Executive summary:

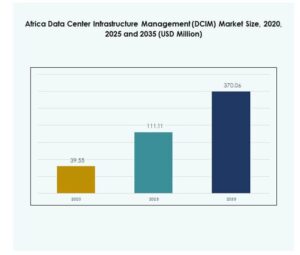

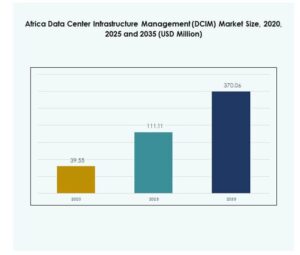

The Africa Data Center Infrastructure Management (DCIM) Market size was valued at USD 39.55 million in 2020, reached USD 111.11 million in 2025, and is anticipated to reach USD 370.06 million by 2035, at a CAGR of 14.55% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Africa Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 111.11 Million |

| Africa Data Center Infrastructure Management (DCIM) Market, CAGR |

14.55% |

| Africa Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 370.06 Million |

The market is driven by rapid digitalization, expanding data center investments, and growing adoption of automation technologies. Increasing use of AI, IoT, and cloud-based management tools is improving operational visibility and energy efficiency. It is helping enterprises enhance uptime, optimize resources, and ensure sustainability. Businesses and investors view the market as a key enabler of Africa’s digital transformation, offering strong potential in power management and smart infrastructure solutions.

Southern Africa leads the market with mature digital infrastructure and strong data center presence. South Africa remains a regional hub due to its reliable energy supply and advanced connectivity ecosystem. Nigeria, Kenya, and Egypt are emerging growth centers supported by government-backed ICT initiatives and private investments. North and East Africa are gaining momentum through rising cloud adoption and localization policies that attract global players into the continent’s expanding data ecosystem.

Market Drivers

Rising Demand for Digital Infrastructure and Data Localization

The Africa Data Center Infrastructure Management (DCIM) Market is driven by the continent’s rapid digital transformation and data sovereignty initiatives. Businesses and governments are investing in localized data storage and cloud services to ensure compliance with regional regulations. Increasing smartphone penetration and internet connectivity are creating a surge in digital traffic across major economies. It is enabling efficient monitoring and asset optimization in expanding facilities. Enterprises in banking, telecom, and e-commerce sectors are prioritizing data localization to enhance security. The growing reliance on cloud computing supports advanced data governance systems. Africa’s digital policies are encouraging private investments in hyperscale and colocation centers. This creates significant growth momentum for DCIM adoption.

- For instance, in July 2025, Morocco’s Ministry for Digital Transition and Administration Reform announced plans to develop a 500 MW renewable-powered hyperscale data center in Dakhla. The project aims to strengthen Morocco’s data sovereignty and support national cloud infrastructure using clean energy sources, as confirmed by official government statements and data center industry reports.

Adoption of Automation, AI, and IoT in Data Center Operations

Artificial intelligence, machine learning, and IoT integration are transforming how African data centers manage workloads. It is improving operational visibility and predictive maintenance efficiency. Automation allows managers to control temperature, energy, and capacity remotely, minimizing downtime and enhancing resilience. AI-based analytics platforms are detecting inefficiencies before failures occur. Telecom providers and cloud operators are adopting these technologies to optimize asset utilization. Continuous innovation in smart sensors and automation frameworks supports scalable growth. Automation reduces energy waste, enabling sustainability compliance across facilities. The advancement of IoT-enabled DCIM solutions is reshaping Africa’s digital ecosystem.

Rising Investments in Hyperscale and Colocation Data Centers

Rapid expansion of hyperscale and colocation facilities across South Africa, Kenya, Nigeria, and Egypt is driving demand for DCIM tools. Global firms are partnering with local operators to enhance capacity and manage complex energy networks. It is allowing better control over power usage effectiveness and uptime. The entry of cloud giants like Amazon Web Services, Microsoft, and Huawei Cloud accelerates adoption. Data centers are incorporating DCIM to handle increasing IT loads and diverse workloads. The market benefits from Africa’s strategic geographic location linking Europe and Asia. Government incentives and foreign investments are improving infrastructure reliability. These developments strengthen Africa’s position in global digital trade networks.

Sustainability and Energy Efficiency as Strategic Priorities

Sustainability is becoming a central focus for operators across the region. Energy costs are high, making efficiency a financial and environmental priority. It is encouraging operators to use renewable energy integration and advanced cooling solutions. Solar and wind projects are being linked to data centers to reduce carbon footprints. DCIM software supports detailed tracking of energy use, enabling compliance with ESG standards. Enterprises are recognizing the long-term savings of sustainable systems. Investors view this as a key differentiator for future-ready operations. The move toward energy-efficient DCIM designs promotes resilience in a fast-evolving digital economy.

- For instance, Teraco began construction on a 120MW utility-scale solar photovoltaic plant in Free State, South Africa, November 2024, with the renewable energy wheeled to Teraco’s Johannesburg and other data centers, providing a concrete base for powering client cloud and AI applications from sustainable sources.

Market Trends

Shift Toward Modular and Scalable Infrastructure Designs

Data center developers in Africa are increasingly adopting modular and prefabricated infrastructure. The Africa Data Center Infrastructure Management (DCIM) Market benefits from this transition by offering better scalability and faster deployment. Modular facilities enable flexible capacity expansion while maintaining performance standards. It is supporting remote management and quick integration with renewable energy systems. Prefabrication lowers construction costs and time, improving returns on investment. Colocation providers are leveraging these designs to serve diverse enterprise needs. This approach ensures efficient energy management and reduces operational complexity. Modular scalability strengthens Africa’s competitiveness in global digital infrastructure.

Integration of Cloud-Native DCIM Platforms

Cloud-based DCIM platforms are gaining traction across the continent. It is providing operators with centralized control, remote access, and real-time insights. These solutions are allowing businesses to manage assets distributed across multiple sites efficiently. The Africa Data Center Infrastructure Management (DCIM) Market is witnessing increasing adoption of SaaS-based models for cost efficiency. Cloud-native DCIM enhances collaboration between IT and facility teams. Enterprises are migrating from traditional tools to more dynamic hybrid models. This shift improves uptime and resilience while reducing hardware dependency. The transition marks a major technology upgrade across regional data centers.

Emergence of Edge Data Centers to Support AI and IoT Expansion

Edge computing is transforming Africa’s connectivity landscape. The deployment of edge data centers supports low-latency applications in telecom and smart city projects. It is reducing network congestion and enhancing real-time data processing. The Africa Data Center Infrastructure Management (DCIM) Market is aligning with this shift by providing lightweight, adaptive monitoring systems. Edge DCIM platforms help maintain operational reliability in smaller, distributed environments. Telecom and logistics companies are adopting these models for faster response times. This trend supports local cloud adoption and AI integration. Edge infrastructure expansion is crucial for Africa’s digital competitiveness.

Increased Focus on Cybersecurity and Data Governance Integration

Growing cyber threats are pushing data center operators to integrate security management with DCIM systems. It is enabling unified monitoring of both physical and digital assets. The Africa Data Center Infrastructure Management (DCIM) Market is evolving toward compliance-driven frameworks to protect critical data. Operators are adopting advanced access control and encryption features. Governments are introducing cybersecurity laws that encourage stronger data governance. The integration of threat analytics into DCIM improves incident response. Enterprises are investing in risk management to maintain trust and business continuity. This trend reinforces Africa’s digital infrastructure security standards.

Market Challenges

High Infrastructure Costs and Energy Supply Limitations

The Africa Data Center Infrastructure Management (DCIM) Market faces challenges from limited infrastructure and unstable energy supply. Building large-scale facilities requires significant investment in power, cooling, and connectivity. It is difficult for small and medium enterprises to adopt advanced DCIM systems due to cost barriers. Frequent power outages increase operational risks and maintenance costs. Many regions still lack consistent grid access, affecting uptime performance. Renewable integration remains slow in certain countries, restricting sustainable deployment. Local skill shortages make implementation complex. These barriers slow the pace of digital transformation in underserved markets.

Limited Skilled Workforce and Regulatory Barriers

Technical expertise in DCIM software and operations remains limited across Africa. It is restricting effective system deployment and optimization. Many operators struggle with integrating modern tools into legacy infrastructures. Regulatory frameworks on data protection differ across countries, creating compliance issues. Import duties and complex licensing processes delay new technology adoption. Regional disparities in internet access hinder market uniformity. Investors remain cautious in volatile markets lacking transparency. These challenges collectively slow the growth potential of DCIM innovation in the region.

Market Opportunities

Growing Renewable Energy Integration and Green Data Center Development

The shift toward sustainable data centers presents major opportunities for operators and investors. The Africa Data Center Infrastructure Management (DCIM) Market benefits from government and private efforts to reduce carbon emissions. Solar and wind projects are increasingly tied to new data center developments. It is encouraging vendors to design energy-optimized DCIM software for real-time tracking. Partnerships between utilities and technology firms are expanding clean energy adoption. This transition supports ESG compliance and long-term cost reduction. Sustainable initiatives are expected to attract more foreign direct investments.

Expansion of AI, Edge, and Cloud Infrastructure Ecosystems

Rapid AI and edge computing adoption creates a new wave of opportunity. It is driving demand for intelligent DCIM systems capable of predictive maintenance and workload automation. The Africa Data Center Infrastructure Management (DCIM) Market benefits from growing collaborations between telecom and cloud providers. These alliances expand coverage and reduce latency for AI-driven operations. Enterprises are investing in hybrid solutions that combine local edge capabilities with cloud scalability. The growth of smart city and IoT initiatives further accelerates deployment. This evolution strengthens Africa’s position in the global digital value chain.

Market Segmentation

By Component

Solution segment dominates due to increasing deployment of AI-integrated monitoring platforms that optimize resource utilization. The Africa Data Center Infrastructure Management (DCIM) Market is witnessing growing demand for software-driven solutions to reduce downtime and energy consumption. Services segment is also expanding as businesses seek consulting and maintenance support. Rising operational complexity encourages managed service models for multi-site visibility and control.

By Data Center Type

Enterprise data centers lead the market due to the need for secure, in-house data processing by major corporations. It is followed by colocation and managed centers that provide scalable infrastructure for SMEs and startups. The Africa Data Center Infrastructure Management (DCIM) Market gains traction from hybrid facilities blending cloud and edge computing capabilities. Growth in colocation centers reflects the rise in regional cloud adoption and connectivity expansion.

By Deployment Model

Cloud-based models hold the largest share due to their scalability and lower upfront investment. The Africa Data Center Infrastructure Management (DCIM) Market benefits from SaaS-based delivery models that support remote management. Hybrid deployments are expanding in enterprises needing flexible control and compliance. On-premises solutions remain relevant in sectors with high data sensitivity.

By Enterprise Size

Large enterprises dominate due to higher budgets and complex IT environments requiring integrated monitoring systems. Small and medium enterprises are adopting cost-efficient cloud DCIM platforms. The Africa Data Center Infrastructure Management (DCIM) Market supports both segments by offering scalable subscription models. Growing digitalization among SMEs strengthens market penetration across emerging economies.

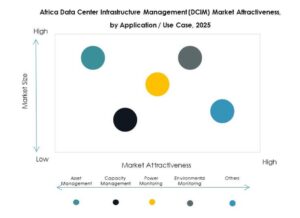

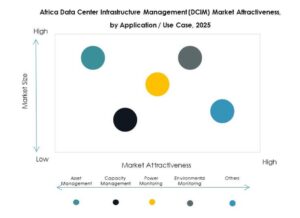

By Application / Use Case

Power and environmental monitoring lead adoption due to the focus on energy efficiency and operational safety. The Africa Data Center Infrastructure Management (DCIM) Market also sees rapid adoption in asset and capacity management. Business intelligence and analytics tools improve performance insights. Enterprises are prioritizing applications that minimize downtime and improve asset lifecycle management.

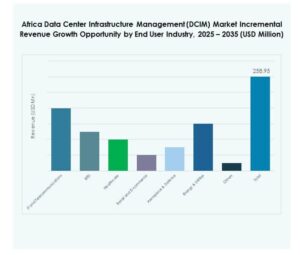

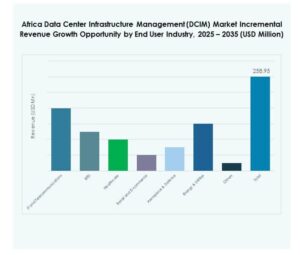

By End User Industry

IT and telecommunications dominate due to massive data generation and network expansion. BFSI and healthcare sectors are increasing investments in secure, compliant infrastructure. The Africa Data Center Infrastructure Management (DCIM) Market is gaining adoption across retail, energy, and defense sectors. Digitalization and automation are expanding use cases across multiple verticals.

Regional Insights

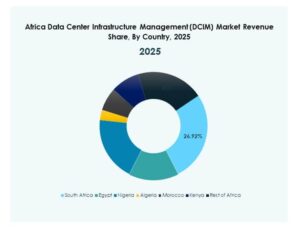

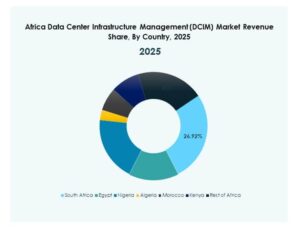

Southern Africa Leading with Strong Infrastructure and 38% Market Share

Southern Africa leads the Africa Data Center Infrastructure Management (DCIM) Market with a 38% share driven by advanced facilities in South Africa. The country hosts numerous hyperscale and colocation centers powered by renewable energy. It is the region’s innovation hub, attracting major cloud providers. Strong connectivity and stable energy supply sustain leadership. Government-backed digital transformation programs enhance ecosystem growth. Johannesburg and Cape Town remain critical data exchange hubs. The subregion’s maturity supports regional cloud service expansion.

- For instance, in August 2025, Teraco completed its JB4 hyperscale data center expansion in Johannesburg, achieving a 50 MW critical IT load and marking it as Africa’s largest data center by installed capacity; the site is powered by a mix of solar and grid energy with advanced sustainability features.

Northern Africa Expanding with 26% Share through Government-Led ICT Initiatives

North Africa holds a 26% market share supported by Egypt and Morocco’s rising digital investment. It is experiencing steady adoption of DCIM in state and private data centers. Governments are investing in digital infrastructure and cloud zones. Telecom modernization projects enhance power and connectivity reliability. The subregion benefits from proximity to Europe and robust subsea cable links. Ongoing data localization policies encourage further domestic capacity development.

Eastern and Western Africa Emerging with 36% Combined Share

Eastern and Western Africa together account for 36% of the market. Nigeria and Kenya lead expansion through strong private and foreign investments. The Africa Data Center Infrastructure Management (DCIM) Market is gaining from regional cloud deployment and rising edge computing demand. Energy diversification and local innovation hubs enhance ecosystem growth. Ghana and Ethiopia are witnessing data center construction to support e-government and fintech services. These subregions represent the next frontier for sustainable infrastructure growth.

- For instance, in July 2024, PAIX Data Centres expanded its Ghana facility to 1.2 MW, making it one of the largest in the country, adding advanced cooling, security, and higher renewable energy integration to support rising digital services demand.

Competitive Insights:

- Sunbird Inc.

- Nlyte SoftwareDevice42

- ABB Ltd.

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd.

- IBM

- Schneider Electric SE

- Siemens AG

- HPE (Hewlett Packard Enterprise)

- Vertiv Holdings

The Africa Data Center Infrastructure Management (DCIM) Market features a competitive environment shaped by global and regional leaders focusing on innovation and operational efficiency. It is characterized by continuous investment in automation, AI-based analytics, and cloud-native management platforms. Schneider Electric, Vertiv, and Huawei dominate through integrated power, cooling, and monitoring solutions. IBM, HPE, and Cisco strengthen their positions with hybrid and cloud-based DCIM frameworks. ABB and Eaton leverage expertise in energy optimization to enhance sustainability. Sunbird, Nlyte, and Device42 drive adoption among enterprise users through modular and user-friendly software platforms. Competition centers on technological adaptability, strategic alliances, and service reliability to support Africa’s expanding digital infrastructure.

Recent Developments:

- In September 2025, Digital Parks Africa, a South African-owned data center provider, entered into a partnership with iXAfrica Data Centres, a prominent data center operator, to advance data center operations and infrastructure connectivity across Africa. This alliance is set to enhance digital transformation by combining their resources and expertise to offer robust data center solutions for the continent’s fast-expanding digital ecosystem.

- In September 2025, Cybastion, a U.S. technology firm, in collaboration with Cisco, Hewlett Packard Enterprise, and Schneider Electric, announced a landmark partnership for a national data center and digitalization initiative in Côte d’Ivoire. Underpinned by a $100 million Export-Import Bank of the United States (EXIM) financing guarantee, this project aims to modernize digital infrastructure and government services, further accelerating Africa’s data center and DCIM market growth.

- In April 2025, the International Finance Corporation (IFC) made a significant move by committing $100 million to the Raxio Group for the development of new data center facilities in Ethiopia, Angola, and Côte d’Ivoire. This investment is designed to boost Africa’s digital infrastructure management capabilities while facilitating modern, energy-efficient data centers throughout the region.