Executive summary:

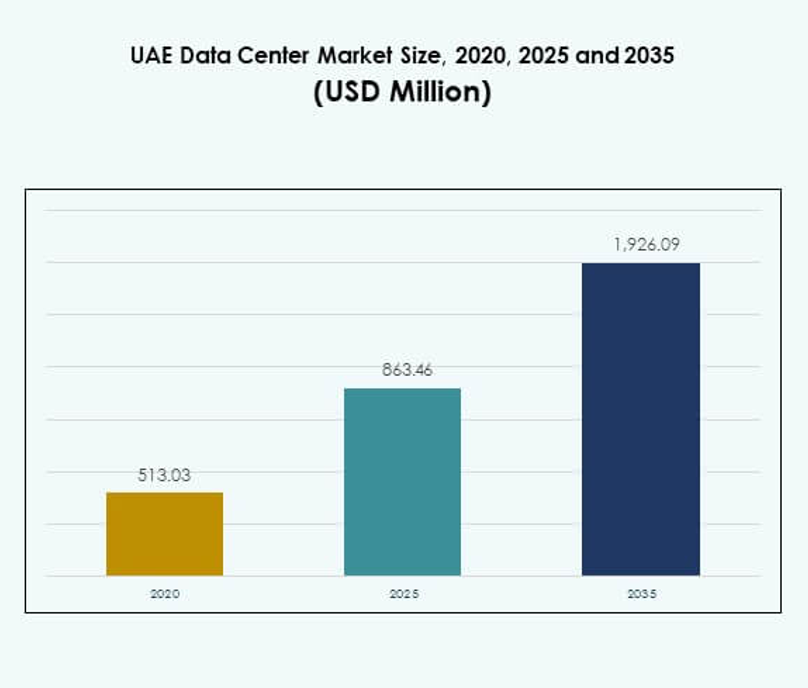

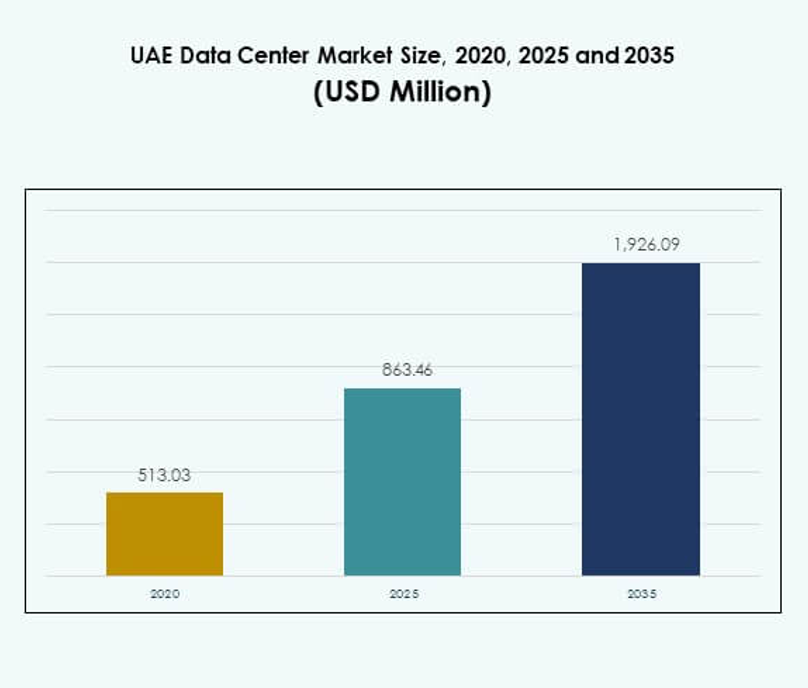

The UAE Data Center Infrastructure Management (DCIM) Market size was valued at USD 4.62 million in 2020, reached USD 12.75 million in 2025, and is anticipated to reach USD 44.84 million by 2035, at a CAGR of 15.17% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| UAE Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 12.75 Million |

| UAE Data Center Infrastructure Management (DCIM) Market , CAGR |

15.17% |

| UAE Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 44.84 Million |

The market growth is driven by rapid digitalization, AI adoption, and the increasing need for efficient power and cooling management. Enterprises are integrating IoT and cloud-based DCIM solutions to achieve real-time asset visibility and operational efficiency. Continuous innovation in automation, predictive analytics, and sustainability-focused systems enhances performance. The market holds strong strategic importance for investors as it supports the UAE’s expanding digital economy and infrastructure modernization efforts.

