Executive Summary:

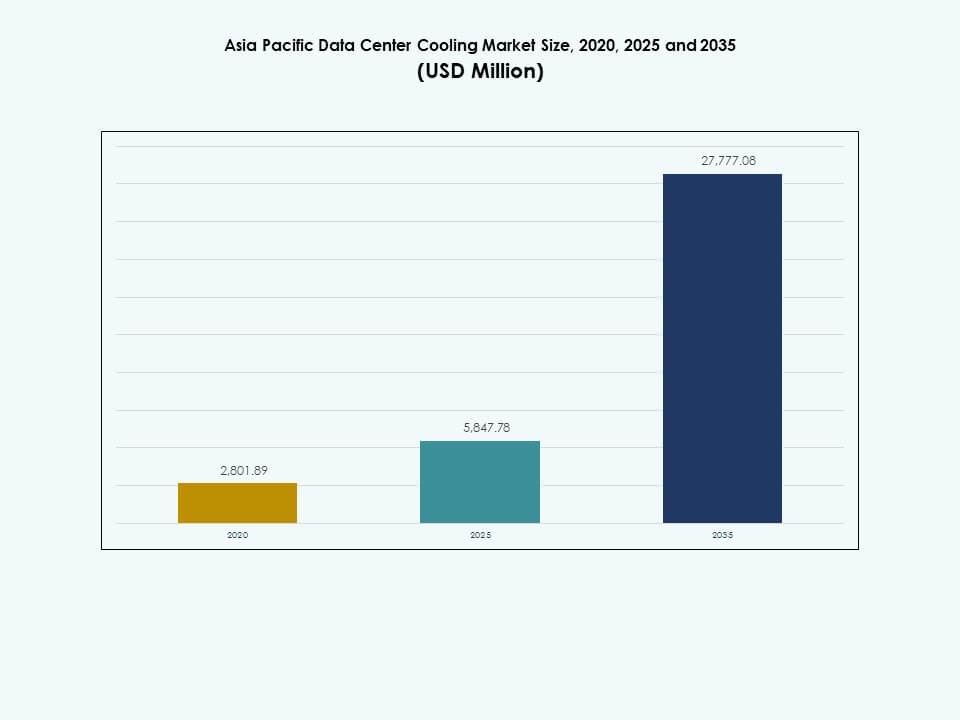

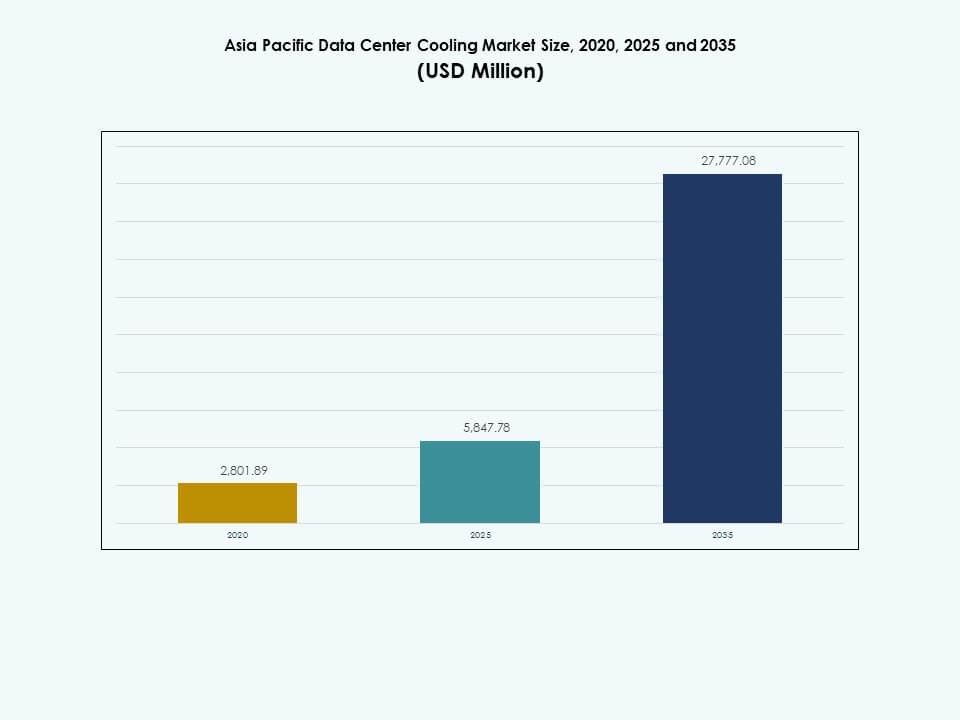

The Asia Pacific Data Center Cooling Market size was valued at USD 2,801.89 million in 2020 to USD 5,847.78 million in 2025 and is anticipated to reach USD 27,777.08 million by 2035, at a CAGR of 16.79% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Asia Pacific Data Center Cooling Market Size 2025 |

