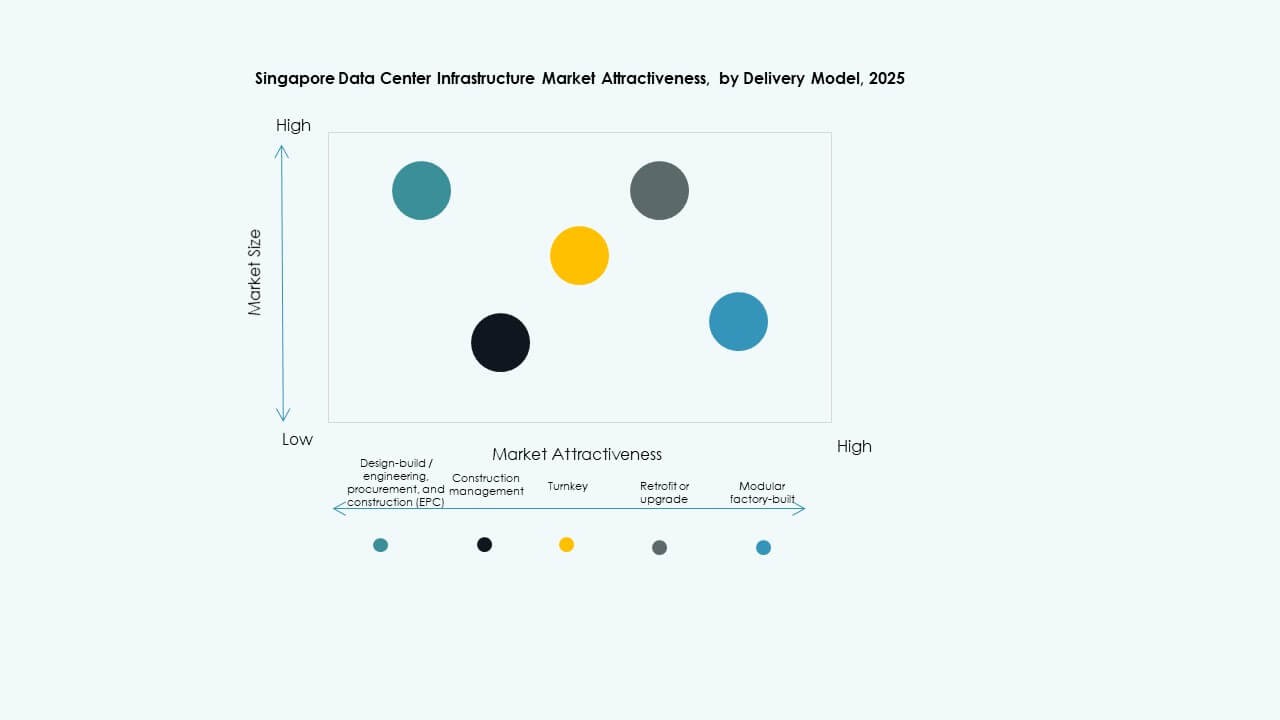

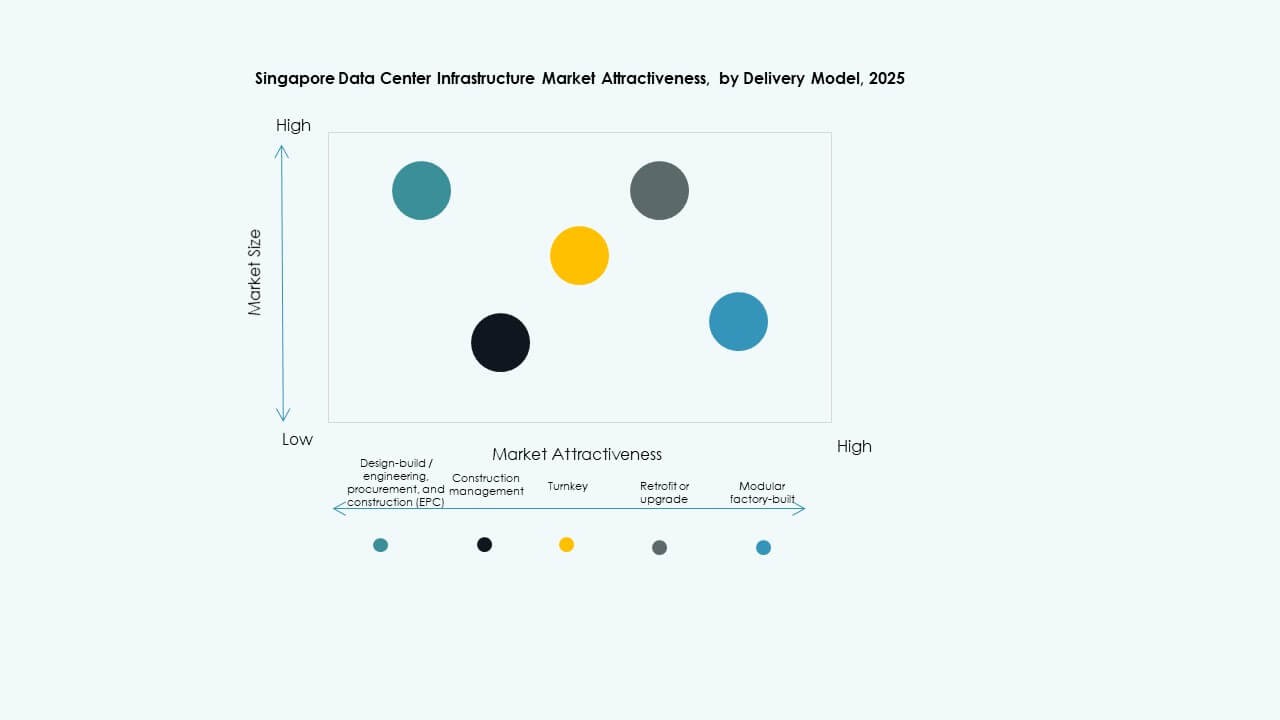

By Delivery Model

Turnkey and modular factory-built delivery models lead due to faster deployment timelines. EPC and construction management remain essential for complex sites. Retrofit projects rise as existing buildings are upgraded. Design-build models offer customization for hyperscale needs. The market shifts toward integrated delivery for cost and speed benefits.

By Tier Type

Tier III facilities dominate Singapore’s data center landscape, offering high uptime and cost balance. Tier IV grows slowly, targeting mission-critical workloads. Tier I and II remain limited to smaller enterprise or edge deployments. Certification and operational maturity drive investment decisions.

Regional Insights

Regional Insights

Central Singapore Holds 42% Share Due to Connectivity, Utilities, and Existing Campus Footprints

This region houses key colocation hubs, enterprise zones, and government-linked projects. Access to dense network fiber, stable power, and existing submarine cable links gives it an edge. The Singapore Data Center Infrastructure Market in this zone focuses on upgrading existing sites and vertical expansion. Players like Equinix and Digital Realty operate multi-building campuses here. Development faces high costs, but long-term occupancy remains strong.

Western Singapore Captures 37% Market Share Driven by Land Availability and Industrial Zoning

Jurong and Tuas regions offer industrial parks and grid capacity for hyperscale builds. Developers secure long-term leases and develop modular campuses. The Singapore Data Center Infrastructure Market benefits from lower land costs and proximity to submarine cable landings. Players like Keppel Data Centres and STT GDC expand projects here. This region offers future scalability for power-intensive applications.

- For example, STT GDC’s STT Defu 3 development in an industrial cluster is planned as a 15 MW facility, contributing to a broader Defu campus footprint that scales capacity for hyperscale and power‑intensive workloads.

Northern and Eastern Singapore Share 21% Market Driven by Edge, 5G, and Urban Micro Sites

These areas support smaller deployments closer to end users. Smart city infrastructure, hospitals, and public agencies demand localized compute. The Singapore Data Center Infrastructure Market supports edge data centers that complement core zones. Operators deploy micro sites to handle latency-sensitive traffic. Urban building integration becomes key for further growth.

- For instance, Digital Realty’s SIN12 data center in Loyang on Singapore’s eastern side is designed to provide up to 50 MW of critical power capacity and spans roughly 34,000 square meters, demonstrating a high‑capacity site serving enterprise, cloud and regional traffic near key connectivity hubs in Singapore’s data center ecosystem.