Regionally, Dubai leads the market with its advanced data center ecosystem and investment-friendly infrastructure. Abu Dhabi follows, focusing on sustainable and high-capacity facilities that align with national energy goals. Emerging hubs like Sharjah and Ajman are expanding through new AI-ready and colocation data centers. These developments strengthen the UAE’s position as a regional leader in intelligent infrastructure management.

Market Drivers

Adoption of AI and IoT for Real-Time Infrastructure Monitoring

The UAE Data Center Infrastructure Management (DCIM) Market is propelled by widespread adoption of AI and IoT technologies that enable real-time infrastructure visibility. Companies deploy intelligent sensors for predictive maintenance and performance optimization. AI algorithms help forecast energy demand and manage workloads efficiently. This integration reduces downtime and enhances power usage effectiveness. Investors value these innovations for operational efficiency and lower total cost of ownership. The government’s focus on digital transformation boosts deployment rates. Growing data volumes from enterprises create long-term investment potential.

- For instance, G42, in collaboration with OpenAI, Nvidia, Oracle, and Cisco, is developing the Stargate UAE AI data center in Abu Dhabi. The project will launch its initial 200-megawatt phase in 2026, expanding toward 1 gigawatt of capacity, and represents a major step in advancing the UAE’s national AI infrastructure strategy.

Strategic Push Toward Smart and Sustainable Data Centers

Green data centers are becoming central to the UAE’s digital strategy. The market aligns with the UAE Net Zero 2050 initiative, promoting sustainability through efficient resource use. Operators invest in energy-efficient cooling and renewable power systems. These practices strengthen brand reputation and ensure compliance with environmental standards. It is now critical for global firms operating in the region. The adoption of DCIM platforms improves power and thermal management. Sustainability-driven innovation positions the UAE as a regional leader. Businesses benefit from optimized performance and reduced carbon footprints.

- For instance, Moro Hub’s Green Data Center in Dubai, powered entirely by solar energy from the Mohammed bin Rashid Al Maktoum Solar Park, delivers 6.3 megawatts in its first phase. Inaugurated in 2023, it is recognized by Guinness World Records as the world’s largest solar-powered data center, reducing over 10,500 tons of CO₂ emissions annually.

Integration of Cloud-Based DCIM Solutions Across Industries

Cloud-based DCIM solutions are transforming infrastructure management and scalability. Enterprises prefer these systems for flexible deployment, centralized control, and faster updates. It enables cross-facility monitoring and dynamic workload distribution. The integration with public and private clouds increases operational transparency. This adoption supports hybrid architectures popular in telecom, healthcare, and finance. It strengthens resilience and improves disaster recovery. Vendors expanding local data zones enhance trust in regional solutions. Businesses and investors gain from reduced latency and compliance assurance.

Rising Investment in Digital Infrastructure Modernization

The UAE’s growing digital economy accelerates demand for modern DCIM solutions. Large-scale projects in Dubai and Abu Dhabi drive competitive innovation. Enterprises invest in automation tools to manage high-density facilities effectively. DCIM platforms enable visibility across power, cooling, and asset utilization. It supports national goals for AI, 5G, and smart city development. Partnerships between global tech firms and local players expand infrastructure reliability. These investments enhance operational intelligence and data governance. Investors view this momentum as a key growth driver for long-term returns.