USD 5,847.78 Million |

| Asia Pacific Data Center Cooling Market, CAGR |

16.79% |

| Asia Pacific Data Center Cooling Market Size 2035 |

USD 27,777.08 Million |

Rising adoption of high-density computing drives strong demand for efficient cooling technologies. Companies invest in liquid cooling, modular systems, and AI-based thermal automation to support dense workloads. Operators upgrade older facilities to match new performance and sustainability expectations. Growing cloud footprints and edge deployments increase demand for scalable cooling. These shifts attract investors seeking exposure to long-term digital growth.

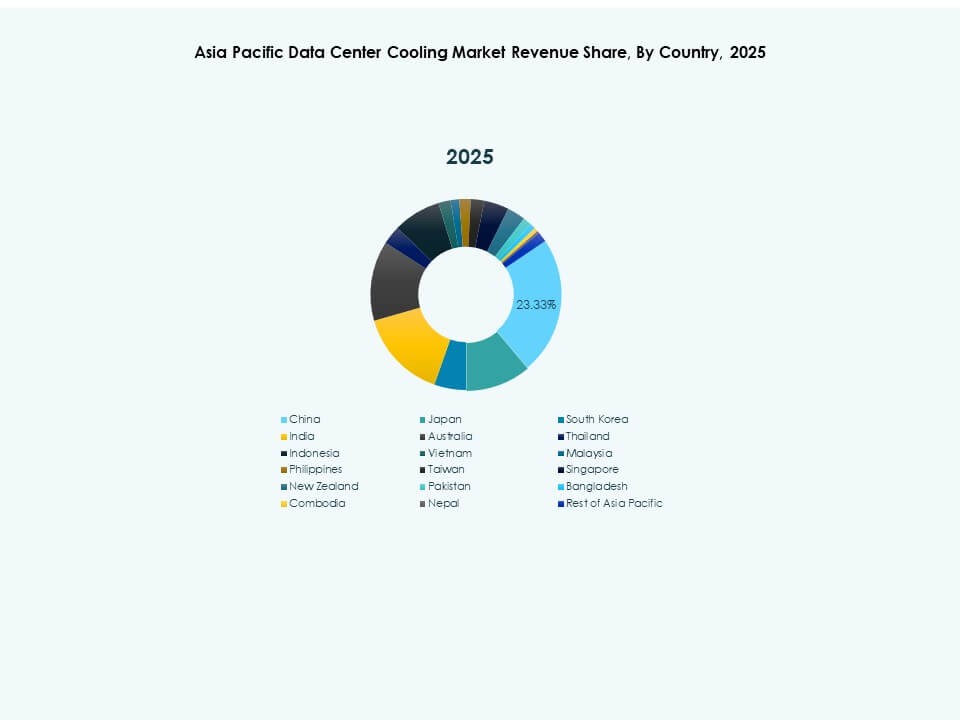

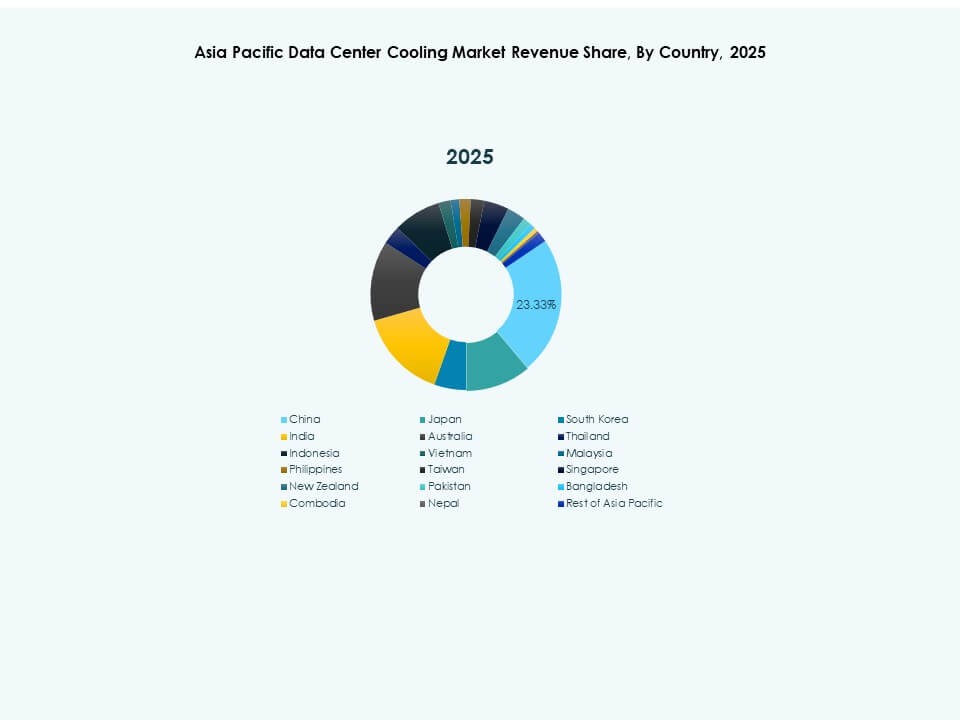

East Asia leads due to its dense hyperscale clusters and rapid cloud expansion. South Asia and Southeast Asia are emerging as new hotspots driven by data localization rules and rising digital consumption. Mature markets show strong replacement demand for efficient cooling, while developing markets benefit from large greenfield construction. Regional growth reflects rising computing intensity and greater focus on sustainability across key economies.

Market Drivers

Market Drivers

Strong Acceleration of High-Density Computing Needs Across Cloud and AI Workloads

The Asia Pacific Data Center Cooling Market gains strong momentum due to rapid expansion of high-density compute clusters. Hyperscale operators upgrade cooling to support GPU racks and AI-heavy architectures. Investors view the region as a strategic digital hub, driving faster modernization. Liquid cooling, precision systems, and advanced airflow methods gain wider acceptance. Automation strengthens energy control in dense environments. Enterprises shift