Executive summary:

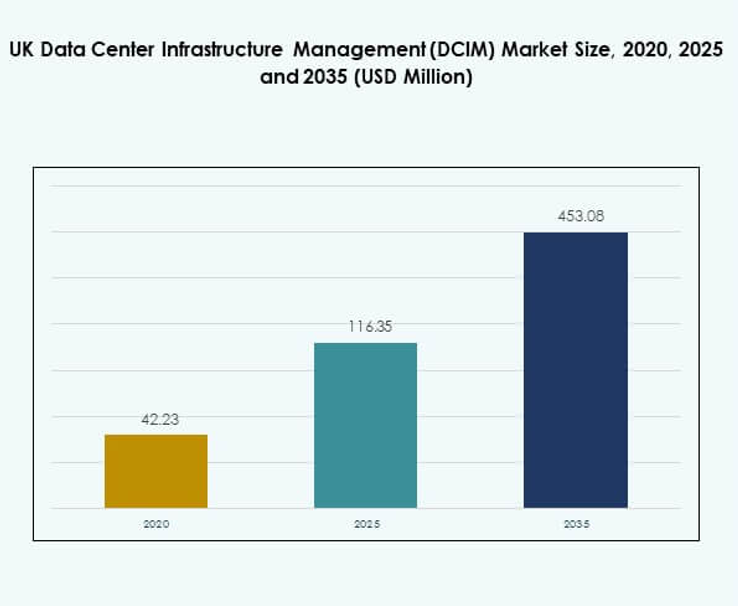

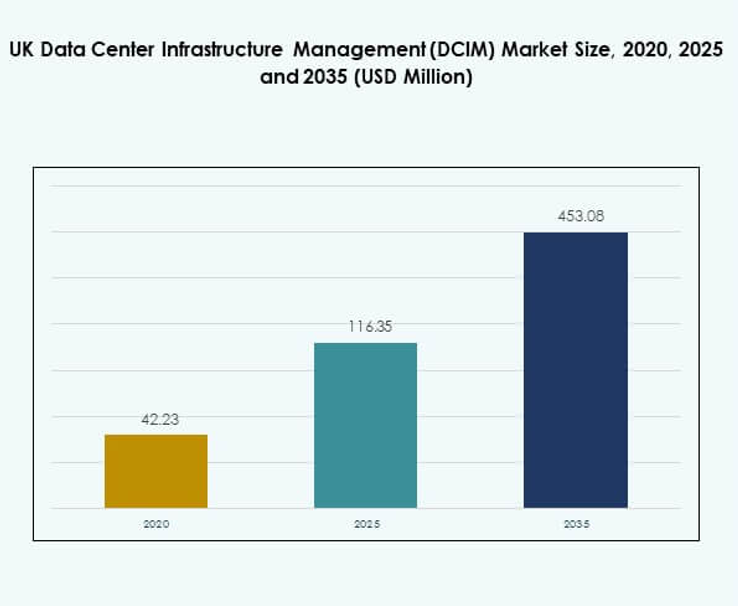

The UK Data Center Infrastructure Management (DCIM) Market size was valued at USD 42.23 million in 2020 to USD 116.35 million in 2025 and is anticipated to reach USD 453.08 million by 2035, at a CAGR of 16.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| UK Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 116.35 Million |

| UK Data Center Infrastructure Management (DCIM) Market, CAGR |

16.34% |

| UK Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 453.08 Million |

The UK DCIM market is advancing through rapid technology adoption, particularly artificial intelligence, IoT, and cloud-driven solutions that improve operational efficiency and automation. Innovation in predictive analytics, real-time monitoring, and hybrid infrastructure management has made DCIM platforms essential for enterprises seeking resilience and sustainability. It plays a strategic role in optimizing energy use, strengthening cybersecurity, and ensuring compliance, making the market attractive for both businesses and investors pursuing digital transformation.

Regionally, the UK leads Europe’s DCIM adoption due to London’s role as a financial hub and its strong digital infrastructure. Western Europe continues to dominate with advanced IT ecosystems and regulatory support, while Central Europe is expanding with new investments in colocation and cloud services. Eastern Europe remains an emerging area, where rising connectivity, digitalization programs, and cost-effective infrastructure are supporting gradual adoption of DCIM platforms.