Market Trends

Shift Toward Modular and Edge-Ready DCIM Architectures

A major trend shaping the UAE Data Center Infrastructure Management (DCIM) Market is modular architecture integration. Edge-ready systems allow scalability and faster deployment for new workloads. Enterprises adopt containerized setups that support AI and IoT operations efficiently. It helps maintain low latency for mission-critical applications. Vendors design modular DCIM to manage distributed networks seamlessly. The flexibility allows expansion across multiple data sites. This trend supports rapid digitalization in urban and remote regions. Modular DCIM is now essential for cost-efficient infrastructure scalability.

Increased Focus on Cybersecurity and Regulatory Compliance

Data center operators emphasize strong cybersecurity frameworks within DCIM solutions. The rise in AI workloads demands stricter access control and data protection. It integrates threat detection, automated alerts, and incident management features. Companies align operations with UAE’s data privacy regulations and global standards. Compliance ensures trust among enterprises and multinational clients. Vendors introduce encryption-enabled platforms for risk mitigation. Security-driven DCIM adoption increases demand in critical sectors like BFSI and defense. This focus enhances operational integrity and investor confidence.

Emergence of AI-Driven Predictive Maintenance Systems

AI-based predictive maintenance is redefining asset reliability and uptime. Machine learning tools identify equipment stress patterns early. It allows operators to replace or recalibrate assets before failure occurs. This capability extends hardware life and improves energy efficiency. The technology reduces operational costs across multi-site facilities. Predictive insights help allocate maintenance budgets effectively. Vendors integrate AI modules into standard DCIM suites. These developments enhance productivity and strengthen the UAE’s global data center competitiveness.

Hybrid Infrastructure Optimization through Unified DCIM Platforms

The growing hybrid infrastructure model reshapes management needs across enterprises. Unified DCIM systems combine on-premise and cloud-based monitoring. It improves operational coordination between legacy and next-generation environments. Companies gain actionable insights from integrated dashboards and analytics. This shift promotes flexible workload balancing across locations. The trend supports scalability without increasing complexity. Adoption rises among telecom and IT sectors expanding AI ecosystems. Hybrid optimization enhances reliability and cost predictability for long-term sustainability.

Market Challenges

Complex Integration of Multi-Vendor Systems and Legacy Infrastructure

The UAE Data Center Infrastructure Management (DCIM) Market faces challenges integrating new DCIM platforms with older data systems. Legacy equipment lacks compatibility with modern APIs and automation frameworks. Operators struggle to unify monitoring tools across diverse environments. It increases setup costs and delays system interoperability. Complex migration processes discourage smaller enterprises from full-scale adoption. Vendors must develop plug-and-play solutions to simplify transitions. The lack of standardized communication protocols limits scalability and reduces efficiency. Overcoming integration barriers remains a critical industry objective.

High Capital Requirements and Shortage of Skilled Professionals

Capital-intensive deployment remains a major restraint in DCIM expansion. Implementing advanced monitoring systems and AI-driven tools demands substantial investment. Smaller firms often find operational upgrades financially challenging. It also faces a regional shortage of skilled professionals trained in DCIM analytics. Limited technical knowledge delays deployment and increases maintenance dependency. Training initiatives and public-private partnerships are essential to address these gaps. Investors hesitate without guaranteed long-term ROI. These financial and skill-related challenges could slow overall market growth momentum.

Market Opportunities

Government Support and Expansion of AI-Enabled Infrastructure

The UAE Data Center Infrastructure Management (DCIM) Market benefits from government-led digital transformation programs. National projects promote AI integration, sustainability, and smart city expansion. Operators leverage this environment to implement AI-ready DCIM systems. It enhances data intelligence and operational transparency across hyperscale centers. New AI-driven DCIM products attract foreign investment. Local partnerships strengthen technology transfer and infrastructure resilience. The supportive policy ecosystem creates a favorable growth landscape for new entrants.

Rise in Renewable Energy and Green Data Center Projects

The UAE promotes renewable-powered data centers to meet sustainability goals. Operators deploy energy-efficient DCIM platforms for tracking power and cooling systems. It enables transparency in environmental performance reporting. Green-certified data centers gain preference among global clients. Investors view this segment as a stable long-term opportunity. The combination of clean energy adoption and automation strengthens global competitiveness. Growth in green infrastructure reflects the UAE’s sustainability-driven innovation approach.