workloads to regional clouds that demand higher cooling performance. The market pushes operators to deploy efficient systems that lower thermal risk. It supports long-term digital growth across multiple industries. Strong cooling performance becomes vital for AI clusters. New facility designs optimize airflow to handle higher heat loads.

Expansion of Hyperscale Infrastructure and Edge Deployments Across Key Economies

Hyperscale cloud providers accelerate new builds to handle fast digital adoption, and this trend reshapes cooling design across the region. Operators integrate modular cooling to match rapid build cycles. Heat loads rise due to AI and analytics workloads, creating stronger need for efficient systems. Enterprises place workloads closer to users, increasing edge site construction. The Asia Pacific Data Center Cooling Market supports this shift by offering scalable and flexible cooling. It helps service providers keep stable uptime under higher compute intensity. Firms invest in intelligent controls to optimize airflow. Cooling systems evolve to manage complex, distributed digital infrastructure. Edge clusters gain importance for low-latency operations. New operational models demand higher cooling precision.

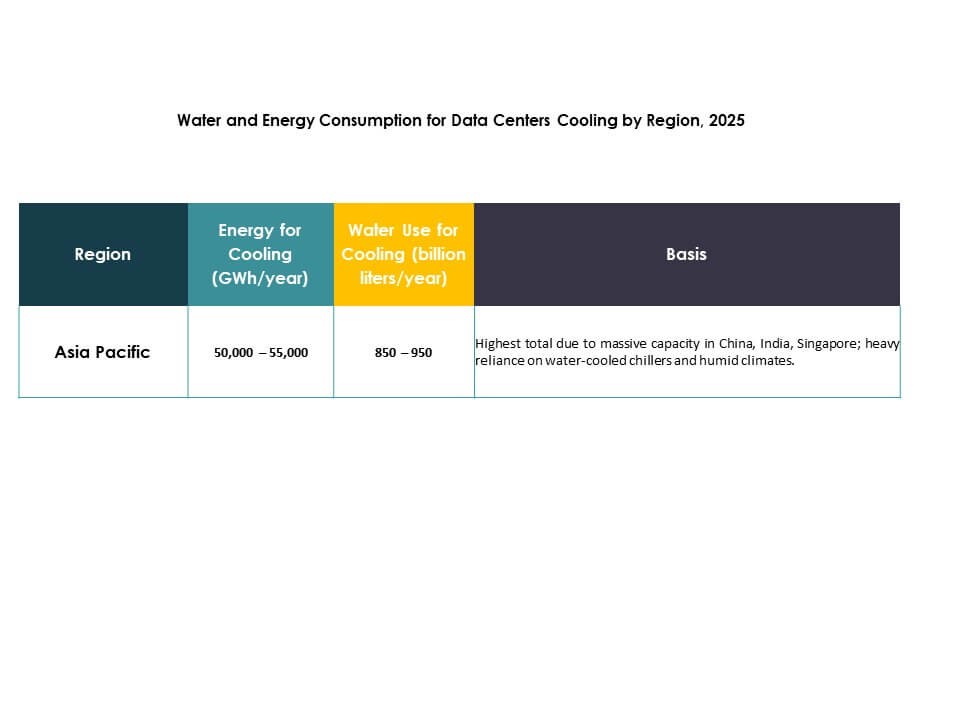

- For example, Google reports that water-cooled data centers use about 10% less energy and produce roughly 10% lower carbon emissions compared with air-cooled sites, according to the company’s published sustainability documentation. The company also confirms that more than 25% of its global data-center campuses operate using reclaimed or non-potable water sources. These practices reflect Google’s broader approach to responsible cooling and water stewardship.

Shift Toward Green Cooling Infrastructure and Sustainability-Centric Modernization

Greater emphasis on sustainability drives a significant shift toward efficient cooling solutions. Operators replace older systems with low-carbon options across major markets. Low-water technologies gain preference due to environmental expectations. Enterprises demand cooling systems that support long-term energy goals. The Asia Pacific Data Center Cooling Market enables this transition through efficient designs. It helps operators meet corporate sustainability commitments. New builds integrate smart heat-management tools to reduce resource use. Growing compliance rules accelerate adoption of clean cooling across the region. Green cooling becomes essential for meeting corporate ESG goals. Modern sites adopt designs that limit resource strain.

Adoption of Smart Cooling Technologies for Stable Thermal Performance

AI-based controls shape the next phase of cooling advancement across the region. Automated systems adjust airflow to match changing compute heat loads. Operators rely on real-time monitoring for precise thermal management. High-density sites deploy advanced sensors to stabilize conditions. The Asia Pacific Data Center Cooling Market benefits from strong digital maturity. It supports operators that seek predictable performance under heavy compute demand. Enterprises adopt predictive cooling tools to lower operational risk. Intelligent systems improve thermal reliability across next-generation data centers. Smart controls lower the risk of heat spikes. New monitoring frameworks improve long-term uptime.

- For instance, Alibaba Cloud’s Xixi campus in Hangzhou deployed its AI-powered “Energy Expert” platform as part of a smart campus initiative. Over six months, this platform reduced air-conditioning energy use during summer by 17%, cut off-peak energy usage by 30%, and lowered total yearly electricity use by 600,000 kWh, according to Alibaba’s officially published pilot and campus-wide results.

Market Trends:

Market Trends:

Rapid Uptake of Liquid Cooling to Support AI and GPU-Intensive Environments

Liquid cooling adoption grows due to rising thermal challenges in advanced compute nodes. Operators move toward direct-to-chip designs for consistent performance. Energy footprints shift when GPU clusters require stronger thermal response. The Asia Pacific Data Center Cooling Market supports this transition with scalable liquid infrastructure. It enables operators to deploy dense hardware without thermal instability. Enterprises exploring AI workloads rely on next-gen cooling for efficiency. Heat-recovery interest grows due to thermal output from liquid systems. Region-wide adoption expands with steady modernization. More hyperscalers test immersion systems for dense racks. Liquid cooling becomes essential for AI-heavy compute zones.

Wider Integration of Modular Cooling Blocks for Flexible Build Cycles

Operators deploy modular cooling to accelerate construction and shorten delivery timelines. Modular blocks reduce design complexity across edge and hyperscale sites. Capacity scaling becomes easier with standardized cooling units. The Asia Pacific Data Center Cooling Market drives interest in plug-and-play thermal systems. It improves predictability in project execution. Enterprises favor modular designs for easier upgrades. Operators combine modular cooling with automation for strong stability. Rapid build cycles strengthen adoption across digital hubs. Uniform modules simplify site replication across regions. Modular systems reduce deployment delays for new data halls.