Market Drivers

Market Drivers

Adoption Of Advanced Technologies To Optimize Data Center Operations

The UK Data Center Infrastructure Management (DCIM) Market benefits from the strong adoption of artificial intelligence, IoT, and predictive analytics to enhance operational efficiency. These technologies enable precise monitoring of energy consumption and resource allocation. Enterprises are turning to intelligent automation to minimize downtime and improve system reliability. It is gaining importance as organizations seek proactive solutions for workload optimization. Innovation in AI-driven systems creates measurable improvements in performance benchmarks. Investors view advanced technology adoption as a critical driver of digital transformation. This adoption strengthens the market’s growth potential and enhances competitive differentiation.

Growing Focus On Energy Efficiency And Sustainable Infrastructure Development

The UK Data Center Infrastructure Management (DCIM) Market is driven by the rising demand for sustainable operations. Organizations are prioritizing green solutions to reduce power costs and comply with environmental regulations. It supports efficient cooling management and helps reduce greenhouse gas emissions. Enterprises investing in eco-friendly technologies benefit from long-term cost savings. Real-time monitoring of energy flow enhances transparency in data center operations. Green initiatives are influencing procurement strategies across industries. Innovation in energy-efficient systems gives providers an edge in competitive markets. The increasing emphasis on sustainability acts as a major growth catalyst.

- For instance, the Old Oak and Park Royal Development Corporation (OPDC) in London developed a district heat network funded with £36 million from the UK government, using waste heat recovered from local data centers to provide heating for more than 10,000 homes and 250,000 square meters of commercial space.

Strategic Need For Resilient And Secure Digital Infrastructure

The UK Data Center Infrastructure Management (DCIM) Market is expanding due to the need for stronger resilience and security across enterprises. Businesses depend on DCIM platforms for continuity of critical services. It ensures operational stability by detecting threats early and safeguarding infrastructure. Cybersecurity integration within DCIM tools offers enhanced protection against evolving risks. Investors prioritize solutions that combine security with cost optimization. Organizations value reliable systems to meet compliance standards. Adoption of advanced DCIM platforms strengthens disaster recovery strategies. This growing reliance on security-focused solutions drives strategic investment decisions.

Rising Investments In Hybrid And Cloud-Integrated Models

The UK Data Center Infrastructure Management (DCIM) Market is experiencing growth from increasing investments in hybrid and cloud-integrated models. Enterprises are adopting DCIM tools to manage diverse environments spanning on-premises, cloud, and edge data centers. It enables seamless integration across platforms, driving flexibility and scalability. Hybrid solutions offer businesses greater control while reducing dependency on a single infrastructure. Cloud integration provides efficiency gains and cost advantages. Enterprises pursuing multi-cloud strategies require DCIM for visibility and control. Investors identify hybrid DCIM models as critical for future scalability. This transition reinforces the market’s long-term relevance.

- For instance, Vertiv launched the MegaMod CoolChip in July 2024, a high-density prefabricated modular data center platform used in the UK to accelerate AI and hybrid cloud deployments. This technology supports seamless DCIM integration across on-premises, cloud, and edge environments, allowing enterprises to maintain visibility and automated control over diverse digital assets, and it has enabled businesses to scale hybrid solutions while improving workload management efficiency.

Market Trends

Integration Of Artificial Intelligence For Predictive And Prescriptive Capabilities

The UK Data Center Infrastructure Management (DCIM) Market is shaped by growing AI integration that supports predictive and prescriptive decision-making. AI enables operators to anticipate failures and plan capacity expansion more effectively. It provides actionable insights into power, cooling, and workload management. Predictive models reduce costs associated with downtime and inefficiencies. Prescriptive capabilities improve long-term planning and budgeting processes. AI integration strengthens competitive advantage for solution providers. Enterprises adopting AI-based DCIM experience significant operational benefits. This trend drives stronger adoption across industries seeking digital resilience.

Expansion Of Edge Data Centers To Support Digital Transformation

The UK Data Center Infrastructure Management (DCIM) Market benefits from the expansion of edge data centers designed to support faster connectivity and localized computing. Edge sites require DCIM tools to handle distributed infrastructure effectively. It enhances visibility into remote assets and ensures uptime. Businesses rely on DCIM for real-time monitoring of edge deployments. Growth in IoT and 5G applications is accelerating this trend. Edge data centers highlight the need for decentralized management platforms. Investors see opportunity in scalable DCIM solutions for edge ecosystems. This expansion transforms operational priorities across multiple industries.

Shift Toward Modular And Scalable Infrastructure Deployments

The UK Data Center Infrastructure Management (DCIM) Market is witnessing demand for modular and scalable deployments that support flexibility. Enterprises seek modular systems that adapt to evolving business needs. It improves speed of deployment while lowering upfront capital expenditure. Modular infrastructure also simplifies expansion planning for businesses of different sizes. Scalability strengthens long-term operational efficiency and reduces risks. Vendors are investing in prefabricated solutions to meet industry requirements. Enterprises value the combination of agility and cost efficiency. This trend reshapes how organizations plan future infrastructure investments.

Adoption Of Cloud-Based DCIM For Remote Monitoring And Control

The UK Data Center Infrastructure Management (DCIM) Market is observing rising adoption of cloud-based platforms that support remote management. Enterprises favor cloud DCIM to ensure accessibility and centralized control across distributed operations. It enhances collaboration by enabling multiple stakeholders to monitor systems. Cloud platforms reduce the need for high upfront infrastructure investments. Real-time visibility into capacity and utilization improves decision-making. Integration with existing IT service tools increases functionality. Enterprises view cloud-based DCIM as critical to hybrid strategies. This adoption reflects the market’s growing preference for digital-first operations.

Market Challenges

Complexity Of Integration Across Hybrid And Legacy Infrastructure

The UK Data Center Infrastructure Management (DCIM) Market faces challenges from integration with hybrid and legacy systems. Enterprises often struggle to unify diverse environments into one coherent framework. It increases costs for implementation and requires skilled professionals to manage transitions. Compatibility concerns arise when linking legacy tools with cloud-based DCIM platforms. Vendors must provide flexible integration solutions to reduce barriers. Limited technical expertise in smaller organizations slows adoption. Customization needs also create additional complexity. The difficulty of managing diverse ecosystems continues to challenge smooth deployment.

High Costs And Concerns Around Long-Term Return On Investment

The UK Data Center Infrastructure Management (DCIM) Market is hindered by concerns related to high upfront costs. Enterprises hesitate to invest in advanced DCIM solutions without clear ROI timelines. It requires substantial financial resources to implement enterprise-wide systems. Long payback periods discourage SMEs from adoption. Budget constraints in cost-sensitive industries limit demand. Investors assess risk carefully before committing to large-scale projects. Vendors face pressure to demonstrate measurable value through pilot deployments. Cost perception remains a significant barrier for market expansion.

Market Opportunities

Growth Potential From Rising Digital Transformation Initiatives Across Sectors

The UK Data Center Infrastructure Management (DCIM) Market offers opportunities due to large-scale digital transformation initiatives. Enterprises are embracing cloud, automation, and analytics at a faster pace. It requires advanced DCIM platforms to support operational efficiency and regulatory compliance. Industry-wide adoption of hybrid systems creates demand for unified visibility. Healthcare, BFSI, and retail sectors present strong prospects. Vendors offering customizable solutions can capture significant share. Rising demand for automation in capacity and asset management reinforces opportunity. Investors find long-term growth attractive in this context.

Emergence Of AI And Sustainability As Core Differentiators In Market Growth

The UK Data Center Infrastructure Management (DCIM) Market is positioned to benefit from the convergence of AI capabilities and sustainability objectives. It strengthens infrastructure by enabling predictive insights while reducing energy consumption. Enterprises are prioritizing carbon-neutral operations with measurable performance indicators. DCIM providers leveraging AI to achieve sustainability compliance gain competitive advantage. Expansion of renewable energy in data centers supports wider adoption. Vendors innovating in eco-friendly monitoring tools are expected to expand their footprint. Sustainability-focused innovation drives long-term opportunities for industry stakeholders.

Market Segmentation

By Component

The UK Data Center Infrastructure Management (DCIM) Market is dominated by solutions, holding the largest share due to advanced monitoring and analytics platforms. Solutions offer real-time insights into energy use, asset performance, and resource optimization. Services play a supporting role, providing integration, maintenance, and consulting expertise. Demand for solution-based models continues to expand as organizations prioritize automation and predictive management to reduce downtime and improve sustainability outcomes.

By Data Center Type

The UK Data Center Infrastructure Management (DCIM) Market sees enterprise data centers leading adoption, supported by large IT and financial enterprises. Colocation and cloud data centers are growing rapidly due to the rise of managed services and multi-cloud strategies. Edge data centers are emerging as a strong segment driven by IoT and 5G deployment. Each type requires robust DCIM tools, but enterprise adoption remains dominant given scale and complex infrastructure needs.

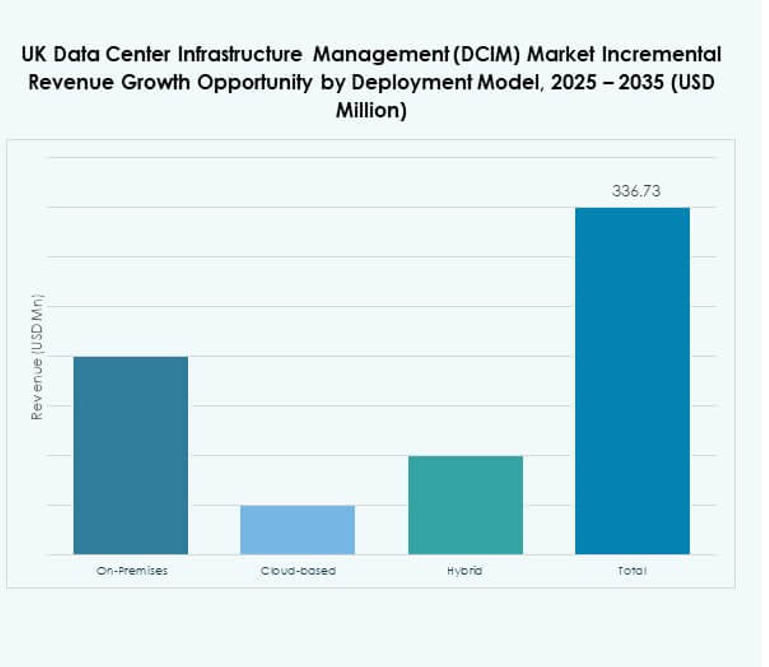

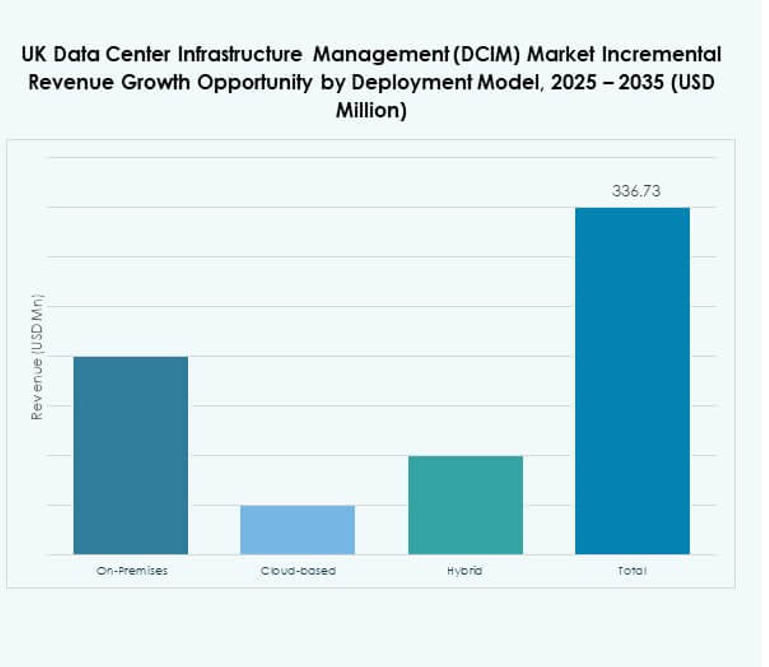

By Deployment Model

The UK Data Center Infrastructure Management (DCIM) Market is shaped by hybrid models, which dominate due to flexibility and scalability. Hybrid deployment enables integration of on-premises, cloud, and edge environments. On-premises models remain significant among enterprises demanding complete control and security. Cloud-based adoption is growing quickly with businesses seeking remote monitoring and cost-effective deployment. Hybrid DCIM stands out as the preferred model for balancing performance and operational agility.

By Enterprise Size

The UK Data Center Infrastructure Management (DCIM) Market is dominated by large enterprises due to their higher investment capacity and complex infrastructure demands. Large companies adopt DCIM platforms to manage scalability, energy optimization, and compliance. SMEs are adopting DCIM at a slower pace due to cost considerations but benefit from cloud-based solutions. The segment is expanding gradually as vendors introduce cost-effective packages tailored for smaller organizations.

By Application / Use Case

The UK Data Center Infrastructure Management (DCIM) Market sees asset management as the leading application due to its importance in tracking performance and utilization. Power monitoring and capacity management follow closely, driven by rising energy costs and the need to optimize usage. Environmental monitoring gains traction with stricter compliance requirements. Business intelligence and analytics are emerging as high-growth areas for enterprises focusing on predictive capabilities. Each use case highlights diverse growth opportunities within the market.

By End User Industry

The UK Data Center Infrastructure Management (DCIM) Market is led by the IT and telecommunications sector due to heavy reliance on data-intensive operations. BFSI represents another dominant industry, requiring DCIM tools for compliance and security. Healthcare adoption is rising rapidly with increasing digital health initiatives. Retail and e-commerce, aerospace and defense, and energy sectors are expanding their reliance on DCIM to improve efficiency. IT and telecom continue to drive the highest demand due to massive infrastructure scale.

Regional Insights

Western Europe Leading The Market With Established Infrastructure And High Investments

The UK Data Center Infrastructure Management (DCIM) Market records Western Europe holding 52% share due to advanced digital infrastructure. London dominates the region with strong connectivity and financial sector demand. It benefits from regulatory alignment, reliable power supply, and global investment inflows. Large enterprises in Germany and France also contribute to market strength. Western Europe remains a priority hub for multinational data center operators. The region maintains a leadership position through established ecosystems.

- For instance, Equinix opened its LD7 data center at Slough, London in 2019, investing £90 million. LD7’s first phase provided 1,750 cabinets with expansion planned to 2,650 cabinets; it offers direct, secure interconnection to over 1,000 businesses and 200+ network providers in London, with latency of around 4 milliseconds to Frankfurt.

Central Europe Growing Steadily With Digital Expansion Across Enterprises

The UK Data Center Infrastructure Management (DCIM) Market shows Central Europe capturing 31% share as enterprises expand digital infrastructure. Countries such as Poland and Czech Republic invest heavily in colocation and cloud facilities. It benefits from strong industrial bases and growing adoption of hybrid models. Central Europe attracts attention from global investors seeking untapped potential. Increasing reliance on DCIM strengthens operational efficiency in mid-sized enterprises. The region is gradually becoming a competitive hub.

- For instance, Beyond.pl Data Center 2 in Poznań, Poland is the only data center in the European Union possessing both ANSI/TIA-942 Rated 4 (Tier 4) and EN 50600 Class 4 certifications, confirming top-tier resiliency and security. It operates on a campus powered entirely by renewable energy, offers up to 8 MW of built-out power, 12,000 sq.m. of white space, and has maintained 100% uptime since launch.

Eastern Europe Emerging With Rising Cloud And Edge Deployments

The UK Data Center Infrastructure Management (DCIM) Market highlights Eastern Europe with a 17% share, emerging through expanding edge and cloud deployments. Countries such as Romania and Hungary are advancing digitalization programs. It supports demand for distributed infrastructure and sustainability-focused systems. Growing internet penetration and regional investments strengthen adoption. Eastern Europe gains visibility as enterprises seek cost-effective alternatives. This region remains a promising growth frontier in Europe’s digital economy.

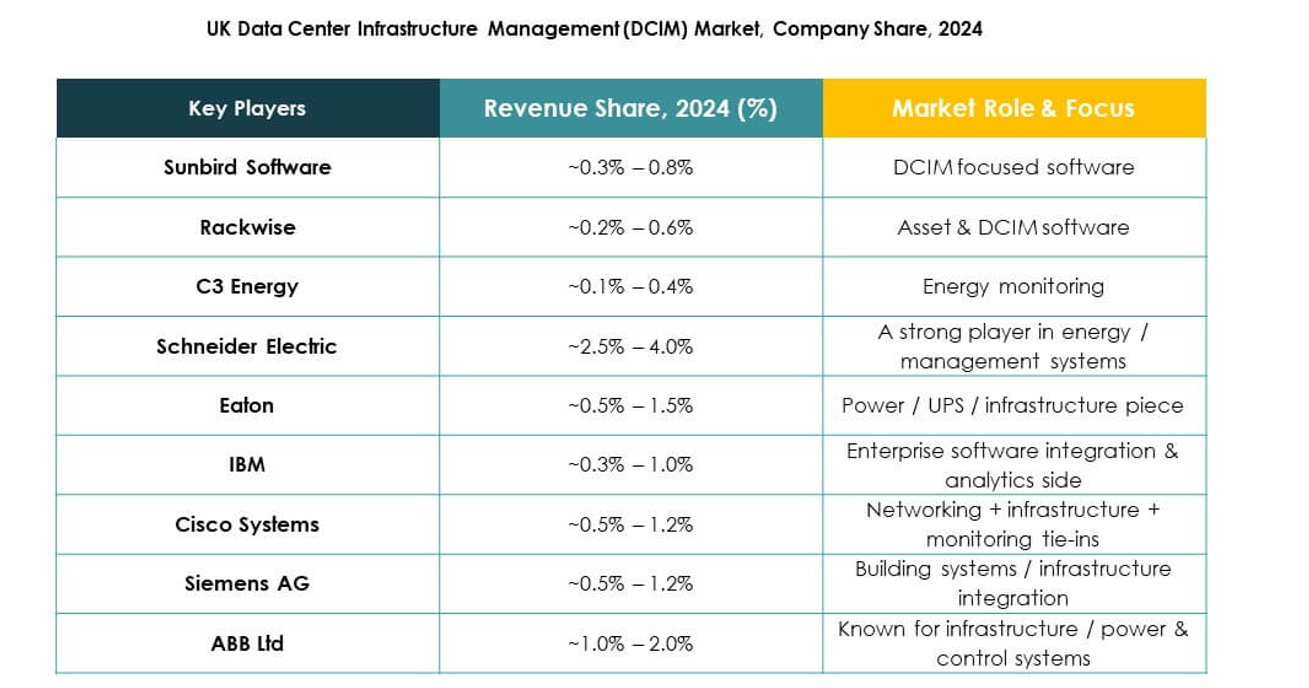

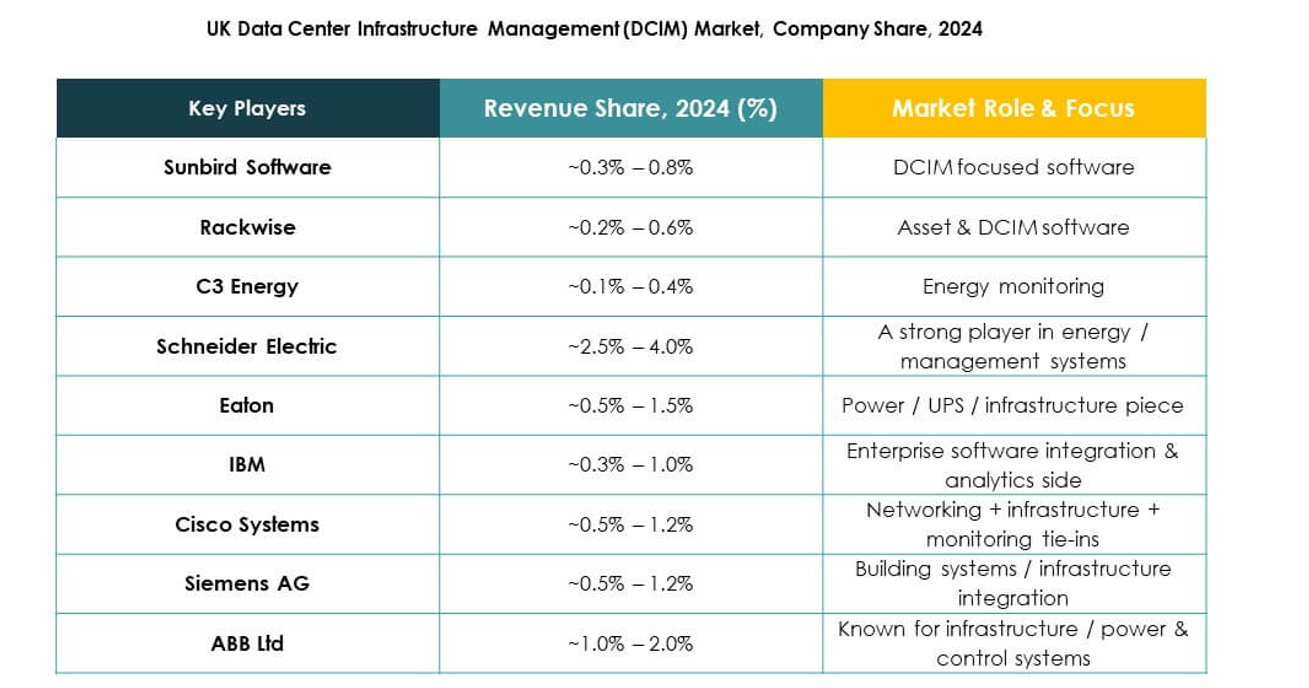

Competitive Insights:

- Sunbird Software

- Rackwise

- C3 Energy

- Oneview Software

- Servicenow (UK)

- Optimity

- Netcall

- ABB Ltd.

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd.

- IBM

- Schneider Electric SE

- Siemens AG

- HPE (Hewlett Packard Enterprise)

- Delta Electronics

The UK Data Center Infrastructure Management (DCIM) Market is highly competitive, with global leaders and regional specialists driving innovation across solutions and services. Established firms such as Schneider Electric, Siemens, Cisco, and IBM dominate through integrated platforms, strong partnerships, and investments in AI-driven monitoring. Technology providers like ABB and Huawei focus on sustainable operations and energy efficiency to capture enterprise demand. Mid-tier companies including Sunbird Software and Rackwise strengthen their positions by offering niche DCIM tools with simplified interfaces and strong analytics capabilities. It continues to attract new entrants that leverage cloud-based models and hybrid deployment features. Competitive differentiation often depends on scalability, cybersecurity compliance, and integration with existing IT service systems. Vendors are also expanding through mergers, acquisitions, and localized strategies to enhance their share in the growing UK market.

Recent Developments:

- In August 2025, Schneider Electric introduced Gateway, a new program under its partner framework offering resellers free licenses, training, and enablement tied into EcoStruxure IT for better DCIM infrastructure reach.

- In February 2025, Schneider Electric acquired a controlling stake in Motivair, the liquid-cooling specialist, to strengthen its cooling portfolio within its DCIM and data center offerings.

- In June 2024, Schneider Electric entered a partnership with DC Smarter to integrate its DC Vision digital twin software into the EcoStruxure IT Advisor DCIM platform, enhancing real-time 3D visualization and operational insights.

Market Drivers

Market Drivers