Competitive Insights:

- ST Telemedia Global Data Centres

- Keppel DC REIT

- Equinix

- Schneider Electric

- Delta Electronics

- Vertiv Group Corp.

- Dell Inc.

- Cisco Systems, Inc.

- ABB

- Lenovo

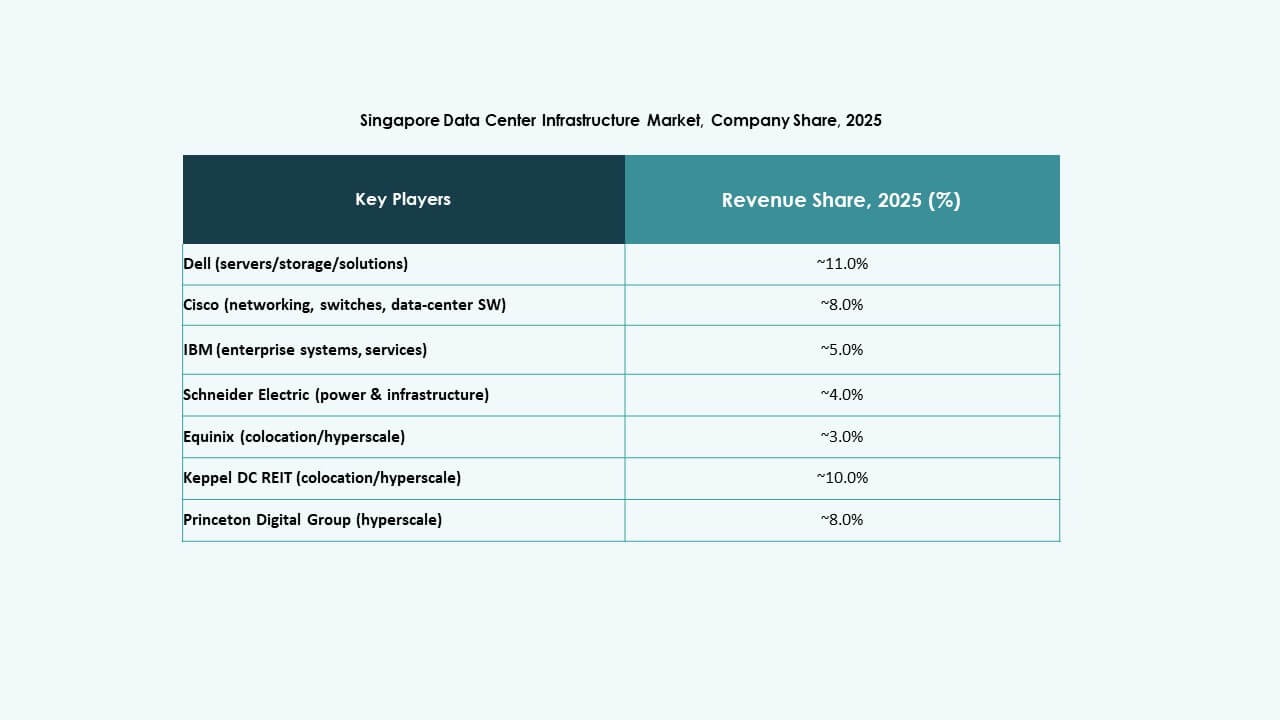

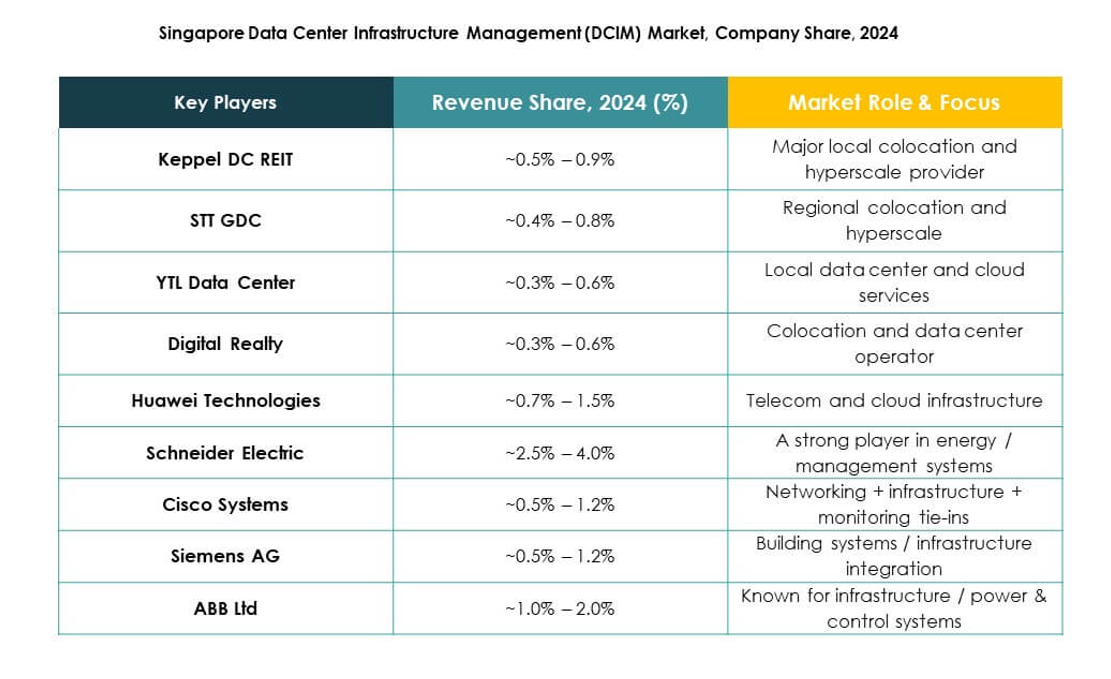

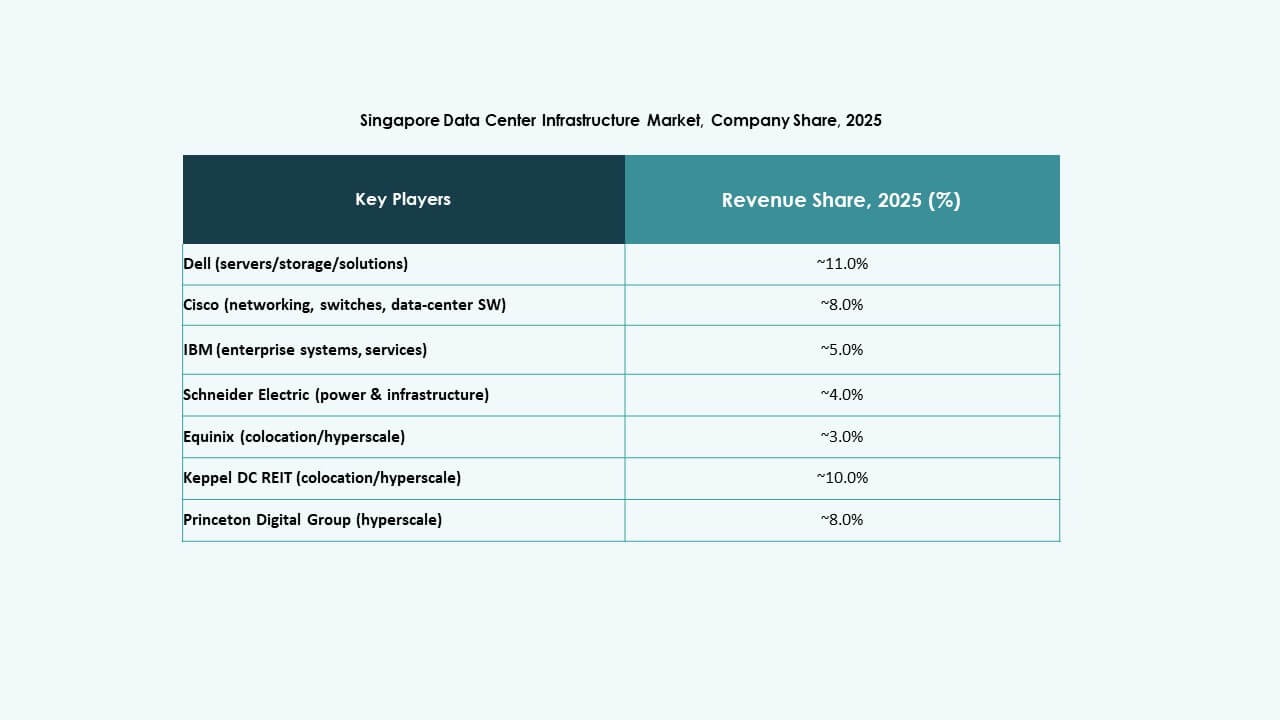

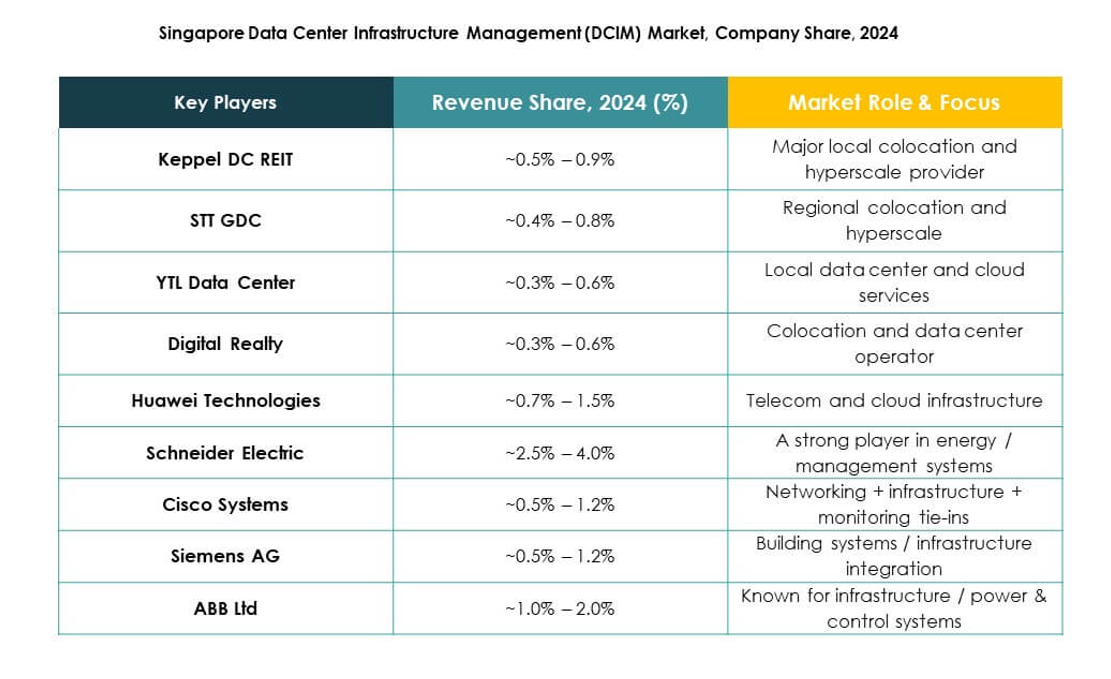

The Singapore Data Center Infrastructure Market is highly competitive, with both local operators and global technology vendors shaping its direction. Colocation giants like Equinix, STT GDC, and Keppel DC REIT continue expanding through multi-story, high-capacity campuses in key zones. These firms invest in low-PUE, AI-ready, and modular infrastructure to attract cloud and enterprise clients. IT hardware leaders including Dell, Cisco, and Lenovo provide scalable compute, storage, and networking equipment across hyperscale and edge deployments. Schneider Electric and Vertiv dominate power and cooling systems, offering integrated solutions with automation and monitoring features. The Singapore Data Center Infrastructure Market rewards innovation in energy efficiency, resilience, and system integration. It remains attractive for operators that combine scale, sustainability, and interconnection density across new and upgraded sites.

Recent Developments:

- In November 2025, investment firm KKR and Singapore Telecommunications (Singtel) entered advanced negotiations to fully acquire ST Telemedia Global Data Centres (STT GDC) for about USD 3.9 billion, potentially giving them full ownership of one of Singapore’s largest operators.

- In August 2025, Equinix announced issuance of S$650 million (about USD 505 million) in green bonds to fund sustainable data center projects within Singapore. This financing supports green energy initiatives and expansion of interconnected facilities, strengthening Equinix’s role in the Singapore Data Center Infrastructure Market’s growth toward energy‑efficient infrastructure.

Market Trends

Market Trends Market Challenges

Market Challenges

Regional Insights

Regional Insights