Market Segmentation

By Component

The solution segment dominates the UAE Data Center Infrastructure Management (DCIM) Market, holding the largest market share. It includes modules for energy monitoring, asset tracking, and network control. The service segment grows steadily due to demand for maintenance and system integration support. Vendors focus on AI-enabled analytics and security solutions. Solutions enable predictive control and cost optimization for large facilities. Their reliability and adaptability ensure consistent performance in evolving data environments.

By Data Center Type

Enterprise data centers hold a major share due to the large-scale operations of telecom and BFSI sectors. Managed and colocation edge data centers follow closely, driven by scalability needs. Cloud and edge facilities expand rapidly with smart city projects. It supports distributed workloads with improved energy and resource control. Growth in hybrid and colocation infrastructure drives technological collaboration. Enterprises seek flexible architecture to meet dynamic computing requirements. This diversification defines the UAE’s modern digital ecosystem.

By Deployment Model

Cloud-based DCIM solutions lead adoption due to scalability and remote accessibility advantages. On-premises models retain relevance in regulated industries requiring strict data control. Hybrid deployments are rising as organizations balance performance and security. It supports distributed computing environments across multiple sites. Enterprises prefer cloud integration for faster deployment and real-time analytics. Vendors invest in hybrid architectures for better resource coordination. This balance between flexibility and control defines the future adoption trend.

By Enterprise Size

Large enterprises dominate deployment due to complex data operations and regulatory needs. SMEs are catching up with affordable, cloud-based DCIM tools. It provides scalability without heavy upfront investment. Larger firms use AI-powered systems for capacity planning and fault prevention. SMEs adopt modular DCIM for agile operations and reduced costs. Growing digital transformation across businesses drives steady expansion. The shift toward cloud-native solutions boosts SME participation in infrastructure modernization.

By Application / Use Case

Power monitoring leads due to energy optimization requirements in high-density environments. Asset management and capacity management follow with rising automation levels. Environmental monitoring gains traction as sustainability becomes central to operations. It ensures efficient thermal and humidity control in data facilities. BI and analytics applications improve decision-making with real-time data insights. Advanced use cases strengthen predictive operations. This diversification highlights the market’s evolving role in data-driven facility management.

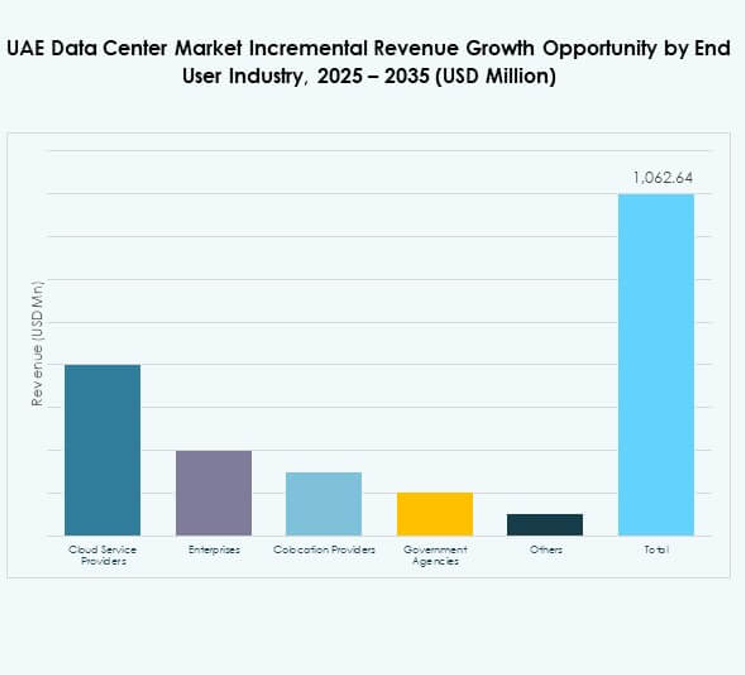

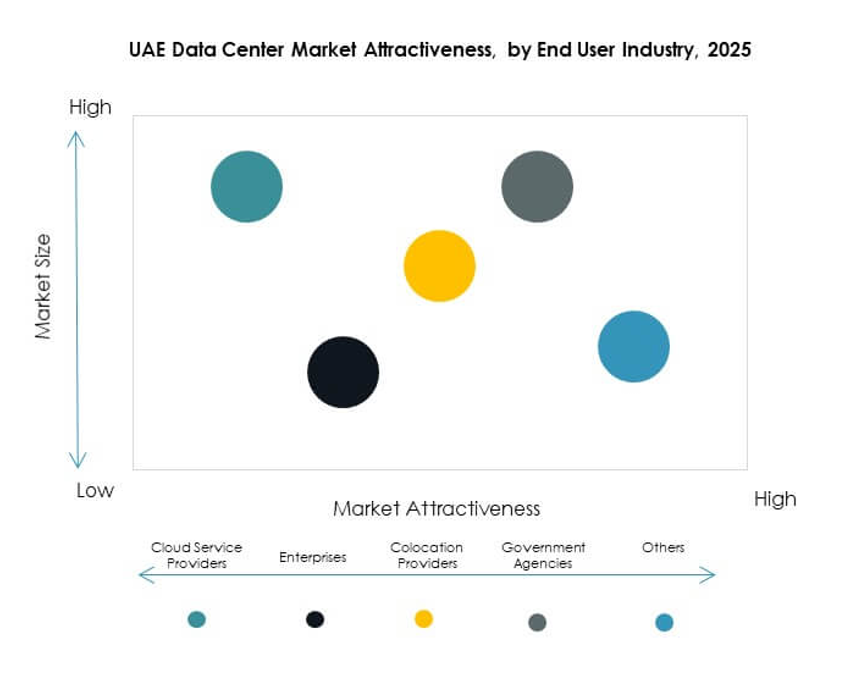

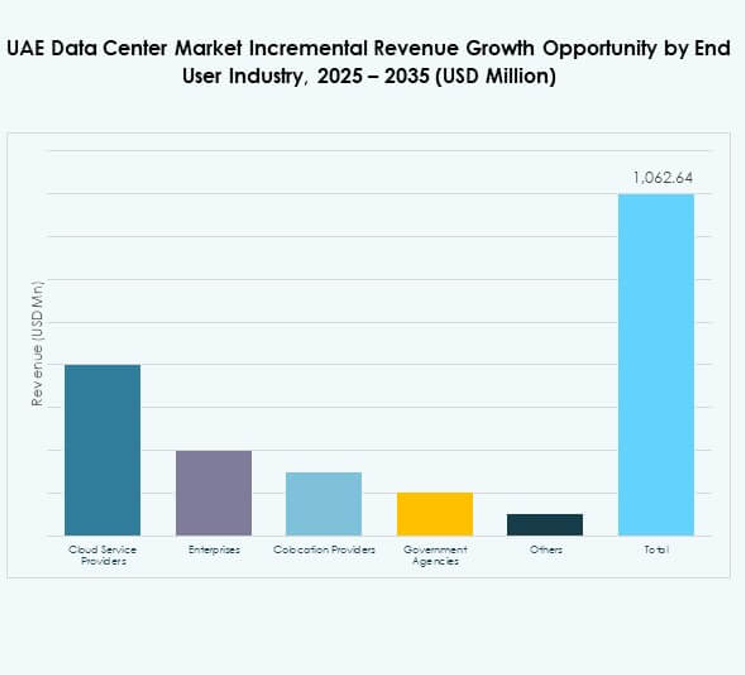

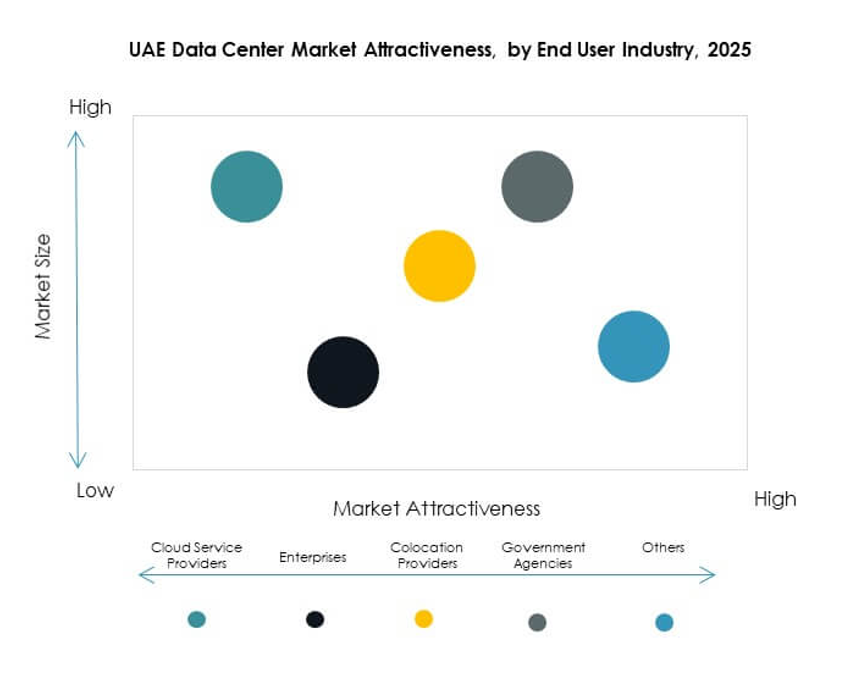

By End User Industry

IT and telecommunications dominate due to rapid digitalization and 5G expansion. BFSI follows with strong focus on data protection and compliance monitoring. Healthcare adopts DCIM for uptime reliability in connected hospitals. Retail and e-commerce sectors rely on it for online infrastructure stability. Aerospace and defense integrate DCIM for mission-critical control. Energy and utilities apply DCIM for sustainability and power efficiency. The cross-sector adoption demonstrates the market’s broad industrial relevance.

Regional Insights

Dominance of Dubai as the Primary Data Center Hub (Market Share: 52%)

Dubai leads the UAE Data Center Infrastructure Management (DCIM) Market due to advanced connectivity and cloud adoption. It hosts several hyperscale data centers operated by global and regional firms. The city’s favorable regulations and infrastructure readiness attract foreign investments. High-density facilities support AI, IoT, and 5G workloads. Dubai’s Smart City strategy accelerates innovation adoption in DCIM systems. Investors regard it as the most mature and profitable subregion for infrastructure expansion.

- For instance, du and Microsoft broke ground in 2025 on a AED 2 billion hyperscale data center in Dubai, designed to host advanced AI-powered applications and cloud workloads, establishing it as a leading site for AI infrastructure in the region.

Growing Presence of Abu Dhabi in Energy-Efficient Infrastructure (Market Share: 33%)

Abu Dhabi rapidly develops sustainable and large-scale data facilities with a focus on renewable power integration. It emphasizes operational efficiency and advanced automation. The city invests heavily in DCIM systems supporting smart grids and AI-driven management. Abu Dhabi’s industrial diversity encourages cross-sector digital integration. It attracts major international technology partners for long-term collaborations. The region strengthens its position as an emerging technology hub for sustainable data infrastructure.

Emergence of Sharjah and Northern Emirates as Future Growth Clusters (Market Share: 15%)

Sharjah and the Northern Emirates are evolving as secondary hubs for emerging colocation and edge centers. Lower operational costs and strategic location advantages attract mid-sized enterprises. It supports AI-based infrastructure solutions for regional data processing. Government-backed projects aim to decentralize digital infrastructure beyond Dubai and Abu Dhabi. The regions focus on developing high-efficiency DCIM deployments. These efforts will enhance data resilience and strengthen national coverage of smart data operations.

- For instance, UAE-based XDS Data Centres officially inaugurated a 1MW immersion-cooled colocation data center in August 2025 at the Sharjah Research, Technology and Innovation Park. This facility uses advanced immersion cooling to support live AI workloads and was established as a validation site for power and thermal systems, with plans for future expansion, as confirmed by official press releases and data center industry reports.

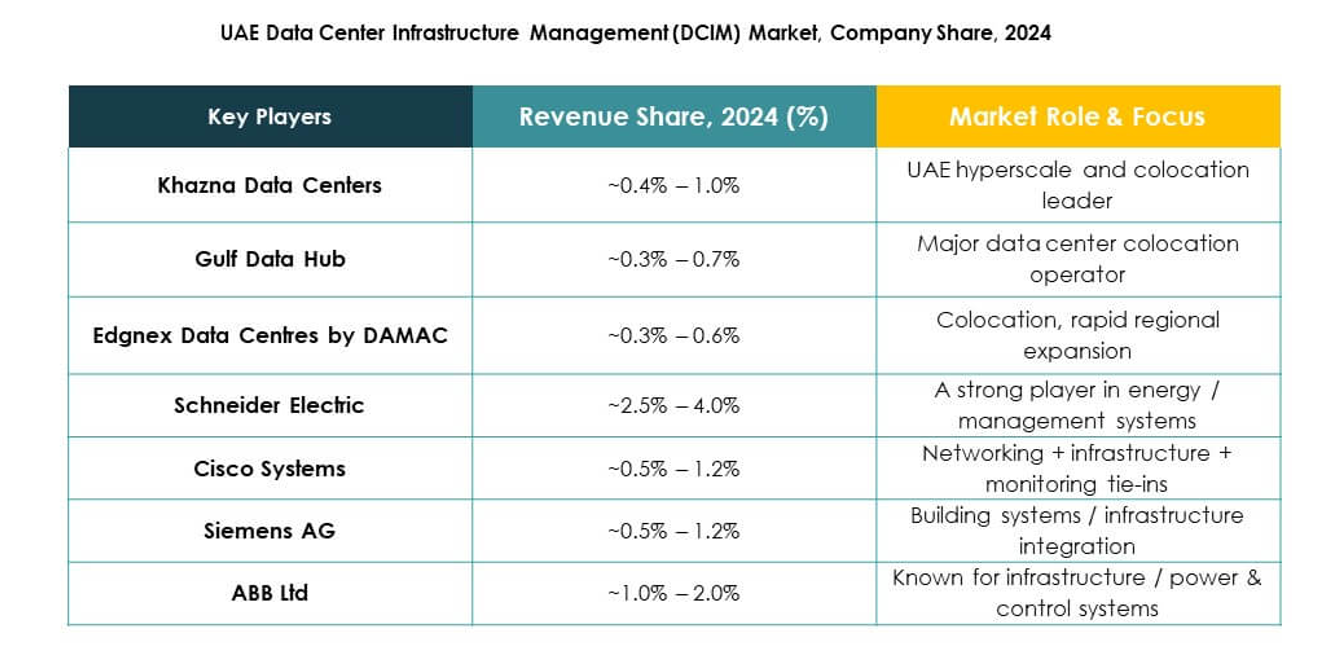

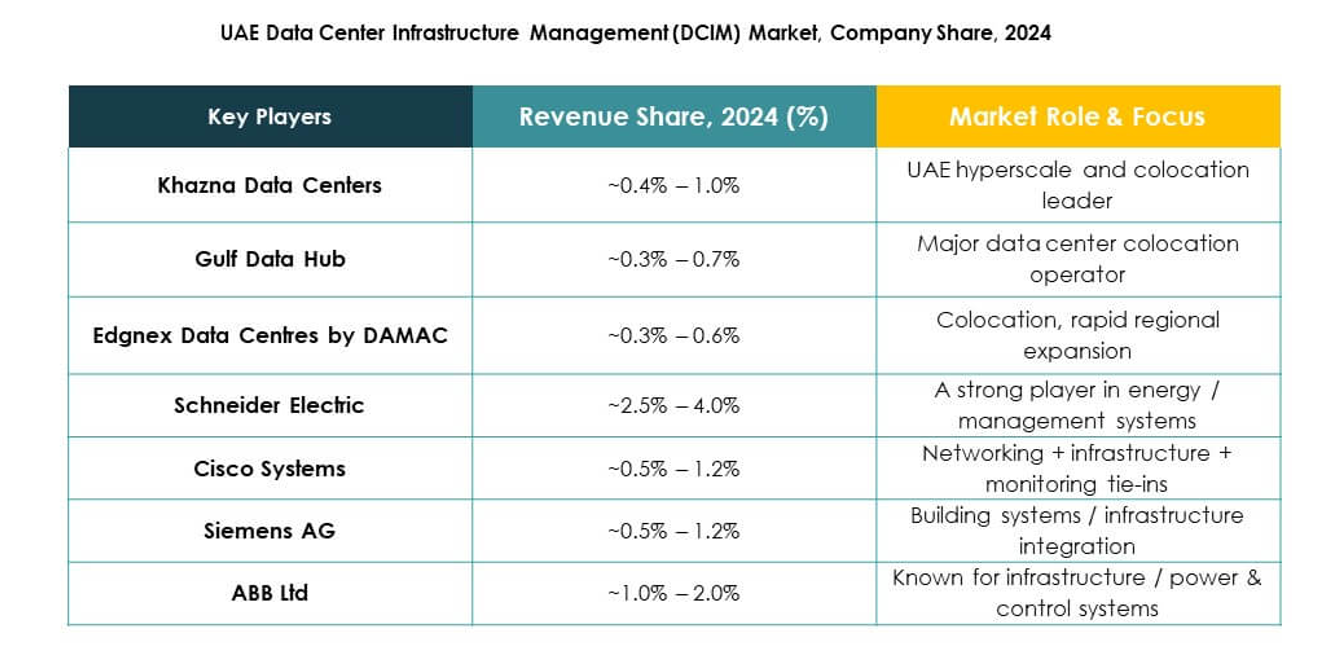

Competitive Insights:

- Khazna Data Centers

- Gulf Data Hub

- Edgnex Data Centres by DAMAC

- Center3

- ABB Ltd.

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd.

- Schneider Electric SE

- Siemens AG

The UAE Data Center Infrastructure Management (DCIM) Market features a balanced mix of regional data center operators and global technology leaders. It is driven by partnerships between infrastructure developers and equipment providers focused on AI-enabled automation, sustainability, and energy optimization. Khazna Data Centers and Gulf Data Hub lead domestic expansion, while Edgnex and Center3 strengthen regional capacity through high-density projects. Global players such as Schneider Electric, Huawei, and ABB deliver advanced DCIM platforms that integrate AI, IoT, and hybrid deployment capabilities. Siemens and Cisco enhance digital infrastructure through intelligent monitoring and power management. Competitive differentiation centers on sustainability, real-time analytics, and scalability to meet the UAE’s rapid digital transformation goals.

Recent Developments:

- In September 2025, Khazna Data Centers secured a $2.62 billion credit facility from a consortium of local banks, aimed at expanding its UAE and international footprint, including two new facilities in Abu Dhabi, one in Dubai, and the region’s first AI-enabled data center in Ajman.

- In June 2025, DAMAC Group unveiled the rebranding of its data center arm, Edgnex Data Centres by DAMAC, as DAMAC Digital to reflect its strengthened global strategy for AI-ready infrastructure, with ongoing and developing projects across the Middle East and beyond.

- In April 2025, du, an Emirati telecommunications company, entered into a partnership with Microsoft to develop a AED 2 billion ($544 million) hyperscale data center in Dubai. This strategic initiative aims to boost national cloud and AI capabilities in the UAE and significantly enhance du’s existing data center infrastructure.

- In January 2025, Gulf Data Hub announced a strategic partnership with global investment firm KKR, where funds affiliated with KKR acquired a stake in GDH, committing more than $5 billion to expanding data center capacity and supporting hyperscale and AI demand across the Gulf nations. The partnership also accelerates GDH’s expansion into Bahrain, Kuwait, Oman, and Qatar, reinforcing its leadership position in the region.