Executive summary:

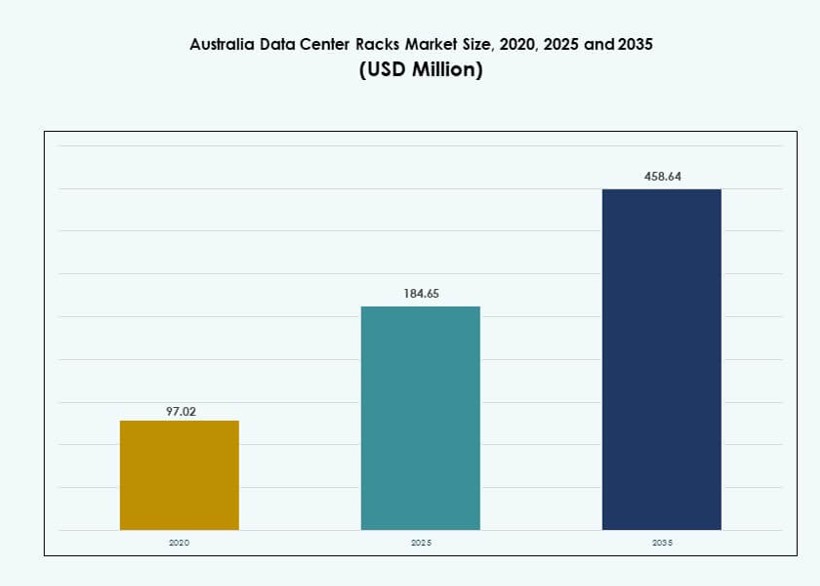

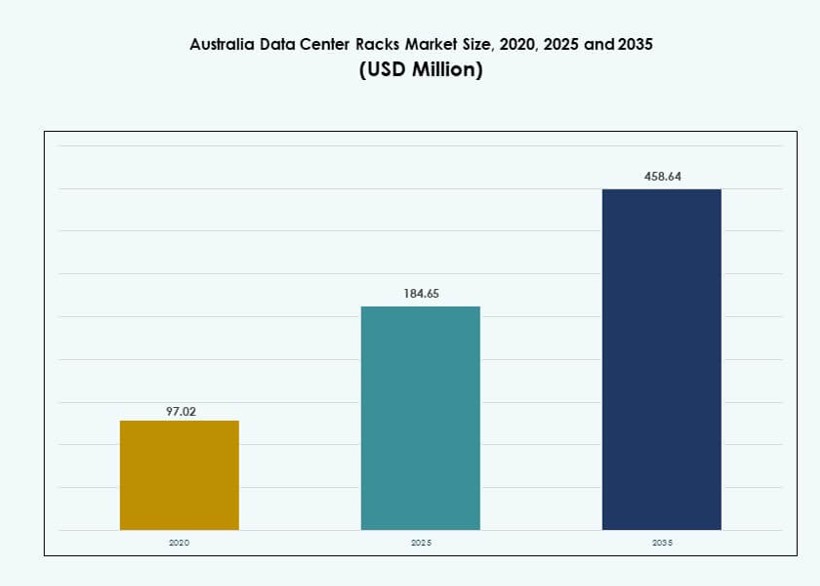

The Australia Data Center Racks Market size was valued at USD 97.02 million in 2020 to USD 184.65 million in 2025 and is anticipated to reach USD 458.64 million by 2035, at a CAGR of 9.45% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Australia Data Center Racks Market Size 2025 |

USD 184.65 Million |

| Australia Data Center Racks Market, CAGR |

9.45% |

| Australia Data Center Racks Market Size 2035 |

USD 458.64 Million |

Australia’s data center rack market is being shaped by hyperscale growth, AI workloads, and demand for modular deployments. Enterprises are upgrading infrastructure to support higher rack densities and integrated cooling. Innovations in rack design, such as smart features and liquid cooling support, are gaining traction. The market is also driven by data sovereignty laws pushing local infrastructure builds. Investors see long-term value in energy-efficient and scalable rack systems. Strategic partnerships between global OEMs and regional providers are increasing. Demand is shifting toward pre-configured, intelligent cabinets. High adoption of cloud and edge computing further accelerates rack modernization.

New South Wales leads the market, driven by Sydney’s dominance in colocation and cloud infrastructure. Victoria, especially Melbourne, is growing due to enterprise demand and tech sector expansion. Queensland and Western Australia are emerging regions, supported by edge deployments and industrial digitization. These zones see investments in rugged, modular rack systems to support regional connectivity and remote processing. Infrastructure projects and localized workloads are driving demand across Australia’s east and west corridors. Each region’s growth reflects a shift toward decentralized and high-performance compute models.

Market Dynamics:

Market Drivers

Rise in Hyperscale and Cloud Deployments Driving Rack Density and Power Requirements

Hyperscale cloud providers and colocation operators continue expanding across Australia, requiring high-density rack configurations to support modern workloads. The demand for racks capable of handling 20–50 kW per rack is growing due to AI, analytics, and real-time processing needs. Major players are adopting scalable cabinet solutions integrated with advanced cooling. Innovation in power distribution and cable management enables better airflow and performance. The Australia Data Center Racks Market gains strategic value from these shifts in deployment models. Investors view it as an infrastructure pillar supporting digital services and economic growth. Rack upgrades improve both space efficiency and operational uptime. Edge workloads also drive modular deployments that need custom rack designs. The ongoing shift favors partners offering flexibility, integration, and energy optimization.

- For instance, Equinix SY7 Sydney data center supports 4 kW per cabinet density with N+1 UPS redundancy.

Strong Focus on Data Sovereignty and Localized Infrastructure Development Supports Rack Demand

Government regulations on data residency have increased investments in domestic data centers with secure, localized storage and processing. Enterprises and cloud operators must build or lease capacity within Australian borders. This localization trend fuels consistent demand for cabinets that meet national compliance and physical security standards. The Australia Data Center Racks Market benefits from new private and public sector infrastructure. Sensitive industries such as banking and healthcare prioritize rack enclosures with tamper-proof designs and access control. Businesses seek to reduce latency and retain operational control, which further drives regional rack installations. Public-private partnerships help build data resilience, making racks critical infrastructure. Rack systems are becoming smarter, with embedded sensors and analytics for compliance monitoring. Demand for such capabilities strengthens across enterprise and hyperscale layers.

Adoption of Liquid and Hybrid Cooling Technologies Demands Custom and High-Capacity Racks

Rising rack densities push the limits of air-based cooling, leading to a shift toward liquid or hybrid systems. Data centers are integrating rear-door heat exchangers, direct-to-chip cooling, and immersion systems that need specialized racks. These solutions require structural modifications, high thermal thresholds, and enhanced sealing. The Australia Data Center Racks Market is seeing rising adoption of such advanced rack formats. It is pushing vendors to innovate in materials, airflow channels, and frame load capacities. Facilities prefer prefabricated racks that integrate power and cooling modules for quick deployment. Liquid-compatible racks support sustained performance for AI, HPC, and GPU-based workloads. Rack design is now integral to data center thermal strategy and long-term energy savings. This evolution positions racks as high-value assets rather than passive infrastructure.

Digital Transformation and 5G Expansion Stimulating Edge Rack Installations in Regional Hubs

Australia’s digital economy is expanding across urban and regional zones, driving the need for edge data centers. Telecom providers and CDN operators are deploying localized nodes to meet low-latency demand. These installations rely on compact racks that integrate compute, network, and power in minimal footprints. The Australia Data Center Racks Market benefits from this decentralization trend. Growth in smart cities, connected healthcare, and autonomous systems further boosts demand for edge-ready cabinets. Regional zones are seeing investments in prefabricated and modular rack systems. Lightweight and ruggedized racks gain traction in areas with limited support infrastructure. Investors favor regions offering strong fiber, power, and regulatory clarity. Rack deployment is directly tied to regional digitization programs and broadband initiatives, creating stable demand cycles.

- For instance, AirTrunk’s SYD2 Sydney facility delivers over 50MW IT load capacity across multiple halls for edge and hyperscale workloads.

Market Trends

Integration of Smart Rack Features for Real-Time Monitoring and Asset Management

Data center operators are increasingly adopting smart racks with embedded sensors, environmental monitors, and RFID tagging. These features provide real-time insights into temperature, humidity, airflow, and power consumption. Smart racks help optimize workload placement and reduce failure risks. The Australia Data Center Racks Market is aligning with global trends that favor intelligent infrastructure. Operators can use DCIM software and rack-level data to improve operational visibility. Smart racks support predictive maintenance and asset tracking. They also align with green compliance by enabling better energy metrics. Enterprises seek racks that integrate with BMS and cloud-native monitoring platforms. This trend is gaining traction across colocation and enterprise segments.

Rising Demand for Customizable, Prefabricated, and Scalable Rack Solutions

Operators now prioritize rack solutions that can be rapidly deployed, reconfigured, or scaled without major redesigns. Prefabricated racks with integrated cabling, PDUs, and containment are becoming the norm. These plug-and-play solutions reduce installation time and minimize deployment risks. The Australia Data Center Racks Market reflects a shift toward flexibility and modularity. Standardized 42U and custom above-42U racks are being tailored for AI, HPC, and mixed workloads. Scalable racks offer better cost control across project phases. Enterprise IT teams prefer pre-configured racks that meet specific power and cooling thresholds. Local integrators are collaborating with OEMs to meet regional preferences. The demand spans from hyperscale to edge environments.

Adoption of AI and HPC Workloads Accelerating Rack-Level Thermal and Power Innovation

The growing adoption of GPU and AI-centric workloads is transforming rack architecture across core and edge facilities. These racks must accommodate higher power loads and integrated cooling solutions. Operators are deploying racks capable of supporting 30–50 kW for AI clusters. The Australia Data Center Racks Market is responding with next-generation designs that feature stronger frame structures and airflow optimization. Liquid cooling compatibility is now a default feature for many designs. Facilities require racks with hot-swappable power modules and busbars for flexibility. AI-focused racks often include internal cable trays for better airflow. These innovations are driven by demand from research, telecom, and financial segments. Rack configurations directly affect workload performance.

Shift Toward Sustainable and Circular Rack Manufacturing Practices

Environmental concerns are pushing data center builders to choose racks with low-carbon footprints and recyclable materials. Vendors are adopting steel with reduced embodied carbon and aluminum alloys that allow reuse. The Australia Data Center Racks Market is influenced by green procurement policies across public and private sectors. Enterprises demand lifecycle assessments, EPDs, and energy performance reports. Rack vendors are also offering take-back programs and modular upgrades to extend product life. Sustainable packaging and local sourcing reduce emissions further. These practices help clients meet ESG targets while minimizing waste. Innovation in materials also enables lighter racks with strong load-bearing capacity. The move toward sustainable racks is gaining speed.

Market Challenges

Limited Domestic Manufacturing Capacity and High Dependence on Imports Increase Cost and Lead Times

Australia relies heavily on imported rack systems, components, and accessories, mainly from North America, Europe, and Asia. This dependency creates risks from currency fluctuations, port congestion, and global supply disruptions. Lead times for high-specification racks often exceed project schedules, causing deployment delays. The Australia Data Center Racks Market faces pressure from rising logistics and import costs. Limited domestic manufacturing capacity prevents operators from rapidly scaling up or customizing solutions. Regulatory checks, customs duties, and certification issues add to complexity. Sourcing locally would reduce risks, but current fabrication capabilities are insufficient. Until local production scales, the market remains vulnerable to supply chain instability.

Skilled Labor Shortages and Regulatory Compliance Burdens Affect Rack Deployment Efficiency

Data center expansion projects often face delays due to a shortage of skilled workers who can handle rack assembly, power configuration, and integrated cooling systems. High-density and liquid-cooled racks need specialized installation knowledge. The Australia Data Center Racks Market is affected by a tight labor market and training gaps. Compliance with AS/NZS standards, electrical codes, and fire safety laws also adds to the deployment burden. Errors in rack layout or cabling can lead to inefficiencies and operational risks. Delays in inspections and certifications further slow down project timelines. These issues impact scalability, especially for hyperscale and edge facilities. Investing in workforce training and streamlined regulations is essential for sustained growth.

Market Opportunities

Growing Edge Deployment Across Rural Zones Unlocks New Demand for Ruggedized Rack Designs

The expansion of edge computing in healthcare, agriculture, mining, and logistics is creating new rack installation demand across Australia’s rural and semi-urban regions. The Australia Data Center Racks Market can capitalize on this trend by offering compact, rugged, and prefabricated racks for edge nodes. It will require vendors to provide mobility, high IP ratings, and remote monitoring capabilities. Low-power designs with integrated cooling gain traction in low-support environments. Local governments and telcos continue funding regional connectivity projects that expand rack use cases.

Investments in AI Infrastructure and Sovereign Cloud Platforms Drive Specialized Rack Demand

National cloud policies and AI adoption are triggering demand for secure, high-capacity racks across commercial and government workloads. The Australia Data Center Racks Market is positioned to benefit from data localization mandates and sovereign cloud partnerships. Enterprises seek high-density racks with integrated PDUs and smart access control. Public sector digitization projects create long-term contracts for compliant rack installations. The focus on secure infrastructure opens doors for rack vendors offering localized integration and long-term service support.

Market Segmentation

By Rack Type

Cabinet racks dominate the Australia Data Center Racks Market due to their versatility, security, and compatibility with power and cooling systems. They support a wide range of server, storage, and networking equipment while enabling airflow control and access management. Open-frame racks hold a smaller share, preferred for test environments and small deployments. The “others” segment includes wall-mount and enclosed frame variants, which find use in edge setups. Cabinet racks remain the preferred choice for enterprise and hyperscale facilities.

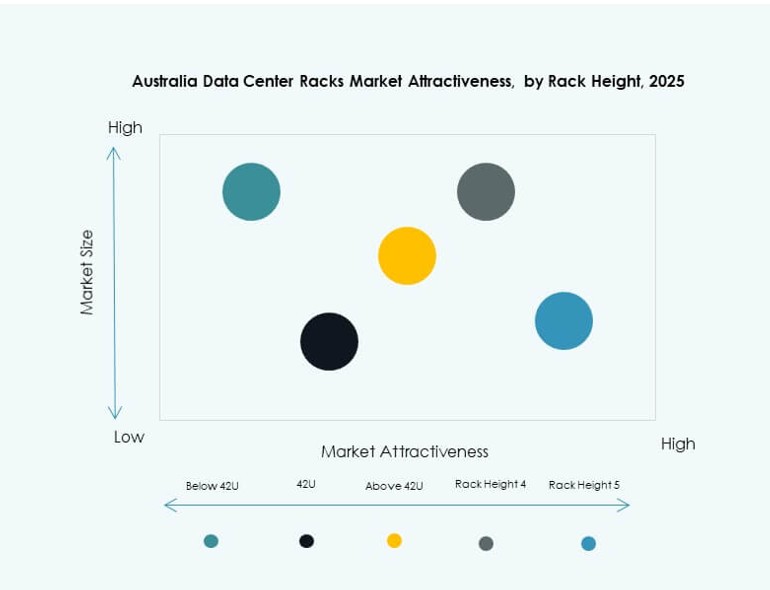

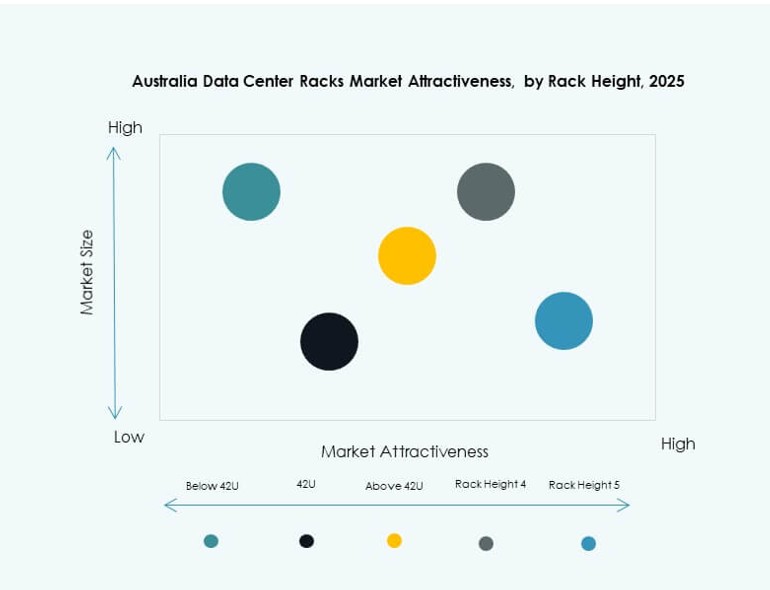

By Rack Height

42U racks account for the largest market share in the Australia Data Center Racks Market due to their standardization and broad vendor compatibility. These racks offer optimal space efficiency and meet most IT workload needs. Above 42U racks are gaining popularity in high-density and AI-driven deployments where taller frames offer greater capacity. Below 42U racks serve compact and edge installations, though their share is smaller. Future growth lies in customizable taller rack formats to handle next-gen processing loads.

By Width

The 19-inch rack width is the industry standard and dominates the Australia Data Center Racks Market, supporting a broad ecosystem of IT equipment. These racks ensure compatibility across servers, switches, and PDUs. The 23-inch width is used in telecom setups and legacy systems but sees limited adoption in new data centers. The “others” category includes custom widths for specialized use cases such as deep learning clusters. Growth remains concentrated in standardized 19-inch racks for ease of integration.

By Application

Server racks lead the Australia Data Center Racks Market due to growing compute demand from AI, big data, and cloud services. These racks are optimized for airflow, cable routing, and power delivery tailored to server performance. Network racks hold a smaller share but remain critical for managing switching and routing layers. Demand for network racks rises with data center interconnect and SDN rollouts. The application mix will evolve with increasing disaggregation and modular design trends.

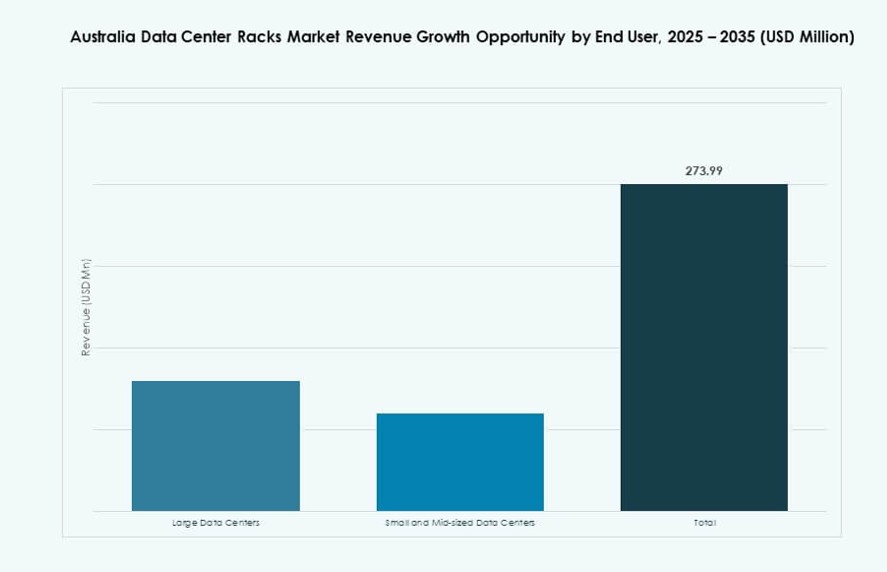

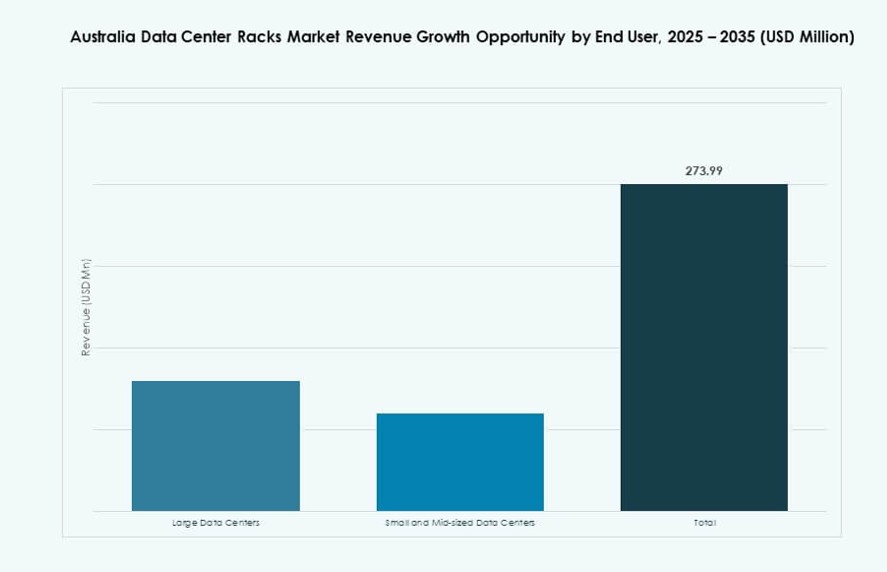

By End-user

Large data centers dominate the Australia Data Center Racks Market, driven by hyperscale projects, government platforms, and cloud hubs. These facilities require scalable and high-density rack deployments that align with AI and edge workloads. Small and mid-sized data centers contribute steadily, focusing on modular racks and prefabricated systems. Demand from regional and colocation facilities supports rack customization. Both segments seek intelligent racks with monitoring features and integrated cooling capabilities.

By Vertical

The IT & telecom sector leads the Australia Data Center Racks Market, driven by cloud expansion, mobile growth, and network transformation. BFSI and government sectors follow, driven by data security needs and compliance. Healthcare gains traction through connected devices and medical data storage. Energy and retail verticals adopt rack solutions for remote monitoring and real-time analytics. Other verticals include media, education, and manufacturing, where digital transformation increases rack adoption. IT & telecom remains the primary driver of demand.

Regional Insights

New South Wales Leads with 36.5% Share Due to Sydney’s Dominance in Colocation and Cloud Facilities

New South Wales remains the largest contributor to the Australia Data Center Racks Market, holding a 36.5% share. Sydney serves as the national hub for cloud, colocation, and enterprise hosting due to its mature infrastructure and strong interconnection fabric. Major providers maintain their regional headquarters and primary availability zones in this area. Government projects and corporate demand for proximity-based services continue to boost rack installations. Facilities here prioritize high-density cabinets for scalable deployment. The demand remains steady across hyperscale and edge layers.

- For instance, NEXTDC’s S3 Sydney data center provides 80MW IT capacity and supports 10,800 racks, enabling high-density deployments with Tier IV uptime certification.

Victoria Accounts for 27.8% Share Driven by Enterprise Growth and Secondary Cloud Zones

Victoria, particularly Melbourne, captures around 27.8% of the Australia Data Center Racks Market. The region benefits from its role as a secondary availability zone for major cloud players. Enterprise IT transformation in finance, retail, and public services supports steady rack demand. High-speed fiber networks and government incentives help the region attract new data center investments. Operators are expanding capacity using prefabricated rack solutions. The market here is shaped by hybrid deployments across enterprise and mid-sized segments.

Queensland and Western Australia Are Emerging, with a Combined Share of 21.2% Led by Edge and Industrial Growth

Queensland and Western Australia jointly account for 21.2% of the market, led by edge data center growth and industrial digitization. These regions see increased activity in mining, logistics, and telecom edge nodes. Regional governments support connectivity and data localization projects, driving demand for compact and ruggedized rack formats. Rural zones need low-latency data processing, which pushes demand for modular and mobile racks. Vendors offering custom enclosures and integrated cooling gain early traction. Growth in these zones will accelerate with expanding broadband and power infrastructure.

- For instance, NEXTDC’s P2 Perth facility delivers 20 MW capacity across 1,200 racks with a target PUE of 1.15, tailored for industrial edge processing.

Competitive Insights:

- Schneider Electric

- Vertiv Group

- Chatsworth Products

- Cisco Systems, Inc.

- Dell Inc.

- Rittal

- Hewlett Packard Enterprise

- Eaton

- Legrand

- Panduit Corp.

The competitive landscape of the Australia Data Center Racks Market features a mix of global OEMs and regional integrators, each offering differentiated capabilities across rack types, densities, and cooling integration. Vertiv and Schneider Electric lead in prefabricated, high-density cabinets and smart rack technologies. Cisco and Dell provide integrated compute-rack-network solutions tailored for hybrid cloud. Rittal and Panduit serve industrial and modular applications, while Eaton and Legrand focus on power-integrated enclosures. Vendors are enhancing support for liquid cooling and rack-level analytics to serve AI and edge workloads. Partnerships with hyperscalers and local cloud firms influence positioning. It favors firms that offer faster deployment, compliance-readiness, and localized support. Competitive success hinges on innovation, service, and adaptability to rising power and density needs.

Recent Developments:

- In August 2025, Vertiv finalized the acquisition of Great Lakes Data Racks & Cabinets for about $200 million. The deal broadens Vertiv’s ability to offer customised rack enclosures, seismic cabinets, and integrated solutions for AI, edge, and hyperscale environments.

- In June 2025, Schneider Electric introduced its latest EcoStruxure Rack Solutions and Prefabricated Modular EcoStruxure Pod Data Center systems. These solutions enhance support for high‑density racks with liquid cooling, advanced PDUs, and frameworks built for HPC and AI workloads, addressing rapid growth in complex data hall requirements.

- In April 2025, Legrand acquired Computer Room Solutions, a Sydney-based vendor specializing in server racks, security caging, and uninterruptible power supply systems, strengthening its data center hardware portfolio and regional footprint in the Asia-Pacific market, particularly for edge, colocation, and enterprise deployments in Australia.