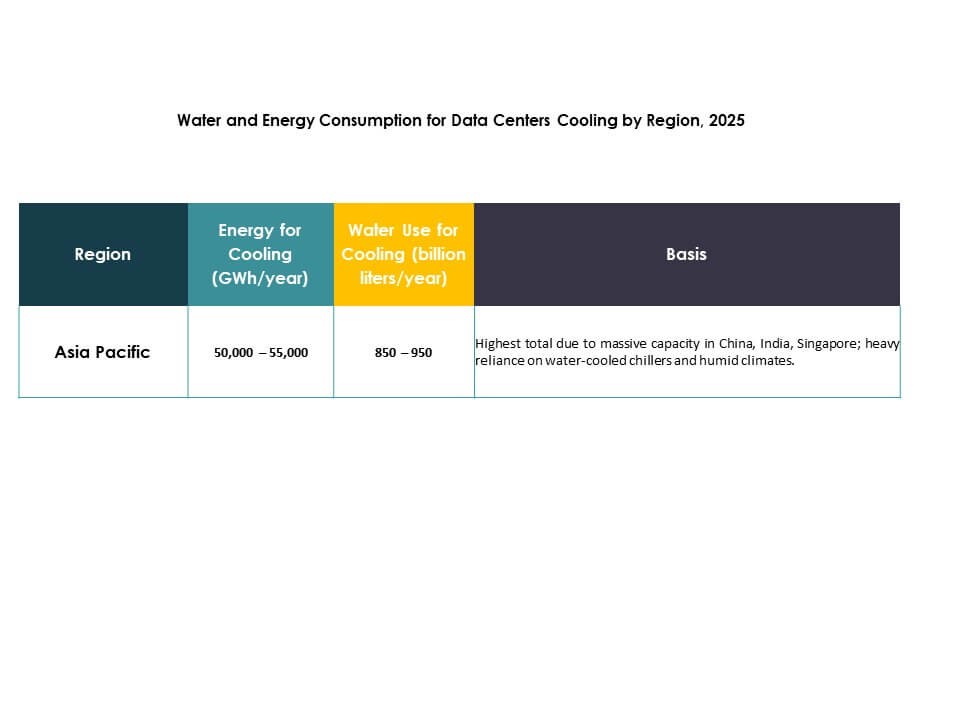

Growing Use of Free-Cooling and Low-Water Cooling Technologies

Free-cooling gains traction in regions with favorable climate. Operators move to low-water designs to reduce resource pressure. Chiller-less architectures appear in new builds across select economies. The Asia Pacific Data Center Cooling Market responds with innovative low-water systems. It supports operators facing tight environmental expectations. Heat-exchanger technology improves efficiency in hybrid cooling setups. Local industries adopt green designs for stronger resilience. New sites integrate weather-adaptive systems for energy reduction. Low-water systems gain demand in water-stressed cities. More operators pursue air-based cooling for compliance.

High Preference for Smart Monitoring and Predictive Maintenance Frameworks

Thermal sensors gain wider use due to dense compute racks. Operators deploy predictive tools to reduce downtime. AI-based insights improve airflow performance. The Asia Pacific Data Center Cooling Market enables advanced monitoring across new and existing sites. It supports operators handling fluctuating compute loads. Enterprises adopt monitoring tools to extend equipment life. Predictive cooling platforms reduce manual intervention. Remote diagnostic capability grows across regional facilities. Smart analytics help forecast failure points. Cooling decisions improve through better real-time insights.

Market Challenges:

Market Challenges:

Rising Thermal Loads Create Pressure on Cooling Efficiency and Infrastructure Resilience

Thermal demands rise across hyperscale and enterprise facilities due to dense compute. Operators struggle with load variability across GPU clusters. Older cooling systems show limits under higher heat output. The Asia Pacific Data Center Cooling Market faces pressure to maintain stable conditions. It forces operators to upgrade systems faster than planned. Energy use challenges intensify under heavy workloads. Enterprises need strong reliability during peaks. Modernization timelines become more complex for legacy facilities. High-density racks increase stress on airflow distribution. Cooling gaps widen when sites delay upgrades.

Regulatory Constraints and High Cost of Sustainable Cooling Deployment

Environmental rules tighten across major markets. Operators face higher cost structures for compliant cooling. Water-use restrictions impact design decisions across urban hubs. The Asia Pacific Data Center Cooling Market responds with low-resource systems. It forces companies to rethink procurement and sourcing cycles. Capital expenditure rises due to green mandates. Skilled labor shortages delay project execution. Complex permitting slows development in key regions. Sustainability reporting increases pressure on operators. Compliance gaps create operational risk during audits.

Market Opportunities:

Expansion of AI, Cloud, and Edge Workloads Driving Demand for Advanced Cooling

AI and cloud adoption boosts demand for efficient thermal systems. Enterprises embrace new workloads that increase heat density. Hyperscale sites expand faster, opening space for innovative cooling. The Asia Pacific Data Center Cooling Market supports strong investment in new cooling designs. It helps operators deliver predictable performance. Edge sites create new demand clusters. Regional players explore advanced cooling for long-term scalability. Adoption grows across both new builds and upgrades. AI-heavy clusters accelerate the need for precision designs. Strong digital expansion strengthens long-term cooling investments.

Growing Push for Sustainable Cooling and Heat-Reuse Adoption

Operators invest in systems that support regional sustainability goals. Heat-reuse interest rises across urban areas. Low-carbon cooling gains traction due to strict expectations. The Asia Pacific Data Center Cooling Market supports green designs at scale. It encourages operators to upgrade legacy systems. Water-efficient cooling gains priority in resource-stressed areas. Enterprises adopt sustainable cooling for compliance. Clean cooling becomes a strong opportunity across new construction cycles. Heat-recovery programs create value for nearby communities. Modern cooling aligns with long-term environmental commitments.

