1. Introduction

1.1. Market Definition & Scope

1.2. Research Methodology

1.2.1. Primary Research

1.2.2. Secondary Research

1.2.3. Data Validation & Assumptions

1.3. Market Segmentation Framework

2. Executive Summary

2.1. Market Snapshot

2.2. Key Findings

2.3. Analyst Recommendations

2.4. Market Outlook (2025–2035)

3. Market Dynamics

3.1. Market Drivers

3.2. Market Restraints

3.3. Market Opportunities

3.4. Challenges & Risks

3.5. Value Chain Analysis

3.6. Porter’s Five Forces Analysis

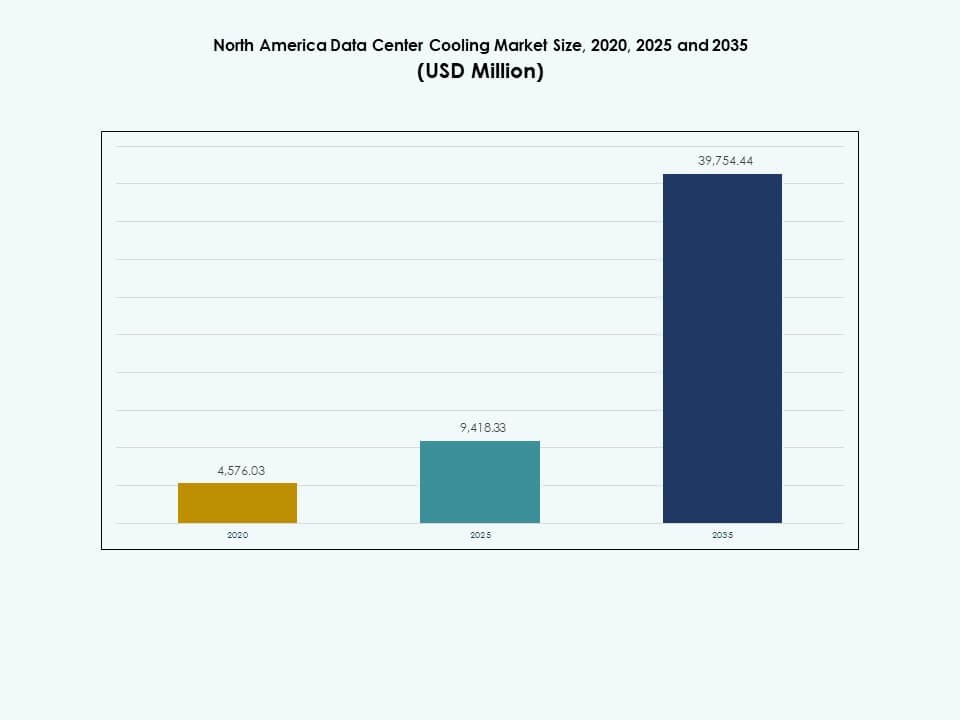

4. North America Data Center Cooling Market – Market Sizing & Forecast

4.1. Historical Market Size (2020–2025)

4.2. Forecast Market Size (2026–2035)

4.3. Market Growth Rate Analysis

4.4. Market Outlook by Country

5. Capital Expenditure (CapEx) Analysis

5.1. CapEx Trends by Cooling Solution

5.1.1. Investment patterns across air-based, liquid-based, hybrid, and immersion cooling

5.1.2. CapEx share by cooling equipment type (CRAC/CRAH, chillers, cooling towers, economizers, etc.)

5.1.3. Regional CapEx trends

5.1.4. OEM vs. retrofit investment analysis

5.2. Return on Investment (ROI) & Payback Period Analysis

5.2.1. ROI by cooling technology type

5.2.2. Cost-benefit comparison: air cooling vs. liquid cooling vs. immersion cooling

5.2.3. Payback period across Tier I–IV data centers

5.2.4. Case examples of cost savings through energy-efficient cooling adoption

6. Data Center Cooling Capacity & Utilization

6.1. Installed Capacity (MW & Sq. Ft.) by Cooling Solution

6.1.1. Installed cooling capacity by solution type and Country

6.1.2. Cooling system density (kW/rack and per sq. ft.)

6.1.3. Capacity expansion trends by hyperscale vs. colocation vs. enterprise

6.2. Utilization Rates & Efficiency Metrics

6.2.1. Cooling system utilization vs. design capacity

6.2.2. Average and peak load management practices

6.2.3. Equipment lifecycle and performance benchmarks

6.3. Power Usage Effectiveness (PUE) & Energy Efficiency

6.3.1. Average PUE by data center size and cooling technology

6.3.2. Comparison of traditional vs. green cooling systems

6.3.3. Cooling system contribution to total facility energy consumption

6.4. Rack Density & Cooling Efficiency

6.4.1. Average rack density (kW/rack) trends

6.4.2. Cooling adequacy vs. rack load

6.4.3. Relationship between high-density workloads (AI, HPC) and cooling requirements

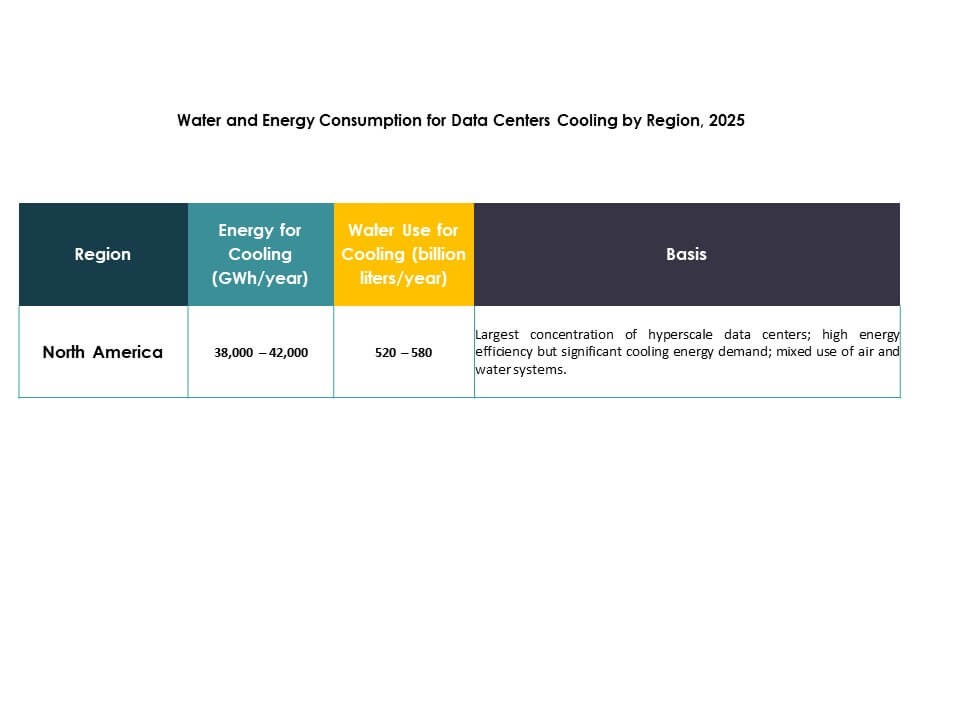

7. Data Center Cooling Market, Energy & Resource Consumption Analysis

7.1. Energy Consumption Analysis

7.1.1. Total energy consumption by cooling solution type (air-based, liquid, hybrid, immersion)

7.1.2. Energy intensity per MW of IT load

7.1.3. Energy share of cooling in total facility power (cooling load ratio)

7.1.4. Annualized Energy Efficiency Ratio (EER / SEER) by cooling system type

7.1.5. Trend in energy consumption reduction through automation, AI, and free cooling technologies

7.2. Water Consumption Analysis

7.2.1. Water Usage Effectiveness (WUE) – liters per kWh of IT load

7.2.2. Water consumption by cooling technology (evaporative cooling, adiabatic cooling, etc.)

7.2.3. Water recycling and reuse systems in data centers

7.2.4. Impact of Regional water scarcity regulations on cooling system choice

7.2.5. Shift from water-intensive to air-based or hybrid systems

7.3. Combined Energy–Water Efficiency Metrics

7.3.1. Energy-Water Nexus in cooling optimization

7.3.2. Correlation between PUE, WUE, and total operational cost (OpEx)

7.3.3. Case studies of zero-water or waterless cooling deployments

7.4. Benchmarking & Comparative Analysis

7.4.1. Benchmarking against ASHRAE, Uptime Institute, and DOE standards

7.4.2. Comparison of North America WUE/PUE averages by Country

7.4.3. Best practices adopted by hyperscalers (AWS, Google, Microsoft, Meta, etc.)

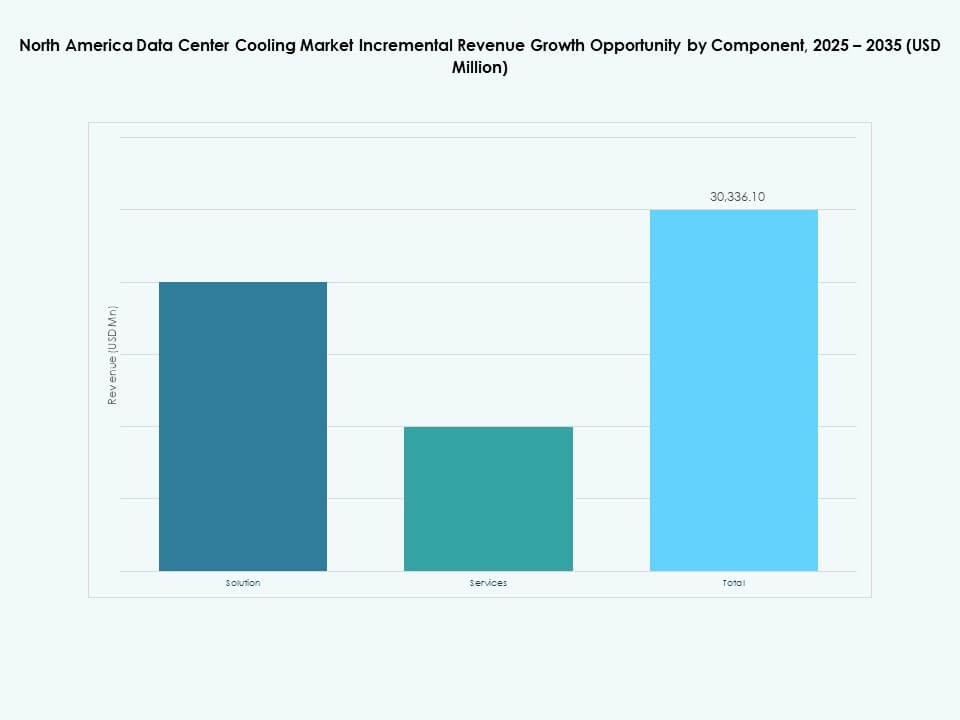

8. North America Data Center Cooling Market – By Component

8.1. Solution

8.2. Services

9. North America Data Center Cooling Market – By Data Center Cooling Solution

9.1. Air Conditioners

9.2. Precision Air Conditioners

9.3. Chillers

9.4. Air Handling Units

9.5. Liquid Cooling

9.6. Others

10. North America Data Center Cooling Market – By Service

10.1. Installation & Deployment

10.2. Support & Consulting

10.3. Maintenance Services

11. North America Data Center Cooling Market – By Enterprise Size

11.1. Large Enterprises

11.2. Small & Medium Enterprises (SMEs)

12. North America Data Center Cooling Market – By Floor Type

12.1. Raised Floors

12.2. Non-Raised Floors

13. North America Data Center Cooling Market – By Containment

13.1. Raised Floor with Hot Aisle Containment (HAC)

13.2. Raised Floor with Cold Aisle Containment (CAC)

13.3. Raised Floor without Containment

14. North America Data Center Cooling Market – By Structure

14.1. Rack-Based Cooling

14.2. Row-Based Cooling

14.3. Room-Based Cooling

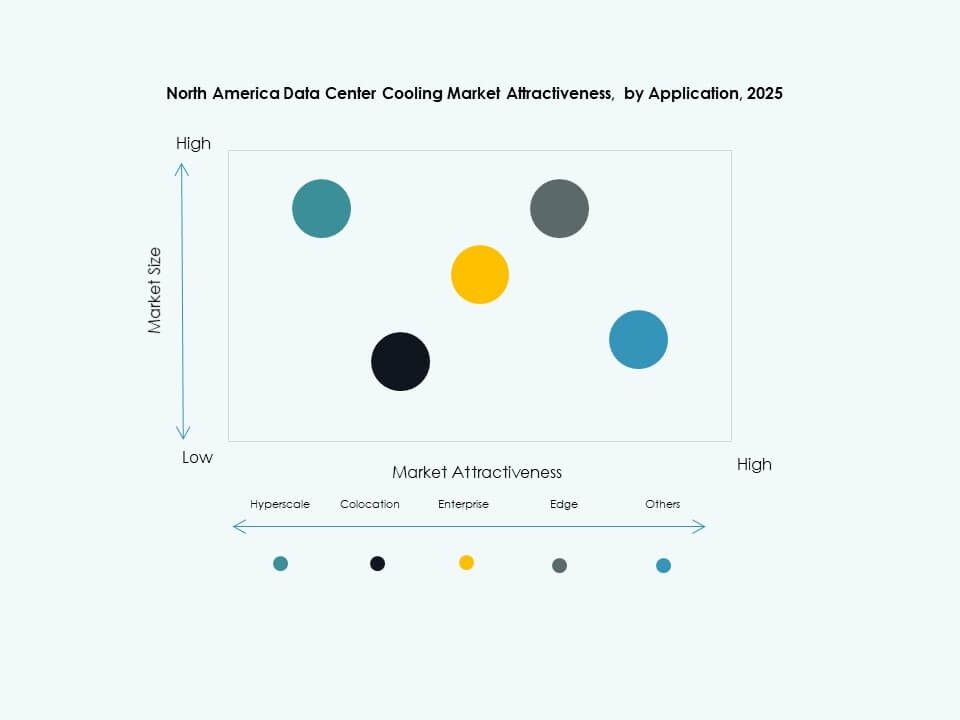

15. North America Data Center Cooling Market – By Application

15.1. Hyperscale Data Center

15.2. Colocation Data Center

15.3. Enterprise Data Center

15.4. Edge Data Center

15.5. Other Data Centers

16. North America Data Center Cooling Market – By End-user

16.1. Telecom

16.2. IT

16.3. Retail

16.4. Healthcare

16.5. BFSI

16.6. Energy

16.7. Others

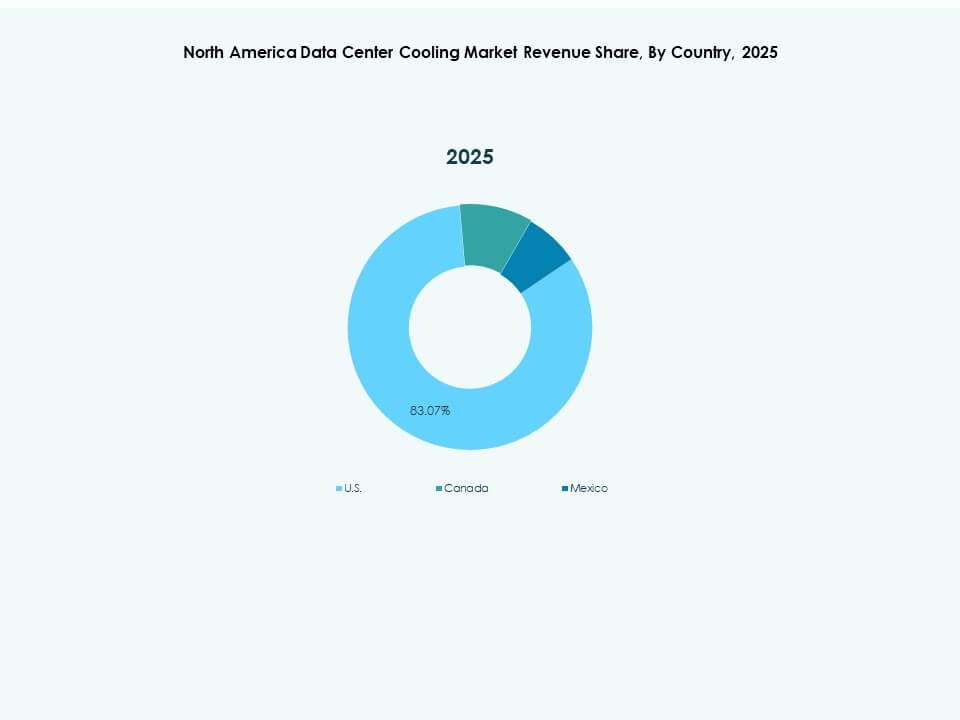

17. North America Data Center Cooling Market – By Country

17.1. North America

17.1.1. U.S.

17.1.2. Canada

17.1.3. Mexico

18. Sustainability & Green Data Center Cooling

18.1. Energy Efficiency Initiatives

18.1.1. Deployment of free cooling, adiabatic cooling, and economizers

18.1.2. Smart control systems for temperature and airflow optimization

18.1.3. Case studies of efficiency improvement programs

18.2. Renewable Energy Integration

18.2.1. Integration of solar, wind, or geothermal sources in cooling operations

18.2.2. Hybrid systems combining renewable energy with mechanical cooling

18.3. Carbon Footprint & Emission Analysis

18.4. GHG reduction initiatives

18.5. LEED & Green Certifications

18.5.1. Share of cooling systems installed in LEED, BREEAM, or Energy Star certified facilities

18.5.2. Compliance with ASHRAE and ISO energy efficiency standards

19. Emerging Technologies & Innovations

19.1.1. Emerging Technologies & Innovations

19.1.2. Liquid Cooling & Immersion Cooling

19.1.3. Adoption rate and technology maturity

19.1.4. Key vendors and installations by Country

19.1.5. Comparative analysis: performance, cost, and energy savings

19.2. AI & HPC Infrastructure Integration

19.2.1. Cooling demand driven by AI training clusters and HPC systems

19.2.2. Adaptation of cooling design to high heat density workloads

19.3. Quantum Computing Readiness

19.3.1. Cooling requirements for quantum processors

19.3.2. Potential cooling technologies suitable for quantum environments

19.4. Modular & Edge Data Center Cooling

19.4.1. Cooling strategies for prefabricated and modular facilities

19.4.2. Compact and adaptive cooling for edge sites

19.5. Automation, Orchestration & AIOps

19.5.1. Integration of AI-driven thermal management

19.5.2. Predictive maintenance and automated cooling optimization

20. Competitive Landscape

20.1. Market Share Analysis

20.2. Key Player Strategies

20.3. Mergers, Acquisitions & Partnerships

20.4. Product & Service Launches

21. Company Profiles

21.1. Asetek, Inc.

21.2. Danfoss

21.3. Dell Inc.

21.4. Johnson Controls International plc

21.5. Midas Immersion Cooling

21.6. Mitsubishi Electric Corporation

21.7. Modine Manufacturing Company

21.8. Munters

21.9. Nortek Air Solutions, LLC

21.10. NTT Ltd.

21.11. nVent

21.12. Rittal GmbH & Co. KG

21.13. Schneider Electric

21.14. STULZ GmbH

21.15. Vertiv Group Corp.

Market Challenges

Market Challenges Market Segmentation

Market Segmentation

Recent Developments:

Recent Developments: