Executive summary:

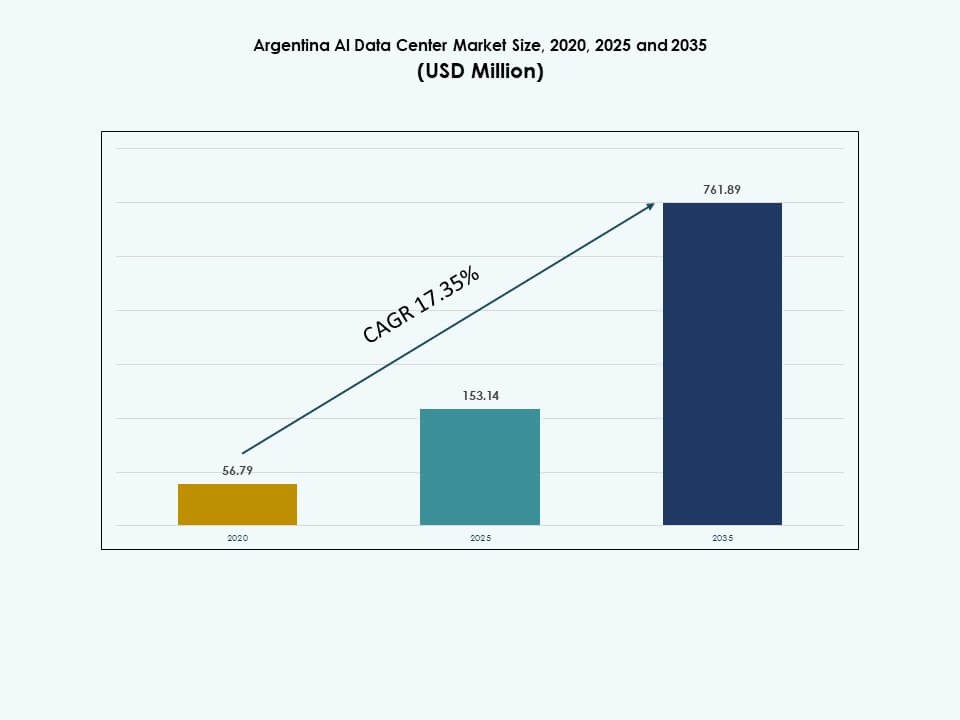

The Argentina AI Data Center Market size was valued at USD 56.79 million in 2020 to USD 153.14 million in 2025 and is anticipated to reach USD 761.89 million by 2035, at a CAGR of 17.35% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Argentina AI Data Center Market Size 2025 |

USD 153.14 Million |

| Argentina AI Data Center Market, CAGR |

17.35% |

| Argentina AI Data Center Market Size 2035 |

USD 761.89 Million |

The market is growing due to rising adoption of AI in banking, healthcare, and public services. Enterprises are investing in high-performance infrastructure to support machine learning and generative AI models. Government-backed digital transformation and favorable data localization policies enhance investor confidence. Local service providers are upgrading facilities with liquid cooling and AI-ready orchestration platforms. The market offers strategic value to companies seeking scalable and low-latency infrastructure for Spanish-language AI applications.

Buenos Aires leads the Argentina AI Data Center Market due to its dense connectivity, skilled labor pool, and established enterprise demand. Córdoba and Santa Fe are emerging as secondary hubs with regional edge deployments and academic collaborations. Mendoza supports niche verticals such as agritech and logistics. These subregions enhance national coverage, with infrastructure now expanding beyond metro areas to support AI decentralization and digital equity.

Market Dynamics:

Market Drivers

Government Policies and Private Sector Push Toward AI Infrastructure Development

Argentina’s digital modernization programs are pushing demand for AI-capable data center infrastructure. Government incentives supporting digital public services, AI regulations, and local R&D attract new investments. The private sector is adopting AI models in sectors like banking, healthcare, and logistics. These shifts create strong demand for computing infrastructure tailored for AI training and inference. The Argentina AI Data Center Market is aligning with national strategies for technological advancement. Businesses rely on AI data centers to lower latency and meet compliance needs. These facilities enable scalability, resilience, and workload optimization. They also support edge applications in provincial hubs and smart cities. AI-backed digitization drives foundational growth for infrastructure investments.

- For instance, OpenAI and Sur Energy signed a letter of intent in October 2025 for the Stargate Argentina project, planning a 500 MW facility in Patagonia for next-generation AI computing.

Rising Demand for High-Performance Computing and AI-Optimized Architectures

Industries in Argentina are scaling up their use of AI, which requires GPU-accelerated servers and high-speed interconnects. Hyperscale and colocation providers are deploying racks built for liquid cooling, high-density power, and fast memory access. AI model training and inference are becoming core business functions. Enterprises need robust infrastructure to process large datasets and real-time predictions. It creates sustained demand for data center upgrades and capacity expansion. The Argentina AI Data Center Market is central to enabling enterprise AI workloads across sectors. Deployment of high-performance clusters supports model performance, reliability, and reduced downtime. Data centers now serve as engines for digital strategy execution. This accelerates ecosystem-level innovation and transformation.

- For instance, Cirion expanded its BUE1 data center in Buenos Aires, adding over 2 MW of power and 160 racks to support GPU-heavy AI workloads.

Digital Transformation Across Core Sectors Fuels AI Data Center Adoption

Healthcare, BFSI, and telecom sectors are embedding AI into diagnostics, credit scoring, and customer analytics. Each use case adds pressure on backend systems to handle more compute, storage, and secure data flow. This shift increases uptake of AI-ready infrastructure, including hybrid and edge models. Many Argentine firms are adopting AI tools to stay regionally competitive. The Argentina AI Data Center Market provides the needed infrastructure backbone for this transition. It allows latency-sensitive workloads to run locally while maintaining centralized control. Such infrastructure supports compliance with data sovereignty laws. Digital-first strategies across verticals are increasing infrastructure scale and complexity. The demand aligns with AI maturity and IT modernization timelines.

Strategic Location for Southern Cone AI Workload Distribution and Interconnectivity

Argentina’s geographic position offers natural advantages for connecting southern South America’s AI ecosystem. The market benefits from subsea cable links, terrestrial fiber routes, and satellite gateways. Proximity to Chile and Brazil enhances its relevance in regional workload distribution. It positions Argentina as a node for Spanish-language AI model hosting. The Argentina AI Data Center Market supports edge deployment in remote areas. Its growth enables decentralized AI services across borders. This geographic advantage attracts global cloud and infrastructure providers. Domestic providers also scale to serve cross-border demand. Infrastructure in Argentina now plays a central role in Latin America’s AI backbone.

Market Trends

Growth of Liquid Cooling and Power-Dense Infrastructure for AI Training Workloads

AI training workloads in Argentina are becoming more power-dense, driving the need for liquid cooling adoption. Traditional air-cooled systems are insufficient for modern GPUs and large clusters. Operators are shifting toward immersion cooling, direct-to-chip cooling, and chilled plates. These innovations improve energy efficiency and reduce thermal stress on hardware. The Argentina AI Data Center Market reflects this transition through new facility designs. Data centers are adding redundant cooling paths and AI-based environmental controls. Developers are optimizing data hall layouts for airflow and rack utilization. Efficient cooling also improves PUE and aligns with ESG goals. Sustainability pressures drive faster uptake of energy-efficient thermal designs.

Shift Toward Hybrid Cloud AI Architectures with AI-Native Control Planes

Enterprises are adopting hybrid AI deployment models with flexible workloads across cloud and on-prem infrastructure. AI-native orchestration platforms allow users to train, deploy, and monitor models from unified control layers. This shift changes how resources are allocated, managed, and scaled. Workloads shift between edge, private cloud, and public cloud depending on latency, cost, or data locality. The Argentina AI Data Center Market supports this model with hybrid-ready infrastructure stacks. Providers integrate cloud-native software, accelerators, and scalable interconnects. AI pipelines now include federated learning, model versioning, and automation. This trend strengthens enterprise control over sensitive AI workflows and speeds up time to insight.

Rising Deployment of Edge Data Centers in Non-Metropolitan Zones for AI Inference

Inference workloads are becoming more latency-sensitive, driving demand for edge facilities closer to users. Argentina sees rising deployments in secondary cities like Rosario, Córdoba, and Mendoza. These edge data centers support real-time applications in healthcare diagnostics, autonomous vehicles, and industrial control. They enable AI execution at the source of data generation. The Argentina AI Data Center Market adapts by supporting modular, containerized edge solutions. Telcos and cloud providers are key stakeholders expanding regional reach. Edge nodes lower bandwidth usage and improve service quality. AI use at the edge improves customer responsiveness and supports regional innovation. Local demand tailors infrastructure growth beyond Buenos Aires.

Standardization of AI-Ready Data Center Certification and Design Compliance

Argentina’s data center industry is adopting international certifications for AI infrastructure readiness. Providers are aligning with LEED, Uptime Tier, ISO/IEC standards, and AI-specific benchmarks. These certifications improve investor confidence and ensure alignment with enterprise-grade workloads. Certified facilities offer better uptime, cybersecurity protocols, and AI workload resilience. The Argentina AI Data Center Market reflects these standards across new builds and retrofits. Design templates now include redundant networking, scalable GPU racks, and intelligent load-balancing. It improves competitive standing in Latin American markets. Certified facilities attract hyperscalers, cloud-native startups, and enterprise users. Certification trends shape buyer expectations and raise market benchmarks.

Market Challenges

Volatile Macroeconomic Conditions Limit Long-Term Infrastructure Investments

Argentina faces persistent inflation, currency fluctuations, and capital controls, impacting investment predictability. These macroeconomic factors reduce foreign direct investment in infrastructure-heavy industries. AI data center projects require long-term capital and stable energy pricing. Developers face cost overruns, delays, and financing difficulties. The Argentina AI Data Center Market navigates high-risk environments with flexible strategies. Political instability and regulatory uncertainty also affect site acquisition and permitting timelines. Exchange rate volatility raises costs for imported servers and power equipment. These conditions delay decision-making for hyperscale builds. Infrastructure providers seek hedging mechanisms and public-private cooperation to reduce exposure.

Grid Reliability, Energy Tariffs, and Carbon Constraints Impact Scalability

AI workloads need reliable, high-density power which Argentina’s grid struggles to supply consistently. Regional outages, aging infrastructure, and peak-load issues disrupt uptime. Energy subsidies distort pricing and create long-term uncertainty for power-intensive operations. The Argentina AI Data Center Market faces pressure to integrate on-site renewables or backup power systems. Environmental concerns add another layer, with scrutiny over data center carbon emissions. Operators must meet performance metrics while balancing energy security. Upgrading electrical infrastructure is capital-intensive. Energy policy misalignment complicates scaling timelines. Firms seek zones with grid stability and clean energy commitments to ensure continuity.

Market Opportunities

Localized AI Model Hosting and Language-Specific Optimization Demand Growth

AI adoption in Argentina creates new opportunities for local model hosting and Spanish-language fine-tuning. Enterprises want models tailored for regional dialects, regulatory needs, and sectoral datasets. The Argentina AI Data Center Market supports these efforts with domestic infrastructure. It reduces latency, enhances control, and meets compliance expectations. Hosting local AI models strengthens digital sovereignty. It also creates room for new service providers offering AI hosting, tuning, and inference APIs.

Expansion of Public and Private Cloud Zones to Support National AI Strategy

Argentina’s national AI strategy creates an opportunity for global and regional cloud providers to expand their zones. Establishing new availability zones can lower latency, increase sovereign control, and meet sectoral compliance. The Argentina AI Data Center Market aligns well with this shift, offering land, talent, and energy resources. Expansion opens doors for partnerships in AI research, edge computing, and public sector digitization.

Market Segmentation

By Type

The Argentina AI Data Center Market is dominated by colocation and enterprise facilities, accounting for over 50% market share. These facilities offer customized environments for training and inference tasks in AI-centric organizations. Hyperscale developments are gradually expanding as cloud providers enter the market. Edge or micro data centers are emerging in remote areas to support low-latency AI use cases. This diverse mix ensures broad accessibility and regional workload distribution.

By Component

Hardware forms the largest segment in the Argentina AI Data Center Market, supported by GPU servers, accelerators, and power systems. It holds over 60% share due to high demand for compute and cooling infrastructure. Software and orchestration platforms are growing fast, enabling AI workload optimization and automation. Services such as maintenance and AI-specific deployment consulting are also gaining traction among enterprises with limited in-house expertise.

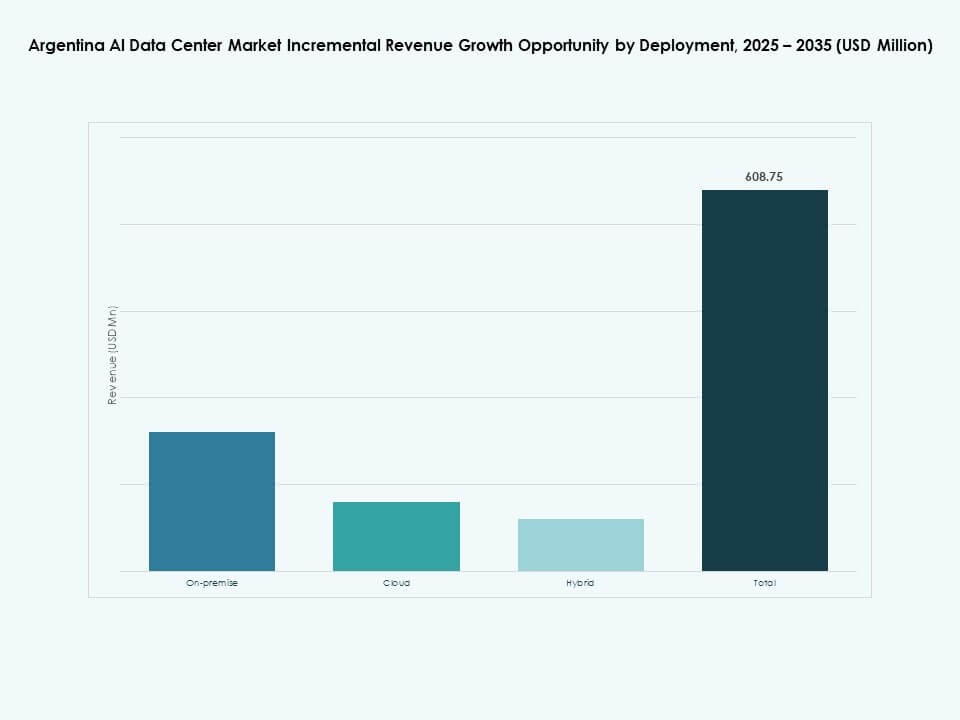

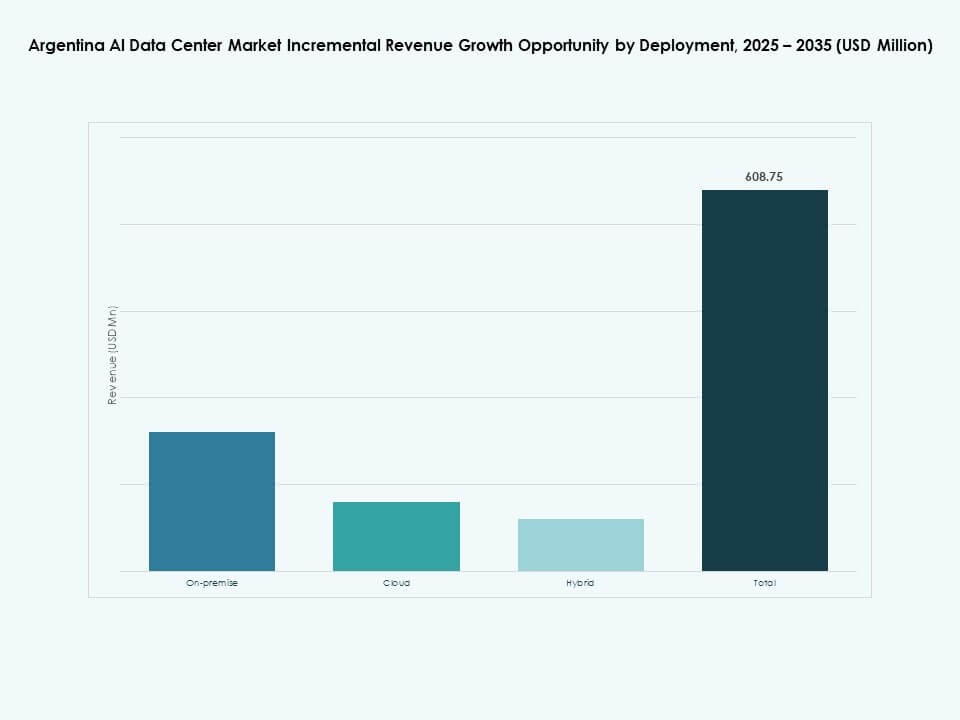

By Deployment

Cloud deployment leads the Argentina AI Data Center Market due to flexibility and scalability benefits. Public cloud zones and hybrid offerings are expanding across verticals. On-premise models remain strong in regulated sectors such as BFSI and government. Hybrid deployments are gaining popularity as enterprises balance cost and compliance. This mix supports varied AI maturity levels across user groups.

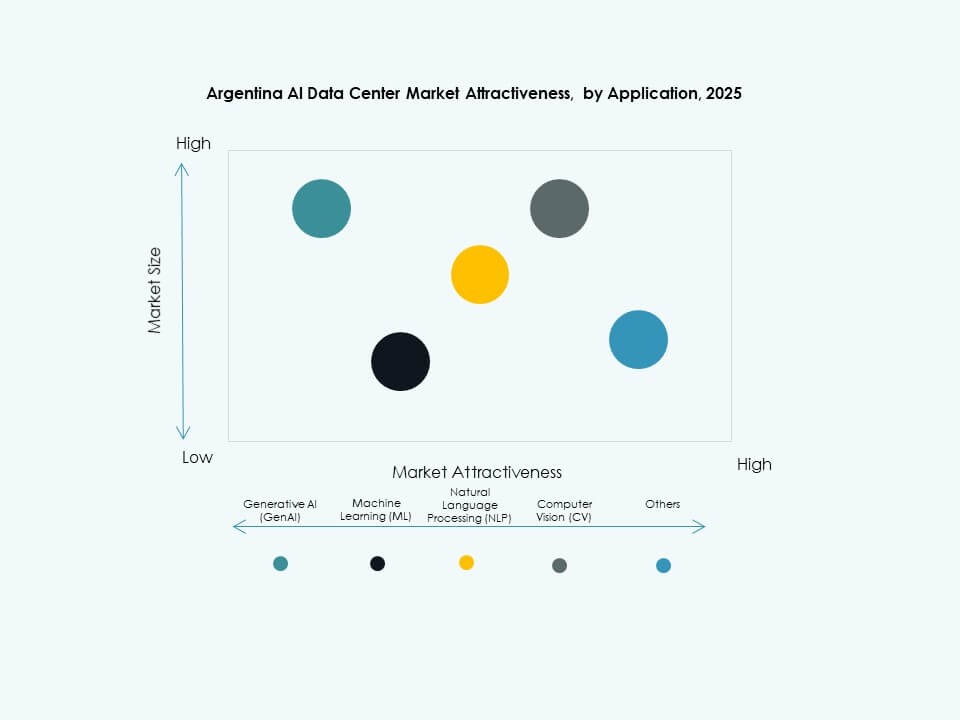

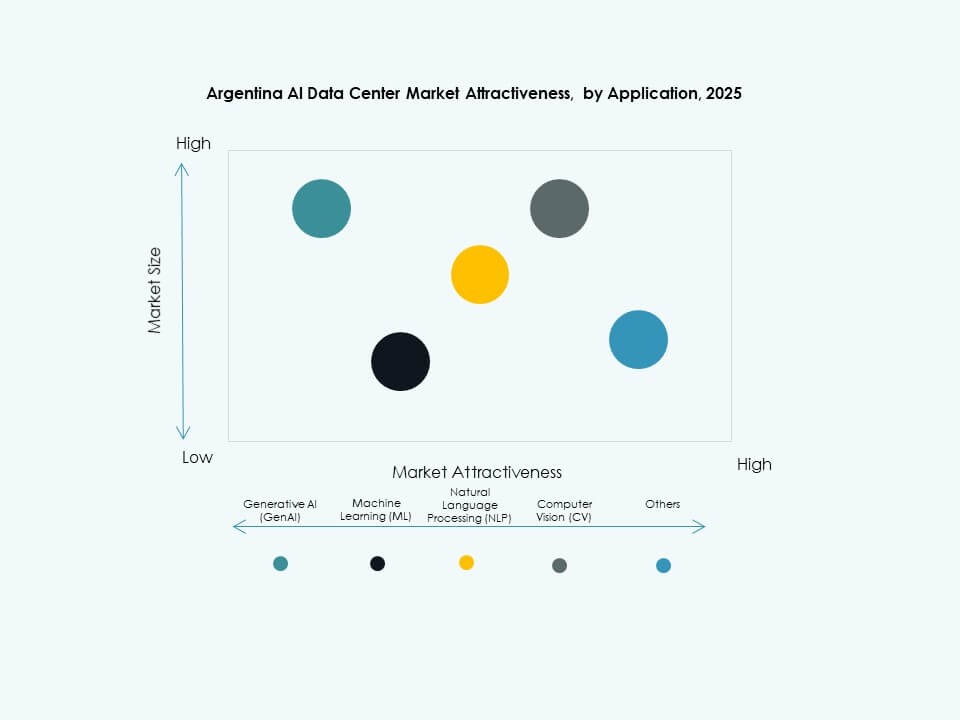

By Application

Machine learning holds the highest share in the Argentina AI Data Center Market due to its wide application in analytics and automation. Generative AI is rising fast with use cases in media, education, and legal. Natural language processing and computer vision segments are gaining traction in retail and surveillance. The “Others” category includes predictive maintenance and anomaly detection in manufacturing and utilities.

By Vertical

The BFSI segment dominates the Argentina AI Data Center Market, driven by AI-based fraud detection and credit analytics. Healthcare is growing fast due to AI use in diagnostics and patient management. IT and telecom sectors adopt AI for network optimization and support automation. Retail, manufacturing, and automotive follow, with varying levels of digital maturity. Media and entertainment are also investing in generative content workflows.

Regional Insights

Buenos Aires Metropolitan Region – Leading Hub with Over 60% Market Share

Buenos Aires leads the Argentina AI Data Center Market with over 60% share due to its dense fiber infrastructure and enterprise presence. It hosts the majority of colocation facilities, public cloud zones, and innovation clusters. The region benefits from government-backed digital transformation and proximity to financial and healthcare headquarters. It remains the prime site for hyperscale deployments and interconnection platforms.

Córdoba and Santa Fe Provinces – Emerging Regional Technology Hubs

Córdoba and Santa Fe collectively contribute around 20% market share, driven by growing edge deployments and tech ecosystems. These provinces benefit from skilled labor, academic institutions, and expanding telco infrastructure. Córdoba supports AI startups and software firms needing localized compute resources. Santa Fe attracts industrial AI workloads from logistics and agro-tech sectors. These subregions support decentralization of AI infrastructure.

- For instance, Córdoba hosts several tech parks and public-private innovation clusters that support digital infrastructure development, positioning the province as a secondary hub for enterprise and SaaS workloads. Santa Fe, especially Rosario, has emerging data center activity linked to logistics, manufacturing, and agro-tech industries.

Mendoza and Others – Secondary Growth Corridors with Niche AI Demand

Mendoza and smaller provinces account for the remaining 20% of the Argentina AI Data Center Market. These areas show potential for edge facility growth, particularly in AI-powered surveillance, mining, and healthcare. Smaller cities adopt modular data centers tailored for specific verticals. National and provincial AI policies encourage local infrastructure development. These zones are critical for national coverage and resilience in distributed AI infrastructure.

- For instance, Southern Patagonia features a cool climate year-round, making it attractive for energy-efficient infrastructure. The region’s low ambient temperatures offer potential for natural cooling strategies in future data center planning.

Competitive Insights:

- IPLAN

- Grupo Datco

- Cirion Technologies Argentina

- Telecom Argentina Data Centers

- Microsoft (Azure)

- Amazon Web Services (AWS)

- Google Cloud / Alphabet

- Equinix

- Digital Realty Trust

- NVIDIA

The Argentina AI Data Center Market features a mix of domestic telecom operators, regional cloud service providers, and global hyperscale leaders. Local players such as IPLAN and Grupo Datco focus on enterprise colocation and managed infrastructure. Global firms like AWS, Google, and Microsoft lead the push for AI-native cloud zones. NVIDIA influences backend infrastructure through its AI accelerator stack, while Equinix and Digital Realty build interconnection hubs. Cirion and Telecom Argentina extend metro and long-haul fiber backbones to support dense AI workloads. Competition centers on latency, AI-readiness, and sustainability. It is shifting toward hybrid models, edge deployments, and high-performance cooling infrastructure tailored for AI.

Recent Developments:

- In December 2025, Amazon Web Services (AWS) and Google Cloud launched a joint multicloud networking service designed to improve connectivity, reduce downtime, and enable high-speed private links between their platforms, benefiting AI data center operations globally including in emerging markets like Argentina.

- In September 2025, Telecom Argentina unveiled plans to upgrade all 16 of its data centers nationwide to 10 MW capacity each, specifically to handle surging AI workloads and enterprise demand alongside its 5G rollout.

- In August 2025, in Cirion Technologies Argentina expanded its BUE1 Data Center in Buenos Aires enhancing high availability, energy efficiency, scalability, and security to support artificial intelligence workloads and regional digital transformation.