Market Segmentation:

By Component

The Asia Pacific Data Center Cooling Market shows strong dominance for solution components due to high deployment of precision systems, chillers, and liquid cooling units. Solution demand rises as hyperscale and enterprise operators expand dense compute zones. Services gain traction through installation, consulting, and predictive maintenance needs. Modernization cycles strengthen interest in service contracts for uptime stability. The solution category holds the largest share due to higher capital involvement. Services grow with increased reliance on monitoring tools. Regional data hubs require constant support for complex thermal environments. Operators prefer integrated contracts to reduce operational risk. Strong digital growth fuels recurring service expansion.

By Data Center Cooling Solution

Air conditioners and precision units maintain a strong share due to broad installation across large halls. Chillers remain essential for stable thermodynamic control in high-load environments. Liquid cooling gains strong momentum for AI and GPU-intensive racks. The Asia Pacific Data Center Cooling Market supports hybrid systems to balance cost and energy performance. Air handling units enhance airflow quality and improve rack stability. Operators adopt mixed solutions to match diverse computing needs. Legacy halls continue using air-based systems, while new builds lean toward liquid designs. Cooling flexibility becomes a core design priority. Adoption scales as compute density increases across regional sites.

By Service

Installation and deployment services dominate due to active construction of hyperscale and colocation facilities. Support and consulting services expand due to complex thermal configuration needs. Maintenance services grow with adoption of predictive monitoring and advanced sensors. The Asia Pacific Data Center Cooling Market relies on strong service networks to ensure long-term stability. Firms require technical guidance for liquid and hybrid cooling adoption. Service contracts become vital for uptime protection. Skilled technicians support rapid deployment cycles. Operators depend on service teams for lifecycle optimization. Regional demand rises as more facilities upgrade legacy cooling systems.

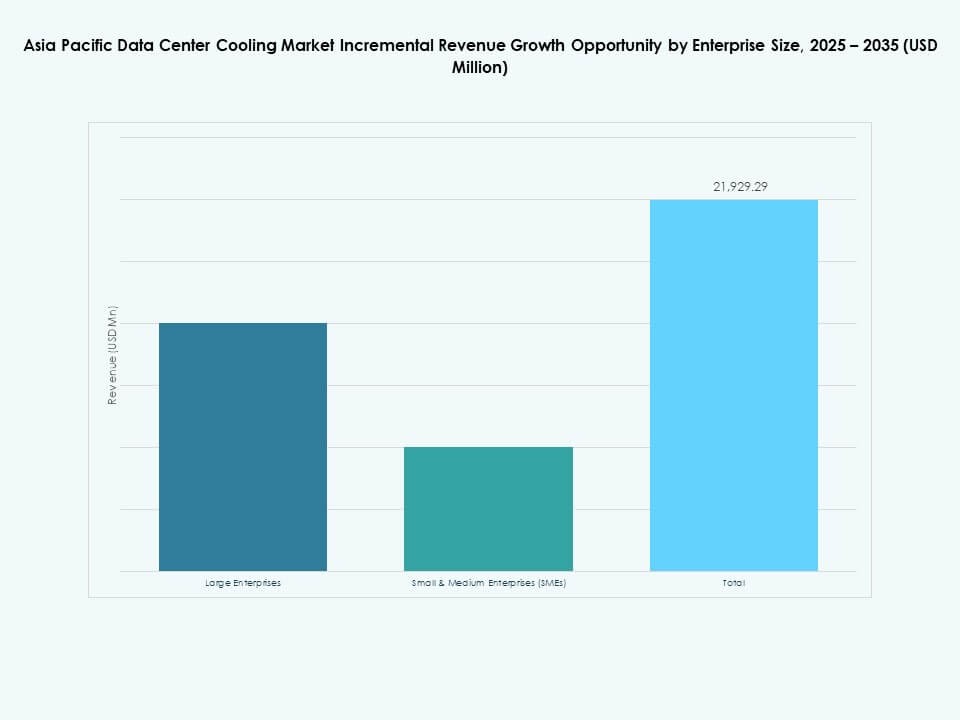

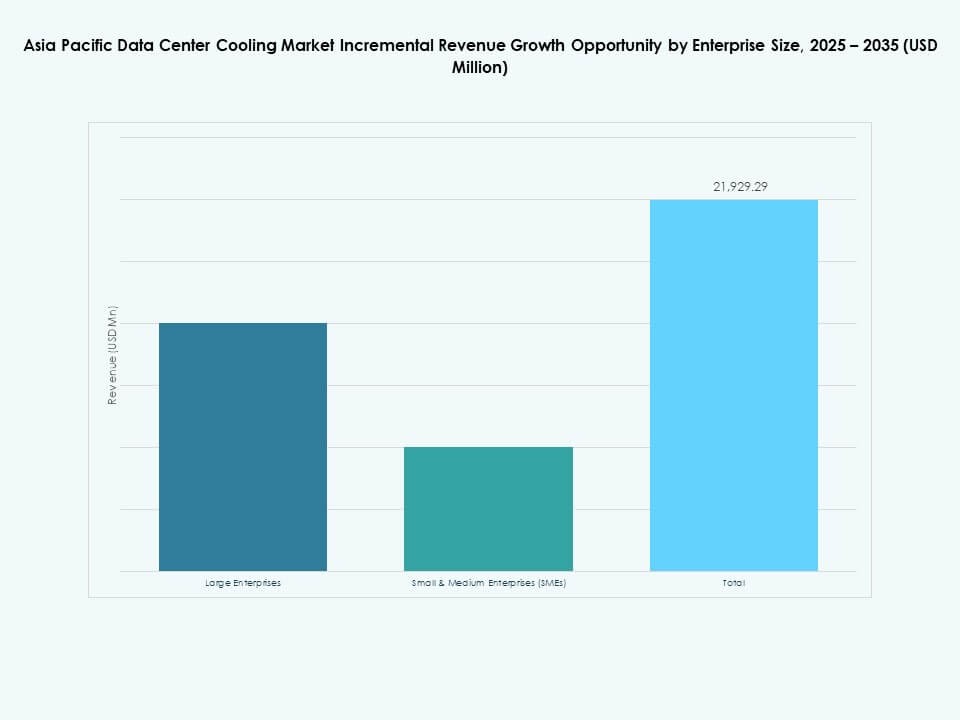

By Enterprise Size

Large enterprises lead adoption due to higher compute intensity and large-scale infrastructure footprints. SMEs expand adoption through cloud transitions and modular cooling installations. The Asia Pacific Data Center Cooling Market supports both segments with flexible and scalable designs. Large enterprises deploy precision cooling to stabilize high-density racks. SMEs adopt cost-efficient modular systems to manage growth. Expanding workloads require consistent thermal performance across all enterprise types. Cloud-driven transformation increases cooling deployments among mid-size firms. Both tiers adopt monitoring systems for stability. Strong digital acceleration drives sustained cooling investment.

By Floor Type

Raised floors dominate due to improved airflow distribution and stronger cable routing flexibility. Non-raised floors grow in compact or modular data centers. The Asia Pacific Data Center Cooling Market supports both designs across diverse deployment environments. Raised floors enhance cooling efficiency for dense compute zones. Non-raised floors match modern, space-optimized layouts. Operators select floor types based on facility constraints and cost goals. Airflow systems adapt to layout variations to ensure stability. Raised floors remain preferred for larger hyperscale facilities. Both formats continue to show strong market relevance.

By Containment

Hot aisle containment holds a strong share due to superior thermal separation performance. Cold aisle containment remains widely used across mid-size and legacy environments. Raised floors without containment decline because of energy inefficiencies. The Asia Pacific Data Center Cooling Market encourages HAC for high-density deployments. CAC supports facilities needing structured airflow control. Operators invest in containment retrofits to boost energy performance. Containment improves predictability under heavy compute loads. Adoption grows due to sustainability targets. Modern sites prioritize containment to reduce cooling waste.

By Structure

Room-based cooling leads due to widespread legacy installations. Row-based cooling expands in environments needing zone-level efficiency. Rack-based cooling grows fast due to liquid and direct-to-chip adoption. The Asia Pacific Data Center Cooling Market supports structure selection based on density profiles. Room-based cooling remains useful for large open halls. Row systems boost control in medium-density setups. Rack systems suit AI-heavy compute spaces. Mixed-structure environments emerge across hybrid facilities. Flexible cooling structures help operators meet rising thermal loads.

By Application

Hyperscale data centers lead adoption due to massive computing requirements. Colocation sites expand cooling investments as enterprises shift workloads off-premises. Enterprise data centers upgrade cooling to maintain performance during digital expansion. The Asia Pacific Data Center Cooling Market aligns with rising edge deployments across multiple industries. Edge facilities grow due to latency-sensitive applications. Other data centers integrate cooling upgrades to match expanding workloads. Cooling needs vary by density and scale. Operators adjust cooling strategies to meet diverse application demands. Sustained growth across all applications strengthens market maturity.

By End-User

Telecom and IT sectors lead cooling adoption due to strong digital infrastructure demands. BFSI requires high reliability for regulated workloads. Healthcare increases cooling investment for expanding digital health records and imaging systems. The Asia Pacific Data Center Cooling Market supports retail, energy, and other sectors with scalable systems. Telecom upgrades intensify with 5G and edge expansion. IT environments shift heavily toward cloud-based workloads. Energy and retail require stable cooling for analytics-driven operations. End-users adopt efficient systems to protect critical workloads. Broad sector diversification sustains strong cooling demand.

Regional Insights:

Regional Insights:

East Asia Dominance Driven by Strong Hyperscale and Cloud Concentration

East Asia holds the largest share of the Asia Pacific Data Center Cooling Market due to strong hyperscale presence, dense urban demand, and fast cloud expansion across major economies. Operators deploy advanced cooling to support rising thermal loads from AI and HPC clusters. Energy-efficient designs gain high priority as sustainability rules strengthen. It enables stable performance for fast-growing enterprise workloads. Regional hubs attract major investments in new data center parks. New cooling technologies gain rapid adoption due to tech maturity. Cross-border cloud growth strengthens infrastructure demand. Cooling standards continue to rise with ongoing hyperscale expansion.

South Asia Emerging Through Cloud Growth and Digital Transformation

South Asia secures a rising share of the Asia Pacific Data Center Cooling Market due to strong cloud adoption, enterprise digitalization, and new data center development programs. Local compliance rules accelerate investment in efficient cooling. Operators deploy scalable systems to handle evolving IT demand. It supports enterprise modernization across diverse sectors. Government-backed infrastructure projects encourage tech expansion. Regional cloud zones expand cooling footprints. Edge deployments increase thermal needs across distributed locations. Strong IT growth pushes operators to adopt advanced cooling systems.

- For example, CtrlS operates India’s only certified Tier IV data center, with its Mumbai campus supporting liquid-cooling racks and high-efficiency thermal infrastructure designed for a PUE near 1.42, according to technical disclosures. Public documentation also notes that the site maintains N+N redundancy across critical systems to support high-performance workloads. These features position the facility among India’s most resilient data-center environments.

Southeast Asia Gaining Traction Through Edge and Colocation Expansion

Southeast Asia retains a growing share of the Asia Pacific Data Center Cooling Market due to rising colocation demand, rapid e-commerce expansion, and strong cloud-region development. Edge facilities play a key role in supporting low-latency workloads. Operators adopt green cooling to meet sustainability goals. It aligns with national energy mandates across multiple countries. Cooling upgrades strengthen performance for high-density deployments. Foreign investment accelerates region-wide data center expansion. New digital zones push operators toward advanced cooling systems. The region gains strategic value due to its diverse and expanding data economy.

- For example, ST Telemedia Global Data Centres (STT GDC) in Singapore publicly reports the deployment of direct-to-chip liquid cooling and AI-enabled optimization at its STT Loyang facilities, achieving up to 30% energy savings in cooling operations. Company disclosures also highlight meaningful reductions in water consumption due to these technologies. These upgrades support sustainable performance for hyperscale and colocation customers under Singapore’s strict efficiency requirements.

Competitive Insights:

- Hairf Network Power Beijing Co Ltd

- Blueway Electric Appliances Co. Ltd.

- TICA

- Mitsubishi Electric Corporation

- Fujitsu

- Hitachi Ltd.

- Daikin Industries Ltd.

- Blue Star Ltd.

- Voltas Ltd. (Tata Group)

- Kirloskar Pneumatic Company Ltd.

- Godrej & Boyce Manufacturing Co. Ltd.

- Temperzone Ltd.

- Seeley International

- Braemar Air Conditioning

The Asia Pacific Data Center Cooling Market features strong competition between global OEMs and regional specialists that focus on high-efficiency thermal systems. Companies expand portfolios across precision cooling, liquid cooling, and modular systems to support rising compute loads. It encourages firms to strengthen designs that fit hyperscale, colocation, and enterprise deployments across diverse climates. Large vendors invest in R&D to offer low-water and energy-efficient solutions, while regional manufacturers compete on cost and customization. Strategic partnerships grow across cloud providers and engineering firms, creating deeper involvement in long-term cooling projects. Product reliability, service capability, and integration with smart controls shape competitive positioning. Vendors pursue efficiency certifications to meet sustainability expectations. Firms grow regional footprints to secure contracts in emerging digital hubs.

Recent Developments:

- In October 2025, Alibaba Cloud announced the commercial deployment of next-generation liquid cooling technologies across several data center campuses in Beijing and Hangzhou, targeting improved energy efficiency and environmental sustainability.

- In May 2025, Chemours formed a partnership with Navin Fluorine to develop and localize Opteon™ two-phase immersion fluid, set for rollout in China in 2026. This collaboration will provide local data centers with state-of-the-art immersion cooling solutions, contributing to reduced power usage effectiveness (PUE) for high-density workloads.

- In December 2024, Vertiv Group Corp acquired certain assets and technologies from BiXin Energy Technology Co., Ltd. to further expand their footprint and technical capabilities in the data center cooling market, particularly focusing on technological advancements for AI-optimized cooling

Market Drivers

Market Drivers Market Trends:

Market Trends: Market Challenges:

Market Challenges: Regional Insights:

Regional Insights: